Related Topics

Causes of the American Revolution

Britain and its colonies had outgrown Eighteenth Century techniques of governance. Unfortunately, both England and America lacked the sophistication to make drastic changes smoothly.

Whither, Federal Reserve? (2)After Our Crash

Whither, Federal Reserve? (2)

Philadelphia Changes the Nature of Money

Banking changed its fundamentals, on Third Street in Philadelphia, three different times.

Shaping the Constitution in Philadelphia

After Independence, the weakness of the Federal government dismayed a band of ardent patriots, so under Washington's leadership a stronger Constitution was written. Almost immediately, comrades discovered they had wanted the same thing for different reasons, so during the formative period they struggled to reshape future directions . Moving the Capitol from Philadelphia to the Potomac proved curiously central to all this.

Favorites - II

More favorites. Under construction.

...Potential New Constitutional Amendments

New topic 2012-08-01 18:50:35 description

Unwritten Constitutional Modification

It is so difficult to amend the Constitution, we mostly don't do it. Our system is to have the Supreme Court migrate slowly through several small adjustments, watching the country respond. Occasionally we have imported new principles, sometimes not entirely wise ones, adopted without the same seasoning.

Restoring the Gold Standard by Levering Judges' Salaries

|

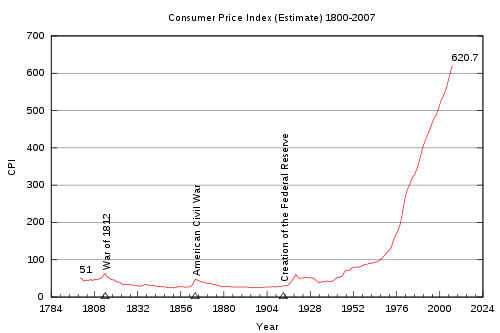

| Gold Inflation |

Generally speaking, creditors hate inflation and favor a gold standard because they fear debtors -- who outnumber them at the polls -- will dishonor their debts by inflating the currency. And debtors generally are rather serene about the risk of inflation, for the same reason in reverse. Since governments are almost invariably debtors, the combination of government and debtors on the side of promoting inflation represents a dishearteningly strong force for creditors to combat. It is plain for everyone to see that inflation has been steadily moving ahead. But it is something for everyone to ponder that leaving creditors with only one recourse is almost certain to translate that particular recourse into action. Creditors will raise interest rates in anticipation of inflation, and the economy will suffer for debtors as well as everyone else.

So, hard-money advocates like the Paul family of Texas have been rather nonplussed to discover that Federal Judges have handed them in 2010 a very effective weapon they had long overlooked. It should be no surprise that it came from that direction; judges are long accustomed to looking backward to the historical origins of the laws they are charged with interpreting. In this case, the defining statement is found in the Declaration of Independence.

Parenthetically, conservatives are reluctant to include the Declaration in an explanation of the Constitution, since it is plainly true the Constitution was written to correct the weaknesses of the Articles of Confederation, which was much more closely defined by the circumstances of the Declaration. The almost immediate response to any such logical jump over the Constitution, particularly those of Abraham Lincoln, is to thump the maxim that The Declaration of Independence is not Law. And it isn't; it's just in this case it makes a concise statement of a major reason we were offended by the King of England:

"He has made judges dependent on his will alone, for the tenure of their offices, and the amount and payment of their salaries."

Note the operative phrase dependent on his will alone , which takes us back to the Magna Carta, where even the King must obey the Law. If judges are the umpires, it isn't in accord with deeply felt British culture that the King could force the umpires to favor his wishes in their official decisions, by threatening punishment on their persons. No, thousand times no. Anyone can see that.

Furthermore, the determination of underlying intent is so difficult to prove, and so easy to deny, that it is scarcely mentioned in the debate. If two motives seem possible, the other party will assert the high-sounding one and deny the ulterior one. The offended party will instinctively suspect the reverse and will brush aside any protestations to the contrary. Since that is bound to happen, please skip the preliminaries and get on with the evidence. So it is in this case; any reduction in the judge's salary is treated as an attempt to influence official decisions. The Administration maintains a reduction of Federal judge salaries is necessary for budgetary reasons. Please don't insult my intelligence that way. You aren't allowed to reduce the salaries of judges for any reason.

From this rather easy position to take, it is only a short step to say that refusing to raise judge salaries during inflation is a reduction of salary in real terms, after adjusting for inflation. Your paper money is phony; I want to preserve my purchasing power. Your refusal to adjust for inflation is even more clearly a salary reduction since the link to gold was severed during the Nixon and Johnson administrations. We are not on anything remotely resembling a gold standard; we are on a monetary standard which is by law adjusted to inflation, and just about nothing else. Hubert Humphrey may have thought he was creating a loophole by mandating concern with unemployment, but just try to convince the judges of the Supreme Court of that one.

And so, it seems predictable that Judge Beer of the Eastern District of Louisiana, and his fellow judges, will achieve an effective gold standard for Federal Judges if they have the fortitude to tough it out. After that, it gets harder, Congressman Paul. You have to push the concept that what is fair for Federal Judges is fair for everyone else. You should assume that judges will vote in their own favor, and therefore reasonably assume that the public will vote in its own favor, too. If that be treason, said Patrick Henry, make the most of it.

Originally published: Thursday, July 01, 2010; most-recently modified: Sunday, July 21, 2019