Related Topics

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Computerized Finance to the Guillotine

|

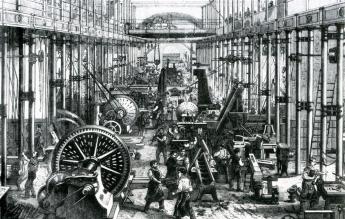

| Industrial Revolution |

Creative destruction seemed a violent driver for the past two centuries, injuring a lot of harmless occupations and provoking their resistance to progress. The Industrial Revolution was bad enough, arousing Engels and Marx. But the computer revolution works faster, putting the pedal to the floorboard in a lot of ways, changing almost every life in some way, only faster. We could be approaching a violent second Luddite reaction if we don't keep our heads.

The legitimate complaint about the electronics revolution is that it is going in the right direction, but exceeding a reasonable speed limit. Elegant novelties that function smoothly deceive us into expecting perfection too soon, developing a habit of depending on innovations which are still a little shaky. But the banking industry, which presently bemoans securitized mortgages, swaps, and other products of the computer age, could not possibly have coped with the vast expansion of bank transactions without computer assistance. Computerized fraud is a problem, but street crime has markedly declined in response to ubiquitous cell phones in the pocket of every innocent bystander. The press is vexed by Internet competitors and bloggers by the million, but democracy is the better for it. Sometimes a simple solution will solve a problem created by computers, but to a major degree, only computers can get us out of the fix we are in.

For example, it seems plausible that the flaw in securitized mortgages lies in the inevitable loss of diligence by banks who originate mortgages with full knowledge that they will immediately be sold. Requiring an originating bank to retain 10% of the mortgage permanently would also force it to maintain an accurate tracking system for the other 90%, providing analysts a way to assess the performance of the originator, and regulators a way to control the volume. Maybe a simple rule like that would suffice, but if not the solution would probably consist of a massive computer programming effort to maintain records in excruciating detail.

|

| Madam LaFarge |

It's probably true that five years ago hardly any bank president could have offered a simple coherent explanation of what a derivative is, and it is certainly true that's the case for 99% of the population today. But that is the worst possible reason to destroy derivatives, which offer a breath-taking advantage in scale and diversification, and ultimately in risk abatement. Bundling thousands of mortgages leads to a much more precise estimation of the risk of the bundle than a banker could make of a single mortgage. If you know the risk with precision, the assessment of risk will be more accurate and almost certainly cheaper. There will be, there must be dislocations of prices as one system morphs into another. Temporary halts and moratoriums are justified, but demagoguery and Luddite riots are pitiful harmful responses. Politicians up for election are a menace in any crisis, where they come in various guises. There's giggling while the heads roll. There's also Charles de Gaulle, purring that he wanted to go to Heaven, he just was in no particular hurry to get there.

|

| Charles de Gaulle |

But let's be careful of our slogans, here. It certainly is preposterous to say that anything which is poorly understood must be a villain. It's also unwise to be drawn into a swamp. The banking industry faces dissolution if they can't keep up with electronic advances in their industry, so it is inevitable that speeding up wrong approaches will only make some parts of the credit crunch worse. Most of the cost-effectiveness of computers in the past have grown out of revising and replacing old methods, not from speeding up dumb ones. For example, if you want to know why health insurance is so expensive and cumbersome, you need only ask why it is so profitable. Once the huge investment in computerizing a system has been made, replacing it with a better system gets to be nearly impossible.

Ultimately, our present dilemma is this: we don't yet know how bad the problem is. It seems a reasonable possibility that this crunch happened just in time. Bad, it is true, but not yet catastrophic. If 3% or even as much as 10% of mortgages are foreclosed, the present system can absorb the loss, learn its lessons, and move on. A loss of a hundred billion dollars would probably lead to business more or less as usual. A loss of four hundred billion would however probably imply a serious recession, but when you start talking trillions, you are talking disaster. Most of the immediate uncertainty arises from ARM, the adjustable rate mortgages, and the degree of leverage in the debts of financial intermediaries. It's quite uncertain how many people took out mortgages they will not be able to afford at higher future rates of interest, or how many people took advantage of low rates for five years knowing they were planning to sell and move on during that interval, anyway. With regard to business loans, a mild drop in the economy will make it hard for businesses to cover highly leveraged loans. A huge drop will make it impossible for many businesses to survive, and they won't. A trillion-dollar aggregate loss would certainly provoke some welcome bipartisanship in Congress, but it might trigger a collapse of the Chinese economy or other unthinkable contingencies. Forcing more transparency into the present murk is the most urgent need, and that might well imply a concerted crash electronic analysis effort, with the way opened by some enabling legislation. Speeding up is only a good thing if you are headed in the right direction.

Originally published: Thursday, December 27, 2007; most-recently modified: Wednesday, May 15, 2019