Second Edition, Greater Savings.

The book, Health Savings Account: Planning for Prosperity is here revised, making N-HSA a completed intermediate step. Whether to go faster to Retired Life is left undecided until it becomes clearer what reception earlier steps receive. There is a difficult transition ahead of any of these proposals. On the other hand, transition must be accomplished, so Congress may prefer more speculation about destination.

Health Savings Accounts: Planning for Prosperity was released before I could polish it, because a national debate about Health Insurance Reform was in progress, and I wanted to put some ideas into circulation. This second edition is a more polished version, arriving a little late to the party. It abandons the old version of N-HSA and substitutes a new version. Its revenue is not only greater, but becomes more predictable. So the net outcome is more foreseeable as we approach it.

Whether to stop there, or go on to three more distant goals (Retirement Communities as the New Center of Health Delivery, The Place of the Elderly in Modern Life, and Total Market Index Funds as a Currency Standard ) will be worked out as the project proceeds. That's the author's problem, not the public's.

It always has been clear Classical Health Savings Account promises only to reduce national healthcare costs by a big chunk, which may still not cover the full 18% of Gross Domestic Product we now spend. The New HSA surely reduces net costs still further, but with a caution: revenue depends on average investment income, and future discovery costs are unknowable.

- FRONT STUFF: Health Savings Account: Second Edition, Greater Savings

- Health Savings Accounts: Classical Model New topic 2015-09-03 22:42:59 description

- N-HSA: The New Health Savings Accounts Some new ideas are ready to be debated. Here are the ones I favor for 2016.

- (3) Obamacare: Speeches New topic 2015-09-25 21:48:47 description

- Passive Investing Low-fee, low-turnover investing of diversified index funds is sweeping away old-fashioned investment management.

- Old Age, Re-designed A grumpy analysis of future trends from a member of the Grumpy Generation.

- Why Bother Investing? In a sense, money is worthless until you spend it.

- Whither, Federal Reserve? (2)After Our Crash Whither, Federal Reserve? (2)

- Whither, Federal Reserve? (1) Before Our Crash The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

- Banking Panic 2007-2009 (1) Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

- Healthcare Reform: Looking Ahead (2) The way to make certain you have enough -- is to have too much.

- Medical Economics (2) New topic 2013-04-09 21:37:40 description

- Medical Malpractice The medical system is on the point of abandoning the city to escape abusive lawsuits. A series of observations about shared blame, ultimately assigns responsibility to the mistake of allowing this matter to be covered by insurance, thus creating a financial target.

- Medical Economics Some Philadelphia physicians are contributors to current national debates on the financing of medical care.

- Healthcare Reform:Saving For a Rainy Day Lifetime Health Savings Accounts

- Health Savings Accounts, Regular, and Lifetime We explain the distinction between Health Savings Accounts, Flexible Spending Accounts, and Lifetime Health Savings Accounts. Sometimes abbreviated as HSA, FSA, and L-HSA. Congress should make it easier to switch between them. All three are superior to "pay as you go", health insurance now in common use, only slightly modified by Obamacare. It's like term life insurance compared to whole-life. (www.philadelphia-reflections.com/topic/262.htm)

- Health Insurance Clinton Health Plan and its replacements.

- Government Organization Government Organization

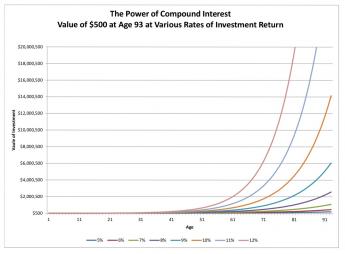

- Financial Planning for a Long Retirement

How should individual investors ensure they have enough money for retirement?

Such a person is often a professional or entrepreneur who has worked to accumulate the wealth. Legions of "advisors"line up to take this money and manage it or else to sell "products" that promise to solve some problem or other. Without this background, extra savings will be needed, to buy advice. And advice is not invariably reliable.

A person who has created his/her career and its wealth from scratch, can likely manage investments themselves, or at least supervise the process from a position of strength from observation. Reliable advice is not always cheap.

This collection of articles explains to the individual investor how to take control of their wealth. They may eventually decide to look for help from an advisor but they will retain control of their assets and they will know what to do.

Financial Planning videos on YouTube - Federalism Slowly Conquers the States Thirteen sovereign colonies voluntarily combined their power for the common good. But for two hundred years, the new federal government kept taking more power for itself.