Related Topics

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

American Finance After Robert Morris

Robert Morris can be fairly said to have made the American Revolution possible.

Philadelphia Changes the Nature of Money

Banking changed its fundamentals, on Third Street in Philadelphia, three different times.

Unwritten Constitutional Modification

It is so difficult to amend the Constitution, we mostly don't do it. Our system is to have the Supreme Court migrate slowly through several small adjustments, watching the country respond. Occasionally we have imported new principles, sometimes not entirely wise ones, adopted without the same seasoning.

Our Federal Reserve : Biddle's Bank (2)

|

| Nicholas Biddle |

In 1823, the Biddles were prosperous, having made money in real estate (a Biddle ancestor had been a member of the Proprietors), and influential, having been Free Quakers who sided with the Revolution. So, Nicholas Biddle became the president of the Second Bank at 4th and Chestnut. Like all banks, he was given the ability to create money by taking deposits and loaning them out. Since in this process, two people (the depositor and the borrower) think they have the same money, there is effectively twice as much of it -- unless both actually demand it at the same time. If a bank has Federal revenues on deposit, as Biddle did, it is fairly easy for a politically active banker to predict whether that large depositor is likely to withdraw it. Political deposits seemingly make a bank stronger and safer, unless the banker has a fight with a politician. That's banking, but Biddle also became a central banker.

Biddle had ideas, derived in part from Alexander Hamilton. In those days, banks issued their own paper currency, or bank notes, representing the gold in their vaults or the real estate on which they held mortgages. There was a risk in one bank accepting bank notes from another bank that might go bust before you changed their notes into gold. The further away the issuing bank was, the riskier it was to rely on it. So, it was important to be a friendly sort of banker, who knew a lot of other bankers who would accept your money or who were known to be trustworthy.

Nicholas Biddle himself was well known to be pretty rich, and utterly trustworthy. He had a good instinct for how much to charge or discount the banknotes from other banks, or even other states. It was quite profitable to do this, but it became even more profitable when people began to use Biddle's own bank notes because they were safe. By setting a fair standard, he could control the exchange rate -- and hence the lending limits -- of banks that dealt with him. Sometimes a distant bank would get into cash shortages, and Biddle would help them out; if the other bank had a bad reputation, he might not.

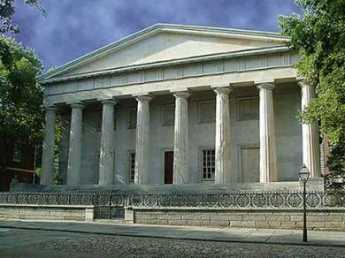

|

| Bank of the United States |

In this way, the Second Bank was a reserve bank for other banks, with its banknote currency coming close to being the currency for the whole country. Soon, within a few blocks of Biddle's Bank, there were dozens of other banks, making up the financial capital of the country. Although it was a little obscure, and even Biddle may not have completely realized what he was doing, in effect his system automatically adjust the amount of currency in circulation to the size of the economy. If the correspondent banks prospered, they issued more currency, and if there was a recession, the country had deflation. The volatility of this system was related to the volatility of a pioneer economy, so Biddle made lots of enemies whenever he guessed about the direction of the economy. It wasn't a perfect system, but at least he kept politicians from inflating the currency to get re-elected, and hence annoyed politicians by constraining them. During the great western land rush of those days, all banks were under pressure to issue more loans than was wise, and politicians were under pressure to make them do so.

The worst enemy Biddle made was Martin Van Buren of New York. Van Buren was a consummate politician, one of whose many goals was to move the financial capital of the country from Chestnut Street--to Wall Street.

REFERENCES

| America's First Great Depression: Economic Crisis and Political Disorder after the Panic of 1837 Alasdarir Roberts ISBN-13: 978-0801450334 | Amazon |

Originally published: Tuesday, June 27, 2006; most-recently modified: Wednesday, May 29, 2019

| Posted by: Michael Kirsch | Dec 11, 2012 2:40 PM |

| Posted by: how to get facebook fans free | Feb 13, 2012 9:57 AM |

| Posted by: esalerugs promo code | Feb 13, 2012 9:13 AM |