Related Topics

N-HSA: The New Health Savings Accounts

Some new ideas are ready to be debated. Here are the ones I favor for 2016.

Graphs of New HSA

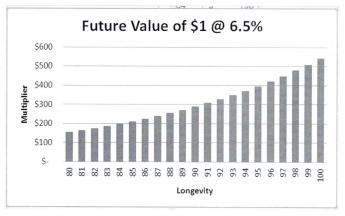

The "future value" of any sum of money is the same as the total amount accumulated in a set period of time, assuming a certain average percent of the tax-exempt gain in compound interest. In matters discussed here, the future value is only generally of concern over long periods of time. Because of compounding, the future value increases at the far end. Here is a graph of the future value of almost anything at 6.5%, starting at age 80:

|

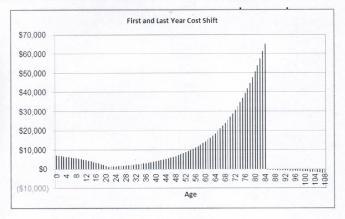

The hypothetical lifetime balance of the escrow portion of a New Health Savings Account would, on average, have a different shape, because the childhood portion is an inheritance at birth. It wears down over the next 20 years, so there is only a small but critical amount left over to grow during the working years, 21-66. Assuming the option is taken to fund both the first and last years this way, maximizing the income, it would look like this, assuming longevity of 84:

|

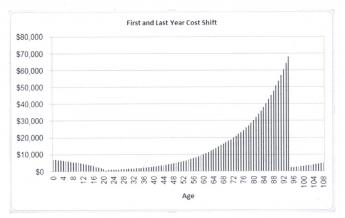

And for age 94, the last two curves have the same overall shape, but internally result in a surplus at age 94 of about $250 a year, because the future value curve tilts upward. Remember, this may be an artifact because there are ten extra years in which to develop new treatments to pay for.

:

|

It is component revenue would consist of $50 deposited in the account at 6.5% compound interest, every year from birth to death. That would vary with the life expectancy, which is now 84 but reasonably expected to reach 94 at some time in the next 90 years. When the contributions stop at death, the compound interest continues to accumulate for up to another 21 years, following the common law principle that perpetuity begins after "one life, plus 21 years".

At the death of the grandfather client, the fund is nearly depleted by his first-and-last year of life reimbursements, but that payment might possibly be delayed a few months if it exactly matched his actual expenses. It could be immediate, with administrative savings, by reimbursing all primary insurance by the average cost of all last years costs. The funds left over would be comparatively small, but they would still generate income until the account is closed. However, they are a contingency cushion, and could be modified if other requirements appear.

There is a calculation perplexity in the fact that compound interest turns sharply upward, toward the end of life. Therefore, an even distribution of deaths, both longer and shorter than the mean, leads to a "profit" from the ones who live longer. Disregarding this point, the outermost limit of contributions at this level of sharply rising returns might be as much as $832,000 for the longevity of 94 and $441,000 if longevity does not increase at all. (That's assuming Obamacare joins the same system but substitutes Catastrophic insurance for the present arrangement.) If longevity does improve, contributions of $50 a year are adequate. The longevity of less than expected (wars, famines, etc.) would mean the deposits would have to be increased. Contributions of $60 a year seem more than adequate, however.

These calculations are based on withdrawals at the time of death, for last year of life, plus the first year of life, and a small surplus to spare. For the time being, the costs and revenue of Obamacare are left to that program to worry about. These accounts continue to accumulate interest during the client's 22-66 age period, but do not affect them. The thirty million uninsureds are also excluded, but it would be my suggestion that they differ so much from each other, they ought to have separate programs for prisoners in jail, mentally retarded, etc.

Originally published: Wednesday, November 04, 2015; most-recently modified: Sunday, July 21, 2019