Related Topics

Health (and Retirement) Savings Accounts: Steps To Lifelong Health Insurance

If you are a fast reader, we will begin with a ten-minute summary of Health Savings Accounts. At first, it covers future revenue, then spending projections follow. No matter how medical care changes, cost and revenue must remain in balance.

Buying Into Medicare, Several Decades Early

Campaigning for President, Hillary Clinton brought up a proposal in 2016 to permit the uninsured to buy into Medicare coverage between the ages of 55 and 65. Eight years earlier, the Congressional Budget Office estimated such coverage would cost about $7600 a year per added client. The appeal is particularly strong for divorced women because employer-based coverage ends when employment does. Nevertheless, the CBO estimate would make this segment the most expensive component of Medicare, so gradualism may have to wait for some enhancements.

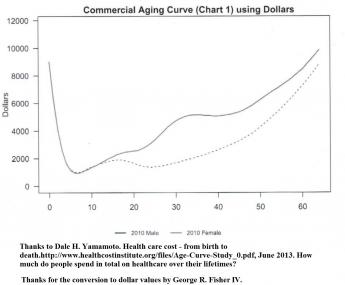

It happens I was working on similar calculations for this book; the CBO estimate of what medical care once cost this 55-65 age group before 2008, seemed reasonable. The shape of the curve has probably not changed much in eight years. Nevertheless, there are now several reasons present estimates may be underestimated. The Consumer Price Index for medical care has jumped around but increased 3.4% a year, or over 30% more than the level eight years ago. Health insurance costs have probably exceeded overall costs for fifty years, so forecasting health insurance premiums has always included some guesswork. The cost curve for 55-65 is at the high end of a rising rate. Including more sick people also means fewer well ones, so there is leverage. The data is based on aggregating claims data from still earlier years, so insurance costs tend to struggle to catch up with community costs. The cost of care inflates, but this portion of the population is at the high end of commercial coverage, so it probably escalates disproportionately.

In addition to statistical underestimation, there are probably invisible sources of confoundment. With Medicare just ahead, these people hold back on elective expenses, with lack of insurance exaggerating the tendency. If the experience with Medicare in 1965 or the ACA more recently, is used as a guide, we can expect a backlog of untreated gallstones, varicose veins, perforated eardrums and the like, to make an appearance once they regain insurance. That's quite different from pre-existing diabetes, heart failure or strokes, and will take longer to appear because it is more deferrable. It would not be surprising to find that post-insured costs are 50% higher than the 2008 CBO estimate, and will remain abnormally high for a decade. Finally, the method of data collection almost guarantees a low result. The published papers relate insurance companies were asked to report their claims, but no mention is made of insurance overhead, while the deductible and copayment ingredients are merely estimated. What seems to be implied is the data does not include insurance costs, probably for competitive reasons. And all of this is before we debate how much to subsidize, or how much it will encourage unemployment if we are too generous.

I surely do not know what is fair and proper to subsidize and can see no good way to estimate it. Medicare is already financed by about 50% government subsidy from the general fund, as well as another 25% from payroll deductions, which have already been collected at a probably lower level. With inflation at 3%, a 3% payroll deduction is less than it seems. No mention was made of the revenue sources for this proposal, but hidden extra subsidies of $5000-6000, per person per year, would seem to be buried in it for someone to pay. While no one disputes the genuine hardship this group experiences, this proposal would only be a bumpy introduction to the practical difficulties of the "single payer" idea.

There is little doubt working women are handicapped in many ways by higher health care costs attributable to pregnancy, and this handicap results in a number of undesirable social consequences. My suggestion has been to shift the cost of obstetrics from the mother's insurance to the baby's, which usually amounts to saying they should be shared by the father's employer through the father. While this shift would have the undesirable feature of shifting costs from the working age group to a childhood group which requires some sort of compensating cost-shifting, it mainly lengthens the period for compound interest to generate investment income, thus lowering the effective cost. A glance at the following chart clearly shows the bump in female costs between ages 15-45, transfer of which would go a long way to bringing the costs of males and females to much the same level. Since this cost would ultimately be born by a transfer of surplus revenue from the Medicare group, it would heighten the attractiveness of the First year of Life Insurance, which will be our next topic.

|

Originally published: Friday, May 13, 2016; most-recently modified: Wednesday, May 15, 2019