1 Volumes

Insurance in Philadelphia

Early Philadelphia took a lead in insurance innovation. Some ideas, like life insurance, flourished. Others have faded.

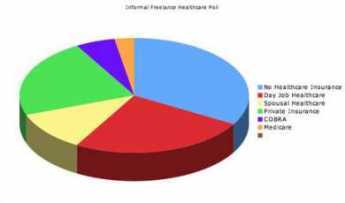

A Fair Plan for Fire Insurance (and Health Insurance, too?)

|

| Penn Mutual |

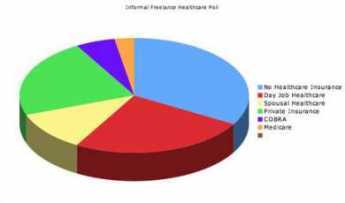

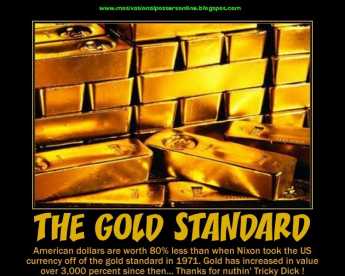

The Fair Plan (sixth and Chestnut, Philadelphia) is a fire insurance company with unusual features. Some day, it is to be hoped some scholar will write a book about the highly mixed motives of the people who created it, compared with the unexpected ways it did or did not fulfill original expectations, of both its creators and its enemies. The Fair Plan only issues fire insurance on houses, if other insurance companies have turned that house down as a bad risk. Such risky houses would normally draw higher premiums for fire insurance, but the Fair Plan insures these risky houses at normal rates. Therefore, it loses money, which is made up by the other regular fire insurance companies in the state in proportion to the business they do, obviously thus raising the price of fire insurance for everybody. But in this way, Pennsylvania guarantees that everybody can get fire insurance. Is this a good idea? Might this be a way to give health insurance to all those people who can't get health insurance? Let's talk about the Fair Plan.

We'll set aside discussion of whether the Fair Plan was a product of cynical politicians pandering for votes, or whether it was a noble gesture for fairness and equality for our poorer citizens. It very likely had elements of both motives in it, but that doesn't matter any more. It's a form of hidden taxation, of course, and it has the result of making Fire Insurance seem more expensive in Pennsylvania than in other places that do their social work with real taxes. Go too far with that, and people will end up buying their insurance in Bermuda instead of boarded-up former fire insurance companies in Pennsylvania.

As the story is now told, the regular insurance companies had a choice of taking the "substandard" applicants in turn ("Assigned Risk") or creating a new company (Joint Underwriting Association). They decided they preferred the JUA. So a company was formed which specializes in nothing but bad risks, including a few arsonists and other unmentionables, but mostly poor people in bad neighborhoods. If we are ever thinking about following the Fair Plan model in health insurance, it would run the risk of being accused of creating a two-class healthcare system. But no one seems to bring up that rhetoric about fire insurance, primarily because there is comparatively little intrusion of politics in the matter, This system is given orders to spread the extra cost of universal fire insurance out to the policy holders of all fire insurance, and it does it very efficiently, without extending its mandate into setting firefighter wages, running fire departments or repainting scorched woodwork. The fundamental decision was whether to spend Society's money this way. Once that decision is taken, the task is to do it efficiently. Notice, this is not compulsory fire insurance; it is compulsory availability of fire insurance.

After the Fair Plan had been running for ten or so years, a funny thing emerged. There were years when the Fair Plan made a profit! The fire insurance industry had absorbed the Fair Plan into their scheme of things, and felt free to increase the number of applicants they rejected, during years when money was tight or business was bad. If you had compulsory availability of fire insurance, the provision of a company which could not refuse an application made it possible for every other company to refuse when it pleased. When the economy encouraged rejection, a better class of applicant came to the Fair Plan, which made the plan more profitable. When economic conditions reversed, this reversed, and the Fair Plan again lost money. For this reason, the insurance industry is very anxious to prevent the Fair Plan from becoming political, or getting tangled up in worthy but extraneous ventures. And that's probably a good model, too, if we are considering adopting a similar system for the health insurance world: stick to your mission.

Since this simple, tested idea never seems to get into the discussion phase of present agonizing over health insurance for the uninsured, it's one clear sign that such discussions at present are not terribly serious.

"New" Health Care Reform, 1965

|

| Lyndon Johnson |

In 1965, Lyndon Johnson caused the enactment of two amendments to the Social Security Act, Titles 18 and 19. Title 18 is now called Medicare (for the elderly), and Title 19 is called Medicaid (for poor people). These two laws were cobbled together as negotiated compromises; the history of this contraption no longer concerns us. The outcome is that Congress created a Federal program for the elderly, and a state-administered program for the poor, partly financed by the states but mostly financed by federal taxes. The states howl that Medicaid is an unfunded mandate, and the Federal bureaucracy snarls that the states are mismanaging someone else's money. The welfare patients are bitter about second-class treatment, and doctors have as little to do with this system as possible. The focus of this article, however, is on the harmful effect of Medicaid on hospitals. Of all the stakeholders affected by Medicaid, the hospitals have historically been the best treated. Nevertheless, it has brought them to the brink of ruin, most of them acknowledge it, and matters are so hopelessly snarled that it is time to call for a transfer of the medical components of Medicaid to Medicare. In plain language, that means replacing state administration with federal Medicare management.

It may seem peculiar to call for extracting the medical components from a medical program. Forty years of creeping modifications in fifty different state directions have resulted in many state Medicaid programs spending more on nursing homes, home care, and various educational programs -- than on the activities of doctors and hospitals as originally intended. After forty years, this creeping mandate shows no sign of abating. It may never abate, but certain parts of it could rather easily be transferred to federal Medicare program, leaving the innovative fringes to fight their own battles with state legislatures, arguing those merits independently of this issue.

From the hospital point of view, Medicaid pays substantially (20-40%) less than the costs it claims to cover. The chiseling is worse in some states than others, but it is hard to find a single state Medicaid program which clearly pays its costs in full. Medicare is pretty tight-fisted, too, but at least a majority of knowledgeable insiders would admit it comes pretty close to paying its audited costs. Everybody else pays more than costs, but for this discussion that is irrelevant. Government as a whole is not paying its fair share, the state-administered portion is responsible, and there was never any non-political justification for having two programs. So, combine them. Other components of Medicaid, however worthy in intent or effect, are the responsibility of the various states which created them. When the states have got non-hospital, non-doctor issues carved out and audited, the merits of federal funding can be examined.

Two other features of the Medicaid mess can be mentioned, so long as they are not allowed to befuddle the main message of program consolidation. In general, the proportion of elderly or poor clients in rural hospitals does not materially differ from the proportion of such clients in urban hospitals. There is institutional variation, of course, but the principal distinguishing feature is that small rural hospital is necessarily semi-monopolies within fifty-mile districts, whereas urban hospitals face competition more directly. State governments, therefore, are unable to impose discounts on rural hospitals with the same leverage and severity. Seeing this, urban hospitals have often applied political pressure on the legislature to extend comparable relief to them. Since local labor and living costs are lower in rural areas, an excuse is created to word regulations and state laws in a way which recognizes parity in the ratio of audited costs to charges rather than the charges or costs themselves. Quite often, hospital accountants can outwit legislatures in these obscurities, leading to rather obscenely high list prices for hospital services, to shift the ratio. Although it has the temporary advantage of further obscuring public market prices for such services, it constitutes a serious injury to uninsured patients. Other persons, who might perceive no personal need for insurance, are driven to buy it in order to protect themselves from gouging.

Medicare itself is certainly not perfect. The largest remaining issue confounding hospital charges can be traced back to weaknesses of a 1983 Medicare law, the Budget Reconciliation Act. Reimbursement legislation traditionally overpays initially, with every intention of paring prices down later. The providers, hardened to this maneuver, try to stonewall all subsequent amendments as long as they can. In this case, the overpayments have persisted so long they have become basic assumptions, triggering internal re-adjustments which make resolution still more difficult. A number of hospitals have been severely fined for violating the spirit of this law, however close they may come to obey the letter of it. On the other hand, other courts have held that a situation which has been allowed to persist so long can be deemed to be settled law. The result is a predicament which is quite unnecessary, and might be rather readily corrected.

But let's not wander too far from the basic proposal. The corresponding (doctor and hospital) portions of Medicaid should be consolidated into Medicare, with remaining issues settled independently. Consolidating two government programs may not quite be the "single payer" concept that others had in mind, but it resolves most of the legitimate problems which provoked that mysterious slogan.

Insuring the Uninsured is Not Entirely a Health Issue

|

| James Madison |

shrewdly observed that people could and would restrain state taxation by moving to a neighboring state. The founding fathers never contemplated health insurance or Medicaid, of course, but the same principle applies there in reverse. If one state gets too generous with health and welfare benefits, people in neighboring states will nowadays hear of it and get on a bus to relocate advantageously. A flood of new low-income citizens may or may not be what a particular state wants, depending on local economic conditions.

For example during the great depression of the 1930s,

|

| The Great Depression |

Unemployment was so widespread that no state dared attract still more of it with generous welfare benefits. On the other hand, during the recovery period that followed World War II, the industrial northern states definitely did attract cheap labor from the southern states, using better health care, freely available, along with better unemployment benefits. In each case, employers alternate between wanting cheap labor or low taxes, while labor representatives relax or toughen their resistance to the cheap competition. Politicians are always looking for the argument that carries the most votes. If you want to understand the persistence of employer-based health insurance alongside unobtainable health insurance for others, look into this trio of motivations.

While it's true state legislatures must tend to the infrastructure, crime conditions and education, they can in the main be regarded as debating societies between employers and labor. There is some, but not much, the difference between Republicans and Democrats on the Medicaid issue. A Democratic Governor will welcome an influx of low-income voters who will normally vote for his party, but labor unions will soon remind him that enough is enough. A Republican Governor will gladly supply cheap labor for the state's employers until rising taxes bring an end to his support. Since the financial stability of the local hospital can be badly jarred by the instability of Medicaid payments, doctors soon get annoyed with the misalignment between state motives and the welfare of their patients. It is not much of an exaggeration, that state coffers might be overflowing with the surplus, but the budget of Medicaid will not rise a penny if it would attract poverty migrants from neighboring states during a period of high unemployment.

The obvious solution is a federal one, imposing uniform standards. But think that over a little before you jump at it. If the federal government pays all of Medicaid costs, it is going to want to administer the program. All states resist that idea, more so if local and federal political domination is in conflict. Small states will universally be fearful of being overwhelmed by large neighbors, particularly when they have achieved advantageous niches. The disastrous condition of the auto industry might persuade Michigan to agree, but Tennessee and other states with Japanese car plants might disagree. As you get close to the border of large states, hospitals near the border can often attract many patients from the other state; strange political bedfellows can link arms in Congress when you might not expect it.

None of this, absolutely none of it, has to do directly with medical care. But the quality of health care is strongly affected, and doctors are sick of hearing about poor sick folks when the real issue is labor availability. The voice is Jacob's voice, but the hand -- is the hand of Esau.

What Good Did Medicare Do?

|

| Amy Finklestein |

An article in the Wall Street Journal Amy Finkelstein of MIT describes evidence that Medicare seemingly produced no provable increase in longevity during the period she studied, which was 1965 to 1975. Thinking back to that time in the practice of Medicine, the conclusion while surprising seems entirely plausible after a little reflection. Our system of charity care was good enough so I really doubt if very many people were allowed to die prematurely because of poverty in 1965, at least in Philadelphia. Charity took care of them. Elective repairs were an entirely different matter, however. Working in charity clinics at the time, I well remember that almost every patient seemed to have bad teeth, an unrepaired hernia, untreated varicose veins, or a positive Wasserman and similar threatening but non-fatal conditions. There existed a vast backlog of untreated non-fatal conditions, almost to the point where it seemed we would never catch up, but of course, we did eventually catch up. Whatever the costs of the government health programs during that decade, they mainly reflect that huge backlog project of correcting health impairments which were nevertheless not an immediate threat to life, in addition to lifting the former financial burden from our charity institutions of treating conditions which were undeniably life-threatening.

From this historical experience it can be deduced that any new proposals for modifying or reforming the medical system should start with the medical situation as we happen to find it. If a great many people are dying of treatable conditions as they are in Asia and Africa today, then it is likely that extra finance will promptly reflect itself as improved population longevity. If that's not the case and other institutions are providing emergency care, you must then look among the backlogs of untreated conditions -- in that locality -- for a justification of new costs and disruption. Since even the non-urgent backlog in America has now been almost totally eliminated, something else must be proposed as a goal for legitimate improvement. Otherwise, you would have to be so far-sighted that you make a decision to spend an extra 10% or so of the Gross Domestic Product for benefits, every year for ten years until some unpredictable long-term benefits appear. It's difficult to imagine our political process launching forth on such an adventure.

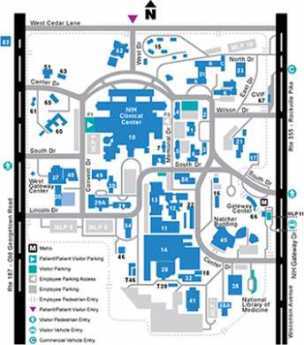

|

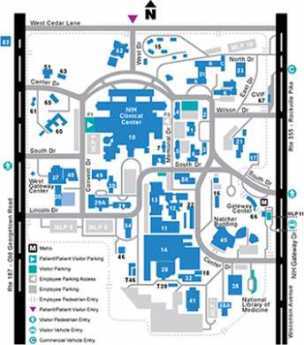

| NIH Map |

However, let's continue to look at what did happen, to see what arguments we might have been imaginative enough to adopt. First of all, we can see that the quality of life of the elderly generation, the one I now belong to, has been enormously enhanced by joint replacement and cataract repair --significantly reducing wheelchair crippling and blindness. Neither of these benefactions can be said to result from a brilliant insight by a genius, but rather a slow, incremental process of adding small enhancements until the desirable result becomes standard practice. This sort of development, as in research and development, is very likely a response to a general increase in the funding of the provider community, as contrasted with targetted extra appropriations to the NIH for example. A plausible case can be made for asserting that the undesignated increased funding of the early Medicare program gave tens of thousands of elderly people -- in the next generation -- a comfortable life rather than a miserable one, several decades sooner than a more frugal medical system would have done.

Secondly, life expectancy did finally increase substantially, perhaps extending an average of ten or more years of life in the period subsequent to the enactment of the Medicare Act. But it did so only after a fifteen or twenty-year lag. It's uncertain how much we may credit Medicare with this benefit, however; the increased basic research funding of the National Institutes of Health seems plausibly responsible. However, at least half of the longevity benefit must be credited to research efforts in the private pharmaceutical industry, which was funded in large measure by Medicare dollars, recirculated through drug purchases. But there's restrained exuberance about even these miracles, which were surely the greatest medical advances in human history.

We have greatly extended the comfortable, useful life of our population, but now must grudgingly admit we directed these benefits to a group of people who are no longer engaged in economic activity. Unemployable people have been transformed into employable ones, but sadly we have mainly given a twenty-year vacation to people who are capable of doing productive work, but don't. Instead, we import millions of foreigners to do the work or outsource it, which accomplishes much the same result without the demographic disruptions. Worse still, we may find these people will often outlive their savings, so the extra longevity could result in years of economic misery and despair, not necessarily an improvement on the physical and medical varieties. In other words, if we had possessed the foresight to see that ultimately improved longevity and life quality was a worthwhile goal, we should then have simultaneously taken the steps to improve economic circumstances which make that medical miracle seem worthwhile.

As we now consider further steps to over fund medical care, or reform it, or make it universal or whatever, perhaps there will be time to consider whether other improvements in American life are needed before there is a net beneficial effect. Either undertaken simultaneously with the health care financing initiatives or even possibly, instead of them.

Community Volunteers in Medicine

|

| Comm Volu In Medicine |

Mary Wirshup has a very different medical background from mine, but she's my kind of doctor. I couldn't help wishing, as she addressed our urban luncheon club, there could be thousands more like her, even while understanding more fully than she seems to, the reasons why doctors are driven from her behavior model. As we parted, it felt like saying a last goodbye to the Spartans marching to Thermopylae.

As 46,000 medically uninsured persons in Chester County get sickness and injuries, they know that a Federal Law prohibits a hospital accident room from refusing to see them, so ways are found to shunt patients to the CVIM free clinic, run by volunteers. This law is, in turn, a response to a government-created situation where a hospital which "accepts" patients must keep them. Any economics teacher can tell you that supply/demand issues are best addressed by price adjustment, so price controls in whatever guise lead to shortages. I must say I have little sympathy with the devious strategies which hospitals often employ to disguise their rejection of uninsured patients. At the same time, I know a lifeboat will sink if too many climbs aboard. Nevertheless, the semantic switch from lack of insurance to lack of care implies that only more insurance can surmount the barriers to care, which is absurd. For one thing, I know too many hospital administrators who are paid a million dollars a year, and one who is paid two million. And at least two health insurance executives are in the newspapers with a net worth over a billion -- yes, that's billion with a b. We have reached a point where reducing all physician income to zero would only reduce "healthcare" costs by 10%. As I look at Dr. Wirshup's modest clothing I can only surmise she plans to continue her modest living until she is 80 years old, after which her savings might see her out. Squeezing physician reimbursement is not intended to save significant money, nor intended to restore physician incomes to more equitable levels. It is intended to address the oversupply of physicians without confronting either the universities or the foreign trained lobby.

The elite tranche of medical schools do their part to relieve physician oversupply without reducing class size, through the encouragement of their students to go into research. I was well along at the National Institutes of Health before I finally decided I had not gone into medical school with that goal, and returned to teaching and patient care in a more satisfying model not too different from CVIM's obviously Pennsylvania Dutch spirit. The Amish at the far western end of Chester County reject the whole idea of insurance; their most characteristic statement is "Don't send me no bills." That attitude is rather a contrast with the shiny housing and automobiles in the Silicon Valley developments of Southern Chester County, or even with some rather bewildered Quaker farm families scattered over the rest of the county next to the horsey set. Chester County is America.

On Second Street in Society Hill, next to the park where William Penn's house stood and a few feet from Bookbinders, is the house of Dr. Thomas Bond. Bond conceived the idea of building the first hospital in America and with Franklin's publicity machine succeeded in getting it built, to care for the "sick poor". Dr. Bond started a second enduring tradition as well. When the Legislature expressed doubt that the institution was sustainable, he pledged to convince the local medical profession to serve the poor without charge. Some of the legislators who voted for the measure did so in the belief that charity care would never appear so the gesture would be without cost. The physicians did indeed come forward, in sufficient numbers to run many institutions for two hundred years. In 1965 health insurance made its national appearance and has regarded the benchmark low costs of charity care as a threat, ever since.

Picking Up the Usual Suspects

The federal government directly controls about half of health care spending and makes rules affecting most of the rest.

|

| Claude Rain |

Every group or business which receives some of this money is alert not to lose it. Many other groups are alert for openings to get more of it. All employ sentries in Washington. False alarms are frequent, stealth attacks are a constant threat, constituents paying the bills demand immediate reassurances. Members of Congress seldom initiate a disturbance unless someone from inside an industry brings it to them. Consequently, when proposals do surface and seem to be serious, the question to be immediately answered is -- who's behind this? If you know who starts something, you can readily imagine the motive, assess the political strength, decide how to respond. With what little was generally known about the Clinton Health Care Plan of 1993, it was easy to imagine a host of people with some motive, but very hard to say who was actually pushing one. Must be a Democrat, obviously, but not immediately obvious which of several possibilities was the real agitator.

Health insurance companies would always seem likely to have proposals about national health insurance. Blue Cross dominates the market in large geographical markets, mainly East Coast, and would seem fearful to lose that dominance in a major upheaval. But other market areas of the country are dominated by commercial insurance companies who might seek to upend the Blue Cross monopoly, but whose form of business would be even more seriously threatened by health insurance innovations. Most commercial health insurance was written by large life insurance companies who regard health insurance as a small sideline for the convenience of their industrial customers. Blue Cross was somewhat more comfortable with government work, particularly since the 1965 Medicare and Medicaid programs were patterned after them. However, Blue Cross was non-profit, thus lacking in incentives, and historically controlled by health care providers. That is, Blue Cross was formed by and dominated by the hospital associations, and Blue Shield was formed by and dominated by medical societies. Since doctors and hospitals were very prompt in announcing their deep concerns and uncertainties about the Clinton Plan, Blue Organizations seemed unlikely to make daring proposals so likely to provoke trouble at home.

Not that some doctors and some hospitals didn't try to see what might be made of this opportunity. At the American Medical Association, certain leaders known to have Blue Shield involvement offered conciliatory remarks about waiting for further details before taking a stance but were abruptly halted by a general opinion that things had apparently already gone too far for substantive negotiation. Much the same thing occurred at the Hospital Association; the winners had too much to lose, the losers had too little influence to matter, and nobody stepped up to claim an inside track. Hospital trustees didn't know what was going on, strongly suspected something was going on and didn't like either situation. If the doctors got mad enough at a hospital, they could ruin it, and if hospitals got mad enough at Blue Cross, it too was ruined. The main strength behind the Blue Cross monopoly position was the secret discount provided to them by hospitals, which was refused to competitor insurance companies but could easily be extended in the interest of fairness. If need be. The commercial competitors wanted that discount much more than they wanted new insurance models.

There is one subset of doctors and hospitals that might be suspected of generating a sweeping revision of the medical system -- academia. Medical schools think of themselves as the appropriate source of vision about the profession they are training, and they run large prestigious hospitals. Their heavy dependence on government research grants, teaching subsidies, and tuition support programs puts them in constant contact with Washington bureaucracy and politics; propinquity is a great match-maker. Their style of salaried faculty creates estrangement from making a living by being paid fees for specified services, and they are reasonably comfortable with the flaws and techniques of professional promotion within a large organization. So, a slogan which has been attributed to Wilbur Cohen himself does not greatly jar on their ears. The author of the Medicare Act is said to have announced that the entire medical system of America could be accommodated by thirty or forty Mayo Clinics. Twist that just a little, and you are imagining he said forty or fifty medical school teaching hospitals. The briefest contemplation and rebuttal will knock down that proposal, such as pointing out that we have several times that many teaching hospitals at present without achieving anything like the nation-wide coverage envisioned. After absorbing the administrative chaos of readjusting to that model, you would confront the old repeated history of grossly overestimating, and then grossly underestimating, the future manpower needs of a medical system in the process of constant scientific turmoil. Suppose you built the fifty Mayo Clinics and found you needed two hundred? Suppose you built two hundred and found you needed seventy? And then, finally, remember that each big city could expect to contain one of these organizations, but the fewer of them there are, the longer the distance everyone else would have to travel to get to them. No one has even ventured to speculate how you could go about doing such a thing, let alone doing it three or four times to get it right. But, but. The infeasibility of academia at the center of medical care delivery does not eliminate the possibility that the idea underlying the Clinton Health Plan may have originated in academia, or that academia might support some similar proposal with something else at its center.

Since it was soon clear that the traditional "players" in the health policy arena were unlikely to be sponsoring some self-serving policy that might masquerade as the Clinton Health Plan, the search went on. There were a number of professional groups within the medical community who had traditionally chafed at the domination of the hierarchy by physician leadership. Nurses, hospital administrators, pharmaceutical companies, druggists, corporate human resources officers, public health officials, social workers, biology teachers all represented groups who derived status with the public by displaying inside knowledge of medicine. But all of them fell silent when a physician entered the room, and tended to shift their emphasis to faults of the "system" or the "industry". Their Washington representatives placed their emphasis on changes in the existing system which might elevate the prestige and income of the members and were particularly vigilant for system modifications intended for other purposes which might nevertheless create advantageous loopholes for the members. All of this is normal striving in the good ole' American way, a polite variant of the mixture of bellicosity and restraint usually seen in the Union movement. These people wanted to improve their income and working conditions but were ultimately quite hesitant about radical proposals that might sink the ship. A quick survey showed they were not supporting any particular reform project, even though they could be counted on to support any reform project. Furthermore, they consistently injured their political strength by extending beyond economic goals to issues like radical feminism in the case of nurses, or direct advertising to the public as in the case of the drug companies, or practicing medicine without a license in the case of limited-license practitioners. These people had votes, influence, and lobbyists, but they did not have a national project for health care reform of their own devising, and they surely were not the people behind the Clinton Plan.

During the six months before The Plan was presented to Congress and the Public, a White House task force said to consist of five hundred secret members was meeting under the direction of President Clinton's wife Hillary. No doubt part of their purpose was to give Hillary a public platform on which to show her stuff, with the idea of someday succeeding her husband as President sort of in the back of her mind. But most of it was also quite practical; somebody had to figure out what this proposal was going to be, and newly elected Bill had to spend most of his time learning how to run the rest of the country. Buried in here was an efficiency principle too; the staff members of every important congressman and senator were involved in the process, making the deals and surfacing the political angles before things had to come down to votes and filibusters. Meanwhile, the rest of the country had to wait outside closed doors, fed by rumors and spin.

How well I remember one public seminar on the subject during this period of suspense. The audience was filled with people thought to be influential with the public, the usual suspects in that sense, too. Representatives of various interest groups were seated up front at a table, and for some reason, I had been picked to represent doctors. Next to me was a druggist who had made a billion dollars starting an HMO; it was intriguing to watch how many well-dressed women with no interest in health care paraded up to the table to show their stuff to the billionaire, while we waited for the meeting to begin. All of the usual suspects of Philadelphia medical care were at the table, each of us wondering what the other was going to say. When some last Very Important Person had wandered in and taken a seat, it was time to begin. The moderator told a funny story or two, and then asked each one of us what we thought of the Clinton Health Plan. One by one, to the utter amazement of us all, we each explained how we were opposed to it.

So obviously this proposal was not coming from the usual agitators. But, remember, somebody was surely behind it. Before we take a stab at that mystery, let's humanize the usual suspects by describing a few of them.

Equal Pay for Equal Work

|

| American Medical Association |

The House of Delegates of the American Medical Association holds a five day convention twice a year. The meetings last from 7 in the morning until midnight, although the main sessions in the auditorium only last eight hours a day for three days. The rest of the time is consumed with meals, committee meetings, geographical caucuses, and even cocktail parties. Newcomers often object to the numerous parties until they come to see that these are merely committee meetings in a different form, with different subsets of the organization picking up the necessary costs. This group of workaholics has to vote on several hundred issues each session, and most Delegates have little advance opinion when they enter the headquarters hotel on the first day. But after meeting with their specialty in one committee, and members of their geographical region in another, and members of their medical school alumni association in yet another, and with issue-oriented groups, political allies, and other layers of an overlapping matrix day after day -- by the time the vote is actually called for, most Delegates could safely predict the correct outcome with very few exceptions. The AMA works at its similar job with far greater intensity than Congress does because Congress has all year to do it, while the doctors have to go home to make a living. Don't worry about the parties, they are really working sessions for everyone except rank newcomers, outsiders, visitors, and wives. What is perhaps more worrisome is the rare occasion when just about every delegate arrives with one opinion and is persuaded by the leadership to adopt the reverse. That can only happen if new information is suddenly revealed, with little time to check its accuracy.

There are usually fifteen or so parties every night, hosted by large state delegations, large specialty assemblies, and coalitions of smaller groups. Fifteen drinks a night would be quite a bit for most folks, and some newcomers are duped into trying to be polite about it. The rest of us take the proffered drink, walk over to a nearby plant stand and dump it. I hate to think of how many potted palms I have fried that way. Each delegation has its own system of organizing these minutes, and I'll try to describe the Pennsylvania system.

Nobody will come to your party if you don't go to theirs, so we make a list and divide the group into those who "travel" to the parties of other states, and those who remain to host our own party, "at the door". Everyone is expected to wear a name tag, containing your name in large type underneath which is your caucus designation, in my case "Pennsylvania". The older members instruct the newer ones to put the name tag just under their right shoulder. That way, you can seem to be looking at the hand you are shaking while freshening your recollection of who in the world you are meeting. You can, of course, do anything you please, but time is short for the transaction of a lot of business, and it's just easier to do routine things the regulation way, and get on with it.

On the evening in question, I was "at the door". The formula, repeated many times, was to extend a hand of greeting and recite, "Welcome to Pennsylvania. Are you looking for some friend in particular? Let me see that you have a drink. Come on in and meet my fellow delegate, Scotty Donaldson." You can shepherd a lot of people more or less gracefully if you reduce the formalities to a routine. After several people had been brought in under the tent, a man with highly polished shoes came up, wearing a name tag that said, "Blue Cross of America". He was greeted, his hand pumped, a drink procured, and was introduced to Scotty, our most famous extrovert. I quickly turned to the next person at the door.

Well, this lady was six inches taller than I am, and fifty pounds lighter. She wore a name tag, identifying her as President of some Nurses Association, "Welcome to Pennsylvania! Is there someone from Pennsylvania you know or would like to meet? Can I......" The apparition didn't even look at me as she brushed past through the door. Heading straight for the gentleman from Blue Cross, she poked her index finger into his chest, stopped him in mid-sentence as he talked to Scotty.

"What I want to know, " she announced to this startled man, "Is when are you people in Blue Cross going to pay nurses as much as you pay doctors?" And here I must admit I have to give this guy credit for unperturbability.

"Well, madam," he said cheerfully, "I think that's going to be quite some time."

A New Gorilla in the Cage

|

| William Clinton |

News reports began to surface that big business was talking to Democrats in the White House about major revisions in the national health delivery system. That in itself was news, because big business normally forbids its employees to talk with regulators, and does not commonly welcome any new regulations. But the Clinton Administration was looking for political allies, while the business community was willing to examine proposals to lighten the burden of employer-based health insurance. The discussions soon probed whether a common system might reduce government costs of Medicare and Medicaid, and simultaneously reduce the costs of employer-paid health insurance. For years, big business had been suspicious that the health community had somehow forced employers to pay an unfairly large share of other people's health costs, through some arcane manipulation of hospital cost accounting. Their term was cost shifting.

The administrators of government programs believed the same thing was happening to them. Since the only group left to benefit were uninsured, the arithmetic was somehow wrong. A 7% population group, most of whom are young and healthy, could not account for annual premium jumps far in excess of the cost of living, occasionally as much as 30% in one year. In both governmental and business minds, the main beneficiaries of cost-shifting must be the hospitals themselves, and the doctors who control them. Somehow, it seems not to have occurred to them that this news was brought to them by their fiscal agents, the health insurance companies, and was therefore likely slanted to avoid attention to middle-man costs. Whenever major negotiations are to be held, CEOs and top politicians take over to make the deals, necessarily basing their judgments on filtered information. Since this is a familiar situation, they employ high-priced consultants.

|

| Clark Havighurst |

The five hundred secret members of Mrs. Clinton's task force were willing to listen to the ideas of anyone who had political clout, especially staff members of Congressional committee chairmen. But these people had been struggling with the problem for fifty years to no avail, so the emphasis had to be on change, on big new ideas. Universities and think tanks were especially welcome to comment, and

Clark Havighurst was particularly influential. But there had to be some kind of track record, some practical experience on which to base such an enormous national initiative. The best available model was the Health Maintenance Organization (HMO), whose most famous proponent was Paul Ellwood, a former midwestern pediatric neurologist who had gravitated into health insurance consulting. Ellwood had a vacation home in Jackson Hole, Wyoming, where he then gathered the non-government component of this movement into his front parlor. Insurance companies, human resources officials, academics, and in later stages the news media, were given the Word, an opportunity to criticize, and an opportunity to have their views coordinated with the government group in Washington. There was a rough division of labor, establishing general regions of dominance; but ultimately, the two components intended to fit together in a unified health system for the whole country, bar none. The business community began to see that inevitably, in that case, the final overarching decisions would be made in Congress.

Health Maintenance Organizations (HMO)

|

| HMO |

It's an ancient wrangle whether a manufacturer should actually own its suppliers or the reverse; or instead whether it's healthier for industry components to stand at arm's length from each other. At issue is not only what is best, but what is fair. If industry mergers seem sufficiently unfair, it will be proposed they should be illegal. That's the main substance of a lot of antitrust argument. Unfortunately, what is valid in good times may be reversed in a downturn. A prosperous supplier of materials often acts as a "cash cow", saving a merged enterprise from bankruptcy. Unfortunately, within a different economic climate one badly failing supplier can bring down the whole merged enterprise. There's also organizational friction; a temporarily prosperous unit may get to thinking it should boss the less prosperous units around. At the very least, the cash cow resists the use of its cash reserves to help "losers". Several centuries of experience have thus left a minefield of old laws, traditions, and ingrained prejudice to undermine any broad standards for what is best. In no field is this truer than the Medical Industry.

Eighty years ago in Houston, the first Blue Cross health insurance company was started for a single group of school teachers to pay for service in a single hospital. That expanded to other subscribers and other hospitals, soon making it more workable for insurance, subscribers, and hospitals to stand at arm's length, allowing for a variety of local combinations. During World War II, combat in the Pacific led shipyards to be built on the West Coast, but westward migration of steelworkers was hampered by lack of local medical facilities for them and their families. Taking advantage of the loophole provided in the wartime wage and price controls, Kaiser Industries attracted medical personnel by building hospitals, paying salaries, and offering physicians ready-made medical practices. Because of various licensing laws, Kaiser's medical enterprise was divided into two corporations, Kaiser and Permanente, so a specialized corporation within the Kaiser-Permanente Foundation could accommodate the licensed practitioners. The salaried nature of the physician organization immediately caused trouble with local fee-for-service practitioners, who were thus excluded from a large population in their neighborhood when they could not readily adjust to varying mixtures of the two payment methods. Their reaction, led by an obstetrician in Stockton, California, was also to organize dual-corporation structures which were exclusively fee-for-service. Because Kaiser had a Foundation, they also called their organizations Foundations for Medical Care. Then, as now, it proved difficult to run a practice with two different reimbursement philosophies in the same waiting room; in time, friction between the two styles tended to increase as doctors who were more comfortable with each style tended to segregate themselves. Since offers of salaries are more immediately attractive to newly-trained physicians, they flocked to California to serve the steelworkers who were in need of doctors. Fee for service, on the other hand, allowed the gradual assembly of a more durable practice composed of patients who could test what they liked before making a permanent allegiance. Essentially, the transients went to Kaiser, more permanent settlers used fee-for-service.

Thus, it came about that several models for health care reform were tested in a few smallish towns of central California. These demonstration experiments may perhaps not meet everyone's standard for scientific purity, but at least they were public examples with the dumber features knocked away. They certainly provided a laboratory where ideas could develop about topics that otherwise were merely opinions and unsupported conjecture. The Foundations demonstrated that physician-dominated organizations could contain costs and maintain quality in a satisfactory way; there had previously been doubted about their ability to contain cost. The Kaiser organization showed that salaried practice performed acceptably as well, both to most staff physicians and to a majority of the patients; there had been doubt about the willingness of the public to limit choices to a panel of assigned physicians, mostly young and usually from elsewhere. Finally, the two systems seemed to be able to live together more or less peacefully; indeed, the California public seemed reassured that two systems apparently kept each other in check.

The first main difference rested on the system of quality control. The local Foundations developed review systems based on peer review and peer pressure; these worked remarkably well, particularly in constraining non-physician costs like pharmacy, tests, and hospitalizations. Cost and quality control in the Kaiser system was more rule-bound and quicker to apply discipline, kept within bounds however by the ability of both patients and staff to jump ship for the other system. Aside from professional peer review, the Kaiser system experimented with owning hospitals, laboratories, pharmacies. Here, the experience directly paralleled the experience of manufacturing industry with its suppliers; when reimbursement was generous suppliers generated welcome revenue. When reimbursement was constrained and substandard, ancillary service losses were unwelcome. Taken overall, the Houston experience was repeated, that ownership of such facilities was mostly a headache. Indeed, subsequent experience has shown the two systems usually co-exist nicely within independent ancillary facilities.

The Stockton, or Foundation for Medical Care, approach grew popular in the West. The variant which grew up in Utah was locally popular and attracted the attention of Senator Wallace Bennett. The Bennett Amendment to the Medicare Act then picked out the peer review system as the secret of success and set up a nationwide system of Professional Standards Review Organizations (PSRO) to conduct peer review of Medicare and Medicaid patients. The drawing of boundaries around these organizations was the most difficult part, and sometimes the boundaries were inept. Rural districts were adamant that the standards of big-city medical schools were not to be applied to their scattered resources, and urban areas saw themselves as ancient Rome surrounded by hostile tribes. Although these difficulties were foreseen, it is not always possible to draw a line that will separate the cultures, particularly where the outward migration of suburban housing was more rapid than the construction of suburban medical facilities, leaving the medical culture unstable. The PSRO system was quite successful in many areas but caused trouble in others that were not adequately addressed. The central concept of the review system was that the doctors who worked together could quite readily identify the outliers, and better than anyone else could judge whether the local situation was justified. True, some practitioner might try to abuse the system to the disadvantage of his competitor, so no adverse decision was final until there had been an opportunity for outside appeal. There might even be a few circumstances requiring a still higher appeal. The system was new and untried, but it produced eminently satisfactory results from the point of view of the Federal Government paying the bills. As former President of one of the largest PSROs in the country, I will assert that there was remarkably little friction or resistance in the medical community. My very good friend, the President of the New York City PSRO says much the same, and most people would say that if you can carry off a new system in New York without a lot of argument, it must work pretty smoothly. The Government wanted to eliminate unnecessary Medicare costs, particularly in hospitals, and it wanted to maintain peace with the medical profession. Hospital costs are obscured by the wide gap between posted charges and true underlying costs, compounded by disagreement about the proper assignment of overhead charges. Charges were not the assignment of the PSRO, utilization was. Days of hospitalization per thousand enrollees fell from roughly 1000 days per thousand to roughly 200 days per thousand, and that satisfies me at least that we were doing our job; physician peer review was doable.

It is likely, however, that peer review was much more apt to produce friction in rural districts. Philadelphia has had more than a hundred hospitals for more than a century. Birds of a feather tend to flock, so the sorting-out process was already far advanced by the application of constrained referrals to practitioners who failed local standards. Mixing members of different hospital staffs on appeals committees was easy in the big cities, and the naturally censorious tendencies of many physicians could be safely counted on to produce adversary balance. Most committees seemed visibly pleased, even relieved, to discover generally good quality in their competitors' practices. However, in the much smaller and more scattered institutions in the nation's regions with low population density, these informal arrangements cannot stretch as well. When there is only one specialist in a field, for example, it is sometimes hard to know whether he is a good one or not, but always easy to say whether you like him or not. Where the population thins out, much greater wisdom is required to make judgments, the number of close cases is greater, and the limited supply of judicious reviewers is similarly stretched. At least that is my surmise, based on knowing the background of most of the AMA delegates who eventually voted 105-96 to condemn the program in a standing vote. The result was the Dornenberger Amendment, which much weakened the system when instead it should have triggered a more profound analysis and reconsideration.

Perhaps we spend too much time here describing a technical process. It is, however, at the heart of what makes the Foundation approach (sometimes called IPA or Independent Practice Association) superior to the HMO. It is now perfectly clear that both doctors and patients vastly prefer the IPA approach to the HMO, and any reasonable politician would jump at it. But there is one fear, summarized by the slogan that the Fox is guarding the Henhouse. In both systems, an attempt is made to combine insurance with the delivery of health care. In the IPA, the physicians are taking the financial risk that aggregate income will exceed aggregate costs; it's a risk contract. In the case of an HMO, the employer or the government is taking the financial risk and therefore wants to control it. If revenue is good, the doctors will prosper in an IPA; the insurance company intermediary will prosper in an HMO. Doctors will care about that little difference, but why should the rest of the country care?

Because the prospect is overwhelmingly likely that future revenues will be constricted until something hurts, and when you starve with a tiger, the tiger starves last. In the case of an HMO, the insurance middlemen will starve last, and the quality of health care will starve fairly early. That's an unwise design. When we get to the point where Congress cuts the budget and watches to see what happens, Congress will cut it some more if nothing bad happens; it will back off only if something bad happens, so something bad is certain to happen. In designing the system, you need to design the internal review authority so it will cut the waste, inefficiency, and luxury first. The reviewer, no matter who it is, will cut himself last, so you need to arrange the incentives for waste to be cut before the reviewer suffers, and quality of care only after the reviewer has suffered. If you wonder why a whole lot of special interests hate physician-dominated review systems, a short answer will be found in this synopsis. A special exception must be devised for rural health systems, which do have a unique problem.

To return to the well-worn slogan about foxes and henhouses, we have overlooked the central question. Who's the fox, and who is the hen?

National Business Coalition on Health

|

| NCOH |

In 1992 the National Business Coalition for Health was just forming at a convention in Chicago. Before I really understood what it was all about, I agreed to their flattering invitation to be the keynote speaker at the kick-off luncheon. Who suggested my name was and is a mystery to me, and I arrived in Chicago with very little idea what they wanted to hear. However, it followed the familiar pattern of inviting the speakers to stay overnight at the hotel on the evening before the meeting began and to meet for drinks at the bar with the organizing leaders. I had enough experience with public speaking to know I could learn the general slant of the thing at such an informal party and adjust the speech to the audience to whatever degree seemed needed. Among the people scattered around at tables was Harry Schwartz, who was also there to give them a speech. Harry had been on the editorial board of the New York Times for many years and was known to be generally quite favorable to physicians. We had both written books about medical care, The Hospital That Ate Chicago in my case, and The Case for American Medicine, in his. We liked each other immediately and fell into an animated cocktail conversation that would eventually be renewed every six months at the American Medical Association House of Delegates meetings, where I was a delegate and he covered the topic for various news media. As we chuckled together about one anecdote or another of medical politics, the bar gradually emptied out. It soon became clear that all the other cronies had wandered off to dinner together, so we ordered dinner on the house, neither one of us have learned just what we were there to talk about. It really didn't bother either one of us very much, since from long experience we could tell some jokes and make it up as we went along. I knew what I wanted to tell businessmen, so it was just a matter of finding a way to lead into it.

The speech seemed to go well. There were several hundred, perhaps even a thousand in attendance, quite convivial and prosperous. As executives usually do, they looked younger than you might expect from the titles on their name tags; they laughed at the appropriate points and applauded at the end. In other words, I went home from Chicago with no more idea what this organization was up to than I had before I came. At the very least, it is clear they were forming a national organization of businesses, with constituent representatives largely drawn from Departments of Human Resources. They wanted to speak for American Business with a more or less unified voice, and the topic seemed to be health care. Although fate had put me into the debate at the very earliest moment at Wills Eye Hospital, this convocation of extroverted Republicans seemed to know a lot more than I did about what was secretly afoot among the Democrats in Washington.

This Chicago tea party did one other thing for me. Many months later, when the editors of USAToday were in search of an editorial page writer who was both a physician and opposed to the Clinton Health Proposal, they called Harry Schwartz. And he suggested to me. They ultimately ended up with a Medical Editorial Advisory Board of five members, at least three of whom were far to the left of me. At the New York Times, of course, Harry Schwartz was considerably more outnumbered than I was. After it was over, Harry and I used to joke that both sides were fairly evenly matched.

Nowheres-ville

|

| Jacob S. Hacker |

In more recent writings, Jacob S. Hacker seems obsessed with social inequality, but while he was a graduate student he wrote an excellent and objective book, The Road to Nowhere containing unique insights into the politics of the Clinton Health Plan of 1993. After that hubby was over, he interviewed most of the important actors in that drama, at least those active in the liberal politics of it, and they talked freely. Like the rest of us, he was unable to identify let alone talk with the leaders of big business, who are of course still pursuing their original goals. What emerges does sound roughly accurate; Hillary Clinton and Ira Magaziner designated to find out what this health business was all about; solicit every proposal on the mind of political, particularly congressional, allies; gather and examine all the useful ideas in circulation in academia and the insurance community; and negotiate possible solutions with a surprising new ally, the big corporate employers. A huge semi-secret task force was then assembled to exchange ideas, discard really bad ideas, and work the proposal into legislative form. There would be internal inconsistencies and conflicts but no matter.

|

| William Clinton |

Congress would work it out, differing versions would appear in House and Senate bills, and President Clinton himself would eventually be able to intervene when things got to the House-Senate Conference committee. Since the Clintons really had no pre-conceived ideas on this complicated topic, the will of the people would emerge from a huge debate, and the will of the people would prevail.

That's one version. The other way to picture this circus would be that a highly skilled politician would offer everybody a chance to propose pet projects, and those who failed adversary process would be obligated to support the ones who did prevail. Trade-offs would be made, as needed, and the political ringmaster in the White House would have the final say.

But the final version was the one that came through to the public and the leaders of big business. You weren't going to know what the plan was all about until it was too late to do anything but accept it after a big sales talk full of snake oil. Big business, which had a serious interest in a particular outcome, also had an army of experienced Washington lobbyists. These people were aware of the unpredictable quirks of the house-senate conference system, were completely confident that the membership of that committee would be stacked in favor of a particular outcome, and knew that a congressional staff with agendas different from those of business would, in the end, be perfectly capable of stealing the show. For major employers, that settled it.

Big business had been wavering about whether to go ahead with their own plans, anyway. They had listened politely and carefully to what the government wished for its own insurance plans, Medicare and Medicaid, and were probably willing to agree. But as matters approached a unified approach, too many things surfaced they didn't like, and too much chance the decisions would go against their wishes. There was too much to lose, too little to gain, and well, we're sorry, we can't go along. This or something rather like it seems to have been the final outcome. The press had been furious about exclusion from major news items, coupled with annoyance at the favoritism toward Mr. Weinstein of the New York Times. The whole medical industry was jittery about exclusion from consultation or even notice; the insurance industry was pretty comfortable with the status quo; the public was in a state of utter confusion After the main partner dropped out, the proposal never even came up for a vote in Congress.

Hold the Presses

|

| Stop the Presses |

At USAToday, techniques are astounding. After getting an 800-word piece, an editor by phone will suggest cuts to 300 words; the piece is always improved. Last-minute speed, trying to watch television, is unbelievable. On one occasion, after a medical meeting in Kansas City, watching a baseball game go into extra innings I fell asleep with the game undecided. The next morning a newspaper was pushed under my door. It was USAToday, not only carrying the final score but a full story, under a color photo of the winning play. Just consider the precision Chicago reporting, Washington DC editing, Kansas City printing and local delivery that took place in seven hours. By contrast in book publishing, a full year often intervenes between manuscript submission and actual bookstore sales.

So on a certain Monday night, the editor called. The Senate Majority Leader, George Mitchell, finally was to unveil the Clinton Health Proposal tomorrow morning. Would I please submit an editorial to run in the morning paper; he would supply the title. It was to be called, What Should Congress Do Now? and the deadline was 7 PM tonight. My watch read 5:30 PM.

Well, what fun. After a few minutes of stumbling around, I resolved to build the editorial around the theme, Don't Make Things Worse. It then seemed natural to allude to similar proposals gone famously wrong, define some predictable traps, and end up with Hippocrates. Over and over it is thundered at medical students: Primum non nocere. First do no harm. It all came together in my head, and I sat at the typewriter to bang it out. But when I came to that last sentence, pleading at least do no harm, I was hit by terrible doubt.

That phrase comes to us in Latin, and Hippocrates was a Greek, living at least five hundred years before the Roman Empire. Famous though the saying is, it wasn't (then) in Bartlett's Quotations, or Roget's Thesaurus, or anything else I could lay my hands on in what was, after all, a medical office. It was 6:50 PM. I called a learned friend from his dinner-table, and he agreed it was a strange business, looked at a couple of books, couldn't help, sorry. So, I drew a deep breath, said the Hell with it, typed in, "As Hippocrates said, At Least Do No Harm," and shoved it into the fax machine. The next morning it appeared, next to two million copies of my photo; so at least the editor seemed to like it. Some friends soon called to say that Senators Dole and Moynihan had adopted the line on the noon and six o'clock news, each attributing it to Hippocrates. No matter what happened to the Clinton Health Plan, it looked to me as though I would be forever guilty of supplying the world with a highly quotable misquotation.

Since then, with more time to do a proper search, I'm unfortunately still uncertain. William Safire at the New York Times, was intrigued but could only refer me to a nice lady at the Library of Congress who was a crony. She tried to help but was stumped. Some Hippocrates scholars at the Library of the Philadelphia College of Physicians were able to find a reference in The Epidemics which seems to say what we are looking for, and that reference has tardily crept into Bartlett's latest edition. Some people think Galen really wrote it, which might account for the Latin; but even that is unsatisfying to scholars. Somebody or other took that phrase, whether written by Hippocrates or not and pounded it over and over until it became a medical student incantation. Even if Hippocrates actually did express that sentiment in passing, it doesn't come through as a really important statement, and there isn't much evidence that his students were repeating it over and over as the words of the master.

My present suspicion is that vague rumors about Samuel Hahnemann, the father of Homeopathy having a hand in promoting the slogan during the Nineteenth century, may have some underlying substance. Homeopathy was a belief system which emphasized the prescribing of infinitely minute doses of medicines. It had a flurry in the 19th Century when conventional Medicine was reeling from excesses of bleeding and purging, which surely did a lot of harm to victims of, say, Yellow Fever. The acrimony even spilled over into the emotionalism of the abortion debate, because laws prohibiting abortion had been sponsored by the allopathic American Medical Association. The verbal warfare between doctors of Homeopathy and "Allopathy" was bitter beyond describing. Although conventional medical care finally got its feet on the ground, and homeopathy is now pretty much a historical relic, the homeopaths did have that big strong point. Doing nothing is clearly better than doing something harmful. Nobody takes Latin, much, anymore. So the modern medical way of saying the same thing has come to be, "The hardest thing to do, is to do nothing". This way of stating the same idea is widely believed to have been offered by William Osler, but after all the controversy about Primam non-nocere , I am now reluctant to be too sure about anything in this area.

Be Careful What You Wish For

|

| Pulse |

Events at the time of the introduction of the Clinton Health Plan to Congress were a confused jumble, but one vignette stands out in my memory. The five hundred or so members of the secret work group were all invited to the White House for a big party, with saxophones and all. On a television interview at home in Minnesota, Paul Ellwood said he wasn't going to the party. Indeed, he looked rather morose and had little to say. It is clear he had advance notice, before the plan even reached Congress, that things were not going the way he wanted. Since the public, even Congressional leaders, were still unclear just what was to be proposed, Ellwood's dejection, or rejection did not come from them. No one has said so, but it must be presumed the rejection came from his sponsors, the business leaders. Business, in short, had pulled out; responsibility probably lies with no more than half a dozen CEOs who continue to be anonymous fifteen years later.

At that confusing time, the reasoning of the masterminds was obscure. Perhaps they decided HMOs were no good; perhaps an outrageous political demand had been linked to the proposal; or there was to be too much political control, too little business control; or perhaps government costs had been shifted onto the backs of employers; perhaps the whole idea sounded too leftist to be comfortable. And perhaps a lot of other things, who knows. Even today, no one has written a book or even listed a few plain sentences of reminiscence.

What is known is that major business employers immediately launched a nationwide initiative to go ahead with a strong push to convert employer-based plans from fee-for-service to managed care HMOs. This was to be the way employers handled health care they were paying for; the government could do as it liked. It must be admitted it was a bold stroke, quite effectively handled. When you consider the rather uncertain legal right they had to impose a system of health care on their employees, it took more audacity to go ahead than you would suppose they could summon. It was a gamble that the Clinton White House would lack the courage to challenge a private initiative to go ahead with what they had so publicly endorsed, and that providers would be so surprised by the concerted coup that they would hold back legal challenge until evidence of antitrust or conspiracy emerged. It was a sort of Battle of the Bulge in reverse, and it might well have been hugely successful except for one thing they did not anticipate. Their employees almost universally hated HMOs when they tried them out. No one likes to be hustled into something he doesn't understand, no one likes to change doctors, no one like to be told he can't have what he expects to have. Employers expected resistance of this sort, but it simply had to be done to save the fiscal health of the business. Unfortunately, what emerged was that it didn't save much more money than its own extra cost to administer. The hard reality of business life is you regularly have to bully people in order to make any money. But bullying people without making any money is a quick route to dismissal. No wonder there have been no memoirs written.

A quick re-appraisal of the Clinton Health Plan was that the two systems, Medicare for people over sixty-five and employer-based for people under sixty-five, were to be merged into a single system for efficiency and better control. There were to be local, regional, and national governing bodies; evidently, the purpose of the National Business Coalitions for Health was to supply a unified business hierarchy to match it up and down the line. Hated politicians, hated bureaucrats and hated unions could be counted on to apply strong pressures; business would have to remain well informed, sternly disciplined, and speak with a single voice for any hope of surviving in such an environment. It is my surmise that such a prospect seemed to guarantee failure for a business. No, we're sorry, Business would draw a bright line at age sixty-five, and run its own show where it ruled the roost.

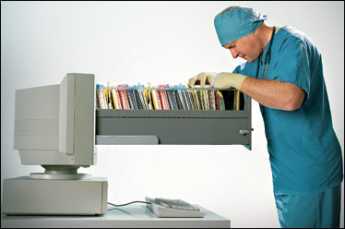

Computerizing Medical Care

Note: This article was written in 1999, long before Computerized Medical Insurance Exchanges were such a disaster:

|

| First Computer |

My first encounter with a computer was in 1958, and I have loved them ever since. As president of what called itself the Delaware Valley Hospital Computing Society, I remember giving a dinner speech concluding as follows: "If you want to be happy for a day, get drunk. If you want to be happy for a week, get married. But if you want to be happy for a lifetime, get a computer!" After fifty years, my affection continues. But to be candid, billions of dollars about to be spent on computers in medical care will mostly be wasted. Even worse, like malpractice suits computers will induce behavioral changes in the system costing far more than the directly visible costs.

That's unpopular news at present since the National Business Coalition for Health has launched a major lobbying campaign to persuade Congress to spend an initial billion dollars inducing physicians to maintain an electronic medical record. Various health insurance companies already provide financial incentives to doctors to file electronic claims forms, eventually threatening to reject any claim submitted on paper. The American College of Physicians has established a rather large department to develop programs for physicians to use in their practices; twenty years ago the University of Indiana started much the same thing. The College of Physicians of Philadelphia has spent close to a million dollars on such a project. It is reported that Microsoft Corp. has a massive project underway to supply electronic medical records. It sounds fairly easy to obtain large research grants from the government to devise something, anything, useful in this area. In my own case, training funds really weren't necessary, since I eagerly got into the field when everybody was a beginner. I was just as good a beginner as any other beginner. But let me repeat: the electronic medical record has been in the past and will be for decades, an expensive digression. In health care, creating more administrative work isn't the solution, it is the problem.

For fifty years the problem with an electronic medical record was that it took too much of the doctor's time to complete his part of the input, and then cost him too much to pay employees to do the rest. Presumably, automatic voice recognition and dictation will soon make it possible to record doctor's notes without handwriting or typing. Since, however, the elimination of current paper forms and check-off boxes will create a major problem in organizing the dictation verbiage, it could add five or ten additional years before programmers manage to rearrange dictation material and effectively integrate it into organized form, complete with laboratory results, dictated x-ray and EKG reports, even small images of the original material. Temperature, blood pressure, weight, photographs and the like can all be readily integrated into the stored electronic record, but to do so usefully is an expensive programming project. Doctors are quite right to be anxious they will lose control of the usefulness of their records in order to ease the task of programmers, speed up the sluggish pace of development, and reduce what will surely be an unexpected cost overrun. Storage and retrieval of such records is known to be an achievable but expensive task, which however also risks sacrificing the speed and ease requirements of the medical task it is supposed to serve -- in the name of cost-effectiveness.

Computers are no longer an unfamiliar tool; physicians have altogether too much experience with "vaporware", unrealized promises of convenience, and the damaging effect on the medical quality of the philosophy of Quick and Dirty. To respond to their resistance to design blunders with an accusation of undue conservatism is to provoke an icy stare and gritted teeth. Inevitably, the effective use of automation will require a redesign of workflow with major disintermediation of "gopher" staff; after all, that is how cost savings are to be achieved. That will provoke outcry that physician time is the most expensive component in the process, but unfortunately, physicians will discover Information Specialists with a business background will brush that argument aside. The most overpaid people on the face of the earth are investment bankers, but information consultants have persuaded business executives that inefficiency of the investment process is more expensive than even an investment banker's time. Having been through this themselves, insurance executives are unlikely to pay the slightest attention to physicians dancing to a familiar old tune.

For all that, data input is not the real problem; it's just the first problem. It's in a class with data storage and retrieval, which is expensive and cumbersome when you add a need for instant access and total privacy. But costs will come down steadily, and eventually, we can expect automated fingerprints or other biological identification, and cheap instant retrieval. Doctors will be able to make rounds in the hospital with a computer in their pocket, record telephone calls in their entirety, dial automatically and whatnot. There are problems with wireless transmission inside buildings with steel girders, and legal requirements for signatures on narcotic orders, but if we are determined, these problems can be overcome as easily as they were with electronic check writing and stock brokerage. Cost may top twenty billion dollars in twenty years, but it all can be done if we insist.

But then you encounter the real problem. Information will accumulate in these records in staggering amounts. Even if you resolutely resist demands to have the nurses record every groan, and the orderlies file every laundry slip, the legitimately important medical information will be exposed as the massive heap of transients that they really are. Plaintiff lawyers will insist no scrap of data may be deleted, hospital administrators will insist on compliance, when in fact most of a doctor's concentrated effort is devoted to brushing aside momentarily distracting data in order to see what's going on and react to it instantly. When a quick look doesn't solve the problem, the doctor goes back for additional data. If you disrupt these skills and traditions of coping with information overload, evolved over centuries, you will at best impose frustrating delays on a complex system under pressure, and ultimately inspire elaborate systems of short-cuts. The Armed Forces are famous for paperwork, but even they know better than to ask a pilot for his Social Security number as he starts a bombing run. The hospital nursing profession has already just about collapsed under paperwork pressure. If you see five nurses in a hospital, three of them will be sitting down writing something. The terrible truth is that no one reads it, no one checks it, and ultimately it sits in the record room waiting for a plaintiff lawyer with unlimited time to sieve out some misrecorded misconception or uninformed conclusion. My faith in the computer is such that I feel sure that methods can be devised to produce periodic summaries, automatic alarm signals, and mostly effective prioritization of data elements. Unfortunately, medical care is changing at such a rapid rate that ad hoc automation of physician thought processes cannot keep up with the current pace of change in medical progress. You would think some things would be unthinkable, but since I can remember the organized campaign to suppress the CAT scan as an unnecessary expense, I confidently predict that programmer inability to keep up with some advance in medical care will at times lead to organized outcry that we should slow down the pace of improving medical care, so that computer clerks can keep up with it. But that is only a small part of the issue, which at its center is that physician time will be dissipated and his attention distracted by presenting him with unwieldy amounts of neatly printed, spell-checked, encrypted and de-encrypted, biometrically secure, hierarchically prioritized -- avalanches of data which are irrelevant to the issues of the moment. The goal is not, after all, an electronic record. The local goal is to decrease the cost of medical care by increasing the productivity of the physician, and the overarching goal is high-quality patient care at a reasonable price. Behind all that, since the impetus comes from NBCOH -- the ones paying the insurance premiums -- suggests that the local goal is not so much the improvement of care as oversight reassurance that cares provided has been as good and as cheap as possible. The goal is legitimate, but this cybernation approach looks to be self-defeating by being overly specific.