0 Volumes

No volumes are associated with this topic

Right Angle Club 2017

Dick Palmer and Bill Dorsey died this year. We will miss them.

The Right Angle President Letter: Wayne R. Strasbaugh

|

| Wayne R. Strasbaugh |

Fellow Right Anglers, As we conclude 2017, it is with pleasure that I submit this report. Our 95th year was marked with the good camaraderie and fellowship that has forever characterized our Club. Unfortunately, it was also a year in which we have had to bid farewell to our former presidents Otis Erisman and Bill Dorsey and longtime members Bob Gill, Dick Palmer, and Alan Lawley. As we begin the New Year, let us remember these gentlemen and their contributions to the Right Angle.

The year began with our adopting amendments to our Constitution and Bylaws designed to conform them to our current practices and procedures. The new position of Membership Secretary was created to provide more focus to our recruitment efforts. The position of Corresponding Secretary, a relic of the pre-internet age, was abolished.

As we enjoyed good food and views of the Philadelphia skyline for the second year at our new Pyramid Club venue, we listened to speakers present a variety of topics - contemporary and historical, cultural and scientific. We may once again justly boast that no one is better informed about the past, present, and future of the Philadelphia area than the members of the Right Angle Club. At two of our lunches, one in March and one in November, we shared these learning opportunities with our lady guests.

Our extracurricular events included the Spring Fling at the Philadelphia Armory, where we were treated to a special tour of the artifacts of the First City Troop, and the Fall Fling at the Headquarters House of the National Society of The Colonial Dames of America in the Commonwealth of Pennsylvania. Finally, the year was capped with a festive Christmas Party at the Acorn Club.

None of these events could have taken place without the contributions of many Club members. In particular, I would like to acknowledge the loyal support I have received from our First Vice President Chad Bardone, who was always willing to fill my place on short notice. Our Second Vice President John Coates deserves kudos for his choice of venues for the Flings and for the Christmas Party, and our Third Vice President Morris Klein credit for pursuing and scheduling our luncheon speakers. Fourth Vice President Bob Lohr efficiently ran an honest lottery.

Treasurer Tom Williams continued to show his mastery of budgets and figures in keeping the Club on a firm financial footing. Recording Secretary Stephen Clowery and Archivist Steve Bennett compiled and preserved Club records for succeeding generations of Right Anglers. Membership Secretary Dan Sossaman II stalked the city and suburbs for prospects who would learn of our deeds by joining the Club. At large Board of Control Members Scott Inglis, Bob Haskell, Sam Weaver, and Jack Foltz testified to the truth of Woody Allen’s adage that “80% of success is just showing up.â€

I would also be remiss if I did not also acknowledge the willingness of Tom Howes to compensate for the Club President’s lack of humor by sharing his words of wisdom with us every week.

Finally, I would like to thank George Fisher for the time and effort he expends every year in producing this Annual Report.

Wayne R. Strasbaugh

President 2017

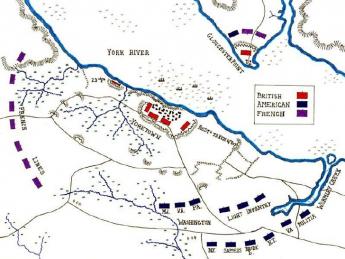

Look Out For That Ship!

Tales of the Sea abound, even a hundred miles from the ocean.

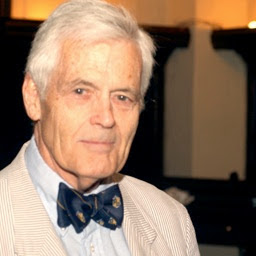

|

We are indebted to the President of the Maritime Law Association of the U.S., Richard W. Palmer, Esq. (who unfortunately died in March 2017 at the age of 97), for both a strange definition and an amusing story. An "allusion" is a collision between a ship and a stationary object, such as a bridge or a dock. As you might imagine, the ship is almost invariably at fault, mainly through errors of the pilot, although hurricanes and other severe weather conditions can make a difference. Moving ships have been running into stationary objects for many centuries, and almost every allision contingency has been explored. Ho hum for maritime law.

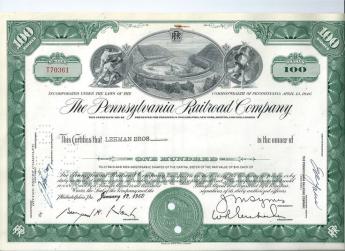

The Delair railroad drawbridge over the Delaware River at Frankford Junction is just a little different. It was built in 1896 when the Pennsylvania RR decided it needed to veer off from its North East Corridor to take people to Atlantic City. For reasons relating to the afterthought nature of the bridge, the tower for the drawbridge is located half a mile away, out of a direct vision of the ships going through. Also, a late development in the history of the river was the construction of U.S. Steel's Morristown plant, bringing unexpectedly huge ore boats from Labrador to the steel mill. The captains of the ships pretty much turned things over to the river pilots, for the last hundred miles of the trip.

|

| Delair Railroad Drawbridge |

Shortly after this iron ore service was begun, the inaugural ore boat Captain had a little party with some invited guests. So it happened that the Commandant of the Port, the Admiral in Charge of the Naval Yard, and other equally high ranking worthies like the head of the Coast Guard were on the bridge of the ore boat, taking careful notes of the procedure.

The ship tooted three times, the shore answered back with three toots. In real fact, they were connected by ship-to-shore telephone for most of the real business, but this grand occasion called for an authentic nautical ceremony. Three toots, we're approaching your bridge. Three toots back, come ahead, the coast is clear. The admirals scribbled it all down.

As the ship approached the point of no return, beyond which it could no longer stop or turn in time to avoid an "allusion", the people on the bridge were appalled to see a train crossing the bridge ahead. Several toots, loud profanity on the ship to shore phone.

No worry, answered the bridge, we'll lift the drawbridge in plenty of time. But half a minute later the bridge controller made the anguished cry that the drawbridge was apparently rusted and wouldn't open, to which the captain shouted, "This ship is going to take away your blankety-blank bridge and sail right through it".

At this point, the pilot took matters into his own hands, and violently threw the rudder hard left, swinging the ship sideways, soon nudging the bridge with some damage, but nothing like the damage of a head-on allision. The lawsuit, as one might imagine, was the outcome.

The attorneys for the railroad were pretty high-powered, too, and had piles of legal precedents to cite. But they were quite unprepared for Dick Palmer to put the Commandant of the Port on the witness stand, reading slowly and painfully from his very detailed notes about the conversations on the bridge, about the approaching drawbridge.

And so, Philadelphia can now claim to have experienced one of the very few instances where a ship ran into a bridge -- and the court found the bridge to be entirely at fault.

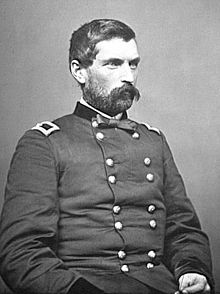

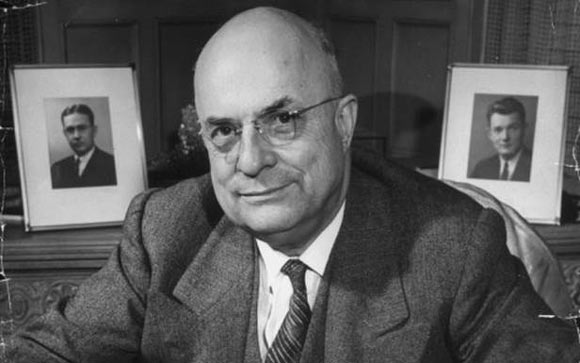

Bill Dorsey: Death of a former President

|

| William G. Dorsey |

Philadelphia is a city of rivers, so it is not surprising that membership and presidency of the club sometimes has a nautical tint. This year, Bill Dorsey the President of the Delaware River Pilots Association and a former President of the Right Angle Club, died at the Quaker Retirement Community in Kennett Square called Kendall. He was a joyful presence in the club, and will be much missed.

The Right Angle Club is a dressy one, but not many members realize that dressiness is part of the tradition of the Delaware River Pilots Association. When the pilot transfers from the pilot boat in Lewes Delaware to climb the rope ladder into the incoming vessel, it has been traditional for centuries for him to be dressed for a state occasion. Regardless of the weather, it is traditional for the pilot to be piped aboard, dressed in formal clothes. We have a photo of Cap'n Bill, dressed in blue serge pinstripes, climbing up the side of a Labrador iron ore bulk cargo in Lewes, and quite obviously enjoying the experience.

|

| Delaware River Pilots Association |

The pilot association is an exclusive organization, often requiring hereditary status , as is often true of trade Unions which date back to medieval times. But they have to know their stuff, always anticipating the possibility of a court appearance with millions of dollars at stake. That is particularly true in port cities with a long estuary, which in Philadelphia's case is over a hundred miles long. Bill, like many officers and port wardens, was active in Delaware politics, and lived in one of a row of pilot mansions along the canal from Lewes to Rehoboth, Delaware. This combination of the raucous conviviality of a trade union politician, together with the utter seriousness of guiding a multi-million dollar ocean ship up a hundred miles of shoals, is approached somewhat by the conflicts of the pilots of ocean-spanning airline pilots with the reckless fearlessness required in their trade.

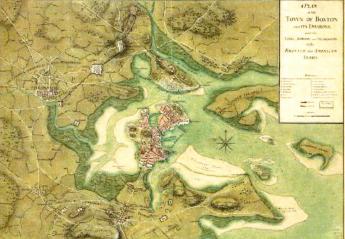

Bill and I were conceivably related. Or at least in the Eighteenth Century the chartmaker of the mouth of the Delaware was one Joshua Fisher, expelled from his profession when he refused to stop charting the Delaware out of fear that one of those charts would fall into the hands of the British Navy. Joshua then moved to the banks of the Schuylkill and his family disappeared when revolution was declared; no one has seriously investigated this vaporous history. Like so much folklore, more people would probably be happier if much of it were allowed to float away.

Pirate Lair

|

| Jolly Roger Flag |

Delaware takes a ninety-degree turn right at about the place where the Salem nuclear cooling towers are visible on the Jersey shore, and great quantities of silt have piled up in the river there, making marshes and swamps. There is a rumor that Captain Kidd tied up among these marshy islands, and much better evidence that Blackbeard the Pirate used the Delaware marshes as a hideout. Since a high-speed highway, with limited access, now rushes visitors to the slot machines of Dover and the beaches of Lewes, no one much notices that this area hasn't changed much from what it probably looked like three hundred years ago.

But if you take the old road, Delaware Route 9, you wander through the backcountry and are only likely to meet duck hunters. At one point, with a lake to one side and the river on the other, a watchtower has been erected for bird watchers and the like. It's very beautiful there, and quiet.

So one day I drove up, parked my car at the base of the tower, and climbed a hundred steps to the top. Blackbeard was not in evidence, but it was easy to see how he might feel pretty secluded in the coves and behind the trees. There were lots and lots of birds, interesting enough but mostly unidentifiable by me. Like most big-city lovers of the environment, I mostly classify birds as little brown jobs (LBJ) and big black buggers (BBB). And then a car drove up, with some chattering teenagers.

|

| Copperhead |

From a hundred feet up, it was hard to tell what they were saying, and it probably didn't matter much. Until suddenly one of the girls screeched out, "Oh look! There's a big snake under that man's car! "

One of the boys in the car shouted out, "That's a copperhead snake! I've never seen one so big!"

And so, they roared off into the distance, leaving the marshy paradise to me and the snake. What do I do now?

I waited, hoping the snake would go away. But it started to get dark, and now it was even more unattractive to chase around with snakes. So, creeping to the bottom of the stairs, I made a dash for the car door, jumped in, and slammed it tight.

As I drove away, I could not see any snake on the ground under the place where I had parked. To this day, I don't know if there really was a snake there or not.

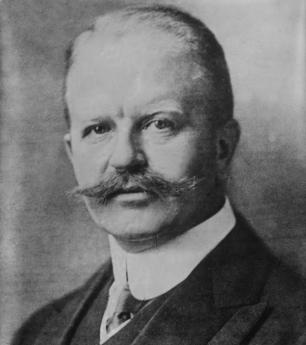

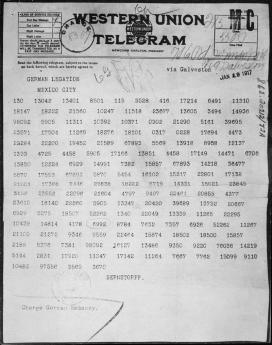

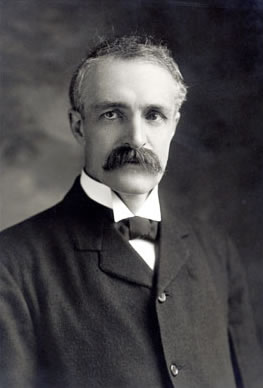

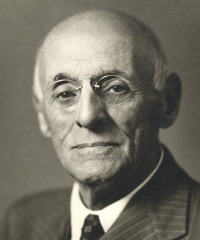

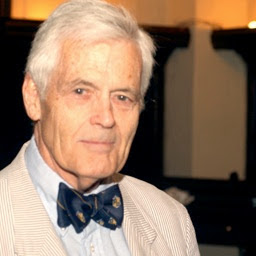

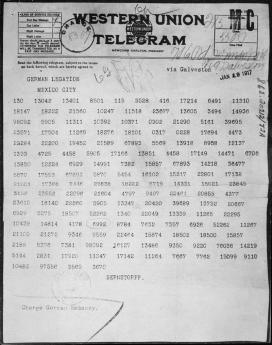

The Zimmerman Telegram

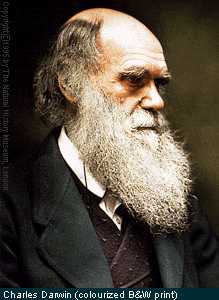

|

| Arthur Zimmermann |

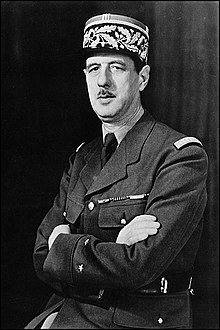

Sometime in February 1917, Zimmerman the German foreign minister sent a telegram to the President of Mexico, in code. The Germans sensed their submarine warfare might win the war for them, he wrote, and so it might be very helpful to have a second front attacking the allies' main supplier, the United States. Germany would then win World War I, able to give Mexico --Texas, New Mexico, and Arizona. The British intercepted the telegram, decoded it, and wasted no time putting the translation on Woodrow Wilson's desk.

Wilson had just won a Presidential election on the platform, "He kept us out of the war." Furthermore, the Germans were the single largest ethnic minority in America. But no matter. Nevertheless, within a few days, Wilson stood before a joint meeting of Congress urging them to declare war on Germany.

|

| Telegram in Code |

The consequences were immediate: the German minority was cowed with shame and counting World War II as a continuation of World War I, sixty million people were subsequently killed because of a single heedless telegram. In retrospect, Wilson should have kept it quiet, privately negotiating something from Germany in return for ignoring the thoughtless telegram, and maybe keeping us out of two World wars. That's the sort of thing that gets played around with when a responsible leader creates an uproar over catching an enemy with red hands. Otherwise, the carelessness tempts diplomats to assume he really did want a war, and needed a pretext for it.

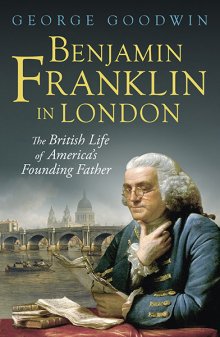

It may violate the Constitution or some partisan law created by Congress, but it's the way diplomacy has been conducted ever since--well, since Benjamin Franklin was Ambassador to France, at any rate. It isn't exactly leadership, but it might have saved millions of lives. Muhlenberg told us, "There's a time to preach, and a time to fight." What he seemed to forget was the part about preaching.

Uncorking the Past

|

| Patrick E. McGovern PhD |

The Right Angle Club was recently visited by Patrick E. McGovern, PhD. Scientific Director, Biomolecular Archaeology Project, Adjunct Professor, Anthropology, University of Pennsylvania Museum of Anthropology and Anthropology. Author,"The Quest for Wine, Beer, and Other Alcoholic Beverages; "Rediscovering ancient fermented beverages throughout the world."

Professor McGovern calculates that alcohol has been used as an intoxicating beverage for over 2700 years. Because our species began in Africa, that's the place you first find evidence of booze. As a matter of fact, the Milky Way is just filled with loose alcohol, with millions of gallons floating around its center, so alcohol has probably been around for eons longer than we know. Alcohol is just a step of fermentation away from sugar, so it has probably been bubbling around almost as long as life.

The association of yeast fermentation with cell life has fascinated at least one other Penn Professor (Doug Wallace), who feels mitochondria are pieces of plants which have somehow got incorporated into animal cells, and probably account for the limited carbohydrate metabolism in animal forms, concentrating an unusually large proportion of cancer transformations in the process. If so, it's a mixture of good and evil, like so much of life.

|

| Alcohol Fermentation |

So if it's so easy to transform carbohydrate into alcohol, it figures, the dominant beverage will be fermentation of the local dominant carbohydrate. For the most part that's rice in the Orient (beer), fruit in central Asia (wine), and a tribe's favorite beverage tends to endure as long as they stay in the same region, eating the same food. I was tempted to ask about the beer-wine divide along the Rhine River but decided not to veer too far from archaeology or chemistry. The spread of potato-generated vodka seemed abstraction enough for the lunch-time entertainment of gentlemen who do lunch together, ride the train together, and occasionally venture into off-color jokes and games of chance.

We did sample Dr. McGovern's own private stock, a mixture of wine, beer, and mead. Quite tasty.

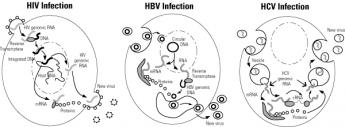

The Wistars Think Big, But Talk Softly

|

| The Wistar Institute |

The Wistar Institute sits on the Penn campus, surrounded by Penn buildings. But it is entirely independent of Penn, dedicated to doing cutting-edge research which leads to practical applications later. They have fourteen new laboratories dedicated to fields most people know nothing about, and lots of old laboratories dedicated to the same. It's certainly something to have a scientific institute in our midst, especially one which refrains from blowing its own horn, and yet privately regards anything short of a Nobel Prize, as a failure.

|

| James Hayden |

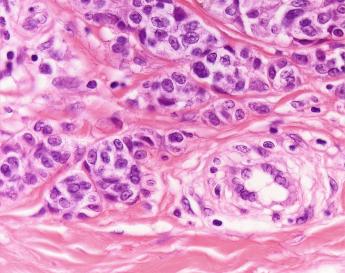

A recent speaker at the Right Angle Club was James Hayden, the Managing Director of Wistar's Imaging Facility. His specialty seems to be taking pictures through a microscope, which conform to the general principle that the closer the image is to the microscope, the shorter the focal distance must become. The consequence is that microscopic pictures are unable to see all the way through the entire slice at any one focal length wider than the cell itself. The advent of digital photography requires a full thickness slice, but only a portion of its depth is visible at any one time and must be stained. Gradually the impression emerges that full-depth digital photography requires a three-dimensional scale. If time is a fourth dimension, there are two more dimensions to round out the six dimensions which are photographed by a million-dollar microscope. And the resulting image, of which he showed many, stops resembling a pea in a pod with smooth edges and increasingly looks like a network of bushy strands with a nucleus buried deep within its depths.

|

| Melanoma Cell |

He described one extreme of this process as coming from boring a hole in the top of a mouse's skull, replacing the hole with a small window of glass, and showing a single melanoma cell metastasizing through the mouse's brain like a sheaf of wheat invading a cornfield. The heat it requires to keep the cell alive is often enough to damage the region, and all sorts of technical problems emerge from staining the cell part with pretty, but toxic, dyes. Having looked at a great many tissue slices after they were "fixed" (ie killed) by soaking in chemicals, I can tell you the old style looks nothing like the new one. It's going to take a long time and a lot of money to use this higher resolution, but you can tell at a glance that our thought processes about what cells are doing, will undergo some radical changes in the near future. And it will require a lot more expensive research to determine whether these new insights will be worth the money. Let's hope they are.

|

| Galileo's telescope |

Mr. Hayden promised to look into whether it might be possible to send an Internet link to a multi-dimensional picture of a cell in action, in which case members of the Right Angle club may be able to see this wonder in the original. Otherwise, it's sort of like Galileo's telescope, forcing the skeptic to take the inventor's word for it, as the only alternative to burning at the stake. In that particular historical case, the Pope was unable to decide which to do, so as I remember it he banished the guy.

The Burdens of the Rich

|

| Pulitzer Prize |

The details are hazy, but sometime after graduating as a Registered Nurse my mother-in-law had a spell as a private-duty nurse for the daughter of Mrs. Pulitzer, and, I suppose later, became head nurse in the University of Pennsylvania unit in France, during World War I. Let's talk about Mrs. Moore, first. The Pulitzers had given the Pulitzer Prize, owned a chain of newspapers, and naturally owned several houses. Although I have to imagine there was a Mr. Moore somewhere, everything was referred to as if it belonged to Mrs. Moore, and Mr. Moore never appeared in the stories. They had a child with rheumatic fever, who was the reason they had a private nurse. Mrs. Moore devoted one afternoon a week to pay bills, which were numerous because of all the staff they employed at several houses scattered around the country, in New York, at Bar Harbor, and so on. One day, seated at her desk, she turned to the nurse and asked her if she had any idea what a burden it all was.

|

| Miss Brothers (Ms. Miriam Blakely) |

My mother-in-law had always been very self-assured, and this time she drew herself up in full nurse dignity. "Mrs. Moore," she said, "I don't feel a bit sorry for you." But as more than a century goes past, I have come to see the rich lady had a point. What purpose is there to be rich, if you are expected to spend large amounts of time being a clerk? There were diamonds and minks to be got out of storage for the banquets and then put away with moth crystals. There were silver spoons to be counted, and portraits of ancestors to be varnished. The gardener seemed to dip into the best wine, the kitchen maid didn't clean up properly, the roof in the Florida house leaked. Instead of being the rich lady with a glamorous life, she was at best acting the part of the mayor of a small town. And instead of being awestruck, she hired nurse was in effect telling her she was a spoiled brat. The story dramatizes, to be the head nurse of a famous hospital, helping the doughboys win the war to end all wars, that was somebody to look up to.

It wasn't the work. Anyone who has watched nurses rebels against typewriters in one generation and sit glued to a monitor with a very similar keyboard in the computerized phase of change can recognize it wasn't the work. Not even if it means picking bloody sponges off the operating room floor, or the final degradation of digging out an impaction with others watching you do it. The hallmark, the final test, was to do it without hesitation and never display the slightest sign of complaint. Because the point of pride was to be useful without the slightest sign of disgust. Dignity, doing something which other girls recoiled at doing. The snotty little brats.

|

| Nursing School |

It took some time for me to recognize that the image of nursing was formed in Nursing School, so strongly that the Nursing School was really the heart of any hospital. They would come back to reunions for generations, regaling their old friends with stories of Miss This or That, the tough old head nurse with a heart of gold. The head nurse was the mother-figure and the role model. Anything you could do, she could do better. When she dismissed you, you deserved to be dismissed. You didn't know starch until you saw her starched uniform. And the cap. You could tell what school had trained her, after a glance at her cap. And when the caps went, the uniforms were replaced with green un-ironed operating room gowns, not the same thing, at all. The schools were replaced by money from the US Government, sought after by the nursing lobby, and eagerly accepted by the administrators of hospitals, who didn't know what they were doing. The girls didn't know any better, either, thinking about what they needed was a diploma. So now we contemplate a nurse with a bachelor's degree, or even a doctorate, without the faintest idea what to do, placed in charge of practical nurses in their forties who know everything about nursing worth knowing. So they retreat into the nurse's lounge, writing volumes of notes which no one ever reads. The girls who enter the few schools left are much the same. Show me a well-run hospital and I'll show you a hospital that still has a school. Show me a hospital that recruits its nurses from a nearby university, and I'll show you a hospital which is run by administrators.

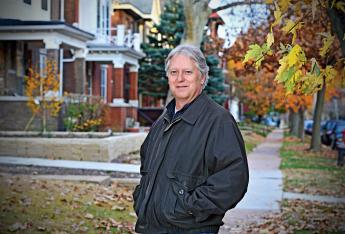

Ethnic Cemeteries

|

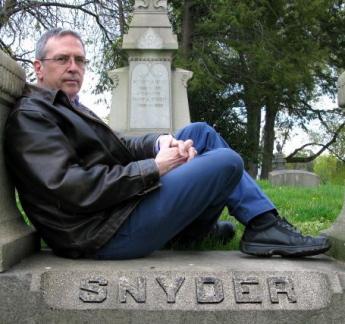

| Ed Snyder |

Schneider spelled Snyder (or Snider) is almost certainly a Pennsylvania Dutch surname in some sense. I presume Ed Snyder is of that derivation, but at any rate, he addressed the Right Angle Club recently on the subject of photographing cemeteries. Along the way, he seems to have picked up a lot of historical facts about graveyards, which he put together into a fascinating story. I get the impression many of the traditions he described originated in Europe and were transported here by various waves of immigration. So we don't have much information about the origins of those customs, except by inference.

|

| Meeting House on 4th |

The Quakers who settled Philadelphia in the early 1680s didn't believe in putting your name (or your picture) on anything, feeling that would be idolatry. The tradition, plus the yellow fever epidemics, accounts for the Meeting House at Fourth and Arch having forty thousand people buried in its yard, in five layers, but above them only two tombstones. Just why those two were exceptions is not described. Jonathan E. Rhoads, the famous University of Penn surgeon, has his name on a pavilion at the hospital to which he raised a loud objection, but he finally died there himself, saying, "It didn't look so bad." So we have comparatively few early Quaker monuments still standing in the Quaker City, although it does seem pretty certain the Quakers are not responsible for the midnight vandalism now sweeping the country, toppling tombstones. In any event, there definitely is an anti-cemetery movement going around our nation, possibly dating back to the days when bodies of parishioners were buried in churchyards if they were in good standing, sort of a giant compost heap. On the other hand, some people remember that Antigone went to some lengths to recover and honor her dead brother on the battlefield of ancient Greece. And that one of the reasons the Romans fed the early Christians to the lions was their horror at the retention of the bones of ancestors in the catacombs. Christians actually took residence in the mortuaries in the expectation of a second coming for everybody. The Mormon infatuation with genetic ancestors may be part of this concept.

|

| Laurel Hill Cemeteries |

It has been said that if you stick a shovel in the ground anywhere, you will encounter a cemetery, but not in Philadelphia. Somewhere around 1830, we imported the French set of traditions of cemeteries, which you can still see as the questionable tombstones of Abelard and Heloise outside Paris. Laurel Hill in Philadelphia was started as an intentional commercial imitation, at a time when you had to take a boat on the Schuylkill to get there, taking the whole family along to have an all-day picnic among your ancestors; and mighty industrial potentate families competed to construct the biggest most expensive mausoleum for the family. Laurel Hill has since fallen into some disrepair, but there is a restoration movement actively repairing it, collecting donations, tracing histories, etc. Neill Bringhurst, a former president of the Right Angle Club, was once the owner, but he vigorously disliked the whole idea and sold it. Woodland, near the University of Pennsylvania, is the other surviving cemetery of this elegance, and it is kept up much better than Laurel Hill, except for the tangled bushes around the periphery to maintain privacy. Woodland is right next to an extensive trolley-car terminal, thus conveying some idea of its former popularity. Prior to being a cemetery, it was the mansion site of Andrew Hamilton, whom George Washington used to visit on his way to Mount Vernon. As you recall, this Hamilton was the original Philadelphia Lawyer, who went to New York to defend the freedom of speech of Peter Zenger the newspaper man accused of telling the truth when he slandered the Governor. Considering the successor governors of New York, it's a good thing he won the case. History has it he was a young unrecognized lawyer, but in fact, Hamilton was the most eminent lawyer of his time, having originally purchased what is now Independence Hall.

|

| Marble Angels |

The traditions of marble angels hovering over tombstones seem to have been imported by Irish and Italian immigrants and are reflected in their present cemeteries. And the Pennsylvania Dutch tombstones and records are intact in Hummelstown PA, dating back to the Seventeenth century. It reflects that this particular branch landed in New York, went up to the Hudson to Kingston, and back down to the Harrisburg area on the Susquehanna. Meanwhile, the Quakers further East were burying their dead in layers without "markers".

There's probably a lot more to this history, but burials are sort of private affairs, so most church groups are unaware of dissenting attitudes, not very far away from them.

Deputy Managing Director

|

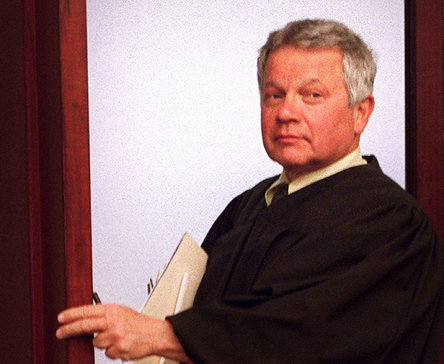

| Judge Benjamin Lerner |

The Deputy Managing Director of Philadelphia, former Judge Benjamin Lerner, honored the Right Angle Club by coming to lunch, recently. He immediately improved our opinion of him by first explaining why he resigned as Judge.

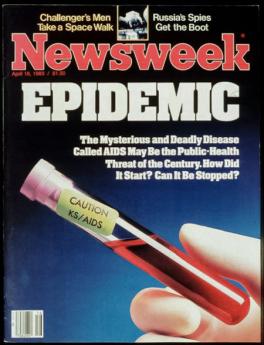

It seems the Inside Baseball of the last Mayor's election shifted the politics quite a lot. Under Mayor Nutter, the department heads reported to the Mayor, but under the new Mayor Kenney, everybody reported to the Managing Director. So Judge Lerner promptly resigned his judgeship and became Deputy Managing Director, if you see the drift of the power shift. He had become exercised about the drug problem in Philadelphia, wanted to do something, and knew the ropes to get it done. You've got to like a man like that.

It doesn't matter what happened to get him mad. The drug situation in this town is a disgrace, and any number of reasons might have got the Judge angry. It's too early to know what he can accomplish in his short time in office, but I have every confidence that if he can't improve things, it's time for all of us to move to another city. Because no one can fix it if he can't.

0

|

| Drug Situation |

In fact, I happen to know something he admitted he didn't know. Several years ago I was mugged in the middle of a police stake-out, so they caught the culprit. That's a pretty open and shut case, but the defense attorney apparently tried to stall me out of being a witness. For nine --nine -- consecutive trials, I canceled appointments and appeared at 9 AM. By the afternoon, I sat there waiting to be told the trial was postponed -- for a prisoner in custody, no less. In any event, I then watched nearly a hundred trials during these nine periods, and every one of the defendants told the Judge he had been smoking drugs, outside the courtroom in the corridor. Well, as a witness I was free to walk around, and I can tell you nobody was smoking drugs in the corridor. I knew for a fact they were telling the judge they were addicts when they weren't. I haven't the slightest idea why they were doing this, but I presume they had discovered some loophole in the law and were exploiting it. A rule that drug addicts escape a jury trial might be a plausible explanation, but I simply don't know.

The Judge agreed with me he had no idea of this behavior, or if it continued to happen. But I am willing to bet, it's now going to stop.

Suited To A "T"

|

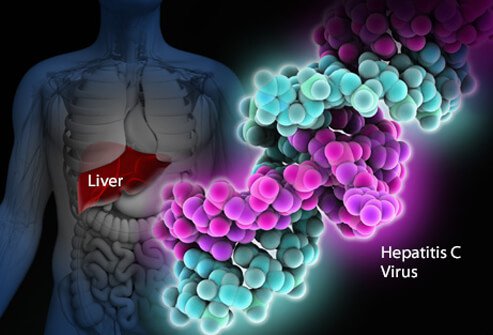

| Mucous Membrane Pemphigoid |

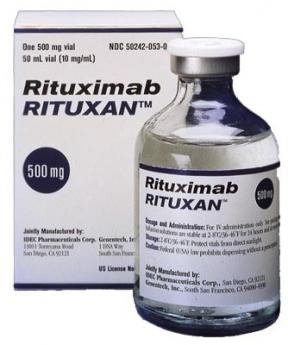

After sixty years as a doctor, it's a little disconcerting to find I have a disease I never heard of. It's better in a way, but in this sense it is worse, to be cured by a treatment I never heard of, either. The disease is mucous membrane pemphigoid, and the cure is Rituxamide. Am I right? Most readers have never heard of either one, but like just about every other patient, I think you all must just be panting to hear about it.

|

| Rituximab |

It turns out I had heard about the disease, but someone had changed its name from lichen planus to mucous membrane pemphigoid. The drug, Rituximab, has been around since 1997, treating rheumatoid arthritis, so it's not completely novel, either. It simply hadn't been used for this condition, which was rare. When we got semantic issues straightened out, and I had experienced a second round of treatment, I attended a seminar on lung cancer. That's the sort of thing doctors do for entertainment.

To my puzzlement, I was told a "me, too" variant of this same drug extended the life of lung cancer patients, but only if they were heavy smokers who quit smoking. That sounded peculiar, essentially saying you live longer from lung cancer if you smoke heavily and don't quit. You get a little euphoric when you take a steroid drug to ease the Rituximab, so I was overcome with the audacity to go to the microphone and announce I thought they lived longer, not because it helped the lung cancer, but because they lived longer by having fewer heart attacks and strokes from the smoking they had quit. Of course, I was politely told I didn't know what I was talking about. But an immunologist in the audience rose to say he agreed with me, because he had been giving the drug to practically every patient in his immunology practice, and quite a few of them got better. (To explain, the drug knocks out the T cells, which mediate most autoimmune diseases, so it sounded plausible.) So that's where matters stand. After everybody scrambles to try the drug on various autoimmune patients, some sort of order will probably emerge.)

But before everyone who reads this demands that his doctor gives him this drug for itchy skin, let me tell you the subsequent story. My insurance company sent me what is known as an "EOB" (explanation of benefits) which had two numbers on it. In the upper left-hand corner, it said my bill was $67,000. In the lower right -hand corner, it said the amount owed was $0.00. Somewhere between the two numbers is the amount you would have to pay if you didn't have insurance, the rest is someone's mark-up. I set about to find out how much the drug really costs to manufacture, and it's hard to find out. Someone said $4, but I can scarcely believe it.

Post-Graduate Medical Education in Philadelphia

|

| Robert H. Jackson |

Lawyers will tell you a newly graduated lawyer doesn't know much about the practical aspects of law practice. That seems to date back to the days when a lawyer didn't go to law school at all but instead studied the law in the office of a practicing lawyer. It seemed to work out all right since Abraham Lincoln didn't go to law school, and the last Supreme Court Justice not to go to law school was "Scoop" Jackson, who presided over the Nuremberg Trials. The first law school in America was naturally at the University of Pennsylvania, founded by a lawyer who was very influential at the Constitutional Convention, also held in Philadelphia -- James Wilson, so all those lawyers who wrote the Constitution had either studied law without benefit of Law school, or else were rich and had travelled to London to study at the Inns of Court. James Wilson had a famous battle at his house at 3rd and Walnut, subsequently known as the Battle of Fort Wilson, where five later delegates to the Constitutional convention were attacked by what some call a "mob" in 1779, and probably carried a vivid recollection of the event when they were later writing the "original intent" of that document. In any event, the five law schools which style themselves "national law schools" and from which almost all of the big law firms draw corporate lawyers, are pretty firm about the fact that they will teach the associates all they need to know about the practicalities of the law. There are dozens of "state law schools" who feel differently about this, but it can be noticed that all of the Supreme Court Justices come from national law schools at the present time.

|

| Abraham Flexner |

Well, medical schools were pretty much divided along the same lines until the Flexner report of 1913, and subsequently the division was between general practitioners and specialists, with the specialists receiving practical training as residents in hospitals. The medical school administrators never liked this arrangement, and have worked hard to envelop specialty training into the school hospitals. If you hear talk of "town and gown", this is the topic they are usually centered on. The division was pretty static until 1965, held together by the fact that residents in training were paid very little or nothing, so the schools were restrained in their eagerness. With the advent of Medicare, however, arrangements resulted in -- for practical purposes -- the residents being paid a generous salary in order to pay off their medical school debts. Nobody has mentioned this evolution in the current Obamacare-Trumpcare squabble because it isn't central to the argument, but it's part of the mix, all right. Obamacare went a considerable distance toward centralizing specialist training in the payment juggling, and before that, it had a lot to do with Medicare retaining open teaching wards, when the clear intent was promised to start at the economic bottom of the ladder with semi-private accommodations for everyone. And it had a lot to do with the closing of Philadelphia General Hospital, which had seven thousand beds during the Civil War, and three thousand at the end of World War II. One post-war blue ribbon committee, convened to evaluate PGH, began its report with "Philadelphia can indeed be proud..." At the end of WWII, sixty-five percent of the Delaware Valley hospital beds, in 165 hospitals, were free ward beds.

On the other hand, it must be admitted that thirty years have been added to average American life expectancy, in the past century. The system can't be terribly bad, although it is a trifle expensive, and every surviving hospital has a brand-new hospital building, plus more administrators than doctors, depending on how you define an administrator or a doctor for that matter.

|

| College of Physicians of Philadelphia |

To get back to "continuing" post-graduate medical education, both the College of Physicians and the County Medical Society have largely given it up, replaced in part by seminars financed by drug firms. Naturally, these seminars favored the use of the latest drug, were featured with free lunches for the residents, and highly criticized for a conflict of interest. So in time Sydney Kimmel the philanthropist was persuaded that continuing medical education (at a time of almost tumultuous innovation) was in a sorry state in Philadelphia, and donated something like $250 million to the establishment of a medical school that would do nothing else or words to that effect. I attend six or so all-day seminars yearly and find them to be excellent. The last one only cost me $190, and the drug companies donated the meals. So the reviews have to be mixed since I keep wondering where all of the rest of the money went, and keep thinking about that aphorism of Hippocrates, which speaks of teaching without charge.

|

| Hippocratic Oath |

As historical background, the following exerpt is taken from the original Hippocratic Oath: To hold him who has taught me this art as equal to my parents and to live my life in partnership with him, and if he is in need of money to give him a share of mine, and to regard his offspring as equal to my brothers in male lineage and to teach them this art - if they desire to learn it - without fee and covenant; to give a share of precepts and oral instruction and all the other learning to my sons and to the sons of him who has instructed me and to pupils who have signed the covenant and have taken an oath according to the medical law, but no one else.

The modernized Hippocratic Oath, written by Louis Lasagna of Tufts University, goes as follows: I swear to fulfill, to the best of my ability and judgment, this covenant: I will respect the hard-won scientific gains of those physicians in whose steps I walk, and gladly share such knowledge as is mine with those who are to follow.

(1) Medicine at the Two Ends of Life: First year of Life, and Last Years of Life.

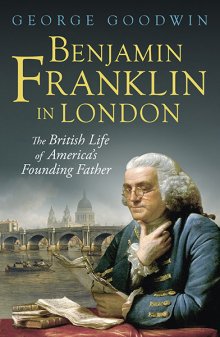

Benjamin Franklin founded the Ivy League's University of Pennsylvania, but he was surely no academic. He was a practical man, looking for practical results, and some of the fiercest battles he fought concerned the direction and purposes of his University, especially the nature of its mission. At a time when most Ivy League Universities were mostly divinity schools, he would not Pennsylvania tolerate it that way for his own, and to this day the University of Pennsylvania has no divinity school, although it does have something very close. If there had been such a thing in his day as a Nobel Prize, he would have won it for his achievements in electricity. In the centuries-long journey from divinity school to occupational credentials, Franklin's position and the general academic position have drawn marginally closer together. The first academic course in science was only taught around the time of the Civil War. The term "philosophy" would now be used as a word for "science", and a Doctorate of Nuclear Physics would puzzle most physics majors, even though they aspire to achieve that Ph.D. degree. The American Philosophical Society is quite definitely a scientific society, and most definitely was founded by Benjamin Franklin. These were not idle arguments in the Age of Reason.

To speak more practically, a great bulk of scientific achievement consists of experiments to reduce complexity, and ultimately to reduce costs. No doubt there are scientific discoveries of new fields, and probably the greatest prestige attaches to those who uncover some totally original feature. But the surprising bulk of the effort is devoted to simplifying and reducing costs. If a scientist employed by a big company should discover some cheaper way to do something more simple, he will be rewarded, and it may well make his career. If he discovers how to solve a mathematical equation in significantly fewer steps, his accomplishment is described as "elegant". That's the nature of science, to accomplish a goal, no matter how complicated. To make it profitable, you cut out a lot of the fumbling and get right down to the nub of a solution, with fewer steps, and cheaper materials. If you are unsatisfied with this generalization, just compare some random salaries of chemical engineers, with theoretical chemists.

There's even a story they tell in England about Franklin and King George. It seems lightning struck the steeple of St. Paul's Cathedral, and quite naturally the King consulted with Franklin about a lightning rod since Franklin lived a few blocks away. The King wanted a brass ball on the top of his church. Franklin made the rare miscalculation of openly disagreeing with the King. "No, your Majesty, it should be an iron spike. " The English implies the story depicts a foreign printer telling the King what to do and was, therefore, himself a fool. The American version of the same story would have it the King was a fool to tell the greatest living expert on lightning rods what was what about lightning rods. The founder of the American diplomatic corps probably would never have chosen such words, but "Who the hell do you think you are, telling me what is best in lightning rods", would probably summarize it. Well, America and Great Britain fought an eight-year revolution over this difference in attitudes, and so it seems likely Franklin and the Trustees of the University he founded, used stronger words that are now reported in alumni magazines.

The moral of all this is, no matter how silly the argument seems to strangers, the protagonists sometimes feel strongly enough to make trouble for those who do not accord their views proper deference. The fact Franklin acted in such an out-of-character way, is probably proof of how strongly he really felt about it.

So, to sum it all up, it is an American trait to acknowledge start-up costs but to surmise that in the long run, it's cheaper to eliminate a disease than to count the cost of curing it. No one knows whether research will lead to eliminating the cost of disease, but most Americans will presume it will, and most Americans will somewhat minimize the time it will take to accomplish it. We imitate the attitudes we suppose our mentor must have had, and indeed he may well have had them. The logic of the matter will only take you so far. At the rate we are going, I feel we might eliminate most diseases within the span of the next century. I feel medical costs a century from now will be -- not just could be --eliminated except for the cost of childbirth and death. You may disagree; no one knows. That's why participation in a long-term program to deal with the matter, should remain voluntary until the outcome is clear. In matters like this, everyone tends to overstate his case. Therefore, no one is entitled to force others to swallow their doubts.

(2) Death as a Portion of Lifetime Health Expense

No amount of scientific research can eliminate the twin cost of being born, and of dying. Nations differ about such costs, but if you want to know what they should be, just look at what they are. Such irreducible healthcare costs are about half of the present total. That leaves the other half of the cost, which might be eliminated by scientific research. If it takes a century to do it, the total elimination of disease cost might be accomplished at a price of about a half a percent per year. That's not totally impossible.

But scientific healthcare cost is different from truck maintenance, in part because some of the components cannot be replaced. The cost of prolonging useful truck life is largely the cost of devising improved maintenance; it's the best we can do within remaining mindful of what it costs. What's mainly different from healthcare is we have declared an end to economic ("useful") life at the time of retirement. Unless productivity of the elderly starts to improve, their retirement costs will rise, even if the cost of healthcare approaches zero. Let's put it another way: the faster healthcare costs come down, the faster retirement costs will go up. Simple arithmetic shows real healthcare costs can only be further reduced by half or $175,000 per lifetime. Useful lifetimes, on the other hand, have already been declared finished by the age of 60-65. The gap is still widening, but even if research stops that trend, things will get worse. Using actuarial methods, it has been calculated that average lifetime medical costs are now about $350,000 per individual, denominated in the year 2000 dollars , and assuming present longevity. That doesn't count health insurance cost, by the way. And it doesn't help to say Social Security payments should be progressively raised, because that's also incomplete arithmetic. Old folks must find something remunerative to do.

With some reservations, the Medicare agency calculates half its expense is devoted to the last four years of someone's life, all of its present expense is approximately $50 billion annually. Unfortunately, 9 million Medicare recipients are disabled but not yet aged 65, so terminal care costs less than $143,000 per person in the year 2000 dollars if you include many permanently disabled persons. Reversing the calculation, you might save $200,000 per person if you paid for nothing but terminal care. Additionally paying for childbirth and neonatal costs might still reduce average savings to approximately $175,000, or about half. That's approximately how you might justify the slogan, "Paying for only the essential two ends of life, would likely cut government costs in half." Another way of looking at it would be to accept Mrs. Sibelius's approximation that half of Medicare costs are borrowed. Paying only for birth and death would leave the present system roughly intact, except it would eliminate the borrowing. Better hurry up, interest rates are expected to rise.

Leaving things roughly intact would assume research costs are lumped with treatment costs. Both offsetting costs might be projected to disappear in a century, although probably at variable speeds. Furthermore, providers of treatment and providers of research are only human; they tend to attack the most expensive diseases first, particularly focusing on painful and mortal conditions. That's only a rough approximation. Everybody has lobbyists, and Congress must take care to balance inputs against the goal: to reduce the net sum of research costs and treatment costs in the year 2000 dollars, by a fraction of a percent (?half a percent?) per year, and to keep that up for a century.

It doesn't sound impossible to construct and enforce such a budget on the combined treatment and research communities, even recognizing the vagaries of taxation and demography. Perhaps a five-year running average would be manageable. But there is one big thing missing. We swept this issue under the rug for fifty years and we could do it for another fifty if we tried hard enough. That is -- we have neglected to consider the cost of success. As the health of the public improves, they live longer. In our system, that means they will need more money for retirement. Lots of money.

With a fixed retirement age, things get worse. Someone is currently running for President of France on a platform of lowering the retirement age to 55. We are, by contrast, at least grudgingly raising the retirement age to 67, at the risk of tearing the political parties apart attempting it. Although Medicare is technically an amendment of the Social Security Act, the retirement age of Social Security has remained essentially stationary, while benefits rise slowly but menacingly in response to inflation at 3% a year. Retirement costs are almost certain to rise more quickly than health costs fall because illnesses are episodic whereas retirement is continuous. Aside from the impossibility of negotiating a solution to this monetary quandary, there is the social disruption of having nothing remunerative to do. There is only so much golf or bridge a normal person can stand to do. Only so much traveling to do before you meet yourself coming back. Only so many fish to catch, entertaining to do, and booze to drink. We have some serious thinking to do before we find anything which is as satisfying as having an occupation. Young people imagine taking a vacation from age 18 to 48 is the same as from ages 60 to 90, but it isn't the same at all. Let's repeat: the cost of improved medical care is not primarily that the doctors will fail, it is that the doctors may succeed, and then you won't know what to do with yourself.

Two Central Mistakes In The Design of Health Insurance.

Concentrate on two flaws in healthcare. If uncorrected, no scoring -- dynamic or otherwise -- will conceal collective failure to address health costs seriously. Other problems should stand aside while these two are considered.

The first is pay-as-you-go. Its name misleads, because the younger generation, enjoying good health, pays its parent's high health costs toward the end of life, passing their own to their children. Medicare's first generation thus was given a free ride, so my mother who died at the age of 103, represents a whole generation who paid essentially nothing for thirty years of expenses. This example of debt being passed along for fifty years, got bigger with time throughout 18% of Gross Domestic Product, even with low-interest rates. We must liquidate that debt, invest the idle savings until needed for healthcare, and eliminate the annual 50% Medicare deficit to creditors. Quite a task.

An important result would be the incentive to save, replacing the incentive to spend. HSAs demonstrate net savings in health- the cost of at least 20% because, in a Health Savings Account, young people of each generation earn interest while they save for their own subsequent health costs, instead of spending immediately for anonymous demographic groups of strangers. At this point, another unexpected bonus appeared:

Some people have the luck not to get very sick, thus able to accumulate tax-exempt money in the account until they turn 66. Since everyone gets Medicare eventually, current law turns HSA accumulations into largely unnoticed tax-exempt retirement funds. (It's mandatory, whereas I would prefer an option.)

A second blunder reached the surface. Medicare provided better medical care, but made longevity increase, laying bare it had added thirty years of retirement cost. Sickness cost is episodic, but retirements are continuous. Consequently, additional retirement costs can become several times as costly as the sickness costs they replace. Talk about sweeping something under a rug.

It will not be easy to produce packages of proposals to cover the transition to a less costly funding system. But no health funding scheme other than Health Savings Accounts provides even the flimsiest scaffold for addressing this issue. Social Security has such a mission but is hopelessly underfunded. So the second of two big problems facing us, is: we failed to anticipate success.There is a third big elephant in this room to be wiped out with a paragraph of legislation. Scratch any regulation and you find a lobbyist underneath it. Half the population enjoys a tax deduction denied the other half, and that other half is restless. Unless big corporations yield to the demand for equality, there will be continued agitation. No doubt lobbyists promise to address this issue under tax reform and perhaps plan to reserve their concessions for later trade-offs. But one half of the public owes such a large debt to that other half, little quid pro quo is justified. Permitting HSA to pay the premiums for required high-deductible insurance could accomplish it in a handful of sentences.--------------------------------------------------------------------------------------------

The fourth big issue offers hope, instead of despair. Medicare coverage for young unemployable persons ("disabled") was effectively broadened to over 90 %, by unemployed effectively changed to unemployable. Higher costs were thus added to basic costs for 9 million of the 46 million regular Medicare recipients, rather than remaining lumped with the 30 million uninsured unemployables (requiring specialized programs.) These higher costs of average Medicare per employable person, have been overlooked by most commentators, making ordinary Medicare seem costlier than it really is. It's bad, all right, but not quite as bad as it seems. Documenting that fact, as well as shifting the medical income tax inequity to the tax bill, leaves only two new issues to address: pay-as-you-go, and retirement funding. That's quite enough for a first round.

Paying for Medicare Transition with Trust Funds.

Since its finance isn't much affected by the Affordable Care Act, there's a temptation to skip over Medicare. But ACA deficits and design flaws frequently grew out of Medicare's initial design decisions. Furthermore, the scientific tendency has been to cure acute diseases of younger people first, so the trend predicts still more high expense (chronic disease) patients will migrate toward Medicare. The ultimate prediction is for little to be left uncured at some distant time, except in the first year of life and the last year of life.

Changed Circumstances. There have been three main changes since some wag called Medicare the third rail of politics -- "just touch it and you're dead". The first change since 1965 is much-increased longevity as a consequence of much-better healthcare. Someone must have seen this coming, but apparently, no one spoke up. Although prolonged retirement is expensive, notice also how it prolongs the period of time available for compound interest to work, so the income curve starts to bend upward after thirty or forty years, regardless of the economy.

Secondly, passive, or index, investing has greatly simplified and strengthened amateur investing. Finally, the Health Savings Accounts appeared, often producing savings of 20-30%. It's time to re-examine the assumptions of 1965, with these three lights shining on them: longevity, passive investing, and payment design. We are not recommending that HSA be entirely funded by index funds, but merely recoiling from too much debt backed by government guarantees. (see below)

Proposed. In "Ye Olde" Medicare, the average beneficiary pays $56,000 per lifetime (in payroll withholding tax and premiums), but it actually costs the government at least $112,000 per person -- the remaining $50,000 or so per person is secondarily borrowed, so there are no left-overs for retirement. But prolonged longevity and longer retirement, hence more borrowing, are inevitable consequences of better healthcare with the present design. Viewed in that light, Medicare is broke. But viewed as a transition problem, it paradoxically addresses half of it; since half, the Medicare transition is already covered by bond issues. Put that together with the halving provided by Last Year of Life re-insurance, and you have made big progress toward transition. We also offer several other proposals for transition.

Our "New" Medicare, by contrast, seemingly could pay for all its present medical care, plus appreciable retirement cost, with the same revenue. Minimal extra government debt, no rationing or curtailment of service. It does it without changing major program elements; this is a financial change, not a medical one. It really does let you keep your own doctor, and doesn't tell him how to treat you, because it doesn't concern such things. Half of all medical expense is covered by Medicare. And we propose to fund half of that, plus all of the obstetrical/pediatric care, with First and Last Years of Life Re-Insurance. Transition begins to look feasible if we can convince old folks with a fixed income to take a chance on it.

Tools Seemingly Available for Transition to the New System, But Presently Not Provided For in Law: (See below) 1) Scientific break-through cures which significantly reduce the cost of Medicare. 2) Gradual buy-ins for latecomers, which significantly reduce the buy-in cost for people well past 65 at the start. 3) Special Trust Fund Extension eligibilities after death or before childbirth. Compound interest doesn't need the owner to be alive. 4) Delaying the Start of a Childhood Roll-Over. 5) Graduated Retirement as funding develops. All of these will be explained later, and the news is not all bad.Transition costs dominate the replacement of almost any health insurance, so let's restate the theory. A J-shaped cost curve forces a J-shaped revenue stream. When you switch systems, you must reverse the order, paying expensive existing ones first; and funding proves inadequate unless you can double it. If you could just manage, it would be possible to make partial cost savings you could boast of, but except for the Postmortem Trust Fund way you must pay double for all of it, or give up the attempt. By contrast, if you have at your disposal a large new source of credit like a postmortem Trust Fund, with an elastic retirement fund absorbing embarrassing surpluses, you can survive early misjudgments. Medicare could pay for its entire cost with compound interest on what subscribers now contribute, save for the fact it will have inadequate cash flow from people on their deathbeds. But if the death of the subscriber is ignored, the inflow of funds from surviving depositors could continue into postmortem trust funds of the decedents. At 7% return, extending the payments to the length of perpetuity (21 years) would multiply its amount four times, reducing the problem to a quarter of where it started. The transition time is thereby considerable shortened. For transition purposes, it might be wise to create a contingency fund, of up to $250 at birth. But remember, the size of the gap in a life plan can only be finally addressed after we see what is to become of the ACA (Obamacare). For the purposes of this book, we simply treat the ACA as if it were revenue-neutral, a somewhat unlikely forecast, but a completely understandable assumption.Extra Tools, Needed From Congress: "Change the destination" of Medicare's Withholding Tax, and Premiums, so the same money, plus interest, end up in the individual's Health Savings Account, instead of Medicare. That's in return for the subscriber agreeing to buy out Medicare at its mandatory onset, plus any other imposed conditions. There is one technicality: the tax exemption is currently distributed through the income tax system, while it should be added to the HSA, instead. Furthermore, if a considerable surplus (more than $100, say) from compound interest persists after withdrawals, the choice of buying out Medicare can be offered at its beginning age up to the perpetuity limit (on average, age 104), disregarding whether the depositor is still alive or covered by a special successor trust fund. Re-depositing in an HSA should make such contributions tax-exempt and earn compound interest (we hope, at 7%) in an escrowed sub-account which bypasses current medical costs until it is time to use them for Medicare. At least, escrowed in a way which cannot be diverted from Medicare use. Therefore, average payroll-withholding transforms from $28,000 ($700 yearly for forty years, taxable) into health care worth on average 18% more than that, or $825, because it's before-tax, and at 7% grows to $138,000 at age 65 (Try that out on your Internet compound interest calculator). That's what folks are paying right now, but including the tax exemption isn't as smooth as it could be. Don't forget the escrow feature, which keeps people from being their own worst enemies when other purchases compete for the single-purpose savings escrow.

Starting at any age before 66, it could then transform $1400 yearly Medicare premiums, before tax, and thus really $1650 into 18% more for twenty more years, and also pays tax-exempt interest. (Most people will find they have to read this several times because Health Savings Accounts are the only plan enjoying these particular features.) The net effect of augmented income tax augmentation, compounded, is to transform $56,000 before tax, into $534,000 before-tax at age 84, the present life expectancy, not counting $112,000 borrowed by the government, which we hope they can eventually stop borrowing. That doesn't sound like good arithmetic, but If you don't believe it is possible, just try it on one of the Internet's free compound interest calculators. (Furthermore, if an afterdeath trust fund is created to the limit of a legal perpetuity [one lifetime plus 21 years], the present expenditure would be subsequently transformed by compound interest into whatever $2,066,000 is worth at the time, we should hope amply providing for all of Medicare, plus some generous retirement without government borrowing. You won't be surprised to find others think this is more than you will need. We will later suggest better ways to rearrange the same facts, but this summary contains the general idea in highly condensed form.

Although an accumulation of over $2 million per subscriber seems adequate for any normal purpose, it should be recognized that this figure only applies to someone who started saving from birth and waited 104 years to collect. Therefore it would only be a theoretical issue for a long time. A far more generous sum is possible earlier if the original purposes of payments are ignored, and the principle adopted that the largest contribution should begin earliest. That maneuver results in payments age 104 of $30,165,195.00 which would make most people giggle. The obstacle to overcome is the resistance stirred up by matching Medicare premiums to newborn children's HSAs. However, if the system needs more money, this is the place to get it. By adopting this principle, a $2 million fund is achieved at age 60 instead of 104, which eliminates the need to consider several other strategies, expenses and objections thereto, subsequent to a Medicare buyout. It would make an $18,000 grandchild gift seem trivial, and last year of life strategy unnecessary, for example.

Broad Brush

Other Voices: Rethink Lifetime Health Finance

Barron's recently invited 1000-word summaries of radical change proposals. tg.donlan@barrons.com

Health insurance financing is a gigantic wealth transfer system. Politically, it is described as a transfer from rich to poor. But it really is a transfer from one age bracket (working people) to two non-working ones, children and retirees. Add thirty years of longevity by curing the diseases of one age group faster than another, and the balance between age and wealth distributions gets bent out of shape. Socially, it's dangerous. It gets even worse to base one-year casualty insurance on employment, tempting employers to dump a system which ends when employment does patch together by tax incentives. Average employment duration is around three years, so almost every condition soon becomes a pre-existing one, whenever employees lose their insurance. Insurance companies see what's coming, and cannot be blamed for getting out before it collapses.

More revenue would help, but existing sources are almost exhausted at 18% of GDP, while a rapid change in health delivery would flirt with disaster. But one thing remains: using the idle money in pay/as/you/go to fund a transition matching a change in spending incentives, or even scientific research eventually eliminating the disease. It would work with income returns of between 3-7%. Compound interest on money already collected would pay the deficit. Extension of the age limits on Health Savings Accounts would stop the borrowing, and trust funds would extend the compounding for 21 years past the average age of death upward, to the point it would far exceed the need for retirement funding through taxation or borrowing. Transfer of $4000 of each grandparent's HSA surplus (at death plus 21) to the HSA of one grandchild would add another 21 years to compounding downward, leaving several millions of dollars per person for retirement, curing a number of social turmoils in the process. That probably wouldn't happen completely, but a Medicare surplus rather than a deficit would allow any transition to be much speedier. The present 2.9% employment tax presently collected from working people would equal or exceed what is needed if compounded. Since the new fiscal limits would be enforced by the laws of mathematics, there would be far less temptation to spend it on battleships. Further extensions of longevity would increase revenue faster than inflation could undermine it. Essentially, it would be asked to match 104 years of compounding--with what took 42 years to accumulate. There's plenty of slack if you try those simple numbers on a free compound interest calculator, found on everybody's Internet. A second chance to do what we should have done in the first place.

True, the necessary change in incentives would come from unifying three systems into one lifetime one, incentivized by noticing the remarkable savings already created by millions of Mid-Western subscribers to HSA. A few sentences of amendments to existing law should be all that Congress needs to struggle with since these are existing programs. Whereas the R's need to see a single-payer system has become a single-saver system, the D's can save face by asserting they are the same thing.

George Ross Fisher MD 3 Haddon Avenue South Haddonfield, NJ, 08033 Cell 215-280-6625 office 856-427-6135 Email: grfisheriii@gmail.com

Currencies Owned by Nations, or by People?

|

| King Midas |

Let's remember why this subject came up -- we essentially don't have a monetary standard, gold or anything else, although it seems likely a suitable monetary standard would lead to a better state of economic affairs. King Midas is thought to have invented the metallic-standard idea, and whether that is true or not, national currencies backed by gold are thousands of years old. No doubt, the Spanish galleon idea was a new slogan for an old idea which goes back at least as far as paper money. Consequently, people carried the gold coins around in purses, but still trusted the King to accumulate the gold and mint it into coins for them.

|

| Gold Coins |

History shows that kings regularly abused this intermediary role, by shaving the coins and other forms of short-weighting them. Meanwhile, kings felt they needed to accumulate funds for wars and other national purposes, and controlling the currency was a needed revenue generator. But the land was also used for aggressive national purposes, rewarding local chieftains for their loyalty, and substituting for the loan of mercenaries or other war materials. But when you give away land, you give away part of your kingdom, always a risky business. The more you think about history, the more convincing is the argument for gold, from the point of view of the king, if he is the middle-man. The argument for the individual citizen to surrender his gold to the King to parcel out to the citizens a second time is a little less dispositive. People have always grumbled about taxes and demanded more than protection in return for paying them. But pacifists have always resisted taxes disproportionately, arguing if we could become more peaceful, we might need fewer taxes. In a modern context, it is hard to imagine individual citizens making atom bombs, aircraft carriers and other means of winning wars. Less convincingly, the idea of a government using taxes to create state capitalism has been a second-best argument for governments to expropriate individual wealth. If it works at all, it has not proved itself in two hundred years of trying. Nevertheless, this line of thinking probably enlists significant leftist opposition to individual possession of physical wealth.

|

| Industrial Revolution |

Although the idea has provoked angry discussion for centuries, it is likely the opposition of leftists and the uneasiness of rightists would at best limit support to winning the agreement of a bare majority of the rest, probably only under convulsive circumstances, and probably only to a partial degree. The prospect of individual wealth possession, without forcible physical defeat, must content itself with sharing possession of the monetary standard with the government, until a partial test of the idea shows it has such economic advantages to trade and to peace, that further resistance is futile. The concept may possess such power, but it must overcome what is at present an unconvinceable opposition, and rest its case on unexpected success with creeping implementation.

The closest historical test would be the international experience with Spanish pieces of eight during the age of piracy. We do not have adequate history to use this period as a dispositive example, but it is certainly true that government was weak on the high seas And that national currencies regained dominance afterward when governments got stronger. It is also true the age of piracy was followed by the Industrial Revolution, or the Age of Enlightenment, or the French Revolution. A case could be made that any one of these consequences had roots in the Age of Piracy, but not a sufficiently powerful one to end debate. Here again, we must carry analysis as far as we can, but only expect to settle the question after experimentation with it. So, let's describe it more fully, to see where that gets us.

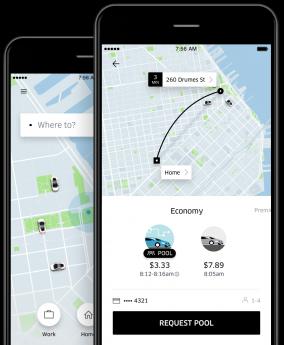

Uber and 215 Get A Cab

|

| Uber or Taxi |

Uber is a taxicab company which has been around for a year or so but has finally caught on in Philadelphia, exposing some of the more disconcerting facts of taxi medallions. It is rumored to be true that the fees collected for taxi monopolies often contribute half of some city's budgets, although of course, that couldn't be true in Philadelphia. A taxicab company buys a medallion for each cab, indicating a right to operate a cab, and the taxi drivers will tell you their medallions cost several hundred thousand dollars apiece. Most taxi drivers don't own their cabs, so these reports may contain an element of grievance against the actual owners, or the city, or both. At any rate, what is being sold is a monopoly, and the fares they charge customers must recover it. So Uber entered the scene, and the customers have a certain amount of sympathy with them. Uber isn't a taxi owner, it's sort of a cab-summoning system, but to the customer, it's hard to tell a difference. To the city, which is in the medallion-selling, or perhaps monopoly pay-to-play business, it's an important legal distinction, which so far they haven't found a way to throttle. In the long run, of course, an improved and cheaper cab-summoning business will improve the local economy and bring in higher revenue, while in the still longer run, it will throttle the city if they don't keep up with other cities which have a better cab-summoning system. Of course, that didn't bother the maritime unions when they drove away from the ocean-shipping trade, and it doesn't seem to bother the unions which control the Convention Center, or the stagehands who make it expensive to put on shows, operas, and concerts. Or, for that matter, the residents of the city who regularly vote a change of political control, every seventy years.

|

| Uber App |

The Uber drivers explain that they own their cabs, and must keep them fresh and clean according to Uber standards. Each cab has a portable internet connection, with an Uber software package for which the drivers probably pay a fee, but the "app" is free to the customers. When you tell the program where you are and where you want to go, the central office uses GTF to locate and assign your trip to the nearest Uber driver cruising in your neighborhood, whose location is also tracked by GTF. The result is a binging sound in the cab, and a picture of the cab on a map in the customer's "app", together with a button to push to connect the customer's phone to the driver. So the driver, cruising nearby with another customer, can immediately shift to the cab-requester in about five minutes. You can tell him what color overcoat you are wearing, and how to negotiate the lane you live on, beware of the dog. In about five minutes you can watch on your portable computer-- while his cab negotiates the turns to pick you up, which he does, and zips you off to where you want to go. The company already has your credit card, so you just get off, and the driver zips away on another call that came in while you were traveling. The driver is often a lady, which fearful lady customers like to see; the lady driver is often a mother who likes to choose her own hours to work, while there is someone at home to watch the kids.

|

| Uber Logo |

There are some features which might be called disadvantages. The driver is unable to call the dispatcher, so there is no way to notify the dispatcher there is construction at your pick-up point, or it's a blind alley to be avoided if you didn't know the landmarks, yourself. That means the driver doesn't wait very long if you are not where he thought you were, and although you can watch him drive away on the internet screen, he's off on another call while you stand in the rain. And the price of the ride is apparently a continuous auction, so you can watch it go from $13 to $5 and then back to $10; the truth is most people don't know what they were charged until they see the credit card invoice.

The competition has apparently stimulated the local cab monopoly to produce an imitation app, called 215 Get a Cab, for the medallion folks. I haven't tried it yet, but it's heartening to see the effect of competition on an otherwise closed system with political overtones. The last cabby I engaged proudly showed me there were eight cabs within two blocks of where I stood to shiver, vainly tooting on my taxi whistle. So, even the medallion taxis are better off for Uber with its destructive innovation. So far.

The Definition of a Real Philadelphian (1914)

|

| Elizabeth Robbins Pennell |

There are several million people living in Philadelphia, but of course, not all of them are real Philadelphians. >Elizabeth Robbins Pennell, a friend and biographer of James McNeill Whistler, tells us the definition of a real Philadelphian in 1914.

"I think I have a right to call myself a Philadelphian, though I am not sure if Philadelphia is of the same opinion. I was born in Philadelphia, as my father was before me, but my ancestors, having had the sense to emigrate to America in time to make me as American as an American can be, were then so inconsiderate as to waste a couple of centuries in Virginia and Maryland, and my Grandfather was the first of the family to settle in a town where it is important, if you belong at all, to have belonged from the beginning. However, [my husband's] ancestors, with greater wisdom, became at the earliest available moment not only Philadelphians, but Philadelphia Friends, and how much more that means Philadelphians know without my telling them. And so, as he does belong from the beginning, and as I would have belonged had I had my choice, for I would rather be a Philadelphian than any other sort of American, I do not see why I cannot call myself one despite the blunder of my forefathers in so long calling themselves something else."

--Our Philadelphia, 1914

Two Central Mistakes In The Design of Medicare.

There are surely dozens of misjudgments in our health system but concentrate on two of them. If correct, they could transform the system, while if uncorrected, no scoring -- dynamic or otherwise -- will conceal our collective failure to address health costs seriously. Other problems can stand aside while these two are considered.

The first is pay-as-you-go. Its name is misleading, because the younger generation, mostly enjoying good health, pays for the previous generation's dauntingly high health costs toward the end of life. Medicare started in 1965 and grew for fifty years. The first generation thus was given a free ride, so my mother who died at the age of 103, represents a whole generation who paid essentially nothing for thirty years of expenses. This hot potato of debt was passed along for fifty years, getting bigger with time and baby booms. The burden of 18% of Gross Domestic Product became unsupportable, even with abnormally low-interest rates. We must now liquidate the debt burden, invest the idle savings until needed for healthcare, and thus eliminate the annual 50% Medicare deficit to foreign nations. Quite a task.

An important result of replacing pay-go with pre-payment is the incentive to save, replacing the historical incentive to spend. Actual experience with HSAs demonstrates net savings in health cost to be at least 20%. Using a Health Savings Account, young people of each generation save for their own subsequent health costs, instead of spending immediately for anonymous demographic groups of strangers. At this point, another unexpected bonus appeared: