Related Topics

Philadelphia Politics

Originally, politics had to do with the Proprietors, then the immigrants, then the King of England, then the establishment of the nation. Philadelphia first perfected the big-city political machine, which centers on bulk payments from utilities to the boss politician rather than small graft payments to individual office holders. More efficient that way.

Investing, Philadelphia Style

Land ownership once was the only practical form of savings, until banking matured in the mid-19th century. Philadelphia took an early lead in what is now called investment and still defines a certain style of it.

Philadelphia Economics

economics

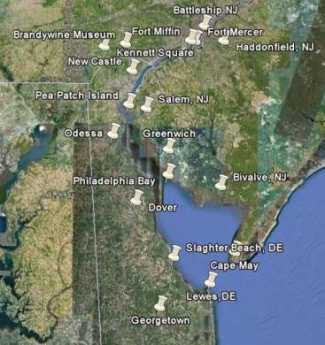

Land Tour Around Delaware Bay

Start in Philadelphia, take two days to tour around Delaware Bay. Down the New Jersey side to Cape May, ferry over to Lewes, tour up to Dover and New Castle, visit Winterthur, Longwood Gardens, Brandywine Battlefield and art museum, then back to Philadelphia. Try it!

Start in Philadelphia, take two days to tour around Delaware Bay. Down the New Jersey side to Cape May, ferry over to Lewes, tour up to Dover and New Castle, visit Winterthur, Longwood Gardens, Brandywine Battlefield and art museum, then back to Philadelphia. Try it!

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Right Angle Club 2009

The 2009 proceedings of the Right Angle Club of Philadelphia, beginning with the farewell address of the outgoing president, John W. Nixon, and sadly concluding with memorials to two departed members, Fred Etherington and Harry Bishop.

Medical (#2)

New topic 2019-05-24 23:10:33 description

Philadelphia City Controller

|

| Alan Butkovitz |

The Right Angle club was pleased to hear the City Controller, Alan Butkovitz, give us an insider's view of the municipal finances, but was a little startled to hear how badly the national banking crisis has affected our city. While of course the city does a lot of things, its present finances can be summarized as mainly consisting of two things: the pension system and the management of police/fire/corrections.

Mayors of this city for several decades have been following the national pattern of government to transfer its deficits to the pension funds of the employees. That has the effect of shifting the cost of present operations into the far future and avoiding present confrontations by promising even more generous pension benefits in the future. Over time, the future gets closer and closer; to a large degree, it is right now. Pension funds are largely independent organizations, supposedly receiving current contributions to be invested for future distribution. That requires an assumption about how much investment growth will be achieved in the meantime, now set by the Philadelphia Board of Pensions at 9%. That's not impossible to achieve in some medium-term intervals. But it's optimistic, even inconceivable, for long-haul investing; over periods of thirty or more years, most experts say that 4% is about all anyone gets. More to the point, 9% is particularly unachievable right now, in the present crash of national financial markets. That's bad enough, but repeated shortfalls in contributions to the fund have left it funded at 53% of the calculated requirement to pay the pensions of the future, even using the unrealistic 9% return assumption. A few years ago, Mayor Rendell worried about the underfunding and brought it up to 70% with a billion-dollar bond issue. Unfortunately, the crash in the markets has brought it right back down to 53% again. So, it's fair to say the pension fund is a couple of billion dollars short, even if you accept a 9% income accumulation -- which you probably can't, but at least it brings the pension fund to 70% funding in forty years. Call it four billion dollars short, just to be conservative, since it is presently admitted to being two billion. That isn't Mayor Nutter's fault, but it's sure his problem; and if it gets worse, it will be seen as his fault.

The other expense item of note includes 42% of the budget in the police, fire and prisons systems (education is handled separately through the school board). If you fired all those people, or they quit, we wouldn't have a city, we would have a jungle. But the Controller describes all three as terribly mismanaged, with the local police stations in a deplorable state of disrepair and degradation, bathrooms you wouldn't think of using, and so on. The fire department has only a minor number of fires to fight, perhaps four or five hundred a year, but it includes the emergency rescue services which respond to a couple hundred thousand calls a year. The rescue people report to the firemen, and there is social friction between the two, working to the disadvantage of rescue. It costs about $500 to respond to a call, and it isn't entirely satisfactory to send a fire truck to help someone with a heart attack. The Controller had a number of horror stories about administrative mismanagement in this area. As far as prisons go, everybody knows prisons are bad places, and ours are no exception. Confrontation with the unions is definitely in the future for the Mayor, and the city is going to be in pretty bad shape if he doesn't win some arguments.

That's the expense side of the municipal budget; the revenue side is equally gloomy. The offhand comment was that real estate taxes could double without bringing the pension system under control for twenty years. If our taxes are significantly higher than neighboring cities, or even just the same as in cities with superior uniformed services, it will be hard to attract and hold business taxpayers, causing municipal finance to spiral downward. Along the course of this patter-song, it isn't exactly reassuring to learn that it now takes the City 21 days to process a check and that absenteeism in some departments runs to 20%. We've heard a lot of denunciation of Mayors Giuliani and Bloomberg in New York, but their absenteeism runs 3% because investigators are sent to the house of an absentee, who is subject to court martial if he isn't home.

Somewhere in this nightmare lurks the hidden migration of the unionized workers. Starting with Mayor Rizzo or even earlier, the uniformed services were the main political support of the Democrat political machine. Quietly, they have moved out to the suburbs where the schools are better and the taxes are lower, and it is now said that 70% of union workers live (and vote) outside the city limits. The unions talk tough, bluffing through the uncertainty when their members can no longer provide the votes to be so fearsome. To some degree, their weakening political power is augmented by using their pension funds to provide construction loans for new commercial real estate. Some of that political clout is used up by the need to get zoning variances and tax abatements for the projects. A lot of these power shifts are hard to assess from the outside, but a trend is clear.

The controller didn't mention it, but the city is not only a pension investor in bonds but also an issue. Interest rates are about as low as they can get while the Federal funds rate is nearly zero, so there is only one direction they can go in the future -- sooner or later they will go up. By the iron law of bond financing, the value of the underlying principle will then go down. That could provide an opportunity to buy them back at lower prices, or it could break the city's financial back financing higher interest payments. However, for the pension fund side of things, exactly the opposite is true. Maybe Hizzoner can tap-dance around these dangers and opportunities, but most mayors would have trouble pronouncing the words.

It's part of the job description for the controller to be a pessimist. But the most you can make of this mournful dirge is to hope he is completely wrong.

Originally published: Friday, March 06, 2009; most-recently modified: Sunday, July 21, 2019

| Posted by: Jeremy Leipzig | Mar 23, 2009 9:48 AM |

how is that even possible with the residency requirement? I don't know any city workers who are living outside Philadelphia.