1 Volumes

Second Edition, Greater Savings.

The book, Health Savings Account: Planning for Prosperity is here revised, making N-HSA a completed intermediate step. Whether to go faster to Retired Life is left undecided until it becomes clearer what reception earlier steps receive. There is a difficult transition ahead of any of these proposals. On the other hand, transition must be accomplished, so Congress may prefer more speculation about destination.

N-HSA: The New Health Savings Accounts

Some new ideas are ready to be debated. Here are the ones I favor for 2016.

Re-designing the Place of Medicare

One must be sympathetic with the original designers of modern conventional health insurance. They had few models to work with and no advance knowledge of how medical care would evolve in the following century. Most major scientific advances have driven disease costs away from working people. Consequently, retirees expanded in number. The result is employer-based insurance with a little remaining disease in the employees, but which still ends at the time of retirement. Consequently, Medicare developed in part as one way to tax workers to pay for retirees. Longevity continued to expand, but initial revenues became exhausted, and the government quietly resorted to deficit financing. As the balance of payments turned negative after 1965, we resorted to foreign borrowing. It is now revealed by Secretary Sibelius that 50% of Medicare funding is a subsidy, temporarily funded by borrowing (selling them U.S. bonds) from the Chinese government.

This situation cannot continue indefinitely, and it especially cannot be extended to other programs in the form of "single payer" programs. The Health Savings Account retains the spread-the-risk feature of insurance but more or less limits it to hospital inpatients, who are in no position to negotiate prices, by utilizing high-deductible insurance. In the outpatient area, the early adopters have demonstrated a 30% reduction in costs in the outpatient area, while prudent shopping is rewarded by returning the savings to the individual. It helps cost-saving to have a defined incentive, that any unused surplus may be used for retirement. This success prompts another warning: merging Medicare with other health programs would clash with merging Medicare with Social Security.

It seems certain to a doctor that the enormous resources being devoted to medical research will eliminate at least one of the half-dozen remaining expensive diseases within a decade or two. If we are lucky, the ongoing costs of this future cure will be less than the present cost of treating it. That's what happened when we woke up to the preventive value against heart attacks and strokes, of a little aspirin tablet. Even if early costs are high, patents soon run out, competitive products emerge, competition brings down the cost of that disease. Repeat that miracle five or six times in the next fifty years, and the whole cost issue changes. Instead of worrying about the cost of dying too soon, we will gradually worry more about the cost of living too long. Medicare will shrink, but Social Security will get more expensive. What could possibly make more sense than to merge Medicare with Social Security? And, what would be more unfortunate, than to merge Medicare with healthcare programs for other ages, thereby creating more or less direct competition for available funds and program control? Perhaps that could be avoided, but choices would be governmental rather than individual. And they would be wasteful, generating resistance to reducing one part of the program, rather than diverting any unused medical budget toward retirement benefits.

So it seems in the interest of retired people to soften their resistance to the development of programs to shift unused Medicare funds to retirement. That is, to close down Medicare as it becomes unneeded, allowing the individual subscriber to decide the balance between them, in his own particular case. Inevitably, that would provoke resistance, but it need not constitute the third rail of politics: touch it and you are dead.

Accordingly, we examine in this section of the book, just what might be involved in allowing voluntary, gradual, buy-outs of a Medicare program which surely cannot continue on its present course indefinitely. It's just one part, but an important part, of funding about half the cost of healthcare, other than Obamacare.

Rexamining the Role of Children

In a way, health insurance suits family plans better than individual ones, because often there is only one responsible working person to foot the bill for everyone. But equally often it is the other way, every ship on its own bottom. Politicians know a no-win situation when they see it, so the matter seldom gets an enduring if arbitrary solution.

So it should be no surprise that responsibility for obstetrical costs has no solution, only expedients in a changing world. It's probably one of the hidden pressures for letting the government pay for it, so we can all forget the issue. Another feature is that it's expensive. The statistic seems high, but 3% of health costs are supposedly derived from the first year of life, and that means $10,000, which really seems quite high. And the report of the first 21 years developing 8% of health costs, also seems high. But something costs that much, and its costs must be paid by someone. As I thought about it, childhood is the reverse of all other health costs, where most people can save money and then spend it. It's impossible to pre-fund newborn costs unless they are paid by some other generation, on the baby's behalf. If that's the case, what would be so bad about grandparents pre-paying a baby's cost?

Furthermore, the grandparents have only recently rejoined the family. In my own case, I had four grandparents like everyone else. But I never met them. I have two great-grandchildren who are almost as tall as I am, and numerous grandchildren who are taller. For decades I have had them to my house for Christmas. All of this seems to relate to my own longevity, and is the destiny of almost everyone else, too.

So this observation is the underlying basis for suggesting we examine generation-skipping for the first year of life. It has the additional advantage of lengthening the period for compound interest to work, especially if the grandparents can save some surplus from Medicare to start the process. If you add that desirable feature to Medicare, you have just about solved a problem where no one else has a clue.

Principles of Invesment Income, Multiplied by Compound Interest

One secret of success for Classical Health Savings Accounts lies in recognizing a single approach is inadequate; at least two approaches are required. Catastrophic health insurance spreads big risks (mainly hospitalizations), while tax-free accounts promote more frugal spending for small ones (mainly ambulatory care). Combined in an HSA, they do what neither does alone, by covering overlaps. Now I contend, six principles in combination can create even greater savings, when separately they might create more confusion.

1. Redesign Insurance. Health insurance has traditionally been upside down. Starting with "first dollar" coverage, really sick people feared bankruptcy when medical costs outran policy limits for the last dollar. Obviously, it would be better to ensure big catastrophes first, skipping small ones if funds run out. If we must have mandatory health insurance, the thought ran, let it be the high-deductible catastrophic variety, with out-of-pocket limits protecting outliers. To a certain extent, the Affordable Care Act moved in that direction, possibly opening room for compromise. Deductibles should be high, but co-payments are useless and should be eliminated. Subsidies should subsidize people, not specific programs, and should avoid taxing the same program they are supporting.

2. Indirect Transfers Between Age Groups. Working-age people largely finance the health system but most don't get sick themselves, whereas sick people are mostly retired and on Medicare. That makes young people restless, while Medicare breaks the national budget with a 50% subsidy. (It's largely accomplished through bond-loans from foreign countries, like China.) The age-related funds' transfer is desirable but is now largely left to hospital cost-shifting. The cost could be lessened by letting the worker keep health money in his HSA, earn interest, and spend it on himself when he ages. 2b. Furthermore, I propose we shift the cost of the two most expensive medical years of life to individual escrow funds during the period of investment. To be specific, shift the cost of the first and last years of life from coverage by catastrophic health insurance and Medicare -- to repaying average national cost (reported by Medicare) back to the insurers who originally paid the bills. That's technically known as first and last years of life reinsurance.

3. Funds Creation. How might we pay for this transfer? Well, in the first place, living people are assumed to have somehow already paid for their birth year. It will be forty more years before new ones are even half-way phased in. Even terminal care costs will not level out until life expectancy stops lengthening. Revenue, on the other hand, could commence immediately. The hard part of revenue production lies in fixing "agency" failures. That is, avoiding spending it in the meantime, and keeping middle-men from poaching on it. I propose individual escrow accounts are preferable to agency management by either government or private sector financial institutions. Saving for your own rainy day is much more palatable than taxing for transfers between demographic groups. The cost of passive investment in index funds is small, and long-run gross returns approach 11%, or 7% net. But middle-man costs are often too high. Considering the trillions in index fund potential, these inert investments might even be considered for a substitute currency standard. Gold is too rigid, government judgment always proves too inflationary.

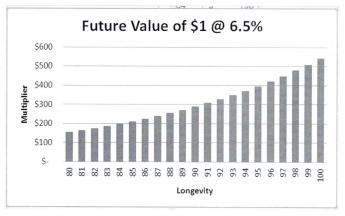

4. Compounding. Meanwhile, it helps to recall what the Ancient Greeks knew about compound interest. Money at 7% doubles in ten years, and therefore with life expectancy now at 84, can expect to double more than eight times. 2,4,8,16,32,64,128,256, (512- 1024). Unfortunately, the rounding errors also get compounded. Therefore, although the general concept is unchanged, one dollar at birth actually grows to about $289 at the average time of death by present expectations of it. By that time, life expectancy will likely grow by unpredictable amounts, so it might actually transform one dollar into $500 if inflation is held to no more than 3% -- or to some other value, more or less. The main hope for price stability lies, not so much with the Federal Reserve, as in medical science reducing the burden of disease and increasing the productivity of the delivery system. I feel confident last-year costs can be covered, either by patient contribution or by government subsidy, if -- transition costs are absorbed over the first decade or so, if the Federal Reserve can successfully hold inflation below 3%, and if medical science can cure one or two major diseases inexpensively in the next fifty years. Otherwise, this could merely be a proposal for generating tons of new revenue but would fall short of paying for all the healthcare affected. Even covering by only 10% would produce staggering sums, however.

Let me remind you, those extrapolations are for only one dollar invested. More specifically, the goal of the proposal is to pay for the last year of life by some variant of one-time investing of $150 at birth, possibly even as much as $50 per year. This should be enough to relieve the debt pressure on Medicare and to reduce the cost of catastrophic care for the rest of the population considerably. It's still much less costly than continuing the present approach.

5. Adding a Generation to the Family. To include the cost of children, we propose increasing the $150 at birth to $200 (potentially, $25 a year) and transferring the resulting surplus, from the grandparent's "bequest" to the Health Savings Account of no more than one grandchild at birth, thereby adding 21 years of compounding, broadening the scope to the first 21 years of life, and further reducing the premiums of catastrophic coverage for the rest of the population. Child-care costs are far more significant than they sound, and all health care plans have faltered on them. It is nearly impossible to refund the day you are born, particularly when the responsible parents are young and financially insecure, facing the cost of an automobile, a house, college education, and another child. For a remarkably small dollar cost, compound interest can greatly relieve this social environment, and therefore I advocate the small additional cost of extending the first year of life to the first twenty-one of them. And funding them via the grandpa route.

6. Tax Equity. Additional required regulations are more or less self-evident, but the most important one would be to permit paying for catastrophic insurance premiums by the Health Savings Account itself, thereby creating tax exemption equivalent to employer-based insurance.

(7) The overall result presented here is to shift the costs of children up to age 21, plus the last year of life, to a longer compounding period and to their ultimate source, which is working people from age 22-66. It adds a major source of revenue through extended compounding, and it does this at the reinsurance level, mostly insurance company to an insurance company. By shifting these costs, other programs cost less, and cost-shifting at the hospital level should greatly be reduced. As scientific research reduces costs, Medicare is destined to shrink, so its revenue can gradually be shifted to retirement income. That isn't exactly privatization, although politics may describe it so. In the far, far, future, health care might reduce along with a designated pathway to nothing but the first and last years of life. Or, the concept may be dismantled and pieces of it used in other ways.

(8) The alternative for tax equity is much more drastic -- of reducing corporate tax rates, sufficiently to compensate companies for losing their existing tax preference. For years, reformers have advocated tax equalization by eliminating the tax deduction for employees. It hasn't been successful, so now we advocate equalization first, reduction later. If that is blocked, there is no choice but to lower corporate taxes, paradoxically the source of the problem.

Making Money With Math

Two themes run through the following modification of the Health Savings Account idea. The first is, we should seek ways to extend the period of time, during which compounding has a chance to work. The definition of forbidden perpetuity was created in the Seventeenth Century: one lifetime, plus 21 years. There is no reason why an American judge could not declare some other period of time to be a perpetuity, but this one has served for several centuries and therefore probably is at least as useful as any other. It seems to be an adequate compromise between fairness of inheritance, and Puritan encouragement of self-advancement through merit and industry. Longer than that would discourage the work ethic for descendants, and shorter than that would discourage the work ethic of elderly parents who might not live to be rewarded for late-life efforts. Perhaps other considerations were at work, but I personally feel no pressure to change the traditional definition. Therefore, the average longevity plus 21 years is here accepted as the limit of tax-exempt inheritance. It, therefore, sets a time limit we should accept when we are looking for the maximum return on a Health Savings Account; from birth to 105 years later, and a little longer if average longevity increases.

That's the first goal. The second is to create uniformity in the name of fairness and to use the uniformity to calculate the future. Obviously, people die at different ages, but the last year of life is the point beyond which everyone has less interest in accumulating money for himself, and the first year of life is the time when birth costs occur to everyone. So everyone gets his full life expectancy to calculate returns, and the average longevity is a surrogate for that. That leaves an extra 21 years, which we utilize, to include the grandparents in the family circle, permitting the idea that grandparents are funding grandchildren. Because American demographics reveal 2.1 children per mother, they result in one grandparent funding, one child. Thus, the stipulation that each person who dies must contribute one average grandchild's cost to the inheritance pool, in one way or another.

If you estimate the average rate of compounding accurately, you should be able to calculate the maximum income achievable by Health Savings Accounts. Somewhat less accurately, it is possible to calculate and make mid-course adjustments to, future reductions of health care cost for individual persons. If the maximum is known and adjusted for failure to contribute to the fund, it should be possible to calculate the incentive for continuing to fund or to borrow to fun, in the face of some household disruption. A sense of security is created. More than anything else, an incentive to save is created in the young. Furthermore, each subscriber can calculate the very large consequences of seemingly minor middle-man costs, and therefore resist them.

Finally, a consequence of this design is to maximize the lifetime income of the designated escrow fund. Not only is the duration of compounding stretched to its maximum, but it is aimed at stretching from childhood to the time of maximum health expense, usually the last year of life, and thereby getting the most out of the investment. Exceptions will of course occur. By using national averages, the bookkeeping cost is reduced. By using Medicare cost data, accuracy is enhanced. And by switching the cost-shifting to the reinsurance level from the (at present) largely hospital level, subscribers should barely notice it is happening.

Graphs of New HSA

The "future value" of any sum of money is the same as the total amount accumulated in a set period of time, assuming a certain average percent of the tax-exempt gain in compound interest. In matters discussed here, the future value is only generally of concern over long periods of time. Because of compounding, the future value increases at the far end. Here is a graph of the future value of almost anything at 6.5%, starting at age 80:

|

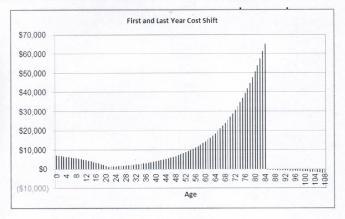

The hypothetical lifetime balance of the escrow portion of a New Health Savings Account would, on average, have a different shape, because the childhood portion is an inheritance at birth. It wears down over the next 20 years, so there is only a small but critical amount left over to grow during the working years, 21-66. Assuming the option is taken to fund both the first and last years this way, maximizing the income, it would look like this, assuming longevity of 84:

|

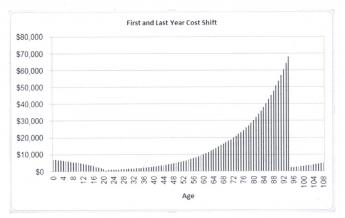

And for age 94, the last two curves have the same overall shape, but internally result in a surplus at age 94 of about $250 a year, because the future value curve tilts upward. Remember, this may be an artifact because there are ten extra years in which to develop new treatments to pay for.

:

|

It is component revenue would consist of $50 deposited in the account at 6.5% compound interest, every year from birth to death. That would vary with the life expectancy, which is now 84 but reasonably expected to reach 94 at some time in the next 90 years. When the contributions stop at death, the compound interest continues to accumulate for up to another 21 years, following the common law principle that perpetuity begins after "one life, plus 21 years".

At the death of the grandfather client, the fund is nearly depleted by his first-and-last year of life reimbursements, but that payment might possibly be delayed a few months if it exactly matched his actual expenses. It could be immediate, with administrative savings, by reimbursing all primary insurance by the average cost of all last years costs. The funds left over would be comparatively small, but they would still generate income until the account is closed. However, they are a contingency cushion, and could be modified if other requirements appear.

There is a calculation perplexity in the fact that compound interest turns sharply upward, toward the end of life. Therefore, an even distribution of deaths, both longer and shorter than the mean, leads to a "profit" from the ones who live longer. Disregarding this point, the outermost limit of contributions at this level of sharply rising returns might be as much as $832,000 for the longevity of 94 and $441,000 if longevity does not increase at all. (That's assuming Obamacare joins the same system but substitutes Catastrophic insurance for the present arrangement.) If longevity does improve, contributions of $50 a year are adequate. The longevity of less than expected (wars, famines, etc.) would mean the deposits would have to be increased. Contributions of $60 a year seem more than adequate, however.

These calculations are based on withdrawals at the time of death, for last year of life, plus the first year of life, and a small surplus to spare. For the time being, the costs and revenue of Obamacare are left to that program to worry about. These accounts continue to accumulate interest during the client's 22-66 age period, but do not affect them. The thirty million uninsureds are also excluded, but it would be my suggestion that they differ so much from each other, they ought to have separate programs for prisoners in jail, mentally retarded, etc.

The Accordion Principle

If you will tell me the average investment return and the amount you invest in an escrow account, I can easily tell you how much money you will have at any future age. You can't do that very well, so we are going to show some rough guesses. It is simple to tell you the amount you will have if you live an average life expectancy, it's just hard to say what the life expectancy will be in the coming century. Next, you will have to tell me what kind of healthcare you want to cover, at today's rates, and at today's rate of inflation. Future projections are just guesses, however. The simplest kind of question would be what kind of health care do you want to cover, covering what ages, paying for it at the time of your death, at average life expectancy. In parentheses after each amount you would need, is the amount that would have to be deposited at birth to reach that particular goal at the death after 6.5% interest compounded. To stay on the safe side, the following costs are based on fractions of $ 350,000-lifetime calculation, rather than actual figures, and are therefore possible on the high side. For example,

Last year of life:$48,000 ($165 at birth, once)

Last two years of life:$56,000 ($193 at birth)

Last three years of life:$64,200 ($221)

All 18 years of Medicare:$187,000 ($646)

All of Medicare, paying no premiums(13%):$162,000 ($559)

All of Medicare, refunding payroll deductions(38%):$118,000 ($107)

First year of life (grandchild):$10,000 ($34)

First 21 years of life (grandchild):$28,000 ($96)

First and last years of life: $58,000 ($200)

All of Medicare plus all of childhood: $ 146,000 ($504)

Note: All "data" above are approximations of relative amounts. The last year of life contains hospice, etc, and the first year reflects obstetrical costs. Some cost offsets cannot be readily calculated for individual years from public sources. In fact, one of the implicit reasons for suggesting first-and-last year funding is to separate those costs which can be reduced through eliminating the disease by research, from the two extremes of life, where that is less likely.

Other things can be calculated, but the math gets a little beyond my pay grade. After all, if you reimburse the cost of the last year of life, the costs for the other 18 years of Medicare will be reduced. To calculate that, you would have to know how many Medicare recipients there are at various ages, and whether certain age groups have special costs. If you reimburse all of Medicare costs, the resulting cost for all of Medicare should be zero, so you are allowed to deduct all present funding sources, but only in that one instance. But there are lots of complicated data, like how much do we owe the Chinese Government for Treasury bonds to cover previous deficits, and do you want to include these servicing costs in the cost of Medicare? Do you actually want to do this, or are you just shopping? This is a quick shopping guide.

The accordion principle should be clear enough. If someone finds a cure for cancer, we could probably afford to reimburse two or three more years at the end of life. In all probability, a system like this would start with the last year and add other portions of the program if surpluses appeared. To do this sort of thing in an orderly manner, it would be desirable to start searching immediately for portions of all healthcare programs to peel off at pre-calculated rates. Not everything would be as simple to calculate as the average cost of a particular year of life. Cures for the remaining dozen major diseases are probably inevitable, but the timing and cost of those cures are impossible to judge in advance. The extraordinary extra costs of being born and dying do the bear investigation but are not relevant to this immediate discussion.

So we start with an average balance at age 84, after a lifetime of depositing $50 a year and investing @ 6.5%, of nearly $300,000. What would you like to fund with that? The answer I would give is the healthcare costs of the first and last years of life. They would phase in gradually, and give the greatest impact for the money. And the deliberate use of approximate numbers is intended to imply only that a relatively small amount of investment will buy a whole lot of healthcare if you go about it in this general way. Plenty of people can supply more precise calculations, but nobody is likely to come closer to the final answer than this.

Reducing This Process to a Formula? This approach reduces to: accumulating a sum of money in an escrow fund starting at birth and reaching a peak at death; then re-distributing the accumulation to repay a series of other funds which have actually financed the medical care. By making reasonable assumptions about the ingredients of this process, we can approximate its limits. We chose 6.5% as an interest rate. It was a stretch perhaps but allows simple calculation by the reader. If you take the trouble to divide the amount required by the (single-premium) deposit at birth, you will see the ratio is always 289. But this only applied to this longevity of age 90 At age 80 it would have been 154, and at age 100 it will be 543. That is, if longevity continues to increase, we can expect the multiplier to increase returns toward $543 per dollar invested at birth. The consequence is, as longevity increases by ten years we can provide more money for the same investment. In this case, we choose to represent it as $250 per year bonus for the elderly during their Medicare years. More likely, it should serve as a margin for error in these distant uncertainties. And it certainly illustrates how spending from the fund should be as delayed as possible, to achieve maximum returns.

Selecting Pieces of the Transfer Process. We show in the table what the average balance should look like within the escrow fund. It essentially transfers $70,000 to a fund with a lifetime duration for compounding, instead of using the actual age of the decedent, and it reaches for the maximum possible interest income; the graph shows the lifetime balance of the fund at various stages of life. Theoretically, it could be used for any healthcare purpose, but the reality is that distant events are more efficiently served. Although transfers between generations may seem bizarre, they seem to be the most rewarding way to pre-fund the health costs of newborns. For practical purposes, this is often the only it can be done, at all.

The Transition Into N-HSA

Since we propose to fund the end of life with money generated many years earlier, and since the whole structure disintegrates if funds are spent prematurely, it might be a long time before savings amount to much for the people funding them. A long gap between savings and spending generates the income windfall, but failure to distribute the windfall generates restlessness. Saving for one's own later spending does help pacify restless people, and is a major reason for using individual accounts rather than pooling. Minimal amounts of insurance and government redistribution are necessary, but as much as possible should be confined to 5% of the population which generates 40% of the costs. Self-interest thus concentrates transitional revenue as a whole toward individuals who do not live long enough for a full cycle to rescue them. With many contingencies certain to arise in such a long interval, it is difficult to construct a convincing model, except by estimating the upper limit of what it can produce and then guessing at the lower limit of what might satisfy the participants. What follows is an attempt to do that.

The cost of dying is always likely to be greater than the cost of being born. In our estimates, it is taken to be five times as great. Between birth and death, rent-seeking is a formidable competitor to program reduction whenever science produces lower medical costs. Intermediate steps and middle-men should be as few as possible. A reward system should be devised for intermediaries who demonstrate low costs. To be blunt about it, this is one of the strong arguments for individual rather than merged accounts, and private rather than political control; history shows a need for such a bias. It has been Medicare experience that 5% of the clients generate 40% of the costs, so here is another guide for the model. Each year, about 6.6% of Medicare patients die. The number of newborns plus immigrants of various ages are both likely to be capricious and will constantly vex projections. We must do better than we did with the baby boom bulge, where adverse projections were ignored for decades. Scientific advances are likely to mitigate diabetes, Alzheimers, cancer, Parkinsonism, osteoporosis, and a dozen less common degenerative diseases, during the next century. So longevity will increase. Although a dozen, now less common, diseases will take their place, the tendency will be for healthcare costs to decline after age 55 and diffuse more widely after age 75. Since costs will be less affected before age 55 than afterward, there is a potential for investments and compound interest to rescue us in time, since Medicare now covers about half of the costs, and Medicare will continue to expand for increasingly older members. As costs flatten out, there will come a time to take the jump to an entirely new but less expensive system.

The secret of a successful transition is to hold back expenditures but accelerate revenues until the two are close. Then take the jump.

There are such big differences in average health costs between men and women, between regions of the nation, and between employment situations, not to mention income brackets and ethnic groups, the earnest, honest statistics available to the public about its health costs are alarmingly variable. When the recent commotion about the costs of Obamacare are added in, with the delayed changes in the status of employment inclusion, plus unexpected jumps in insurance premiums ranging up to 50%, this seems like a poor time to be talking absolute numbers. Consequently, we prefer to make our transitional projections in terms of relative values. It seems more accurate to say that if women of reproductive age continue to cost 20% more than men, the savings will be 20% greater -- if you follow our plan. Consequently, it is probably more meaningful to project a 50% improvement in both costs, than to make a thousand mistakes in estimating all the numerical variations of the same idea. Only when prices stop changing so rapidly will it be safe to be more specific.

Accordingly, we note that substituting catastrophic insurance for Obamacare ought to reduce costs by 30%. And paying for childhood and last year of life by reinsurance-switching ought to shave off 20% more. Consequently, the addition of $50 per year premium cost (paid into the escrow fund) and substitution of catastrophic insurance, combined ought to reduce costs by about 50%. Since Medicare now consumes about half of health costs, we ought to be ready to complete the transition in about half of the life expectancy, or 42 years. Scientific advances should shorten this time interval, and the many extra suggestions of this book ought to provide additional financial cushions against surprises. Consequently, we project that a transition should take no longer than 42 years, and we fervently hope that luck could improve on that. But 42 years is what we project. Can anybody propose a plan which would improve on that projection? It's, of course, a pity we didn't do this ten years ago, so it would only take 32 more years, but that should be a caution that if we spend ten more years calling each other names, it will take 52 years.

A physician friend of mine was a patient of a famous neurosurgeon who had joined a group and accepted a salary. Quite recently, he visited the neurosurgeon, only to have the interview interrupted by an automated telephone call. The automated message was to the effect that time scheduled for the visit had expired, and he should quickly terminate the office visit. The neurosurgeon remonstrated, to little avail. It seems safe to predict this whole relationship is soon to terminate, although it will be interesting to watch. There are limits to what evasions can be devised, as well as to what controls will be tolerated. I predict this neurosurgeon and this institution will eventually test such limits.

In the same way, I predict a funded pre-payment system will eventually devise enough compromises to keep its system functioning. It produces too much extra revenue to tolerate unlimited abuse. Any system which can produce so much revenue that inflation protectors are necessary, and one which at the same time is so complex it requires actuaries to project revenue--will find the necessary accommodations.

In Sum: N-HSA

So now we have two products, Classical HSA, and New HSA. The first is growing and prospering, but needs some brief, liberating Congressional language to free it from tax-inequality, and deposit limits. With about two sentences of legal language, the Classical version should be a wonderfully simple way to reduce healthcare costs and provide a way to fund retirement costs at the same time.

The New-HSA, by comparison, would require much more extensive legislation, but it could result in a massive reduction of healthcare costs. It is capable of enlarging for new remedies, and shrinking if we cure a few diseases. It could even accommodate subsidizing the poor, or building substantial retirement funds. It could provide a framework for whole-life approaches in an environment of competition if people with that sort of experience step forward. It would, however, require a great deal of legislation. It would encounter opponents who would be disadvantaged by change, by disintermediation, by competition, and by politics. So it might not look like what I envision after we are through with it.

Its greatest danger is its greatest strength: since it could make healthcare cheaper, it could be captured by those who desire, not improved health so much, as an improved Christmas tree.

8 Blogs

Re-designing the Place of Medicare

New blog 2015-10-07 20:31:54 description

Rexamining the Role of Children

New blog 2015-11-12 21:58:05 description

Principles of Invesment Income, Multiplied by Compound Interest

New blog 2015-10-01 18:42:52 description

Graphs of New HSA

New blog 2015-11-04 20:25:56 description

The Accordion Principle

New blog 2015-11-08 22:19:17 description

The Transition Into N-HSA

New blog 2015-11-10 21:59:25 description

In Sum: N-HSA

New blog 2015-11-11 00:20:15 description