5 Volumes

Constitutional Era

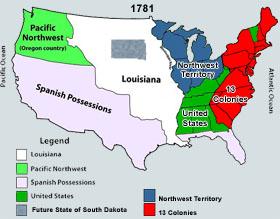

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

BANKS REDEFINED

American banking was invented in Philadelphia. The banking center of America has moved away and changed in extraordinary ways but the foundations remain.

Philadephia: America's Capital, 1774-1800

The Continental Congress met in Philadelphia from 1774 to 1788. Next, the new republic had its capital here from 1790 to 1800. Thoroughly Quaker Philadelphia was in the center of the founding twenty-five years when, and where, the enduring political institutions of America emerged.

Money

New volume 2012-07-04 13:46:41 description

Nineteenth Century Philadelphia 1801-1928 (III)

At the beginning of our country Philadelphia was the central city in America.

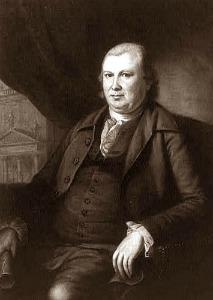

Albert Gallatin

A magnificent but largely forgotten man.

Albert Gallatin: Enigma Furioso

|

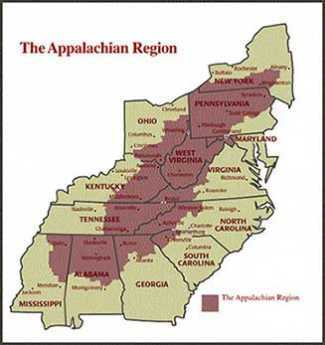

| Appalachia |

Abraham Alphonse Albert Gallatin was born to a rich, famous and noble family in the French part of Switzerland in 1761, but soon became a rich orphan fleeing to America in the 1780s to escape overbearing and grasping relatives. He started out in America teaching French at Harvard but soon purchased Friendship Hill, a 600-acre estate south of Pittsburgh along what was to become the National Road. At first, he ran a busy general store but soon branched out into successfully buying and selling real estate. Although Uniontown now seems a lonesome hermitage in Appalachia, it was then part of the area disputed between Pennsylvania and Virginia, coveted by both states because it seemed like the main route to Ohio when Ohio was the Golden Frontier. Friendship Hill is now a National Park, near Fort Necessity, also near General Braddock's grave, and the birthplace of George Catlett Marshall. So it had its attractions, but Gallatin led such a frenzied life it is hard to believe he spent much time there. There is a reason to believe he was one of the main instigators of the Whiskey Rebellion. Hamilton, and probably Washington, certainly thought so.

|

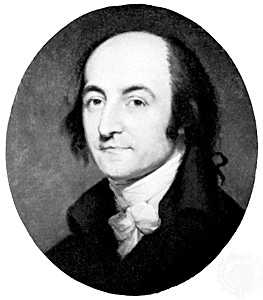

| Albert Gallatin |

Almost immediately after arrival in America, Gallatin threw in his lot with Thomas Jefferson in resistance to the centralizing, Federalist, qualities of the new Constitution. Both of them were looking for more liberty than the Constitution offered. The movement they led became the anti-Federalist party and would have been the anti-constitution party except for reluctance to oppose the towering figure of George Washington. Gallatin's French loyalties seem to have overcome his aristocratic family background in supporting what enemies of the French Revolution had called Jacobin (or "Republican") notions. His Swiss background additionally gave him great credibility in high finance in backwoods America. In spite of being rather out of place among Virginia Cavaliers, his personal qualities seem to have made him a natural politician. He hated Hamilton's idea of the National Bank, arguing against it effectively in the unsophisticated company. The issue was not so much opposition to banking, but to government dominance in central banking. He was certainly right that mixing the two created a constant risk of inflation from yielding to political demands, an empirical observation almost without any exception for 800 years. However, it was too early in the history of central banking to perceive that it was debtor pressure which promotes inflation. Governments are almost invariably debtors themselves, whereas the elites he was attacking, in general, become creditors, resisting inflation. Inflation is merely a variant of defaulting on debts, which debtor governments happen to have at their disposal because they control the currency.

At this early stage of central banking, America was largely using its vast amounts of land as a substitute for money, but quickly adapted to Hamilton's new monetary system which was far more flexible. Gallatin later played a role in the chartering of both the Second and the Third Banks, although his motives here were somewhat different. (Government caps on interest rates induced the Banks to lend to only the best risks, which amounted to favoring Philadelphia over the frontier, Gallatin's main constituency.) He was appointed U.S. Senator for Pennsylvania at the age of 32 but was evicted on a straight party vote on the ground that he had not been an American citizen for the required nine years. It seems likely that accusation was correct. He was soon elected a Congressman, becoming Chairman of Finance (later called Ways and Means), the majority leader after five years. In retrospect, while it seems perplexing that a sophisticated financier would oppose a central bank, his opposition may have been mainly against having politicians operate one, a rather unavoidable consequence of government control. Hamilton's idea that deliberately going into debt was a way to establish "creditworthiness" was denounced as particularly offensive by those who disdained indebtedness as the most dangerous sin of commercial life. The anti-Federalists were clearly wrong on this point, but it is possible to sympathize with their suspicions. Even today, the unwillingness of banks to lend money to someone who has no history of the previous borrowing is one of those things which seem so natural to bankers, and so irritating to apostles of thrift.

It remains unclear to history whether Gallatin had really never believed what he was saying, or had gradually changed his mind as he gained experience. He did confess or perhaps suddenly realize his error as the War of 1812 approached and he was Secretary of the Treasury. In this awkward event, he found himself charged with organizing the finance of a war with no way to do it. What was worse, Jefferson relentlessly pursued the closure of the National Bank for ideological, even fanatical, reasons; and Jefferson was the boss. The resolution of this conflict was to enrich Stephen Girard even further, while forcing Gallatin to a humiliating public reversal of stance. Nevertheless, America simply had to have a bank to fight a war. It is greatly to Gallatin's credit that his frenzied and obviously sincere entreaties to the bewildered Jefferson and Madison then saved the Nation from a disaster of foolish consistency. In a larger sense, the dramatic reversal of stance also played a role in shifting American sympathies from France to England. American sympathies were then wavering. On one side, there was gratitude to the French for bankrupting themselves with unwisely large loans to our struggling revolution, and for allying themselves with that revolution, soon imitating it with a revolution of their own against the common slogan, oppressive monarchy. True, there was more than a little hankering for the annexation of large chunks of Canada. That was one side of it, which Lafayette, Girard, Gallatin, and Jefferson labored to enhance, probably with their eye on French Quebec. On the other hand, there was that appalling genocide of the Jacobin guillotine, which Napoleon soon threatened to extend to all European monarchies within his reach. The Seven Years War, which we called the War of the French and the Indians, had left memories in America that French ambition could extend from Quebec to Louisiana and include Haiti. The French once even occupied Pittsburgh, and their Indian allies had scalped settlers in Lancaster. That was not so long ago. Furthermore, the English invention of the Industrial Revolution was immensely attractive to artisan Americans. Ultimately, we made our choice for steady prosperous commerce of the British sort, rather than glittering glorious conquest, of the French style. By 1813, Gallatin had served longer as Secretary of Treasury than anyone before or since, and earlier had a more distinguished career as both Congressman and Senator than all but a few have ever achieved. When he was offered the position as a commissioner to negotiate the Treaty of Ghent ending the War of 1812, it was natural to expect that it would be the final act of his long political career. It was, however, only the beginning of a ten-year diplomatic career as Ambassador, first to France and then to England. Following that with still another new career, he took up academic work, returning to America to found New York University, personally establishing the academic discipline of study in Indian Affairs and language, and founding the American Ethnological Society. Gallatin wrote two books about Indian language patterns and first suggested that the similarities between the languages of North and South American Indians probably meant they were related tribes. In another sphere, Gallatin is credited with originating the American doctrine of manifest destiny.

While skipping from one distinguished career to several others, Gallatin never forgot he was a banker. He wrote the charter for the Second National Bank ("Biddle's Bank"), plus the Third Bank of Pennsylvania, and founded the National Bank of New York, which was named Gallatin's Bank for a while, before gradually evolving into what is now called J.P. Morgan Chase Bank. As a diplomat, he negotiated many boundary disputes, including Oregon, Maine, and Texas. He bitterly opposed the annexation of Texas.

When it comes to writing about Gallatin, there is so much to say it is hard to say anything coherent. He was such a virtuoso of public life that he defeats his biographers in their central task, of telling the world what he was like. There haven't been many if indeed there were any, enough like him to offer a comparison. And yet history has not been kind to him. He can comfortably claim the title of the most famous American, that no one since has ever heard of.

Gallatin, Part 1

|

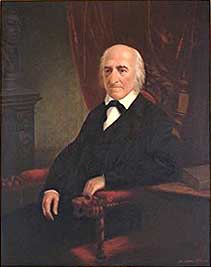

| Albert Gallatin |

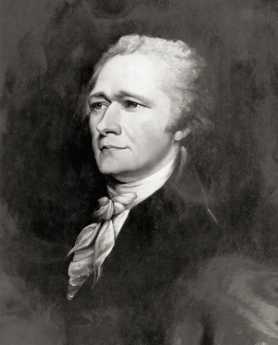

William Shakespeare died two centuries before the Whiskey Rebellion of 1794, but he left us a clear outline of his style. Tragedies end with everyone getting killed, comedies end with everyone getting married, but histories have no clear beginning or end. The Hollingshead chronicle underlying this particular effort is the excellent history by Robert E. Wright and David J. Cowen, called Financial Founding Fathers. The story of the young Swiss aristocrat Albert Gallatin, plonked into the backwoods of Pennsylvania only to be relentlessly pursued by his arch enemy General Alexander Hamilton, ends in 1804 when Hamilton is killed in a duel by the Vice President of the United States, Aaron Burr.

Act 1. Ex-Senator Gallatin.

Aged 33, Gallatin was young to be a U.S. Senator, but his Swiss background in finance made him one of only five or six Americans who knew anything about banks. Unfortunately, his passionate Swiss frugality immediately made him the arch enemy of Secretary of the Treasury Alexander Hamilton who wanted to combine state debts from the Revolutionary War into a national debt. This thorn in Hamilton's side was removed by evicting Gallatin from the Senate on the grounds that he had not been a citizen for the ten years required by the Constitution. Unfortunately, that was true. It was nevertheless galling that Robert Morris, the other Pennsylvania Senator, would vote against him. The humiliation of being forced to leave Philadelphia and ride horseback to his home in Fayette County, right on the Indian frontier among the semi-barbarian Scotch Irish, was extreme.

Act 2. Caught in the Middle.

When Gallatin arrived home in the backwoods, the incensed local farmers instantly rallied around him as the perfect leader of a rebellion they wanted to start. A four-year war with the Indians in nearby Ohio had shut off all hope of marketing their grain to the West, and the Allegheny Mountains made it unprofitable to ship it to the East. Their response was to distill it into whiskey, which would not spoil with storage, and was more compact to transport. Assisted in part by Quakers' horror at selling whiskey to the Indians, Hamilton had pushed through a tax on whiskey which rendered it impractical to make it at all. Gallatin was already Hamilton's enemy, and Gallatin the European knew how to talk to those swells in the East. Gallatin did make rousing speeches about injustice but always cautioned the wild men to behave peacefully. That wasn't exactly what the angry farmers wanted, so Gallatin soon became the enemy of both sides of the dispute when the western Pennsylvanians organized a rebellion. Both sides made threats to assassinate him.

Act 3. The Lion Roars

President George Washington didn't know much about banks or taxes, but he knew a lot about law and order, and he wasn't having any rebellions. Ordering up an army of fifteen thousand men, he and General Hamilton led it across the state of Pennsylvania to hang 'em. Meanwhile, however, General "Mad" Anthony Wayne had defeated the Indians along the Miami River in Ohio, thus removing the main reason for whiskey manufacture, and finally proving to the anti-Constitution Jeffersonians that the federal government really was a useful thing to have. Washington dropped out at Bedford and went back to running the country, allowing the relentless Hamilton to charge forward to Pittsburgh. By that time, the farmers had pretty well dispersed, but to Hamilton they were traitors and that particularly included Gallatin.

Act 4. Local Hero

Two ringleaders were convicted of treason, everyone was threatened and interrogated. Hamilton was particularly anxious to include Gallatin in the net, but no one in that frontier culture would accuse Gallatin of participating in the call to violence or testify to any treasonous speech by him. In the midst of the uproar, Washington rose to the occasion and pardoned them all. Every last one of them.

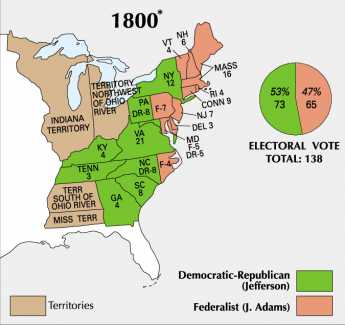

Act 5. Secretary Gallatin

In a surge of jubilation, western Pennsylvania elected Gallatin as their congressman, sending him back to Philadelphia where he could do them some good. And indeed he quickly assaulted all of Hamilton's policies, both good and bad, as well as just about every other Federalist program. He quickly rose to the effective leadership of Congress and swung the crucial 1800 election from Aaron Burr to Thomas Jefferson. Since Jefferson was another Virginia Cavalier who knew nothing about finance, it was a foregone conclusion that President Jefferson would appoint Gallatin to be Secretary of the Treasury. Finally, in 1804 Burr removed Hamilton from public affairs on the flats of Weehawken. At the news of the death of his enemy, Gallatin shed not a tear. His memorial was the statement that "a majority of both parties seemed disposed.....to deify Hamilton and to treat Burr as a murderer. The duel, for a duel, was certainly fair."

Gallatin Part II

Act 1 Gallatin Triumphantly Returns to Congress.

When Washington pardoned the Whiskey Rebels, Gallatin was immediately elected to Congress. It was his payback time for Hamilton and all his works. The desperate Federalists tried to oust him a second time with a Constitutional Amendment, which failed before the force of Gallatin's oratory. Gallatin then threw his influence behind Jefferson's deadlocked congressional contest with Aaron Burr, electing Jefferson and earning his own reward as Secretary of the Treasury. Although elected Vice President, Burr's fury is turned against Hamilton, foreshadowing the coming duel.

Act 2 The Virtuoso Financier.

Jefferson proves hopeless in domestic affairs, so Gallatin essentially takes over that role, just as Hamilton had taken over from Washington, who was another Virginia cavalier adrift in these matters. Gallatin promptly repealed the whiskey tax, cut government expenses, in particular, the million dollars annual tribute to the Barbary pirates, and almost performed magic in financing the Louisiana Purchase together with Stephen Girard and William Bingham.

Act 3 Burr Kills Hamilton

After his Vice President kills the leader of the opposition party, Jefferson's party was on the political defensive. But not Gallatin, who spits out his famous remark, "A majority of both parties seem disposed to deify Hamilton and treat Burr as a murderer. The duel, for a duel, was certainly fair." It is an all-time low moment in the politics of the young nation.

Act 4 Diplomacy or War?

As the Napoleonic wars engulf the whole world, both England and France harass our merchant ships, and cries go up for war. Partly out of a desire to annex Canada in the process, Gallatin sneers at proposals to restrain the fighting Europeans with mere sanctions. His prediction proves dismayingly correct that nothing would come of it except to make our own citizens into smugglers.

Act 5 War It Is.

The First Bank's charter was to expire in 1811, and the bank closed, creating an opportunity for Girard to buy it out and finance the coming war himself. Gallatin was desperate to end the war as quickly as possible, especially after the British burned Washington. To speed matters up, Gallatin took a leave of absence and went off to the peace conference in St. Petersburg himself.

Epilogue in front of the curtain.

Gallatin finally announces his resignation from the longest term of Treasury Secretary in our history. He is seventy years old, three scores and ten. Rather than play golf, he was to spend the last eighteen years of his life in three more careers. As a diplomat, he negotiated both our permanent northern and southern borders. As an academic, he founded the discipline of ethnology with the study of native Indian languages, meanwhile founding New York University. And as a banker, he founded a bank which has since evolved into JPMorgan Chase. After all, a man has to find something to keep himself busy.

Virginia Invades Pennsylvania

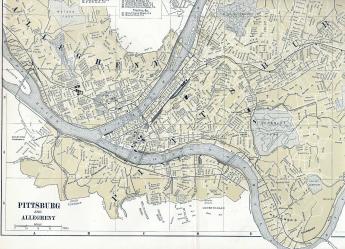

|

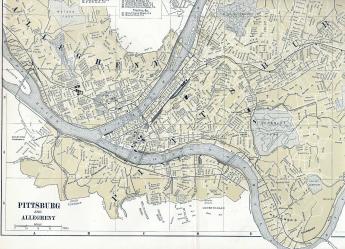

| Map of Pittsburg |

Pittsburgh is situated at a water gap, where a prehistoric North-South river broke through the mountain to the West. Thus, the southerly Monongahela river joined the northerly Allegheny to form the Ohio river at the "Golden Triangle". Virginian explorers saw the Monongahela as their path to the mid-West, the French in Canada saw the Allegheny as their path from the Great Lakes to the Mississippi, while William Penn had an awkward charter saying he owned the whole territory. To make matters worse, the region was largely settled by semi-barbarian Scotch-Irish squatters, while the equally fierce Indian tribes were pretty outraged by the white men. Benjamin Franklin added his bit to uproar by buying the territory from the Iroquois at the 1754 Albany Conference, when it belonged to the Delaware tribe, who promptly became the main exterminators of General Braddock's army. Lord Dunmore also bought the Ohio territory from the Iroquois, in spite of the fact that it traditionally belonged to the Shawnees. The whole region was a seething cauldron of massacres and assassinations, betrayals and vengeance. Not exactly a place to welcome pacifist Quaker governance.

|

| Young George Washington |

It would be interesting to know George Washington's later thoughts about this region since he was the young officer who started the French and Indian War in 1753. The Governor of Virginia had learned the French were fortifying Fort Duquesne at the forks of the Ohio and sent Washington to warn them to desist. He barely escaped with his life, and soon accompanied General Braddock's English troops to their own disaster in 1755. In 1758 the British sent General Forbes with a British army to wipe out Fort Duquesne, which he did, establishing Fort Pitt on the ashes. Fort Pitt somehow remained under the control of -- Virginia -- until 1777.

|

| Delaware River |

The Penn proprietors were vigilant, but patient when they had to be. Presumably through influence with the British crown, the Penns gave their consent to the Forbes expedition only on condition their ownership rights were recognized. Their argument was a difficult one to maintain in the face of military realities, since their charter read that the western boundary of Pennsylvania was to be five degrees west of the Delaware River, a rather vague concept in the wilderness of Appalachia. It was maintained that such a boundary would naturally parallel the twists and turns of the Delaware, at a distance of several hundred miles west. Such a preposterous boundary was soon abandoned for the cubist idea of several straight lines with bends at major levels of the Delaware River. With all disputants rather befuddled, it was finally established that any possible variation of language and interpretation would still put the boundary at least six miles west of the forks of the Ohio. Seeing the main point of the sophistry was lost in any event, Virginia gave up.

It might be possible to be sympathetic with Virginia's claim, except for Lord Dunmore the Governor. After all, Virginia had shed blood for the area, surveyed it, built roads, and persuaded the British Ministry to support them militarily. The Pennsylvanians only had a piece of parchment, carelessly engraved with an unworkable depiction of vague boundaries in the woods which totally ignored the most important natural landmark. But Lord Dunmore was too clever by half.

It would appear that his scheme was to make the region uninhabitable by stirring up the Indians and settlers into ferocious massacres. With these competing claims eliminated, it would be far easier to negotiate with other competitive claimants. Virginia was by far the largest of the thirteen colonies, and Pennsylvania was notoriously the most unwilling to meet force with force. It would be interesting to see studies of the inside pressures and negotiations which eventually made Virginia back off. But it seems safe to believe that the necessity for the colonies to unite in their common struggle for independence was in one form or another, the definitive force.

At any rate, at the end of a long career, in 1794 President George Washington personally led an army into Pennsylvania's Appalachia to suppress the Whiskey Rebellion at a town called Monongahela. It would be immensely revealing to know what his thoughts and reflections were, as he jiggled along on his horse.

Designing the Convention

|

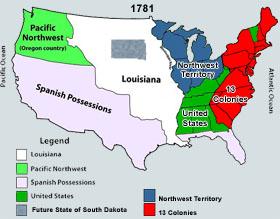

| The Convention and the Continent |

THE prevailing notion of the Constitutional Convention once depicted James Madison as seized with the idea of a merger of former colonies into a nation, subsequently selling that concept to George Washington. The General, by this account, was known to be humiliated by the way the Continental Congress mistreated his troops with worthless pay. But recent scholarship emphasizes that Washington noticed Madison in Congress becoming impassioned for raising taxes to pay the troops, was pleased, and reached out to the younger man as his agent. Madison seemed a skillful legislator; many other patriots had been disappointed with the government they had sacrificed to create, but Madison actually led protests within Congress itself. A full generation younger than the General and not at all charismatic, Madison's political effectiveness particularly attracted Washington's attention to him as a skillful manager of committees and legislatures. Washington was upset by Shay's Rebellion in western Massachusetts, which threatened to topple the Massachusetts government, but Shay's frontier disorder was only one example of general restlessness. There was a long background of repeated Indian rebellions in the southern region between Tennessee and Florida, coupled with uneasiness about what France and England were still planning to do to each other in North America. It looked to Washington as though the Articles of Confederation had left the new nation unable to maintain order along thousands of miles of the western frontier. The British clearly seemed reluctant to give up their frontier forts as agreed by the Treaty of Paris, and very likely they were arming and agitating their former Indian allies. Innately rebellious Scotch-Irish, the dominant new settlers of the frontier, were threatening to set up their own government if the American one was too feeble to defend them from the Indians. The Indians for their part were coming to recognize that the former colonies were too weak to keep their promises. With the American Army scattered and nursing its grievances, the sacrifices of eight years of war looked to be in peril.

The Union is much older than the Constitution. It was formed, in fact, by the Articles of Association in 1774. It was matured and continued by the Declaration of Independence in 1776. It was further matured ... by the Articles of Confederation in 1778. And finally, in 1787, one of the declared objects for ordaining and establishing the Constitution was "to form a more perfect Union.

|

| A.Lincoln, First Inaugural |

Even Washington's loyal friends were getting out of hand; Alexander Hamilton and Robert Morris had cooked up the Newburgh cabal, hoping to provoke a military coup -- and a monarchy. Because they surely wanted Washington to be the new King, he could not exactly hate them for it. But it was not at all what he had in mind, and they were too prominent to be ignored. So he had to turn away from his closest advisers toward someone of ability but less stature and thus more likely to be obedient. It alarmed Washington that republican government might be discredited, leaving only a choice between a King and anarchy. Particularly when he reviewed shabby behavior becoming characteristic of state legislatures, something had to be done about a system which proclaimed states to be the ultimate source of sovereignty. Washington decided to get matters started, using Madison as his agent. If things went badly he could save his own prestige for other proposals, and Madison could scarcely defy him as Hamilton surely would. Washington could not afford to lose the support of the two Morrises, and still, expect to accomplish anything major. Madison had been to college and could fill in some of the details; Washington merely knew he wanted a stable government and he did not, he definitely did not, want a king. Many have since asked why he renounced being King so violently; it seems likely he was projecting a public rejection of the Hamilton/Morris concept in a way that did not attack them for proposing it. It was a somewhat awkward maneuver, and to some degree, it backfired and trapped him. But Madison proved a good choice for the role, and things worked out reasonably well for the first few years.

The powers delegated by the proposed Constitution to the Federal Government are few and defined. Those which are to remain in the State Governments are numerous and indefinite.

|

| J.Madison, Federalist#45 |

Madison was young, vigorous and effective; he held the widespread perception of the Articles of Confederation as the source of the difficulty, and he was a reasonably close neighbor. He was active in Virginia politics at a time when Virginia held defensible claims to what would eventually become nine states. Negotiations for the Northwest Ordinance of 1787 would be going on while the Constitutional Convention was in session, and Virginia was central to both discussions. After conversations at Mount Vernon, a plan was devised and put into action. Washington wanted a central government, strong enough to energize the new nation, but stopping short of a monarchy or military dictatorship. There were other things to expect from a good central government, but it was not initially useful to provoke quarrels. Madison had read many books, knew about details. Between them, these two friendly schemers narrowly convinced the country to go along. As things turned out, issues set aside for later eventually destroyed the friendship between Washington and Madison. Worse still, after seventy years the poorly resolved conflict between national unity and local independence provoked a civil war. Even for a century after that, periodic re-argument of which powers needed to revert to the states, which ones needed to migrate further toward central control, continued to roil a deliberately divided governance.

|

| Constitutional Convention |

For immediate purposes, the central problem for the Virginia collaborators was to persuade thirteen state legislatures to give up power for the common good. The Articles of Confederation required unanimous consent of the states for amendment. To pay lip-service to this obstacle, it would be useful to convene a small Constitutional Convention of newly-selected but eminent delegates, rather than face dozens of amendments tip-toeing through the Articles of Confederation, avoiding innumerable traps set by the more numerous Legislatures. In writing the Articles of Confederation, John Dickinson had been a loyal, skillful lawyer acting for his clients. They said Make it Perpetual, and he nearly succeeded. The chosen approach to modification was first to empower eminent leaders without political ambitions and thus, more willing to consent to the loss of power at a local level. Eventual ratification of the final result by the legislatures was definitely unavoidable, but to seek that consent at the end of a process was far preferable because the conciliations could be offered alongside the bitter pills. Divided and quarrelsome states would be at a disadvantage in resisting a finished document which had already anticipated and defused legitimate objections and was the handiwork of a blue-ribbon convention of prominent citizens and heroes. By this strategy, Washington and Madison took advantage of the sad fact that legislatures revert toward mediocrity, as eminent citizens experience its monotonous routine and decline to participate further in it, but will make the required effort for briefly glamorous adventures. Eminently successful citizens are somewhat over-qualified for the job, whose difficulties lesser time-servers are therefore motivated to exaggerate. To use modern parlance, framing the debate sometimes requires changing the debaters. In fact, although he had mainly initiated the movement, Washington refused to participate or endorse it publicly until he was confident the convention would be composed of the most prominent men of the nation. This venture had to be successful, or else he would save his prestige for something with more promise. Making it all work was a task for Madison and Hamilton, who would be replaced if it failed.

|

| John Dickinson |

While details were better left hazy, the broad outline of a new proposal had to appeal to almost everyone. Since the new Constitution was intended to shift power from the states to the national government, it was vital for voting power in the national legislature to reflect districts of equal population size, selected directly by popular elections. That was what the Articles of Confederation prescribed. But no appointments by state legislatures, please. In the convention, it became evident that small states would fear being controlled by large ones through almost any arrangement at all. On the other hand, small states were particularly anxious to be defended by a strong national army and navy, which requires a large population size. England, France, and Spain were stated to be the main fear, but small states feared big neighboring states, too. Since the Constitutional convention voted as states, small states were already in the strongest voting position they could ever expect, particularly since the Federalists at the convention needed their votes. Eventually, the agreement was found for the bicameral compromise suggested by John Dickinson of Delaware, which consisted of a Senate selected and presumably voting as states, and a House of Representatives elected in proportion to population; with all bills requiring the concurrence of both houses. From the perspective of two centuries later, we can see that allowing state legislatures to redraw congressional districts gives them the power to "Gerrymander" their election outcomes and hence restores to the populous states some of the internal Congressional power Washington and Madison were trying to take away from them. In the 21st Century, New Jersey is an example among a number of states where it can fairly be said that the decennial redistricting of congressional borders accurately predicts the congressional elections for the following ten years. The congressional seniority system then solidifies the power of local political machines over the core of Congressional politics. However, the irony emerges that Gerrymandering is impossible in the Senate, and hence legislature control over their U.S. Senators has been weak ever since the 17th Amendment established senatorial election by popular vote. That's eventually the opposite of the result originally conceded by the Constitutional Convention, but possibly in accord with the wishes of the Federalists who dominated it.

|

| Electoral College Method for Election of the President |

This evolving arrangement of the national legislative bodies seemed in 1787 an improvement over the system for state legislatures because the Federalists believed larger legislatures would contain less corruption because they had more competing for special interests to complain about it. There were skeptics then as now, who wished to weaken the tyranny of the majority so evident in the large states and in the British parliament. To satisfy them, power was redistributed to the executive and judicial branches, which were intentionally selected differently. Here arises the source of the Electoral College for the election of the President. It gives greater weight to small states (and provokes a ruckus among large states whenever the national popular vote is close). Further balance in the bargaining was sought by lifetime appointments to the Judiciary, following selection by the President with the concurrence of the Senate. Without any anticipation in this early bargaining, an unexpectedly large executive bureaucracy promptly flourished under the control of the chief executive, lacking the republicanism so fervently sought by the founders everywhere else. This may be in harmony with the Federalist goal of removing patronage from legislature control, but Appropriations Committee chairmen have since found unofficial ways to assert pressure on the bureaucracy. It's quite an unbalanced expedient. Only in the case of the Defense Department is the balancing will of the Constitutional Convention made clear: the President is commander in chief, only Congress can declare war. Although this difficult process was meant to discourage wars, it mainly discouraged the declaration of wars; other evasions emerged. From placing the command under an elected President, emerges a stronger implicit emphasis on civilian control of the military, loosely linked to the fairly meaningless legislative approval of initiating warfare. There have been more armed conflicts than "declarations" of war, but no one can say how many there might otherwise have been. And there have been no examples of a Congress rejecting a President's urging for war.

And that's about it for what we might call the first phase of the Constitution or the Articles. In 1787 there arose a prevalent feeling that national laws should pre-empt state laws. In view of the need to get state legislatures to ratify the document however, this was withdrawn. The Constitution was designed to take as much power away from the states as could be taken without provoking them into refusing to ratify it. Since ratification did barely squeak through after huge exertions by the Federalists, the Constitution closely approaches the tolerable limit, and cannot be criticized for going any further. Since no other voluntary federation has gone even this far in the subsequent two hundred years, the margin between what is workable and what is achievable must be very narrow. Notice, however, the considerable difference between Congress having the power to overrule any state law, and declaring that any state law which conflicts with Federal law is invalid.

The details of this government structure were spelled out in detail in Sections I through IV. However, just to be sure, Section VI sums it all up in trenchant prose:

This Constitution, and the laws of the United States which shall be made in pursuance thereof; and all treaties made, or which shall be made, under the authority of the United States, shall be the supreme law of the land; and the judges in every state shall be bound thereby, anything in the Constitution or laws of any State to the contrary notwithstanding. The Senators and Representatives before mentioned, and the members of the several state legislatures, and all executive and judicial officers, both of the United States and of the several states, shall be bound by oath or affirmation, to support this Constitution; but no religious test shall ever be required as a qualification to any office or public trust under the United States.

Except for some housekeeping details, the structural Constitution ends here and can still be admired as sparse and concise. That final phrase about religious tests for office sounds like a strange afterthought, but in fact, its position and lack of any possible ambiguity serve to remind the nation of grim experience that only religion has caused more problems than factionalism. Madison was particularly strong on this point, having in mind the undue influence the Anglican Church exerted as the established religion of Virginia. There are no qualifications; religion is not to have any part of government power or policy. By tradition, symbolism has not been prohibited. But government as an extension of religion is emphatically excluded, as is religion as an agency of government. Many failures of governments, past and present, can be traced to an irresolution to summon up this degree of emphasis about a principle too absolute to tolerate wordiness.

Constitutionality of the Monetary System

|

| The Constitution |

In noting that our Constitution has lasted for over two centuries, we assert that this simple short document has largely anticipated everything important to anticipate, including the Industrial Revolution, atomic warfare, and the Information Age, to name a few. When an occasional issue arises that is not only unmentioned in the Constitution but where no one is certain what to do, our system leaves us spiritually adrift. Such an issue is found in o0ur monetary system, where we have been wandering for two hundred years.

The founding fathers worried a great deal that popular majorities would abuse minorities, particularly in the case of the majority poor people voting themselves the property of minority rich ones, or that debtors in the majority might dishonor the rights of creditors. Although we have developed a welter of laws about debt and creditors, bankruptcy and taxation, they are if anything too specific. What is lacking is a few general words in the Constitution about the principles of credit and money. The problem now is the same as it was in 1787; we don't know what to say.

|

| Albert Gallatin |

For a very long time, some very well educated people were strongly opposed to the creation of a bank, later to mean a banking system. Alexander Hamilton's proposition that a "national debt is a national treasure" was greeted with horror by several Presidents, as well as by Albert Gallatin, one of the most sophisticated financial thinkers of the time. Underlying this perplexing reaction to the simple proposal to create a bank was surely the perception that making the Federal Government into a substantial debtor creates a powerful ally to all debtors in their eternal struggle with all creditors; the outcome of such an unequal struggle would inevitably be to the disadvantage of creditors. In common parlance, the word capitalist seems to imply a creditor. It took a very long time for it to become understandable that debtors, too, were essential beneficiaries of a capitalist system, but that idea still often meets with dissent. However, when millions of the world population belong to religions which prohibit the payment of interest, it should not be surprising to find many Americans who cannot get their heads around the idea that debtors and creditors need each other to an equal degree.

In the case of inflation, governments have always been somewhat favorable to debauching the currency. Naturally, a major debtor hopes to repay its debt with cheaper money. Since it has more or less always been necessary to use police powers to maintain a common currency, Kings and governments have long been in control of money, whether that means gold bars or beaded wampum. And for the same length of time, governments have been discovered bending the rules in favor of themselves. Bronze has been substituted for gold, the edges of coins have been shaved, the printing presses print paper money unrestrainedly, and the consumer price index has been manipulated to encourage inflation. Political parties have sought votes from debtors by promising to regulate banks, promote silver as a substitute for gold, disadvantage foreign competitors, inhibit or manipulate the value of the currency on foreign exchanges.

|

| Alan Greenspan |

For forty years we have operated without any fixed standard for money. Money for all that time has lacked any physical representation or discipline. Money has become a computer notation. At first, it was based on calculations of monetary aggregates, a bewildering concept promoted by Milton Friedman. More recently, it is entirely based on inflation targeting as promoted by Alan Greenspan. With a target of maintaining steady prices, an inflation rate of 2% is set as a specific target for the Federal Reserve. If inflation falls below that target, more money is created; if it rises above that level, less money is created. How much there is of it does not matter; it's beyond calculation. Although this simplified description fills almost any listener with doubts, it seemed vindicated by seventeen years without a notable recession. Even though events beginning in 2007 raise pretty serious doubts, it may still prove to be the best possible monetary system.

Even though this most fundamental of all commercial issues cry out for a simple principle to be stated in the Constitution so that neither populist congressmen not rapacious financiers can ruin us, it is not presently possible even to imagine what a new Constitutional amendment would, should or even could say. Meanwhile, some immense power rests in the hands of shadowy figures whom we blindly trust, for lack of a better idea about how we should select them or what we should instruct them to do.

Premature Solutions to the Credit Crisis of 2007

One of the things being said in Academia in 2008 is that the 1929 crash was the result of many futile attempts to preserve the gold standard. That's the first time that particular formulation has surfaced in eighty years. It may not be correct at all, and even if correct it doesn't say what should have been done about it. Life is short and the Art is long, but somebody must do the best he can with the information available. Unemployment was over 30% in those days, and hundreds of Americans froze to death in the Depression because they could not afford to heat their rooms. Right or wrong, there are times when some action must be taken. But if you can possibly sit tight and figure out a sensible thing to do, it's certainly better.

So, we hear proposals from Henry Kaufman to create a separate Federal Reserve for big institutions alone, while others say banking oversight is already too fragmented between the Fed, the Controller of the Currency, the Secretary of the Treasury, the FDIC, state banks and national banks, the SEC, the Bureau of Management and Budget, and on and on. This line of argument takes the formulation that we should regulate mortgages, no matter who is involved in them, rather than banks, on non-bank institutions. On one point everyone is in agreement, that we need more information more quickly, more transparency, less asymmetry of information. At the same time, everyone is aware that it probably will eventually be possible to describe this whole mess on one sheet of paper; the truth is totally hidden by information overload. Don't talk so much; say something.

At the GIC (Global Interdependence Center) recently, a brilliant professor of the Wharton School gave a magnificent summary of the situation, now nine months old, enumerating a number of insights which had not even occurred to an audience of bankers and businessmen. They applauded enthusiastically, and then someone asked how Credit Default Swaps fit into this picture since they had not been mentioned. It immediately became embarrassingly evident that the professor knew almost nothing about that topic beyond a couple of pat sentences. But Credit Default Swaps now total trillions and trillions of dollars, more than doubling in a year. Since they are private transactions unreported to regulators, no one has measured the matter or will divulge what has been measured. But since they represent a volume several time the size of the underlying debt market, and every swapper swaps with someone else, it seems inevitable that huge imbalances exist somewhere. It would be nice to have a general idea out of whose pockets the excesses come, and into whose pockets they go. Maybe all this is irrelevant to the present crisis, but it isn't irrelevant to the distrust and fear in the markets. If someone proposes a law about this situation, he had better have divine guidance.

An example of what causes markets to freeze up because people are afraid to buy, comes from an anonymous person in an elevator. Speeding between floors, he remarked earnestly to a friend, that when he worked for Goldman Sachs his department churned out dozens of innovative debt instruments. If one of them happened to get popular, then and only then did they set about devising ways to measure them, and adjust the prices. It's impossible to stop rumors of this type because they sound so plausible. In fact, they may even be true.

In fact, some of the most incisive comments come from people with no insider information at all. Such as a businessman who listened intently to the lecture and then called out, "Where were the accountants in all this? Aren't they paid to know what is going on?" The answer was that FASB rules should be tightened up. Maybe so, but it sounds a little thin.

The political risk is considerable. Only 6% of the population is old enough to remember 1929 and its aftermath, only 25% more can remember 1973, and 25% more can remember 1991. That means that nearly fifty percent of the public can never remember a severe recession at all. A politician running for office could tell them anything, and they would have no reason to challenge it. Or put it this way: the advisors who elected a young President could tell him anything, and it isn't certain he would fire them for it.

Federal Reserve Changes Its Business Model

Americans generally do not begrudge the success of neighbors; the achievement of someone else takes away nothing from me. In that spirit, we like to see developing countries rise up out of poverty. A more prosperous world is a safer one.

|

| Philadelphia Federal Reserve |

Rising international prosperity can, however, disrupt matters. When developing countries become producers, they can get inflation if they suddenly have more money than they know how to spend. Sudden wealth can come from discovering oil or gold or copper; slowly learning how to manufacture something is a safer way to prosper. Inflation and huge internal income disparities often lead to revolutions, so the wiser countries sterilize local money by exporting it. Coups and dictatorships are what happens if a developing country doesn't export its inflation; sudden wealth gives the appearance of being underserved. Conversely, our recent dot-com and Sunbelt real estate bubbles show what happens to the neighbors if developing-world inflation gets dumped on them. Eventually, of course, developing countries eventually balance their new production with new consumption, and the world settles down to a new balance. Never mind denouncing the rubbish the newly-rich decide to consume; its only problem for others lies in using up the world's resources faster. Developing countries commonly export inflation to other nations in the form of commodity inflation. The neighbors can soon have a commodity bubble on their hands; when any bubble bursts, a sharp recession can quickly follow, and after that, some other kind of bubble appears. What is new and disruptive is not oil or gold or copper; it is too much money.

With luck, these disruptions consequent to a neighbor's prosperity are soon overcome by improvements in productivity. But productivity itself can create a bubble. One huge productivity windfall for America is the astonishing thirty-year extension of longevity we have experienced; in time, we will surely devise occupations for retirees more productive than thirty-year vacations. Such balancing adjustments right now seem most likely to grow out of electronic productivity, using home sites as work sites.

So in short, America must read just like everyone else and one systematic readjustment has just surfaced at the Federal Reserve. The flood of money from China and the Persian Gulf sought an outlet in our economy, adopting the device of shifting American credit sources from banks to Wall Street ("securitization"). Cheap money once derived from bank deposits in local banks; since it now often originates abroad, it now must travel through the "carry" trade and similar innovative channels for foreign surpluses to get to Wall Street investment banks, which in turn distribute the money ("credit") to American businesses which can use it more productively than the developing countries can. Through securitization (turning loans into securities), Wall Street was able to make home mortgages directly, with only token involvement of local banks. Credit markets froze up because the new procedures had neglected to enlist local bankers in the process of checking the credit-worthiness of borrowers. So long as Wall Street can continue to find new sources of cheap money, this upheaval of finance is likely to be permanent because it is desired by both sides. Access to cheaper loans and access to safer investment harmonize the needs of the haves and the have-nots. Because in its haste this new development precipitated a banking crisis, there is some danger that Congress will overreact by prohibiting securitization rather than correcting its flaws. In every participant's eyes, it's cheaper and more efficient, but new efficiency threatens old inefficiencies. This one threatens the old deposit-based banking system, and since the Fed's control of the currency is based on its control over the depository banks, it threatens the Federal Reserve. That's the real driving force behind the Fed seeking control of non-traditional credit sources; that's now where the money is.

On March 16, 2008 things came to a head with the impending collapse of Bear Stearns, a Wall Street investment bank heavily involved in Credit Derivatives. There are rumors the rescue plan implemented over a weekend had actually been devised and held ready long before then. Many imperfections now surface with experience, but at least the plan had likely been explored as thoroughly as logic without direct experience ever allows. For example, the dispersal of manufacturing around the globe favored making pieces of a product and selling them to an assembler, rather than enveloping the whole process of making a product in one giant corporation. It's cheaper, that's why they do it. But the process of buying and selling pieces to other companies greatly expanded the need for short-term credit. Therefore, it was quite unexpected that Lehman Brothers, which specialized in such short-term loans, suddenly went bankrupt for lack of quick access to capital. In the panic, it is unfortunate that Lehman apparently concealed its situation from investors. There is a danger that Congress will draw the wrong moral and somehow block the globalization of manufacture.

The Federal Reserve Act was passed by Congress in 1913, and most observers believe the Fed's inexperience in 1932 repeatedly made matters worse in that formerly greatest of all bank panics. The new plan of 2009, therefore, had to step around some limitations imposed by Congress in the past, the political pressures generated by an impending presidential election, and the powerful resistance from private industries whose future was affected. The adroitness with which such a complex matter was handled over a weekend will surely become legendary, but maybe not soon. Probably because of existing legal roadblocks, three "lending facilities" were created, but a single device was at the heart of it. Instead of lending money, the Federal Reserve offered to swap securities with new non-bank managers of retail credit. The investment banks held massive security for loans which could not be sold in paralyzed markets but could be swapped or used as security for a loan, particularly if the government stood behind the innovative transactions. Wall Street in a word had plenty of wealth, but could not turn it into money fast enough to pay its bills. So sidestepping the legal constraints, instead of giving Investment firms money as a lender of last resort, the Federal Reserve swapped Treasury Bills for the "frozen" assets held as security for mortgage loans. The securities had been "caught in a loan" as the expression goes. There isn't much difference between Treasury bills and cash, or between exchanging bonds and selling them. But the new approach could be quickly and legally accomplished, and once done, the Federal Reserve was the master of investment banks. It became effectively their lender of last resort. A great deal of advance thought must have gone into devising this readjustment to the reality that over half of loans were not backed by bank deposits, but by the securitized debt of foreigners. Regulations will ensue, hearings will be held and laws passed, but the Fed has regained control of the money supply if it can manage to make this maneuver understandable by the public.

There was a moral hazard in this; the presence of a lifeguard tempts swimmers into deeper water. It was somewhat inflationary in the midst of an inflation threat. No doubt the Federal Reserve regards these negatives as prices worth paying, and they probably are. The decisive remaining issue is not whether the initial shape of this transformation is exactly correct; it surely isn't. Just as was true in 1932, what will ultimately matter most will be whether, with this altered stance, the Fed will adjust quickly and appropriately to future difficulties. And whether politicians will even permit it to do the right thing, assuming anybody then knows what the right thing might be.

www.Philadelphia-Reflections.com/blog/1465.htm

Azilum: French Asylum on the Susquehanna

Off with their heads!, she said. They have refused my cake in preference of moldy bread, by God"

Morris Upended by a Nobody

THE Revolutionary War ended militarily with the Battle of Yorktown in 1781, and diplomatically with the Treaty of Paris in 1783. The careers of Washington and Franklin appeared to be complete, while the economic and financial career of Robert Morris seemed likely to stretch for decades into the future. But as matters actually turned out for these three fast friends, it was Washington who was propelled into a new political career, Franklin soon died, and Morris got himself into a career-ending mess. The financial complexity and economic power of the United States did grow massively in the next several decades, but unfortunately, Robert Morris was soon unable to exert any leadership. At the end of Washington's eight years as President, the power of the Federalists, and particularly the three men most central to it, was coming to a close. John Adams had a tempestuous single term, and then Federalism was all over.

|

| Robert Morris |

The end of the Eighteenth century marked the end of The Enlightenment and the beginning of the Industrial Revolution, accompanied by many national revolutions, not just the American one. This was a major turning point for world history. The momentum of these upheavals still continues, but it is clear that the Industrial Revolution of which the Morris banking revolution was an essential part swept the world far faster than the social and political revolution, in which he also played a pivotal role. In the banking and industrial revolution, it is universally agreed that Morris was almost always right. In the social and political world, it is conversely agreed he was quite wrong. Essentially, Morris assumed that a small minority, an aristocracy of some sort, would rule any country. Within weeks of the ratification of the new Constitution, or even somewhat in anticipation of it, America made it clear that replacing an aristocracy of inheritance with an aristocracy of merit would not satisfy the need. Morris, born illegitimate and soon an orphan, was obviously in favor of promotion based on merit. John Adams defined leadership even more narrowly; he said a gentleman was a man who went to college, and he probably meant Harvard. Nobody extended the leadership class to include Indians and slaves, but the backwoodsmen of Appalachia made it clear that power and leadership at least included them. Thomas Jefferson was the visible leader of this expansion of the franchise, but changed his mind several times. James Madison switched sides; Thomas Paine switched in the opposite direction. The leaders of Shay's Rebellion and the Whiskey Rebellion lacked coherence and consistency on this point; instead of agitating for a refined goal, they mostly seemed to be running around looking for a leader. William Findlay, on the other hand, knew what he wanted. The issue might be defined as follows: it was obvious that hereditary aristocracy was too small and too inflexible to suffice, but it was also obvious that every man a king was too inclusive. An expanded leadership class was needed, but its boundaries were indistinct and contentious. But to return to Findlay, who at least had a clear idea of what he wanted.

|

| William Findlay |

William Findlay was a member representing Western Pennsylvania in the State Legislature, in 1785. It would be difficult to claim any notable accomplishment in his life; he was largely uneducated. The new leadership class must, therefore, include both the uneducated and the mediocre. The Legislature at that time met in the State House, Independence Hall, in Philadelphia, where no doubt the unconventional dress and manners of backwoodsmen did not pass without audible comment. Findlay made his own political goals quite explicit; he was for paper money to facilitate land speculation which could make him rich. Wealth was a goal, but it did not confer distinction. The rights of the Indians, the rights of the descendants of William Penn, the rights of the educated class and the preservation of property were all just obstacles in the way of an ambitious man who had carefully studied the rules. Everybody's vote was as good as everybody else's, and if you shrewdly controlled a majority of them, you could do as you please. If this meat-ax approach had any rational justification, it lay in the essential selfishness of every single member of the Legislature, working as hard as he could to further his own interest. If someone controlled a majority of such votes, then the majority of the public were declaring in favor of the outcome. Those who believed in good government and the public interest were saps; the refinements of education mostly just created hypocritical liars. There was a strain of Calvinism in all this and a very large dose of Adam Smith's hidden hand of the marketplace. If you were rich, it was proof that God loved you, if you were poor, God must not think much of you, or He wouldn't have made you poor. Findlay had the votes and meant to become rich; if his opponents didn't have the votes, they could expect soon to be poor. In this particular case, the vote coming up was a motion to renew the charter of the Bank of North America. Findlay wanted it to die.

|

| America's first bank, the Bank of Pennsylvania |

It came down to a personal debate between Findlay, and Robert Morris. Morris had conceived and created America's first bank, the Bank of Pennsylvania. Today it would be called a bond fund, with Morris and a few of his friends put up their own money to act as leverage for loans to run the Revolutionary War. After a short time, it occurred to Morris that the money in a bank could be expanded by accepting interest-bearing public deposits and making small loans at a higher interest rate, which is the way most banks operate today. Accordingly, a new bank called the Bank of North America was chartered to serve this function, which greatly assisted in winning the Revolutionary War. There was no banking act or general law of corporations; each corporation had its individual charter, specifying what it could do and how it would be supervised. When the charter came up for renewal, Findlay saw his chance to kill it. Morris, of course, defended it, pointing out the great value to the nation of promoting commerce and maintaining a stable currency. The reply was immediate. Morris had his own money invested in the bank and only wanted to profit from it at the public expense. His protests about the good of commerce and the public interest in stable money were simply cloaking for this rich man's greed to make more money. Findlay made no secret of his interest in reverting to state-authorized paper money, which could then be used by the well-connected to buy vast lands in Ohio for speculation. There were enough other legislators present who could see welcome advantages, and by a small majority the charter was defeated.

|

| John Hancock |

At this point, Morris made a staggering mistake. After all, he was a simple man of no great background, largely uneducated but fortified by his ascent in society from waterfront apprentice to the highest of social positions, a friend of George Washington and Benjamin Franklin, acclaimed as a financial genius, the man who saved the Revolution, very likely the richest man in America. For many years, he had harbored not the slightest doubt of his personal genius, his absolute honesty, and total dedication to the welfare of his country. To have this reputation and accomplishment sneered at by a worthless backwoodsman, a man who would stoop to using the votes of other backwoodsmen to accomplish self-enrichment, was intolerable. Morris announced and actually did sell out his entire business interest as a merchant, at a moment when he fully understood the new nation was about to enjoy an unprecedented post-war boom. So much for his self-interest. It helps to understand that John Hancock and Henry Laurens had done the same thing in Boston and Charleston, against what we now see as a strange aristocratic tradition of prejudice against bankers and businessmen. In even the few shreds of aristocracy now surviving in Britain and Europe, the tradition persists that a true aristocrat is so independently wealthy that no self-interested temptations can attract him away from purest attention to the public good. The original source of this wealth was the King, who conferred high favor on those who served the nation well. A curious exception was made for wealth in the form of land, the only dependable store of tangible wealth, and transactions in land. Wealth was something which came from God and the King in return for public service. Land ownership was its tangible storage and transfer medium. Otherwise, grubbing around with trade and manufacture was beneath the dignity of a true gentleman.

|

| Henry Laurens |

We now know what was coming. Wealth was soon to be the reward of skill and merit, recognized by fellow citizens in the marketplace, by consensus. Findlay and his friends wholly accepted this conclusion, unfortunately skipping the merit part of it for several decades. In their view, you were entitled to the money if you had the votes. As the nation gradually recognized that rewards must be durable, and once granted were yours to have and to hold, the new nation gradually came to see the need for durable ownership of property. Unless or until the owner places it out at risk in the marketplace, legislative votes may not affect its ownership. Our system ever since has rested on the three pillars of meritorious effort, assessment of value by the free market, and respect for pre-existing property. That's quite a change from the Divine Right of Kings, and therefore quite enough material to keep two political parties agitated for a couple of centuries. And quite enough change to bewilder even so brilliant a victim as Robert Morris.

Funding the National Debt

|

| Alexander Hamilton |

Although Alexander Hamilton's arresting slogan that "A national debt is a national treasure" has diverted attention to the underlying idea toward him, Robert Morris had introduced and argued for the same insight in the preamble to his 1785 "Statement of Accounts". The key sentence was, "The payment of debts may indeed be expensive, but it is infinitely more expensive to withhold payment." This fatherly-sounding advice was surely a distillation of a long life as a merchant, and the gist of it may have been passed down to him as an apprentice. Failure to pay your debts promptly and cheerfully results in the world assigning a higher interest rate to your future credit; it is not long before compounded interest begins to drag you down. It doesn't exactly say that, but that's what it means.

|

| Liberty Bond |

Another way of looking at this folk wisdom is that it leads to a simplified method of organizing the finances of an organization. Because higher rates of interest are demanded of long-term borrowing than short-term, it becomes efficient to segregate them. That is, to establish a cash account for every-day transactions, and a separate bond account for a long term, or capital, debt. As bills arrive, they need only be verified for accuracy and sent for payment from either a cash account or a capital account. The original responsibility for agreeing to such debts lies with top management, not the treasurer. The job of the treasurer's office is to pay legitimate bills as quickly and cheerfully as possible, ignoring any imprudence of earlier agreeing to them; rewards will come from lower interest charges and improved credit rating. An unexpected benefit of thus organizing institutions and governments is to make the accounting profession possible. Accountants perform the same function in every business, whether the business is selling battleships or parsnips. The accounting profession made itself computer-ready, two hundred years before the computer was invented.

|

| Robert Morris |

In the same document, the retiring national Financier was advising the wisdom of "funding" the war debts, which were largely owed to France, with whom relations were rapidly souring. Lump them all together into a fund, issue bonds and sell them as representations of the nation's capital at the time of issue. Disregard what the money was used for, by either the debtor or the creditor. In spite of appearances, money sequestered in a fund for later payment belongs to the creditor the moment it is promised, not the moment it is transferred. Morris and Hamilton discovered that the fund itself had the property of a bank, in creating money. As long as the creditor did not cash your bonds, he could use them as money, in effect doubling the amount of money you yourself can spend. It was this discovery which so exhilarated Alexander Hamilton, causing him to over-praise the methodology to an already suspicious Congress. Tending toward the teachings of Shakespeare's Polonius, Hamilton's excitable manner caused them to remember, neither a borrower nor a lender is. But Congress was eventually persuaded. The federal government lumped the states' debts together in an "assumption of debts" , consolidated all these various little debts into a single "funded debt", and made the deal work with changing the "residency" of the nation's capital from Philadelphia to the banks of the Potomac. It was called the Great Compromise of 1790.

Morris well understood that a funded system requires some final payor of last resort. Such a payor need set aside only a small portion of the debt for dire contingencies, but his name gets first attention on the list presented to prospective creditors. In 1778 Morris had offered his own personal wealth as that last resort, which the public at the time trusted far more than the Treasury of the United States. Over the next twenty years, he came to realize that the last resort of established nations, no matter what the paper said, was the aggregate underlying wealth of the whole nation. With a vast continent stretching to the West, and countless immigrants clamoring to join from the East, the wealth supporting the debt of the United States in 1790 seemed endless. After two hundred years we have finally begun to accumulate a national debt which equals our Gross Domestic Product, and have only begun to pull back as we observe what happens to other nations who got to that point sooner. Let's hope devising an automatic check and balance does not require a second Robert Morris. Men like him can be hard to find, so limit your debts -- or your nation's debts -- to sixty percent of your assets. Financial geniuses are invited to devise a better debt limit, if they can.

Bonds--Do They Have A Future?

|

| Relic of the Past? |

EVER since we finally went off the gold standard completely during the Nixon Administration, the Federal Reserve has adjusted our money supply to create a fairly steady 2% inflation. If inflation is ever less than 2%, the Fed puts more money into circulation. Since many bonds are paying less than a 2% dividend, everybody who buys and holds them at par will lose money in "real" terms. That is, everyone who buys bonds when they are issued and sells them when they mature will lose spending power. Since they fluctuate in the meantime, it is possible for a trader to buy them when they are undervalued by the market. That trader will possibly make money, but only because someone else lost money. Something like that occurred during the recent financial crash bailout, when interest rates declined from 3% to less than 2% but were repurchased by the Fed as "Quantitative Easing", effectively giving speculators a 33% profit at government expense. But that doesn't happen often, and just guess who ultimately lost the money the speculators made. There is also that daunting question: when the time comes for the Federal Reserve to disgorge them, just who is going to buy all these cheapened bonds? In Japan, bonds paid a dividend of less than the rate of inflation for more than a decade; it's hard to think of a reason why the same thing could not happen in America. So it's also hard to imagine a reason why buy-and-hold investors should not abandon bonds, perhaps suddenly all at once, at some unknown time in the future. At that point, many of them will resolve never to try that, again. The whole idea is troubling.

It's particularly troubling in view of the lack of success, so far, of TIPS. These vehicles are new; perhaps the algorithm is set to ignore minor inflation and will over-respond to more major inflation, ultimately rewarding those who buy them. But at least so far, they are a disappointment. Furthermore, TIPS are quite cleverly designed to be inflation-protected, while unfortunately inflation usually does not follow a straight line but is volatile, or saw-toothed; the jury is still out. The jury better hurry up, because all investors look for net income after expenses, which include brokerage costs, taxes, and inflation. A long-term bond might have to pay a dividend approaching 4%, just to emerge with the same net value it started with; after five years of 4%, you could be 20% behind. And yet, the bond market with or without inflation protection is far larger than the stock market and compares in size with all other kinds of market. Who buys them, especially in these huge quantities?

Somebody must maintain statistics which answer this question, but as a guess, the main buyers are insurance companies, endowments, annuities, hedge funds, banks. And foreigners, of course, to whom our follies seem trivial compared with their own. The great argument for bonds is the safety of principal, and although safety is in question anywhere there is inflation when the topic is cash flow, safety is definitely an issue. Cash shortages are what cause bankruptcies, which are mainly useful in providing time to liquidate underlying wealth to pay restless creditors. The management of a non-profit organization must meet its payroll out of cash flow, so non-profits protect themselves from dissolution by having a regular flow of nominally secure bond dividends. Income from donations and contributions can be particularly weak during times of economic stress. Since most for-profit organizations also experience variable periods of time without profits, their situation does not differ greatly from nonprofits. That's particularly true when a for-profit organization has a vocal, activist stockholder group, who will protest fiercely if the management retains abundant cash. For such a predicament, holding bonds creates safety by some definition. The price of that safety is the long-term average loss on the bond portfolio; the company's alternative losses are whatever it takes to maintain a stable work force during unstable times. The business school assessment of this tradeoff is that bond losses can usually be passed through to the customers as a business cost, while layoffs and strikes may not be.

To restate the characteristics of willing bond purchasers, they are governments and corporations who have no common stock issuance alternatives, but regularly face a need to have money available for payroll. They also include borrowers and lenders at nominal interest rates like banks and insurance companies, who can afford to ignore inflation because their own liabilities are in nominal dollars, or come due at a date certain. And then, there are a host of beneficiaries of special-interest bond provisions, like "Flower bonds", state and municipal governments, foreign aid, student aid, etc. As an overall statement, natural bond buyers are those who either do not possess steady equity (common stock) alternative to offer investors or else are shielded in some way from the inflation and tax costs of buying bonds. Speculators and traders are excluded from the discussion because fixed-income trading is a zero-sum game, something you should teach your children to avoid. Other than these special niche opportunities, bonds should be regarded by the ordinary investor as trading opportunities when interest rates get too high, which is roughly every fifteen years or so.

Things in the bond market were not always so bad; Robert Morris, Jr. was a genius for devising this market in 1784. But the equity market was then not so well developed, life expectancies were shorter, and a minimum 2% inflation was not guaranteed by the Federal Reserve. The income tax had not been invented. It was possible to enjoy the promised benefits of lending in those days, for decades or even lifetimes. It was much harder to find investments of superior performance, without getting involved in business management. Meanwhile, the bond market just got huger and huger. Modifying or dismantling it in logical ways would have enormous disruptive effects. So enormous, the Congress has just adopted the stance called "kicking the can down the road", which is a debt you never seriously intend to repay.

Are we waiting for the bond market, the bond vigilantes, or speculators to find some vital vulnerable flaw, and topple it all into the ashcan of history? Or is there some better plan that no one has mentioned?

Muddle: The War of 1812

|

| H.G. Callaway |

HOWARD Callaway is an old friend and an expert historian of the War of 1812. This is the two hundredth anniversary of that war, so Howard is in demand as a speaker. At a recent meeting of the Right Angle Club, he gave a fascinating recital of his analysis of the reasons for the war, and its subsequent upheavals in American politics. The audience at the Club stayed well beyond the allotted hour to ask questions and finally had to be sent home by the moderator. We will here try to summarize his views fairly.

American impressions of this war come largely from Henry Adams, who wrote a nine-volume history of it, concluding it was a senseless muddle. Henry Adams however, was the grandson of John Quincy Adams, and the great-grandson of John Adams, both of whom were active participants of the event, its causes, or its consequences. He later killed himself, having displayed fugues of depression in his autobiographical Education of Henry Adams. No matter how serene his writing style, you have to be a little careful about the views of such an involved person. New England hated this war almost universally, not a single Federalist congressman or Senator voted for it, and the Federalist political party essentially dissolved as a consequence of it. New England even considered secession. In particular, maritime New England hated the two-year embargo on European trade which Thomas Jefferson had imposed as a measure short of war. Since Jefferson had stripped the Army down to 3000 soldiers and the Navy down to a single ship -- he didn't have many choices. Great Britain at that time had eight hundred ships in its navy. When it came, the war was mainly supported by the more rural South and West of the nation. It was the war of the "republican" political party of Jefferson and Madison, actively demonstrating that Virginia had defeated the Federalists and now would dominate American politics for decades. Regardless of details, the War of 1812 made it clear that New England was not the central essence of America any longer; the rest of the country would not follow its lead.

|

| Henry Adams |