Related Topics

American Finance After Robert Morris

Robert Morris can be fairly said to have made the American Revolution possible.

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

...Trying Out the New Constitution

George Washington's first term as President was much like a continuation of the Constitutional Convention, with many of the same participants.

Albert Gallatin

A magnificent but largely forgotten man.

Whither, Federal Reserve? (2)After Our Crash

Whither, Federal Reserve? (2)

Philadelphia Changes the Nature of Money

Banking changed its fundamentals, on Third Street in Philadelphia, three different times.

Robert Morris and America

Robert Morris was an energetic problem-solver. In solving those problems he devised some innovative solutions which have become such axiomatic principles of a republic and its economics, that his name is seldom associated with them.

Unwritten Constitutional Modification

It is so difficult to amend the Constitution, we mostly don't do it. Our system is to have the Supreme Court migrate slowly through several small adjustments, watching the country respond. Occasionally we have imported new principles, sometimes not entirely wise ones, adopted without the same seasoning.

Funding the National Debt

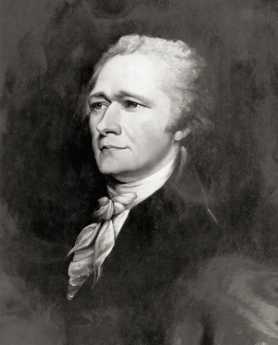

|

| Alexander Hamilton |

Although Alexander Hamilton's arresting slogan that "A national debt is a national treasure" has diverted attention to the underlying idea toward him, Robert Morris had introduced and argued for the same insight in the preamble to his 1785 "Statement of Accounts". The key sentence was, "The payment of debts may indeed be expensive, but it is infinitely more expensive to withhold payment." This fatherly-sounding advice was surely a distillation of a long life as a merchant, and the gist of it may have been passed down to him as an apprentice. Failure to pay your debts promptly and cheerfully results in the world assigning a higher interest rate to your future credit; it is not long before compounded interest begins to drag you down. It doesn't exactly say that, but that's what it means.

|

| Liberty Bond |

Another way of looking at this folk wisdom is that it leads to a simplified method of organizing the finances of an organization. Because higher rates of interest are demanded of long-term borrowing than short-term, it becomes efficient to segregate them. That is, to establish a cash account for every-day transactions, and a separate bond account for a long term, or capital, debt. As bills arrive, they need only be verified for accuracy and sent for payment from either a cash account or a capital account. The original responsibility for agreeing to such debts lies with top management, not the treasurer. The job of the treasurer's office is to pay legitimate bills as quickly and cheerfully as possible, ignoring any imprudence of earlier agreeing to them; rewards will come from lower interest charges and improved credit rating. An unexpected benefit of thus organizing institutions and governments is to make the accounting profession possible. Accountants perform the same function in every business, whether the business is selling battleships or parsnips. The accounting profession made itself computer-ready, two hundred years before the computer was invented.

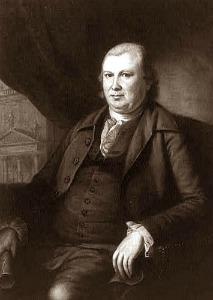

|

| Robert Morris |

In the same document, the retiring national Financier was advising the wisdom of "funding" the war debts, which were largely owed to France, with whom relations were rapidly souring. Lump them all together into a fund, issue bonds and sell them as representations of the nation's capital at the time of issue. Disregard what the money was used for, by either the debtor or the creditor. In spite of appearances, money sequestered in a fund for later payment belongs to the creditor the moment it is promised, not the moment it is transferred. Morris and Hamilton discovered that the fund itself had the property of a bank, in creating money. As long as the creditor did not cash your bonds, he could use them as money, in effect doubling the amount of money you yourself can spend. It was this discovery which so exhilarated Alexander Hamilton, causing him to over-praise the methodology to an already suspicious Congress. Tending toward the teachings of Shakespeare's Polonius, Hamilton's excitable manner caused them to remember, neither a borrower nor a lender is. But Congress was eventually persuaded. The federal government lumped the states' debts together in an "assumption of debts" , consolidated all these various little debts into a single "funded debt", and made the deal work with changing the "residency" of the nation's capital from Philadelphia to the banks of the Potomac. It was called the Great Compromise of 1790.

Morris well understood that a funded system requires some final payor of last resort. Such a payor need set aside only a small portion of the debt for dire contingencies, but his name gets first attention on the list presented to prospective creditors. In 1778 Morris had offered his own personal wealth as that last resort, which the public at the time trusted far more than the Treasury of the United States. Over the next twenty years, he came to realize that the last resort of established nations, no matter what the paper said, was the aggregate underlying wealth of the whole nation. With a vast continent stretching to the West, and countless immigrants clamoring to join from the East, the wealth supporting the debt of the United States in 1790 seemed endless. After two hundred years we have finally begun to accumulate a national debt which equals our Gross Domestic Product, and have only begun to pull back as we observe what happens to other nations who got to that point sooner. Let's hope devising an automatic check and balance does not require a second Robert Morris. Men like him can be hard to find, so limit your debts -- or your nation's debts -- to sixty percent of your assets. Financial geniuses are invited to devise a better debt limit, if they can.

Originally published: Wednesday, November 02, 2011; most-recently modified: Monday, July 22, 2019