Related Topics

Haddonfield (all 26)(1 of1)volume 38

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

Historical Preservation

The 20% federal tax credit for historic preservation is said to have been the special pet of Senator Lugar of Indiana. Much of the recent transformation of Philadelphia's downtown is attributed to this incentive.

Philadelphia Economics

economics

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

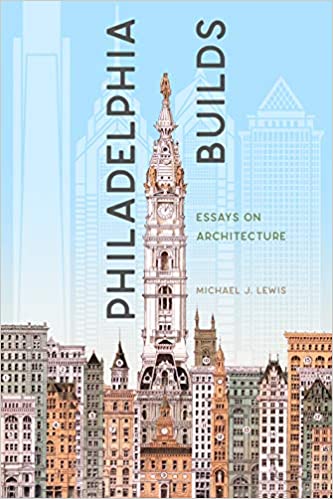

Architecture in Philadelphia

Originating in a limitless forest, wooden structures became a "Red City" of brick after a few fires. Then a succession of gifted architects shaped the city as Greek Revival, then French. Modern architecture now responds as much to population sociology as artistic genius. Take a look at the current "green building" movement.

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Right Angle Club 2010

2010 is coming to a close, a lame-duck session is upon us, and probably after that will come two years of gridlock. But the Philadelphia Men's Club called the Right Angle, keeps right on talking about the current scene. A few of these current contents relate to speeches given elsewhere.

City of Homes

At first, there were limitless forests, but then the city burned down. After that, the "Red" city has long been built of brick. Philadelphia's masonry future is unknown, but it won't be wood.

Selling Entire Towns

|

| Jason Duckworth |

Recently, Jason Duckworth of Arcadia Land Company entertained the Right Angle Club with a description of his business. Most people who build a house engage an architect and builder, never giving a thought to who might have designed the streets, laid the sewers, strung out the power and telephone lines, arranged the zoning and otherwise designed the town their house is in. But evidently it is a very common practice for a different sort of builder to do that sort of wholesale infrastructure work -- privatizing municipal government, so to speak. A great deal of what such a wholesale builder does involves wrestling with existing local government in one way or another, getting permits and all that. In a sense, the existing power structure is giving away some of its authority and does so very cautiously. Sometimes that involves suing somebody or getting sued by somebody. Perhaps even greater braking-power on unwelcome change is that the wholesale builder is in debt until the last few plots are sold, and realizes his profit on stragglers. Since it often happens that the last few plots are the least desirable ones, this is a risky business. Big risks must be balanced by big profit potential, and one of the risks of this sort of privatization is that too much consideration may be given to the players at the front end, the farmer who sells the land and the builder who must keep costs down, at the expense of the long-range interests of the people who eventually live in the new town. Top-down decision making is much more efficient, but its price is decreased responsiveness to citizen preferences.

|

| For Sale |

As it happens, Arcadia specializes in towns designed to look like those built in the late 19th Century. Close together, a front door near the sidewalks, front porches for summer evenings. To enhance the feeling of being in an older village, Arcadia specifies certain rules for the architecture, to make it seem like Narberth or, well, Haddonfield. Until recently, suburban design emphasized larger plots of land, and few sidewalks, with streets often ending in cul-de-sacs instead of perpendicular cross-streets in the form of squares. The "new urbanism" appealed to those who were seeking greater privacy, revolving around the idea that if you wanted anything you drove your car to get it. Three-car garages were common, groceries came from distant shopping centers. There are still plenty of new towns built like that today, but Arcadia appeals to those who want to be close to their neighbors, want to meet them at the local small stores scattered among the houses. In the 19th Century, this sort of town design was oriented around a factory or market-place; since now there are seldom factories to orient around, the appeal is to two-income families who want to live in an environment of similar-minded contemporaries. The whole community is much more pedestrian-oriented, much less attached to multiple automobiles.

Since Mr. Duckworth mentioned Haddonfield, where I live, I have to comment that the success of living in a town with older houses depends a great deal on the existence of a willing, capable yeomanry. Older houses, constantly at risk of needing emergency maintenance, need available plumbers, roofers, carpenters, and handy-men of all sorts. Because it is hard to tell a good one from a bad one until too late, this yeomanry has to be linked together invisibly in a network of pride in the quality of each other's work and willingness to refer customers within a network that sustains that pride. A tradesman who is a newcomer to the community has to prove himself, first to his customers, and almost more importantly to his fellow tradesmen. If you happen to pick a bad one, good workmen in other trades are apt to seem mysteriously reluctant to deal with you as a customer, because you too are somewhat on trial. Maybe you don't pay your bills, or maybe you are picky and quarrelsome. In this way, the whole community is linked together in a hidden community of trust. Over time, the whole town develops certain recognizable social characteristics that a brand-new town doesn't yet need. If that time arrives without a network of reliable tradesmen, the town soon deteriorates, house prices fall, people move away.

|

| Fannie Mae |

It's curious that the residents of such a town are a breed apart from the merchants in the nearby merchant strip. If the merchants of town life in that same town, there is much less conflict. More commonly, however, the merchants rent their commercial space and commute from distant places. That disenfranchises them from voting on school taxes and local ordinances and creates a merchantile mentality as contrasted with a resident community, dominated by high school students. One group wants lower taxes, the other group wants to get their kids into Harvard. One group wants space for customer parking, the other group is opposed to asphalt lots. And in particular, the residents want to avoid garish storefronts and abandoned strip malls. Since the only group which has an influence on both sides of this friction are the local real estate agents and landlords, their behavior is critical to the image of the town. When real estate interests are not residents of the town it is ominous, and they are well advised to remember that the sellers of houses are the ones who choose a real estate agent for a house turn-over. There's more to this dynamic than just that, but it's a good place to begin your analysis. Suburban real estate interests are constantly tempted to get into local politics, but politicians are the umpires in this game, and it soon becomes bad for their business if real estate agents potentially put their thumb on the scales.

|

| FHA Seal |

All politics is local, but all real estate is not entirely local. The present intrusion of the Federal Government into what is normally a purely local issue has become more pointed in the present real estate recession. Almost all mortgages are packaged and sensitized by "Fannie Mae and Freddy Mac". By overpaying for the mortgages they package, these two federal agencies are subsidizing the banks they buy the mortgages from. Or, that is half of the subsidy. The other half is the Federal Reserve, which presently lends money to banks at essentially zero interest. Acquiring free money from the "Fed", while selling mortgages to Fannie Mae at above-market rates, the federal government supports the banks at both ends. And that's not quite all; there is something called the FHA, Federal Housing Authority, which guarantees mortgages. Essentially an insurance policy, the FHA guarantee is issued for a cost to home buyers who meet standards set by Congress (for which, read Barney Frank and Chris Dodd). Although houses during the boom were selling for 18 times the estimated rental value, they are now selling for 15 times rental. FHA will insure such risks, but the banks won't lend more than the normal proportion, which is 12 times rental. Consequently, almost all mortgages are FHA insured, while the federal administration storms with a fury that the banks "won't lend". And indeed it begins to look as though banks will never issue uninsured mortgages until home prices fall another 25%. If home real estate prices do decline to a normal 12 times rental, a lot of people (i.e. voters) will be unhappy, and not just homeowners who bought at higher prices. The market is fairly screaming that you should sell your house and rent, but so far at least, these federal subsidies seem to be holding prices up. When normal pricing arrives, the recession is just about over, but it certainly won't feel that way if you are a seller.

Originally published: Monday, May 24, 2010; most-recently modified: Sunday, July 21, 2019