Related Topics

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

American Finance After Robert Morris

Robert Morris can be fairly said to have made the American Revolution possible.

Philadelphia Changes the Nature of Money

Banking changed its fundamentals, on Third Street in Philadelphia, three different times.

Philadelphia Reflections (6)

New topic 2017-02-06 21:23:28 description

Our Federal Reserve: Okayed (3)

|

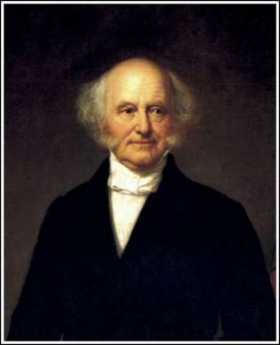

| Martin van Buren |

The 8th President of the United States, Martin van Buren, was born in Kinderhook, New York along the Hudson. He was known as "Old Kinderhook", so in time he initialed his documents "OK", and that's how that slang term originated. It's also of note that his retirement home in Kinderhook was named Lindenwald, although any connection with the terminus of the PATCO high-speed line is unclear. His real claim to fame is that he sort of invented what we know as the a modern political system, particularly that unfortunate doctrine known as the "spoils system". The full allusion is "to the victor belongs the spoils". The two-party a system, the Democratic Party, spinning, log-rolling, and other clever manipulations were of his devising. He must have been pretty shrewd, having defeated De Witt Clinton for Governor of New York, when Clinton was known as one of the most ruthlessly ambitious politicians around. Recognizing he was unlikely to be elected President, van Buren took on Andrew Jackson the war hero and manipulated him into the presidency, with the clear understanding that when Jackson stepped down, van Buren would have the job, next. Van Buren was a cabinet officer during Jackson's first term and Vice President during the second term. During that time, he was the real power running things from the shadows. He ruined the careers of John Calhoun and Henry Clay, regularly taking both sides of a number of disputes over the extension of slavery into new Western territories. What people ultimately thought of all this may be judged from the fact that he ran unsuccessfully for re-election -- three times.

It is therefore not certain just whose ideas were in operation when Jackson blocked the re-chartering of Biddle's bank, but one main benefit, "cui bono?", went to New York. Wall Street had sold stocks under a Buttonwood tree for fifty years, but its real start in the the financial world can be traced from Jackson's action.

The Industrial Revolution and the expansions of the United States by the Louisiana Purchase, the annexation of Texas and the Mexican acquisition caused an an explosion of new wealth, and hence an urgent need to make some better financial alignment of three asset classes: land, precious metals, and currency. Everywhere and at all times it is arguably what the land is really worth; 19th Century America it was particularly speculative, because there was so much of it. Most of the many bank waves of panic during that century can be traced to excessive borrowing to speculate in raw land. When Jackson closed Biddle's reserve bank, the land the speculating public was ecstatic because of any constraints on the lending power of banks made it harder to sell real estate. But what had been done was to eliminate the only reasonably effective way of matching the a true wealth of the country with its circulating monetary assets, and after a brief boom, the almost certain consequence was going to be a national bank panic. It came in 1837, during the first year of Martin van Buren Presidency.

The only imaginable alternative to a market-based monetary system is a government-based one. Van Buren's political behavior was by almost by itself sufficient warning of the danger of allowing politics into this matter. For nearly a century, one warning was enough.

Originally published: Friday, June 23, 2006; most-recently modified: Wednesday, May 29, 2019