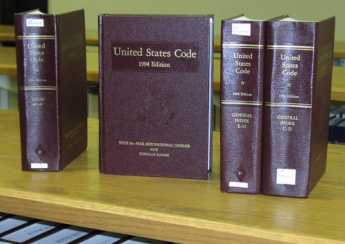

6 Volumes

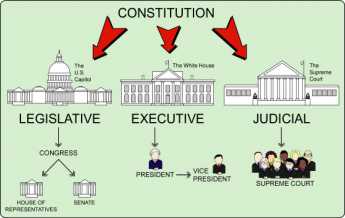

Constitutional Era

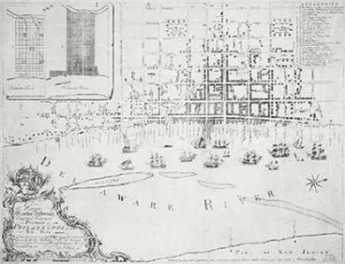

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

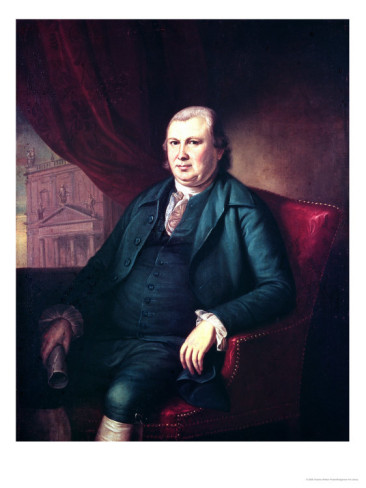

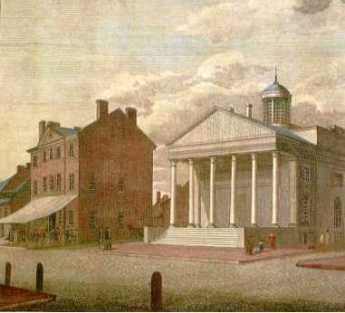

BANKS REDEFINED

American banking was invented in Philadelphia. The banking center of America has moved away and changed in extraordinary ways but the foundations remain.

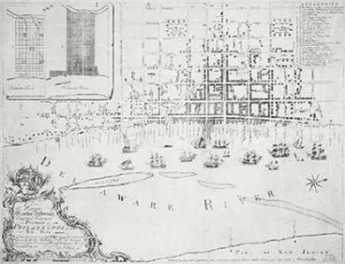

Sociology: Philadelphia and the Quaker Colonies

The early Philadelphia had many faces, its people were varied and interesting; its history turbulent and of lasting importance.

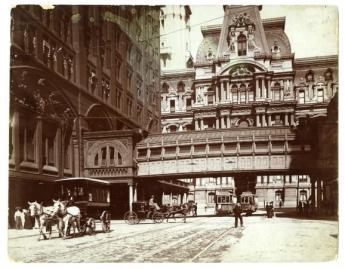

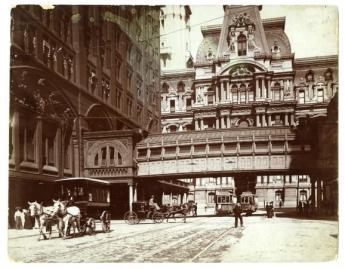

Philadelphia: Decline and Fall (1900-2060)

The world's richest industrial city in 1900, was defeated and dejected by 1950. Why? Digby Baltzell blamed it on the Quakers. Others blame the Erie Canal, and Andrew Jackson, or maybe Martin van Buren. Some say the city-county consolidation of 1858. Others blame the unions. We rather favor the decline of family business and the rise of the modern corporation in its place.

Worldwide Common Currency and Corporate Headquarters

The Death of Money

A New Era in Politics: Clinton, Obama, and Trump

New forms of communication made the party system largely obsolete.

Dislocations: Financial and Fundamental

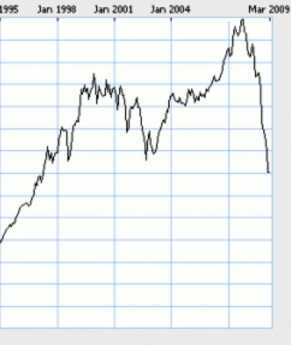

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Future historians will have fun arguing whether the banking dislocations of 2007 caused the popping of the real estate bubble. Or whether the fall of real estate prices triggered the banking panic. It is also possible to argue the rapid growth of new wealth in the Far East released more financial liquidity than the credit systems could absorb, causing the real estate and credit bubbles in the first place. Unless you believe the rising price of oil was more disruptive, starting in the Middle East, not the Far East. And finally, it is possible to argue as we do here, that all these dislocations would have been relatively easily absorbed except for the long slow transformation of the banking system, caused by and greatly accelerated by -- the computer revolution. We don't expect this to be a popular line of thought, or an easy one to understand.

Future historians will have fun arguing whether the banking dislocations of 2007 caused the popping of the real estate bubble. Or whether the fall of real estate prices triggered the banking panic. It is also possible to argue the rapid growth of new wealth in the Far East released more financial liquidity than the credit systems could absorb, causing the real estate and credit bubbles in the first place. Unless you believe the rising price of oil was more disruptive, starting in the Middle East, not the Far East. And finally, it is possible to argue as we do here, that all these dislocations would have been relatively easily absorbed except for the long slow transformation of the banking system, caused by and greatly accelerated by -- the computer revolution. We don't expect this to be a popular line of thought, or an easy one to understand.

Macroeconomics of The 2007 Collapse

Sudden wealth creation, whether from the discovery of gold or oil, the conversion of poverty into useful cheap labor, or the sudden abundance of cheap credit, is of course a good thing. Sudden wealth creation can be compared with a stone thrown into a pond, causing a splash, and ripples, but leaving a somewhat higher water level after things calm down. The globalization of trade and finance in the past fifty years has caused 150 such disturbances, mostly confined to a primitive developing country and its neighbors. Only the 2007 disruption has been large enough to upset the biggest economies. It remains to be seen whether a disorder to the whole world will result in a revised world monetary arrangement. One hopes so, but national currencies, tightly controlled by local governments, have been successful in the past in confining the damage. This time, the challenge is to breach the dikes somewhat, without letting destructive tidal waves sweep past them. Many will resist this idea, claiming instead it would be better to have higher dikes.

It is the suddenness of new wealth creation in a particular region which upsets existing currency arrangements. Large economies "float" their currencies in response to the fluxes of trade, smaller economies can be permitted to "peg" their currencies to larger ones, with only infrequent readjustments. Even the floating nations "cheat" a little, in response to the political needs of the governing party, or, to stimulate and depress their economies as locally thought best. All politicians in all countries, therefore, fear a strictly honest floating system, and their negotiations about revising the present system will surely be guilty of finding loopholes for each other; the search for flexible floating will, therefore, claim to seek an arrangement which is "workable".

In thousands of years of governments, they have invariably sought ways to substitute inflated currency for unpopular taxes. The heart of any international payment system is to find ways to resist local inflation strategies. Aside from using gunboats, only two methods have proven successful. The most time-honored is to link currencies to gold or other precious substances, which has the main handicap of inflexibility in response to economic fluctuations. After breaking the link to gold in 1971, central banks regulated the supply of national currency in response to national inflation, so-called "inflation targeting". It worked far better than many feared, apparently allowing twenty years without a recession. It remains to be investigated whether the substitution of foreign currency defeated the system, and therefore whether the system can be repaired by improving the precision of universal floating, or tightening the obedience to targets, or both. These mildest of measures involve a certain surrender of national sovereignty; stronger methods would require even more draconian external force. The worse it gets, the more likely it could be enforced only by military threat. Even the Roman Empire required gold and precious metals to enforce a world currency. The use of the International Monetary Fund (IMF) implies attempts to dominate the politics of the IMF. So it comes to the same thing: this crisis will have to get a lot worse, maybe with some rioting and revolutions, before we can expect anything more satisfactory than a rickety negotiated international arrangement, riddled with embarrassing "earmarks". Economic recovery will be slow and gradual unless this arrangement is better, or social upheavals worse, that would presently appear likely.

World Finance, Columbus Day 2008

|

| Prime Minister Gordon Brown |

WITH voters watching three weeks before the 2008 American presidential election day, finance ministers and their political masters met to decide a basic question: dare they risk disaster to save the existing system, or play it safe by sacrificing small banks to rescue big ones? That is, guess if the situation is so bad only strong rowers can be allowed in the lifeboat, or whether things are really manageable enough to try to save everybody but at the risk of worse consequences for failure. For example the credit default swap mystery; there are $60 trillion notional value insurance policies in existence to cover $20 trillion of bonds. Is that massive double-counting, or an actual disaster so severe it makes every other consideration trivial? Answer quick, please, the ship looks like it might sink. At first, it seemed strange a Labor government in England would propose saving only the strong until you realize that Prime Minister Brown is protected from his Left, while the Democrats in America want to use a fairness argument to win their election. A Republican lame-duck president must do the deciding, a man who has been shown to be both a tough politician and a fearless gambler; playing things safe is not his style. The Dow Jones average soared a thousand points in a day's trading on the prayer that things were finally under control. But take a look around.

Little Iceland and Switzerland are proud to house some enormous banks. But if those banks approach failure, their homeland treasuries are far too small to bail them out.

On the other hand, little Hungary has a negligible banking system, so Hungarians commonly borrow money from foreign banks. The national currency devalued by half in this crisis, so most Hungarian mortgages doubled in price. Reserve systems based on national governments suddenly look obsolete.

Try another approach. Little Ireland went ahead and guaranteed all deposits in its financial institutions. Money from England and the rest of Europe immediately poured in to enjoy that guarantee, forcing other grumpy nations to match the unwise Irish offer. There's a sense that nations are losing control of their affairs.

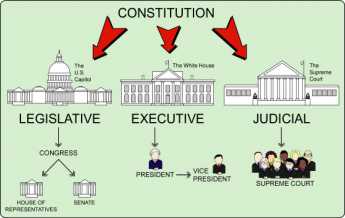

Europe consists of 27 nations, of which fifteen are in the Euro zone. There are common currency and a constrained central bank, but can this gaggle of geese possibly agree on concerted action in this crisis? America was once in this situation under the Articles of Confederation, but even after almost losing the Revolutionary War, George Washington was nearly unable to get the colonies to form a union. Even after this experience, the Southern Confederate States later adopted the same system of a central currency without a central government and really did lose their war.

Are we to infer from Prime Minister Brown's attitude toward banks that he might soon suggest ditching little nations in order to save bigger ones?

www.Philadelphia-Reflections.com/blog/1525.htm

Rescuing International Finance?

Let's begin this discussion of international finance by relating the story of how the United States solved the same problem in 1913. This wasn't a ho-hum bit of history, it set the pattern the world is now about to adopt or reject. Remember, our current lame duck President comes from Texas.

|

| Federal Reserve Building |

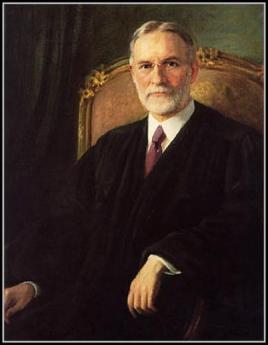

In 1913, the Federal Reserve system was created. It had various purposes, but it essentially stripped the state governments of the ability to adjust interest rates and placed that power in Washington DC. The appointment process to the Fed board was tinkered with to achieve as much independence from politics as possible, although it was unrealistic to think politics would be totally excluded. Politicians never give up power voluntarily, but in this case, they also escaped blame for the unpleasant things a central bank is occasionally called on to do, so it was a deal. The remaining uncertainty thus became the question of whether the states would yield to federal authority on interest rates, something they had consistently resisted ever since the Constitution was ratified. The first resister was Texas.

|

| Franklin D. Roosevelt |

It suited the Texas economy to have lower interest rates than other states, but the fledgling Federal Reserve decreed that the nation as a whole needed higher rates. In a fairly typical Texas style, Texas just lowered rates anyway. Almost immediately, nobody would deposit money in Texas banks, who were flooded with requests for loans from the rest of the country. That situation couldn't last more than a few days, so Texas capitulated, and no state has defied the Federal Reserve since then. In this little story lies the hope that a similar international banking arrangement can be devised, and announced shortly after November 15. That would probably put George W. Bush in a class with George Washington and Abraham Lincoln in the history books, his current low popularity not withstanding. For that reason alone, there is cause for concern about the newly elected incoming President. The worrisome historical model at this level lies in the refusal of newly elected Franklin D. Roosevelt to cooperate with the lame duck Herbert Hoover during a similar economic crisis of 1933. On the level of "practical" politics, Roosevelt got away with this deplorable behavior, by enacting many of Hoover's proposals six months later and taking full credit. The country was much worse off as a result, but Roosevelt nevertheless seems to have achieved enduring historical praise for his imaginative ideas. This time, one would hope that fear of the blogosphere, the London Economist and the Wall Street Journal would make such behavior politically unprofitable for either Obama or the maverick McCain. But you never know.

|

| Henry Paulson |

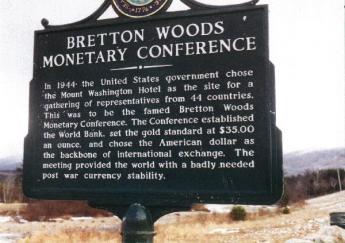

Now, to return to the present crisis. In a sense, every type of financial institution from banks to hedge funds, every nation from America to Zimbabwe, and every expert from Hank Paulson to Barney Frank -- has been tested, and occasionally failed quite visibly. People are scared, have every reason to be. But on the other hand, sound reasoning will never defeat politics and financial greed, except in a rare crisis containing obvious general danger. So, this mess represents an opportunity for the think tanks to be given a chance at leadership, just as John Maynard Keynes was listened to respectfully at Breton Woods in 1944. It was just about the last time a guru got his way without the use of financial power or an overwhelming voter mandate. As Franklin Roosevelt is reported to have said, "I don't understand a word the man says, but we must do something."

|

| Barney Frank |

Let's use a few examples out of a great many available. Ireland issued a guarantee for all the deposits in its banks. Immediately, money poured into Irish banks from British depositors, unsettling the British banking system. So the United Kingdom had to issue the same guarantee, and then other nations followed. America rescued Bear Stearns, Fannie Mae, and AIG, and finally called a halt at Lehman Brothers. Other nations copied this approach of rescuing institutions in trouble until the Bank of England copied the Swedish approach of 1991 of reversing this approach. If you are in a sinking lifeboat, you want to rescue the best rowers, not the weakest. But there are some small countries with big banks, like Switzerland and Iceland, where it would be impossible for a small government to rescue a huge international bank within its borders. Conversely, the Eastern European countries have essentially no local banks. In the case of Hungary, most home mortgages were held in Austrian and Swiss banks. When the flow of funds forced a devaluation of the local currency, the cost of almost every mortgage in Hungary doubled, and the national government could do nothing about it.

Let's mention what may well be the largest such factor in this international banking game, the so-called Japanese carry trade. When the overheated Japanese stock market collapsed fifteen years ago, the Ministry of Finance responded by lowering interest rates to one or two percent. Taking into account the inflation rate, Japanese banks were paying the borrower to take their money. So, the international banking community promptly responded by borrowing money in Japan at 2% and lending it out in Germany at 8%. Amounts of money in the trillions churned through this money machine. An unknowable but large amount of this money originated in China, which was trying to prevent its surpluses from provoking a revolution with inflation. The Japanese carry trade is at an end except in reverse, as money is flowing back to the now seemingly safe Japanese economy. Perhaps even a casual reader can look up from the World Series and the presidential election, to realize that absolutely everybody is scared, and possibly scared enough to do something cooperatively. It means loss of national power and sovereignty for everybody, a reconsideration of the European Common Market, and setting aside any disruptive schemes to discipline Premier Putin's behavior as a hidden by-product. As Frank Roosevelt said, we don't understand a word of it, but we must do something.

|

| The World Bank Logo |

Among the small practical ideas advanced, one of the most promising is to persuade the Chinese government to float its currency. We have historically tolerated small primitive countries when they try to struggle out of poverty by artificially cheapening their currency. In China's case, and before that in Japan's, cheapening the currency in order to stimulate exports has been politely referred to as "pegging the currency to the dollar". Pegging it low, that is. But Japan and China are no longer barefoot and aspire to become important figures in international finance. China is said to resist this proposal on the grounds that it needs 7% annual growth to prevent social unrest leading to a revolution. To some extent, this is probably just bargaining talks, and the counter-proposal offered is to strengthen Oriental power within the International Monetary Fund, as part of the process of increasing the power of the now-indolent IMF. We will have to wait for November 15 to see if clever little schemes like this one will suffice for the purpose. Much depends on China's willingness to cooperate, but even more, depends on the validity of blaming present messes on currency manipulation for the purpose of mercantilism. Beggar thy neighbor behavior has certainly been common; the question is whether it was the main cause.

If all those think tanks led by the Bank of England, have found the stone whose removal will start a benevolent avalanche, a second Breton Woods conference might just get us out of the soup; within two years we should be pleased with the way our cleverness restored the world to prosperity. If not, more grandiose ideas must be desperately considered. Europe must abandon all those silly five-hundred-page constitutions and form a national union. In our own case, that worked for eighty years and then we had a civil war, but even a repetition of all that sounds better than what we now face. If Europe simply cannot seize the moment, it is very likely to retreat into insignificance. Under those changed circumstances, the world economy will amount to three nations: China, India and the USA. We have yet to learn whether the Chinese and particularly the Indian governments can summon up enough domestic leadership to deserve a place in international leadership. And that presently is far from certain.

Bye, Bye, Banks

|

| Fort Knox |

Banking is a comparatively recent invention; in its present form, it's only a couple of centuries old. Paper certificates circulated as money, representing precious metals like gold and silver in the bank vaults, eventually concentrated in Fort Knox as Federal Reserves. When the economy grew faster than the supply of gold, silver was also monetized, then diluted by only partial reserving. Finally a couple of decades ago we abandoned precious metal reserving entirely, and resorted to partial reserving leveraged to a virtual concept known as Federal Reserves whose quantity depended on the behavior of American inflation. Almost the whole world soon depended on the American Federal Reserve to stand behind its virtual dollars, formerly redeemable in gold or silver, but now based on inflation targeting. That is, the Fed sets a target of something like 2% inflation a year, and either absorbs currency or floods the world with currency, sufficient to maintain a steady match to the target. It's a little uncomfortable to see the standard of measurement shifting, from inflation as most people understand it, to "core" inflation, which subtracts the cost of food and oil. Especially oil. It's additionally disquieting to realize that the Fed is dependent on its own computers, reading other people's computers, all subject to the frailties of computers. to determine the degree of match to the target. We sort of got into this fix because the supply of precious metals was inelastic; perhaps the present expedient could become a little too elastic because it is so heavily dependent on vast streams of computerized information. Garbage in, garbage out?

|

| Federal Reserve Bank |

Meanwhile, banks simply had to surrender to the obvious efficiencies of using electronic stored-program calculators. Paper checks, canceled checks, and bank tellers are consequently disappearing. Banks themselves are disappearing, as anyone can see by looking at the abandoned stone tombs on America's main streets. At the moment, the process is one of concentration of smaller banks into bigger ones; eventually, there will be some kind of transformation of the way they conduct business to a point where banking could effectively disappear. Who needs banks, anyway? One significant answer to that question is that, the Federal Reserve Bank needs them. And the rest of us need the Federal Reserve because that's how the value of money is determined nowadays.

|

| Federal Reserve |

Customers, however, don't need banks for deposits; money market funds pay higher interest rates. There's no need for banks to provide loans; credit cards do that for small borrowers, while big borrowers float bonds through an investment banker. Bank vaults may be useful to store grandmother's pearl necklace, but no one needs vaults to store securities, which are now mainly held as bookkeeping entries in "street" name. People used banks for the origination of mortgages, but other institutions could serve as well. Anyway, home mortgage origination is what broke down in August 2007, when banks eluded Federal Reserve lending constraints by selling mortgages to subsidiary corporations they often owned. To repeat, we need banks because the Federal Reserve needs banks to control the currency, through regulating loan volume, which is achieved by regulating the number of reserves that banks are required to maintain. Reflect on how that matters to currency.

Before a bank makes a loan, only the depositor owns the money in question. After a loan is made, two people have a claim on the money, the borrower and the depositor. Although there is a fine distinction between money and credit, between money and liquidity, the real point is that making a loan effectively doubles the money. If a bank is then only required to keep half of its total loan volume in reserve, the money in circulation is multiplied four times what it was, and so on. Loan volume is also controlled by its scarcity value, which is indirectly affected by setting short-term interest rates. Unfortunately, cheaper money is worthless -- the dollar goes down in relation to the currency of the rest of the world. There are probably other ways which could be devised to control the currency, but a time of frozen credit markets is a dangerous time to consider radical changes in the currency. If the Fed is forced to make such changes, they had better be correct.

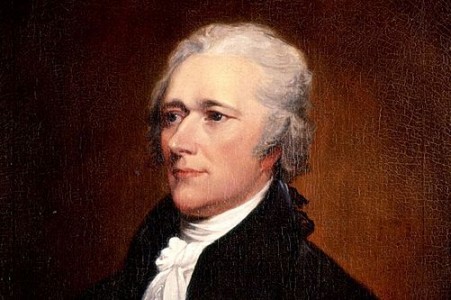

It's unfortunately also true that radical changes can only be made when people are scared stiff by a crisis. Is it entirely out of the question that we may soon need to scrap the Federal Reserve system? Just think back to the bitterness when Hamilton and Jefferson, later followed by Biddle and Jackson, fought about whether central banks were necessary at all. Or, more recently in 1913, when Wall Street and the Progressive movement fought about whether there was a need to create a Federal Reserve. Disputes about financial matters have been at the core of most political party disputes, since the founding of the Republic. Decisions made in the past have not always been the right ones. Nevertheless, since the banks anyway appear to be on a long slow slope to extinction as a result of the computers that briefly made them prosperous, maybe we should revise the way the Federal Reserve controls currency. Without the Fed to defend them, banks' prospects look bleak.

As Computers Displace Money, Trust But Verify

|

| The honking of the Horn |

The Internet has made computing power ubiquitous. No longer need individuals to be at the mercy of institutions with whom they do business. However, new habits are hard to learn, so individuals still hesitate to challenge institutions. Sophisticated but inexpensive software from companies like Intuit nevertheless makes it nearly effortless for humble customers to have every bill and transaction cross-checked for them, and actually, in the resulting arguments. Its high time balance was restored because computers do send out lots of errors which have the effect of creating or destroying wealth. Indeed, much of the current credit muddle grows out of abbreviated records systems, organized for the convenience of only one party in a transaction. The transaction system would be streamlined, not hampered, by more adversary challenge and cross-verification at the level of individual items rather than merely cross-footing the totals. Indeed, add the filtering of information by third-party intermediaries, plus monitoring by regulators, and a need for some defined fault-tolerance emerges from the hopeless complexity. We must restructure relationships to ensure that small errors are trapped and isolated, not allowed to aggregate to a point where a mysterious failure of the books to balance can bring enormous systems to a halt. In this article, we mention the vulnerability of banks, financial derivatives, the Federal Reserve system, and the health insurance system. If everything worrisome went wrong at once, it could be quite a mess.

For the opening example, this article was written two days after the author discovered a sizable error in his stock brokerage reporting. It was in my favor, else I might sound less relaxed. Even so, the condescending stone-walling encountered was a powerful warning, since at the end of the day it proved to be entirely the fault of a software vendor for several brokerage houses. A few decades ago, a housewife would have been in a stronger position with her department store billing department because it was effective to refuse to pay the bill. Just try that today: the current practice of employing vendors to handle merchant billing soon separates the dispute from the circumstances of it. That's an underlying difficulty with all third-party arrangements; expedients selected to avoid a problem often make matters even more frustrating for the defenseless counterparty, who eventually longs for government intervention.

To a certain extent, customers have been forced to agree to this situation voluntarily, because of the mind-boggling complexity or greater cost of not agreeing. Until about fifteen years ago, it was conventional to place engraved stock certificates in a safe deposit box. Dividends were received as paper checks, endorsed and deposited in a bank. The bank microfilmed the checks, the customer could photocopy them.

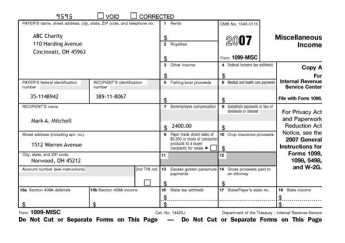

|

| Form 1099 |

Power was then reasonably symmetrical, arms-length and simple in concept even if overall it was an expensive, inefficient transaction. A mountain of receipts, a quarterly blizzard of mail. At tax time, an error-prone chore to manage the papers. So, in response to the gentle suggestions of tax accountants, it seemed heaven-sent to take certificates out of bank vaults and place them in "street name" with a broker. Tax time condensed to attaching a single piece of paper, the Form 1099, to the tax form. Instead of calling a broker and asking, "How's the market?" people now go to his website and review how a whole portfolio is performing, hour by hour. The efficiency gain is enormous; the transaction cost reduces at least 90%. But then -- you discover seven-figure errors can be created by an invisible computer programmer, initially denied as impossible and then defended with a blizzard of words. Worse still, the error did not come from an employee of the broker, it came from an employee of his software vendor in another city. The error did not surface in the brokerage house records, but in what was transmitted to a second software company a continent away, whose phone is answered in India. Two questions arise: what would have been the predicament if the error had been against me instead of in my favor? And secondly, what might have happened next if the misinformation about my imaginary windfall had been sent, not to a software house, but to the Internal Revenue Service as a Form 1099?

Now think of another order of magnitude. Instead of a housewife coping with the department store bill, replace her with a million brokers, a million investment bankers, a million electronic exchanges, and regulators, and tax collectors. Just one quantitative trader is known to handle ten thousand transactions an hour. Since transactions are global, a zillion foreign counterparties get orders for a zillion transactions. Underneath all this, a magnified error can emerge from one software vendor placing unwarranted faith in one programmer trainee, in a hurry to get home for dinner.

National Debt, National Blessing

|

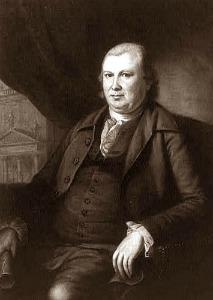

| Alexander Hamilton |

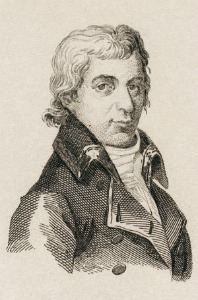

In 1789 while arguing for the establishment of a National Bank, Alexander Hamilton made one of the most famous counter-intuitive assertions of his controversial career. "A national debt, if it is not excessive, will be to us a national blessing".

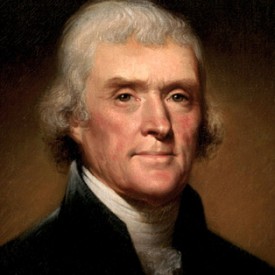

The very suggestion of such an idea enraged Thomas Jefferson and his Calvinist adviser, Albert Gallatin. James Madison, ever the political schemer, immediately recognized a new bargaining chip in his move to relocate the national capital to Virginia. Political parties were promptly invented to mobilize votes on both sides, and the national bank remained a divisive issue for half a century afterward. Neither a borrower nor a lender is; how could anyone, then or now, say the debt was a blessing?

Indeed, that's evidently how the leaders of Singapore, Malaysia, Australia, China, and several other prosperous states still feel about it. While not eliminating taxes, these countries accumulated surpluses and created sovereign-wealth funds. Having paid off the national debt, and still finding a national surplus, what else are you going to do with it?

|

| Gallatin |

These countries hired investment advisers to buy stock for the funds, evidently feeling American stocks were the safest bet; it's hard to criticize that conclusion. In the present credit crunch, they are investing five and ten billion per transaction in the equity of America's premier investment banks. So far, they only acquire 5 or 10 percent ownership, but then the credit crisis may not be over yet. For them eventually to acquire 51% controlling ownership somewhere is not at all inconceivable. An ominous sign of where that might lead is found in our own captive pension funds. The state employee pension funds have quickly become captive to unions with their own agenda, with the result that the prosperity of the companies in the portfolio could be sacrificed to the benefit of interest groups. And yet, it wouldn't be so hard for America to do the same thing. If Congress had adopted the Bush proposal of three years ago to create an investment fund for Social Security, we ourselves would soon have what amounts to the largest sovereign wealth fund in the world. Could this be a solution to the weakness of the Federal Reserve in controlling the currency with bank debt? Could we somehow create a common world currency based on a common fund of sovereign wealth funds and with that, create a new definition of wealth based on equity rather than debt? The technical answer to the potential corruption issue would probably lie in stripping the voting power from such shares and then submerging them in a world index fund. The United Nations sound of it nevertheless still boggles the mind. Are people who oppose an equity-based world currency going to be forced like Gallatin to eat their own dusty words when the reality of debt-based currency sinks in? How many of the ambassadors of ideas about such suggestions, both pro, and con, would eventually surface as sneaky connivers like Madison, with a hidden side-agenda? After all, in a democracy, everyone is expected to marshal every argument, weak or strong, for his own self-interest.

|

| Federal Reserve |

The loss of banks as a tool for the Federal Reserve would undermine the way the Fed does its job. A deeper reality is that many governments really don't want the job to be done perfectly and independently. The European common currency, the Euro, is already irking the French and other national governments who sometimes hanker to inflate away their debts or deflate their way out of the subsequent inflation. A perfectly automatic currency regulation threatens an important ingredient of the sovereignty of nations, thus the whole concept of nationhood. Somehow, the desire of markets to enhance wealth must come to terms with the desire of governments to re-elect themselves.

It will take more than the present crisis to provide credibility for ideas as wild as substituting equity-based currency for the present debt-based one. Unless someone devises a better-sounding scheme, it seems more likely that financial Jacobins will propose sacrificing the unwelcome intruder. Derivatives, whatever that means, started this mess. Maybe we should make them illegal.

Computerized Finance to the Guillotine

|

| Industrial Revolution |

Creative destruction seemed a violent driver for the past two centuries, injuring a lot of harmless occupations and provoking their resistance to progress. The Industrial Revolution was bad enough, arousing Engels and Marx. But the computer revolution works faster, putting the pedal to the floorboard in a lot of ways, changing almost every life in some way, only faster. We could be approaching a violent second Luddite reaction if we don't keep our heads.

The legitimate complaint about the electronics revolution is that it is going in the right direction, but exceeding a reasonable speed limit. Elegant novelties that function smoothly deceive us into expecting perfection too soon, developing a habit of depending on innovations which are still a little shaky. But the banking industry, which presently bemoans securitized mortgages, swaps, and other products of the computer age, could not possibly have coped with the vast expansion of bank transactions without computer assistance. Computerized fraud is a problem, but street crime has markedly declined in response to ubiquitous cell phones in the pocket of every innocent bystander. The press is vexed by Internet competitors and bloggers by the million, but democracy is the better for it. Sometimes a simple solution will solve a problem created by computers, but to a major degree, only computers can get us out of the fix we are in.

For example, it seems plausible that the flaw in securitized mortgages lies in the inevitable loss of diligence by banks who originate mortgages with full knowledge that they will immediately be sold. Requiring an originating bank to retain 10% of the mortgage permanently would also force it to maintain an accurate tracking system for the other 90%, providing analysts a way to assess the performance of the originator, and regulators a way to control the volume. Maybe a simple rule like that would suffice, but if not the solution would probably consist of a massive computer programming effort to maintain records in excruciating detail.

|

| Madam LaFarge |

It's probably true that five years ago hardly any bank president could have offered a simple coherent explanation of what a derivative is, and it is certainly true that's the case for 99% of the population today. But that is the worst possible reason to destroy derivatives, which offer a breath-taking advantage in scale and diversification, and ultimately in risk abatement. Bundling thousands of mortgages leads to a much more precise estimation of the risk of the bundle than a banker could make of a single mortgage. If you know the risk with precision, the assessment of risk will be more accurate and almost certainly cheaper. There will be, there must be dislocations of prices as one system morphs into another. Temporary halts and moratoriums are justified, but demagoguery and Luddite riots are pitiful harmful responses. Politicians up for election are a menace in any crisis, where they come in various guises. There's giggling while the heads roll. There's also Charles de Gaulle, purring that he wanted to go to Heaven, he just was in no particular hurry to get there.

|

| Charles de Gaulle |

But let's be careful of our slogans, here. It certainly is preposterous to say that anything which is poorly understood must be a villain. It's also unwise to be drawn into a swamp. The banking industry faces dissolution if they can't keep up with electronic advances in their industry, so it is inevitable that speeding up wrong approaches will only make some parts of the credit crunch worse. Most of the cost-effectiveness of computers in the past have grown out of revising and replacing old methods, not from speeding up dumb ones. For example, if you want to know why health insurance is so expensive and cumbersome, you need only ask why it is so profitable. Once the huge investment in computerizing a system has been made, replacing it with a better system gets to be nearly impossible.

Ultimately, our present dilemma is this: we don't yet know how bad the problem is. It seems a reasonable possibility that this crunch happened just in time. Bad, it is true, but not yet catastrophic. If 3% or even as much as 10% of mortgages are foreclosed, the present system can absorb the loss, learn its lessons, and move on. A loss of a hundred billion dollars would probably lead to business more or less as usual. A loss of four hundred billion would however probably imply a serious recession, but when you start talking trillions, you are talking disaster. Most of the immediate uncertainty arises from ARM, the adjustable rate mortgages, and the degree of leverage in the debts of financial intermediaries. It's quite uncertain how many people took out mortgages they will not be able to afford at higher future rates of interest, or how many people took advantage of low rates for five years knowing they were planning to sell and move on during that interval, anyway. With regard to business loans, a mild drop in the economy will make it hard for businesses to cover highly leveraged loans. A huge drop will make it impossible for many businesses to survive, and they won't. A trillion-dollar aggregate loss would certainly provoke some welcome bipartisanship in Congress, but it might trigger a collapse of the Chinese economy or other unthinkable contingencies. Forcing more transparency into the present murk is the most urgent need, and that might well imply a concerted crash electronic analysis effort, with the way opened by some enabling legislation. Speeding up is only a good thing if you are headed in the right direction.

2008 -- A Time to Reflect

|

| Gas Prices |

The Northeast portion of America is cold; most of its public concern traces back to high prices for fuel oil. The Southwest, however, is warm and more concerned with house prices and mortgages. Air conditioning has been the main source of the South's revival. This geographic split in attention will have a powerful effect on politicians in an election year. We can only hope the ambivalence cancels out and restrains legislative action until it is at least clear what the extent of the damage is. Meanwhile, don't do something, just stand there. A central question is whether there are too many houses in California, or too few. For decades, Westward migration outpaced housing construction, so California house prices have long been too high, mortgage lending too "innovative". While it is natural for western builders to feel there are now too many houses for sale in California, a case can be made that present noises are merely squawks as house prices settle to more reasonable levels. With luck, the West may just ride it out. But after adjustment for current emigration, an excessive number of housing units per capita might just warrant paradoxical solutions for California. Empty houses usually breed slums, that's pretty simple. But please, could someone explain securitized mortgages?

Other sorts of people should be pondering where the long slow decline of banks is going to lead. It makes a difference whether regular banking and investment banking will merge -- or have a collision. Much will depend on how well the two industries manage their massive computer systems; the heavy reliance of commercial banks on software vendors (rather than doing their own programming) is not an encouraging sign. The person who can fix their problems lives in India. Something is going to have to change in the way the Federal Reserve manages the money supply if money is largely borrowed abroad. Commercial lending migrates toward non-bank sources and eventually deprives the Fed of useful tools. Commercial banks, investment banks, and the Federal Reserve all have different sorts of risk. But when a complex system is placed under stress, it is the weakest link in the chain at that moment which breaks.

Happy New Year, every one.

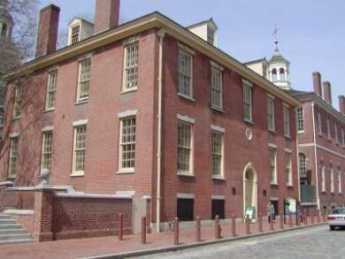

Report Identity Theft to the Secret Service

The Internet provides new blessings, but new problems as well. Identity theft has now ballooned from a rarity to a fairly serious issue. After initial turf confusion, the issue has been assigned to the U.S. Secret Service. If it happens to you, that's where you make your anguished call. (1-877-ID-THEFT) or www.consumer.gov/idtheft

There's a certain logic to regarding identity theft as a modern form of counterfeiting, which has been with us since the days of William Penn. Shirley Vaias, representing the Philadelphia regional Secret Service, recently addressed The Right Angle Club of Philadelphia on the topic. It makes sense to learn the Service is headquartered on Independence Mall, across from the Mint. The crude forms of printing in the 18th Century made counterfeiting easy, and ever since the early days, there's been a race between improvements in technology and improvement in counterfeiting. We now have a paper with little red fibers in it, watermarks, serial numbers, color-shifting inks, microprinting of secret messages in the portraits, special magnetic strips, and probably lots of other clever things we aren't told about. The Bureau of Printing and Engraving is changing the currency, one bill at a time, and recently there was a new ten-dollar bill. A counterfeit version was in circulation within six hours.

ATM machines are equipped with counterfeit-recognition devices, and special gadgets are provided for banks and retail stores, but one detection device traditionally catches most fake bills. After handling huge amounts of currency, bank tellers catch a counterfeit just by the feel of the paper. Color photocopiers are getting better and cheaper, but of course, they can't change the serial numbers, so they aren't as smart as they seem. About one-hundredth of one percent of the currency in circulation appears to be fake, so you are pretty safe, but the possessor of a bad bill is deemed to be the one out of luck. The consequence is that many citizens suspect a bad bill, take it to a bank and have it instantly confiscated without recourse. That would seem to discourage reporting a counterfeit, encourage passing it off to an unsuspecting friend, and overall seems terribly unfair; but it results from the wisdom of the ages. Experience shows honest citizens are indeed tempted to try to pass the money on. While the banks don't enjoy being policemen, the effect is that counterfeits will circulate until they hit a bank, and thus confiscation is fairly comprehensive.

As the printing of money gets more complicated, the special presses needed to produce good money has become a monopoly of certain German companies, who sell the machines to other countries. Some of the American presses thus got into the hands of some Russians, who sold them to the North Koreans. So for a while at least, the North Korean government was printing American currency. It provoked vigorous countermeasures, the nature of which is confidential.

A bill of any denomination costs the government about half a cent to produce and lasts about four years in circulation. When tons of old bills are retired from circulation, the serial numbers are recycled; to an outsider, that sounds like an impossibly tedious job, but they say they do it. There's also the issue of seignorage, a term for the profit the government makes when the paper currency gets destroyed in one way or another, costing less than a cent to replace. Just how profitable the currency business is, cannot be accurately determined, because a lot of it is buried or hidden in mattresses and might someday resurface. But there is a substantial profit, which like any shrewd businessman, the government weighs against the cost of detection. Bail bonds and casinos are big sources of bad money, as could be readily imagined, and hence it is in their interest to get pretty sophisticated (and extremely unpleasant) about detection. On balance, however, it can be expected that legalized gambling in Philadelphia will promote more counterfeiting in the local economy, and hence is an offsetting cost of the tax revenue.

Over the centuries, governments have learned how to cope with counterfeiting, and there is actually much less of it than a century ago. You win some and you lose some; life just goes on. With internet identity theft, however, the criminals are developing techniques faster than governments have learned to combat them, and it is governments who struggle to catch up. Unfortunately, everybody takes a business-like approach to the matter, asking whether the precautions cost more or less than the losses. It would seem that if money continues its migration from paper currency to bookkeeping entries, it will eventually seem unsatisfactory for only one party in a transaction, a bank let us say, to keep the books while the public simply trusts them. Eventually, each individual will be forced to seek the protection of some sort of computerized system keeping the counter-parties honest, on behalf of the public, and to prevent a paralysis of commerce. Identity theft is getting expensive enough to warrant the effort.

Just how to do all that is not too clear. So, in the meantime, just let the Secret Service figure it out.

What's a Repo?

|

| Bear Stearns |

On St. Patrick's Day, 2008, Bear Stearns became insolvent and was given to J P Morgan. The Federal Reserve assumed all risks. Effectively, the fifth largest investment bank in America was nationalized for $2 a share, because no private bank would buy it at any price. A year earlier it was worth $170 a share, even one trading day earlier it sold for $26.

At the heart of this catastrophe were "repo's", or repurchase agreements. (They should not be confused with repossessions of cars and other hard goods bought on time, which are also called repo's.) Although most people had never heard of the high-finance version of repo's, the volume of these instruments had grown to $5 trillion by January 2005, presumably even several times larger than that when they caused the nationalization of Bear Stearns. Newsmedia accounts offered the guess that 16% of the resources of the whole financial sector were caught in open repo's when the music stopped. Repo's must be awfully good, or awfully bad.

|

| J.P. Morgan |

They were both of these things at once. Like so many innovations in the post-computer era, they offered a major cost saving to an inefficient transaction system but were so successful they overwhelmed the institutions which flocked to their reduced cost. The unanticipated difficulties might have been imagined, but they were not adequately guarded against. Essentially, these loans limited exposure to a few days, a feature that made them appear quite safe. Unfortunately, tons of these loans could expire simultaneously if a rumor got started and everyone held off using them for a week. With a run on a bank, at least people have to take action to withdraw their money; but with these things, simple inaction quickly led to massive cash shortages at the bank. Speeding up the loan process had made it cheaper, but made it vulnerable.

|

| Hedge Fund |

Consider the inefficient complexities of a bank loan. The bank wants collateral, perhaps 80% of the value of the loan. The ability of the borrower must be investigated, a clear title assured, and papers arranged for transfer in case of defaulted collateral. Lawyers must organize the agreements, and it all takes time, costs money. To go through all this for a one-week loan for anything less than huge transactions is simply not practical. So the idea was devised to sell the collateral to the lender at a discount, together with a repurchase agreement to buy it back at full price. For safety sake, the discount could be greater than the interest cost, and part of it returned if all went well. The collateral could be held by a third party, who essentially guaranteed the details while the collateral itself never moved. Bear Stearns had perfected these variations at such favorable prices they dominated the market for them with hedge funds; the margin for error narrowed when interest rates dropped, cash got scarce when investors got uncomfortable, the whole hedge fund industry was suddenly paralyzed, and everything connected to hedge funds was frozen secondarily. Much of this was handled automatically by computers, so huge volume made it impossible for anyone to know who might be insolvent. It seemed comparatively harmless to decline to play this game for a few days, but it was not harmless if most people decided to do so at the same time. The daily variations of interest rates and/or duration generate a ("Gaussian") normal distribution curve for the risk, predicting serious deviations will occur once every two centuries. But when events --even false rumors -- suddenly get everyone's attention at once, small daily fluctuations no longer bear much relationship to the frequency of violent fluctuations. Once-in-a-century events start to happen every few years. At those times, the public stops speaking with a million voices and shouts in unison. Quite often, there is no cataclysmic event to trigger it. Like the conversational babel of a dinner party, it can all stop at once for no particular reason.

|

| Black Swan |

The mathematics of this matter could be taught to a tenth-grade math class. It starts to get beyond everybody's anticipation however when two such Black Swan events happen at the same time. In this case, an unanticipated pause for a few days bumped into the rule that non-bank institutions must mark their portfolios to the market every day. But for days at a time in this crisis, there could be no trading in certain issues; there was no market to mark to. How then can you demonstrate your solvency -- what might your competitors be hiding during these unannounced market holidays? And, since banks are in the same pickle but aren't required to mark to market, how can you trust them to pay bills? When you see European banks, who must obey new rules called Basel II, go bankrupt and get nationalized, how can you be sure American banks, who needn't obey Basel II until 2009, are any safer bet?

Progress is progress, but how much of it can we cope with?

The 'repo' market from Marketplace on Vimeo.

SCORE

|

| Mark Maguire |

Frank Pace, formerly Secretary of the Army, founded SCORE, the Service Corps of Retired Executives, in 1964. Philadelphia was one of the main founding chapters but tended to dwindle as business large and small dwindled after the bombing of West Philadelphia by the then-Mayor; former executives living in the suburbs lost interest. In December 2006, Mark Maguire took charge and gave SCORE a new direction. This former executive of Rohm and Haas is not related to the baseball home-run king, but at least his name is easy to remember.

The new sociology of center city demanded that more small businesses be started by minority residents, who have very little family and cultural experience in this sort of activity, which nevertheless is recognized as the main source of job creation in any area. It turns out that the main source of energy in the minority community is among minority women, who are particularly unfamiliar with the problems of small business. So, SCORE needs to dispel a number of misconceptions and unrealistic ambitions, and familiarize these budding entrepreneurs with the tax and regulatory headaches ahead of them, and teach them to be watchful of common traps and obstacles, learn to cope with fair competition, and how to recognize the signs of fraud before it happens to them.

The usual vehicle for teaching these elements of commercial life is to induce the writing of a detailed business plan, which executives can criticize for lack of realism or inadequate capitalization, suggesting ways to succeed in a field that experiences 50-60% failure in the best of circumstances. Some of this requires face-to-face discussions, lectures, and required reading. But much of it can be handled with weekly email consultations, a favorite tool of Philadelphia's SCORE chapter. Much of it can be addressed by referring the client to the proper agency or service business, or bank. SCORE has a strict ethical code for its volunteers, including a prohibition of becoming a vendor or participant in the business.

In addition to the changing nature of new small businessmen, there is a changing demographic of the volunteer executives who do the advising. Over 80% of them describe themselves as retired, but in fact, it is rare for one to be totally retired from all business activity. These guys really like to work, and a thirty-year vacation is not their goal in life. Just by acting as an example, they are establishing an important goal for the young businessmen and women who look to them for guidance. Work is how you accomplish something in life, and work, believe it or not -- is fun.

www.Philadelphia-Reflections.com/blog/1430.htm

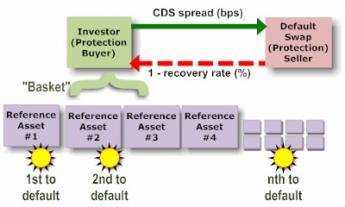

HowTo Create A Subprime Derivative

Novation

|

| American Stock Market |

Novation is a term that perhaps nobody but a specialist expert can now define, but is nevertheless destined to be politicized in the coming election campaign to the point where almost everybody could be shouting it like a war cry. That is unless the hired political consultants decide some other feature of credit derivatives serves warcry purposes better. We're talking sixty trillion dollars here, about five times the size of the domestic American stock market.

Someone owned or thought he owned pieces of paper worth this staggering sum, which can be regarded as side bets on the bond market. Just as in a horse race, where you don't usually own the horse when you bet on the winner, you needn't own the bonds to bet on whether they will default. The side bet is often between two outsiders who acquired their bets through, well, novation. The process begins as a credit derivative, in which someone gets paid an annual sum in return for agreeing to pay off -- if the bond defaults. That could be regarded as a useful insurance policy, making more credit available by making it safer to buy bonds. The bondholder gives up a little interest in return for assurance the bond is now completely safe. Sucker.

|

| Sun Belt Mortgage |

Like the Sun Belt mortgage originator, the originators of these derivatives often wasted little time clipping off a fee and passing the carcass to someone else. And that process got repeated until the accumulating fees in the chain slowed the process to a point where the weakest or most reckless holder got into danger. The game might have slowed to the point where it became self-correcting, but what actually seems to have happened is that much of the long-term debt involved was financed by short-term borrowing, and the start of some rumors triggered a run on the bank. Not exactly, of course, but when institutions which had made one-week or one-month loans stopped lending, it only took a few days for the money to run out and Bear Stearns was quickly unable to pay its bills even though it started the week with $18 billion in reserves.

|

| Securities and Exchange Commission |

That short description is about the best that can be made out of an opaque situation, based on what the Securities and Exchange Commission is willing to tell reporters about its investigation. More will be forthcoming, and no doubt some villains and fools will emerge with a lot of blame. For example, the price of credit derivatives concerning Bear Stearns debt had been creeping up steadily during the month before the explosion; whether somebody knew something bad, or whether there really was something bad is presently unclear. It's disconcerting to learn that Goldman Sachs was dumping this paper, and JP Morgan Chase was mostly buying it, but it's early days for unfounded suspicions. More will come.

Now to return to novation. We legal novices learn that novation transfer is the same as assignment transfer, except all parties have to agree to novation before it can take place. That's going to make it harder for a lot of people to deny they knew what was happening. The astonishingly large sums involved are apparently not entirely real, because in some way the old debt is not extinguished, and the new debt is merely added to the sum total outstanding. That surely means the same debt is counted several times, and the apparent sum is to some unknowable extent much larger than the underlying reality. This also accounts for the amazing speed of growth. In January 2007 the total was said to be about $25 trillion, in January 2008 it was reported to be $42 trillion, and in May 2008 it was said to be $60 trillion. Things which move that fast can quickly spin out of control, especially when short term creditors need to do nothing much for a couple of weeks as their money emerges from the pool. Some people did sell short, of course, but whether that was panic or malicious must probably be left to politicians to declaim.

Surely the most terrifying part of this simple story is that so much money could be moved around without public awareness. When the $25 trillion figure emerged, a number of people asked what in the world was going on, and kept asking that question for eighteen months. Nobody knew nothing.

Federal Reserve Changes Its Business Model

Americans generally do not begrudge the success of neighbors; the achievement of someone else takes away nothing from me. In that spirit, we like to see developing countries rise up out of poverty. A more prosperous world is a safer one.

|

| Philadelphia Federal Reserve |

Rising international prosperity can, however, disrupt matters. When developing countries become producers, they can get inflation if they suddenly have more money than they know how to spend. Sudden wealth can come from discovering oil or gold or copper; slowly learning how to manufacture something is a safer way to prosper. Inflation and huge internal income disparities often lead to revolutions, so the wiser countries sterilize local money by exporting it. Coups and dictatorships are what happens if a developing country doesn't export its inflation; sudden wealth gives the appearance of being underserved. Conversely, our recent dot-com and Sunbelt real estate bubbles show what happens to the neighbors if developing-world inflation gets dumped on them. Eventually, of course, developing countries eventually balance their new production with new consumption, and the world settles down to a new balance. Never mind denouncing the rubbish the newly-rich decide to consume; its only problem for others lies in using up the world's resources faster. Developing countries commonly export inflation to other nations in the form of commodity inflation. The neighbors can soon have a commodity bubble on their hands; when any bubble bursts, a sharp recession can quickly follow, and after that, some other kind of bubble appears. What is new and disruptive is not oil or gold or copper; it is too much money.

With luck, these disruptions consequent to a neighbor's prosperity are soon overcome by improvements in productivity. But productivity itself can create a bubble. One huge productivity windfall for America is the astonishing thirty-year extension of longevity we have experienced; in time, we will surely devise occupations for retirees more productive than thirty-year vacations. Such balancing adjustments right now seem most likely to grow out of electronic productivity, using home sites as work sites.

So in short, America must read just like everyone else and one systematic readjustment has just surfaced at the Federal Reserve. The flood of money from China and the Persian Gulf sought an outlet in our economy, adopting the device of shifting American credit sources from banks to Wall Street ("securitization"). Cheap money once derived from bank deposits in local banks; since it now often originates abroad, it now must travel through the "carry" trade and similar innovative channels for foreign surpluses to get to Wall Street investment banks, which in turn distribute the money ("credit") to American businesses which can use it more productively than the developing countries can. Through securitization (turning loans into securities), Wall Street was able to make home mortgages directly, with only token involvement of local banks. Credit markets froze up because the new procedures had neglected to enlist local bankers in the process of checking the credit-worthiness of borrowers. So long as Wall Street can continue to find new sources of cheap money, this upheaval of finance is likely to be permanent because it is desired by both sides. Access to cheaper loans and access to safer investment harmonize the needs of the haves and the have-nots. Because in its haste this new development precipitated a banking crisis, there is some danger that Congress will overreact by prohibiting securitization rather than correcting its flaws. In every participant's eyes, it's cheaper and more efficient, but new efficiency threatens old inefficiencies. This one threatens the old deposit-based banking system, and since the Fed's control of the currency is based on its control over the depository banks, it threatens the Federal Reserve. That's the real driving force behind the Fed seeking control of non-traditional credit sources; that's now where the money is.

On March 16, 2008 things came to a head with the impending collapse of Bear Stearns, a Wall Street investment bank heavily involved in Credit Derivatives. There are rumors the rescue plan implemented over a weekend had actually been devised and held ready long before then. Many imperfections now surface with experience, but at least the plan had likely been explored as thoroughly as logic without direct experience ever allows. For example, the dispersal of manufacturing around the globe favored making pieces of a product and selling them to an assembler, rather than enveloping the whole process of making a product in one giant corporation. It's cheaper, that's why they do it. But the process of buying and selling pieces to other companies greatly expanded the need for short-term credit. Therefore, it was quite unexpected that Lehman Brothers, which specialized in such short-term loans, suddenly went bankrupt for lack of quick access to capital. In the panic, it is unfortunate that Lehman apparently concealed its situation from investors. There is a danger that Congress will draw the wrong moral and somehow block the globalization of manufacture.

The Federal Reserve Act was passed by Congress in 1913, and most observers believe the Fed's inexperience in 1932 repeatedly made matters worse in that formerly greatest of all bank panics. The new plan of 2009, therefore, had to step around some limitations imposed by Congress in the past, the political pressures generated by an impending presidential election, and the powerful resistance from private industries whose future was affected. The adroitness with which such a complex matter was handled over a weekend will surely become legendary, but maybe not soon. Probably because of existing legal roadblocks, three "lending facilities" were created, but a single device was at the heart of it. Instead of lending money, the Federal Reserve offered to swap securities with new non-bank managers of retail credit. The investment banks held massive security for loans which could not be sold in paralyzed markets but could be swapped or used as security for a loan, particularly if the government stood behind the innovative transactions. Wall Street in a word had plenty of wealth, but could not turn it into money fast enough to pay its bills. So sidestepping the legal constraints, instead of giving Investment firms money as a lender of last resort, the Federal Reserve swapped Treasury Bills for the "frozen" assets held as security for mortgage loans. The securities had been "caught in a loan" as the expression goes. There isn't much difference between Treasury bills and cash, or between exchanging bonds and selling them. But the new approach could be quickly and legally accomplished, and once done, the Federal Reserve was the master of investment banks. It became effectively their lender of last resort. A great deal of advance thought must have gone into devising this readjustment to the reality that over half of loans were not backed by bank deposits, but by the securitized debt of foreigners. Regulations will ensue, hearings will be held and laws passed, but the Fed has regained control of the money supply if it can manage to make this maneuver understandable by the public.

There was a moral hazard in this; the presence of a lifeguard tempts swimmers into deeper water. It was somewhat inflationary in the midst of an inflation threat. No doubt the Federal Reserve regards these negatives as prices worth paying, and they probably are. The decisive remaining issue is not whether the initial shape of this transformation is exactly correct; it surely isn't. Just as was true in 1932, what will ultimately matter most will be whether, with this altered stance, the Fed will adjust quickly and appropriately to future difficulties. And whether politicians will even permit it to do the right thing, assuming anybody then knows what the right thing might be.

www.Philadelphia-Reflections.com/blog/1465.htm

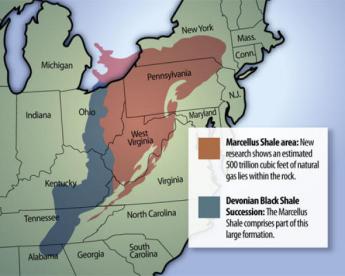

Africa Comes to the Schuylkill

A journalist, John Ghazvinian, recently toured the many countries of Africa, wrote a book about it and carried his message to the Right Angle Club of Philadelphia. Philadelphia does not think of itself as particularly involved in oil matters, or African ones. But the fact is the refineries on the Schuylkill down by the airport generate two-thirds of the gasoline now used on the East Coast, and right now it mostly comes from Nigeria. There was a time when the crude oil coming to Philadelphia came from Venezuela, but politics are a little unpleasant there at present, and anyway Venezuelan oil is heavy and full of acids. The refineries which specialize in that kind of heavy oil are on the Gulf Coast. Long before the Venezuelan era, the Philadelphia refineries were constructed to refine crude oil from upstate Pennsylvania. They were once the main source of the dominance of the Pennsylvania Railroad, because oil refining from Bradford County gave the Pennsy a return freight, whereas the competitive railroads running out of New York and Baltimore had to return from the West without cargo.

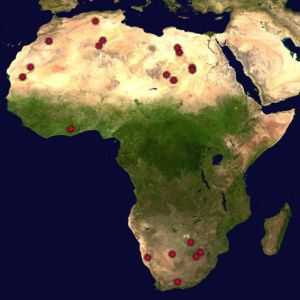

|

| African Map |

There are 54 countries on the continent of Africa, quite different from each other in character. One dominant characteristic of Africa is its lack of natural ports, and even the Mediterranean ports are cut off from the rest of the continent by the huge transcontinental stripe of Sahara desert. Major wars and famines, monstrous genocides, unspeakable cruelty, and poverty go on there without much notice by the rest of the world.

The largest country in Africa is Nigeria. Anyone with even minor dealings with Nigeria soon sees that corruption and dishonesty pass all Western imagination, and they have serious tribal warfare as well. The discovery of large deposits of oil in the region faced the international oil companies with a rather serious difficulty. For instance, Shell Oil has had over 200 employees kidnapped for ransom and is seriously contemplating abandoning its whole venture. At the moment, corruption is coped with by constructing oil wells a hundred miles out in the ocean.It's almost true that the huge tanker ships make from Philadelphia and return, without the crew talking to any natives of Africa.

We hear that genocide is in full bloom in the Sudan, and that poverty in that country similarly passes belief.

|

| Chad Poverty |

They have oil in the South of Sudan so we may hear more of it. Chad has poverty and oil, and civil war. They have a big Exxon facility, but there isn't a single gasoline station in Chad. At the moment, Angola has paused in its enormous civil war, which killed millions, and Chevron will surely encounter unrest before it is done. Gabon appears to be extremely prosperous, from oil money of course, but they are being ravaged by the Dutch Disease, of which more later.

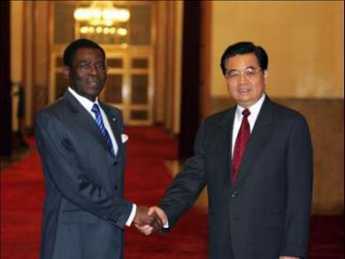

Apparently, Equatorial New Guinea sets some sort of record for wild behavior. It has lots of oil, and a strong Chinese influence. The current

|

| Mbasogo and Jintao |

President of Equatorial New Guinea got his job by shooting his uncle. But don't feel too sorry for the uncle, who used to have an annual Christmas morning celebration, consisting of herding his enemies into a football stadium, and shooting them for the edification and entertainment of the populace. After listening to Mr. Ghazvinian, it seems small wonder that so few American tourists, or journalists, or even missionaries, manage to complete extensive African excursions. As everyone notices, if you don't have journalists, there is never any news.

Let's turn to the Dutch disease,

|

| David Ricardo |

of which Africa currently displays many examples likely to torment economics students for decades after Africa eventually rivals Houston. Let's start with David Ricardo, who electified the Nineteenth Century world of economics with his principle of comparative advantage. Ricardo pointed to the obvious truth that always and everywhere a nation does best for itself by identifying its best economic feature and then sticking to it. If every country wakes up and does that, every country must then trade with its neighbors for other things it isn't so suited to make. Consequently, tariffs and trade barriers are a hindrance for everyone, in time impoverishing all nations in the cycle, whatever short-run advantages of tariffs may seem enticing.

|

| North Sea Gas |

So far as I know, Ricardo was quite right, but someone had better hurry up and reconcile his underlying premise of comparative advantage with the Dutch Disease. The Dutch disease was identified and named by an anonymous writer for the London Economist about thirty years ago. Noticing that the Netherlands experienced a marked worsening of its general economy after the discovery of North Sea gas deposits, the observer for the magazine concluded that sudden accumulation of wealth in the gas industry led to a rise in the value of the Dutch currency, soon making it impossible for non-gas industries to export, unable to compete at home with now-cheaper foreign imports. Naturally, investors rushed to invest in gas, sold their holdings in other industries, and Holland was propelled in the direction of a one-industry economy, quite at the mercy of fluctuating prices of gas. This was the Dutch Disease born, and Ricardo's principle of comparative advantage exposed to quite a severe challenge from which it has not completely recovered. This is important, so how about a simpler description: When gold is discovered, people drop tools to have a gold rush. Wealth lost from dropping tools is greater than wealth gained from the gold.

Fear of the Dutch disorder seems to be the reason why the Chinese are buying our Treasury Bonds, the Japanese engaging in the astonishing "carry trade," and the Arabs buying American private equity funds. The common strand through all these schemes is this: By sending their bonanza savings abroad, they "sterilize" them from their tendency to force their currency upwards. They are exporting inflation, but also endangering their own struggling non-bonanza industries, which are the main hope for diversifying their economies and getting rid of the Dutch effect. Somewhere during this balancing act, politicians get involved and make things worse. So they call in their generals and admirals, to explore solutions we prefer they were not in a position to explore. Simpler description: When you discover oil, inflation soon follows. And all too often, revolution follows that.

The 1787 the American Constitution unknowingly cured thirteen cases of the Dutch Disease, by imposing absolute freedom of interstate commerce. After eighty years, the benefits of this national union would persuade the North to bleed and die for it. Although the Confederacy thought they were fighting for their way of life, meaning slavery, even the Southerners today recognize they are better off in a Union. Unfortunately today, the European nations are still having a hard time believing the benefits of union could possibly outweigh their allegiances to language, religion, and the wartime sacrifices of their ancestors. They are very wrong, but we are wrong to sneer at them. Except for maybe Switzerland, it is difficult to name another instance in all of history where several independent states gave up local sovereignty for the benefits of a diversified economy with local pockets of comparative advantage. Let's restate it again: the Dutch disease is a result of sudden single-industry prosperity in a country too small to control it.

By the way, what eventually happened to the Dutch? It seems likely that absorption of little Holland into the European Common Market helped dilute the corrupting effect of gas prosperity. It suggests the possibility that Dutch can be reconciled with Ricardo through the common denominator of reduced national barriers to trade and currency-- reduced sovereignty in a milder form. But it's a hard slog. Maybe we could envision annexing Alberta to soften the commotion of oil tar, but it takes a lot of imagination to see the amalgamation of China and India, any time soon. There may thus be nations too big to merge, but nevertheless, it would probably be less destabilizing to merge with all of Canada than just with Alberta if you overlook the obvious fact that it is easier to persuade a small country than a big one. Just kidding for the sake of example, of course, since Canada shows no interest in the idea.

Meanwhile, take a look backward from the highway overpass the next time you travel to the Philadelphia Airport. There's a lot more going on in those refineries than just black liquid flowing into steel pipes.

After a Year of Crisis, Fannie and Freddy Finally Get the Spotlight

|

| Freddie Mac Corp. |

A year after potential financial collapse burst on the scene, the public (and Congress) are beginning to understand what collateralized debt obligations (CDO) are, and how Fannie Mae and Freddie Mac work. It begins to seem they are much the same thing in different clothes, that securitization of mortgages began with Fannie Mae if not Farm Credit in 1916, and that these bewildering new Wall Street CDO creations are just new variations of an old idea. The devil, as always, is in the details.

|

| Freddie Mac Corp. |

Originally, Government Sponsored Enterprises (GSE) began in 1916 with the Farm Credit System and entered the home mortgage secondary market in 1938 with the creation of FNMA (Fannie Mae). Populist in the first case and Depression-fighting in the other, the idea was that third-party reinsurance would make mortgages safer, and thus lower interest rates for a favored population segment (farmers and homeowners). Although no promises were made to bail out failing loans, GSEs eventually grew large enough to seem able to force the government to rescue them in the event of failure. They were claimed to be "too big to be allowed to fail". In addition to this implicit government backing, there was a twist created by making debt interchangeable with equity. "Securitization" was a process of bundling many mortgages into a package sold to the public as a stock issue. Since FNMA was a creditor, rising interest rates created profits for the shareholders, while falling interest rates depressed share prices. Steady predictable mortgage prices could be offered to homeowners, while the risk was transferred to the shareholders. To a certain but much lesser degree, some of the risks of falling real estate prices were transferred to the shareholders as well. Finally, the reduced risk in this arrangement led to lower prices for mortgages, regardless of the state of the economic cycle.

|

| Michael Milken |

To some unknowable degree, enthusiasm for mortgage-backed securities in the private sector was enhanced by fear or even loathing of government involvement in the financial system style of banana republics or the Weimar Republic in 1922. To compete with the lower interest rates of government-backed security, the efficiency of the private sector could be combined with innovations made possible by the computer. Mathematical models were devised to calculate mortgage interest rates by working backward from the default rate in a huge universe of mortgages. During the savings and loan crisis two decades earlier, Michael Milken had promoted the idea that prevailing interest rates on mortgages were higher than were justified by the prevailing rate of default in a large pool. If the uncertainty of risk for a single mortgage could be submerged within the fairly certain risk of a large pool, it should be possible to offer generally lower prices than even those of the government-backed GSE system. In spite of the recent panic, the reasoning behind both systems, government and private, seemed to suggest that securitization of debt continues to be a sound idea.