Related Topics

Investing, Philadelphia Style

Land ownership once was the only practical form of savings, until banking matured in the mid-19th century. Philadelphia took an early lead in what is now called investment and still defines a certain style of it.

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Philadelphia Economics

economics

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

Right Angle Club 2007

A report, to the year 2007 shareholders of the Right Angle Club of Philadelphia, by the outgoing president.

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Africa Comes to the Schuylkill

A journalist, John Ghazvinian, recently toured the many countries of Africa, wrote a book about it and carried his message to the Right Angle Club of Philadelphia. Philadelphia does not think of itself as particularly involved in oil matters, or African ones. But the fact is the refineries on the Schuylkill down by the airport generate two-thirds of the gasoline now used on the East Coast, and right now it mostly comes from Nigeria. There was a time when the crude oil coming to Philadelphia came from Venezuela, but politics are a little unpleasant there at present, and anyway Venezuelan oil is heavy and full of acids. The refineries which specialize in that kind of heavy oil are on the Gulf Coast. Long before the Venezuelan era, the Philadelphia refineries were constructed to refine crude oil from upstate Pennsylvania. They were once the main source of the dominance of the Pennsylvania Railroad, because oil refining from Bradford County gave the Pennsy a return freight, whereas the competitive railroads running out of New York and Baltimore had to return from the West without cargo.

|

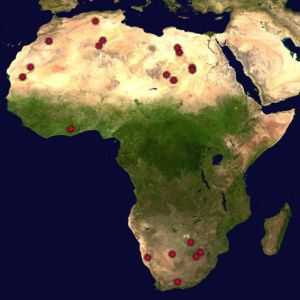

| African Map |

There are 54 countries on the continent of Africa, quite different from each other in character. One dominant characteristic of Africa is its lack of natural ports, and even the Mediterranean ports are cut off from the rest of the continent by the huge transcontinental stripe of Sahara desert. Major wars and famines, monstrous genocides, unspeakable cruelty, and poverty go on there without much notice by the rest of the world.

The largest country in Africa is Nigeria. Anyone with even minor dealings with Nigeria soon sees that corruption and dishonesty pass all Western imagination, and they have serious tribal warfare as well. The discovery of large deposits of oil in the region faced the international oil companies with a rather serious difficulty. For instance, Shell Oil has had over 200 employees kidnapped for ransom and is seriously contemplating abandoning its whole venture. At the moment, corruption is coped with by constructing oil wells a hundred miles out in the ocean.It's almost true that the huge tanker ships make from Philadelphia and return, without the crew talking to any natives of Africa.

We hear that genocide is in full bloom in the Sudan, and that poverty in that country similarly passes belief.

|

| Chad Poverty |

They have oil in the South of Sudan so we may hear more of it. Chad has poverty and oil, and civil war. They have a big Exxon facility, but there isn't a single gasoline station in Chad. At the moment, Angola has paused in its enormous civil war, which killed millions, and Chevron will surely encounter unrest before it is done. Gabon appears to be extremely prosperous, from oil money of course, but they are being ravaged by the Dutch Disease, of which more later.

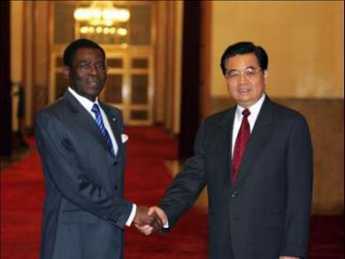

Apparently, Equatorial New Guinea sets some sort of record for wild behavior. It has lots of oil, and a strong Chinese influence. The current

|

| Mbasogo and Jintao |

President of Equatorial New Guinea got his job by shooting his uncle. But don't feel too sorry for the uncle, who used to have an annual Christmas morning celebration, consisting of herding his enemies into a football stadium, and shooting them for the edification and entertainment of the populace. After listening to Mr. Ghazvinian, it seems small wonder that so few American tourists, or journalists, or even missionaries, manage to complete extensive African excursions. As everyone notices, if you don't have journalists, there is never any news.

Let's turn to the Dutch disease,

|

| David Ricardo |

of which Africa currently displays many examples likely to torment economics students for decades after Africa eventually rivals Houston. Let's start with David Ricardo, who electified the Nineteenth Century world of economics with his principle of comparative advantage. Ricardo pointed to the obvious truth that always and everywhere a nation does best for itself by identifying its best economic feature and then sticking to it. If every country wakes up and does that, every country must then trade with its neighbors for other things it isn't so suited to make. Consequently, tariffs and trade barriers are a hindrance for everyone, in time impoverishing all nations in the cycle, whatever short-run advantages of tariffs may seem enticing.

|

| North Sea Gas |

So far as I know, Ricardo was quite right, but someone had better hurry up and reconcile his underlying premise of comparative advantage with the Dutch Disease. The Dutch disease was identified and named by an anonymous writer for the London Economist about thirty years ago. Noticing that the Netherlands experienced a marked worsening of its general economy after the discovery of North Sea gas deposits, the observer for the magazine concluded that sudden accumulation of wealth in the gas industry led to a rise in the value of the Dutch currency, soon making it impossible for non-gas industries to export, unable to compete at home with now-cheaper foreign imports. Naturally, investors rushed to invest in gas, sold their holdings in other industries, and Holland was propelled in the direction of a one-industry economy, quite at the mercy of fluctuating prices of gas. This was the Dutch Disease born, and Ricardo's principle of comparative advantage exposed to quite a severe challenge from which it has not completely recovered. This is important, so how about a simpler description: When gold is discovered, people drop tools to have a gold rush. Wealth lost from dropping tools is greater than wealth gained from the gold.

Fear of the Dutch disorder seems to be the reason why the Chinese are buying our Treasury Bonds, the Japanese engaging in the astonishing "carry trade," and the Arabs buying American private equity funds. The common strand through all these schemes is this: By sending their bonanza savings abroad, they "sterilize" them from their tendency to force their currency upwards. They are exporting inflation, but also endangering their own struggling non-bonanza industries, which are the main hope for diversifying their economies and getting rid of the Dutch effect. Somewhere during this balancing act, politicians get involved and make things worse. So they call in their generals and admirals, to explore solutions we prefer they were not in a position to explore. Simpler description: When you discover oil, inflation soon follows. And all too often, revolution follows that.

The 1787 the American Constitution unknowingly cured thirteen cases of the Dutch Disease, by imposing absolute freedom of interstate commerce. After eighty years, the benefits of this national union would persuade the North to bleed and die for it. Although the Confederacy thought they were fighting for their way of life, meaning slavery, even the Southerners today recognize they are better off in a Union. Unfortunately today, the European nations are still having a hard time believing the benefits of union could possibly outweigh their allegiances to language, religion, and the wartime sacrifices of their ancestors. They are very wrong, but we are wrong to sneer at them. Except for maybe Switzerland, it is difficult to name another instance in all of history where several independent states gave up local sovereignty for the benefits of a diversified economy with local pockets of comparative advantage. Let's restate it again: the Dutch disease is a result of sudden single-industry prosperity in a country too small to control it.

By the way, what eventually happened to the Dutch? It seems likely that absorption of little Holland into the European Common Market helped dilute the corrupting effect of gas prosperity. It suggests the possibility that Dutch can be reconciled with Ricardo through the common denominator of reduced national barriers to trade and currency-- reduced sovereignty in a milder form. But it's a hard slog. Maybe we could envision annexing Alberta to soften the commotion of oil tar, but it takes a lot of imagination to see the amalgamation of China and India, any time soon. There may thus be nations too big to merge, but nevertheless, it would probably be less destabilizing to merge with all of Canada than just with Alberta if you overlook the obvious fact that it is easier to persuade a small country than a big one. Just kidding for the sake of example, of course, since Canada shows no interest in the idea.

Meanwhile, take a look backward from the highway overpass the next time you travel to the Philadelphia Airport. There's a lot more going on in those refineries than just black liquid flowing into steel pipes.

Originally published: Tuesday, June 26, 2007; most-recently modified: Monday, May 13, 2019