3 Volumes

Surmounting Health Costs to Retire: Health (and Retirement) Savings Accounts

Health Savings Accounts: Steps To Lifetime Health Insurance

From 1981 to the Present.

Consolidated Health Reform Volume

To unjumble topics

Health (and Retirement) Savings Accounts: Steps To Lifelong Health Insurance

If you are a fast reader, we will begin with a ten-minute summary of Health Savings Accounts. At first, it covers future revenue, then spending projections follow. No matter how medical care changes, cost and revenue must remain in balance.

President Trump has been elected. This book is written during the "lame duck" interval between election and inauguration. The Democrats have been defeated, but still have a vote; in another couple of months, real changes of office take place. News media have nothing much to talk about, except Presidential appointments and conjectures about the future. We are in much the same position, except we offer a serious alternative to the Affordable Care Act.Dozens of times, the Republican House of Representatives has already voted to repeal the Affordable Care Act, only to have either a Senate filibuster or a Presidential veto turn back repeal. Republicans are now reminding the public that not a single Republican Congressman has ever voted for the Affordable Care Act. Obamacare might be one thing or another, but it surely isn't bipartisan.

With changing control of the White House, and a majority of the Senate re-emerging Republican in the recent election (to say nothing about dozens of state legislatures), a successful repeal effort for ACA seems inevitable if only as a victory announcement; serious crippling amendments likely to follow. In that uproar, only five Democratic Senators need to acknowledge a public mandate from the election, and ACA will be gone. Republicans temporarily conceal serious weakness in changes they prefer; lacking details to attack, Democrats taunt the Republicans as having no replacement at all. It's a weak moment in our system of government, raising concern our international enemies might take advantage of its predictability.

Transition. Even if Republicans display a perfect plan, they must then navigate a vulnerable transition to implement, possibly even to pass it. Transition in a plan matches transition in political control, so authors of books must adjust as they can. Our intention originally was to spend the briefest time introducing a plan, and then go on to the subject of its transition. The book now is reversed: transition first, then return to a fuller description of how Health Savings Accounts would provide a cheaper and better framework for financing healthcare. And then -- how to keep revenue and spending in continuous balance, when they are separated by at least one generation. To some degree, the plan and its transition are much the same, and it isn't accidental. In fact, the pair would extend over such a long period, the two of them become more a process of continuous change than a static blueprint. This time, reform must absolutely have a bipartisan flavor.The unprepared reader must consequently forgive this brief introduction to a very complicated system.

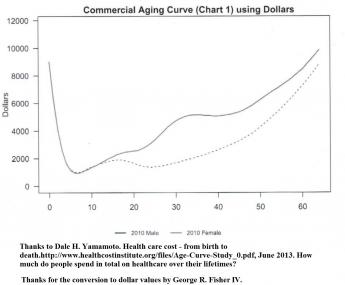

First of all, is there enough money in our economy to do it? We are lucky to have actuaries like Dale H. Yamamoto figure out a rough way to predict how much it will cost in the future. It probably isn't precise to say it will average $350,000 per lifetime in year 2000 dollars, but at least the assumptions for such approximation can be stated, to be revised as we revise the assumptions. The demographic prediction -- how many people there will be -- is equally rough, but similarly based on definable assumptions. They lead to a prediction of xxx millions in 2117. Multiplying one by the other, we would arrive at a figure for how much for the whole nation will need -- in inflated dollars -- for healthcare by that time.

That really is less useful than how much it will cost per person, adjusted for inflation, no matter what our population. It will be $350,000 in year 2000 dollars, less or greater, largely depending on scientific discoveries in the meantime. For methodologic reasons, I suspect it is 17% more than that, adjusted for insurance costs, and therefore will be 17% more in the future, as one example of adjusted assumptions. That's surely inaccurate, but it gives us a ballpark number.

Or it might expose a counter-proposal which the voters simply don't like. We might even go back to where we were in the past, but doing so would raise an unpleasant question about why we ever went through all the fuss. Two quite different questions are posed. This book is a brief analysis of both (Is there enough money to cover a better system? How do we get from here to there?) There might be enough money, if we rearrange payment flows, as we shall shortly see.

Finding big money might be accomplished the way whole-life life insurance does it, by collecting many small premiums years in advance, magnified by compound interest in the meantime. But how can we then find revenue for actual healthcare every single day during a century of growth and change-over? How do we transform "pay-as-you-go", into total pre-payment? Since we are considering total lifetimes, in our existing system it comes in pieces which we cross-subsidize in an expensive way, for almost a century. Transition from Medicare for a portion of it is somewhat easier; it purports to be funded by taxation, so it needs less transition, and no one has the courage to change it much, anyway. So we heedlessly begin with Medicare, which some people hope will never be disturbed, while others feel, everything should imitate. Serious health costs are constantly migrating toward Medicare, no serious analysis can avoid discussing it.

But in just what condition president-elect Trump will find the rest of medical care, is far less clear and it too must be studied. The rest of healthcare may contain the poor people; it also contains all the revenue creation. The non-Medicare portion was designed piecemeal, with resulting gaps and overlaps. In fact, the uproar about health insurance might be described as actually a confused rebellion of healthy young people, reluctant to continue subsidizing sick old ones. That's especially true in a recession which hits younger people harder than older ones. In the case of employer-based insurance, it would be new hires rebelling against existing ones, because new hires often move to new jobs before they get much benefit from their insurance reserves, which then become cheaper for the old hires. There's really no alternative to discussing every major component.

Tons of money for future use do not pay current bills, but lengthy transition pushes huge Medicare expenses to the head of the line. There are people in hospital beds today, expecting their bills to be paid. The "J-shaped curve" of lifetime medical expenses does make revenue accumulation possible, but pre-payment transforms this J-shape into a big problem for transition. This "transition problem" requires a clever navigator, who has sensible plans to choose between. The Health Savings Account offers both long term solutions and a fall-back for current emergencies. Quite obviously, a bond issue might be needed to cover early funding gaps, but beyond that, there must be re-designs to cover criss-crossing needs, with an effective salesman leading public support for a proposal which is hard to understand.

There are many pieces to this transition problem. President Obama discovered thirty million people with such wildly different requirements (prison inmates, illegal immigrants, soldiers in uniform, mentally retarded, etc.) they didn't fit any one-size fits- all solution, no matter what had been promised to average folks. President Trump is about to discover different solutions are needed for different age groups. Early problems requiring bond issues will discover existing bonds; we have already issued too much debt from wars and other entitlements. Medium term solutions for a decade of change, and long-term issues may not be suitable for bonds at all. Meanwhile, the system is so huge, mistakes in judgment had best be corrected before they get worse.

We begin this discussion with Medicare, because serious healthcare problems are migrating into the elderly. Medicare covers 50% of healthcare costs, and the proportion steadily increases. With 9 million disabled persons added to 44 million old folks, Medicare will increase still faster and more expensively. Meanwhile, President Obama chose to structure the ACA to include a large portion of the wage-earning age group of non-sick, only to discover they also didn't conform to community distributions of disease. The employer-based group, in the same age group but selectively healthier, found their premiums could then do nothing but go up. It didn't prove to be a useful beginning, so let's look first at the sick half he excluded, which you might suppose is receiving a subsidy from younger people.

Here are some blueprints, Donald. Good luck, Mr. President. Whether some citizens hate you, or some citizens love you, doesn't much matter . What matters is, we all need you to succeed.

Paying for Medicare Transition with Trust Funds.

Since its finance isn't much affected by the Affordable Care Act, there's a temptation to skip over Medicare. But ACA deficits and design flaws frequently grew out of Medicare's initial design decisions. Furthermore, the scientific tendency has been to cure acute diseases of younger people first, so the trend predicts still more high expense (chronic disease) patients will migrate toward Medicare. The ultimate prediction is for little to be left uncured at some distant time, except in the first year of life and the last year of life.

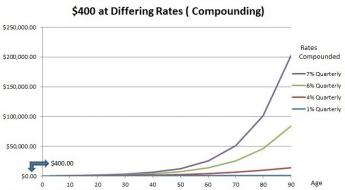

Changed Circumstances. There have been three main changes since some wag called Medicare the third rail of politics -- "just touch it and you're dead". The first change since 1965 is much-increased longevity as a consequence of much-better healthcare. Someone must have seen this coming, but apparently, no one spoke up. Although prolonged retirement is expensive, notice also how it prolongs the period of time available for compound interest to work, so the income curve starts to bend upward after thirty or forty years, regardless of the economy.

Secondly, passive, or index, investing has greatly simplified and strengthened amateur investing. Finally, the Health Savings Accounts appeared, often producing savings of 20-30%. It's time to re-examine the assumptions of 1965, with these three lights shining on them: longevity, passive investing, and payment design. We are not recommending that HSA be entirely funded by index funds, but merely recoiling from too much debt backed by government guarantees. (see below)

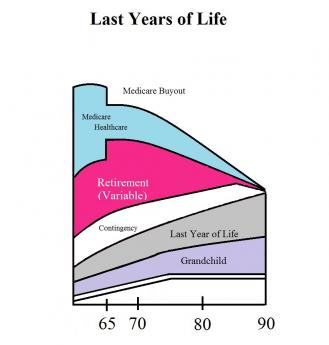

Proposed. In "Ye Olde" Medicare, the average beneficiary pays $56,000 per lifetime (in payroll withholding tax and premiums), but it actually costs the government at least $112,000 per person -- the remaining $50,000 or so per person is secondarily borrowed, so there are no left-overs for retirement. But prolonged longevity and longer retirement, hence more borrowing, are inevitable consequences of better healthcare with the present design. Viewed in that light, Medicare is broke. But viewed as a transition problem, it paradoxically addresses half of it; since half, the Medicare transition is already covered by bond issues. Put that together with the halving provided by Last Year of Life re-insurance, and you have made big progress toward transition. We also offer several other proposals for transition.

Our "New" Medicare, by contrast, seemingly could pay for all its present medical care, plus appreciable retirement cost, with the same revenue. Minimal extra government debt, no rationing or curtailment of service. It does it without changing major program elements; this is a financial change, not a medical one. It really does let you keep your own doctor, and doesn't tell him how to treat you, because it doesn't concern such things. Half of all medical expense is covered by Medicare. And we propose to fund half of that, plus all of the obstetrical/pediatric care, with First and Last Years of Life Re-Insurance. Transition begins to look feasible if we can convince old folks with a fixed income to take a chance on it.

Tools Seemingly Available for Transition to the New System, But Presently Not Provided For in Law: (See below) 1) Scientific break-through cures which significantly reduce the cost of Medicare. 2) Gradual buy-ins for latecomers, which significantly reduce the buy-in cost for people well past 65 at the start. 3) Special Trust Fund Extension eligibilities after death or before childbirth. Compound interest doesn't need the owner to be alive. 4) Delaying the Start of a Childhood Roll-Over. 5) Graduated Retirement as funding develops. All of these will be explained later, and the news is not all bad.Transition costs dominate the replacement of almost any health insurance, so let's restate the theory. A J-shaped cost curve forces a J-shaped revenue stream. When you switch systems, you must reverse the order, paying expensive existing ones first; and funding proves inadequate unless you can double it. If you could just manage, it would be possible to make partial cost savings you could boast of, but except for the Postmortem Trust Fund way you must pay double for all of it, or give up the attempt. By contrast, if you have at your disposal a large new source of credit like a postmortem Trust Fund, with an elastic retirement fund absorbing embarrassing surpluses, you can survive early misjudgments. Medicare could pay for its entire cost with compound interest on what subscribers now contribute, save for the fact it will have inadequate cash flow from people on their deathbeds. But if the death of the subscriber is ignored, the inflow of funds from surviving depositors could continue into postmortem trust funds of the decedents. At 7% return, extending the payments to the length of perpetuity (21 years) would multiply its amount four times, reducing the problem to a quarter of where it started. The transition time is thereby considerable shortened. For transition purposes, it might be wise to create a contingency fund, of up to $250 at birth. But remember, the size of the gap in a life plan can only be finally addressed after we see what is to become of the ACA (Obamacare). For the purposes of this book, we simply treat the ACA as if it were revenue-neutral, a somewhat unlikely forecast, but a completely understandable assumption.Extra Tools, Needed From Congress: "Change the destination" of Medicare's Withholding Tax, and Premiums, so the same money, plus interest, end up in the individual's Health Savings Account, instead of Medicare. That's in return for the subscriber agreeing to buy out Medicare at its mandatory onset, plus any other imposed conditions. There is one technicality: the tax exemption is currently distributed through the income tax system, while it should be added to the HSA, instead. Furthermore, if a considerable surplus (more than $100, say) from compound interest persists after withdrawals, the choice of buying out Medicare can be offered at its beginning age up to the perpetuity limit (on average, age 104), disregarding whether the depositor is still alive or covered by a special successor trust fund. Re-depositing in an HSA should make such contributions tax-exempt and earn compound interest (we hope, at 7%) in an escrowed sub-account which bypasses current medical costs until it is time to use them for Medicare. At least, escrowed in a way which cannot be diverted from Medicare use. Therefore, average payroll-withholding transforms from $28,000 ($700 yearly for forty years, taxable) into health care worth on average 18% more than that, or $825, because it's before-tax, and at 7% grows to $138,000 at age 65 (Try that out on your Internet compound interest calculator). That's what folks are paying right now, but including the tax exemption isn't as smooth as it could be. Don't forget the escrow feature, which keeps people from being their own worst enemies when other purchases compete for the single-purpose savings escrow.

Starting at any age before 66, it could then transform $1400 yearly Medicare premiums, before tax, and thus really $1650 into 18% more for twenty more years, and also pays tax-exempt interest. (Most people will find they have to read this several times because Health Savings Accounts are the only plan enjoying these particular features.) The net effect of augmented income tax augmentation, compounded, is to transform $56,000 before tax, into $534,000 before-tax at age 84, the present life expectancy, not counting $112,000 borrowed by the government, which we hope they can eventually stop borrowing. That doesn't sound like good arithmetic, but If you don't believe it is possible, just try it on one of the Internet's free compound interest calculators. (Furthermore, if an afterdeath trust fund is created to the limit of a legal perpetuity [one lifetime plus 21 years], the present expenditure would be subsequently transformed by compound interest into whatever $2,066,000 is worth at the time, we should hope amply providing for all of Medicare, plus some generous retirement without government borrowing. You won't be surprised to find others think this is more than you will need. We will later suggest better ways to rearrange the same facts, but this summary contains the general idea in highly condensed form.

Although an accumulation of over $2 million per subscriber seems adequate for any normal purpose, it should be recognized that this figure only applies to someone who started saving from birth and waited 104 years to collect. Therefore it would only be a theoretical issue for a long time. A far more generous sum is possible earlier if the original purposes of payments are ignored, and the principle adopted that the largest contribution should begin earliest. That maneuver results in payments age 104 of $30,165,195.00 which would make most people giggle. The obstacle to overcome is the resistance stirred up by matching Medicare premiums to newborn children's HSAs. However, if the system needs more money, this is the place to get it. By adopting this principle, a $2 million fund is achieved at age 60 instead of 104, which eliminates the need to consider several other strategies, expenses and objections thereto, subsequent to a Medicare buyout. It would make an $18,000 grandchild gift seem trivial, and last year of life strategy unnecessary, for example.

Two Central Mistakes In The Design of Medicare.

There are surely dozens of misjudgments in our health system but concentrate on two of them. If correct, they could transform the system, while if uncorrected, no scoring -- dynamic or otherwise -- will conceal our collective failure to address health costs seriously. Other problems can stand aside while these two are considered.

The first is pay-as-you-go. Its name is misleading, because the younger generation, mostly enjoying good health, pays for the previous generation's dauntingly high health costs toward the end of life. Medicare started in 1965 and grew for fifty years. The first generation thus was given a free ride, so my mother who died at the age of 103, represents a whole generation who paid essentially nothing for thirty years of expenses. This hot potato of debt was passed along for fifty years, getting bigger with time and baby booms. The burden of 18% of Gross Domestic Product became unsupportable, even with abnormally low-interest rates. We must now liquidate the debt burden, invest the idle savings until needed for healthcare, and thus eliminate the annual 50% Medicare deficit to foreign nations. Quite a task.

An important result of replacing pay-go with pre-payment is the incentive to save, replacing the historical incentive to spend. Actual experience with HSAs demonstrates net savings in health cost to be at least 20%. Using a Health Savings Account, young people of each generation save for their own subsequent health costs, instead of spending immediately for anonymous demographic groups of strangers. At this point, another unexpected bonus appeared:

Some young people have good luck not to get sick very much, thus accumulating tax-exempt money in the account when they turn 66. In fact, most people do escape serious illness until about age 55. Since everyone gets Medicare eventually, current law turns HSA accumulations into a tax-exempt retirement fund, a provision which went largely unnoticed. (It's mandatory, while I would prefer an option.)

At this point, a second blunder by the designers of Medicare reached the surface. Medicare provided better medical care, made longevity increase, but laid bare it had added thirty years to be financed as retirement cost. Sickness cost is episodic, but retirement costs are continuous. Consequently, these additional retirement costs may eventually become several times as costly as the sickness costs they replaced.

I cannot claim it will be easy to scrape together a package of proposals to cover the transition to a considerably less costly funding system. But I have tried, and suggestions follow in this book. No health funding scheme other than Health Savings Accounts provides even a flimsy scaffold for addressing this new issue. Social Security does have such a mission, but it is hopelessly underfunded. I'm afraid we have to say this impending disaster is largely a consequence of Medicare's success. So this is the second of two big problems facing us: we failed to anticipate success.But there is a third big elephant in this room which might be wiped out with a paragraph of legislation. Scratch any regulation and you usually find a lobbyist underneath it. Somewhat over half of the population enjoys a tax deduction which is denied to the other half, and that other population is restless about it. Unless big corporations soon yield to the demand for equality of treatment, there will be continuing agitation. No doubt it is contemplated to address this issue in the looming tax reform, and perhaps the defenders of this inexcusable situation plan to reserve their concessions for later trade-offs. But after seventy years of this inequity, one half of the public owes such a large debt to that other half, little quid pro quo is justified. Permitting HSA to pay the premiums for its required high-deductible insurance could accomplish this in a handful of sentences, eliminating the grievance.

And what might be called the fourth big issue actually offers hope, instead of despair. Medicare coverage for young unemployable persons ("disabled") was effectively broadened to over 90% in 1984. Narrowly higher costs were thus added to basic Medicare costs for 9 million of the 46 million regular Medicare recipients, rather than remaining lumped with the 30 million uninsured unemployables (requiring specialized programs.) These higher costs of average Medicare per employable person, have been overlooked by most commentators, making ordinary Medicare seem costlier than it really is. It's bad, all right, but not quite as bad as it seems. Documenting that fact, as well as shifting the medical income tax inequity to the tax bill, thus leaves onlytwo new issues to address: pay-as-you-go, and retirement funding. That's quite enough for the first round.

Modifying Medicare Early, Using It Later

Pay/Go Becomes Prepaid

In 1965, the originators of Medicare made two mistakes, both of which seemed perfectly understandable at the time. To get the program rolling, they enrolled my parents' generation to enjoy the benefits without charge, if they were already over age 65 (my mother lived to be 103). And for the same reason, they used current revenues to pay for such older people, who had never contributed to their own costs. The system was called "pay as you go" to justify taking current revenues to pay for benefits unsupported by previous contributions. Money flowed out as fast as it was received, but Medicare never made a serious effort to catch up.

Consequently, there was no interest paid for the use of the money, but the program did get started, years before it would otherwise seem feasible. The program is now over fifty years old however, and it still isn't gathering interest on cash which doesn't get spent for decades. Furthermore, the health of the population invisibly improved so rapidly that decades were added to the lifespan of Americans, and the interest income being lost steadily increased, as well. Since everyone likes to live thirty years longer, pay as you go was considered a reasonable price to pay for it.

However, the possibility has apparently been overlooked that a transition to pre-paid insurance might only be mildly painful. And even if the transition proved to be very painful, eventually the cost savings of Medicare passed on to the subscriber, might be reduced by millions and millions. It is now time to examine whether biting this bullet could really be relatively painless any longer and whether it would save much money. The answer appears to be Yes to both questions. To begin, the arithmetic will be skipped, and the reasoning explained. Following that, the arithmetic is concentrated for those who wish to reassure themselves; it may be skipped by those who don't. If you get the reasoning straight, the math is easily checked by compound interest calculators on the Internet. If you do that, you may find the Internet calculators sometimes create some errors themselves, however, so check your fact-checking.

Medicare is partially prepaid by withholding roughly 3% of a subscriber's wages in advance, as can be seen on any pay stub. From age 25 to age 65, the money aggregates to equal about a quarter of Medicare's actual cost. Another quarter is repaid by premiums, from people actually receiving Medicare. Although the data is overwhelmingly voluminous, it can be found among the Internet reports of CMS, the Center for Medicare and Medicaid. Since patient payment revenues thus aggregate to only half of the total Medicare expenditures, the residual half is paid out of the general fund of taxes, and later borrowed to restore the fund. (Partisans might say it is laundered through the general fund before it is borrowed.) About 13% of our bonds are held by oriental foreigners, and most of the rest is loaned to American citizens. This is how Mrs. Sibelius explained things in her report on the Internet when she was in charge of it. The accumulating debt is now becoming serious, even accounting for the slang phrases used in Congress, suggesting this debt can never be repaid. Stick it to the Chinese, except 87% of it is ultimately owed to U.S. citizens. And U.S. citizens would take most of the haircut, as another saying goes if the debt were dishonored.

Now, focus on an important feature of the average Medicare cost. As a total departmental cost, it includes every person who becomes eligible for Medicare by attaining age 65. It is not exactly what the average person pays, rather, it includes the whole program including those who pay nothing. Therefore, privatizing Medicare with the same funds would not deprive the indigent of anything at all; present funding already includes them. That's one of the main attractivenesses of "single payer", defined as Medicare for everyone at any age-- it's essentially all-inclusive. Unfortunately, its deficit is all-inclusive, too. For present analysis it's a rhetorical advantage to say, any new system using the old money would be all-inclusive as well. Except for half of the increased cost causes a correspondingly increased deficit. At present, the annual deficit is about $200 billion.

It's also important to acknowledge that extended retirement benefits are an innate obligation of Medicare, and right now retirement costs aren't provided at all, except for the (older) Social Security program. Good care leads to a longer life, and we should be grateful. But longer life is expensive, and most people will find they have not saved nearly enough to make it comfortable. For this, there should be more sympathetic. Nothing like this had ever happened before, so some skeptical people cannot be entirely blamed for wanting to see some hardship before they believe the government cannot borrow its way out of it. The financial crunch of some sort is surely coming in the near future because we are recovering from a recession, a political party deadlock, and the threat of both domestic uproar and international discord, both at once. But the health care arithmetic remains pretty clear, as we will see in the next section.

At present, about half the cost of Medicare is recovered by the U.S. Treasury. Without paying any interest, the revenue immediately gets spent, and an equal amount is borrowed -- that's what we just said. So to speak, we only propose to change the mailing address of the checks, that's what we also said. Just deposit that same money (in the same amount) into your Health Savings Account, get a tax deduction for doing so, and earn compound interest on the combined amount. With a tax deduction adding 18% in value and transferring the money at age 65, it will in fact be more money than you appear to need, and it would certainly be less debt.

For the first time, it provides some retirement money "to compensate" for the extra longevity Medicare has provided. If you earn enough investment income (say, 7%), it will be enough to pay for the whole program, including indigents and disabled, so long as they are over 65 or entitled to a special Medicare disabled program, as 9 million already are. Remember, that promise includes a retirement fund. If you don't earn enough investment income, it won't cover it all but it will surely cover more than it would have, without any compound interest and tax shelter. And the investment return would probably be increased at the expense of the financial community, who will resist. Fee-only advice, rather than commissions, would add about one percent to investor returns, according to the Wall Street Journal, although lobbyists for Wall Street vigorously deny it. The proposal here is to insist both systems operate side-by-side until the difference is clear.

Although the arithmetic seems to be pretty evident, we do advise creating a contingency fund in addition, just to be safe. The contingency fund would have to be at least a hundred dollars at birth and might be as much as two hundred-fifty. That's the only extra expense for a lifetime of healthcare and retirement which actuaries estimate to cost an average of $350,000 per average lifetime, plus an equal amount for retirement, to say nothing about the hidden elimination of the government's deficit for Medicare. That's a pretty good bargain, so we suggest consideration of paying some of the resulting surpluses to a children's fund, rather than just letting it appear in estates. You can tell yourself you've helped little children while protecting yourself against contingencies. The Medicare crisis goes away, the Retirement crisis is abated, the national debt stops expanding, and a start is made on the childhood problem -- all with money you're already spending, plus a hundred or so dollars, just for safety and dignity. Read on, just in case you are good at math, and you don't believe in miracles.

By the way, it has been implied this release of money is due to inflation, and it is true the inflation assumption (for income and general expenses alike) remains about 3%. But the real success secret beyond any person's control is inherent in the mathematics of compound interest. When an investment goes much beyond thirty years in duration, the effective interest rate rises spectacularly; you can thank Medicare for that, if you wish, or perhaps Aristotle. Inflation raises your retirement cost, that is true. But it also raises your income, so at present, it's a short-term wash except for scientific advances, which are surely a long-term net improvement.

Steps in the Staircase, Extending for Decades.

There are traps on every step of the staircase to an improved healthcare financing system. They are teased out in four preceding books, step by painful step. A brief summary is therefore important for orientation, especially for newcomers.

A Health Savings Account misleads a newcomer into thinking it is a single process, when in fact it starts with two processes, welded together. It begins with a high-deductible health insurance policy and adds a Christmas Savings Fund to help beginners overcome the initial deductible. That is, it began as a bare-bones indemnity policy for poor people because it's the cheapest form of insurance. It has the characteristic that the higher the deductible, the lower the premium. It's true it leaves the subscriber without coverage for a few years when he is young, but the Affordable Care Act has made high deductibles essentially mandatory, so we start out even. Once there are enough deposits in the account to cover the deductible, the subscriber is completely covered from the first dollar of health care. But since he has the alternative of paying cash for small claims, it carries an incentive to leave it untouched as a tax-exempt fund for larger later claims. Since the true deductible is what is left unpaid, it is quite true the premium does not rise when the depositor crosses that invisible line. When he does, he can rightly claim to have first-dollar coverage at high-deductible (low) premiums. It's a bargain, and he is allowed to deposit $3400 yearly into the account, getting a tax deduction for it, and no taxes when he spends it for healthcare. Health Savings Accounts are the only health plan with this feature. It gathers compounding interest as long as there is money in it, which will turn into an IRA (Individual Retirement Account) when he joins Medicare. It's the only plan with that feature, as well, and the American Academy of Actuaries found it was 30% cheaper than regular insurance.

Part of the savings came from the tendency of HSAs to pay small bills with a debit card, working on the assumption the depositor will not spend his own money as freely as he spends an insurance claim. Since health insurance averages 17% costs, the main claim to process, it taught everyone the lesson that the expensive claims processing costs could be avoided by giving the subscriber some "skin in the game." When you compound these two savings for several decades, a surprising amount of income is generated, which ultimately is available to spend in retirement. And if you spend it for healthcare, you probably won't survive quite as long. The serious disease is being pushed steadily later in life, to the point where half of the sickness cost is paid by Medicare, and half of that covers the last four years of life. Longevity, in short, has increased by nearly thirty years in the past century. At the rate this is going, retirement costs will soon exceed healthcare costs, and a dual-purpose Health Savings Account is the only health insurance which covers both purposes.

Therefore, this program is available as a fall-back, in case of a sudden collapse in the Affordable Care Act. The incoming President won the election as a change agent, and he may have other plans. But the House of Representatives has voted to repeal the ACA many times, only to be thwarted by the threat of a filibuster in the Senate or veto by the former President of the opposite party. Very shortly, we may find ourselves without ACA, and nothing ready to replace it. Since the HSA is owned by the subscriber, and innumerable financial institutions are able to supply it, it makes for a quick replacement. A very short technical amendment would repair the few flaws to appear in thirty years, like expanding the age, occupational and contribution limits, and allowing a tax deduction for the insurance component by permitting the tax-exempt account to purchase the catastrophic insurance, currently forbidden. Given a week or two, Congress could improve on that, but it makes a swift substitute very simple.

However, the HSA has been around for thirty years, and bigger ideas have emerged. The retirement feature is the first feature to appear, inadvertently thwarted by the mandatory roll-over on attaining Medicare coverage. The roll-over is a good idea, but it should be optional up to a somewhat later age. We will return to that unexpected twist in the next section. Because Medicare is beginning to accumulate the most serious illnesses, the bullet will have to be bitten; Medicare really ought to be the first existing health plan to join the Health Savings Plan network. Unfortunately, retirees are particularly wary of change to their plan, and must be persuaded.

Since other health insurance needs to share in this feature as well, provision ought to be made to add their finance stream to the Health Savings Account pattern, like adding pearls to a necklace. As long as they remain revenue neutral, there would be no objection to adding them to the Health Savings Accounts in order to share in the retirement incentive. This might be considered if new programs for prison inmates, illegal immigrants, etc. want to get started rapidly, and would greatly facilitate the transition. Great overhead savings are possible through merging operations permanently, but permanence is not as essential as a speedy onset. Just as Medicare is accumulating the bulk of serious chronic disease, employer-based health insurance, and ACA contain the bulk of the money generation. A very expensive transfer system, using the government as a bank, has been virtually constituted for the purpose of uniting the money with the disease cost, across age barriers. This problem is expensive, and getting worse. However, no one wants to subsidize some other insurance, so every ship on its own bottom -- revenue neutrality, -- is a price that must be paid for the independence of the various delivery systems. These are the steps on the staircase., which may take decades to complete. The very least which can be required is to keep any windfall scientific breakthroughs, permanently within the healthcare realm, untouchable by regional, governmental, industry or legal encroachment.

Because very large amounts of money must be held by a custodian for many decades, special precautions must be constructed to keep it from wandering to unintended purposes, such as aircraft carriers, to say nothing of imperfect agency of the usual type. The awkwardness of the Tenth Constitutional Amendment must be satisfied, possibly through the court system, possibly legislatively. All these things require time to resolve, and a full implementation cannot be expected during many changes of political control. Neither the outcome nor the cost can be precisely predicted. But if we rescue healthcare from earlier blunders, and avoid new ones in retirement funding, we can be very proud of ourselves.

Now, let's take a look at the age limit for surplus funds in the account.

Law of Perpetuities

It may be a surprise, but the concept of a Limiting Factor (the Law of Perpetuity) may once again intrude the U.S. Supreme Court into the Affordable Care Act. It may also be a little hard to follow, so pay attention to what would ordinarily be regarded as a dry subject.

The concept of a limiting factor makes modern law, and possibly modern economics, possible. Several centuries ago, well before the US Constitution was written, lawyers came to see that many things are only possible if you don't carry them too far. The operation of compound interest is an example. In ordinary human commerce, the tendency of compound interest to rise over time leads to an eightfold rise over one lifetime of 84 years (48 in 1901 to 84 in 2017). A 200-year lifetime would lead to even more rise, to the point where one dollar invested at birth at 7% would pay for the entire average medical cost of a lifetime of $350,000 expressed in the year 2000 dollars. But quite obviously, if some scientist discovered a drug which lengthened life that much, something in the law would have to be changed to hold the economic world together.

So, about three hundred years ago, some English judge laid down the Law of Perpetuity, stating that Trust Funds may not endure for more than one lifetime, plus 21 years. It's proved to be a useful limiting factor, not likely to be changed easily. Congress might feel empowered to change it, but too much of modern commerce revolves around this definition of perpetuity, for the public to permit tampering without huge uproar. Notice the flexible wording: 21 years plus one life expectancy. Changing life expectancy would not invalidate the law.

A century ago, life expectancy was thirty years shorter, five doublings at 7%. And now it is more than eight doublings or in effect (2,4,8,16,32,,64,128,-->)256 times the original number. But that doesn't matter, because the law only effectively states its limit is 2 doublings (four times as much) more than the life expectancy at birth. A century ago, that implied two hundred-fifty-fold increase more than the starting amount at birth, and today it implies a thousand times. Inflation chugs along at 3% simple interest in both cases, at a growth rate doubling in 24 years (72/3). That's three doublings at simple interest a century ago, versus four doublings today. The important present difference is the thousand-fold compounded gain, compared with only 256-fold compounded at 7% a century ago, a seven-hundred-fold difference in the base price. The problem we have nevertheless still threatened less than forces opposed to changing the Perpetuity age limits.To summarize, compound interest on Medicare-linked investment has gained six or seven hundred-fold over inflation in a century, as a result of medical progress bumping against mathematical principles. This difference is not likely to change in the coming century, because longevity at birth would have to increase to age two hundred to overwhelm the judges into changing the age limits of such a fundamental law. If net Medicare-linked costs rise to approach that level, moreover, this revenue opportunity might disappear.

There is no reason to avoid exploiting this opportunity while it lasts. It presents a quick and dirty solution to the present urgent problem, which is to find alternative proposals for reforming transition to healthcare financing, in case the Affordable Care Act is suddenly repealed. At the present time, the opportunity to reduce the effective cost of transition lies in the gap between the average age of death and the Law of Perpetuity -- about twenty years. At 7%, that's two doublings or four-fold profitability. The question becomes whether to raise the term limit of the Health Savings Accounts above its present level of the age of Medicare attainment. The natural instinct would be to terminate the HSA at death, but the Perpetuity law would permit 21 years more. Since the life and health of the depositor has very little bearing on this subject, Congress has the opportunity to allow Trust funds to continue to earn investment interest after death, until either its Medicare funding debts are extinguished, or the birthdate of the deceased depositor reaches 104 and is terminated by the unchanged Law of Perpetuity. The effect of doing this would multiply the funds for the transition by 400%, and largely solve the problem if the Trust applied all funds to the debt incurred when offered the opportunity to choose. When we get to that subject, the transition is the big obstacle for three reasons: 1) There may not be enough money to do it. 2) The transition may take too long if it is constrained by available funds. 3) And the courts may find some reason to block it.

As a non-lawyer, I can see no technical reason why this could not be done, but some reason might be invented for political reasons. Unanticipated problems might arise, but under present law the challenge would probably come through the State courts, using the Tenth Amendment as a basis. If the adoption of the idea is voluntary with the States, or if demonstration projects are employed, a conflict between jurisdictions is very likely, and the U.S.Supreme Court would have to settle the conflict. This split approach might satisfy both State and Federal proponents enough to remove the obstacle, because the Wickard v. Fillmore decision still rankles after eighty years, and after much longer than that from the Civil War, memory of which still greatly affects the regional popularity of federalism.

Several other ways to pay for the transition costs, or shorten the transition time, will be offered in later chapters. But only this simple change is required early in the process, and so only this proposal will transform transition from a plan to a process. It has always bothered me for a complete transition to take nearly a century, during which interval there would be many changes of political control of Congress. In turn, those transitions offer a chance to smother central concepts in a welter of obfuscation. And that applies to all transitions, suggesting original planning should always be followed. To a certain degree, that has sometimes proved useful, but the transition in this particularly vexed case is going too far with it. So having major alternative approaches, and thus creating opportunities for later innovation, seems on balance a worth-while addition.

The Plan

It is time to present an outline of the proposal for replacing the Affordable Care Act with a cheaper payment design, owned by the subscriber himself. We first described its chief obstacle, paying for transition to it, not just because the proposal has to be shaped around that obstacles solution. It quickly becomes apparent people are so incredulous about overcoming a century-long year transition, they lose interest in details of it. Essentially, the solution consists of borrowing from trust funds after death, or possibly in anticipation of birth. This, in turn, generates income from extending the period of compound interest, which actually increases with a longer time period. Once it is accepted the protracted transition can be shortened into reasonable time periods, people are more willing to look at the overall proposal..

Most health insurance depends on overcharging healthy young people, using that accumulated surplus to pay for expensive old folks. Because people often change jobs, it becomes difficult for employer-based insurance to do that, so employer control of the system depends on the contortion of giving insurance as a gift to the employee. That allows the employer to set the terms while increasing funds with a tax deduction. This questionable approach is only tolerated because it works, and nothing else seems to. However, in the long run, it increases costs, and we are reaching the point where it has to end. With a plausible transition, we can at least look at alternatives.

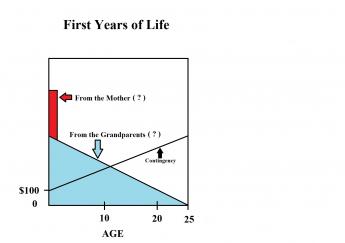

The beginning of earnings happens to coincide with the least expensive period of life, around age 25. Children can get expensively sick, but someone has to give them the money for it. The period from childbirth to age 25 is a sort of no-man's land, neither self-supported nor assuredly funded by solvent parents. So let's assume children's health costs are donated by someone else, and the system really starts with approximately the 26th birthday. With the first paycheck, the new employee begins to contribute 3% of his earnings to Medicare. That's right now, and the employment period lasts approximately until the 65th birthday, followed by 20 years of Medicare premiums, until age 85, the present life expectancy. We suggest the payroll tax be paid into the individual's Health Savings Account instead of the Medicare "Trust Fund". If Congress would permit it, it would generate much more money if the premium expectancy were paid first, followed by forty years of the payroll deduction. That leaves 21 more years for a postmortem Trust Fund to make up any difference caused by starting later than at birth, reducing the implicit debt by 75%. Any surplus can be used for retirement purposes, any deficit remaining at age 104 can be written off. A table will show this system could supply ample funds for Medicare, and a variable amount for retirement. There are five special considerations, more or less optional in timing a phase-in:

1. Scientific Attrition of Healthcare Costs. We presently experience a period when new curative drugs costing pennies to manufacture, are being sold for eighty thousand dollars per treatment. Presumably, this will be a brief period because no government can tolerate it for long. After turmoil is overcome, we can expect a series of scientific discoveries will eliminate many health costs, often preceded by a brief period of raising them, first. It may be tumultuous, but the eventual outcome will be substantial lowering of before-inflation costs of medical care. It might require a century, although probably will be considerably sooner before we see health costs approaching those of the first-year and last-years of life. Executives of pharmaceutical companies may have other plans, but I have confidence in scientists' love of fame, driven by thirty or forty billion a year of research dollars, to sweep contrary trends aside. In the coming century, you can share my confidence that after-inflation health costs will come down. It will be up to Congress to be sure such savings are retained within the health system and not spent on battleships, or new substitutes for sickness care.2. Not a Single-Payer System, but Pearls on a String, Linked by Escrowing. This is essentially the same problem the Constitutional Congress faced in 1789. One side justifiably wanted a powerful central government for taxes and defense. In time, the central government was given a few enumerated powers by the Tenth Amendment to accomplish these goals, but everything else remained locally controlled. The dual problems were resolved with a dual ("federalized") system, which lasted 80 years until slavery and the Civil War broke it apart. Applying the same principles to Healthcare financing faces the same sort of issue, with the major difference that Healthcare financing is destined to get easier in spurts, constantly illustrating hope for the future. What holds it together is escrow a binding agreement to do what you promised unless some third party custodian decides you need an exception. The present four components are held together by escrow accounts, each ship on its own bottom, with a court system to allow for occasional special circumstances for one component to subsidize another. Other entities could add pearls to the necklace as desired. It has its fragilities, but it ought to last a century. If it doesn't seem to be working, a single payer's flaws can still be re-examined. But that's why we must wait to see what Obamacare really costs, with subpoena power to be sure the data reflects the complexities. The working age population in ACA really ought to produce surplus revenue, but indications are it wants to be subsidized. For the present, approximately revenue-neutral would suffice.

3. Component-shifting, Replacing Hidden Cost-shifting. The lifetime cost curve of healthcare is J-shaped from birth to death. Both the balancing problem and the revenue solution revolve around keeping revenue and cost manageably in balance at each stage, so transfer systems are minimized, not exaggerated. As a generalization, our proposal depends on moving payment compartments to other stages of the J-shaped curve. Obstetrical-pediatric costs are shifted from the mother to the child. The child's cost is shifted to investment-overfunded Medicare; male-female costs are equalized by removing them from the mother. The overall effect is to transfer obstetrical/childhood costs from single mothers and employers to Medicare (from the far end of the J-shaped curve to the opposite end), which is overfunded by the tail end of the compound interest curve. It's inevitably a little lumpy, and the final result must be smoothed out with the familiar tricks of accountants. It may seem difficult to persuade a dozen industry executives to shift business components like checkers, but it's a whole lot easier than persuading millions of customers to rearrange their health insurance habits. The new source of revenue is investment income from the currently indolent revenue stream , so there's considerable extra revenue to pacify a few losers.

The specifics are: transfer obstetrics/pediatrics from mother to child, donate that cost (supposedly $18,000) at birth to the Health Savings Account of the child, and eventually to his Medicare voluntary buy-out escrow at age 65. Any surplus is used for retirement, less buy-out costs for last-year of life re-insurance and childhood costs. (By the way, I bet we will find it doesn't cost $18,000 to bear and support a child; much of that big-ticket cost must be cost-shifted accounting maneuvers for malpractice, bad debts, etc.)

4. Computers: Finance Industry Suffers, Amateur Investors Prosper. Burton Malkiel showed a Random Walk Down Wall Street was mostly superior to the sharp-penciled judgment of experts, while John Bogle made economy-wide investing practicality, with index funds. Adjusted for fees, it was pretty hard for an investor to improve on low-cost total market index funds, just buy 'em and forget 'em.

Bogle's funds now total in the trillions of dollars, still growing fast, with only the crooked ones left to worry about, although the year you were born and the year you happen to die will affect the result beyond anyone's control. Otherwise, this approach will suddenly give millions of people superior results cheaply. When you compound the results for most of a century, a few tenths of a percent difference in return make a big difference in final outcome.

On the other hand, risky investments offer higher returns, so total market index funds must be chosen with care. The narrow index funds, by industry, for example, are not what we are describing. Our present calculation is that a steady 6.7% average return will suffice for a medical lifetime. Professor Ibbotson of Yale reports the stock market has averaged 10-11% for the past century, and inflation has averaged 3%; the result is 8% real return to be split between Wall Street and the investor, When you consider who is taking what risk, the investor has a reasonable argument he deserves (but often does not get) 6.7%. And when you observe the violence with which lobbyists reject mandatory fiduciary (the customer's interest ahead of the intermediary's) relationships where 1% is at stake, it won't be an easy settlement.

5. First Year and Last Year of Life Re-insurance. Two things make this transition idea possible. Not only is 50% of health cost concentrated in Medicare, but 50% of that is concentrated in the last four years of life. Secondly, the two halves of Medicare revenue stream can be separated by paying cost components into different escrow funds, reunited after death and/or borrowed, as seems expedient.

Effectively, this can remove half of Medicare cost from the mainstream, and it's the half which will shrink from scientific advances of the future. The terminal care half is more resistant to shrinking, is payable after death, and therefore puts less pressure on transition, demanding expediency only for half the costs. Essentially, this dual approach is an alternative or supplement, to Postmortem Transition Trust Funds. If both methods are employed, the transition phase can be considerably shortened. If half of Medicare cost is already "in the bank", it should also reassure many older subscribers of its safety.

It's presently difficult to know what to do with First Year of Life Insurance until we are more certain of its real cost. It's held in reserve until we can judge what its urgency is.

Well, What About Catastrophic Health Insurance, All by Itself?

To have a Health Savings Account, you must also have a high-deductible insurance policy by law, and naturally, there are premiums for it. Since I favor just about everyone having a Health Savings Account, I also favor everyone having Catastrophic insurance, as Scott Gottlieb and James C. Capretta advocate in a recent Wall Street Journal Op-ed article. Unfortunately, it is not entirely clear what that might cost, but we could find out by learning what it must cover.

Salesmanship. It's true the vendors of catastrophic insurance have been reluctant to advertise prices or even quote them over the phone. That's an unfortunate feature of many big-ticket items sold on commission. Desiring to save price for the last item of discussion, salesmen frequently leave room for discounting their commission against the customer's guess at the lowest possible price. Everyone who has bought an automobile is familiar with the issue; it's not in the salesman's interest to be up-front with his best offer. When it's included in the Bronze plan of the ACA, they quote the minimum price at about a hundred dollars a month. But that is not the whole pricing problem with Health Savings Accounts.

Boundaries. It comes down to rules for the product's boundaries. I fought hard for the HSA law, and am proud of it. Unfortunately, it contains a clause requiring customers to be employed, which cuts out policies for children. It also terminates at age 65, when Medicare ends your cost worries, but creates the unique ability to roll unspent HSA money into retirement funds. Essentially, "employment" limits health insurance to the middle third of an average lifetime, where only a third of health expense is found. Without a transfer mechanism, that makes life insurance difficult. So within the fixed limits, there also exists an unnecessary second uncertainty about its permanence. In the past, a significant portion of insurance profit comes from people who drop their policies. Why wouldn't they drop them, when they threaten to lose usefulness? People do make wrong choices, but in general, they know their best interests. Make it an option, and price it accordingly.

Compound Interest Grows with More Time. When allies want to make catastrophic insurance universal, apparently without required linkage to Savings Accounts, one has to worry it might pass in a form making other proposals politically more difficult. It considerably reduces attractiveness to subtract years from compound interest that way. Especially during sixty years of employer-based insurance, where custodial costs might be 0.1%. The proponents of catastrophic alone probably would not object to widening its age and employment limits, but you never know how negotiations could turn out. Custodial cost isn't hard to fix, but meanwhile, a final price must be stated, so I have a proposal.

Cost. There's no price mentioned for just leaving an account in the background whenever it shows zero spending activity for minor custodial cost. Remember, it provides an access route to retirement funding and greatly enhances yield. It's thus a valuable feature for both parties if dual coverage is permitted. In fact, a base price for zero spending activity, plus additional surcharges for months in use, might significantly improve present premium structures, which depend too much on sharing profits with a broker in order to reduce premium cost. The suggested option would approach charging ten dollars a month without activity, twenty-five dollars a month for outpatient spending, plus five hundred dollars a month for hospitalization. Internal subtraction from account balances could eliminate new billing costs; a short period of experience would restore predictability, as it does in banks.

Taxes. Dual coverage is commonplace in coinsurance, supplemental insurance, etc. so there is little reason to prohibit it here. Instead of catastrophic insurance firmly outside a tax-exempt savings account, as at present, the configuration might better become catastrophic with tax exemption, included within an HSA twin package. That would make an HSA equal with employer-based insurance as a matter of Constitutional tax equity. Instead of potentially offering everybody a chance to become a virtual millionaire if he is frugal, stripping the two apart in the suggested way might only leave coverage for the ultimate benefit of hospitals, the most expensive component of our present system, it is true. But that would eliminate year-to-year carryover, thus crippling innovations which greatly outweigh the nuisance.

Playing it Safe. and Shooting for the Stars. The proposal inadvertently implies: No funding for retirement, no removal of obstetrics from employer coverage, no male-female equalization, no Medicare buy-out option, no mechanism for lifetime coverage. It's a retreat, not a courageous advance, to split the Health Savings Account and discard such enormous potential. At the very least, we should all be fighting to permit HSA as a dual optional addition to any health plan, at any age, disregarding employment status. When we first find out what its mandated extent would be, we'll be able to estimate its cost.

And something else needs to be said. All of the first part of this book concentrates on using HSAs to transfer funds from the profitable age groups to the expensive ones. Without the linkage to an account, there is no way left to substitute for hospital cost-shifting, a growing evil. At the same time, it is necessary to restrain medical prices from rising. As Justice Cardozo observed, sunlight is the best disinfectant, so hidden cost-shifting tempts honest people into crooked behavior. Open-book accounting is better. Saving for your own old age is better than using the government as a bank to subsidize people you never met.

Preliminary Summary

Let's stop for a moment to review where we are. Several books ago, I announced my conviction that Health Savings Accounts are just about the only alternative to the Affordable Care Act to have completed all the steps of legislation, and many of the steps of establishing a national network. It has been tested over a period of thirty years and has probably discovered and corrected most of the many minor flaws to surface in testing actual operations of a big project. HSA could be implemented nationally during the sort of insurance crash which has been widely predicted. Unless it faces a national last-ditch rebellion by millions of people, a few corrective technical amendments could be added in a week, and the rest of its implementation would be temporarily solved. I'm sure I don't want to see such a thing actually happen, but if it does, I think HSA would get us through the crisis. Perhaps for that very reason, the crisis won't occur because it wouldn't accomplish much except further polarizing people. After all, most people are not desperately sick all at once, and Health Savings Accounts could patch something together for the many who are not desperately sick, while hospitals are full of administrators who know what to do. Without hysteria pushing us, of course, we could do better.

A Necklace of Pearls. A much better approach would be to continue a slightly modified Health Savings Account while we study how to add pearls to the necklace, one by one. It could be done in a year, although two or three years would be better. There are several alternatives available for demonstration projects if there is time to implement several, picking out the best ones. If our Congressmen didn't spend so much time commuting, or in the telephone call center soliciting, they might conduct a surprisingly large amount of legislation. In that sense, adding an atmosphere of urgency might be a good thing. I believe calculations demonstrated there could be plenty of money available to mount a full implementation, with only political and psychological resistance. From Pearl Harbor to Hiroshima, we fought an entire World War in that much time.

Topple the Finance System? In fact, I believe the Federal Reserve would be horrified at the prospect of giving thirty million dollars to every citizen, and resistance from their direction would overall be useful in redirecting 18 percent of GDP. We don't operate on a monetary standard anymore, and yet we do. You can't be certain any printing press money would assuredly be redeemed in gold, but on the other hand, we own multiple tons of gold bullion in Fort Knox and similar places. Something could be patched together.

Start with Cost Accountants. My advice would be to start with a large team of accountants, to fan out and assess where the bodies are buried, and how bad the damage might have been. For example, I would love to know what the tangled motives could be, for hospitals to overcharge so drastically for drugs, knowing full well the insurance companies will disallow the majority of such overcharges, and their own business office will discount most of the uninsured bills. There must be some financial motive, probably rooted in some overlap between independent laws, but all I ever got from hospital accountants was a smirk when I questioned it. A whole nation has become infuriated with such billing practices which seldom result in much revenue. It took me years to figure out why outpatient charges tend to be so much higher than inpatient ones for the same service, and why business executives force employees into captive insurance policies in spite of "job lock" and associated unpleasantness resulting from employer ownership of the policies. And so forth. The basic question is, what is preventing market forces from holding prices down. Please don't just give up and ask for more stringent price controls. Just take a hard look at indirect overhead costs, for example. Health insurers surely must know some of the answers; shake tips out of their accounting retirees.

And so we come to reversing the payment flow. If you only increase the revenue, don't be surprised if prices rise to wipe out the profit margin. The first part of this book solves a lot of problems by providing more money to the patients. We must establish a balance between fluctuating costs and cash flow which creates a competition between retirement income and health provider income, each of which is unrestrained. Instead, they should restrain each other if we design the system to encourage it.

Unfinished Business

Two things remain to be addressed: the cost of the catastrophic insurance, and the sort of agency which should sell the HSA service. Because both of these issues contain a strong political flavor, and because of the uncertain cost of the Affordable Care Act without subpoena power which the incoming administration will possess if it needs it, it is not possible to integrate these two features just yet. The power to delay action, inherent in the federalized system of governance, makes it difficult even to predict when these obstacles will be cleared away. Presumably, the Scalia vacancy on the Supreme Court will clarify much of this, but a time table is difficult to predict. Nevertheless, it is possible to outline the shape of what is needed.

Catastrophic healthcare insurance is "term" insurance, both in the sense its premium can be changed yearly, and in the sense that individual policies can negotiate their premiums to the degree, the agent is allowed to discount part of his sales commission in order to lower the premium. Thus to be fair, it must be admitted a general premium is difficult to state for a lifetime. The closest I have been able to find for a national insurance company is an offer of a $2000 yearly deductible, for $55 a month premium. But is it automatically renewable? The agent didn't know. What is covered? The agent didn't know.

Anticipating the Need from the Beginning

When you touch a hot stove, the signal makes a round trip to and from your brain in a fraction of a second. But we have been told the tip of a dinosaur's tail is so far from its head, its slowed signals required a second brainlet in the tail of the dinosaur to retransmit in a useful time period. Whether the example is accurate or not, the fable illustrates the utility of speedy information. If we construct a system of paying for Medicare with revenue derived from childhood, we can't wait for the signal to travel for sixty years to those expensive Medicare patients. It would be a useful feature for the two ends of the payment system to communicate instantly. That would only be possible if those two ends were in existence from the beginning of the system. Therefore, it might be important to reorder the sequence more or less simultaneously and to establish communication from the outset. That's true throughout the cycle, but it is particularly important for the two ends of it. The "pearls on a string" design concept might take care of this problem fairly simply.

It's preferable, for instance, to insisting all "pearls" should be revenue neutral and then forgetting about it. Doing that would raise the question of what to do if they don't all prove to be neutral. Evict a member of the circle? Impose a reserve requirement and tax it when ends don't meet? Does one pearl borrow a deficit from another pearl with a surplus? Tax the incoming receipts for last year's deficit? What should be done if some pearl is chronically out of balance, year after year? All of these possibilities may well be encountered, and solutions are more likely to be imposed if they are agreed in advance. Such arrangements are somewhat more secure if agreed as a condition of entry, since that forces revenue and spending to be pretty close at the start, making maintenance easier to continue. But what should the others do if one age group consistently produces a surplus? You wouldn't want to discourage that. What if they all produce surplus?

Inevitably, a more ideal solution is to impose or award a monetary solution, either paying an interest rate or awarding one, for internal borrowing. The problem is a monetary one and should have a monetary solution. For a start, the actually achieved investment return of the depositors seems like a good rate to begin. If the problem becomes a chronic one in spite of a common interest rate, some consideration should be given to modifying the content of the investment portfolio. With millions of individual HSAs owned by amateurs, they should be faced with an idealized solution as a default, trying as hard as possible to avoid doing it by regulation, but probably reserving regulation as a fall-back from market failure.

The starting concept is to invest in the whole economy, prospering or suffering as the whole nation does. A penalty fund composed of drug companies, scientific equipment makers, or makers of other medical products, could be constructed to divert the profits of such industries back to the patient population which supports them. If the effect of HSA deficits is to speculate on insider information, such profits might be refluxed back to the HSA as a means of discouraging speculation with the depositors' money. Or encouraging it for that matter, so long as the effect is to recycle speculative profits back to the people being gouged. Eventually, a system might be imagined of the patient population creating a venture capital fund, whose purpose is to stimulate research in products which transform speculators' profits into products which benefit them even more than in financial ways. We're getting close to government control of private industry when the discussion turns in this way, but perhaps some small experiments would be harmless, or definitions could be devised to distinguish venture capital investment from insider trading. We do seem to have a problem with establishing market prices for medical care, and perhaps there is some value in this type of approach. While we are at it, we might also have a look at the Food and Drug Administration, which seemed to be working well until Senator Kefauver meddled with it.

After a Long Tour of the Transfer Escrow, a Return to the Old Health Savings Account

The Escrow subaccount within Health Savings Accounts now stands unveiled for what it is -- a transfer system between plans. It pays for health insurance, usually not for current care but designated for underfunded future care. Regular Health insurance sometimes contains similar communication-and -funds transfer channels, but informal ones, patchwork for adding new features to existing ones, as in adding federal funds to state-controlled Medicaid. We here offer the escrowed Health Savings Account as an individually owned policy, specifically incorporating specific finances of a string of pearls to new ones with independent delivery- system regulations. As long as the pearls are careful, they can have a neutral transfer system, like the state-national one for the rest of the economy. Disputes are regulated by the courts under a common Supreme Court. The Court might be a new medical one, or use the one we already have.

This tripartite system not only conforms to the Constitution but restrains mission creep. That's historically why we have a Bill of Rights, although the document doesn't say so.

If the escrow subaccount is purely a transfer system between Pearls on a String, what is the function of the non-escrow portion? It is to permit each Pearl to fund separately and independently, and to make it easier to keep one Pearl from subsidizing another inadvertently. An argument can be made that New York now subsidizes Mississippi within the Federal Reserve monetary system, but that was for facilitating the approval of the various states -- the states which badly wanted a Federal Reserve would be taxed extra to get it -- but it is uncertain whether the same considerations apply to healthcare. The absence of cross-subsidy may be seen as an advantage in Healthcare, and therefore the issue should be decided by Congress. Perhaps decision could be delayed until the public gets a sense of what it wants after some defined period of experience.

When Health Savings Accounts were first discussed, it was assumed they would be funded by employer contributions, so and so many dollars per month or per quarter per employee. Tax deductibility would be decided once, and probably continue indefinitely for a class of employees or a certain type of employer. Actually, that proves to be the most difficult method to determine, because health insurance is given to the employee as a gift, and therefore has already been made tax-exempt. The potential for double tax exemption is raised, and various strategies could be adopted to simplify the tax status.

The double tax exemption might well be re-examined, but much of its unfairness traces to employer's inequitable tax exemption in the first place, which we have repeatedly suggested Congress equalize. It might be compared with using the income from municipal bonds, also tax exempt and tangled up in the minimum tax provision as well. If the amount of questionable deposits is overall fairly small, the matter can be taken up in a general revision of taxation and passed over for the present.

The Arithmetic Behind Our Claims, With Commentary

Knowing how to calculate is less important than knowing what to calculate. Any computer's search engine has several free examples of compound interest calculators. It is also useful to know a few short-cut ways of calculating approximate answers in your head, just to keep a check on computer calculations going off the rails. Be careful, because calculators can have bugs (or the computer's memory cache may not unload), but the commoner mistake is to calculate the wrong components.

The chief short-cut to know is a $100 fund of money earning 7% will double to $200 in ten years. Its related fact is, in fifty years a hundred dollars at 7% will equal (2,4,8,16,-->32) times a hundred dollars, or $3,200. With compound interest, the result is not linear. The 7% in 10 years shorthand is a subset of the "rule of 72", which says you can divide 72 by the compound interest rate, to get the number of years it takes to double. So while 7% doubles in 10 years, 6% doubles in 12 years, 10% doubles in 7 years, etc.

It's true, $100 at 10% will double every seven years, (as in 2, 4, 8, 16,--> 32x) in 35 years, or to $3200, reaching the same value as 7%, but in fifteen fewer years. Our economy contains more examples of 7% interest charges, than of 10%. The difference between 7% and 10% is surprisingly great and surprisingly meaningful in reverse. The 10% figure is often applied to impaired credit, or galloping inflation and therefore higher rates are often a warning signal, not an opportunity. Approximations permit the reader to recognize anomalies or to verify accurate calculations without repeating them.

Both approaches, short-hand and the Internet calculator, are recommended for verifying the following calculations, involving advance predictions which cannot be precise. One method of signaling approximation is to round off the answers to three or more digits of zeroes (2,400,000 is most probably an approximation, for example). We prefer fully calculated numbers, not to imply an accuracy which isn't present, but to allow the reader to follow arguments by recognizing components as they jump from line to line without elaborate identification.

-----------------------------------------------------------------------------------------------------------------------------------

Summary of the Math, With Caveats. This proposal is not free, it mainly substitutes investment income for government borrowing. The government thus benefits, but the patient benefits as well because he ends up owning the investment. This is an essential feature, since without it the consumer may see the proposal as benefitting the government, without benefitting himself. The calculations are necessarily rough ones, and 7% may prove optimistic, but the system is self-balancing. Borrowing is reduced, so in the example, the consumer gets the same product for roughly half its present net cost. "Roughly half" is approximate; the actual saving will be determined by market forces, both when he buys the investment, and later when he sells it.

To be explicit, this proposal involves passing early savings into the individual's own savings account, and immediately investing them. The consumer can measure his savings growth and later can watch his own bills being paid with them. He keeps any savings for his own retirement, and even more, if he is frugal enough to generate extra savings. Furthermore, he lives longer, which is largely only possible if his government has the money freed up to spend more billions on basic research to cure the diseases he might have died of. It is, therefore, possible to describe this whole system as a shrewd investment, growing out of cold, hard self-interest. Which, as the owner of the investment, visibly improves the individual's private benefit. So to return to the point we were making in the last chapter, hold off on ridiculing the idea of a newborn babe contributing money to it, it just looks that way at first.