Related Topics

Franklin Inn Club

Hidden in a back alley near the theaters, this little club is the center of the City's literary circle. It enjoys outstanding food in surroundings which suggest Samuel Johnson's club in London.

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

...Trying Out the New Constitution

George Washington's first term as President was much like a continuation of the Constitutional Convention, with many of the same participants.

Right Angle Club 2011

As long as there is anything to say about Philadelphia, the Right Angle Club will search it out, and say it.

Robert Morris and America

Robert Morris was an energetic problem-solver. In solving those problems he devised some innovative solutions which have become such axiomatic principles of a republic and its economics, that his name is seldom associated with them.

Power of the Purse

|

| Liberty Bond |

In 1917, Congress passed a law, quite possibly not understanding its full implications. From the founding of the republic until that time, Congress had approved the exact amount of each bond issue as enacted, neither more nor less. With the First Liberty Bond Act of 1917, however, Congress began to allow the administration to issue bonds as it pleased, up to some specified debt limit. Periodically since that time, as the amount in circulation approaches the debt limit, Congress raises the limit. No doubt this procedural change seemed like legislative streamlining, making it unnecessary for Congress to interrupt other activities to respond to a debt level which creeps up on its own time schedule. The overall effect of this change was significantly different, however, and probably unintentionally.

If the authorized debt limit is raised by large enough steps, it effectively amounts to Congress turning over debt decisions to the executive branch. Conversely, raising the limit only a small amount soon triggers a repeat request, which by routine becomes so inconsequential that Congress stops paying attention to it. Regardless of the size of the block grant, bulk authorization of blocks of debt results in the power of debt creation shifting toward the President. That was not what the Constitutional Convention intended.

|

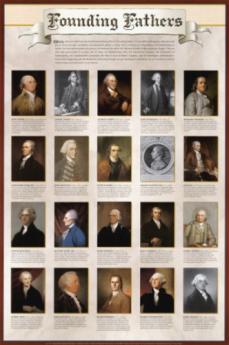

| Founding Fathers |

The Founding Fathers remembered taxation as one of the main issues of the revolt from England. Whether by King or President they had no intention of permitting the Executive to tax as he pleased; the issue traced back to the Magna Charta. Nor would they permit unlimited federal borrowing to generate escape hatches which would soon enough transform into higher taxes. Taxes, therefore, must originate in the House of Representatives, and bond issues were approved one by one. Following the 1917 liberalization, it required only fifty years before unrestrained bond limits reached a point where future national debt obligations loomed beyond the easy ability to pay them off. If they were ever pronounced unpayable by the international bond market, interest rates would rise, and eventually, federal bonds would become unsalable. With Greece, Portugal, and Ireland already flirting with bankruptcy, the approaching danger seems quite understandable to the voting public.

|

| Constitutional Convention |

The issue is constrained by another barrier. The Fourteenth Amendment to the Constitution, Section Four, forbids dishonoring "the validity of the public debt of the United States, authorized by law." Enacted after the Civil War, this Amendment was intended to prevent future states or congresses from reversing the Reconstruction Acts, but it has the additional effect of preventing future Congresses from dishonoring interest and debt repayments on existing debt. The present Congress, therefore, retains the latitude to prohibit the issuance of additional debt but is forbidden from dishonoring existing debt.

This seems like a good principle to re-emphasize, entirely disregarding the merits of the TARP, the Dodd/Frank Act, or Obamacare. Indeed, restating the Constitutional intent for Congress to be chiefly responsible for taxes and debts, seems like a very good thing to do, quite regardless of whether present national debt limits ought to be raised. The 1917 Act was a mistake, probably an unconstitutional one, and should be reversed. Holding conferences in the White House about whether to issue debt raises uncertainty about whose duty it is. The responsibility belongs to the House of Representatives, and should stay there.

Originally published: Thursday, May 12, 2011; most-recently modified: Sunday, July 21, 2019