Related Topics

Right Angle Club 2017

Dick Palmer and Bill Dorsey died this year. We will miss them.

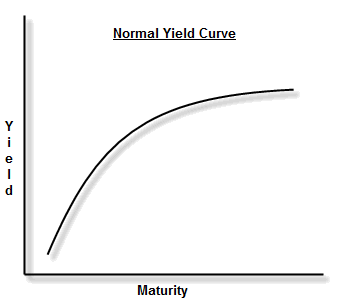

Steep Yield-Curves Subsidize Banks

|

The steepness of the federal interest rate curve on a graph -- three-month treasury bills pay less interest than ten-year government debt, with yields for intervening time durations sloping from low to high -- is all a carefully maintained function of the Federal Reserve. The slope of this curve in the newspapers quickly summarizes the current Fed policy. The Federal Reserve mainly controls the money supply by issuing or retiring short-term government debt; the effect upon supply by such action raises or lowers short-term rates, which in turn "changes the slope of the yield curve at the short end". The Fed ordinarily ignores the cost of longer-term debt, leaving that to be determined by the public bond markets. Less often, the Federal Reserve buys or sells long-term treasury bonds to modify long-term yields, or to adjust the international value of the dollar. By affecting rates at either end of the curve, change in the curve's slope is the result. Sometimes that's intended, and sometimes it just can't be avoided.

Because banks pay interest to depositors at around the short-term rate, while the same banks charge interest rates to borrowers at about the higher federal long-term rate, the current slope of the curve is said to be the main determinant of bank profits. In fact, banks charge whatever the market will bear, and their profitability mainly reflects the cost of the money, which the Fed has the power to set. Banks borrow short and lend long. If the Federal Reserve artificially cheapens costs for the banks, then bank profits get fattened by public subsidy. Of course, it works the other way as well; in a banking crisis, the yield curve can be forcibly steepened to rescue banks from failure, temporarily sacrificing ideal monetary levels for the purpose. For the most part, what's good for banks is good for the economy; but it turns out bank profits are artificially subsidized much of the time. This artificially widened yield curve eventually punishes retirees and other savers by lowering interest rates on their savings accounts, or else it could punish debtors by increasing the interest rate they pay on mortgages and other credit. For political reasons, the pain is usually shared among voting blocs. It can be argued this subtle subsidy of banks by the public creates the compensating benefit of economic stability despite occasional bubbles and recessions like the present one. However, the Federal Reserve system has operated for almost a century, revealing an enduring bias in favor of inflation, i.e, the subsidy of debtors by creditors. Present policy intentionally allows a steady rate of 2-3% inflation, and the century-long effect of such policy since 1913 has been to increase the price of gold from $17 to $900 an ounce. A penny then is a dollar now, making no allowance for income tax shrinkage of such fictitious gains. Overall, the effect of semi-stabilizing the yield curve is to reward banks and debtors, extracting this subsidy from creditors and retirees. To go a step further, independent of the Federal Reserve but by government action, retirees have been compensated in the past by unearned Social Security payments. The payment imbalance of the entitlement programs is admittedly about to shift in the other direction in a few years. All this is rough math, with many individual exceptions; but the initial effect of the Federal Reserve system is to benefit bank profits at the expense of creditors. If we assume creditors react by demanding higher interest rates to compensate for the cost, bank stability is being maintained by increasing interest rates by 2-3%, mostly paid for by borrowers.

Is this standardless monetary standard worth its inflationary cost? Compared with a strict gold standard, yes, it probably is. A limited supply of gold to support a constantly growing economy once led to deflation and economic instability and would do so again. An economy without a hard monetary standard responds to politics, is inevitably inflationary. The political independence of the Federal Reserve is dubious at best, and constantly under populist attack. So slow steady inflation seems to be one part of the system we can live with, in order to avoid either deep deflations or galloping inflations. Gradual low inflation may well be the best compromise we can devise, assuming the method of achieving it is otherwise tolerable. The 2008-2010 banking crisis, however, may be a moment of discovery that market systems must also be able to rely on the assumption that almost every bidder in an auction is limited by his pocketbook. When two or more determined bidders are eager to buy but unlimited in resources, price ceases to have restraining power and becomes irrational. A marketplace can tolerate a few bidding frenzies, but excessively flexible monetary systems lead to bubbles in small markets, explosions in big ones. Disregard of the price is particularly exaggerated by globalized trading systems, where customary prices are soon forgotten by abstraction within a virtual environment of essentially unlimited bidding power by essentially unlimited numbers of bidders. Forbidding to stop, all bidders but one must run out of discretionary money.

Originally published: Monday, May 18, 2009; most-recently modified: Wednesday, June 05, 2019