2 Volumes

Money

New volume 2012-07-04 13:46:41 description

Second Edition, Greater Savings.

The book, Health Savings Account: Planning for Prosperity is here revised, making N-HSA a completed intermediate step. Whether to go faster to Retired Life is left undecided until it becomes clearer what reception earlier steps receive. There is a difficult transition ahead of any of these proposals. On the other hand, transition must be accomplished, so Congress may prefer more speculation about destination.

Why Bother Investing?

In a sense, money is worthless until you spend it.

Planning Horizon: Review Benchmarks

|

| The Economist |

Some waggish but wise publication, perhaps The Economist, reported on the accuracy of predictions at various times in the future. Predicting what you can accomplish in a year is almost always an over-estimate; you can't possibly accomplish that much in a year. Predicting twenty years in advance has the opposite flaw; things will change so much in twenty years, the average person will almost invariably under-estimate the future. So, what's the best time for predictions? According to The Economist, it comes out to be about six years.

Five years seems somehow easier to remember, so let's state a principle of financial planning: review your goals every five years with some professional help. The young fellow needs to have a lawyer review his will because he probably doesn't have one. He needs someone to take a hard and skeptical professional knife to the insurance salesmen who are currently circling their prey. And someone needs to review all of the government, tax and regulatory changes that will affect a young family. For most young people, the investment decisions about stocks and bonds are small because accumulations are small for everyone except professional athletes and entertainers.

If your investment pile is small enough, you can fool around a little. My father used to say the best thing that can happen to you is to lose some money when you are young. When you become tired of that, just make regular automatic deposits into a low-cost widely diversified no-load mutual fund that is very large, say, holding a trillion dollars in assets. It will pretty surely grow steadily in good times and bad, and serve as a warning benchmark for assessing all those fly-by-night investment managers who will besiege you when you accumulate enough money to be worth fleecing.

It's a pity to waste ten or so years of investment opportunity, however. Money at 7% will double in value every ten years. You will probably want to double your nest-egg as many times as you can, which is likely to have a ceiling at 10%, so figure doubling every seven years the rest of your life expectancy, and it is easily shown that frittering away those opportunities to double is a regular, pathetic, loss of opportunity for most of us between the age of sixteen and thirty. Take your hoped-for nest egg at retirement age and double it two and a half times, and you will see what a huge opportunity is regularly lost by just about everyone.

Your parents can improve on that by making investments on your behalf, starting the day you are born. That would cause five extra doublings of your investment accumulation at retirement. But plenty of people have learned the disappointments of betting on infant futures. If you can essentially afford to throw the money away as bad luck, go ahead and do it, but if you are risking someone's college education to do it, then you had better stay away.

A probably more serious debate can be generated by discussing the risks of giving money to teenagers, who may then get all out of social control, throwing in your face, "It's my money and I'll do as I please". The main answer to that offensive discussion is to point out just what it is that most teenagers would do if they had the freedom to do it. Some frugal cultures like the Pennsylvania Dutch will give children some money, hide it secretly in a safe-deposit box without telling the child, and then reveal it when the child seems to be sensible enough to withstand the fever of a gold-rush. The worst outcome of all is to drain the incentives, depriving the child of reasons to work hard. Unfortunately, most teenagers now grow up in a suburb, where it is difficult to conceal the probable existence of assets.

Perpetuities

Although some churches and mummies are well preserved after thousands of years, and no doubt a few corporations do last century, the fact is most of them don't last very long. Most new corporations go bankrupt within ten years, and only one (General Electric) of the original thirty members of the Dow-Jones Industrial Average existed in 1900. Members of the Dow may seem the biggest and best, but in fact, live on a slippery slope. Not-for-profits, like churches, may do somewhat better, although the handful who approach perpetual status may be rare exceptions. One big reason not to leave a major bequest to any of them may well be that most will not survive. While we are on this subject, the same reasoning applies to the stock in for-profit corporations. Since few of them thrive for more than seventy-five years, the idea of buying their stock, holding it forgotten in a safety-deposit box, and passing it on intact to heirs, is probably doomed to investment failure. The oldest stockholder company in America is called the Proprietors of West Jersey, founded in 1676 but still meeting once or twice a year. It would be moderately interesting to know how well this investment performed over the years, but Google sounds like a better bet offhand. Just don't hold it too long.

|

| Cotton Mather |

There may be a connection between success as a non-profit and success in the merciless marketplace. Those who have compiled statistics will tell you that steadily withdrawing more than 4% a year from an endowment portfolio, sooner or later leads to a day when there is nothing left. Most trustees expect better results than that, and most managers of non-profits will need more than that, no matter how big the pile was when they started. Sooner or later, markets will decline, mistakes will be made, and the endowment will be exhausted by "emergency" withdrawals which relentlessly withdraw more than 4%. This pitiful decline might be avoided by gathering the managers of influential non-profits together, giving them a stern lecture, and somehow forcing them to live within their means, but offhand nothing sounds more futile. Jonathan Edwards and Cotton Mather were said to be good at haranguing. But since it must be obvious that non-profits usually survive by constantly soliciting fresh endowment funds, what would be the matter with taking a direct approach to that goal. Why not just state in advance that the institution is only intended to do its good work for say fifty years, and then it must turn its residuals over to somebody else? Not many endowments have been limited to a lifetime of fifty years, but in those who have done so, the experience seems to be that most of them immediately set about to raise additional funds to keep the institution from disappearing. The American Enterprise Institute in Washington, for example, started out dispensing about a million dollars a year; last year it dispensed over $30 million. Whether he intended it or not, the message Mr. Olin transmitted was not that think tanks are only good for thirty years. He told his executors in effect, "You have some seed capital with which to start a think tank. Whether it lasts longer than fifty years, is now up to you."

Taxes as a Form of Consumption

About half of the American public pays federal income taxes, and among the half who don't, a great many receive a green government payment check, meaning they have negative income taxes. The tax assistance companies, H. and R. Block and the like, had little for their offices and staff to do in January, February and March until someone hit on the idea of processing "fundable tax credits" for a fee. That is, the lower-income segments of the population get the promise of an April tax "rebate" as the consequence of tax-form preparation, so H. and R. Block just loans them the money, discounted for fees and interest. It keeps staff busy, generates revenue. Hardly anyone in the upper income half of the population is aware of all this, so there is little political friction. This whole system of income redistribution quite effectively keeps the two halves of the population sitting in the same chairs at the tax-preparation offices, but in different months of the year; one half getting paid, the other half coughing up the payments.

It thus becomes possible for two inflammatory slogans to bandy about, without starting fistfights or revolutions. The first was overheard at a local bank, one stranger remarking to another, "Has it ever occurred to you that taxes are a form of consumption?" To which the other person replies, "Yes, and taxes are the largest expenditure I make." A nation which once went to war over a two-cent tax on tea is remarkably passive about the ways things have evolved, but this essay is not devoted to unfairness. Prepare to hear how the upper income brackets might reduce their taxes, whether that counts as decreased consumption or not. Whenever you tax something, you get less of it; if you tax public income more, the public will earn less. So, this little essay is serious when it proposes that we all earn less, so we can get taxed less. And being taxed less, we need save less for our retirements.

The general principle is this: income is usually taxed in the year it is earned, with some exceptions, rebates and deferrals. The exceptional situations are often referred to as "loopholes" and therefore live in political jeopardy. However, if a person spends the money or dies while these deferrals continue to exist, the income may escape taxation entirely. In a sense, the largest loophole of all lies in the present fact that nearly half the population pays no income taxes at all, so saving income earned under those circumstances may lead to investment capital, which is later spent during highly taxed periods of that same person's life. Money earned by a child, usually on investments donated by a relative, is an example. Since at present, a child may receive annual gifts of $13,000 tax-free, as much as a half-million dollars can be accumulated in this way, always at the risk that laws may be changed and, further, at risk of spendthrift abuse by a psychopathic child. Whether these are wise risks for a parent to take, depends in large part on what sacrifices are made for the purpose, especially loss of parental restraint of unwise spending. A much more serious argument grows out of the possibility that money in the hands of children who lack experience in deferred gratification may actually provoke recreational drug use, or other sociopathic behavior.

Finally, lack of planning may create opportunities as much as planning does. A person who has paid little attention to financial planning may arrive at an advanced stage where life expectancy is considerably shorter. Savings at that point may be divided into money on which deferred taxes must be paid when you spend it, and money on which taxes have already been paid. More savings will be consumed if the individual triggers deferred tax liabilities, than if he just uses up money on which taxes have already been paid. Therefore, if he ignores lifetime habits and spends after-tax capital first -- the whole nest egg will last longer. But none of this deferred-income tax issue can compare with the problem of income on which taxation has been completely forgiven at the time it was spent, the so-called tax expenditures. The largest such tax expenditures are on the interest of home mortgages, on employer-paid (but not self-paid) health insurance, and employer-paid retirement income. Of these, the least consequential are the retirement income, because the tax is merely deferred, not completely forgiven. The two biggest items are home mortgages, which lie at the root of the 2007 financial crash, and employer-paid health insurance premiums, which triggered the Obama health proposal of 2009. The Obama plan purports to rein in health costs, but is estimated by the Congressional Budget Office to cost the Treasury $100 billion a year.

Extra! In the Fall of 2011, this boring matter suddenly came to the surface, in the form of huge American deficits threatening to bankrupt the country, as they were apparently actually going to do in Greece. As politicians do, many attempts were first made to rename the over-spending issue for partisan advantage. It was, for instance, tax expenditure. It was, possibly, a sovereign debt crisis. In any event, the Congressional Budget Office included such wealth redistribution under the heading of tax expenditure, which totalled a trillion dollars. Since everyone was searching for a painless category to eliminate in order to balance the budget, this term was hard to avoid. As far as Congress is concerned, the national deficit is whatever the CBO says it is, and in this case it lumped a lot of things together which politicians would like to split apart. When you take things in small pieces, it becomes possible to boil the frog by slowly heating it up before it realizes it is cooked. Lumping things together induces the frog to jump out of the pot, but however that may be, it has got lumped together by the referee of such matters, and there is a strong possibility it will stay lumped.The essential point for accountants to focus on, is that tax expenditures are all counted as revenue when any non-accountant can see they are expenses. For political speech-making purposes, this distinction is vital and no opponent will let another politician wiggle out of it. And the beauty part of it is that it also spotlights three of the most besetting evils of modern politics: the tax exclusion of employer-based health insurance, the home mortgage interest tax exclusion, and the "earned" income tax credit. The first of these is responsible for our health insurance mess, and the other is responsible for our home mortgage crisis; the two main political problems of the day are suddenly plopped into the limelight, just when a lot of people are looking for ways to hide them. Furthermore, this bombshell was fired by a panel of the four outstanding tax economists of the nation, each of them roundly denouncing them as unthinkable ideas that never should have been born in the first place. Alan Greenspan, famous for unintelligible speech, simply said all of these tax expenditures, every one of them, should be eliminated immediately. One would hope that is clear enough. Martin Goldstein, formerly chairman of President Reagan's Council of Economic Advisors, agreed. As did former Governor Engler of Michigan, widely acknowledged to have rescued his state from impending bankruptcy. Senator Nelson, a Democrat from Florida and chairman of the committee, positively beamed with pleasure. It was hard to think this was anything but a turning point in history; let some political candidate disagree, and he can expect to have his audience shown a videotape of this succinct epic in the history of Senatorial hearings. These greybeards said, in what was obviously an unrehearsed moment, just eliminate these three terrible ideas in one stroke, and the national deficit will be reduced by a trillion. That's what they said, and it's easily proved that they had said it.

Designated Lifetime Funds

|

| Social Security |

Except for Social Security, most retirement funds are not required to be tax-sheltered ("Federally Qualified"), but one would be foolish not to take advantage of the option where possible. Ordinarily, just about every other form of saving must first net out federal taxes. The debts of state governments ("municipal bonds") are free of federal but not state taxes, but reflect that benefit by paying a lower interest rate; any overall advantage must be calculated individually, and quite often it is non-existent. Mandatory taxable income, more-or-less mandatory tax-exempt income, and optional; that's your choice, except for the decision to put them in a federally qualified pension fund. Most people just throw the ownership certificates into a safe-deposit box and forget them. This article suggests you create three funds, whether in a lock-box or brokerage account and mentally rename them by overall purpose. There's not much you can do about tax status, but you have a little latitude about how and when you spend the money. It can make a certain amount of difference because increasingly it is true that investment performance is affected by taxes and fees. Friends, neighbors, and classmates may tell dazzling stories about astonishing investment luck, but if you want to have the best performance in your social circle over the very long haul, you would be well advised to focus on taxes, transaction costs, and fees. Especially fees.

|

| Saving Bonds |

When Grandpa gives a brand-new grandchild a hundred dollars, it can be spent on a new rattle or it can be invested. Rattles usually win, but occasionally it gets invested; what it's worth when the newborn finally dies will mostly depend on two things: how old he is when he dies, and how young he was when he started the investment. To make it easy to calculate, let's assume a life expectancy of 85 years, and an interest rate of 7%; that seems to imply a value of $40,000 at the time of death. That seems to imply a value of zero if he dies without spending any of it, and value somewhere around $30,000 if he pays current income taxes. But if he pays $100 a year for the lock-box, he will only have $20,000 left after expenses. And if he pays fees for his checking account, or receives only nominal interest for a savings account, he may end up with nothing at all. Since that's the usual outcome of most cases of Grandfather gifts, perhaps the choice of a rattle isn't so reprehensible. The whole investment process is too expensive to bother with until the sum involved is several thousand dollars. At fifty times the hundred dollar gift we started with, the investment is $5000, and its final result is a retirement fund of two million dollars. Yes, the arithmetic can be argued with, and yes, lots of things can go wrong in 85 years. Maybe a one-million dollar benefit is more likely, but no one can dispute that it's a pretty easy way to die a millionaire instead of a paper.

All right, that's your Contingency Fund. It's taxable, but almost everyone can start it pretty young and forget about it for long periods of time.

|

| Tax Fund |

The Tax Exempt Fund gets created when you start to work, even for a few days as a teenager. Several percents of your earnings will be withheld for the Social Security program, which requires that you apply for a Social Security number. If you wish, you can start depositing up to a set limit of your earnings as a tax-exempt fund for retirement, currently called an IRA or a 401-k fund. Your income taxes for the current year will be tax-sheltered, up to the amount taxed on the amount you contribute. It's a good thing to get one of these funds started as soon as you are legally able to do it, so the mechanics are completed while the amounts are still small. The suggested funds are the ones with the smallest administrative costs, which will probably be no-load index funds; if the fund you choose has more than a trillion dollars under its control, you are probably reasonably safe. Try to keep depositing automatically, right up to the maximum amount allowed by the law, right up to the day you die if they will let you, and select the option of automatically re-investing any dividends. Until these vehicles were created, just about the only tax-exempt investments anyone could buy were tax-exempt municipal bonds and life insurance. Both of these vehicles have some major disadvantages; the IRA and 401-k mechanisms allow you to apply the tax exemption to just about any investment you choose, so they are just as good as anything you can buy, plus having the advantage of being tax sheltered. If anyone proposes investments other than IRA/401-k before you exhaust the limits of these, that person has some serious explaining to do; at the very least get a second opinion. It will be a rare person under the age of forty, perhaps an entertainer or professional athlete, who has money left to invest after fully exhausting the tax exemptions. That's because the typical young person takes on the burden of buying a house or paying for private education for children, and there just isn't enough money to go around.

|

| Life Insurance |

Life Insurance is a comparatively poor investment, and it is an even worse investment if it is purchased without investigation or comparison shopping. Some insurance companies, like Northwestern Mutual, have considerably better results than the average, and some other very large, very famous "leading" life insurance companies have pretty inferior results. Life insurance does provide some tax exemption, however, which varies a little between states as a result of the McCarran Fergusson Act of 1945. However, the legislation does produce tricky features, like tax-exempting either the owner or the beneficiary of the policy, but not both. The entire first-year premium is ordinarily paid to the salesman as a commission, and sometimes the commissions continue for life. But that is only part of the incentive which the life insurance salesman has for selling excess coverage. The other incentive is worth serious pondering: the main source of life insurance profits derives from a large number of clients who pay premiums for a while and then drop the policy without collecting on it. The deplorable national statistics on temporary job loss, personal bankruptcies, and divorce carry implications of considerable weight for the purchase of life insurance; investment is limited to what you happen to have, but life insurance is based on projections of what you hope to have, or what you fear.

Playing The Cards As You Are Dealt Them

|

| Hand your Dealt |

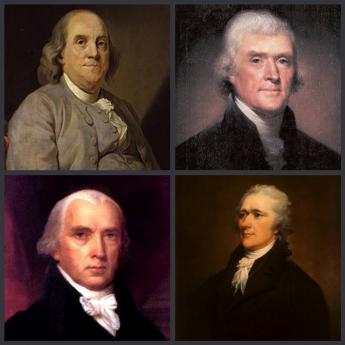

A century ago it began to be usual to expect to earn a living for most of your life, certainly for most of your life after you finish school. But at the turn of the Twenty-first century, it is becoming more accurate to say that life is divided into thirds, one for school, one for work, and one for retirement. It seems hard to believe this trend can continue much further, with two-thirds of the population either in school or just loafing. Sooner or later there is surely going to be a revolution in the education industry, and a second one in the retirement entitlements of fairly healthy people who could be working but are not. At the moment, planning consists of devising strategies for coping with uncertainties about just where the boundaries will fall for individuals or couples; that's the topic on the table. But it is impossible to avoid mentioning that the largest unemployed labor pool is soon going to be the group from age 65 to age 85, and it is this group which is going to have to supply the unaffordable manpower required to care for a huge future population aged 85 to 105. At the other end of the working-years border, the education industry seems already starting to force the issue. College tuitions have been raised to approximately double their actual underlying cost, with the surplus internally redistributed as scholarships to more than half the students. That increases the pool of students able to afford college, but it only conceals for a few more years the recognition that we are graduating more students than the workforce can absorb, and must eventually stop doing it. After all, very few of our Founding Fathers went to college, while Benjamin Franklin the greatest overachiever of them all, only finished the second grade.

At the moment, however, the greatest opportunity for individuals to re-align their assets with their life expectancies, is to retire later or to go to college less, thus stretching out individual earning years by as much as ten percent. Our society could pour more money into medical research, but once we have achieved a cheap effective cure for cancer and Alzheimer's disease, the demand for research will soon experience a cooling of public enthusiasm. And individuals have the ability to make appreciable reductions in their living costs by re-defining what is a luxury and what is a necessity. This essay confines itself to planning the finances to match revenue to need, as currently defined by public opinion.

Let us assume a young person begins to work at an average age, accumulates as many after-tax assets and as much tax-sheltered retirement income as possible, retires at an average age, and lives for an average life expectancy. Since these times and amounts cannot be precisely predicted, they should be conservative. Thirty years of retirement is more than most people currently get, but may even be an underestimate of what the average person can expect. Thirty years of no earned income will require a nest-egg of two million dollars at retirement time if annual expenditures of $100,000 are expected. That's pretty generous, but half that amount is not certain to provide luxury living at $50,000 a year, and still requires a million-dollar nest egg. Cutting that in half a second time confronts people with $25,000 income based on half a million in savings. Most people cannot expect so many assets to accumulate, and most people would have a marginal existence on $25,000.

It simplifies planning somewhat to narrow the time-spans. If a person is within ten years of his life expectancy, he can probably safely spend every penny of his savings if there is some sort of insurance or cost averaging annuity for his age group. Above a certain asset level, this would take the form of an average terminal-years fund, plus a contingency fund. However, there would assuredly be hardship cases who cannot manage such a minimum and would require a subsidy. Estimating in advance just what proportion would require subsidy is difficult, but the magnitude essentially will determine whether this approach is feasible or not. If not, we would essentially be in the position of a third-world country, taxing the working population to pay for this subsidy, and thus crippling the economy. Long before this was tolerated, the education industry would have experienced some harsh treatment designed to force a larger proportion of students back into the workforce.

Investment Consequences

|

| Baby Boomer |

One of the main risks anyone takes by investing is the risk that market conditions may not ideally match their age bracket; there may be wars, depressions, and inflations at just the wrong time. Given enough time, conditions will generally recover, but the baby boom did follow one generation throughout its lifespan. And wars and famines may not just affect the economy, they may personally snuff you out. On the other hand, the steadily increasing life span of the past century gives most people three family generations to consider, when for centuries most people only personally knew two generations, and for centuries before that, only one. Generally speaking, huge demographic changes take place so slowly the law of averages dominates it, and if you are suddenly snuffed out by a rare disease, well, that can't be helped.

Investment is generally a process of taking surplus idle money from one period of life and making it grow until a period of heavy spending is reached; the working third of life funds the third spent in retirement. Paying for school is usually the gift of one generation to another to enhance its employability and social stature, displacing dowries and the clergy in the process. Scientific education, for the most part, did not exist until 1860.

|

| Nest Egg |

The size of the starting investment nest egg is crucial; it can make a huge difference, but mostly doesn't. A frugal early life will enhance it; frugal habits are apt to be permanent. Generally speaking, leveraged investing is unwise, although there are periods of time when interest rates are so abnormally low that leveraging is tempting. Unfortunately, periods of low interest rates are generally followed by high rates, accompanied by ruinous declines in the value of the loan or bond principal. For the most part, long periods of stable interest rates are best for everyone in the economy, most periods of volatile interest rates are only safe for professionals, and long periods of extreme interest rate volatility are safe for the average investor only when his age bracket gives him a secure job when interest rates are low, and good fortune gives him lots of cash when interest rates are high.

Is Stock Trading Passe?

|

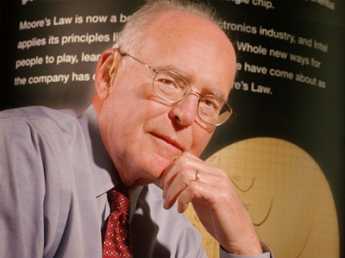

| Gordon Moore |

Moore's Law is named after Gordon Moore, who pointed out that computer chips seemed to double their speed every few years, an important issue affecting the cost of computers and the heat they give off while operating, and so on. In fifty years, there have been enough doublings of speed to make it often irrelevant whether they get any faster for the job they are intended to do. No one really cares whether a blink of an eye gets any quicker. The question is beginning to arise whether it makes any practical difference if the trading of stocks gets faster.

|

| U.S. Stocks |

At the moment, it's widely quoted that 70% of stock trades on major exchanges are now conducted between two unattended computers; it won't be long before 100% are. All of the inefficiencies of trading pits, with shouting and shoving, winking and maybe some front-running, will vanish into the humming of progressively smaller electric machines. Kinks will appear then get ironed out, perhaps after another Long Term Capital episode or two. The cost of trading will become vanishingly small, essentially a chess game between mathematics wizards. But volatility will smooth out, and costs will become negligible. So far as we can see, that's the end of the line, beyond which a computer speed sixteen times as fast serves no extra purpose.

But John Bogle, who invented the index fund and grew Vanguard to several trillion in assets, amused himself recently in front of a bedazzled audience. Several large funds, maybe even a lot of them, are taking what looks like a static mass of sleeping stocks and trading them internally at a rate of thousands per second, hoping to make a tiny fraction of a penny per trade individually, and a whole lot of profit for the managers in aggregate, while giving the appearance of standing still. Is this a good thing or a bad thing? Hard to say. John Bogle seems to imply it might even be a bad thing. Whatever it is, it is not the end of the line.

|

| John Bogle |

For completeness, look at the opposite end of this spectrum. Once more, it is John Bogle who points out that the price of the stock can be divided into its earnings, its dividends, and its speculative volatility. Total earnings for the past century have averaged 9.1%, but if you strip off the effect of price-to-earnings variance, you have an investment return of 8.8%, essentially the same in the eyes of normal people. The way an investor could strip away the P/E volatility -- is to buy the whole company. When you own the whole company, public opinion stops influencing the price. Holding companies can do that, as can private equity funds, and even Warren Buffett. If you are playing this game, all you need is a big-enough holding company with honest management or at least one independent method for estimating a fair price. If you are a value investor like Warren, buying the company for a P/E ratio well below 12.5 and holding it forever, you ought to achieve a return which significantly exceeds 8.8%. If you are an investment bank on Wall Street, you may buy the stock cheap, fix it up, and sell it rather soon for a much higher P/E ratio. Either way, there are transaction costs and taxes only twice, when you buy it and when you sell it. An investment company can do all kinds of things, but an individual investor should know enough to adjust his buying (of shares of these intermediaries) to a youthful stage of life, and his selling to his retirement years. It cannot be claimed the quirks have been completely worked out, but it's a start. Come back in a few years and see what has been added to this idea to make it air-tight.

Bonds--Do They Have A Future?

|

| Relic of the Past? |

EVER since we finally went off the gold standard completely during the Nixon Administration, the Federal Reserve has adjusted our money supply to create a fairly steady 2% inflation. If inflation is ever less than 2%, the Fed puts more money into circulation. Since many bonds are paying less than a 2% dividend, everybody who buys and holds them at par will lose money in "real" terms. That is, everyone who buys bonds when they are issued and sells them when they mature will lose spending power. Since they fluctuate in the meantime, it is possible for a trader to buy them when they are undervalued by the market. That trader will possibly make money, but only because someone else lost money. Something like that occurred during the recent financial crash bailout, when interest rates declined from 3% to less than 2% but were repurchased by the Fed as "Quantitative Easing", effectively giving speculators a 33% profit at government expense. But that doesn't happen often, and just guess who ultimately lost the money the speculators made. There is also that daunting question: when the time comes for the Federal Reserve to disgorge them, just who is going to buy all these cheapened bonds? In Japan, bonds paid a dividend of less than the rate of inflation for more than a decade; it's hard to think of a reason why the same thing could not happen in America. So it's also hard to imagine a reason why buy-and-hold investors should not abandon bonds, perhaps suddenly all at once, at some unknown time in the future. At that point, many of them will resolve never to try that, again. The whole idea is troubling.

It's particularly troubling in view of the lack of success, so far, of TIPS. These vehicles are new; perhaps the algorithm is set to ignore minor inflation and will over-respond to more major inflation, ultimately rewarding those who buy them. But at least so far, they are a disappointment. Furthermore, TIPS are quite cleverly designed to be inflation-protected, while unfortunately inflation usually does not follow a straight line but is volatile, or saw-toothed; the jury is still out. The jury better hurry up, because all investors look for net income after expenses, which include brokerage costs, taxes, and inflation. A long-term bond might have to pay a dividend approaching 4%, just to emerge with the same net value it started with; after five years of 4%, you could be 20% behind. And yet, the bond market with or without inflation protection is far larger than the stock market and compares in size with all other kinds of market. Who buys them, especially in these huge quantities?

Somebody must maintain statistics which answer this question, but as a guess, the main buyers are insurance companies, endowments, annuities, hedge funds, banks. And foreigners, of course, to whom our follies seem trivial compared with their own. The great argument for bonds is the safety of principal, and although safety is in question anywhere there is inflation when the topic is cash flow, safety is definitely an issue. Cash shortages are what cause bankruptcies, which are mainly useful in providing time to liquidate underlying wealth to pay restless creditors. The management of a non-profit organization must meet its payroll out of cash flow, so non-profits protect themselves from dissolution by having a regular flow of nominally secure bond dividends. Income from donations and contributions can be particularly weak during times of economic stress. Since most for-profit organizations also experience variable periods of time without profits, their situation does not differ greatly from nonprofits. That's particularly true when a for-profit organization has a vocal, activist stockholder group, who will protest fiercely if the management retains abundant cash. For such a predicament, holding bonds creates safety by some definition. The price of that safety is the long-term average loss on the bond portfolio; the company's alternative losses are whatever it takes to maintain a stable work force during unstable times. The business school assessment of this tradeoff is that bond losses can usually be passed through to the customers as a business cost, while layoffs and strikes may not be.

To restate the characteristics of willing bond purchasers, they are governments and corporations who have no common stock issuance alternatives, but regularly face a need to have money available for payroll. They also include borrowers and lenders at nominal interest rates like banks and insurance companies, who can afford to ignore inflation because their own liabilities are in nominal dollars, or come due at a date certain. And then, there are a host of beneficiaries of special-interest bond provisions, like "Flower bonds", state and municipal governments, foreign aid, student aid, etc. As an overall statement, natural bond buyers are those who either do not possess steady equity (common stock) alternative to offer investors or else are shielded in some way from the inflation and tax costs of buying bonds. Speculators and traders are excluded from the discussion because fixed-income trading is a zero-sum game, something you should teach your children to avoid. Other than these special niche opportunities, bonds should be regarded by the ordinary investor as trading opportunities when interest rates get too high, which is roughly every fifteen years or so.

Things in the bond market were not always so bad; Robert Morris, Jr. was a genius for devising this market in 1784. But the equity market was then not so well developed, life expectancies were shorter, and a minimum 2% inflation was not guaranteed by the Federal Reserve. The income tax had not been invented. It was possible to enjoy the promised benefits of lending in those days, for decades or even lifetimes. It was much harder to find investments of superior performance, without getting involved in business management. Meanwhile, the bond market just got huger and huger. Modifying or dismantling it in logical ways would have enormous disruptive effects. So enormous, the Congress has just adopted the stance called "kicking the can down the road", which is a debt you never seriously intend to repay.

Are we waiting for the bond market, the bond vigilantes, or speculators to find some vital vulnerable flaw, and topple it all into the ashcan of history? Or is there some better plan that no one has mentioned?

Federal Reserve Power Play

|

| Power Play |

Traditionally, the biggest financial problem for governments -- whether kings or democracies -- have been paying for wars. The Revolutionary War (Robert Morris and the King of France), the War of 1812 (Stephen Girard), and the Spanish American War (J.P. Morgan) were essentially financed by a single institution allied with the government. However, the Civil War, World Wars I and II, were so big that ways of spreading the debt had to be found. In all wars, monarchs seek to maintain control of the nation in spite of their own uneasy dependence on funding sources. The Federal Reserve founded in 1913 was thus founded as a private institution with a Federal partner; it was a public-private partnership.

The enormous sums involved created temptations to extend the Fed's power beyond wars into other cataclysmic financial events. The nature of war changed, both as a cause and a consequence. However, in a sense, politics never change. We hear congressional chairmen ask why the private sector has so much to say, and we hear bankers announce the government has no place in private finance. The Federal Reserve itself maneuvers within boundaries of its "independence". Most central banks have a mission statement limiting them to maintaining price stability (against both inflation and deflation), but the United States Federal Reserve has the additional mission of reducing unemployment. Recently, the targets are stated to be 2% inflation and 6.5% unemployment. The Fed Chairman, Ben Bernanke, now seems to feel the traditional tool of manipulating interest rates is inadequate for severe economic shocks, and perhaps inadequate to maintain both goals indefinitely. He has therefore introduced a novel approach, mysteriously called Quantitative Easing.

Acting as the lender of last resort, central banks have used their regulatory power over banks and currency to manipulate short-term interest rates. Because commercial banks make a profit in the spread between low short-term borrowing and higher long-term lending, the "yield curve" controlling short term rates is ordinarily an adequate lever for Fed purposes to control long rates indirectly. This is possible because so many short-term loans are rolled over repeatedly; the extra interest for a similar long-term bond represents public attitudes about the risks of the future. However, in major financial upheavals adjusting short term rates may become inadequate, and Bernanke sought a way to control long term rates directly throughout the private economic sector.

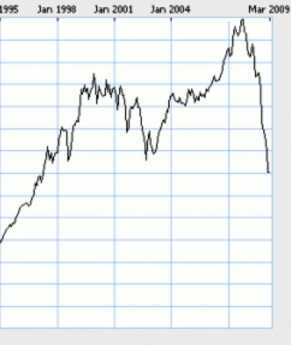

By controlling both ends of the spread, Bernanke gained more control, but with lessened market guidance, he acquired a greater risk of misjudgment. In any event, the Federal Reserve began to accumulate huge amounts of dubious or "distressed" debt. Andrew Mellon once advised Herbert Hoover to "wring the rottenness out of the system". Mellon meant that any bank foolish enough to offer loans to weak counterparties, deserved to go bankrupt, while those foolish enough to accept such loans deserved to be punished. Although such utterances by a very rich man were politically unacceptable during a depression, Mellon was surely correct in observing that extreme financial panics were basically a psychiatric problem. Irrational exuberance occasionally drives markets too high, panic then drives them too low. The modern twist is, at the turn, when everyone tries to get out the door at the same time, markets can freeze up. Mr. Bernanke civilized Mr. Mellon's approach somewhat, but the underlying idea was the same: get the bad loans out of circulation, so bankruptcies and foreclosures stop feeding public overreaction. Underneath this approach runs the assumption most people are not hopelessly overextended; the economy is basically sound. However, bankruptcy has one advantage here, over gentler kinder ways of isolating bad from further injuring the good. When an institution disappears, its problems are permanently removed from the economy. To a large degree, "sterilizing" operations are only useful if market crises are really artificial ones, which fail to notice how sound the economy really is. As our measuring systems get more precise, of course, market crises might someday actually represent the facts of the matter.

Three signal events extended Mr. Bernanke's latitude to act. His personal credibility had been enhanced by successful QE1 management of the 2008 freeze-up of financial markets. He had loaned when others were reluctant, unfroze the markets, and returned a profit for the government. Secondly, the two-decade Japanese recession showed how "zombie banks" resulted from paralyzed inaction on bad loans. And third, the Scandinavian countries had a glamorous recovery from a brief depression, apparently as a result of adopting Calvinistic punishment of economic exuberance. It was a fearsome "good bank, bad bank" approach. The general public may not have this view of events, but they meant a great deal to the Federal Reserve Board of Directors. His credibility allowed Bernanke to survive his unsuccessful attempt through QE2 to stimulate the economy with trillions of dollars in make-work employment financed by the public sector. In essence, QE3 consisted of buying every bond the market refused to buy, even including billions of dollars of mortgage-backed bonds where politicians were excoriating into accepting prices lower than their probably worth. The Federal Reserve accumulated trillions in bonds but did not pay for them by printing money, but rather by increasing the reserves of commercial banks. This allowed them to pay essentially zero interest rates, but maintain a steep interest curve (between short and long term) as an inducement to the banks to loan. So far at least, banks have refused to loan, partly because banks are trying to de-leverage thirty years of excessive lending, and partly because chastened borrowers refuse to borrow. Meanwhile, the "hard goods" the public had accumulated, autos and refrigerators, mergers and infrastructure, were gradually wearing out; someday they would need to be replaced and constitute "growth". In the meantime, the Fed seems to plan to retain the bad debts in its vaults, safely immune to "marking them to market", which is to say holding them until the bond markets assign them higher values while proclaiming their current market value is temporarily under-appreciated. Nevertheless, these bonds will eventually reach their expiration date, and the market price at that moment will reveal the true cost of replacing them with new loans. With charming modesty, Mr. Bernanke admits there are many outcomes he is unable to predict.

Although Ben Bernanke has not announced it, he seems presently willing to hold these bad debts indefinitely. Interest rates are low, so not only is it cheap to hold them, but their value is artificially overstated. Presumably, however, he is unwilling to run a Zombie Federal Reserve indefinitely. Interest rates will, therefore, return to normal, sending the interest cost to the government soaring. Somehow, the public repeatedly fails to appreciate that lowering interest rates increases the market value of bonds by making money appear like magic, whereas raising interest rates depresses bond values by making money vanish. It requires a vibrant economy to withstand such a shock, so raising interest rates can easily precipitate a deep recession. At the first sign of interest rates rising, the prices of all bonds could plummet. Almost every investment advisor in the nation is already advising clients to "lighten up" on bonds. Meanwhile, the elderly small savers holding their savings in banks, are suffering from lack of income; it is remarkable there has been so little complaint, but when it comes, it will persist and have political force. Somewhere the spring is coiling. One real danger is the economy will still be unready for normal interest rates when politics force them to go up. It is frequently estimated to require ten years to be sure that (unlike 1937) a major second depression will not emerge when short-term government debts come due. The big problem with all borrowing that never changes is that someone expects you to pay it back.

Another bleak possibility is that a currency war will break out during the vulnerable interval. The U.S. dollar recently declined sharply, and other countries responded immediately with devaluations of their own. That may have been a test, but if it was, we failed. Just as industries will move to a U.S. state with low taxes, they will move to nations with undervalued currencies. The new multinational corporation permits rapid internal transfers within companies that they need not move their headquarters. Immigrants do move, and if forcibly restrained, will start riots or even revolutions. Currency wars are also very bad news, powerfully inhibiting government action. Consequently, there is a tendency to substitute international debt default, which is the same thing as devaluation in being sudden and done with, unlike inflation which can be insidious. Since it cheats foreigners more than local citizens, politicians prefer devaluation of the currency. But otherwise, there is no great difference between devaluation and inflation.

To repeat, there is little difference between Country A inflating, and Country B defaulting. Mr. Bernanke has temporarily sterilized the inflation alternative by funding his QE3 by expanding bank reserves rather than printing currency. Unfortunately, this has so far hardly stimulated bank lending at all, which itself is beginning to tempt private investors to get directly into the banking business because it offers them a chance for high yield. However, if any significant number of university endowments or pension funds try their hand at being bankers, they are apt to learn there is more to banking than they imagine.

If Quantitative Easing becomes widespread in a world-wide recession, some nation is going to prove to be insolvent. That is, when the central bank has sold off the profitable or break-even securities in the portfolio, the probability exists that some country will find it cannot service its debt. That debt anyway has been shown to be worthless because no one will buy it. Its credit may then be worthless, its currency without value, its markets in an uproar, and its people in revolt. Other countries will be urged to support the failing one, and who knows how panic will spread. Somewhere along the line, the bond markets may take "the bull by the horns" and -- and what? If foreign governments try to intervene, their own currency could plummet. There is, indeed, quite a lot we don't understand.

So it all boils down to two disastrous alternatives for the Federal Reserve to start liquidating QE3 bonds before the economy recovers. Either the bond markets intervene, or the Federal Reserve just continues to hold those trillions of bonds indefinitely, as a Zombie central bank. We could have a second recession, or another rush to get out the door. The prospects are so horrifying that we all have to hope Mr. Bernanke keeps his cool, and gets lucky. As a fallback, whether all that sequestered debt could be transformed into the international reserves for a new Bretton Woods agreement, is now too distant a prospect for outsiders to have a reasoned opinion about. Nevertheless, the interest earnings of debt that large might be able to moderate considerable deflation. Further, the seemingly unlimited ability to create or destroy money through interest rate manipulation should be able to modulate considerable volatility of currencies, perhaps of economies. Ever since the gold window was closed in 1971, it has been asked whether currencies without the backing of some commodity can survive, and the present economic travail may be the test of it. But since an international currency exchange probably cannot be created except in a crisis, let's hope we never have to learn the answer.

Bretton Woods

|

| The Bretton Woods conference in 1944 |

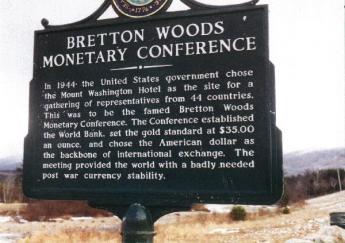

Stripped of its mystery and irrelevant details, the Bretton Woods conference agreed that all nations would make their currency convertible into U.S. dollars, and the U.S. would make its currency convertible into gold. Since World War II had left the United States with the only major working economy, it sold goods to the rest of the world and the rest of the world sent us their money to be converted into dollars; we had a "favorable balance of trade." Somewhere in the 1960s the rest of the world got on its feet, and we began to have an unfavorable balance of trade. After a while, foreigners started converting their dollars (the "reserve" currency) into gold. By 1971, the depletion of gold from Fort Knox became alarming, and the United States stopped converting its currency into gold. From that point onward, all currencies became effectively computer notations, whose value as a medium of exchange was what their government said it was.

Paradoxically, it is hard to see how this system would work without a government in charge of it, although private substitutes would probably soon appear if governments relaxed their monopoly on currency. Since a great many people dislike their governments for one reason or another, they chafe at a system which forces them to keep their governments in order to prevent commercial chaos. For those who do not adequately understand this, governments all stand ready to maintain themselves with force, and many other people dislike that feature even more. Since it took place at the same time, the Vietnam protest movement may have had some relation to this major change in the nation, misunderstood perhaps, but viscerally perceived. In view of President Nixon's central role in all of this, one is even tempted to speculate that his electoral promise of a secret means to end the Vietnam conflict, coupled with the subsequent peaceful surge of China and the financial recycling of Chinese money through Treasury bond purchases, may all have been subjects discussed during his historic trip to China.

However that may be, it is a fact that the Vietnam War ended, the Chinese economy flourished with American help, and the deposit of Chinese money in our economy helped fuel a massive economic bubble, and the weakest links in the chain -- mortgage-backed securities -- were the place the bubble burst. Not much of this could have occurred with a gold standard, and in many circles, this was regarded as proof that gold was a barbarous relic. In retrospect, few would deny we had been leveraging our economy to dangerous heights, for nearly fifty years. In 1996, Alan Greenspan denounced our "irrational exuberance", and yet the bubble did not burst for another twelve years. If we succeed in deleveraging our economy until it reaches 1996 levels, it will be regarded as a remarkable success. But the Chairman of the Federal Reserve at that time described it as a dangerous level. And looking back over the centuries, an indescribable number of kings were dethroned or beheaded because they evaded the rather irrational restraints of a scarce, hence precious, barbarous relic. Balanced against that, a billion Asiatics have been raised out of poverty, and the economy of the world overall would seem opulent to our grandfathers. Somehow, we must find the wit and the self-restraint to solve this problem.

REFERENCES

| The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order:z Benn Steil: ISBN-13: 978-0691149097 | Amazon |

Enforcing the Constitution: Civil Monetary Penalties (CMP)

|

| Founding Fathers |

The 1787 Constitution created three branches of government along with their defined powers but described no remedy for a branch overstepping its boundaries. Gradually, a system evolved for declaring some laws unconstitutional, one by one, clarifying individual issues along the way. By contrast, the founding fathers viewed the President as an agent of Congress, expecting Congress to devise controls if needed. George Washington had an intense distaste for monarchs, and eight years as Commander in Chief had exposed no taste for conflict with the Continental Congress. Unfortunately, this has proven to be unusual for Presidents, especially as popular sovereignty appears to expand the Presidential mandate. Moreover, Washington himself developed more friction with Congress during his two terms as President.

In retrospect, the main factor behind Presidential restlessness is the experience of misinterpreting the meaning of a broader electoral mandate, which can more properly be traced to hasty repair of the defects of the 1800 election process. Experience has shown that while ignoring rules invites anarchy, the impeachment of a President usually seems too drastic a remedy for unwelcome innovation while impeaching the whole Legislative Branch for failure to supervise in a general way, is incomprehensible. The President needs some sort of supervision. While the original intent was to have Congress do the supervising, the Supreme Court is now probably better suited for judging the issue of unconstitutional behavior, except for the awkwardness that the President appoints the Supreme Court. These are the simple ingredients of a solution, preferably unwritten and revolving around conferring special "standing" in special circumstances.

|

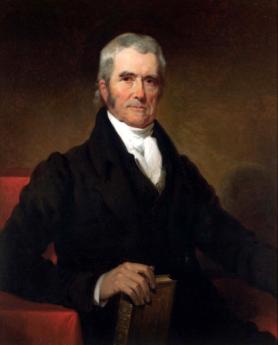

| Chief Justice, John Marshall |

At present, grievances tend to accumulate until someone acquires "standing" by being injured. At present it is generally true a grievance scarcely matters if no one is injured, but the exception is the lack of redress for injury to the Constitution, whereby everyone may be injured. Furthermore, actual experience with creeping boundary encroachment has mostly proved to be nuanced, rather than confrontational, gradual rather than abrupt. The descriptive example is that of a frog in a gradually heated pan of water, whereby the frog is cooked faster than he realizes he is in danger. Otherwise, the courts have evolved an unspecified balance which has proved remarkably serviceable.

It took thirty years for John MarshalI to formulate the general approach needed. In Marbury v. Madison , his first action after becoming Chief Justice, John Marshall suggested a writ of Mandamus (i.e. "We command...") from the Court might well be the first step in what he coyly described as only a hypothetical situation. Only lawyers were expected to recognize fully that If the President ignored the writ, then the grounds for impeachment might escalate, with the President forced into the role of flouting a decision of the Court. Regardless of how it stood on the original issue, the public would likely support a Court in performing its duty to make difficult decisions.

One way or another, the national issue would become one of whether the nation wished to continue with its Constitution; Marshall had only outlined the steps the process would probably take. At several points along the way, the Chief Justice would have a chance to back off. But Marshall's lifelong hatred of his cousin Thomas Jefferson was so well known there was little doubt he was serious. Knowing of his cousin's hatred for him, President Jefferson let the matter drop; subsequent Presidents followed his example. Generations of lawyers have studied this case and pondered its implications. The solution to the problem of extending it from unconstitutional laws to unconstitutional behavior, probably already exists in many minds.

11 Blogs

Planning Horizon: Review Benchmarks

How often should a person review his whole situation, with professional help? Answer: every five years.

How often should a person review his whole situation, with professional help? Answer: every five years.

Perpetuities

Although most founders of institutions look far into the future, the fact is comparatively few corporations, for-profit or not-for-profit, last longer than seventy-five years.

Although most founders of institutions look far into the future, the fact is comparatively few corporations, for-profit or not-for-profit, last longer than seventy-five years.

Taxes as a Form of Consumption

Most people find taxes are their biggest expense. Why not reduce them?

Most people find taxes are their biggest expense. Why not reduce them?

Designated Lifetime Funds

Nowadays, the government incentivizes most investment funds to be taxable, but curiously certain funds are forced to be tax-sheltered, while personal latitude exists for others. Since most people are eventually forced into having three types of funds anyway, some thought might be given to which purposes are most suitable.

Nowadays, the government incentivizes most investment funds to be taxable, but curiously certain funds are forced to be tax-sheltered, while personal latitude exists for others. Since most people are eventually forced into having three types of funds anyway, some thought might be given to which purposes are most suitable.

Playing The Cards As You Are Dealt Them

Living on earned income is a fairly recent phenomenon. Just when we start to get used to it, it steadily diminishes as a proportion of life span.

Living on earned income is a fairly recent phenomenon. Just when we start to get used to it, it steadily diminishes as a proportion of life span.

Investment Consequences

How you should invest to meet major spending goals will depend on how you view your chances of recovery from intervening slumps, and how long you have left to do the recovering.

How you should invest to meet major spending goals will depend on how you view your chances of recovery from intervening slumps, and how long you have left to do the recovering.

Is Stock Trading Passe?

Computers have been in some sort of use for trading stocks, for over fifty years. Are they reaching their limits?

Computers have been in some sort of use for trading stocks, for over fifty years. Are they reaching their limits?

Bonds--Do They Have A Future?

It's increasingly hard to imagine why investors buy bonds because it's increasingly difficult to imagine an end to inflation.

It's increasingly hard to imagine why investors buy bonds because it's increasingly difficult to imagine an end to inflation.

Federal Reserve Power Play

Evidently, the Federal Reserve feels it never has to restore those bonds it holds to the private sector. The bond market may not stand for it, so hold your breath.

Evidently, the Federal Reserve feels it never has to restore those bonds it holds to the private sector. The bond market may not stand for it, so hold your breath.

Bretton Woods

The Bretton Woods conference in 1944 was very simple. The U.S. dollar alone was convertible into gold, but all other currencies were convertible into U.S. dollars. To prevent Fort Knox from being completely depleted of gold, the convertibility of dollars into gold was also soon discontinued. Effectively, all money everywhere was thus just a computer notation, controlled by the U.S.government. Temporarily, the dollar became a reserve currency, supplementing gold. Effectively, we were testing whether we needed a metallic standard at all.

The Bretton Woods conference in 1944 was very simple. The U.S. dollar alone was convertible into gold, but all other currencies were convertible into U.S. dollars. To prevent Fort Knox from being completely depleted of gold, the convertibility of dollars into gold was also soon discontinued. Effectively, all money everywhere was thus just a computer notation, controlled by the U.S.government. Temporarily, the dollar became a reserve currency, supplementing gold. Effectively, we were testing whether we needed a metallic standard at all.

Enforcing the Constitution: Civil Monetary Penalties (CMP)

The Constitution does not define penalties if one branch of government oversteps its grant of authority. But starting with writs of mandamus , the U.S. Supreme Court has left the other two branches with little alternative but compliance.

The Constitution does not define penalties if one branch of government oversteps its grant of authority. But starting with writs of mandamus , the U.S. Supreme Court has left the other two branches with little alternative but compliance.