Related Topics

Investing, Philadelphia Style

Land ownership once was the only practical form of savings, until banking matured in the mid-19th century. Philadelphia took an early lead in what is now called investment and still defines a certain style of it.

Computers, Digital Cameras, and Cellphones

Much of the early development of the electronic computer took place in Philadelphia. We lost the lead, but it might return.

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

Right Angle Club 2011

As long as there is anything to say about Philadelphia, the Right Angle Club will search it out, and say it.

Why Bother Investing?

In a sense, money is worthless until you spend it.

Is Stock Trading Passe?

|

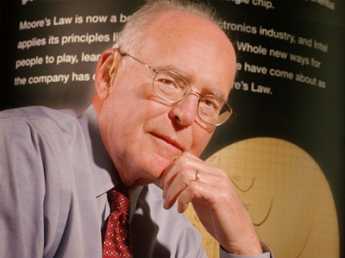

| Gordon Moore |

Moore's Law is named after Gordon Moore, who pointed out that computer chips seemed to double their speed every few years, an important issue affecting the cost of computers and the heat they give off while operating, and so on. In fifty years, there have been enough doublings of speed to make it often irrelevant whether they get any faster for the job they are intended to do. No one really cares whether a blink of an eye gets any quicker. The question is beginning to arise whether it makes any practical difference if the trading of stocks gets faster.

|

| U.S. Stocks |

At the moment, it's widely quoted that 70% of stock trades on major exchanges are now conducted between two unattended computers; it won't be long before 100% are. All of the inefficiencies of trading pits, with shouting and shoving, winking and maybe some front-running, will vanish into the humming of progressively smaller electric machines. Kinks will appear then get ironed out, perhaps after another Long Term Capital episode or two. The cost of trading will become vanishingly small, essentially a chess game between mathematics wizards. But volatility will smooth out, and costs will become negligible. So far as we can see, that's the end of the line, beyond which a computer speed sixteen times as fast serves no extra purpose.

But John Bogle, who invented the index fund and grew Vanguard to several trillion in assets, amused himself recently in front of a bedazzled audience. Several large funds, maybe even a lot of them, are taking what looks like a static mass of sleeping stocks and trading them internally at a rate of thousands per second, hoping to make a tiny fraction of a penny per trade individually, and a whole lot of profit for the managers in aggregate, while giving the appearance of standing still. Is this a good thing or a bad thing? Hard to say. John Bogle seems to imply it might even be a bad thing. Whatever it is, it is not the end of the line.

|

| John Bogle |

For completeness, look at the opposite end of this spectrum. Once more, it is John Bogle who points out that the price of the stock can be divided into its earnings, its dividends, and its speculative volatility. Total earnings for the past century have averaged 9.1%, but if you strip off the effect of price-to-earnings variance, you have an investment return of 8.8%, essentially the same in the eyes of normal people. The way an investor could strip away the P/E volatility -- is to buy the whole company. When you own the whole company, public opinion stops influencing the price. Holding companies can do that, as can private equity funds, and even Warren Buffett. If you are playing this game, all you need is a big-enough holding company with honest management or at least one independent method for estimating a fair price. If you are a value investor like Warren, buying the company for a P/E ratio well below 12.5 and holding it forever, you ought to achieve a return which significantly exceeds 8.8%. If you are an investment bank on Wall Street, you may buy the stock cheap, fix it up, and sell it rather soon for a much higher P/E ratio. Either way, there are transaction costs and taxes only twice, when you buy it and when you sell it. An investment company can do all kinds of things, but an individual investor should know enough to adjust his buying (of shares of these intermediaries) to a youthful stage of life, and his selling to his retirement years. It cannot be claimed the quirks have been completely worked out, but it's a start. Come back in a few years and see what has been added to this idea to make it air-tight.

Originally published: Tuesday, September 27, 2011; most-recently modified: Wednesday, May 22, 2019

| Posted by: esalerugs coupons | Feb 13, 2012 9:17 AM |