1 Volumes

Rt. Angle by Years

The history of Philadelphia"s finest men's club.

Right Angle Club: 2016

In progress.

H.I.V., AIDS, and the Law

|

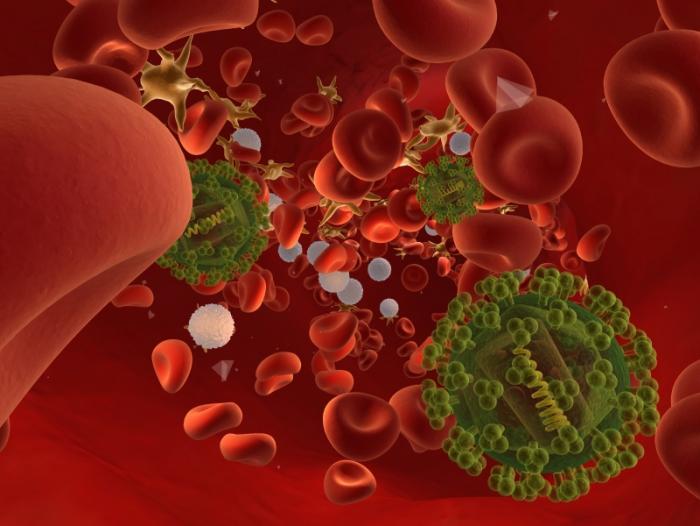

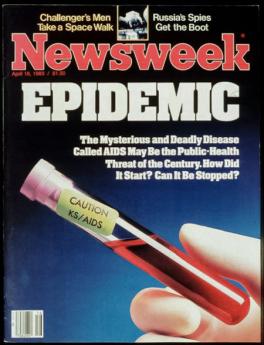

| AIDS |

We had a meeting in March at our new quarters in the Pyramid Club, conventional in all respects except members were urged to bring a female guest. It was extremely well attended, which probably improved the food somewhat. Come to think of it, the jokes were cleaned up a little bit, too. But because the central subject was also doubly controversial, covering both the subject of AIDS and the trial bar, I omit all names from this report, in an effort to maintain neutrality on the specific case matter, while discussing the general subject of conflict between the bar and the medical profession.

|

| AIDS knowledge |

The case under discussion took place in 1987, so it is important to remember the state of knowledge about A.I.D.S at that moment. Nobody knew for certain what caused the disease, or how to treat it. It was universally fatal and seemed to be contagious in some way. At least, it seemed to originate in Africa among primates, and when brought to America through Haiti, seemed to concentrate on male homosexuals, although not exclusively. It had a peculiar concentration of brain tumors and a strange proclivity for yeast infections of the lung. At first, there was no test for this condition, but over the course of fifteen years went from a totally mysterious and ominous condition to a curable disease. Indeed a largely preventable one, caused by a virus of the retro-virus variety, for which a highly reliable blood test was devised, and quite effective treatment. Comparatively few Americans now die of AIDS, now called H.I.V. infection, although the disease continues to spread devastation in countries with more primitive medical systems. I hope I have given a fair summary of one of the most rapid investigations into a new complex disease in all of medical history. Enormous amounts of money were poured into research in this condition, probably greatly stimulated by public pressure generated by the gay community, and others.

|

| "Philadelphia" |

The lawyer who presented the case to us was called into the matter by a client who had been fired because he had the condition. How much the client, defendant law firm, or plaintiff lawyer knew about the condition at the time was not elaborated. But it surely was incomplete, quite possibly quite rudimentary. Expert witnesses were consulted, although it is not clear how much they could have known at the time, either. In any event, it was determined the patient was still able to work at the time he was fired. The state of the law on the subject was equally fuzzy in 1987, and the basis of the claim was an infringement of disability fairness or some legal variation of this language. He wasn't disabled, was the basis for the court's decision, and in a sense that was true.

However, a question was raised from the audience as to whether the issue of contagiousness in the workplace was raised, and the plaintiff lawyer replied it was not; perhaps his impromptu response was somehow inaccurate. However, taking matters at face value, it is possible to imagine the executive of the firm was alarmed by the possibility that other members of the firm would resign rather than subject themselves to the hazard of contracting the disease themselves, thereby destroying the firm. Even so, dismissing the employee seems excessive; he might have been given a medical leave of absence, or some other means of preventing the spread of the disease might have been devised. But the point is the firm had a legitimate concern, and probably could not be sure of reassuring the other employees in a scientific way; an unwarranted panic could not be prevented by legitimate scientific arguments available at the time. That the firm chose a cumbersome unfair way of protecting themselves is not completely surprising, any more than a guaranteed way to escape a fire in a theater is even now available, except by not going to the theater.

|

| Louis Pasteur |

Until Louis Pasteur discovered the germ theory of disease around 1880, epidemics of contagious disease devastated whole communities for thousands of years. Thucydides described an epidemic in ancient Athens hundreds of years B.C., and even today we are not entirely certain what that disease really was. Since that time, society has developed legal and management techniques of mild utility, since the courts have had to devise some sort of order out of this panic situation. But whether the best scientific approach takes fifteen years to emerge, or centuries, the court decision has to be made on principles which may seem wrong-headed in retrospect. Once the scientific facts are firmly established, the process of undoing unfortunate precedents has to be commenced during which, further blunderings may take place. Finally, the courts and the medical profession may come to agree on the best approach, but it can take a long time. Since presumably there will be future outbreaks of future unknown diseases, I have a suggestion.

Discussions between the two professions ought to be held, to devise a mechanism of appeal to a special scientific court devoted to the problem which arises. The appeals court should refrain from issuing legal opinions until the scientific matter seems to have settled down, but a scientific opinion about the current state of scientific understanding might be quite welcome. At least the provisional court would know its decision would have to be provisional, anticipating later revisions of the law which undo judicial precedents set in a time when only expediency was possible. The situation already exists of the Courts of Equity, designed to meet situations where injustice obviously exists, but no law can adequately address it.

Exit Strategy: Medicare as the First Pearl in the HSA Necklace

Placing a termination point for Health Savings Accounts was originally occasioned by recognizing the overlap created in 1965 by Medicare for everyone. At the time, it seemed pointless to be covered by Health Savings Accounts in addition to Medicare, and there was confusion with Health Spending Accounts with their "use it or lose it" features. Pouring remaining HSA surpluses into a regular IRA retirement fund, seems in retrospect the most effective way to create some incentive to save as much as you can in the Accounts. You couldn't lose it and might well need it. To a certain degree, the size of the resulting retirement package is determined by the frugality of the individual client during his whole medical lifetime long before, but also during, the time he is on Medicare.

He would, however not be in the position of needing to do that, if he had been born earlier. The subscriber to an HSA could continue to deposit extra tax-exempt money in the roll-over IRA for his retirement, giving the appearance of laundering it. Unfortunately, he would first have to drop out of the healthcare benefits, so he would lose the laundered tax exemption for health benefits on withdrawal. You would now have to view the extended tax exemption as repairing that unintended inequity. As Medicare began to be less generous, there were increasing gaps in coverage, and there may be many more in the future.

In what follows, we extend the retirement roll-over idea to several other medical entitlements without suggesting it be required as a universal rule. The time-honored old approach was to use an insurance surplus to reduce costs by recycling its surplus, but there are other things to consider. The first would be to imagine a theoretical sharp drop in the cost of Medicare, itself. Since 80% of Medicare is now spent on five or ten diseases, the possibility of a sudden cheap cure of one of those diseases is raised. The astonishing savings in the cost of strokes and heart attacks, created by taking a daily aspirin tablet -- shows what it might be possible to imagine as happening again. Not to promise, but to imagine.

On the other hand, it is also possible to imagine less desirable priorities getting into the competition for such a financial windfall. Confronted with the issue, the average person would likely suspect such a windfall might as likely pay for aircraft carriers as Medicare deficits. But another opinion would emerge and should be the default position. The Medicare program and its members had experienced the unexpected -- and expensive -- a consequence of more protracted retirement than they planned on (five times as expensive, by one estimate). A more just assignment of such windfall would be to pay for the extra-long retirement cost it had provoked. If other emergencies seemed more pressing at the time, they could always be given priority on the money, but by default, Medicare should first pay for its own consequences. In fact, nothing of the sort occurred.

In a sense, President Obama later created the same political problem for himself with the original budget for Obamacare. He did not need to make any speeches directing attention to the diversion of Medicare money to help pay for Obamacare costs, because plenty of Republican opponents were studying the budget. And plenty of Republicans remembered Richard Nixon's advice, "Watch what I do, don't listen to what I say." Having spoken to many groups of retirees about healthcare financing, I am acutely aware that retirees are watchful for any move to strip Medicare funds for Obamacare's benefit. It's about their highest priority.

And indeed their anxiety would be heightened by discovering Medicare is already 50% subsidized by general taxation, and then unsustainably maintained by borrowing money (selling US Treasury bonds) to foreign countries like China. And still more to the point, medical costs have been and will continue to migrate from working-age people to retirement age people in the future. Just about everyone who dies right now dies at Medicare expense. Even more than that, the effect of medical science has tended to eliminate terminal medical costs for people under 65, shifting them to people who get sick when they are over 65. It can be predicted a major cause of future Medicare cost increases, compared with the cost of living, lies in this shift of disease cost to the elderly. So it's a little hard to project whether Medicare costs will go up or go down, even if the cost of illness remains the same.

Recipients will change insurance compartments. Many attempts have been made to shift Medicare costs to the non-stick working population, such as through the payroll tax deduction and hospital internal cost-shifting, but the trend continues. A more sophisticated thing for the retirees to worry about, is the instability of a system which depends for its financing on that one-third of the population who are at work -- but who are themselves becoming progressively more healthy -- to support the medical finances of the other two thirds of the population, who are sick.

Taken in summary, there exists a great political opportunity for both political parties to put a stop to this "third rail of politics" talk. And to amend the Medicare Law immediately to provide that any declines in Medicare costs be immediately transferred to Social Security, for the purpose of paying for further increases in longevity. That provision should not cost much for some time to come. But the incentive it would give to the retirees to reduce their health expenditures might be considerable. Just as the comparable position Health Savings Accounts achieved, once Medicare coverage was attained.

But its real benefit might be tested on that fateful day in the future. The day you pick up the morning newspaper and discover someone has cured cancer.

(Second Edition)Exit Strategy, Health Savings Account Death Balances

A subscriber with both Medicare coverage and an HSA may die with a balance left in his HSA account. That's what we would like to see since it suggests ample provision for two universal needs. But what is the most useful re-direction of the surplus? Having died he can no longer use it, and his will may or may not indicate his wishes. True, he originally deposited the money in the account but escaped income tax, so the government retains some sort of ownership right to the principal and its income.

If the government follows my suggestion, it will have established a first and last year of life re-insurance program. In that case, a thing likely to result in a surplus at grandpa's death would be to use it to reduce the cost of health insurance for the grandchild. As they say, possession is nine-tenths of the law. Here, it seems a valuable thing to encourage, since it reduces the reluctance to fund the health expenses of a vaguely-related or even unrelated grandchild. Society not only has an incentive to soften the burden of maintaining the population but it probably also has the incentive to diminish its frictions. The less it costs, the more it eases the friction of odd-ball relationships, making it less likely for divorces, gender-changes and unrelated hostilities to end up in court. It thus suggests a welcome candidate for a default use of the money. Everyone who considers these matters deeply should remember, the traditional judge of such matters once was the family unit.

Having considered such a contingency, the next question arises whether all surplus in the HSA of someone who dies should be treated the same way-- that is, adding it to a first and last year-of-life pool. It would thus assist a basic function of everyone, and leave the burden of proof on those who feel a particular family situation has a higher claim on the money than society as a whole. A somewhat different approach might be to recognize newly-deposited money in an HSA is mostly original fully-taxed money, but over time a growing proportion of it comes from investment interest on the tax deduction. That is, the funds of younger people are mostly their own, but toward the end of life, the government tax exemption has a growing claim to ownership. It would not seem unreasonable to switch the ownership presumption at the age of retirement, or some other surrogate for advancing age and changing responsibilities. These things change with time; consider how many orphanages there were a century ago, and how few there are today.

HRSA preferable to 401(k)?

A recent article in the Wall Street Journal announced to the world that Health Savings Accounts were a better bargain for the investor that was 401(k). That's certainly true if you spend the money in an account for approved medical expenses, or if you roll it over into an IRA at the time you receive Medicare. But it's also even arguably if you spend it in any other circumstance.

Let's put it this way: If you had an IRA or 401(k) but not a Health Savings Account how would you justify it? The HSA gives a double tax exemption for health services, but you are no worse off if you remain healthy. Of course, you are better off with an HRSA. Of course, that may change, but then the oceans might someday pour over Chicago.Most of the arguments for having an HSA rather than a 401(k) boil down to saying they are the same thing, but HSA gives you some healthy options in addition, so why not have them. However, it is possible that your employer has selected a poor 401(k) vendor, one who adds unnecessary fees and requires investments which themselves have poor performance because they are loaded with more fees. So, if you are dissatisfied with 401(k) results through your employer, you may wish to shop around for a better deal, and you might as well pick one with some health benefits attached. After all, the Affordable Care Act mandates high-deductible insurance, so that part of the requirement is likely to be fulfilled already. Since you picked it because of disappointment with your employer's 401(k) investment results, you may encounter some resistance from the Human Relations Department. All in all, there is little value in switching until the employer mandate issue is settled -- except the value of the uproar you create, trying to get treated more fairly. However, there are a few other issues if you have an agreeable employer.Well, you can't have an HRSA if you are under 21, over 65, or covered by a health insurance policy that doesn't have a high deductible. The Affordable Care Act mandates high deductibles for everybody, but there are still occasional loopholes, probably soon to be closed. If your policy has co-insurance features, that's actually probably an argument to switch out of it. You can't have an HSA if you are also covered by some other government plan. All three plans are sometimes subverted by self-serving intermediary fees, but you just have to shop around for the ability to choose your own investments. That may cause you to pick an inferior health insurance plan, so keep looking. Eventually, some people will reach their limits and need more than one retirement plan, but that's different. Although Health Saving Accounts are spreading nicely, there must be a hundred million people who have no reasonable answer to the question of why they have a 401(k) but not an HRSA, so please read on.

Claims Adjusting for Trivial Claims. In the first place, the HSA wanted to make it possible to skip the middle-man cost and oversight, and simply pay bills with a debit card. So an "allowable" medical expense is more broadly defined than what a health insurer might allow, or at the very least it dispenses with the cost (and delay) of insurance review prior to payment. Since the Account part of the HSA was mainly intended to pay for deductibles, it didn't seem cost-effective to subject extra costs to fruitless but expensive insurance scrutiny. It also eliminated the delay occasioned by remaining on the desk of the hospital billing department for several weeks before someone submits it to the insurer to pay -- when the debit card could just as well have paid it immediately. Just how much these thoughtless design features actually add to the cost is uncertain, because it's used as an excuse for delays which may have other causes.

Skipping Insurance Claims Entirely for Small Claims. As things have turned out, forty percent of HSA accounts have never submitted a claim. Maybe they don't get sick, but more likely the client calculates it is cheaper for him, in the long run, to pay his small out-patient charges in cash, while letting the Account gather compound interest. Aristotle is said to have complained that most debtors don't realize how compound interest is itself compounded, and rises with time. But maybe debtors are now smarter than Greeks in a Toga. A debit card directly adds 2% to the cost, while interest rates vary with the economy. Incurring costs greater than the net is a waste of money, largely growing out of a supposition the employer is paying for this as a gift, and taking a tax deduction at higher corporate rates. That's only true half the time, but the other half hasn't marshaled their lobbyists to equalize the tax exemption. Apparently, Congress believes the self-employed don't deserve this tax exemption as much as employees of major corporations do. Or possibly eighty years isn't long enough for Washington to fix the flaw. Let's go on with this, a bit.

Non-trivial Returns From Saving Small Scraps. We were saying HRSAs were a better investment than 401(k). To go forward with the logic, the client is effectively taking out a loan from his 401(k) when he pays his medical bills from it, or in cash if the purpose is to preserve the preferable interest-bearing account. Assuming both accounts pay the same (you didn't get sick), the result is a wash. But as time goes on, the effective compound interest rate will steadily rise; so the extra profit was made without incurring any extra risk. That may not seem like much until you employ the old maxim that money at 7% will double in ten years. Two, four, eight, sixteen, thirty-two -- it rises 3200% in fifty years. The stock market may rise or fall during those fifty years, and the client may get any one of a thousand diseases. Inflation may intervene, wars are likely to break out. But the relentless superiority of this riskless choice will persist. And get this: at the conclusion of the exercise, the client who gets sick pays no tax, while the one who was scared to do it, pays the higher progressive tax rate he attains later in life. The hypotheticals have to be carefully chosen to reach any other conclusion. But remember to get started young, because to wait ten years will reduce the multiplier from 32 to 16. The millennial generation complains the tax laws are stacked against them, but I don't see it. They are offered the chance of a lifetime, but they will only get one bite at the apple.

Is that all? Well, no, but there are competitors. The deposits in a Health and Retirement Savings Account, just as surely as the deposits in a 401(k), are occasionally subject to rather extreme middle-man costs. The stock market has steadily risen by 11% for the past century. Never mind that it's true past results can be unsound future predictions, just recall that even the "buy and hold" philosophy has seldom presented the investing customer with more than 5% net-of-inflation return. That's because inflation took away 3%, and hedging against "black swan" crashes (by putting 40% of the portfolio into bonds) has taken away 2% more. That leaves about 1% for the customer and the broker to fight about. More than anything else, this slim working margin has driven the investor to choose "buy and hold" over "market-timing". The evidence continues to accumulate that "buy and hold" is at least as successful as "market-timing", but people continue to market-time when they are desperate for the occasional big winner, never mind that big loser outnumber them. To me, the conclusion is clear the public will increasingly squeeze their friendly advisors for a wider slice of the pie. And in this, our central theme is repeated; the HRSA will out-perform the 401(k). Because the shopper for an HSA manager is the customer, whereas the choice of a 401(k) manager is made by the employer. Pass all the laws you wish about kickbacks; allowing the customer to select the manager will usually beat letting the employer do it for him. There's often nothing so expensive as getting something free.

Washington's Real Motivations

Washington could occasionally display a wicked temper, but in general he was a reserved and dignified man. Physically large and unusually athletic, he tended to dominate by glaring at people rather than debating them. And so, after a lifetime of leadership and distinction, he seldom engaged in arguments. As a consequence of this studied behavior, it is possible to have many opinions about his underlying thoughts, except one: he always seems to come out on the winning side. It certainly was effective: he was Commander in Chief, The President and probably the instigator of the Constitutional Convention, and the First President of the United States. To decide whether he got what he wanted means deciding what he wanted, and he hardly ever stated it.

Conrad Black, the newspaperman who went to jail, stated the Canadian point of view, which is perhaps extreme. Black's view was "the Americans" first got the British to help them throw out the French, and then twenty years later got the French to help them throw out the British. These two statements are undoubtedly true if abbreviated. Added to them was the plain history that Washington had personally started the French and Indian War. One has to wonder what was in his mind when the French aristocrat LaFayette came to join him. And later on, what he thought of Thomas Jefferson's love affair with the French Revolution. Or what he thought of the antics of the French ambassador "Citizen Genet".

Washington didn't like the Indians, and he put down the radicals of the Whiskey Rebellion with extreme prejudice. Is it so hard to perceive the barons of Runnymede acting any differently?

Revolutionary Features of Big Data

|

| Professor Kenneth Burdett |

The Right Angle Club, now in new quarters in the Pyramid Club, was recently visited by Professor Kenneth Burdett of the Universities of Pennsylvania and Cornell. A charming fellow with a Scottish burr (he mentioned being born in England), the professor told of a new twist to economics, which mostly employs familiar data in unfamiliar ways. Many concepts central to macroeconomics actually become less informative as net values or ratios of other expressions, losing useful information in the name of abbreviated elegance. "Unemployment" was offered as a handy illustration.

|

| Mark Rank |

We tend to think of 230,000 new jobs this month as a hard fact, whereas employment might be more precisely described as a set of several million people switching jobs each month, offsetting several million others who gain new jobs, along with almost as many who simply decide to leave the workforce and retire. We always sort of knew unemployment was a combination of gainers and losers, but few of us recognized that net turnover affected far larger volumes of people going opposite ways at slightly different rates. The reasons underlying a large flux, in other words, may be much more important than small net overall fluctuations. Or, far larger population upheavals may produce deceptively similar net results. We've been accustomed to judging smaller final ratios than to many-times larger underlying flows, or at least implying undue importance to a small subset of change. What usually happens is vastly larger numbers of people lose their jobs during a depression, but almost as many millions more re-enter the workforce, too, but at a lower wage level.

|

| Thomas A. Hirschl |

Curiously, a new book by Mark Rank of Washington University, and Thomas A. Hirschl of Cornell (!) called Chasing the American Dream: Understanding What Shapes our Fortunes has just appeared, saying much the same thing. Their approach is to develop a figure for the risk of being unemployed for a year in the next 5, 10, or 15; at the moment the answer for unmarried white persons sometime during the next fifteen years in the future, is 32 percent. That seems to be a much more scary projection than setting the present aggregate total unemployment at 4.6%. We'll have to wait 15 years to see which prediction really is more descriptive, or if it has the same consequences we immediately assign to it. But it would appear many assumptions are about to be set on their head, and the quality of our projections is about to shift dramatically. For example, Chairman Bernanke of the Federal Reserve placed great stock on wage inflation being "core" inflation, but these calculations suggest much more can be made of the data than that. Since somehow it is suggested the present recession has eight more years to run, current oversupply may require eight more years to run down; old data restated in this new way may have different implications for policy.

|

| Chasing the American Dream |

Right Angle members who lean both right and left seemed impressed and befuddled by a new view of an old topic, and that's probably a good thing. There seems no question of the validity of the approach, no question of significance, and little doubt of its ability to change attitudes. We look forward to many more such insights from the Dismal Science, of this nature. For instance, this professor of many students of the rentier class remarked at how repeatedly he had been struck by students able to afford red convertibles (and the Princeton tuition cost) were nevertheless willing to throw themselves into the scrum of Wall Street, to make even more money.

He regarded that as a strength of the American economy, in stark contrast to that in Europe, where the first sign of prosperity sent his old acquaintances straight to the pub, to relax a bit. In the British aristocracy, "entering trade" is a low-class thing to do, whereas sitting on the sidewalk sipping wine is the mark of really high class. The American version is reversed, but possibly that's a more useful misconception.

Getting Started

So it's simple to get started, although any obvious modifications like periodic payroll deductions, are between you and your vendor.

To repeat: you choose a high deductible health insurance plan which conforms to regulations. Since they vary in price and service, you are advised to shop around, probably starting with the Internet, or the personnel department of your employer, or your friends. At the moment, a number of features are fixed by the Affordable Care Act, so price and service are really the main issues.

Then, having identified a (high-deductible) insurer and an HSA vendor (perhaps a bank or investment adviser), you are free to switch later, but in the long run you are looking for more-or-less permanent relationships.

You now presumably have your health insurance policy, with a Christmas saving fund arrangement attached. Don't sign anything until you are satisfied with the answer to this question, "How much income can I expect and how much freedom do I have to invest in total market stock index funds, when and if I choose to?"

If you get evasive answers, you might silently plan to sign up, but plan to keep on looking for a better deal to switch to later. At first, it might not matter, but over time you need to find the best arrangement. A debit card attachment is nice. Big vendors are reassuring, but they tend to be inflexible. Bear in mind, there isn't much in it for your advisor unless you keep renewing for a long time, so if you persist, you will probably get an answer. If persistence doesn't work, the outlook for a favorable answer, however, is dim.

So you might suddenly improve the atmosphere if you offer plans to deposit the maximum allowable immediately because a lot of obstacles will likely be waived. Keep that up for as long as you can, at least until minimum balance requirements are fulfilled. If you can't manage it, then use the Christmas fund approaches of payroll deductions and income penalties for as long as you have to, but remember your counterparty really must somehow be paid, even though he always remains a counterparty. What about the retirement income features? You probably don't have to worry about retirement for many years, although it is always wise to check occasionally to see how income compares with the competition. As things now stand, you needn't do anything until you become eligible for Medicare, except keep score between your arrangement and others, reacting appropriately to differences. As the time approaches, you will probably find you have lots of choices of retirement plans, so don't be in a rush to freeze that option.

Whether it is explicit or not, let's say you have done everything necessary for both a health insurance plan and, following that, a retirement plan. The retirement plan will have no money in it until you shift it there from the health insurance plan, replaced with Medicare. There are penalties for early withdrawals, but they can be made if you must. So to summarize, there's a little nuisance when you start, and another bit when Medicare looms. But essentially the Health Savings Account is on auto-pilot if you keep funding it, and events continue to demonstrate you are getting the maximum available return.

That completes the first section of this book. It all may be a little hard to understand, but it's easy to do. The last part of the book is devoted to what else you and Congress might think about, to build additional features on top of this foundation. Most of these extensions would greatly enhance the finances of you and the rest of the country, but all of them must be debated in minute detail before implementation. And all of them require major legislation to be smooth and workable. The Health and Retirement Savings Account as it stands might use a few easy amendments, but it already has most of its kinks worked out. It's already reached the point where the claim can be made it's a whole lot better than any other term insurance plan.

One by one, let's examine the potential multi-year improvements to be debated, so at least you understand where all this might take you.

Looking a Gift Horse in the Mouth

|

| Progressive Era |

The Progressive Era lasted several decades, some say it still continues. Around 1910, the Progressive Era, reacting to the Gilded Age which preceded it, started doing painful things in the best interest of the individual, like the graduated income tax, the War to End Wars, and employer-based insurance.

|

| Harry Truman |

Regardless of originator or date, employer-based health insurance was imported as an idea from Germany in the nineteen-teens, getting started in the nineteen twenties, and becoming the prevailing standard by World War II. Although control later shifted from employers toward government during this period, Harry Truman was unable to move it further. It was only in 1965 that government control jumped forward, coming to a climax in the 1965 Medicare and Medicaid laws. Curiously, the employer-based format itself reached a peak in the Lyndon Johnson legislation. Since 1965, one president after another has struggled to convert the rest of health insurance to government-based but always retaining its same general employer-based form. Along the way, two people significantly modified the model: Abraham Flexner, promoting the research-oriented teaching hospital into custodian of the standard of care, replacing the physician guilds; and Henry J. Kaiser, retaining control of a wage cost by calling it a gift, with high corporate income taxes and exempted employee income taxes reducing its effective cost to the employer. In a curious way, high corporate income taxes increased the proportion of healthcare paid for by the Federal Government, by increasing the value of the deduction. Not everyone would agree with this description of the history, but I'm convinced of its essence.

|

Whether the gift comes from business or from government, makes little difference, except to the two contestants. Henry Kaiser seems to have become enlightened that corporate taxation higher than individual rates actually results in important tax advantages for the employer's gift. It allows employers to shift most of the cost to the government while retaining ultimate control in employers' hands. For many decades the commercial insurance industry tried to break in, but the greatest recent threat to this collusion was accidental. All insurance is a system of cross-subsidies, but the Obama Administration superimposed a subsidy of the poor by the rich, onto an employer system of the young employees subsidizing the older ones. The mismatch between the two seemingly similar subsidies now threatens the coherence of the medical finance system. It also brings out the advantageous warping of the insurance idea by calling it a gift.

|

Furthermore, the gift is ultimately one of money, so how did service benefits get mixed into this? What does the diagnosis have to do with paying hospital bills, except as a mechanism for obscuring the price? The insurance premiums begin with money, and the insurance intermediary ultimately sends money to the provider of care. Money-in, money-out is what the insurance industry calls indemnity insurance. They were using indemnity for centuries before health insurance came along. Why change to a unique and expensive accounting system, if final prices remain unchanged? This device probably started as a way for an insurance intermediary to check the medical validity of a remote claim, but has gradually evolved into an elaborate cost-shifting device. The unfortunate result is to blind the doctors in charge of the true costs of their options. So doctors nowadays totally disregard the posted prices which emerge, when they devise their treatment strategies. The result is very bad, no matter what the original purpose was.

There may be something to the idea that adding diagnoses and services adds enough mystery to the process to keep away competition, but there are business incentives which seem more central. Now that health cost consumes almost 17% of the gross domestic product, corporate taxes are an important part of the federal budget, largely explaining why the President might not want to lower them, even driving international businesses to consider moving abroad, rather than lower corporate tax rates. However, if the tax reduction which results from the gift is considered, the net corporate taxes actually paid are not too different from prevailing international rates. If corporate income taxes were eliminated, at least the employer would have to pay for his own wage costs masquerading as gifts. They might even discontinue them since employers could get the same tax abatement by calling them what they are, wage costs. Following this scenario, the main benefit appears as the tax exemption in the workers' pay package, and the main victims are the competitors who do not receive the gift. If the government is willing to lose the revenue from the tax-paying half of the workforce, they could permit the Health and Retirement Savings Accounts to pay the premiums, essentially providing tax exemption to everyone. If unwilling to lose revenue, the government could start taxing the large employers, which they are now prevented from doing by the seemingly high rates. It's hard to know whom to blame, except this sort of Byzantine structure creates winners and losers, and is ultimately unhealthy.

|

| Abraham Flexner |

Two simple and comparatively painless steps -- equalization of tax preferences, and lowering of corporate income taxes -- might soften the objection to indemnity, so why continue the service benefits concept? For this answer, you must return to Abraham Flexner, who brought Bismarck's "der her Professor" system to America, stimulated much research, and ultimately made teaching hospitals vastly more expensive than community hospitals for routine medical care. And now it is necessary to understand the system of calling all activities which are unrelated to patient care "indirect overhead". Although research is largely funded by outside agencies like the NIH and drug companies, it is described as indirect overhead, and distributed among the patient care bills as additional indirect overhead. Unfortunately, a great deal of bloated administrative cost is classified as indirect overhead, as well. No modern corporation could exist without a certain amount of cross-subsidy, but the present amount of it in hospitals is unreasonable. Beyond a certain level, indirect overhead should be forced out of the hospital cross-subsidy system, funded independently, or at least forced into public view. In short, too much routine care is being reimbursed at a high tertiary care level in the teaching hospitals, and this may well stimulate excessive administrative costs as well, even though it may be hard to trace how it comes about. Their competitors in the community hospitals also probably get a little raise, indirectly, to help suppress their complaints. Wall Street was once lambasted for steak dinners and Superbowl tickets from vendors, but you don't hear much about the hospital administrator version.

To make a long story short, service benefits tend to equalize the cost differences between teaching hospitals and community hospitals, ultimately raising the cost of both, but particularly the cost of routine care in teaching hospitals. Historically, this surplus subsidized the research revolution, to which we owe a thirty-year lengthening of our life expectancy. So, go figure. But nevertheless, it now blinds physicians as much as the public to the true cost of their medical decisions until they are unable to respond effectively to rising prices, and don't try. A century of it is long enough to devise a better approach, so apparently, some pain is needed. But any way you go about lowering them, if you want to control costs, you must start and end with undiluted true costs, not accounting fictions.

Ben Franklin and Brexit

|

| Minister David Cameron |

In June 2016, Great Britain voted by a million plurality, to withdraw from the European Union. The plebiscite was not binding on Parliament, but Prime Minister David Cameron promptly resigned, and there remains little discussion of anything but going ahead with "Brexit". It will take at least two years to accomplish the matter, and there remains great uncertainty about the terms of separation. The British stock market took a sharp dip. Stock markets always hate uncertainty, and from the start, there was little doubt Britain would experience some economic hardship, but still they went ahead with it.

|

| Archbishop of Canterbury |

By the greatest stroke of good luck, I happened to be in London for this event. It had been barely noted in the Americana press before I left, and indeed a discussion group hadn't even put it on the agenda after my return. But let me tell you, the British public was talking about nothing else. From the lowest barmaid in a pub to the Archbishop of Canterbury, there was only one topic of conversation and a very real understanding that Britain might well vote to leave the EU. Once the vote had been taken, of course, even the American public appreciated its significance and its resemblance to the headlong tumult in our own political parties. Donald Trump might well win the election, and logic or rhetoric had little to do with it. Other countries, Scotland in particular, were teetering in the same direction of demonstrating how far a democracy was from a republic when each "leader" had a million constituents. And how well the public appreciated the tendency of elected representatives to forget who elected them. Or else, in more rational moments, to appreciate how difficult it is for elected representatives to communicate with constituents.

|

| Ben Franklin London Townhome |

To go on with this insight for a moment, my Washington daughter tells me Democrat congressmen are required to spend thirty-six hours every week in a call center, soliciting campaign funds; where do they find time to legislate? But the central background reflection I happened to have about Brexit was how enduring the political split apparently was between the Whigs and the Tories. This thought came to me from one of the real reasons I was in London, to visit Ben Franklin's imposing rowhouse on Craven Street, fifty feet from the National Museum on Piccadilly. Franklin lived there for most of eighteen years, in a style quite different from the two-penny loaf of bread in Philadelphia. He was personal friends with five kings, Voltaire, Mozart, and Beethoven, as well as Priestly, Lavoisier, and Hume. Townsend may indeed have passed the Stamp Act, but he invited Franklin to spend the weekend at his hundred-room castle. The neighbors on Craven Street easily recognized the carriage of the Prime Minister when he came to call on Franklin on Craven Street. From the point of view of this social set, the uproar over the colonies was whether England should conquer them and send their raw materials to British factories (the Tory view), or should instead colonize them with Brits, give them the vote, and rule the world as a commonwealth (the Whig view). Naturally, Franklin supported the Whigs, but his loyalty to his good friend George III never wavered until 1775. And then, lightning struck St. Paul's Cathedral.

|

| King George III |

Quite logically, the King asked Franklin's advice. The King, however, insisted on a brass ball on the top of the church. Franklin resisted, saying a spire was much more effective. We don't have the exact words exchanged, but essentially the King said he was going to have his way, while Franklin in effect asked him who he thought he was talking to. In those days, far less direct wording was needed to give offense on such a central issue of the king having the last word whenever he wanted. It is intimated the King suggested to Wedderburn he should take care of the issue for him, and within a few weeks, Franklin was subjected to public humiliation in the cockpit at Whitehall, threatened with arrest, and fled to America to start the war. I had never heard this story, before.

The point leaves me with is not that Franklin lost his cool and should have known better than to express his opinion. Rather, it is the reflection that never before had a king been challenged on his divine opinion on any subject. Just think of the shock this must have caused him, to have to realize this was the first snowflake in a blizzard. With the Enlightenment and the Industrial Revolution, the world was going to be full of experts, who could make a fool of any king by disagreeing with him in public. This particular king was able to have his way, no matter what, but the day was soon approaching when any science editor, any university professor, and ultimately every barmaid in a pub, could pontificate to the Pontiff.

Terrorists: Mafiosa or Just Nuts?

|

| Dr. Eric A. Zillmer |

At a recent meeting of the Right Angle Club, meeting in the Pyramid Club quarters nowadays, a psychology professor from Drexel gave a talk on the psychology of terrorists. He looks as though he played basketball himself, and rather favored the espionage approach to the law enforcement one. Together with the trouble exactly clarifying his role either with Drexel or the government, it all suggested the Yale approach rather than the Notre Dame one if you understand what I mean. He gave an excellent talk, and questions would have gone on for hours if he had been able to stay longer.

|

| al-Qaeda or ISIS |

One interesting distinction he makes is between organized crime and mental illness. That is, between al-Qaeda or ISIS, and solitary Americans who shoot random schoolchildren in high school cafeterias. Both nationalities tend to end up dead at the end of the episodes, because the swat teams called in, have little patience (or trust) with risking lives to read Miranda Rights to people with smoking machine guns in their hands. But either because there are actually some survivors, or because other members of the criminal network are caught and interrogated, several hundred terrorists have ended up in Guantanamo for further interviews. Somehow, or for some reason, it was arranged for our speaker to interview them on cellphones, with a military interpreter on the line.

|

| Suicide Bombers |

Now that the Middle Eastern uprising has gone on for a few years, he said is possible to distinguish two different types of Muslim terrorists, the ones who get blown up in the attack, and others, their handlers whom they have often never met before. These handlers are to pull the triggers on radio devices to set off the suicide vests worn by the "useful idiots", who are sometimes hesitating at the last moment. The ones who get blown up are usually educated young male idealists from the upper classes, quite sane and highly dedicated to the cause they serve. They and their families will be glamorized later for their sacrifice, whereas the gimlet-eyed handlers fade off into the distance through the networks of safe houses. When they do get caught by intelligence agents of various sorts, they generally prove to fit the mold of tough-minded mafiosa, in this tough business for long-run power and control. They might be conspirators, but could hardly be called idealists.

|

| Peaceful Domestic |

At least, that's what our Drexel professor said he believed to be the case, and in general, his prescription for winning this war is to enlist the support of the wavering majority of Muslims who belong to neither one of the activist groups -- yet. Meanwhile, peaceful domestic American citizens can play an important role in distinguishing warrior enemies of several sorts from the occasional young American schizophrenics in cafeterias acting as lone wolves with their mayhem. The American variety needs electroshock therapy more than they need more rights, defense lawyers or longer prison terms. Strengthening or weakening the Second Amendment will have little effect on any of these people, Asian or American, but it might hamper the national survival to mischaracterize the two groups once they are taken into custody. Essentially, the intelligence community doesn't care what is done with the nutcases, as long as you don't hamper their efforts with the Mafiosa. And judging from the Human Rights protectors, they don't much care what happens to the Mafiosa, so long as we protect the rights of nutcases. There are surely a few double-agents mixed in, whose motives for saying what they say, are kept unclear. When the shouting dies down there are nevertheless elements of hope in this controversy. But it could easily get out of control. Because we are outnumbered worldwide, we might just lose.

How to Live a Long Life and Get Rich

|

A long time ago, a rich oriental man flew five thousand miles to ask me a question, "What is the secret of a long life?" I was so startled by the experience I never did ask him why in the world he would think I knew the answer to such a question. But after a few seconds, I blurted out an answer. "The secret of long life," sez I, " is never get sick." I don't know what his opinion of my profundity was. But I do know what he died of. He was executed by his government, so I hadn't given him the right answer to his question.

At other times, people especially my children, asked me how to get rich. After some practice, I developed a pat answer to that one, too. "The secret of getting rich is to spend less than you earn." What I realized too late to be useful, was that "Don't get sick and don't spend more than you earn", is a peculiarly American viewpoint, a Philadelphia attitude, and ultimately a Quaker one. It probably explains why there have been so few Pennsylvania Presidents of the United States, few Nobel prize winners, and relatively few Philadelphia glitterati in general.

|

Because, "Avoid risky behavior" comes closer to the right answer, since risky behavior is a fairly good pathway to glitterati success, and the Quakers had figured out it was a fairly good trade-off, to prefer longevity with prosperity. When I worked at the National Institutes of Health, I was struck by how many eminent scientists went through red lights, and otherwise exhibited risky driving behavior. Everybody knows eminent politicians play around with risky sexual behavior, as do movie stars and glitterati in general. But it is less noticed that America has an even larger proportion of risk avoiders who use that method to live long and prosperously. America has developed an environment where it is possible to get old and prosperous without so much tiresome risk-taking. Kingley's famous text of, "Be a good, sweet child, and let who will be clever", doesn't quite get to the root of it. It's the risk you want to minimize, not cleverness.

And the verb is minimizing, not eliminate. The Quaker term is "steely meekness". And a bothersome American response comes from Winston Churchill, "If the enemy comes, be sure to take one with you."

Pot Belly

In a love song written by T.S. Eliot, the character named J. Alfred Prufrock complains that as he grows old, he wears the bottom of his trousers rolled. College freshmen who encounter this line are apt to glide over it, uncomprehending, but the allusion will eventually grow clearer. The old man tends to find his legs have apparently grown shorter because he has to roll up his pants to keep them from dragging on the ground. Although the cartilages in his knees, hips and the lower spine may have compressed a little, the shortened legs are more apparent than real. The pants seem longer because his belt line has dropped. Dropped below his pot belly, that is.

No medical textbook that I know contains much discussion of pot bellies, even though they are almost universal, and universally noticed. The muscles of the belly wall relax, allowing the guts to bulge forward over the pubic bone.

Even doctors don't know enough about this disorder of old age

|

The aging lungs tend to enlarge, pushing the guts downward. The spine bends forward, and of course, the fat tends to increase inside the abdominal cavity. If there has not been too much weight gain, the pot belly tends to flatten out when its owner lies down on his back; if the weight has been gained, the pot sticks up like a pregnancy, obscuring the lower edge of the rib cage, bulging out at the sides. Normally, a young person's abdomen is described as "scaphoid" or hollowed out like the inside of a rowboat. A skinny young woman has wider flaring hip bones, exaggerating this scaphoid appearance, and making the waist narrower by allowing the guts to drop down into the larger pelvic cavity. Younger people are more active, with more muscle tone holding things together somewhat better.

Anyway, when the older person rolls over in bed, the innards of the belly cavity get squashed against the mattress. The old man's prostate leads to a fuller bladder, which means he gets up earlier when he rolls over it and gets up a lot earlier if he is overweight and has more pot belly. Or it may be the upper stomach that gets squashed, forcing the acid stomach contents up the esophagus and resulting in heartburn, burping, and even cough or hoarseness if the acid gets up into the throat and back down the windpipe. With weight gain, the pressure of lying prone can press against the main leg veins as they cross the brim of the pelvis, resulting in swollen ankles. Since the large intestines are coiled and kinked, external pressure against them causes a minor degree of obstruction which can be experienced as constipation or sometimes bowel urgency. Since the bowels contain a fair amount of gas, pressure on them causes small gas bubbles to merge into larger bubbles, with resulting flatulence which can reach startling proportions in the early morning hours. For all these reasons, people with pot bellies tend to sleep on their backs, causing a lot of snoring. If they snort and waken, they may have night time insomnia, daytime drowsiness. One sure sign of this is that the bed partner flees to a separate bedroom.

Victims of this affliction may, if they choose, imitate Scarlett O'Hara in that famous scene in Gone With the Wind with the slave girls pulling a tight corset even more painfully tight, but corsets are currently out of fashion. Or they can take purple pills to correct the heartburn, or regular laxatives for some of the other problems. In general, however, leg-lifting exercises strengthen the belly wall muscles (abs, I believe they are called), and losing weight by eating less does the rest. Losing weight is never easy, but in this case, a few pounds can make big differences in belly circumference, as measured by the belt size. Nothing will shrink the enlarged lungs pushing down, however, and arthritis of the spine may maintain the forward stoop. Very few older people are complete without some signs of this common affliction. Even so athletic a person as the ramrod-straight George Washington developed just a little pot. And Benjamin Franklin, of course, had a hopeless case.

Girard College as an Entertainment Site

|

| Girard College |

For many decades I have hungered to visit Girard College, sitting like the Parthenon on the Acropolis of Girard Avenue, even decorated with colored searchlights after dark. In its very earliest years, the estate of the richest man in America was entrusted to City Council, but the corruption and lack of progress toward stated goals forced modification. Unseemly behavior by political leadership caused the Board of City Trusts to be created with this monumental sum of money devoted to the education of "poor, white, orphan boys". For many decades, to be a member of the Board was the highest honor in the business community, and several large business empires were added to the responsibilities. Girard had the foresight to state in his will that no Pennsylvania property was to be sold, and when the downtown area began to surround Reading Terminal the wisdom became apparent. His farm was made into rental rowhouses of great profitability in South Philadelphia, a hundred million dollars worth of coal was mined in Schuylkill County, and the first Industrial Revolution grew up in the hinterlands in response to the blockades of the War of 1812. Girard's estate was well managed, indeed, was a showpiece of Philadelphia business acumen. He died with the greatest fortune in America, but that was only the beginning of the industrial power of the leaders who really ran Philadelphia. The school for white orphan boys prospered, not merely because of the corpus of the estate. Time wore on, however, and corruption wormed its way into the Board of City Trusts, the neighborhood around the school deteriorated, and Milton Hershey was able to compete for the dwindling supply of orphans with the benefit of Girard's mistakes and successes, in his own orphanage near Harrisburg. Finally, the great migration of black people from the South took over the electoral dominance of the city to the point of dominating the courts and politics, and black girls now outnumber white boys by a considerable number in the school. Some members of the Board have spent some time in prison, but most of the scandal attached to running an orphanage has migrated to the Milton Hershey School.

|

| Daniel Webster |

It is my understanding that the wall surrounding the school was considered to be entirely too high, so they tell me half of the stonewall is buried beneath the ground, to conform to the donor's wishes about height, but also to remain a more reasonable height on the outside. Girard also provided that no ordained minister should set foot within the walls, a provision which greatly discomfited the religion department. An old gentleman named Mr. Witherbee was once my patient and told me he refused his diploma at the Harvard Divinity School graduation ceremonies and spent the rest of his life teaching Religion at Girard College after the School found he had perfect credentials for the job but lacked the stain of ordination. The President of the Dallas Federal Reserve was once a student at Girard, as was the President of the Insurance Company of North America when it was the largest casualty company in the business. Daniel Webster was engaged to represent the College in Court while he was still in the Senate. I'm told that the boys were dressed by Brooks Brothers, and on and on. I'm also told the new managers of the Board of City Trusts ran down the endowment considerably.

|

| Girard College |

Well, I finally got a chance to see the inside of Girard College, when the Shakspere Society held its annual dinner there, and it is indeed everything it was reputed to be. The Society was in black tie, having cocktails on the portico of what looked like an exact replica of the Parthenon, wafted by spring breezes and later bathed in spotlights, just like the real Parthenon in Athens. There were real guards at the gates. Dinner was superb, held in the main library, beneath a 48-step marble staircase to the second-floor exhibition halls, overseen by a curator, and filled with Chinese porcelains, leather carriages, towering bookcases, and the like. The place was immaculate, and the staircases so wide you could climb dizzying heights without getting dizzy if you stayed close to the wall. No white orphan boys in evidence, however. And for that matter, no black girls, either. Looking out at Girard Avenue, you can see a splendid avenue stretching to the casinos at the far end. And the trees were so tall, you couldn't see what was behind them.

Let's Annex Canada

|

| President Donald Trump |

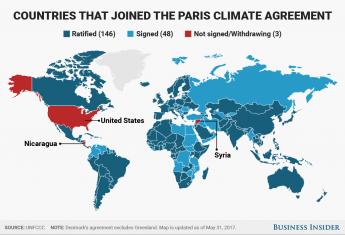

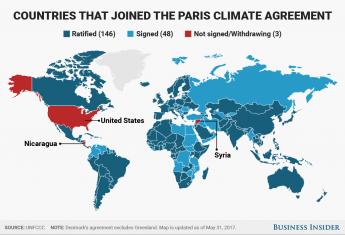

To read the newspapers, President Trump's revoking the Paris Climate Agreement is the biggest thing around. But it has no enforcement provisions, everything is voluntary, and its prospects of making the world colder are slim. The President is acting like a bull in the china shop, while the effectiveness of the document is questionable, indeed. The opposition party appears to have the motive of keeping him busy, so he won't have time to do anything substantial, and his motives are probably similar, except in reverse.

|

| Paris Climate Agreement |

So I hereby propose a different global warming project, following the example of the cavemen. You will recall that during the last Ice Age, the cavemen didn't have a Treaty of Westphalia to worry about. So they adopted a different strategy: they migrated. Since 1648, we now have national boundaries to consider, so our way of creating room to move is to annex Canada. Those Americans who feel like getting colder would then merely have to go where it is cold. What would the Canadians think about that?

|

| Louis-Joseph de Montcalm |

The French Canadians in Quebec might not like my proposal, since they have dark memories of Montcalm, or was his name Wolfe? But the oil-rich parts of Western Canada have oil which probably has some border tax they would like to be rid of. The Eastern part, the Maritime Provinces, petitioned America a few decades ago to annex them, so presumably, they would like to have some gerrymandering, or possibly fishing subsidies would suffice. At least half of the Canadian political class would oppose, but they would be neutralized by the other half who would be in favor. It sounds politically feasible.

|

| Arctic melt |

The attraction would be that it's cold up there, although Toronto and Montreal went underground to keep warm. The Arctic ice pack is melting, and climate change people keep telling us about it, with photos, and the Russians are selling tickets for tourists on ice breakers. If there are any Tories still around, they would vote Republican, whereas the people in Saskatchewan would probably still vote for Socialized Medicine. The French? Well, they would probably have thirty parties and cancel each other. Certain parts of Canada are immersed in the Gulf Stream and are warmer than Boston. I understand some provinces don't have taxes, certainly suggesting a paradise. From what I hear of the behavior of Esquimaux women, there are attractions for men, and the male surplus would certainly attract some American girls.

So what are we waiting for? The Chinese or the Russians might get the same idea, and we could always sell it to them if we are disappointed.

Rescuing Medicare from Its Short-Term Thinking.

Ben Franklin expected a hospital to pay for itself by returning sick people to employment. That misconception runs through medical payments even today.

Instead, our good intentions have created a more expensive problem, with its solutions always just out of reach. If you live longer, you get more retirement to pay for, because society also asks for an age limit to employment. Like Franklin, we might miss our target, but at least we see the goal. Right now the inevitable consequence of eliminating the disease is the extension of longevity. Because retirement is continuous while illness comes in episodes, the extra retirement cost (Social Security payments, if you please) might even become more costly than Medicare. Science may eventually cure enough disease to shave costs down to the first and last years of life, starting if possible with the most expensive diseases first. All fine enough, but not right now.

We must devise a better system than that, which like Health Savings Accounts, could expand from cradle to grave (and 21 years beyond death), generating a surplus by age 65, retaining unused medical surpluses for retirement, and taxable only at death. Because of compound interest, such a result is actually achievable but requires a discouraging length of time. We can buy more time with more money, but the public must agree it is worth it.

A lifetime perspective has six new features, because we begin with a deficit and end with a surplus: 1) Passive investing of reserves as a new revenue source 2) Twenty years of post-mortem Trust Funds to pay for transition 3) Redeployment of current Medicare payments to individual Health Savings Accounts without changes to its delivery system 4) Hooking the pieces together on individual Health Savings Accounts like beads on a string, to increase compounding. 5) Funding retirement with unused augmented Medicare funds, as diseases become cured by science. 6) Reaching zero balance at age 18, by grandparents half-funding the first 18 years for each of 2.1 grandchildren out of HSA surplus. These are unfamiliar concepts, consuming the rest of this essay.

Unfortunately, even if Congress devises a system to do all this, a century is a long time to leave your money in the hands of strangers. There would be one invariable consequence. Whether money is diverted to bankers' salaries or to aircraft carriers, rulers always prefer inflation to long term taxes, and sometimes prefer "imperfect agency" to other short term solutions. Even the Roman Empire eventually succumbed to this conflict. No one oversees other peoples' money as carefully as he would spend his own, so we stand warned by Milton Friedman that your own money management is the only peaceful oversight with a chance of widespread success. Even that success depends on running dual systems during the transition, one fading out and the other fading in. In the technical section which follows, ways are suggested to manage this dilemma, but above all, it seems best to prevent false starts by planning for them. Allow duplication, the ability to make mistakes, and a certain amount of waste from repairing bad choices, as the cost of doing business. Most flaws start as proposed solutions, so it will prove best if winners and losers are widely visible.

This Lifetime Health Savings Account is not a competition of ideologies; it is a series of seemingly unrelated mid-course corrections relating to changing age environments. It leans heavily on putting idle money to work at compound interest, preferably by John Bogle's total market indexing. Even Bogle's system works best with some initial lucky timing. But after a few decades, it would scarcely matter when you started, it only matters how much time you have left. Since the beneficiary is dead by the time of settlement, the ones who will really care are those who must pay off the debts. It is up to beneficiaries to fund it and to educate their descendants to begin early. A single system for everyone will probably never prove universally sensible for hundreds of millions of people. A voluntary system with age quotas seems the most painless way to smooth out an admittedly protracted transition. This is a long term plan with short term concessions.

Non-profit systems are not very good at weeding out failures, so for-profit competition is advisable, to speed things up. But anti-trust violation is a common for-profit short-cut, so modern approaches concentrate on preserving competition, not necessarily efficiency. Always remember we probably have plenty of money, never plenty of time. Young people almost never see it that way.

No other large nation has the money or the brashness to attempt so much change all at once, so there are few foreign models. We are pioneers, and costs will be higher for it. Scientists are not fools, they concentrate research on the eight or ten fatal diseases which (they are told) cause 70% of present costs. But several hundred other diseases wait in line, undermining cost prediction for the coming century. Nevertheless, there are only three stages in life with transitions to consider: childhood, working years, and retirement. Two out of these three are dependent on the remaining one at any particular time, but everybody gets a turn. The easiest way to pay for children is for grandparents to donate at death; the best way to pay for retirement is to add compound interest to what we already have saved, and all the rest depends on working people doing more saving, or less spending than they formerly did. There are lots of gimmicks, but that's the basic plan, while we pray for scientists to eliminate the most expensive disease instead of marking time, counting the number of grains of sand on every beach.

A good plan uses demonstration projects and accepts the possibility of occasionally slowing down. Research and development can be costly at first before costs eventually decline. We may be--or may not be-- as lucky as we were with heart attacks, in which the commonest cause of death was greatly diminished by a daily aspirin tablet. Or we may struggle on as we did with pernicious anemia and diabetes. Both diseases are treated with injections discovered almost a century ago. But pernicious anemia is treated at trivial cost while diabetes struggles as the most expensive chronic disease we have, prolonging life but not extinguishing cost. Only Americans would plunge ahead anyway, while a President would be foolish to try to change deep cultural attitudes too rapidly. We are warned not to see ourselves as exceptional, but we do see ourselves as exceptional, no matter what the facts.

The facts are the Medicare age group has most of the costs, younger people generate most of the savings. Third rail or not, the problem is to manage a gigantic funds transfer between generations while avoiding imperfect agents who divert money to their own purposes. In some ways, it is more a financial problem than a medical one. We watch private insurance pay its executives multimillion-dollar salaries, and we watch our government divert medical money for battleships and babysitting. It is time to stop watching and try modified individual ownership, putting our idle money back to work. Saving our own money for our own retirement if given a choice, instead of forcibly moving money among demographic groups of strangers. Choices should be voluntary and for-profit, so people will actually notice which approach works best, and then switch to it when convinced. This being political, some people will put their thumbs on the scale. But this being America, the public will not be fooled for long.

So this summarizes the idea. What follows is a general outline of vital technical details for pulling it off.

What Long Term Thinking Looks Like.

Let's apply a Due Diligence approach to the technical steps of this proposal. That is, skip past the overwhelming detail of existing data, to focus on conclusions to test. First, divide the population into three groups: dependent children, the working age group, and retirees, and start with Medicare. That's ignoring the advice that Medicare is the "third rail of politics--touch it and you're dead". The easiest place to begin is with the elderly, because they have the greatest medical cost, and anyway if we continue to "kick the can down the road", we are admitting defeat before we even start. Medicare is not only where most of the costs are, but predictably where they will migrate further. It's only half paid for by the recipients, while a major goal is to break even. Indeed, as science cures diseases, surplus should be consumed into a retirement fund, so realistic projection errors could overstate the revenue. As the old Quaker observed, the best way to have enough is to have too much.

The Composition of Medicare. With the single important exception of disabled persons, Medicare eligibility is age-related not income-related. Everyone between the ages of 65 and death (averaging now 84 years) is eligible, regardless of finances. We also contemplate funding children out of this source by transferring 5% for them. It's not much, but it is central, and it dramatizes the cost distribution. The raw data is blindingly comprehensive, sometimes to the point of obscuring important conclusions, so rather than starting with it, we should come back to data after we see what we need.

A fair working assumption is that Medicare borrows about half its costs, while Medicare totals constitute about half of total medical costs. So at least a quarter of all medical costs are already indebted. Medicare's actual sources of hard revenue are about evenly divided between payroll deductions from future beneficiaries, and premiums from existing ones, or about an eighth of total costs, each. So about twice as much is borrowed, as pre-paid in wage tax (one-quarter of total cost borrowed, versus one eighth pre-paid). Since lifetime costs are estimated by actuaries to be $350,000 in year 2000 dollars, the problem is to take $42,500 and turn it into $85,000 in 21 years in a post-mortem trust fund--seemingly at only half the rate of a reasonable rate goal of 7%. Average costs are even somewhat overstated because the 9 million disabled come from younger age groups who also contribute less than average. Furthermore, leftover revenue would probably be available for covering gaps in healthcare coverage in other age groups, as yet to be decided by Congress. You might cover these gaps by doubling the wage withholding tax, but it would be uncomfortable. Our proposal is to substitute compound interest principles, which are harder to explain, but easier to accept.At present, the Health Savings Account is the only medical payment system which could adjust to the predicted migration from healthcare to retirement care, and it is the only component which could then fund all children with about a 4% carry-over from each grandparent to an average of 2.1 children per mother. HSA currently provides for money still left in the account at the time of achieving Medicare coverage, to flow into an IRA which can be spent on anything. If you are lucky with health problems, you can even seem to use the same money twice. That's something to brag about, but it could be made even better. Right now, for a system hoping for millions of subscribers, it is too rigid and uniform. The idea of post-mortem Trust Funds (see 1b) somewhat smooths this out as well as generating a four-fold increase in revenue. Money is left over from Medicare for retirement, and then if there is no debt left over from retirement, you do not need a Trust Fund. But flexibility would be particularly useful during the transitions; some will need it, some won't. The fact that you don't know in advance, enhances the ("Old Quaker") incentive to overfund the balances.

I see no reason for HSA/IRA migrations to be so uniform, so one-size fits all. Surely there will be subscribers who would prefer to accumulate funds for later life, rather than as soon as possible. There is no reason to demand that everyone be within a certain age group or to stop depositing at a certain age. If there is some such reason, it ought to provide for a court or agency to approve exceptions. The same court could handle the vagaries of marriage affecting grandchildren (see 2.0, below).

For example, there is even no reason to terminate accounts at the time of death. The transition will uncover numerous exceptional situations, and some people would even want to create an HSA at age 64. If they want to do it, why spend hours figuring out how someone might somehow game the system with his own money? If their parents can fund an HSA at birth, why not get started twenty years sooner and add four times as much accumulation by age 21? If there must be disincentives to accumulate money, apply them after the termination of the Trust Fund, when family responsibilities are mainly (but not invariably) coming to an end.

Growth. Money at 7% doubles in ten years, so one specific proposal is to re-direct the money already being collected during 60 years, doubling it during a gradually declining 104 years. The money must earn 7% within a Health Savings Account if it is to pay for Medicare plus a million dollars per person left over for retirement. (Bear inflation in mind, however: money at 3% gross might not grow at all.) Compounding should start early in life, remaining in one continuous storage location for as long as possible, with escrowed compartments for specific goals, like buying out or consolidating shorter-term vehicles and anticipating some marital ones. Tweaks to current Health Savings Accounts will suffice but must be at least mentioned in the legislative language, to guide the long-term regulatory one.Only a few present limitations on HSA prevent this lifetime compounding from beginning immediately, and 7% annual returns are expected back from financial intermediaries over the longer term. Even though raw stock market returns have averaged 12% annually over the last century the financial community will probably object to 7% return for the customer from total market index funds because of its 3% inflation assumption within the middleman portion, and the intermediaries have already shown they resent the security measures. (Fear of the trial bar probably plays a role in fiduciary disputes.) But the reward for winning the lobbyist war is funding half of the shortfall deficit by placing risk on the proper shoulders. Two principles guide revenue enhancement : begin to save early, and relentlessly escrow inescapable life goals. Benefits from careful adjustment of terms with legal permission might range all the way from doubled returns, to cutting them in half.

Running through this dispute with your financial advisor is the need to use the "annual total returns" on major domestic total stock market indexes as a benchmark to be exceeded to escape penalties for ethical misbehavior. The principle in Law is well established that if there is no injury, there is no case.

1. Creating Revenue Instead of Floating Bond Issues.

The underlying problem is to fund retirements after you have funded Medicare when both of them begin at the same time. Suggested technical steps now follow, trying to co-ordinate designated approaches as beginning with as little amendment as possible, until the fate of the Affordable Care Act is decided. Beyond that, it is a possibility that, if the tax exemption of employer-based insurance is equalized, funding might become easier for the other half of the employable population . At the time of closing down the trust, there are only two eligible recipients, the Medicare Trust fund, and the IRS, so it usually makes no difference how the Government got the money during the long transition phase, and the extra administrative cost would be considerable.