Related Topics

Japan and Philadelphia

Philadelphia and Japan have had a special friendship for 150 years.

Haddonfield (all 26)(1 of1)volume 38

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

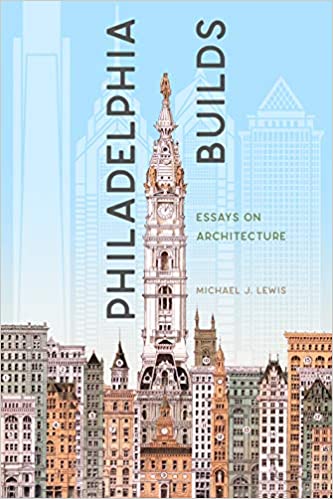

Architecture in Philadelphia

Originating in a limitless forest, wooden structures became a "Red City" of brick after a few fires. Then a succession of gifted architects shaped the city as Greek Revival, then French. Modern architecture now responds as much to population sociology as artistic genius. Take a look at the current "green building" movement.

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Old Age, Re-designed

A grumpy analysis of future trends from a member of the Grumpy Generation.

City of Homes

At first, there were limitless forests, but then the city burned down. After that, the "Red" city has long been built of brick. Philadelphia's masonry future is unknown, but it won't be wood.

Right Angle Club 2011

As long as there is anything to say about Philadelphia, the Right Angle Club will search it out, and say it.

Popular Passages

New topic 2013-02-05 15:24:06 description

Ageing Owners, Ageing Property

|

| Kiyohiko Nishimura |

Kiyohiko Nishimura is currently the Deputy Governor of the Bank of Japan (BOJ), and as such is expected to have wise things to say about finances, as indeed he does. Japan has a far older culture than the United States, and a botanical uniqueness growing out of the glaciers avoiding it, many thousands of years ago. But its latitude is approximately the same as ours, and its modern culture is affected by the deliberate effort of the Emperor to westernize the nation, following its "opening up" by our own Commodore Matthew Perry in 1852. Perhaps a more important relationship between the two cultures for present purposes is that Japan has been suffering from the current deep recession for fourteen years longer than we have. We don't want to repeat that performance, but we can certainly learn from it.

Mr. Nishimura lays great stress on the aging of the Japanese population because, in all nations, houses are mainly purchased by young newly-weds, and sold by that same generation years later as they prepare to retire. If a nation has an elderly population, it can expect a general lowering of house prices someday, reflecting too many sellers leaving the market at the same time. The buyers of those houses are competing with other young people, so the simultaneous bulges and dips of the population at later stages combine to have major effects on housing prices. At the moment, younger couples are having fewer children as a result of women postponing the first one. Nishimura goes on to reflect that something like the same is true of stocks and bonds, although at age levels five or ten years later. One implication is that retirement of our own World War II baby boom is about to depress American home prices, which will likely stay lower for 10-20 more years. Furthermore, our stock market will have a similar effect, stretching the depression out by as much as 5-15 years. The Japanese stock market has been a gloomy place to be during the past fifteen years, and by these lights might continue in the doldrums for another five or so. Meanwhile, our own situation predicts an additional generation of struggle while Japan is recovering. It's best not to apply these ideas too closely, of course, but surely somebody in our government ought to dig around in the data, at least telling us why we ain't goin' to repeat this pattern. Please.

Perhaps because they eat so much rice and fish, the Japanese already have a longer life expectancy than Americans do, but in terms of outliving your assets, that's not wholly advantageous, the way a love of golf might be. The best our nation might be able to do is to examine some of our premises about housing construction. In Kyoto, most houses were built with paper walls, for example.

|

| Commodore Matthew Perry and Japan |

The house walls of the town of Kyoto were in fact made of waxed paper, which seems to work remarkably well. While no one now advocates going quite that far, we might think a second time about building the big hulking masonry houses so favored in our affluent suburbs. Such cumbersome building materials almost dictate custom building and strongly discourage mass production. How likely are such fortresses to survive in the real estate markets of fifty years from now? Judging from my home town, not too well. Haddonfield boasts it has been around since 1701, and there are at most three or four of its houses which have survived that long. We favor great hulking Victorian frame houses, with a good many bedrooms unoccupied, and high drafty ceilings, very large window openings and little original insulation. The heating arrangements have gone from fireplaces to coal furnaces, to oil, and lately to natural gas. The meter reader who checks my consumption every month tells me that almost all the houses now have gas heat, so almost all the houses are using their second or third heating plant, along with their eighth or tenth roof, and thirty coats of paint. This kind of maintenance is not prohibitively expensive, but just wait until the plumbing starts to go, and leak, and freeze, with attendant plastering, carpentry, and painting. Our schools and transportation are excellent, so we have location, location, location. But when the plumbing, heating, and roofing start to require financial infusions all at once, you get tear-downs. A tear-down is a new house in which a specialist builder buys the old house, tears it down, and looks for a buyer to commission the new house on an old plot of land. Right now, there appear to be six or eight such Haddonfield houses, torn down and looking for a buyer to commission a new house on that location, location. If we repeat the Japanese experience, there will be some unhappy people, somewhere. And that will include the neighbors like me, who generally do not relish languishing vacant lots next door, but fear what the new one will be like.

|

| Greenfield Hall |

The thought has to occur to somebody that building the whole town of less substantial materials in the first place would be worth investigation, replacing the houses every forty years when the major stuff wears out. At the present, when a town of several thousand houses has five or six tear-downs, the neighbors would not tolerate replacing tear-downs with insubstantial cardboard boxes. Seeing what has happened to inner-city school systems, the neighbors would be uneasy about "affordable housing" built in place of stately old Homes of Pride. In time, that might lead to a deterioration of one of the two pillars of location, location -- the schools -- and hence to a massive loss of asset value. And yet when those houses empty out the school children, leaving only retirees in place, the schools will not be worth much to the owners or in time to anybody else. There's an unfortunate tendency for local political control to migrate into the hands of local real estate brokers, so you had better be sure any bright new proposal is tightly buttressed with facts.

The only real hope for evolution in this obsolete system may lie in the schools of architecture, strengthened perhaps by some research grants. Countless World Fairs have displayed the proud products of their imaginative thinking, but mostly to no avail. Perhaps the ideas are not yet ripe, but since it would take more than a generation to create a useful demonstration project of whatever does become ripe for decision, let's start thinking about some innovative suburban designs, right now.

Originally published: Monday, September 26, 2011; most-recently modified: Monday, May 13, 2019