Related Topics

Right Angle Club: 2016

In progress.

Introduction: Surviving Health Costs to Retire: Health (and Retirement) Savings Accounts

New topic 2016-03-08 22:42:53 description

Right Angle Club 2017

Dick Palmer and Bill Dorsey died this year. We will miss them.

Looking a Gift Horse in the Mouth

|

| Progressive Era |

The Progressive Era lasted several decades, some say it still continues. Around 1910, the Progressive Era, reacting to the Gilded Age which preceded it, started doing painful things in the best interest of the individual, like the graduated income tax, the War to End Wars, and employer-based insurance.

|

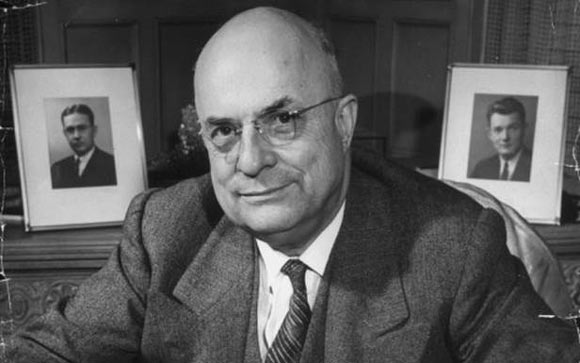

| Harry Truman |

Regardless of originator or date, employer-based health insurance was imported as an idea from Germany in the nineteen-teens, getting started in the nineteen twenties, and becoming the prevailing standard by World War II. Although control later shifted from employers toward government during this period, Harry Truman was unable to move it further. It was only in 1965 that government control jumped forward, coming to a climax in the 1965 Medicare and Medicaid laws. Curiously, the employer-based format itself reached a peak in the Lyndon Johnson legislation. Since 1965, one president after another has struggled to convert the rest of health insurance to government-based but always retaining its same general employer-based form. Along the way, two people significantly modified the model: Abraham Flexner, promoting the research-oriented teaching hospital into custodian of the standard of care, replacing the physician guilds; and Henry J. Kaiser, retaining control of a wage cost by calling it a gift, with high corporate income taxes and exempted employee income taxes reducing its effective cost to the employer. In a curious way, high corporate income taxes increased the proportion of healthcare paid for by the Federal Government, by increasing the value of the deduction. Not everyone would agree with this description of the history, but I'm convinced of its essence.

|

Whether the gift comes from business or from government, makes little difference, except to the two contestants. Henry Kaiser seems to have become enlightened that corporate taxation higher than individual rates actually results in important tax advantages for the employer's gift. It allows employers to shift most of the cost to the government while retaining ultimate control in employers' hands. For many decades the commercial insurance industry tried to break in, but the greatest recent threat to this collusion was accidental. All insurance is a system of cross-subsidies, but the Obama Administration superimposed a subsidy of the poor by the rich, onto an employer system of the young employees subsidizing the older ones. The mismatch between the two seemingly similar subsidies now threatens the coherence of the medical finance system. It also brings out the advantageous warping of the insurance idea by calling it a gift.

|

Furthermore, the gift is ultimately one of money, so how did service benefits get mixed into this? What does the diagnosis have to do with paying hospital bills, except as a mechanism for obscuring the price? The insurance premiums begin with money, and the insurance intermediary ultimately sends money to the provider of care. Money-in, money-out is what the insurance industry calls indemnity insurance. They were using indemnity for centuries before health insurance came along. Why change to a unique and expensive accounting system, if final prices remain unchanged? This device probably started as a way for an insurance intermediary to check the medical validity of a remote claim, but has gradually evolved into an elaborate cost-shifting device. The unfortunate result is to blind the doctors in charge of the true costs of their options. So doctors nowadays totally disregard the posted prices which emerge, when they devise their treatment strategies. The result is very bad, no matter what the original purpose was.

There may be something to the idea that adding diagnoses and services adds enough mystery to the process to keep away competition, but there are business incentives which seem more central. Now that health cost consumes almost 17% of the gross domestic product, corporate taxes are an important part of the federal budget, largely explaining why the President might not want to lower them, even driving international businesses to consider moving abroad, rather than lower corporate tax rates. However, if the tax reduction which results from the gift is considered, the net corporate taxes actually paid are not too different from prevailing international rates. If corporate income taxes were eliminated, at least the employer would have to pay for his own wage costs masquerading as gifts. They might even discontinue them since employers could get the same tax abatement by calling them what they are, wage costs. Following this scenario, the main benefit appears as the tax exemption in the workers' pay package, and the main victims are the competitors who do not receive the gift. If the government is willing to lose the revenue from the tax-paying half of the workforce, they could permit the Health and Retirement Savings Accounts to pay the premiums, essentially providing tax exemption to everyone. If unwilling to lose revenue, the government could start taxing the large employers, which they are now prevented from doing by the seemingly high rates. It's hard to know whom to blame, except this sort of Byzantine structure creates winners and losers, and is ultimately unhealthy.

|

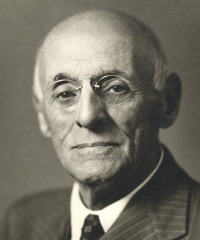

| Abraham Flexner |

Two simple and comparatively painless steps -- equalization of tax preferences, and lowering of corporate income taxes -- might soften the objection to indemnity, so why continue the service benefits concept? For this answer, you must return to Abraham Flexner, who brought Bismarck's "der her Professor" system to America, stimulated much research, and ultimately made teaching hospitals vastly more expensive than community hospitals for routine medical care. And now it is necessary to understand the system of calling all activities which are unrelated to patient care "indirect overhead". Although research is largely funded by outside agencies like the NIH and drug companies, it is described as indirect overhead, and distributed among the patient care bills as additional indirect overhead. Unfortunately, a great deal of bloated administrative cost is classified as indirect overhead, as well. No modern corporation could exist without a certain amount of cross-subsidy, but the present amount of it in hospitals is unreasonable. Beyond a certain level, indirect overhead should be forced out of the hospital cross-subsidy system, funded independently, or at least forced into public view. In short, too much routine care is being reimbursed at a high tertiary care level in the teaching hospitals, and this may well stimulate excessive administrative costs as well, even though it may be hard to trace how it comes about. Their competitors in the community hospitals also probably get a little raise, indirectly, to help suppress their complaints. Wall Street was once lambasted for steak dinners and Superbowl tickets from vendors, but you don't hear much about the hospital administrator version.

To make a long story short, service benefits tend to equalize the cost differences between teaching hospitals and community hospitals, ultimately raising the cost of both, but particularly the cost of routine care in teaching hospitals. Historically, this surplus subsidized the research revolution, to which we owe a thirty-year lengthening of our life expectancy. So, go figure. But nevertheless, it now blinds physicians as much as the public to the true cost of their medical decisions until they are unable to respond effectively to rising prices, and don't try. A century of it is long enough to devise a better approach, so apparently, some pain is needed. But any way you go about lowering them, if you want to control costs, you must start and end with undiluted true costs, not accounting fictions.

Originally published: Wednesday, April 06, 2016; most-recently modified: Thursday, May 23, 2019