Related Topics

Philadelphia Medicine

The first hospital, the first medical school, the first medical society, and abundant Civil War casualties, all combined to establish the most important medical center in the country. It's still the second largest industry in the city.

Philadelphia Physicians

Philadelphia dominated the medical profession so long that it's hard to distinguish between local traditions and national ones. The distinctive feature is that in Philadelphia you must be a real doctor before you become a mere specialist.

Art in Philadelphia

The history of art, particularly painting and sculpture, has been a long and distinguished one. If you add in the art schools, the Philadelphia national influence on artists has been a dominant one.

Particular Sights to See:Center City

Taxi drivers tell tourists that Center City is a "shining city on a hill". During the Industrial Era, the city almost urbanized out to the county line, and then retreated. Right now, the urban center is surrounded by a semi-deserted ring of former factories.

Touring Philadelphia's Western Regions

Philadelpia County had two hundred farms in 1950, but is now thickly settled in all directions. Western regions along the Schuylkill are still spread out somewhat; with many historic estates.

The Main Line

Like all cities, Philadelphia is filling in and choking up with subdivisions and development, in all directions from the center. The last place to fill up is the Welsh Barony, a tip of which can be said to extend all the way in town to the Art Museum.

Montgomery and Bucks Counties

The Philadelphia metropolitan region has five Pennsylvania counties, four New Jersey counties, one northern county in the state of Delaware. Here are the four Pennsylvania suburban ones.

Philadelphia People

New topic 2017-02-06 20:33:59 description

Albert C. Barnes, M.D.

A private investor has the general goal of accumulating enough wealth so, come what may, there will be a little left when he dies. If he has dependents or heirs, he needs somewhat more. Either way, he is not planning for perpetuity or thinking in astronomical time periods. Albert C. Barnes (1872-1951) had to switch his investment goals, in the 1920s, from investing for a comfortable retirement to investing for a perpetual art foundation. Perpetual.

|

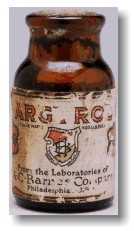

| A bottle of Argyrol |

Having graduated from medical school (University of Pennsylvania) in 1902, and then writing a doctoral thesis in chemistry and pharmacology at the Universities of Berlin and Heidelberg, Barnes invented a patent medicine that quickly made him rich. Argyrol was a mildly effective silver-containing antiseptic with the unfortunate tendency to turn its users permanently slate-gray. The advent of antibiotics has since made Argyrol almost sound like quackery, but it was effective enough at the time to require factories in America, Europe, and Australia, and Barnes became immensely rich with it. The American Medical Association strongly disapproves of physicians who patent remedies, so Barnes was never held in high regard by his colleagues; but it could well be argued that he had as much training as a chemist as a physician, and spent his entire professional life as a chemist, manufacturer, and investor.

|

| The Barnes Gallery |

Barnes was eccentric, all right, but on Wall Street, the saying goes, "What everyone knows, isn't worth knowing." Guided by that principle, in 1929 he sold his company at the very peak of market euphoria, getting out of common stocks at the top of the market. It is small wonder that he soon instructed his Foundation to invest its endowment entirely in bonds. During the 1930s, commodities were extremely cheap because no one had any money. Barnes, of course, had a potful of money and bought hundreds, even thousands, of artworks very cheaply. He also bought 137 acres of Chester County, PA, real estate, and a 12-acre arboretum in Merion Township on the Main Line. Although he is famous for acquiring hundreds of French Impressionist paintings with the advice of Gertrude Stein and her brother Leo, he also bought great quantities of Greek and Roman classical art, African art, and the art of the Pennsylvania German community. He picked up a notable collection of metallic art objects. Most of these "losers" are down in the basement because he had so many Renoirs, Matisse, and Picasso (some of them may be worth $200 million apiece) that the upstairs galleries were pretty well stuffed with them. Viewed from the perspective of an investor with a goal of perpetuity, of course, the things in the basement just happen to be temporarily out of fashion, just like those bonds in the portfolio.

|

| A view inside the Barnes gallery |

Since the Foundation is currently strapped for ready cash, Judge Stanley Ott of the Montgomery County Orphans Court is now being urged to allow the Foundation to break Barnes' will in some way or other. Move the museum to downtown Philadelphia where it can attract more paying visitors. Sell some of that land. Sell some of those paintings in the cellar. Fire some of those employees. But all of these suggestions are short-term solutions, which may injure the long term. Everybody has an idea of what Barnes the rich eccentric would have done if he were alive to do it, but I suspect he would have rejected the whole lot. Barnes the shrewd investor would have taken the most expensive painting off the wall, and sold it to the highest bidder. Buy low, sell high, and the niceties of non-profit professionals are damned. Barnes wasn't in love with one single painting, or one particular school of painterly interpretation, he was in love with Art.

Investment theory has improved in the past fifty years; there have even been some Nobel prizes awarded for new insights. But it still isn't possible to put an investment portfolio on autopilot for perpetuity. Every museum, university, and the foundation has the same problem, with the result that the landscape is littered with the bones of perpetual organizations destroyed by following a fixed formula. With the singular success that Barnes displayed, it isn't surprising that he went a little too far with instructing his successor trustees in what to invest in. Never sell the paintings or the real estate, avoid the common stock, were ideas that worked brilliantly, and may even work most of the time. But sooner or later, the institution will be endangered by following them too literally. Somebody has to have some flexibility. But there is something else that is inevitable, too. Sooner or later, whether it takes fifty years or five hundred years, sooner or later someone will be given the responsibility and the necessary flexibility -- but will try to run off with the boodle, for himself. The balance between necessary prudence and necessary flexibility is impossible to maintain forever, and the Judge will surely have a hard time deciding what Barnes would have decided.

Originally published: Thursday, March 29, 2001; most-recently modified: Monday, May 13, 2019

| Posted by: Fred | Feb 13, 2012 11:33 PM |

| Posted by: SBF | May 21, 2006 9:10 PM |