Related Topics

Philadelphia Medicine

The first hospital, the first medical school, the first medical society, and abundant Civil War casualties, all combined to establish the most important medical center in the country. It's still the second largest industry in the city.

Medical Economics

Some Philadelphia physicians are contributors to current national debates on the financing of medical care.

Insurance in Philadelphia

Early Philadelphia took a lead in insurance innovation. Some ideas, like life insurance, flourished. Others have faded.

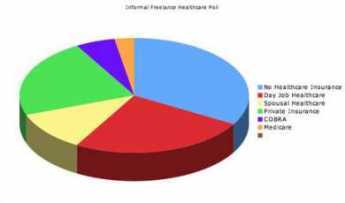

Segmented Health Insurance

|

| Pie Graph |

Everybody knows the old insurance saw, that the big print gives but the small print takes away. If health insurance pays for one sort of thing but not another, there is anxiety that a bewildered patient can be deprived of coverage he thinks he paid for. A patient knows he was sick, that he saw a doctor, or that he went to a hospital; beyond that, it's better not to leave room for arguments. To a certain degree, this is what has made HMOs seem so threatening; complicated assurances can lead to disappointing loopholes. So, for a century it has almost been an article of religious faith that health insurance should cover everything that costs money when you are sick. However, that headlong faith is exactly why the matter needs to be subject to critical review. Not only does monolithic insurance conceal a vast system of cross-subsidies. It has existed for too long when everything else in Medicine has changed for the original premise to be immune to change.

There are health insurance considerations which go beyond mere convenience of administration. Transparency and flexibility, for instance, suffer when everything is under a single blanket. Women pay a share of prostate surgeries they will never have themselves, people who hate abortions have to pay a share of them anyway. The ability to buy what you think you need is taken away, so some people who could afford what they need are unable to afford the whole package because it includes what they feel they would never need. And then there is moral hazard. Some people reach for what they don't need just because it costs nothing extra. Well, this isn't 1930; we don't need to debate the whole issue top to bottom. But there may nevertheless be a few features of global health insurance which could be advantageously teased out separately.

For a first example, look at terminal care. Everybody is going to die, and mostly the cost is picked up by Medicare because most people who die are elderly. Some insight into the issue and a reasonably workable definition of terminal care is provided by the statistic that a third of the expenditures of Medicare is paid for someone in the last year of life. Statistics on the average age at death are known with great precision, so it would be easy to calculate the yearly premium cost at any age or the size of a single-premium policy needed at any age to cover the average cost of the last-year-of-life. If we are ever to fund the unfunded Medicare program, this is the place to start. And if you are wondering how you know in advance when you are going to die, you don't need to know. Just establish an independent "endowment" fund, which reimburses the current Medicare program for any expense incurred during what proves in retrospect to have been the last year. Presumably, the cost of running the unfunded portion of Medicare would then drop by a third, while the cost of the funded third would be diminished by the investment strategy of its manager. The relatively few people who die without Medicare eligibility might be treated in the same way, reimbursing whoever paid the costs, but the risk calculation would be more difficult, and a life insurance policy might be preferable. Once the younger individual with such a designated life insurance policy attained Medicare eligibility, some sort of coordination would be desirable.

Everyone dies once, and no one escapes death. But terminal care benefits are not so terribly different from some other health issues. Nowadays, just about everybody can expect to have two cataract operations, and most people can expect a hernia repair, a gallbladder removal, and if male a prostate removal. Everybody ought to have a pneumonia immunization, and a colonoscopy, by age 66. It would be easy to compile lifetime risks and update them yearly, for the typical male with 1 death, 1 pneumonia vaccination, one colonoscopy, 0.76 prostatectomies, 0.59 cholecystectomies, 0.37 hernia repairs and so on. The cost of this sort of routine care is not really insurance, it is pre-payment. It is not subject to abuse, and need not be challenged or reviewed unless statistical monitoring shows that the incidence of some component was rising in a particular zip code area. In that case, what would be called for would not claim review, it would be provider review.

Perhaps the reader can see where this is going. Having stripped out routine pre-payment as much as is practical, you are left with the unknowable "all other". Insurance which covers this sort of risk becomes true insurance, in an umbrella form. As medical care continues to advance, more things can be moved from "all other" to "routine". Ultimately, and probably sooner than most people would guess, you can achieve a true insurance system, defined as having a trivial insurance premium for a remote risk. From that point forward, you can direct your cost-cutting attention to reducing the cost of routine care. That would include the devising of strategies to pay for luxury versions of routine care, as desired.

Originally published: Wednesday, August 08, 2007; most-recently modified: Friday, May 03, 2019