4 Volumes

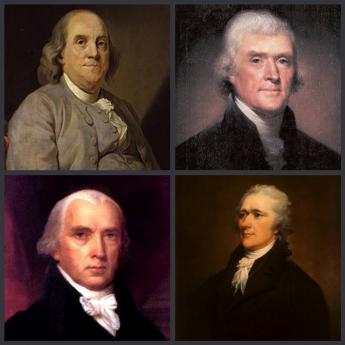

Constitutional Era

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

Sociology: Philadelphia and the Quaker Colonies

The early Philadelphia had many faces, its people were varied and interesting; its history turbulent and of lasting importance.

Money

New volume 2012-07-04 13:46:41 description

Worldwide Common Currency and Corporate Headquarters

The Death of Money

Philadelphia Changes the Nature of Money

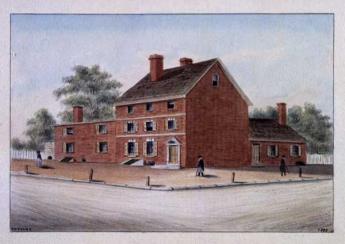

Banking changed its fundamentals, on Third Street in Philadelphia, three different times.

The Industrial Revolution was started by religious dissidents, among whom Quakers were a major force, in the Midlands of England in the early Eighteenth century. The predominantly Quaker city of the time was colonial Philadelphia, where by necessity the financial transactions of commerce were conducted with a system of individual books of account. Both creditors and debtors kept such books; periodically squared them up. In time, it dawned on Alexander Hamilton, a non-Quaker living on Third Street, that such books of account represented the wealth of a business, or at least most of its unspent accumulated profits. Debts were in fact assets, objects of value, growing more valuable with time. The supply of precious metals in which assets were denominated was inelastic, whereas commerce in America was fluid and consistently expanding. These asset/debts did not pay interest, but nominal value in hard coin held steady, thereby effectively increasing in purchasing power. It was colonial debtors who were squeezed by a shortage of gold coins, and consequently it was predominantly debtors who searched for relief through Independence. Not necessarily poor people; the southern plantation class were heavily indebted.

It was just one logical jump for Hamilton to perceive that the national debts accumulated by the young nation during the Revolutionary War were also assets of increasing value, not worthless paper as people seemed to think; and in this case they were valuable possessions of the whole nation. Many prominent people, among them Thomas Jefferson, Albert Gallatin, and later Andrew Jackson lacked the imagination to grasp this simple but counter-intuitive truth, and fought it bitterly. When Hamilton proclaimed that, "A national debt is a national treasure," it was not viewed as a brilliant insight, but a sign of insanity. Somehow, Hamilton managed to persuade George Washington of the truth of it, and the rest is history. Unfortunately, history also includes a tenacious retention of the opposite beliefs buried within the Articles of Confederation by the Confederate States of America, and even the charter of the European Union in the 21st century. Essentially currency, in a confederacy of jealous sovereign states forced to fight a common war, is made independent from the treasuries of those states, who then become its slaves rather than permit others to share its ownership. Lack of perception of this insight nearly lost the Revolution, was a major factor in the loss of the Civil War by the South, and still poses a contemporary risk that it may destroy the European community in the credit panic of 2008. Or adopt the tragic choice to destroy the European common currency in order to break free of its constraints, thus ultimately depriving twenty-seven pitiable little squabblers of the obvious utility of union.

Much economic history lies between 1790 and 2008, but a theme runs through all of it: Hamilton's devotees as much as those of Jefferson are seemingly incapable of understanding how the other side could possibly hold such preposterous ideas. Only Albert Gallatin stands out as an important national leader who switched sides.

But there is major truth in the opposite viewpoint, too. Hamilton's complete statement was " A national debt, if it be not too large, is a national treasure. Two centuries of compromising this definition have led to a system of enlarging national debts without acknowledging them. The present national debt is officially estimated to be about $5 trillion, while the unfunded liabilities of the federal entitlement programs alone are set at around $58 trillion. Inherent in this rampant but unacknowledged growth is the perception of foreigners that we might only be able to sustain a debt of this size -- by dishonoring it.

Quakerism and the Industrial Revolution

|

| Richard Arkwright |

The Industrial Revolution had a lot to do with manufacturing cotton cloth by religious dissenters in the neighborhood of Manchester, England in the Eighteenth Century. What needs more emphasis is the remarkable fact that Quakerism and the Industrial Revolution both originated about the same time, in about the same place. True, the industrializing transformation can be seen in England as early as 1650 and as late as 1880. The Industrial Revolution thus extended before Quakerism was even founded, as well as long after most Quakers had migrated to America. No Quaker names are much mentioned except perhaps for Barclay and Lloyd in banking and insurance, and Cadbury in candy. As far as local history in England's industrial midlands is concerned, the name mentioned most is Richard Arkwright, whose behavior, demeanor and beliefs were anything but Quaker.

He seems to have invented nothing, stealing the patents and ideas of others freely, while disgustingly boasting about his rise from rags to riches. Some would say his skill was in the organization, others would say he imposed an industrial dictatorship on a reluctant agricultural community. He grew rich by coercing orphans, convicts and others he obviously disdained into long, unpleasant, boring and unwelcome labor that largely benefited him, not them. In the course of his strivings, he probably forced Communism to be invented. It is no accident that Karl Marx wrote the Communist Manifesto while in Manchester visiting his friend Friedrich Engels, representing reasonably well the probable attitudes of Arkwright's employees. What Arkwright recognized and focused on was that enormous profits could flow from bringing piecework weaving into factories where machines could do most of the work. Until his time, clothing was mostly made by piecework at home, with middlemen bringing it all together. The trick was to make clothing cheaper by making a lot of it, and making a bigger profit from a lot of small profits. Since the main problem was that peasants intensely disliked indoor confinement around dangerous machines, the industrial revolution in the eyes of Arkwright and his ilk translated into devising ways to tame such semi-wild animals into submission. For their own good.

|

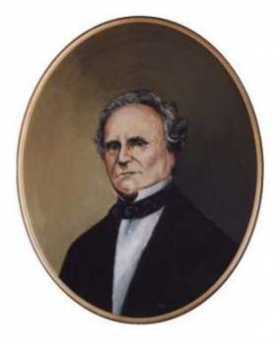

| Charles Babbage |

Distinctive among the numerous religious dissenters in the region, the Quakers taught that it was an enjoyable experience to sit indoors in quiet contemplation. Their children were taught to submit to it at an early age, and their elders frequently exclaimed that it was a blessing when everyone remained quiet, enjoying the silence. Out of the multitude of religious dissenters in the first half of the Seventeenth century, three main groups eventually emerged, the Quakers, the Presbyterians, and the Baptists. Only the Quakers taught that silence was productive and enjoyable; the Calvinist sects leaned toward the idea that sitting on hard English oak was good for the soul, training, and discipline was what kept 'em in line.

|

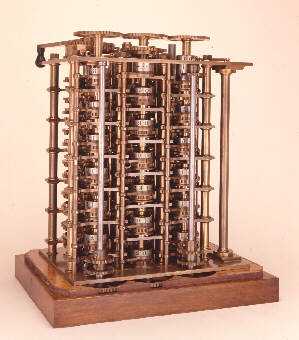

| babbagemaq.jpg |

The Quaker idea of fun through daydreaming was peculiarly suitable for the other important feature of the Industrial Revolution that Arkwright and his type were too money-centered to perceive. If workers in a factory were accustomed to sit for hours, thinking about their situation, someone among them was bound to imagine some small improvement to make life more bearable. If such a person was encouraged by example to stand up and announce his insight, eventually the better insights would be adopted for the benefit of all. Two centuries later, the Japanese would call this process one of continuous quality improvement from within the Virtuous Circle. In other cultures, academics now win professional esteem by discovering "win-win behavior", which displaces the zero-sum or win/lose route to success. The novel insight here was that it has become demonstrably possible to prosper without diminishing the prosperity of others. In addition, it was particularly fortunate that many Quaker inhabitants of the Manchester region happened to be watchmakers, or artisans of similar trades that easily evolved into the central facilitators of the new revolution -- becoming inventors, machine makers and engineers.

The power of this whole process was relentless, far from limited to cotton weaving. When Charles Babbage sufficiently contemplated the punched-cards carrying the simple instructions of the knitting machines, he made an intellectual leap to the underlying concept of the tabulating machine. Using what was later called IBM cards, he had the forerunner of the stored-program computer. There were plenty of Arkwrights getting rich in the meantime, and plenty of Marxists stirring up rebellion with the slogan that behind every great fortune is a great crime. But the quiet folk were steadily pushing ahead, relentlessly refining the industrial process through a belief in welcoming the suggestions of everyone.

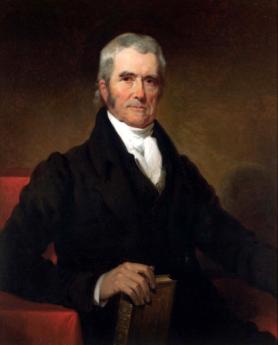

John Head, His Book of Account, 1718-1753

|

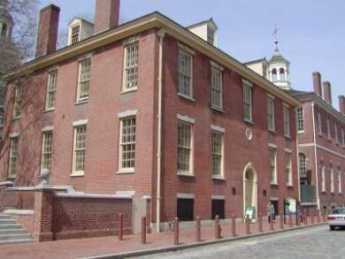

| American Philosophical Society |

Jay Robert Stiefel of of the Friends Advisory Board to the Library of the American Philosophical Society entertained the Right Angle Club at lunch recently, and among other things managed a brilliant demonstration of what real scholarship can accomplish. It's hard to imagine why the Vaux family, who lived on the grounds of what is now the Chestnut Hill Hospital and occasionally rode in Bentleys to the local train station, would keep a book of receipts of their cabinet maker ancestor for nearly three hundred years. But they did, and it's even harder to see why Jay Stiefel would devote long hours to puzzling over the receipts and payments for cabinets and clock cases of a 1720 joiner. Somehow he recognized that the shop activities of a wilderness village of 5000 residents encoded an important story of the Industrial Revolution, the economic difficulties of colonies, and the foundations of modern commerce. Just as the Rosetta stone told a story for thousands of years that no one troubled to read, John Head's account book told another one that sat unnoticed on that library shelf for six generations.

|

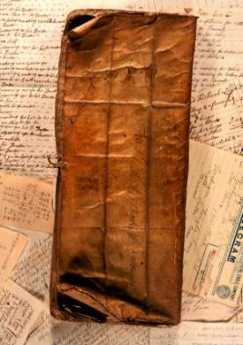

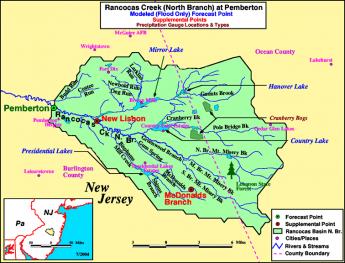

| Colonial Money |

The first story is an obvious one. Money in colonial days was mainly an entry in everybody's account book; today it is mainly an entry in computers. In the intervening three centuries, coins and currency made an appearance, flourished for a while as the tangible symbol of money, and then declined. Although Great Britain did not totally prohibit paper money in the colonies until 1775, in John Head's day, from 1718 to 1754, paper money was scarce and coins hard to come by. Because it was so easy to counterfeit paper money on the crude printing presses of the day, paper money was always questionable. Meanwhile, the balance of trade was so heavily in the direction of the colonies that the balance of payments was toward England. What few coins there were, quickly disappeared back to England, while local colonial commerce nearly strangled. The Quakers of Philadelphia all maintained careful books of account, and when it seemed a transaction was completed, the individual account books of buyer and seller were "squared". The credit default swap "crisis" of 2008 could be said to be a sharp reminder that we have returned to bookkeeping entries, but have badly neglected the Quaker process of squaring accounts. As the general public slowly acquires computer power of its own, it is slowly recognizing how far the banks, telephone companies, and department stores have wandered from routine mutual account reconciliation.

|

| John Head's Account Book |

From John Head's careful notations we learn it was routine for payment to be stretched out for months, but no interest was charged for late payment and no discounts were offered for ready money. It would be another century before it became routinely apparent that interest was the rent charged for money and the risk of intervening inflation, before final payment. In this way, artisans learned to be bankers.

And artisans learned to be merchants, too. In the little village of Philadelphia, chairs became part of the monetary system. In bartering cabinets for the money, John Head did not make chairs in his shop at 3rd and Mulberry (Arch Street) but would take them in partial payment for a cabinet, and then sell the chairs for the money. Many artisans made single components but nearly everyone was forced into bartering general furniture. Nobody was paid a salary. Indentured servants, apprenticeships trading labor for training, and even slavery benignly conducted, can be partially seen as efforts to construct an industrial society without payrolls. Everybody was in daily commerce with everybody else. Out of this constant trading came the efficiency step for which Quakers are famous: one price, no haggling.

One other thing jumps out at the modern reader from this book of account. No taxes. When taxes came, we had a revolution.

www.Philadelphia-Reflections.com/blog/1517.htm

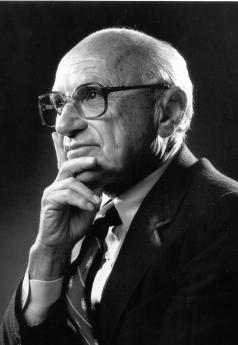

Monetary Causes of the American Revolutionary War

|

|

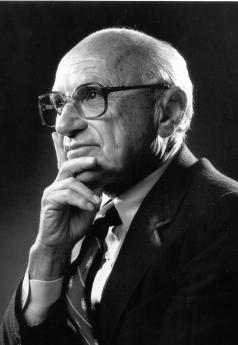

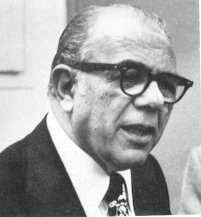

Milton Friedman The Father of Monetarism |

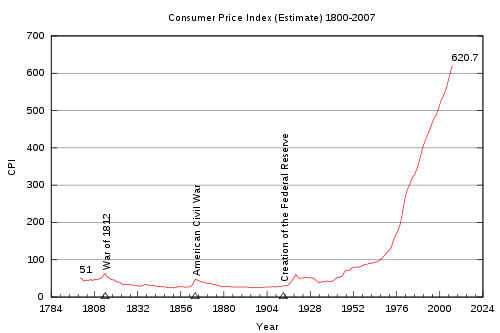

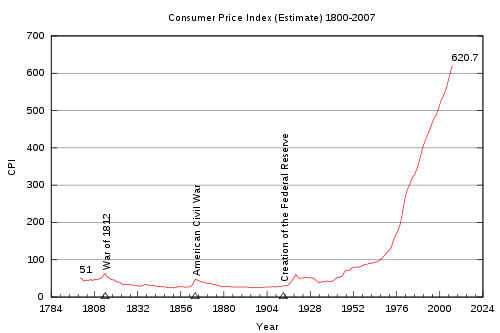

Milton Friedman won the 1976 Nobel Prize in Economics (more accurately, the Bank of Sweden Prize in Memory of Alfred Nobel), for generating controversial ideas made even more annoying to his professional adversaries by his matchless knack for attaching memorable slogans to them. A phrase in question is that "Inflation, always and everywhere, is a monetary phenomenon." Turned around, the converse emerges that the great deflation and depression of the 1930s was caused by a global monetary shortage. Then, to extend the same idea to the American Revolution, it could fairly be argued that inept British contraction of colonial coinage had a lot to do with provoking us to seek independence.

|

| French & Indian War |

Following the French and Indian War, the colonies experienced a major commodity depression which seems to have been caused by wartime shortages followed by post-war surpluses (associated with failure to adjust to the resulting financial confusion). In Milton Friedman's theory, it is the task of any government to maintain stable prices by balancing the amount of currency in circulation with the size of the gross national product. In 1770, the British Exchequer would thus have had to expand and contract the amount of currency in circulation pretty rapidly to maintain economic stability in the bumpy Colonial economy. Essentially, they had to ride a bucking broncho three thousand miles away. In the Eighteenth Century, there was no trace of understanding of the issues involved. Adam Smith's Wealth of Nations was only published in the fateful year of 1776, for example. Even if the techniques for maintaining stable prices had been crystal clear, there was a thirty-day lag in communication across the Ocean, and comparable lags between the colonies, where different imports and exports were affected at varying times. So it is a little harsh to blame the British for the chaotic result, except to notice that strongly centralized, the trans-Atlantic government was by nature unsuitable for managing rapidly-changing problems, currency and otherwise. The British government had more than a century of experience that should have made that clear. That's what the colonists said, in effect, and their solution for it was Independence.

|

| George III |

If you believe Friedman, a shortage of coinage causes a fall in prices or deflation. To correct that, you need a central banker constantly fine-tuning the currency. But banking in the colonies was too rudimentary to consider such a thing. If you needed a mortgage, you went to a prosperous neighbor and borrowed directly from him. That was fine because prosperous colonists had limited opportunities to invest their money conveniently, except by loaning money to their neighbors. Indeed, local communities were knit together socially by the mutual assistance of successful farmers directly assisting their less fortunate neighbors. However, pioneer farming

|

| Depression-era Farm Family |

communities are far too unsophisticated to remain tranquil when problems arise out of abstractions. Suddenly and without apparent explanation, in 1770 there was no money for anybody to use, and the fellow with a mortgage on his farm couldn't make his payments even though he was otherwise entirely successful. His creditor himself than couldn't pay his own bills, and eventually, even the kindliest ones were driven to foreclose the mortgage. It was said to be common for a farm worth $5000 to be sold to satisfy a mortgage of $100. And in this way, many honest and once-prospering farmers were forced to walk past their old home, now owned and occupied by a formerly friendly neighbor. It all seemed bitterly unfair, no one understood what was happening, evil motives were readily suspected, and old religious and personal grievances were heightened. When the British finally imposed a total ban on paper money as well as a prohibition of the export of British coinage outside the United Kingdom, things became almost impossible to manage. Almost no one knew exactly what was going on, but everyone could see it was bad. The colonies rapidly deteriorated toward class warfare, which is what the division between Tories and Rebels was soon to become, with both sides quite rightly asserting they were not responsible, and quite wrongly asserting the other must be.

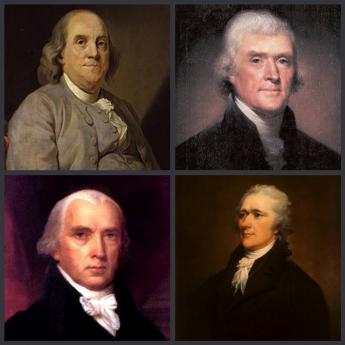

From a far distance, it can be readily perceived the primitive banking and transportation systems of that time were inadequate to respond to the rapidly changing financial problems of a global empire; and it can be readily surmised that many other non-financial issues of governance were similarly hampered by attempting to centralize control over vast distances. In that sense, the colonists were approximately correct in directing their indignation to the person of King George III, whose mother was constantly nagging him to "be a real King". He had the particular misfortune to be dealing with Englishmen, deeply aware of the hidden political agenda made possible in the 13th Century by the Magna Charta and made explicit in 1307, when Edward I agreed not to collect certain taxes without the consent of the realm. Essentially, Parliament placed taxation in the hands of the people, who consistently withheld consent until the king gave them just a little more liberty. This was the reason irksome micromanagement of the distant colonies was immediately countered with the cry of "No taxation without Representation" since membership in the House of Commons was a traditional and historically effective means to the end. But it was getting late for this solution. Maritime New England now wanted to go further than that in order to dominate Western Atlantic trade. Virginia and the rest of the South wanted to go all the way to Independence in order to exploit the vast empty interior wilderness of Ohio and beyond. But the Quaker colonies in the middle felt quite sympathetic with John Dickinson's advice to remain part of the Empire and make a stand for representation in Parliament. When the Lord Howe's British fleet appeared in lower New York harbor an immediate choice had to be made, and ultimately the Quaker colonies were swayed by Benjamin Franklin's embittered report of his mistreatment in Parliament, and his assessment that he could persuade the French to help us. However reluctant they were to resort to force, the Quaker colonies had to choose, and choose immediately: either flee as Tories to Canada, or stand and fight.

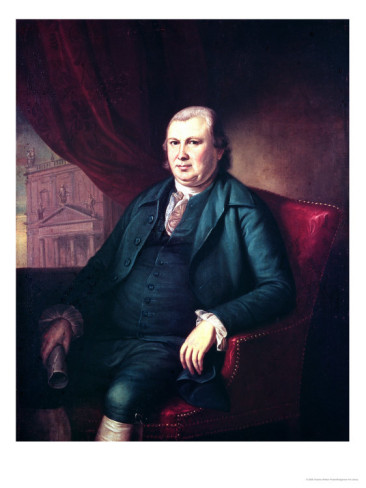

Alexander Hamilton, Celebrity

He had the kind of taudry private life and flashy public behavior that Philadelphia will only tolerate in aristocrats, sometimes.

|

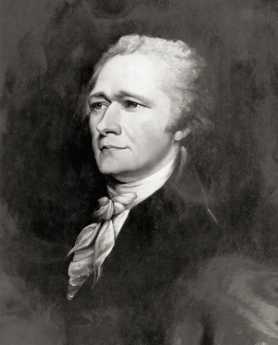

It comes as a surprise that most of the serious, important things Alexander Hamilton did for his country were done in Philadelphia, while he lived at 79 South 3rd Street. That surprises because much of his more colorful behavior took place elsewhere. He was born on a fly-speck Caribbean island, the "bastard brat of a Scots peddler" in John Adams' exaggerated view, was orphaned and had to support himself after age 13. The orphan then fought his way to Kings College (now Columbia University) in New York in spite of hoping to go to Princeton, and has been celebrated ever since by Columbia University as a son of New York. He did found the Bank of New York, and he did marry the daughter of a New York patroon, and he was the head of the New York political delegation. As you can see in the statuary collection at the Constitution Center, he was a funny-looking little elf with a long pointed nose, frequently calling attention to himself with hyperkinetic behavior. Even as the legitimate father of eight children, Hamilton had some overly close associations with other men's wives, probably including his wife's sister. Nevertheless, he earned the affection of the stiff and solemn General Washington, probably through a gift of gab and skill getting things done, while outwardly acting as court jester in a difficult and dangerous guerilla war. There is a famous story of his shaking loose from the headquarters staff and fighting in the line at Yorktown, where he insolently stood on the parapet before the British enemy troops, performing the manual of arms. Instead of using him for target practice, the British troops applauded his audacity. Harboring no such illusions, Aaron Burr later killed him in a duel as everyone knows; it was not his first such challenge.

|

| Alexander Hamilton |

Columbia University President Nicholas Murray Butler told other stories of celeb behavior to reinforce Hamilton's New York flavor. But in the clutch, General Washington learned he could always trust Hamilton, who wrote many of his letters for him and acted as his reliable spymaster. When the first President faced signing or not signing the fateful bill to create the National Bank, a perplexed Washington had to choose between: the violent opposition of Thomas Jefferson and James Madison, or the bewildering complexity of Alexander Hamilton's reasoning in arcane economics. On the one hand, there was the simple principle that owing money was seemingly always evil; on the other was the undeniable truth that for every debit created, you create a balancing credit somewhere. Washington ultimately chose to go with Hamilton, whose reasonings he likely didn't understand very well. If you doubt the difficulty, try reading Hamilton's Report on the Bank, written to persuade the nation and its first President of the soundness of his ideas. And then consider the violence of even present-day arguments about such "supply side" economics.

|

| Nicholas Murray Butler |

All of these momentous events happened in Philadelphia at places now easily visited in a morning's stroll. But Hamilton's image as a Philadelphian, doing great things in and for Philadelphia, was forever tarnished at one single dinner he hosted. Jefferson and Madison, his political opponents but his guests, were persuaded to provide Virginia's votes for the federal takeover of state Revolutionary War debts, in return for offering New York's votes for moving the nation's capital to the banks of the Potomac. True, Pennsylvania allowed itself to be pacified with having the capital remain here for ten years while the southern swamps were being drained. But it was Hamilton who cooked up this deal and sold it to the other vote swappers. Philadelphia felt it was entitled to the capital without needing to ask, felt that Hamilton was deliberately under-counting Pennsylvania's war debts, and this city has never appreciated the insolent idea that its entitlements were forever in the hands of wine-swilling hustlers. As the economic consequences of this backroom deal became evident during the 19th Century, it was increasingly unlikely that Philadelphia would lionize the memory of the man responsible for it. Let New York claim him, if it likes that sort of thing. When Albert Gallatin, who was more or less a Pennsylvania home town boy, attacked Hamilton as a person, as a banker, and as a Federalist -- he had a fairly easy time persuading Philadelphians that this needle-nosed philanderer was an embarrassment best forgotten.

REFERENCES

| Alexander Hamilton Ron Chernow ISBN:978-0-14-303475-9 | Amazon |

National Debt, National Blessing

|

| Alexander Hamilton |

In 1789 while arguing for the establishment of a National Bank, Alexander Hamilton made one of the most famous counter-intuitive assertions of his controversial career. "A national debt, if it is not excessive, will be to us a national blessing".

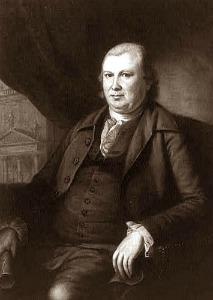

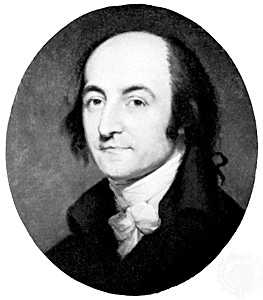

The very suggestion of such an idea enraged Thomas Jefferson and his Calvinist adviser, Albert Gallatin. James Madison, ever the political schemer, immediately recognized a new bargaining chip in his move to relocate the national capital to Virginia. Political parties were promptly invented to mobilize votes on both sides, and the national bank remained a divisive issue for half a century afterward. Neither a borrower nor a lender is; how could anyone, then or now, say the debt was a blessing?

Indeed, that's evidently how the leaders of Singapore, Malaysia, Australia, China, and several other prosperous states still feel about it. While not eliminating taxes, these countries accumulated surpluses and created sovereign-wealth funds. Having paid off the national debt, and still finding a national surplus, what else are you going to do with it?

|

| Gallatin |

These countries hired investment advisers to buy stock for the funds, evidently feeling American stocks were the safest bet; it's hard to criticize that conclusion. In the present credit crunch, they are investing five and ten billion per transaction in the equity of America's premier investment banks. So far, they only acquire 5 or 10 percent ownership, but then the credit crisis may not be over yet. For them eventually to acquire 51% controlling ownership somewhere is not at all inconceivable. An ominous sign of where that might lead is found in our own captive pension funds. The state employee pension funds have quickly become captive to unions with their own agenda, with the result that the prosperity of the companies in the portfolio could be sacrificed to the benefit of interest groups. And yet, it wouldn't be so hard for America to do the same thing. If Congress had adopted the Bush proposal of three years ago to create an investment fund for Social Security, we ourselves would soon have what amounts to the largest sovereign wealth fund in the world. Could this be a solution to the weakness of the Federal Reserve in controlling the currency with bank debt? Could we somehow create a common world currency based on a common fund of sovereign wealth funds and with that, create a new definition of wealth based on equity rather than debt? The technical answer to the potential corruption issue would probably lie in stripping the voting power from such shares and then submerging them in a world index fund. The United Nations sound of it nevertheless still boggles the mind. Are people who oppose an equity-based world currency going to be forced like Gallatin to eat their own dusty words when the reality of debt-based currency sinks in? How many of the ambassadors of ideas about such suggestions, both pro, and con, would eventually surface as sneaky connivers like Madison, with a hidden side-agenda? After all, in a democracy, everyone is expected to marshal every argument, weak or strong, for his own self-interest.

|

| Federal Reserve |

The loss of banks as a tool for the Federal Reserve would undermine the way the Fed does its job. A deeper reality is that many governments really don't want the job to be done perfectly and independently. The European common currency, the Euro, is already irking the French and other national governments who sometimes hanker to inflate away their debts or deflate their way out of the subsequent inflation. A perfectly automatic currency regulation threatens an important ingredient of the sovereignty of nations, thus the whole concept of nationhood. Somehow, the desire of markets to enhance wealth must come to terms with the desire of governments to re-elect themselves.

It will take more than the present crisis to provide credibility for ideas as wild as substituting equity-based currency for the present debt-based one. Unless someone devises a better-sounding scheme, it seems more likely that financial Jacobins will propose sacrificing the unwelcome intruder. Derivatives, whatever that means, started this mess. Maybe we should make them illegal.

After the Convention:Hamilton and Madison

|

| Signers |

The Federalist Papers were written by three founding fathers after the Constitution had been completed and adopted by the Convention. Detecting hesitation in New York, the aim was for publication in New York newspapers to persuade that wavering State to ratify the proposal. It is natural that The Federalist was composed of arguments most persuasive to New York, putting less stress on matters of concern to other national regions. This narrow focus may explain the close cooperation of Hamilton and Madison, who must surely have suppressed some latent concerns in order to present a unified position. In view of how much emphasis the courts have placed on the original intent of almost every word in the Constitution, it seems a pity that no one has attempted to reconcile the words of the principal explanatory documents with the hostile disagreements of their two main authors, almost as soon as the Constitution came into action. Perhaps the psychological hangups would be more convincingly dissected by playwrights and poets, than historians.

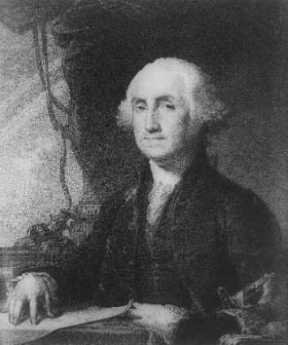

John Jay wrote five of the essays, mostly concerned with foreign relations; his presence here highlights the historical likelihood that Jay might have been the one who first voiced the idea of replacing the Articles of Confederation. At least, he seems to have been first to carry the idea of a general convention for that purpose to George Washington (in a March 1786 letter). The remaining essays of The Federalist were written under the pen name of Publius by Alexander Hamilton and James Madison, both of whom had a strong enough hand in crafting the Constitution, but who quickly became absolutely dominant figures in the two central political factions after the Constitution was actually in operation. And their eagerness to be central is itself telling. They were passing from a stage of pleasing George Washington with his favorite project, into furthering a platform for launching their own emerging agendas. It is true that Madison's Federalist essays were mainly concerned with relations between the several states, while Hamilton concentrated on the powers of the various branches of government. As matters evolved, Hamilton soon displayed a sharper focus on building a powerful nation; Madison scarcely looked beyond the strategies of internal political power except to see clearly that Hamilton was going to get in the way. These two areas are not necessarily incompatible. But it is nevertheless striking that two such relentlessly driven men could work together to achieve the same set of rules for the game they were about to play so unflinchingly. Thomas Jefferson had been in France during the Constitutional Convention. It was he who was most dissatisfied with the resulting concentration of power in the Executive Branch, but Madison eagerly became the most active agent for forming the anti-Federalist party, with all its hints that Washington was too senile to know the difference between a President and a King. Washington abruptly cut him off and never spoke to Madison after the drift of his opinions became undeniable. Today, it is common to slur politicians for pandering to lobbyists and special interests, but that presents only weak competition with the personal forces shaping leadership opinion, chief among them being loyalty to, and perceived disloyalty from, close political associates.

As a curious thing, both Hamilton and Madison were short and elfin, and both relied for influence heavily on their ability to influence the mind of

|

| George Washington |

George Washington, who projected the power and manner of a large formidable athlete. Washington had no strong inclination to run things and, once elected, no particular agenda except to preside in a way that would meet general approval. He had mainly wanted a new form of government so the country could defend itself, and pay its soldiers. Madison was a scholar of political history and a master manipulator of legislative bodies, while Hamilton's role was to supply practically unlimited administrative energy. Washington was good at positioning himself as the decider of everything important; somehow, everybody needed his approval. On the other hand, both Madison and Hamilton were immensely ambitious and needed Washington's approval. This system of puppy dogs bringing the Master a bone worked for a long while, and then it stopped working. Washington was very displeased.

The difference between these two short men immediately appeared in the way they chose a role to play. Madison the Virginian chose to dominate the legislative process as the leader of the largest state delegation within the

|

| Alexander Hamilton |

House of Representatives, in those days the dominant legislative chamber. Hamilton sought to be Secretary of the Treasury, in those days the largest and most powerful department of the executive branch. It's now a familiar pattern: one wanted to form policy through dominating the board of directors, while the manager wanted to run things his way, even if that led in a different direction. Both of them knew they were setting the pattern for the future, and each of them pushed his ideas as far as they would go. Essentially, this could go on until Washington roused himself.

After a short time in office, Hamilton wrote four historic papers about two general goals: a modern financial system, and a modern economy. For the first goal, he wanted a dominant national currency with mint to produce it and a bank to control it. Second, he also wanted the country to switch from an agricultural base to a manufacturing one. You could even say he really wanted only one thing, a national switch to manufacturing, with the necessary financial apparatus to support it. Essentially, Hamilton was the first influential American to recognize the power of the Industrial Revolution which began in England at much the same time as the American Revolution. Hamilton was swept up in dreams of its potential for America, and while puzzled -- as we continue to be today -- about some of its sources, became convinced that the secrets lay in the economic theories of

|

| David Hume |

David Hume and Adam Smith in Scotland, and of Necker in France. Impetuous Hamilton saw that Time was the essence of opportunity; we quickly needed to gather the war debts of the various states into the national treasury, we quickly needed a bank to hold them, and a mint to make more money quickly as liquidity was needed. It seemed childishly obvious to an impatient Hamilton that manufacturing had a larger profit margin than agricultural products did; it was obvious, absolutely obvious, that this approach would inspire huge wealth for the new nation.

|

| Industrial Revolution |

Well, to someone like Madison who was incredulous that any gentleman would think manufacturing was a respectable way of life, what was truly obvious was that Hamilton must be grabbing control of the nation's money to put it all under his own control. He must want to be king; we had just got rid of kings. Furthermore, Hamilton was all over the place with schemes and deals; you can't trust such a person. In fact, it takes a schemer to know another schemer at sight, even when the nature of the scheme was unclear. Madison and Jefferson couldn't understand how anyone could look at the vast expanses of the open continent stretching to the Pacific without recognizing in this must lie the nation's true destiny. Why would you fiddle with pots and pans when with the same effort and daring you could rule a plantation and watch it bloom? If anyone had used modern business jargon like "Win, win strategy", the Virginian might well have snorted back, "When you say that to me, friend, smile."

Second and Market to Sixth and Walnut

Millions of eye patients have been asked to read the passage from Franklin's autobiography, "I walked up Market Street, etc.", which is universally printed on eye-test cards. Here's your chance to do it.

|

| Dr. Fisher |

Emerge from Christ Church onto Market Street, crossing to the Southside. Between Third and Fourth Streets (318 Market), there is a row of Eighteenth-Century Houses, commissioned by Benjamin Franklin, with a central archway leading to the interior of the block where he placed his own house. The restorationists have cleverly displayed the skeleton of the rafters of the house. When the British occupied Philadelphia in 1788, Major Andre (later to become Benedict Arnold's spy-handler) insolently took Franklin's own house as his headquarters (General Howe took Robert Morris's much more splendid house further up Market Street between Fifth and Sixth.) John Andre was court jester for the British officers. He was a poet, playwright, wit, and dashing life of every party. Washington was in tears when he ordered his hanging.

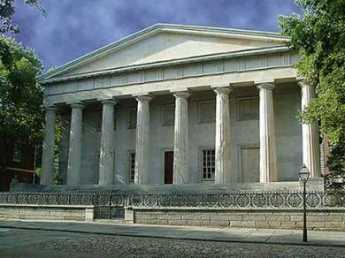

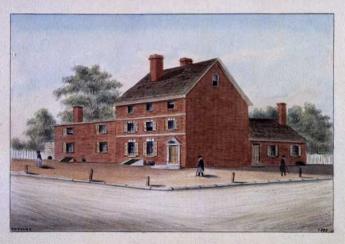

Continue on and out the South end of Franklin Court, onto Chestnut Street, after you have visited the Museum of Ben Franklin, aimed at children but containing examples of his many inventions, a theater with interesting short presentations, and a fascinating sound and light show of Franklin's great moments. The somewhat unexpected underground building is a product of the famous architect, Frank Venturi. At the corner of 3rd and Chestnut (where a restaurant now stands) once stood the house of Alexander Hamilton, and a few houses further North on 3rd Street remains the dilapidated remnant of the business of Anthony Drexel, the mentor and later senior partner to J.P. Morgan. Turning about and looking south, you can see the reason for this concentration of financiers. Just south of Chestnut is the First Bank of the United States (the fascinating Museum of Old House Parts is on the second floor), while the two blocks of Chestnut Street -- Third to Fifth Streets -- are filled with the massive stone piles of other banks of Philadelphia, culminating in that Parthenon-appearing Second Bank, Nicholas Biddle's bank. In the forty years before Andrew Jackson and Martin van Buren interfered, it wasn't Wall Street that mattered, it was Chestnut Street.

Proceed westward on Chestnut Street, and pass the converted bank now used by the Chemical Heritage Foundation, followed by another bank used by the American Philosophical Society as an auditorium. On the other side of the street, an alley leads southward to Carpenters Hall, where the First Continental Congress held deliberations. At that time, it was the largest private building in the Colonies.

Continuing to Fifth and Chestnut, you may wish to take a detour south to around Sixth and Pine to see the mansions of Society Hill, particularly the Powell House and the Physick House. Intermingled with the red brick Georgian style are examples of classical style reflecting French influence. Our present tour, however, points you to the red brick building just to the south of Independence Hall on Fifth Street. It looks like part of the State House complex but is actually the home of the American Philosophical Society, now housing its fascinating museum (seen only by appointment). After that, by all means, stand in line and take the National Parks tour of Independence Hall, which is one of the best displays in the whole Park Service. After that, the tour of the Liberty Bell on the north side of Chestnut is just a trifle tame, but a mandatory visit.

|

| The Curtis Building |

Do not neglect to cross Sixth Street to the Curtis Building, where a few steps inside is the astonishing mosaic constructed by Louis Comfort Tiffany out of Tiffany glass, based on the artistry of Philadelphian Maxfield Parrish. Look around the lobby, which is pretty ornate, but it once held printing presses for the Saturday Evening Post.

Emerge from the Curtis Building on the Seventh Street side. Take a look at the Atwater Kent Museum of the City of Philadelphia, then notice the Jeweler's Row on Samson Street. The house where Thomas Jefferson wrote the Declaration of Independence is at the corner of 7th and Market; it's a reproduction, however. This would bring you back to the subways and high-speed line where the tour began. Instead, the full tour goes back to the Curtis Building and heads south.

Stephen Girard 1750-1831

|

| Stephen Girard |

Girard was born in Bordeaux, France and never went to school. By the age of 23, he had become a sea captain, like his father and grandfather. By the age of 27, he owned his own ship and was thus launched on a successful career in a very dangerous occupation. Depending on the destination and weather during that era, up to forty percent of sailors were lost at sea on long voyages. From the point of view of the passengers and shippers, when you were selecting a captain you wanted one who had returned unharmed from many voyages. It was irrelevant whether he had been lucky, or diligent, or had learned a lot from his relatives in the trade.

Stephen Girard did start with a handicap, being born blind in one eye. It may have been a personality disorder which drove him to precise, minute instructions to his subordinates in excruciating detail; he might now be called a "control freak" and be disliked for it. For example, he kept a handwritten copy of all letters he wrote, and at his death, there were 14,000 of them, sorted and filed. His wife went insane, and after spending years at the Pennsylvania Hospital, was buried on the grounds. If this is the price of being rich, some might consider remaining poor. During his working years in Philadelphia, he would normally get to the counting-house at 5 AM, go to his bank at noon, and go to work on his 600-acre farm in South Philadelphia after 5 PM. He said he liked farm work the best. The image left behind by this role model, then, was workaholic. Nevertheless, if you wanted to become the richest man in America, here was the pattern to follow.

Girard probably came as close as any rich man in history, to "taking it with him" when he died. His innately compulsive personality, combined with the sure knowledge that his relatives and others would probably try to break his will for their own benefit, led to the construction of a last will and testament that withstood a century of court challenges. It launched remarkable philanthropy for thousands of orphans and organized the whole Delaware Valley into an industrial machine unlike anything else in the country. Although he left the largest estate in the nation's history, that estate continued to accumulate money from his minute instructions to executors, eventually enlarging his vast fortune fifty-fold, a century after his death. In retrospect, Philadelphia might well have slowly declined into obscurity after the nation's capital moved to Washington in 1800. Instead, the coal, canal, railroad and industrial empire of the Philadelphia region became the "arsenal of the North" during the Civil War, and the main wealth generator of the Gilded Age which followed.

Girard's business career can be somewhat oversimplified as consisting of shipping at the base of his early good fortune, followed by banking during the era when banking was poorly understood and usually ineptly managed. He ended his career with an eager and successful embrace of the emerging Industrial Revolution. Throughout all of this, he characteristically took great risks for great profits, through recognizing what others were too timid to accept fully. On many occasions, his risky ventures resulted in very large losses, made acceptable by other risky ventures proving unexpectedly successful. An example would be Girard's Bank. When the Federal Government first started and then abandoned the First National Bank Girard bought up the remnants and made a great private success of banking, where he had little previous experience. He saw the potential of the canals, and later the railroads when others were content to be farmers or country gentlemen. When he was 79 years old, he purchased vast tracts of wilderness containing some outcroppings of coal, because he could foresee a great industrial future for the region. No pain, no gain.

Another way of looking at Girard was as the most prominent French-American citizen of his time. He arrived in Philadelphia at about the same time Benjamin Franklin stepped off another boat, returning from abusive treatment by British officials which finally flipped him for American independence. Franklin recognized that independence from England meant an alliance with France, or else it meant defeat. It is possible to view the American Revolution as an episode of France searching for an American foothold after its expulsion fifteen years earlier in the French and Indian War; trouble between Britain and its colonies might re-open opportunities for France. Girard was extremely friendly with Thomas Jefferson, the most Francophile of founders and early American presidents. When the War of 1812 with Great Britain threatened disaster for the new American state, Girard staked $8 million dollars, his whole fortune, on financing that war. During the entire period from 1776 to the Louisiana Purchase, America was wavering between its gratitude to France and underlying loyalty to the English-speaking community. During that long formative period, Girard the very rich Frenchman was hovering in the background, probably influencing American foreign policy more than is known, even today. But the France that Girard stood for was neither aristocratic of the LaFayette variety nor intellectual of the Robespierre sort. It was France of the French peasant, crabbed, acquisitive, and morose, forever responding to a "hidden hand" of his own self-interest in a way that paradoxically benefited his whole community, and thus would have hugely amused the Scotsman Adam Smith.

Our Federal Reserve : Biddle's Bank (2)

|

| Nicholas Biddle |

In 1823, the Biddles were prosperous, having made money in real estate (a Biddle ancestor had been a member of the Proprietors), and influential, having been Free Quakers who sided with the Revolution. So, Nicholas Biddle became the president of the Second Bank at 4th and Chestnut. Like all banks, he was given the ability to create money by taking deposits and loaning them out. Since in this process, two people (the depositor and the borrower) think they have the same money, there is effectively twice as much of it -- unless both actually demand it at the same time. If a bank has Federal revenues on deposit, as Biddle did, it is fairly easy for a politically active banker to predict whether that large depositor is likely to withdraw it. Political deposits seemingly make a bank stronger and safer, unless the banker has a fight with a politician. That's banking, but Biddle also became a central banker.

Biddle had ideas, derived in part from Alexander Hamilton. In those days, banks issued their own paper currency, or bank notes, representing the gold in their vaults or the real estate on which they held mortgages. There was a risk in one bank accepting bank notes from another bank that might go bust before you changed their notes into gold. The further away the issuing bank was, the riskier it was to rely on it. So, it was important to be a friendly sort of banker, who knew a lot of other bankers who would accept your money or who were known to be trustworthy.

Nicholas Biddle himself was well known to be pretty rich, and utterly trustworthy. He had a good instinct for how much to charge or discount the banknotes from other banks, or even other states. It was quite profitable to do this, but it became even more profitable when people began to use Biddle's own bank notes because they were safe. By setting a fair standard, he could control the exchange rate -- and hence the lending limits -- of banks that dealt with him. Sometimes a distant bank would get into cash shortages, and Biddle would help them out; if the other bank had a bad reputation, he might not.

|

| Bank of the United States |

In this way, the Second Bank was a reserve bank for other banks, with its banknote currency coming close to being the currency for the whole country. Soon, within a few blocks of Biddle's Bank, there were dozens of other banks, making up the financial capital of the country. Although it was a little obscure, and even Biddle may not have completely realized what he was doing, in effect his system automatically adjust the amount of currency in circulation to the size of the economy. If the correspondent banks prospered, they issued more currency, and if there was a recession, the country had deflation. The volatility of this system was related to the volatility of a pioneer economy, so Biddle made lots of enemies whenever he guessed about the direction of the economy. It wasn't a perfect system, but at least he kept politicians from inflating the currency to get re-elected, and hence annoyed politicians by constraining them. During the great western land rush of those days, all banks were under pressure to issue more loans than was wise, and politicians were under pressure to make them do so.

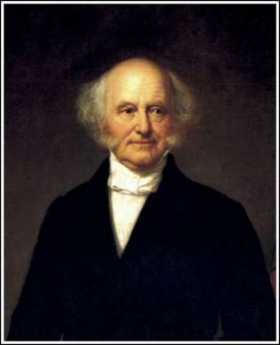

The worst enemy Biddle made was Martin Van Buren of New York. Van Buren was a consummate politician, one of whose many goals was to move the financial capital of the country from Chestnut Street--to Wall Street.

REFERENCES

| America's First Great Depression: Economic Crisis and Political Disorder after the Panic of 1837 Alasdarir Roberts ISBN-13: 978-0801450334 | Amazon |

Our Federal Reserve: Okayed (3)

|

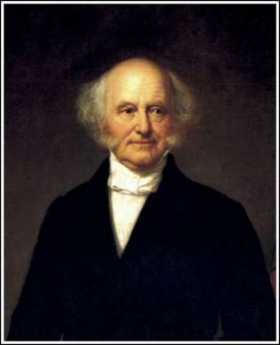

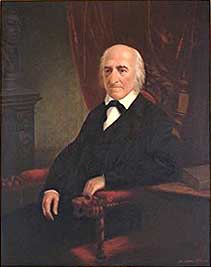

| Martin van Buren |

The 8th President of the United States, Martin van Buren, was born in Kinderhook, New York along the Hudson. He was known as "Old Kinderhook", so in time he initialed his documents "OK", and that's how that slang term originated. It's also of note that his retirement home in Kinderhook was named Lindenwald, although any connection with the terminus of the PATCO high-speed line is unclear. His real claim to fame is that he sort of invented what we know as the a modern political system, particularly that unfortunate doctrine known as the "spoils system". The full allusion is "to the victor belongs the spoils". The two-party a system, the Democratic Party, spinning, log-rolling, and other clever manipulations were of his devising. He must have been pretty shrewd, having defeated De Witt Clinton for Governor of New York, when Clinton was known as one of the most ruthlessly ambitious politicians around. Recognizing he was unlikely to be elected President, van Buren took on Andrew Jackson the war hero and manipulated him into the presidency, with the clear understanding that when Jackson stepped down, van Buren would have the job, next. Van Buren was a cabinet officer during Jackson's first term and Vice President during the second term. During that time, he was the real power running things from the shadows. He ruined the careers of John Calhoun and Henry Clay, regularly taking both sides of a number of disputes over the extension of slavery into new Western territories. What people ultimately thought of all this may be judged from the fact that he ran unsuccessfully for re-election -- three times.

It is therefore not certain just whose ideas were in operation when Jackson blocked the re-chartering of Biddle's bank, but one main benefit, "cui bono?", went to New York. Wall Street had sold stocks under a Buttonwood tree for fifty years, but its real start in the the financial world can be traced from Jackson's action.

The Industrial Revolution and the expansions of the United States by the Louisiana Purchase, the annexation of Texas and the Mexican acquisition caused an an explosion of new wealth, and hence an urgent need to make some better financial alignment of three asset classes: land, precious metals, and currency. Everywhere and at all times it is arguably what the land is really worth; 19th Century America it was particularly speculative, because there was so much of it. Most of the many bank waves of panic during that century can be traced to excessive borrowing to speculate in raw land. When Jackson closed Biddle's reserve bank, the land the speculating public was ecstatic because of any constraints on the lending power of banks made it harder to sell real estate. But what had been done was to eliminate the only reasonably effective way of matching the a true wealth of the country with its circulating monetary assets, and after a brief boom, the almost certain consequence was going to be a national bank panic. It came in 1837, during the first year of Martin van Buren Presidency.

The only imaginable alternative to a market-based monetary system is a government-based one. Van Buren's political behavior was by almost by itself sufficient warning of the danger of allowing politics into this matter. For nearly a century, one warning was enough.

Sixth and Arch to Second and Arch

When the large meeting house at Fourth and Arch was built, many Quakers moved their houses to the area. At that time, "North of Market" implied the Quaker region of town.

|

| Dr. Fisher |

During a recent speech, Senator Arlen Specter let it slip that he had a lot to do with obtaining federal financing to establish the new Constitution Center on the north end of Independence Mall. Probably even more important, he intimated that his wife, Joan Specter, did a lot of domestic agitating to see that it happened. The earmarks were his, the fingerprints were hers. Some have worried that the Supreme Court might be uneasy about a center telling the world what the Constitution is because the Justices see Constitutional interpretation as their unique function. The point that is sensitive is the emphasis on the words "We, the People", which could be seen as urging easy modification of the document by shouting demands or repetition of certitudes without passing due process in order to be considered. The second floor of this enormous new building is devoted to some very skillful exhibits relating to the history and significance of certain features of Constitutional history. The many auditoriums are the site of public lectures and programs, and there is a very interesting set of life-sized bronze figures of every member of the original Constitutional Convention. A striking feature of the display is to show how short and inconsequential Hamilton and Madison seemed to be in person, while Ben Franklin and Gouverneur Morris appear imposing and formidable in the flesh. These things matter in politics.

|

| Free Quaker Meeting House |

Cross Arch Street to the Free Quaker Meeting House, and if you have called the Park Service in advance, perhaps you can visit, noting how visually dramatic design of drastic simplicity can be. Just across Fifth Street is Ben Franklin's gravesite, in Christ Church cemetery, extended to this location when the gravesites became full around the church itself.

|

| Ben Franklin Bridge |

Going down Arch Street from Fifth to Fourth, you can visit the orthodox pacifist Meeting House, it's interior largely unpainted and grimly plain -- quite different from the effect of pristine simplicity of the Free Quakers. If you go inside the meetinghouse, a quiet and unprepossessing Quaker will be more than happy to give you a magnificently short and simple explanation of what Quakerism is all about. In passing down Arch Street, glance at the warehouses on the left, covering the site of what was once a major factory for shoes and uniforms for Union soldiers in the Civil War. Behind the buildings on the North side of the street, as the ground slopes sharply toward the river, you can sense the rough, tough waterfront of the Eighteenth Century. Charles Dickens might have felt entirely at home in the Nineteenth Century. Looking three blocks further North on Fifth Street, you can see St. George's Church, the oldest Methodist Church in the world, its view unfortunately obscured by the approaches to Ben Franklin Bridge.

|

| Elfreth's Alley |

Continue down Arch Street, past the building once said to have been the house of Betsy Ross, turning a half-block to the left on Second Street to the head of Elfreth's Alley. For full effect, continue down the alley to the end, but you will eventually have to retrace your steps because of rearrangements of the streets. Going down Elfreth's Alley, observe how tiny the Colonial buildings are. That's a reminder that placing taxes disproportionately on land will result in small residential plots, even though a whole continent of vacant land stretches to the Pacific. At one time, you might have walked south on Front Street, to Market, and then right to Second and Market. However, the embankment of the Interstate highway blocks you so you have to retrace your steps to Second Street. At the corner of Second and Market, however, do not neglect to look back toward the Southwest corner of Front and Market. The original building has unfortunately been demolished, but here was the site of the London Coffeehouse, where it could be fairly argued the American Revolution began. The owner, John Bradford, first learned of the Tea Act from a sailor at the Arch Street Wharf and fiercely resolved to stir up trouble about it. In retrospect, the Revolution might have seemed justified, but the Tea Act itself was intended by the British to be conciliatory, actually lowering the price of tea.

Now, go to the corner of 2nd and Market, where Christ Church displays Colonial architecture at its most breath-taking. If your feet hurt, you could rest by sitting in the pew once reserved for George Washington.

At this point, you have a choice. You can go South on Second Street to the restaurant and hotel area at the foot of Society Hill, eventually going on to a tour of either the elegant mansions to your right or the waterfront marinas and museums, on your left. Or instead, at Second and Market, you can turn West on Market, crossing at 3rd and Market to go through the archway to Ben Franklin's house and museum, eventually to the financial district and the State House. All of these are good choices, and if you are really smart you will do all of them.

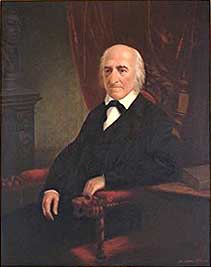

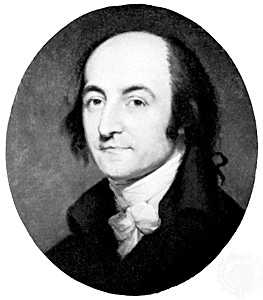

Gallatin, Part 1

|

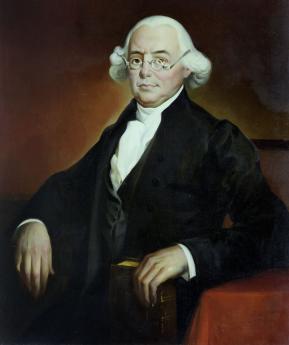

| Albert Gallatin |

William Shakespeare died two centuries before the Whiskey Rebellion of 1794, but he left us a clear outline of his style. Tragedies end with everyone getting killed, comedies end with everyone getting married, but histories have no clear beginning or end. The Hollingshead chronicle underlying this particular effort is the excellent history by Robert E. Wright and David J. Cowen, called Financial Founding Fathers. The story of the young Swiss aristocrat Albert Gallatin, plonked into the backwoods of Pennsylvania only to be relentlessly pursued by his arch enemy General Alexander Hamilton, ends in 1804 when Hamilton is killed in a duel by the Vice President of the United States, Aaron Burr.

Act 1. Ex-Senator Gallatin.

Aged 33, Gallatin was young to be a U.S. Senator, but his Swiss background in finance made him one of only five or six Americans who knew anything about banks. Unfortunately, his passionate Swiss frugality immediately made him the arch enemy of Secretary of the Treasury Alexander Hamilton who wanted to combine state debts from the Revolutionary War into a national debt. This thorn in Hamilton's side was removed by evicting Gallatin from the Senate on the grounds that he had not been a citizen for the ten years required by the Constitution. Unfortunately, that was true. It was nevertheless galling that Robert Morris, the other Pennsylvania Senator, would vote against him. The humiliation of being forced to leave Philadelphia and ride horseback to his home in Fayette County, right on the Indian frontier among the semi-barbarian Scotch Irish, was extreme.

Act 2. Caught in the Middle.

When Gallatin arrived home in the backwoods, the incensed local farmers instantly rallied around him as the perfect leader of a rebellion they wanted to start. A four-year war with the Indians in nearby Ohio had shut off all hope of marketing their grain to the West, and the Allegheny Mountains made it unprofitable to ship it to the East. Their response was to distill it into whiskey, which would not spoil with storage, and was more compact to transport. Assisted in part by Quakers' horror at selling whiskey to the Indians, Hamilton had pushed through a tax on whiskey which rendered it impractical to make it at all. Gallatin was already Hamilton's enemy, and Gallatin the European knew how to talk to those swells in the East. Gallatin did make rousing speeches about injustice but always cautioned the wild men to behave peacefully. That wasn't exactly what the angry farmers wanted, so Gallatin soon became the enemy of both sides of the dispute when the western Pennsylvanians organized a rebellion. Both sides made threats to assassinate him.

Act 3. The Lion Roars

President George Washington didn't know much about banks or taxes, but he knew a lot about law and order, and he wasn't having any rebellions. Ordering up an army of fifteen thousand men, he and General Hamilton led it across the state of Pennsylvania to hang 'em. Meanwhile, however, General "Mad" Anthony Wayne had defeated the Indians along the Miami River in Ohio, thus removing the main reason for whiskey manufacture, and finally proving to the anti-Constitution Jeffersonians that the federal government really was a useful thing to have. Washington dropped out at Bedford and went back to running the country, allowing the relentless Hamilton to charge forward to Pittsburgh. By that time, the farmers had pretty well dispersed, but to Hamilton they were traitors and that particularly included Gallatin.

Act 4. Local Hero

Two ringleaders were convicted of treason, everyone was threatened and interrogated. Hamilton was particularly anxious to include Gallatin in the net, but no one in that frontier culture would accuse Gallatin of participating in the call to violence or testify to any treasonous speech by him. In the midst of the uproar, Washington rose to the occasion and pardoned them all. Every last one of them.

Act 5. Secretary Gallatin

In a surge of jubilation, western Pennsylvania elected Gallatin as their congressman, sending him back to Philadelphia where he could do them some good. And indeed he quickly assaulted all of Hamilton's policies, both good and bad, as well as just about every other Federalist program. He quickly rose to the effective leadership of Congress and swung the crucial 1800 election from Aaron Burr to Thomas Jefferson. Since Jefferson was another Virginia Cavalier who knew nothing about finance, it was a foregone conclusion that President Jefferson would appoint Gallatin to be Secretary of the Treasury. Finally, in 1804 Burr removed Hamilton from public affairs on the flats of Weehawken. At the news of the death of his enemy, Gallatin shed not a tear. His memorial was the statement that "a majority of both parties seemed disposed.....to deify Hamilton and to treat Burr as a murderer. The duel, for a duel, was certainly fair."

Gallatin Part II

Act 1 Gallatin Triumphantly Returns to Congress.

When Washington pardoned the Whiskey Rebels, Gallatin was immediately elected to Congress. It was his payback time for Hamilton and all his works. The desperate Federalists tried to oust him a second time with a Constitutional Amendment, which failed before the force of Gallatin's oratory. Gallatin then threw his influence behind Jefferson's deadlocked congressional contest with Aaron Burr, electing Jefferson and earning his own reward as Secretary of the Treasury. Although elected Vice President, Burr's fury is turned against Hamilton, foreshadowing the coming duel.

Act 2 The Virtuoso Financier.

Jefferson proves hopeless in domestic affairs, so Gallatin essentially takes over that role, just as Hamilton had taken over from Washington, who was another Virginia cavalier adrift in these matters. Gallatin promptly repealed the whiskey tax, cut government expenses, in particular, the million dollars annual tribute to the Barbary pirates, and almost performed magic in financing the Louisiana Purchase together with Stephen Girard and William Bingham.

Act 3 Burr Kills Hamilton

After his Vice President kills the leader of the opposition party, Jefferson's party was on the political defensive. But not Gallatin, who spits out his famous remark, "A majority of both parties seem disposed to deify Hamilton and treat Burr as a murderer. The duel, for a duel, was certainly fair." It is an all-time low moment in the politics of the young nation.

Act 4 Diplomacy or War?

As the Napoleonic wars engulf the whole world, both England and France harass our merchant ships, and cries go up for war. Partly out of a desire to annex Canada in the process, Gallatin sneers at proposals to restrain the fighting Europeans with mere sanctions. His prediction proves dismayingly correct that nothing would come of it except to make our own citizens into smugglers.

Act 5 War It Is.

The First Bank's charter was to expire in 1811, and the bank closed, creating an opportunity for Girard to buy it out and finance the coming war himself. Gallatin was desperate to end the war as quickly as possible, especially after the British burned Washington. To speed matters up, Gallatin took a leave of absence and went off to the peace conference in St. Petersburg himself.

Epilogue in front of the curtain.

Gallatin finally announces his resignation from the longest term of Treasury Secretary in our history. He is seventy years old, three scores and ten. Rather than play golf, he was to spend the last eighteen years of his life in three more careers. As a diplomat, he negotiated both our permanent northern and southern borders. As an academic, he founded the discipline of ethnology with the study of native Indian languages, meanwhile founding New York University. And as a banker, he founded a bank which has since evolved into JPMorgan Chase. After all, a man has to find something to keep himself busy.

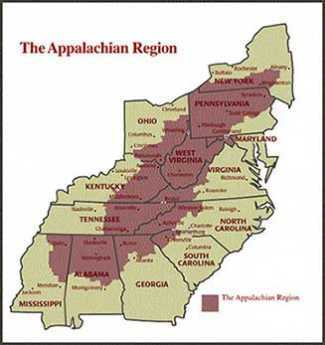

Albert Gallatin: Enigma Furioso

|

| Appalachia |

Abraham Alphonse Albert Gallatin was born to a rich, famous and noble family in the French part of Switzerland in 1761, but soon became a rich orphan fleeing to America in the 1780s to escape overbearing and grasping relatives. He started out in America teaching French at Harvard but soon purchased Friendship Hill, a 600-acre estate south of Pittsburgh along what was to become the National Road. At first, he ran a busy general store but soon branched out into successfully buying and selling real estate. Although Uniontown now seems a lonesome hermitage in Appalachia, it was then part of the area disputed between Pennsylvania and Virginia, coveted by both states because it seemed like the main route to Ohio when Ohio was the Golden Frontier. Friendship Hill is now a National Park, near Fort Necessity, also near General Braddock's grave, and the birthplace of George Catlett Marshall. So it had its attractions, but Gallatin led such a frenzied life it is hard to believe he spent much time there. There is a reason to believe he was one of the main instigators of the Whiskey Rebellion. Hamilton, and probably Washington, certainly thought so.

|

| Albert Gallatin |

Almost immediately after arrival in America, Gallatin threw in his lot with Thomas Jefferson in resistance to the centralizing, Federalist, qualities of the new Constitution. Both of them were looking for more liberty than the Constitution offered. The movement they led became the anti-Federalist party and would have been the anti-constitution party except for reluctance to oppose the towering figure of George Washington. Gallatin's French loyalties seem to have overcome his aristocratic family background in supporting what enemies of the French Revolution had called Jacobin (or "Republican") notions. His Swiss background additionally gave him great credibility in high finance in backwoods America. In spite of being rather out of place among Virginia Cavaliers, his personal qualities seem to have made him a natural politician. He hated Hamilton's idea of the National Bank, arguing against it effectively in the unsophisticated company. The issue was not so much opposition to banking, but to government dominance in central banking. He was certainly right that mixing the two created a constant risk of inflation from yielding to political demands, an empirical observation almost without any exception for 800 years. However, it was too early in the history of central banking to perceive that it was debtor pressure which promotes inflation. Governments are almost invariably debtors themselves, whereas the elites he was attacking, in general, become creditors, resisting inflation. Inflation is merely a variant of defaulting on debts, which debtor governments happen to have at their disposal because they control the currency.

At this early stage of central banking, America was largely using its vast amounts of land as a substitute for money, but quickly adapted to Hamilton's new monetary system which was far more flexible. Gallatin later played a role in the chartering of both the Second and the Third Banks, although his motives here were somewhat different. (Government caps on interest rates induced the Banks to lend to only the best risks, which amounted to favoring Philadelphia over the frontier, Gallatin's main constituency.) He was appointed U.S. Senator for Pennsylvania at the age of 32 but was evicted on a straight party vote on the ground that he had not been an American citizen for the required nine years. It seems likely that accusation was correct. He was soon elected a Congressman, becoming Chairman of Finance (later called Ways and Means), the majority leader after five years. In retrospect, while it seems perplexing that a sophisticated financier would oppose a central bank, his opposition may have been mainly against having politicians operate one, a rather unavoidable consequence of government control. Hamilton's idea that deliberately going into debt was a way to establish "creditworthiness" was denounced as particularly offensive by those who disdained indebtedness as the most dangerous sin of commercial life. The anti-Federalists were clearly wrong on this point, but it is possible to sympathize with their suspicions. Even today, the unwillingness of banks to lend money to someone who has no history of the previous borrowing is one of those things which seem so natural to bankers, and so irritating to apostles of thrift.

It remains unclear to history whether Gallatin had really never believed what he was saying, or had gradually changed his mind as he gained experience. He did confess or perhaps suddenly realize his error as the War of 1812 approached and he was Secretary of the Treasury. In this awkward event, he found himself charged with organizing the finance of a war with no way to do it. What was worse, Jefferson relentlessly pursued the closure of the National Bank for ideological, even fanatical, reasons; and Jefferson was the boss. The resolution of this conflict was to enrich Stephen Girard even further, while forcing Gallatin to a humiliating public reversal of stance. Nevertheless, America simply had to have a bank to fight a war. It is greatly to Gallatin's credit that his frenzied and obviously sincere entreaties to the bewildered Jefferson and Madison then saved the Nation from a disaster of foolish consistency. In a larger sense, the dramatic reversal of stance also played a role in shifting American sympathies from France to England. American sympathies were then wavering. On one side, there was gratitude to the French for bankrupting themselves with unwisely large loans to our struggling revolution, and for allying themselves with that revolution, soon imitating it with a revolution of their own against the common slogan, oppressive monarchy. True, there was more than a little hankering for the annexation of large chunks of Canada. That was one side of it, which Lafayette, Girard, Gallatin, and Jefferson labored to enhance, probably with their eye on French Quebec. On the other hand, there was that appalling genocide of the Jacobin guillotine, which Napoleon soon threatened to extend to all European monarchies within his reach. The Seven Years War, which we called the War of the French and the Indians, had left memories in America that French ambition could extend from Quebec to Louisiana and include Haiti. The French once even occupied Pittsburgh, and their Indian allies had scalped settlers in Lancaster. That was not so long ago. Furthermore, the English invention of the Industrial Revolution was immensely attractive to artisan Americans. Ultimately, we made our choice for steady prosperous commerce of the British sort, rather than glittering glorious conquest, of the French style. By 1813, Gallatin had served longer as Secretary of Treasury than anyone before or since, and earlier had a more distinguished career as both Congressman and Senator than all but a few have ever achieved. When he was offered the position as a commissioner to negotiate the Treaty of Ghent ending the War of 1812, it was natural to expect that it would be the final act of his long political career. It was, however, only the beginning of a ten-year diplomatic career as Ambassador, first to France and then to England. Following that with still another new career, he took up academic work, returning to America to found New York University, personally establishing the academic discipline of study in Indian Affairs and language, and founding the American Ethnological Society. Gallatin wrote two books about Indian language patterns and first suggested that the similarities between the languages of North and South American Indians probably meant they were related tribes. In another sphere, Gallatin is credited with originating the American doctrine of manifest destiny.

While skipping from one distinguished career to several others, Gallatin never forgot he was a banker. He wrote the charter for the Second National Bank ("Biddle's Bank"), plus the Third Bank of Pennsylvania, and founded the National Bank of New York, which was named Gallatin's Bank for a while, before gradually evolving into what is now called J.P. Morgan Chase Bank. As a diplomat, he negotiated many boundary disputes, including Oregon, Maine, and Texas. He bitterly opposed the annexation of Texas.

When it comes to writing about Gallatin, there is so much to say it is hard to say anything coherent. He was such a virtuoso of public life that he defeats his biographers in their central task, of telling the world what he was like. There haven't been many if indeed there were any, enough like him to offer a comparison. And yet history has not been kind to him. He can comfortably claim the title of the most famous American, that no one since has ever heard of.

Constitution-tampering is Unwise

.

Economics of La Cosa Nostra

|

| Angelo Bruno |

During all of the reign of Angelo Bruno, it was a common street opinion that The Organization tried to stay away from drugs, prostitution and shooting anybody except other mobsters. Some of that attitude is found in the scene of the movie The Godfather where a neophyte going to his first killing is instructed to "Watch out for those goddam innocent bystanders". It was okay to bribe the police, not okay to annoy them. Counterfeiting and kidnapping were big no-no's, even though counterfeiting was a core activity for the ancestral Mafia in Western Sicily during the Nineteenth century.

|

| Al Capone |

According to Robert Simone's book, the Philadelphia mob was mainly enriched by loan sharking. There are a lot of people who suddenly need cash desperately and can't get it quickly from banks. Simone himself was a compulsive gambler and frequently was in urgent need of money, either to throw it away or pay it back. Other people get caught in some illegal activity and suddenly need bail money to stay out of prison or up-front money for a lawyer. Or whatever. The Philadelphia mob had a reputation for being able to loan amounts of fifty or a hundred thousand dollars in response to a phone call, with home delivery of the money in fifteen minutes. For this, they would charge interest in the range of three percent a week, well above the usury limit, but probably not greatly out of proportion to the risk of loss. The police have little interest in transactions between willing parties, at least until the borrower fails to pay it back. Even at that point, it becomes a question of whether kneecaps will actually get broken, or baseball bats actually come in contact with skulls. Probably not very often, because the threat seems a credible one.

To run such a business requires large amounts of cash, hidden in safes or bricked up in walls. From this comes theft or attempted theft, with violent defense measures that often don't concern the police, much, unless those aforementioned bystanders get injured. Sometimes couriers get tempted to make unscheduled detours, but the police are fairly tolerant of informal restitution efforts. All in all, it's a nice clean illegal business.