|

|

Judge Edwin O. Lewis

|

Judge Edwin O. Lewis

finally got his way, the Pennsylvania State Government acquired four

blocks of Chestnut Street stretching to the East of Independence Hall,

and the Federal Government acquired four blocks stretching to the

North. Judge Lewis was determined that a real revival of historic

Philadelphia required the clearance of a lot of lands. Those who heard

him describe it will remember the emphasis, "It must be BIG if it is to

serve its purpose."

The

open land is rapidly filling in but for a time the movers and shaker

of this town had to scratch a little to find something to put there.

That's fundamentally why the historic district has a Mint, a Federal Reserve, a Court Houses, a Jail,

and a big Federal Building to house various local offices of the

landlord, the federal government. It's where you go to visit your

congressman, or to renew your passport, or to argue with the Internal

Revenue Service. If you have certain kinds of business, there's an

office for the FBI and the U.S. Secret Service. The mission of the Secret Service is a little hard to explain with logic.

The

Secret Service is a federal police organization, charged with

protecting the President of the United States, and enforcing the laws

against counterfeiting money. In unguarded moments, the Secret Service

officers will tell you they only have one function: to guard

three-dollar bills. The President only comes to town from time to time,

but the mandate extends to the President's family, and to the extended

family of official candidates for election to that office. So, there is

usually always a certain amount of activity relating to running behind

limousines with one hand on the fender, or poking around rooftops near

the speaker's platform at Independence Hall, or talking apparently to a

blank wall, using the microphones hidden in their ear canals. The rest

of the time is taken up with counterfeiters, but even then the

excitement is only occasional, depending on business.

A few years ago, the buzz around the office was that some very good, even

exceptionally good, fake hundred dollar bills were in circulation in

our neighborhood. The official stance of The Service is that all

counterfeits are of very poor quality, easily detected and no threat to

the conduct of trade. Unfortunately, some counterfeits are of very good

quality, not easily detected, and when that happens, The Service is

made to feel a strong sense of urgency by its employers. These

particular hundred dollar fakes were of very good quality.

One

evening, a call came in. Don't ask me who I am, don't ask me why I am

calling. But I can tell you that a very large bag of hundred dollar

wallpaper has just been tossed over the side of the Burlington Bristol Bridge, near the Southside on the Jersey end. Goodbye.

Very soon indeed, boats, divers, searchlights, ropes, and hooks

discovered that it was true. A pillowcase stuffed with hundred dollar

wallpaper of the highest quality was pulled out of the river. By the

time the swag was located and spread out for inspection, it was clear

that several million dollars were represented, but they were soaked

through and through. Most of the jubilant crew were sent home at

midnight, and two officers were detailed to count the money and turn it

in by 7 AM. The strict rule about these things is that all of the money

confiscated in a "raid" was to be counted to the last penny before it

could be turned over to the day shift and the last officers could go

home to bed. After an hour or so, it was clear that counting millions

of dollars of soggy wet sticky paper was just not possible by the

deadline. So, partly exhilarated by the successful treasure hunt, and

partly exhausted by lack of sleep, the counters began to struggle with

their problem. One of them had the idea: there was an all-night

laundromat in Pennsauken. Why not put the bills in the automatic drier, so they could be more easily handled and counted? Away we go.

|

|

Burlington Bristol Bridge

|

At four in the morning, there aren't very many people in a public

laundromat, but there was one. A little old lady was doing her wash in

the first machine by the door. It was a long narrow place, and the two

officers took their bag of soggy paper past the old lady, and down to

the very last drying machine on the end. Stuffed the bills into the

machine, slammed the door, and turned it on. Most people don't know

what happens when you put counterfeit money in a drier, but what

happens is they swell up and sort of explode with a terribly loud

noise. The machine becomes unbalanced, and the vibration makes even

more noise. The little old lady came to the back of the laundromat to

see what was going on.

As soon as she got close, she could see hundred dollar bills

plastered against the window, and that was all she stopped to see. She

headed for the pay telephone near the front of the door. The secret

Servicemen followed quickly with waving of hands and earnest

explanations, but within minutes there were sirens and flashing lights

on the roof of the Pennsauken Police car. Out came wallets and badges,

everyone shouting at once, and then everything calmed down as the

bewildered local cop was made to understand the huge social distance

between a municipal night patrolman and Officers of the U.S. Secret

Service. Now, he quickly became a participant in the great adventure and was delegated the job of finding something to do with armloads of

(newly dried) counterfeit hundred dollar bills. He had an idea: the

local supermarket was also open all night, and they carried plastic

garbage bags for sale. Just the thing. But who was going to pay the

supermarket for the bags? Immediately, everyone was thinking the same

thing.

Fortunately for law and order, the one who first suggested the

the obvious idea of passing one the counterfeits was the little old lady.

At that, everyone came to his senses. Wouldn't do at all, quite

unthinkable. The local cop was sent off for the bags, relying on his

ability to persuade the supermarket clerk. And, yes, they did get the

money all counted by 7 A.M.

One of the things being said in Academia in 2008 is that the 1929 crash was the result of many futile attempts to preserve the gold standard. That's the first time that particular formulation has surfaced in eighty years. It may not be correct at all, and even if correct it doesn't say what should have been done about it. Life is short and the Art is long, but somebody must do the best he can with the information available. Unemployment was over 30% in those days, and hundreds of Americans froze to death in the Depression because they could not afford to heat their rooms. Right or wrong, there are times when some action must be taken. But if you can possibly sit tight and figure out a sensible thing to do, it's certainly better.

So, we hear proposals from Henry Kaufman to create a separate Federal Reserve for big institutions alone, while others say banking oversight is already too fragmented between the Fed, the Controller of the Currency, the Secretary of the Treasury, the FDIC, state banks and national banks, the SEC, the Bureau of Management and Budget, and on and on. This line of argument takes the formulation that we should regulate mortgages, no matter who is involved in them, rather than banks, on non-bank institutions. On one point everyone is in agreement, that we need more information more quickly, more transparency, less asymmetry of information. At the same time, everyone is aware that it probably will eventually be possible to describe this whole mess on one sheet of paper; the truth is totally hidden by information overload. Don't talk so much; say something.

At the GIC (Global Interdependence Center) recently, a brilliant professor of the Wharton School gave a magnificent summary of the situation, now nine months old, enumerating a number of insights which had not even occurred to an audience of bankers and businessmen. They applauded enthusiastically, and then someone asked how Credit Default Swaps fit into this picture since they had not been mentioned. It immediately became embarrassingly evident that the professor knew almost nothing about that topic beyond a couple of pat sentences. But Credit Default Swaps now total trillions and trillions of dollars, more than doubling in a year. Since they are private transactions unreported to regulators, no one has measured the matter or will divulge what has been measured. But since they represent a volume several time the size of the underlying debt market, and every swapper swaps with someone else, it seems inevitable that huge imbalances exist somewhere. It would be nice to have a general idea out of whose pockets the excesses come, and into whose pockets they go. Maybe all this is irrelevant to the present crisis, but it isn't irrelevant to the distrust and fear in the markets. If someone proposes a law about this situation, he had better have divine guidance.

An example of what causes markets to freeze up because people are afraid to buy, comes from an anonymous person in an elevator. Speeding between floors, he remarked earnestly to a friend, that when he worked for Goldman Sachs his department churned out dozens of innovative debt instruments. If one of them happened to get popular, then and only then did they set about devising ways to measure them, and adjust the prices. It's impossible to stop rumors of this type because they sound so plausible. In fact, they may even be true.

In fact, some of the most incisive comments come from people with no insider information at all. Such as a businessman who listened intently to the lecture and then called out, "Where were the accountants in all this? Aren't they paid to know what is going on?" The answer was that FASB rules should be tightened up. Maybe so, but it sounds a little thin.

The political risk is considerable. Only 6% of the population is old enough to remember 1929 and its aftermath, only 25% more can remember 1973, and 25% more can remember 1991. That means that nearly fifty percent of the public can never remember a severe recession at all. A politician running for office could tell them anything, and they would have no reason to challenge it. Or put it this way: the advisors who elected a young President could tell him anything, and it isn't certain he would fire them for it.

|

|

Thirteen Sovereign States

|

In the case of the American Constitution, the initial problem was to induce thirteen sovereign states to surrender their hard-won independence to a voluntary union, without excessive discord. Once the summary document was ratified by the states, designing a host of transition steps became the foremost next problem. The dominant need at that moment was to prevent a victory massacre. The new Union must not humble once-sovereign states into becoming mere minorities, as Montesquieu had predicted was the fate of Republics which grew too large. Nor must the states regret and then revoke their union as Madison feared after he had been forced to agree to so many compromises. As history unfolded, America soon endured several decades of romantic near-anarchy, followed by a Civil War, two World Wars, many economic and monetary upheavals, and eventually the unknown perils of globalization. When we finally looked around, we found our Constitution had survived two centuries, while everyone else's Republic lasted less than a decade. Some of its many flaws were anticipated by wise debate, others were only corrected when they started to cause trouble. Still, many tolerable flaws were never corrected.

Great innovations command attention to their theory, but final judgments rest on the outcome.

|

|

.

|

Benjamin Franklin advised we leave some of the details to later generations, but one might think there are permissible limits to vagueness. The Constitution says very little about the Presidency and the Judicial Branch, nothing at all about the Federal Reserve, or the bureaucracy which has since grown to astounding size in all three branches. Political parties, gerrymandering, and immigration. Of course, the Constitution also says nothing about health care or computers or the environment; perhaps it shouldn't. Or perhaps an unmentioned difficult topic is better than a misguided one. Gouverneur Morris, who actually edited the language of the Constitution, denounced it utterly during the War of 1812 and probably was already feeling uncomfortable when he refused to participate in The Federalist Papers . Madison's two best friends, John Randolph, and George Mason, attended the Convention but refused to sign its conclusions, as Patrick Henry and Thomas Jefferson almost certainly would also have done. On the other hand, Alexander Hamilton and Robert Morris came to the Convention preferring a King to a President, but in time became enthusiasts for a republic. Just where John Dickinson stood, is very hard to say. Those who wrote the Constitution often showed less veneration for its theory, than subsequent generations have expressed for its results. Understanding very little of why the Constitution works, modern Americans are content that it does so, and are fiercely reluctant about changes. The European Union is now similarly inflexible about the Peace of Westphalia (1648), suggesting that innovative Constitutions may merely amount to courageous anticipations of radically changed circumstances.

|

|

President Franklin Roosevelt

|

One cornerstone of the Constitution illustrates the main point. After agreeing on the separation of powers, the Convention further agreed that each separated branch must be able to defend itself. In the case of the states, their power must be carefully reduced, then someone must recognize when to stop. If the states did it themselves, it would be ideal. Therefore, after removing a few powers for exclusive use by the national government, the distinctive features of neighboring states were left to competition between them. More distant states, acting in Congress but motivated to avoid decisions which might end up cramping their own style, could set the limits. The delicate balance of separated powers was severely upset in 1937 by President Franklin Roosevelt, whose Court-packing proposal was a power play to transfer control of commerce from the states to the Executive Branch. In spite of his winning a landslide electoral victory a few months earlier, Roosevelt was humiliated and severely rebuked by the overwhelming refusal of Congress to support him in this judicial matter. The proposal to permit him to add more U.S. Supreme Court justices, one by one until he achieved a majority, was never heard again.

|

|

Taxes Disproportionately

|

Although some of the same issues were raised by the Obama Presidency seventy years later, other more serious issues about the regulation of interstate commerce have been slowly growing for over a century. Enforcement of rough uniformity between the states rests on the ability of citizens to move their state of residence. If a state raises its taxes disproportionately or changes its regulation to the dissatisfaction of its residents, the affected residents head toward a more benign state. However, this threat was established in a day when it required a citizen to feel so aggrieved, he might angrily sell his farm and move his family in wagons to a distant region. People who felt as strongly as that was usually motivated by feelings of religious persecution since otherwise waiting a year or two for a new election might provide a more practical remedy. However, spanning the nation by railroads in the 19th Century was followed by trucks and autos in the 20th, and then the jet airplane. While moving residence to a different state is still not a trivial decision, it is now far more easily accomplished than in the day of James Madison. A large proportion of the American population can change states in less than an hour if they must, in spite of a myriad of entanglements like driver's licenses, school enrollments, and employment contracts. The upshot of this reduction in the transportation penalty is to diminish the power of states to tax and regulate as they please. States rights are weaker since the states have less popular mandate to resist federal control. It only remains for some state grievance to become great enough to test the present power balance; we will then be able to see how far we have come.

|

|

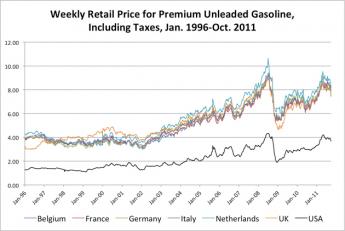

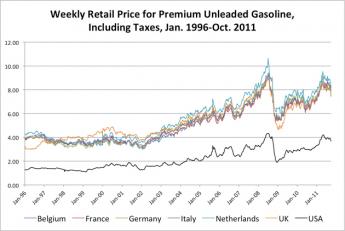

High Gasoline Taxes of Europe

|

Since it was primarily the automobile which challenged states rights and states powers, it is natural to suppose some state politicians have already pondered what to do about the auto. The extraordinarily high gasoline taxes of Europe have been explained away for a century as an effort to reduce state expenditures for highways. But they might easily be motivated by a wish to retard invading armies or to restrain import imbalances without rude diplomatic conversations. But they also might, might possibly, respond to legislative hostility to the automobile, with its unwelcome threat to hanging on to local populations, banking reserves, and political power.

It helps to remember the British colonies of North America were once a maritime coastal settlement. The thirteen original states had only recently been coastal provinces, well aware of obstructions to trade which nations impose on each other. Consequently, they could readily design effective restraints to mercantilism within the new Union. Two centuries later, repeated interstate quarrels provided fresh viewpoints on old international problems. As globalization currently becomes the central revolution in trade affairs of a changing world, America is no beginner in managing the intrigues of international commerce. Or to conciliating nation states, formerly well served by nation-state principles of the Treaty of Westphalia, but this makes them all the more reluctant to give some of them up.

Foreward: Written as Obamacare is beginning implementation amidst considerable resistance, the following paper offers an alternative proposal which is perhaps no less sweeping, but includes much more reform of the existing system than does Obamacare, and much more emphasis on the use of competition and individual responsibility. It is divided into three sections, I: Correcting Non-Cost Issues, II: Correcting the Cost Problem, III: Forestalling Unfortunate Side-Effects.

I: Correcting Non-Cost Issues

The Uninsured. Gail Wilensky, who once ran Medicare, recently commented about Obamacare, "It isn't reforming at all, it is merely coverage extension." Unfortunately, even though it seems to promise universal coverage by mandating it, the GAO estimates that over thirty million people will remain uninsured after Obamacare is fully implemented. Indeed, it is very difficult to see how to include illegal aliens (11 million), the mentally retarded or impaired (8 million), and those in jail (7 million) within one big program which adjusts to the situation of the rest of the American community. The proposal here is to revise downward the idea of universal coverage, to whatever extent the usual form of health insurance is unsuitable for these three (and possibly other) groups. Their special health needs are not easily adaptable to conventional health insurance and would be better served by specialized healthcare programs, structured with their particular problems at the center of the design.

Pre-existing Conditions The American public has become convinced that sick people have only two choices, Mandatory Insurance with compulsory community rates (i.e. Obamacare), or go without insurance. As a matter of fact, every textbook of insurance will list at least three ways of coping with "impaired risks." The industry terms are "Assigned-risk Pools", and Joint Underwriting Associations (JUA). One highly successful model exists for fire insurance, called the Fair Plan. A new insurance company was formed by selling stock to existing fire insurers, which sells fire insurance at standard rates, but only to someone who has been rejected by an ordinary fire insurance company. This form of impaired risk management was the preferred vehicle of the Pennsylvania fire insurance industry because the stock ownership enables the owners to take a tax reduction for losses. Somewhat to their surprise, the Fair Plan proved to be counter-cyclic in a cyclic industry, and actually produced a profit (for the insurance company owners) during economic downturns. An additional source of revenue was provided when other states than Pennsylvania requested to be included. Fire insurance is not the same as health insurance, but they are similar enough to appear workable for managing bad risks with a medical Fair Plan, which deserves at least a pilot study.

Under Obamacare, the problem of pre-existing conditions is solved by individual subsidies, an endless prospect, and by forcing those who do not want insurance to pay the bill for it. The main resistance to a JUA will probably be found among dominant health insurance companies, who have enjoyed near-monopoly status for many decades. Sharing risk is unattractive to them: when there is hardly anyone to share it with, and while historical "sweetheart" arrangements still remain ensconced. To the extent that a JUA would force readjustments, Ms. Wilensky would certainly not lack topics for revision.

Income Tax Reform. Representatives of large major corporations have twice disrupted Federal health proposals at the last moment, after a long period of lobbying as a supposed friend of reform. To that extent, they are friends of conservative forces in medical care. Nevertheless, it is now well past time to demand that their income tax preference devised by Henry Kaiser during World War II be eliminated. The employer gets a tax deduction, and their labor force escapes federal taxation for the gift of health insurance outside the pay packet. Meanwhile, the self-insured and uninsured are asked to pay for health insurance with after-tax income. In summary, the favored arrangements of their insurers with hospitals lead to a preposterous result (which would continue under Obamacare) that the people least able to afford high costs are the ones required to subsidize the people with the best jobs. This situation has three possible solutions: eliminate the tax preference of employed persons, or give the same to the rest of the country. Since there is little likelihood that this situation will be self - correcting, the obvious third choice is to cut the exemption in half and give the same to the rest of the population. No one needs to give Congress a lesson in such compromises, so obviously, progress will require a public uproar.

Interstate Health Insurance Competition The amateurish introduction of Obamacare's health insurance exchanges poisoned public opinion; it may now be even harder to address the political problem they tried to solve with computers. Tracing back to Constitutional restraints on Federal activities, health insurance has always been regulated by states. As a consequence of growing scope and complexity, many states had to choose between multiple small health insurance companies displaying vigorous competition, and a single large-but-effective monopoly in each state. To exaggerate, the result verged on fifty monopolies exhibiting monopolistic behavior.

Instead of devising a Constitutional work-around, Obamacare devised computer solutions to basically political difficulties, using computer subcontractors. It is possible some legislative designers understood the model of the New York Stock Exchange, which permits an interstate exchange to perform the single function of conducting competitive financial transactions between buyers and sellers of corporations which are themselves state regulated. They may have observed that computers superseded manual systems at the stock exchanges, so they took a short-cut. Integration would have required insurance experts and computer implementers to work together, preferably under one roof. A one-step version of this two-step idea might have transformed fifty local monopolies into a system of competitive interstate pricing. But this would have been and continues to be, a daunting time-consuming political process requiring very considerable negotiation with deep skepticism about advice from industry experts with axes to grind. As it now stands, any benefits will prove just as delayed by rushing computer solutions first, as by making the computer system the mathematical statement of a negotiated design. Indeed, negotiations among pseudo-cooperative partners commonly prove more filled with traps and smoke-screens when linked to other objectives, than if the exchange idea had been selected as the single, otherwise unencumbered, goal. It might have taken several election cycles, but the outcome would have been more acceptable.

II: Correcting the Cost Problem

Health Savings Accounts Unless Obamacare regulations somehow cripple the idea, there is nothing right now to keep anyone from starting a Health Savings Account and gather tax-sheltered income for the inevitable rainy day. Everyone should do so, regardless of any other insurance they may have, and right away.

However, Health Savings Accounts once assumed the need would terminate when the individual enrolled in Medicare. The turbulent arrival of Obamacare now raises concern that Medicare will be stripped in order to pay for Obamacare. Since the "single payer" system is the fall-back or possibly even the goal of Obamacare, its final goal is also redefined as lifetime coverage. Whatever the path, it becomes important to project what it might cost. The additional compound interest feature of Health Savings Accounts creates the possibility that HSA is the only approach which could succeed or at least be the first to reach achievability. The steady conquest of disease by Science, the steady increase in productivity by Commerce, the expiration of patent protection, and the relentless tendency of expensive illness to concentrate near the last year of life -- all suggest a feasible lifetime approach is likely within the next sixty years. The best path to feasibility is not speculative borrowing, but inducing the upper 50% of the population by income to overfund their HSAs, by allowing some acceptable ways to spend the unspent surplus. Over time, financial goals should become more precise, and deliberate surplus progressively lessened. As a matter of fact, considerably more than half the population could afford this approach right now, an extension to the rest of the population faces resistance which is more psychological than financial.

In the meantime, individuals need reinsurance. Competitive and political obstacles to high-deductible reinsurance are numerous, but almost all forms of traditional (formerly first-dollar) insurance are arriving at high deductibles by themselves. If that takes too long, individuals with funded HSAs are driven to become over-insured rather than re-insured, by distorting traditional insurance into reinsurance. That is a wasteful approach. Elimination of co-payments (and secondary or tertiary insurance to cover it) with no proven cost-restraining ability, would greatly accelerate the trend to high front-end deductibles, and that trend should be encouraged. Other foreseeable issues would be the sudden appearance of an expensive treatment which greatly prolongs life. Since everyone ultimately dies, this might transform a steady rise in lifetime health costs into two distinct bulges, which is more expensive than one bigger terminal bulge. At the present time, however, new cures for disease merely push back the inevitable average terminal care costs, to a later age. Another way for the future to confound predictions is for the cost of labor to rise more sharply than the Gross Domestic Product since medical care is labor intensive. Finally, life-sustaining organs could become enhanced more than life-enhancing organs, giving us an epidemic of blind people in wheelchairs in place of the charming wits and sages we imagine for our future. None of this is within the control of insurance reform, so we may just have to wait and see. Meanwhile, it would help a great deal for the information-gathering to begin steps toward the goal of continuous monitoring of costs, and projections of future moving cost trends. A universal HSA program will be slowed more because it is new, than because it is impossible.

The Health Savings Accounts uniquely provide a way to circumvent the problems created by "pay as you go," mainly making it possible to gather compound investment income on the unused premiums of young people, no matter how long it takes them to get sick and use the funds. Lifetime HSA also eliminates the issue of "pre-existing conditions", since all costs are calculated into the premiums; and thus it also eliminates gaming the system by those who delay the purchase of the insurance policy. These last two features of lifetime HSA require up-to-the-minute cost data, whereas the compound investment of idle premiums in an HSA terminating at age 65 probably does not. Either way, compound investment income is an intrinsic and unique feature, which has the great advantage of already having the sanction of law. Individually owned HSAs are portable, as employer-based insurance is not, and offer equal tax exemption.

Health Savings Accounts are disadvantaged by a general lack of discount arrangements with hospitals, long arranged for Blue Cross organizations and grudgingly given to newcomer competitors. HSAs lack a large sales force and are sometimes neglected by salesmen of high-deductible insurance, as well as exploited by debit card agencies with unnecessary fees, and investment advisors with excessive fees. All of these things are based on competitive resistance and are not inherent in the insurance plan. More effort should be made to ease them.

Compound Investment Income. Most people, strongly conditioned not to believe in any "free lunch", underestimate the power of compound interest, and fail to appreciate its tendency to accelerate over time. 2,4,8, 16, 32, 64, 128, 256, 512. The big gains are toward the end, while sickness costs get higher as we age; there's a fortunate match of timing. Luckily for illustration, money at 7% interest will double in ten years. Therefore, a dollar at birth is worth $512 at age 90. And it is slow to start; which means if you wait until your 40th birthday, it only costs $16 to catch up and have the same $512 by age 90. Another fact: the average healthcare cost of the last year of life is at present about $5000. That's less than most horror stories would have it, and this low average is explainable by the fact that many people just drop dead without any cost. Let's do some calculating.

Since current regulations permit a maximum $2500 contribution to an HSA, a deposit only once at birth and none subsequently, would find $1,250,000 in the account, surely enough to cover almost any health catastrophe. Depositing $2500 into the account every year from birth to death at age 90 would produce an unimaginably larger result, well beyond any reasonable expectation of average escalation of healthcare costs. Depositing nothing until age 40 and then depositing the $2500 would result in a death benefit at age 90 of only $80,000, but still 16 times the present average cost of the last year of life. Contributing a total of $2500 over twenty years would achieve the same result at twelve or fifteen dollars a year, but would actually encounter resistance from the investment people, who would object to handling such small amounts. But that's a welcome problem, indeed. If all you are worried about is the cost of the last year of life, get an HSA and stop worrying. Unfortunately, our government isn't investing at 7%, it is borrowing at 4%. That's the way we transform a $2500 deposit in an HSA into paying a bill that costs the government at least $10,000. The source of it: using the 1965 expedient of "pay as you go", which means today premiums immediately go to pay for the debts of the past, leaving nothing to invest. And with a retiring baby boom larger than the working generation, the government borrows from foreigners to make up the shortfall.

What's To Be Done With This? Simply paying for the last year of life is as simple as buying insurance to pay for your coffin. We can surely do better than that, but first, we need a transfer vehicle. The fact that Medicare is paying for just about everyone's death means we can transfer the money to Medicare to reimburse them for what they have already paid. They can accordingly reduce the payroll deductions and Medicare premiums by a comparable amount in advance, as an inducement for anyone who agrees and has enough money in his account. We can also use the "accordion" principle and pay for more years prior to death if there is money for it. Even using some of it to pay off the entitlement debt is better than not generating any income at all; only the Chinese benefit from the present approach. Don't forget that "the beneficiary" is really a constant stream of successive people. Although one is now dead, his successor is alive and will do other things once the government threatens to take some away.

It is tempting to consider whether lifetime healthcare costs could be covered by an extension of this idea. Not only present costs are incompletely available, but future costs and future investment returns are not predictable by anyone. The best that can be done is to overfund at first, extend in a deliberate manner, providing bailout avenues for both subscriber and government, and provide incentives to compensate for the overfunding. Seven percent projected income is perhaps generous and tax-sheltered, but still, must contemplate the possibility of a great deal of inflation in after-tax dollars. If it should not, more money will have to be deposited, and the subscribers must agree to that. Against that unpleasant eventuality, it should be a voluntary program, and thus slow to expand.

But therefore it must have enough reserves from the start, with latitude to use the surplus for non-medical purposes once the medical purpose is served. Perhaps something like the Federal Reserve should be considered to protect and regulate it -- public, but reasonably independent within a narrow mission mandate. The pressures to move authority entirely into the public sector, or into the private sector, should be somehow balanced to prevent either one from prevailing. At some times, the deductible will have to be shifted up or down, to keep it midway between the bulk of either outpatient or inpatient costs. Contributions will eventually have to be raised and lowered within broad bands. Alternatives will have to be found for approaches which are new or become obsolete. It is very clear that two insurance systems will have to run concurrently, one to invest and store the money, the other to pay the bills. They will need an umpire, especially if they are successful.

A Note About Investment Vehicles. In speaking of people of all ages and conditions, it must be assumed they are inexperienced, naive investors; some will chafe at this, emphasizing it is their money to do with as they please. There should be some appeal mechanism for this sort of person, but the best defense is good investment performance. Although Index Funds are relatively new, an equity index fund of U.S. stocks above a certain size should be both politically safest and reasonably profitable. The managers should have a certain discretion to use U.S. Treasury bonds, but nothing else without a formal appeal process. In view of the gigantic size, perhaps a few other options might be considered for those who demand them. The administrative costs of such a large fund should be quite low. The management should be aware that the investment advisory industry may not be completely pleased with this arrangement, so the opinion of experts should be treated carefully. The purpose of this fund is not to innovate financially, it is to pay medical bills efficiently, and with the minimum of public uproar.

III: Forestalling Unfortunate Side-Effects.

In the meantime, the Diagnosis-based payment system -- and the reaction of the hospitals to it -- has introduced a new dynamic. It usefully illustrates how far-reaching the unintended consequence of even a small reform can go, before it is even recognized as causing it.

Diagnosis-Related Groups (DRG) To change the subject, a budget reconciliation bill two decades ago slipped in a feature of paying hospitals one of two or three hundred flat rates (there are actually over a million possible diagnoses) for the whole hospitalization. It did not matter how long the patient remained in the hospital, nor how many tests or treatments he underwent -- same flat rate. In spite of efforts to look for "Episodes of Care", ambulatory medical care is not nearly so amenable to this rationing device. As a consequence, hospitals average a 2% profit on inpatient beds, 15% profit on accident rooms, and 30% profit on satellite clinics. Since most dual-use items have the same basic cost whether used for inpatients or outpatients, escalation of outpatient prices results in carrying some pretty fanciful prices over to itemized inpatients, for those items not covered by insurance.

The basic issue is severing connections between costs and prices, and exploiting the public's trust that some connection remains. This situation caused a notable surgeon to exclaim that the "only purpose of having health insurance is to keep the hospital from fleecing you." It is not clear to what extent discounts from inflated prices are used as a competitive weapon in the outpatient area, but the tightly controlled and overpriced ambulance arena suggests that practices bordering on antitrust violations may well exist in some regions. There seems to be the considerable exploration of the legal limits of the present system; medical school tuition is largely set by what the market will bear, and surpluses soon have a way of seeping out of the hospital system into the university's general finances. Colleges without medical schools are upset by this unequal financing mechanism. It is not clear how far this complexity is extending, but such unexplained disruption is bound to cause many eventual problems, return to cost-based pricing is an urgent need. The first step might be to require public disclosure of price/cost ratios in more relevant detail. To abandon cost-based pricing always invites governmental price controls.

Interest Rates, Investment Income, and Inflation When there is inflation, the value of money goes down, so you might expect interest rates -- the rental cost of money -- to go down, too. However, people anticipate higher prices, so lenders build a premium into the interest rate structure to compensate for the value of the money to be lower when it is repaid. That raises interest rates, and the Federal Reserve will generally raise them even higher to put a stop to inflation. So, buying and selling bonds is a zero-sum game, far riskier than it sounds. Consequently, there is a flight toward the common stock, thus raising its price. Meanwhile, inflation usually hurts business, tending to lower the stock prices. As a consequence of all these moving parts, long-term investors are urged to buy at a "fair" price and never sell, no matter what. Even that strategy fails for any given stock because somehow corporations seldom thrive for more than seventy-five years. So, the advice is to diversify into a basket of stocks, and the cheapest way to get that basket is to buy an index fund. In a sense, you can forget about the stock market and let someone else manage the index, for about 7 "basis points", that is, seven-hundredths of a percent. All of this explains the choice suggested for Health Savings Accounts of buying total market index funds. Limiting the universe to American stocks is based on a political hunch that it reduces the chances of harmful Congressional protectionism. Having said that, a Health Savings Account must raise cash from time to time, and to guard against forced selling in a down market, some average amount of U.S. Treasury bonds will have to be maintained. Ideally, the number of Treasuries would be small for young people, and grow as they get older, and therefore more likely to get sick. Pregnancy is the one universal cost risk for younger people, and they know better than anyone what the chances of that would be in their own case.

This approach is greatly strengthened by reference to the modern theory of a "natural" interest rate, to which the whole system has a tendency to revert, if only we knew what the natural rate is. It is not entirely constant, but over time it seems to be something like 2%. If we knew for certain what it was, we could set a goal for perpetuities like the Health Savings Account to be "2% plus inflation". Since inflation is targeted by the Federal Reserve as 2%, that would amount to an investment goal of 4%. If you can buy an American total market index fund consistently gaining at 4.007 % per year, you should buy and hold. If it rains less than that, it is either run by incompetents, or it is a bargain which will eventually revert to 4.007% and pay a bonus. If, on the other hand, it gains more than that, there exists a risk it will revert to the mean. That it is being run by a genius is sales hype to be ignored. We suggest buying into it in twenty yearly installments, which should balance out the ups and downs, so then you can forget about even this issue.

But don't count the same issue twice. In order to assure a 2% real return, it is necessary to obtain 4% in the real world of 2% inflation, and the compounded income of 4% accounts for both in equal measure. A compound income of 6%, however, is two-thirds inflation / one third "real", so artificially raising interest rates to control inflation can progressively overstate the requirement, and hence overdo the deflationary intent. Conversely, when the Federal Reserve fails to raise interest rates as Mr. Greenspan did, the result can be an inflationary bubble. The central flaw in adjusting prevailing rates to current natural rates is that we do not know precisely what the natural rate is. To go a step further for immediate purposes, we are also uncertain how much deviation there is between medical inflation and general inflation. As a result, the best we can expect is to make as much income on the deposits as we safely can, and continuously monitor whether the premium contributions to Health Savings Accounts might need to be adjusted. And the safest way to do that is to have two insurance systems side-by-side, one of them a pay-as-you-go conventional policy for basic needs during the working years, and a second one whose entire purpose is to over-fund the heavy expenses at the end of life and the retirement years, permitting any surpluses to be spent for non-medical purposes. With luck, the beneficiary might retain a choice between increased premiums, and increased (or decreased) benefits.

If these calculations are even approximately close, the financial savings would be several percents of GDP, a windfall so large that mid-course adjustments could be tolerated.

Competition With Hospitals, Not Necessarily Between Them It is comparatively effective for small hospitals to compete with each other, but as transportation improved they grew bigger and greatly expanded their market areas. At that point, they share with big banks the awkwardness of being too big to be permitted to fail. Exploiting this, they have more freedom to raise prices. As they become more efficient, the size which matters is their capacity to support a geographically wider community. It is mostly transportation feasibility which matters, so breaking up ambulance monopolies may hold part of the solution. Satellite clinics have many advantages, but price control is not one of them.

The institutions which suggest themselves as possible hospital competitors are Retirement Communities (CCRC). Because land is cheaper, they tend to be built in the suburban and exurban rings around cities, but the elderly population is growing. Severe illness and disability tend to increase with advancing age, so they suggest themselves as concentration points for all medical care in their region. Almost all of them have infirmaries, many of them have rehabilitation and assisted care capacity. It would seem that what they mostly need is inexpensive ambulance service and a relaxation of regulations which inhibit overlap with lower-level hospital facilities. And, let it be emphasized, an extension of health insurance coverage to allow them to be reimbursed. If general practitioners and pediatricians began to locate offices on the grounds of a retirement community, specialists would soon follow, along with laboratory collection stations and x-rays. Over time, they could be expected to transport surgical patients to distant hospitals, and return them to the local infirmary for convalescence. Some would acquire hospital satellite clinics, but there are too many of them for a single type of development. It is vastly preferable for them to have unlimited hospital connections and unlimited access to their facilities. Their great contribution is potentially to compete with hospitals for certain services, which would be greatly inhibited by single limited franchise affiliations. If competition is encouraged at this level, it could make the usual sort of governmental wage and price control much less necessary. The fear of abusive pricing is one of the major inhibitors of generous health insurance, and it is in the long term self-interest of all health care providers to resist it.

Let's stop for a moment to review where we are. Several books ago, I announced my conviction that Health Savings Accounts are just about the only alternative to the Affordable Care Act to have completed all the steps of legislation, and many of the steps of establishing a national network. It has been tested over a period of thirty years and has probably discovered and corrected most of the many minor flaws to surface in testing actual operations of a big project. HSA could be implemented nationally during the sort of insurance crash which has been widely predicted. Unless it faces a national last-ditch rebellion by millions of people, a few corrective technical amendments could be added in a week, and the rest of its implementation would be temporarily solved. I'm sure I don't want to see such a thing actually happen, but if it does, I think HSA would get us through the crisis. Perhaps for that very reason, the crisis won't occur because it wouldn't accomplish much except further polarizing people. After all, most people are not desperately sick all at once, and Health Savings Accounts could patch something together for the many who are not desperately sick, while hospitals are full of administrators who know what to do. Without hysteria pushing us, of course, we could do better.

A Necklace of Pearls. A much better approach would be to continue a slightly modified Health Savings Account while we study how to add pearls to the necklace, one by one. It could be done in a year, although two or three years would be better. There are several alternatives available for demonstration projects if there is time to implement several, picking out the best ones. If our Congressmen didn't spend so much time commuting, or in the telephone call center soliciting, they might conduct a surprisingly large amount of legislation. In that sense, adding an atmosphere of urgency might be a good thing. I believe calculations demonstrated there could be plenty of money available to mount a full implementation, with only political and psychological resistance. From Pearl Harbor to Hiroshima, we fought an entire World War in that much time.

Topple the Finance System? In fact, I believe the Federal Reserve would be horrified at the prospect of giving thirty million dollars to every citizen, and resistance from their direction would overall be useful in redirecting 18 percent of GDP. We don't operate on a monetary standard anymore, and yet we do. You can't be certain any printing press money would assuredly be redeemed in gold, but on the other hand, we own multiple tons of gold bullion in Fort Knox and similar places. Something could be patched together.

Start with Cost Accountants. My advice would be to start with a large team of accountants, to fan out and assess where the bodies are buried, and how bad the damage might have been. For example, I would love to know what the tangled motives could be, for hospitals to overcharge so drastically for drugs, knowing full well the insurance companies will disallow the majority of such overcharges, and their own business office will discount most of the uninsured bills. There must be some financial motive, probably rooted in some overlap between independent laws, but all I ever got from hospital accountants was a smirk when I questioned it. A whole nation has become infuriated with such billing practices which seldom result in much revenue. It took me years to figure out why outpatient charges tend to be so much higher than inpatient ones for the same service, and why business executives force employees into captive insurance policies in spite of "job lock" and associated unpleasantness resulting from employer ownership of the policies. And so forth. The basic question is, what is preventing market forces from holding prices down. Please don't just give up and ask for more stringent price controls. Just take a hard look at indirect overhead costs, for example. Health insurers surely must know some of the answers; shake tips out of their accounting retirees.

And so we come to reversing the payment flow. If you only increase the revenue, don't be surprised if prices rise to wipe out the profit margin. The first part of this book solves a lot of problems by providing more money to the patients. We must establish a balance between fluctuating costs and cash flow which creates a competition between retirement income and health provider income, each of which is unrestrained. Instead, they should restrain each other if we design the system to encourage it.

Originally the "lower counties" of Pennsylvania, and thus one of three Quaker colonies founded by William Penn, Delaware has developed its own set of traditions and history.

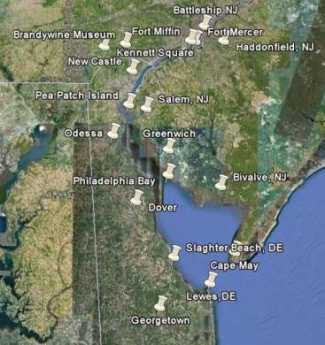

Originally the "lower counties" of Pennsylvania, and thus one of three Quaker colonies founded by William Penn, Delaware has developed its own set of traditions and history. Start in Philadelphia, take two days to tour around Delaware Bay. Down the New Jersey side to Cape May, ferry over to Lewes, tour up to Dover and New Castle, visit Winterthur, Longwood Gardens, Brandywine Battlefield and art museum, then back to Philadelphia. Try it!

Start in Philadelphia, take two days to tour around Delaware Bay. Down the New Jersey side to Cape May, ferry over to Lewes, tour up to Dover and New Castle, visit Winterthur, Longwood Gardens, Brandywine Battlefield and art museum, then back to Philadelphia. Try it! Millions of eye patients have been asked to read the passage from Franklin's autobiography, "I walked up Market Street, etc." which is commonly printed on eye-test cards. Here's your chance to do it.

Millions of eye patients have been asked to read the passage from Franklin's autobiography, "I walked up Market Street, etc." which is commonly printed on eye-test cards. Here's your chance to do it. In 1751, the Pennsylvania Hospital at 8th and Spruce was 'way out in the country. Now it is in the center of a city, but the area still remains dominated by medical institutions.

In 1751, the Pennsylvania Hospital at 8th and Spruce was 'way out in the country. Now it is in the center of a city, but the area still remains dominated by medical institutions. Grievances provoking the American Revolutionary War left many Philadelphians unprovoked. Loyalists often fled to Canada, especially Kingston, Ontario. Decades later the flow of dissidents reversed, Canadian anti-royalists taking refuge south of the border.

Grievances provoking the American Revolutionary War left many Philadelphians unprovoked. Loyalists often fled to Canada, especially Kingston, Ontario. Decades later the flow of dissidents reversed, Canadian anti-royalists taking refuge south of the border.