Related Topics

Right Angle Club 2017

Dick Palmer and Bill Dorsey died this year. We will miss them.

A New Currency? Equity Savings Accounts.

Expanded Health Savings Accounts

Hospitals and their Future

New topic 2019-03-21 19:29:46 description

The Future of Index-fund Investing, Itself

|

| Bank Collapse |

An abundance of threatening international situations might unexpectedly lead to a banking collapse, but since every bull market "climbs a wall of worry", it isn't a threat unless it happens. The introduction of a new international currency is either never going to happen, or it is going to be needed without much warning. It's needed in the developing world, but there's a long way to go before it topples banking systems in the developed world. At the moment, nation-wide index funds might make a perfectly satisfactory currency substitute, like the Spanish pieces of eight. Index funds are tested and available in huge amounts and trusted by everyone who talks about them. They are growing fast and may eventually dominate choices unless something even better comes along. If something better comes along, it is hard to see why we couldn't let the market replace them as fast as people want to buy them. In any event, we have tons of gold as an inert reserve. The question is, will they hang around in their present form long enough to be a useful tool? At the moment, bitcoins are the popular rage to make people rich, but most people feel a secret currency is a good way to make people poor.

|

| Stock Certificates |

Of course, no one can answer such a vague question about a vague future for a vague development. But index funds are essentially nothing but bundles of stock certificates which are easy to buy and sell, easy to lock in a vault, and easy to carry. They have real intrinsic value which can change with the economy and whose value can be checked in an instant. If something better comes along, it's hard to see why you couldn't buy it with index funds. It's hard to see why two or more currencies couldn't co-exist, particularly if the co-existence was temporary and brief. It's hard to see why it couldn't be limited to central banks, who support local secondary currencies with instantaneous appraisals of the mark-up premium. On the other hand, it's hard to see why it couldn't be divided into subunits and carried around in everyone's pocket, if that's what is chosen to do. Since we got along with Spanish doubloons for centuries, it can be assumed it will serve the purpose. Since ownership is registered, it's even got one certain improvement: you can lose it or have it stolen, and still have a way of getting a replacement. In a sense, that was Robert Morris' contribution to currency theory: if a wooden boatload of gold sank, it was gone. But if a boatload of gold certificates sank, the underlying gold was still safe at home.

|

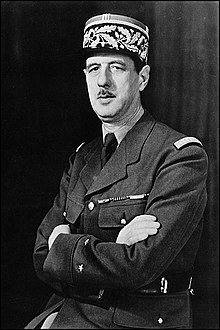

| Charles de Gaulle |

Resistance from those it would put out of work can safely be assumed. Just scratch any regulation, and you will find a lobbyist, usually very well funded. But the hardcore opposition would be from those who see that the currency has real value if you own it legitimately. Its value as a currency is that it is a real value, a piece of the economy, which you can carry with you anywhere. It, therefore, upsets the principle of national boundaries established long ago by the Treaty of Westphalia. If you want to defend this fact, you will say you could buy the country that way, by imagining a horde of "tourists" who open their knapsacks and demand what they bought, which is your economy. Some elderly people may remember the French battleship which Charles de Gaulle sent to New York harbor to demand his gold. It wouldn't take very long for that to be disruptive, as the more recent Irish experiment with lowered tariffs also graphically demonstrated with migrant corporations. Eventually, even the United States had to make itself competitive with the 12.5% tariffs of the Irish Republic. You will find, even though it is denied, that nations with weak economies don't want to be rescued by richer countries, so they will cook their books. Portable ownership of the means of production is not merely portable socialism, it is portable ownership of a corporation which may be indefensible legally, therefore leads to war if you try to exercise the right. So unless simple prevention can be devised, sovereignty is the one thing this money won't buy, even with Brexit. It might someday seem useful to prevent economic sovereignty as well, and for that, we must look to what the European Union devises for its individual component nations since they don't want to adopt the American one. With the exception of the Civil War, we managed to buy our way out of trouble by having rich states support poor ones, since we are all Americans, right? Until we reach the point of industrial states getting along with slave states, it would be better to have national currencies, based on national economies, type unspecified.

|

| Treaty of Westphalia |

Until someone figures out a solution to that issue, a confederation of national currencies based on index funds is about the best we can offer as a short-term solution. You can gamble on long-term stability, but it's your risk to do so, just as it is today. Short-term is worth something substantial, however. Reducing the cost of trade would almost surely inject several percents of GDP into everybody's economy, net of the cost of doing it. It should be the basis of a bull market, for quite a while.

Originally published: Tuesday, January 10, 2017; most-recently modified: Friday, May 31, 2019