Related Topics

(3) Obamacare: Speeches

New topic 2015-09-25 21:48:47 description

Health (and Retirement) Savings Accounts: Steps To Lifelong Health Insurance

If you are a fast reader, we will begin with a ten-minute summary of Health Savings Accounts. At first, it covers future revenue, then spending projections follow. No matter how medical care changes, cost and revenue must remain in balance.

Introduction: Surviving Health Costs to Retire: Health (and Retirement) Savings Accounts

New topic 2016-03-08 22:42:53 description

Health and Retirement Savings Accounts: to Privatize Medicare and Save Money, Too

As earlier sections outlined, Health Savings Accounts were developed by John McClaughry and me in 1981, as a bare-bones health insurance scheme for financially struggling people. The package consisted of the cheapest insurance we could imagine (a high-deductible catastrophic indemnity plan with no co-pay features), attached to what others have aptly described as a tax-sheltered Christmas Savings Fund. That's essentially what you get if you sign up, today. What was this linkage supposed to accomplish? The Account part was intended for folks who must accept a high deductible to lower the cost of health insurance, but who then struggle to assemble the deductible. A combination package thus became the cheapest healthcare coverage we knew how to devise -- the higher the deductible, the lower the premium.

As deposits build up in the account, the remaining deductible falls toward zero, but the premium of the insurance does not rise because the extra cost is excluded from the insurance part. At that point, you could easily describe it as "first-dollar coverage for a high-deductible premium." Stepping through the process should clarify for anyone, how expensive it had always been to include the deductible costs inside the insurance! It certainly compares well with so-called "Cadillac" plans, where the underlying motivation really was to include as many benefits as possible, money no object, with someone else paying for it and then writing off its cost against artificially high corporate tax rates -- which were then eliminated by the same healthcare deduction. If the government elected to subsidize our plan to provide it even more cheaply to poorer people, inter-plan subsidies could easily be arranged for seriously poor people, just as the Affordable Care Act does, by offering to transfer the same subsidy to it. Although HSA is itself absolutely the cheapest, neither it nor the Affordable Care Act is completely free of any cost, so additional features like charity must be supported by additional revenue from somewhere. Cheaper is simpler, simple is easier to understand. But cheaper doesn't mean free.

|

First-dollar coverage by any mechanism generates the danger of spending health money unwisely. That undesirable feature was neutralized by letting subscribers keep what is left over at age 65, thereby generating (and greatly increasing) retirement income. Retirement income is generally in short supply, and there may exist a future danger, that well-meaning attempts to supply generous retirements would destroy this incentive to be frugal. But right now it isn't a worry.

Other Incentives. One thing we didn't immediately verbalize was, making it a bargain entices people to save, even when they are sort of inclined to consume. We didn't think to include regular paycheck withdrawals, but that's another common savings incentive with proven effectiveness. Having loose cash does seem to create a vague itch to spend. But the Health Savings Account specifies an invitation to save for health care, using any surplus for retirement, a much more specific appeal. With that addition, it became a more attractive program, appealing to a larger segment of the population without reducing its appeal to the original ones. Our reaction was that everyone was complaining about high health costs, so the more people Health (and Retirement) Savings Accounts appealed to, the better.

The real game-changer was this: When a subscriber later acquires Medicare coverage, anything left in the fund is automatically turned into a tax-exempt retirement fund, an IRA. As enrollments in HSAs began to boom, it was realized this provision creates an unmatchable retirement fund if someone puts extra money into the account. I wish I knew whose idea originated that. So you might as well say the basic package has three parts: high-deductible health insurance, a spill-over retirement fund, and a Christmas savings fund to multiply savings with compound interest -- useful for both purposes.

It's amazing how many people think HSA has only one feature. It is a double savings vehicle for two sequential stages of life, with the tax advantages of the first stage getting it on its feet. The separation of the account from its re-insuring catastrophic health insurance, also identified the incentive to save, distinguished from a natural desire to share the risk like a hot potato. Adding compound interest adds particular attractiveness for the later stages of life because compounding takes a long time before it means much. It connects two benefits end-to-end, lengthening the time for compound interest to become meaningful for the second one, as it would not if it waited for retirement to begin. We eventually realized the deductible-funding and overlapped retirement-funding package, was the most attractive investment vehicle most ordinary folks could find. Beating it as a retirement fund alone was therefore nearly impossible.

Hence the double-strong incentive to save, sadly missing from every other form of health insurance. We strongly suggest adding this feature to Medicare, which badly needs some such incentive, although retirement is parallel to Medicare, not sequential. Experience shows this unique set of double incentives to buy HSA was effective, so a 30% reduction in premiums for total health insurance began to emerge among pioneer clients, not merely claimed in theory. The recognition of all these advantages led millions of frugal people to sign up without an expensive marketing effort. Everything seemed to fall in place. Even though mandated coverage might have speeded up acceptance, slower adoption avoided the catastrophes of taking on more than could be handled.

So that's where HSA stands today -- the best little health insurance idea available anywhere, unless someone monkeys with it. Even the remote possibility of getting very sick very often was covered by adding the feature of a top-limit to out-of-pocket costs, paid for by dipping into a small portion of savings generated by other features. Anyone who thinks of a better health insurance plan than this one is welcome to offer it. Every addition added to its complexity, but every feature added to its cost-saving.

Let's whisper a reminder to resisters: the policy is owned by the individual rather than his employer, so it doesn't suddenly stop when you change employers or move between states. To a different audience we could whisper, it could bring a second bad feature closer to an end, the business of paying for Medicare with debts which have to be borrowed from foreigners. The Account gathers interest, instead of costing interest. The best part is: it induces the subscriber to hold back from using the account, saving it for more distant requirements, which inconveniently come without warning. Paying for your old age is wonderful, but starting to save while young is vital, and more likely to work. Most plans now maintain an upper limit to the subscriber's out-of-pocket costs, protecting against a second illness with its second deductible. When we say, "That's all there is to it," we really mean that's all the advantages which have so far emerged. It's ready to be renamed HRSA, the Health (and Retirement) Savings Account.

Technical Amendments, Needed at Present.

Now, let's pick the nits, noticing how hard it gets to improve on it. If Congress could pass a few amendments, the following flaws could be more or less immediately repaired:

1. Full Tax-Deductibility. Attractive as it is, HSA still isn't as fully tax-deductible as the health insurance many employed people are given at work. The savings and retirement portions are indeed tax-sheltered, but unlike some of its competitors, the high-deductible health insurance itself stands outside the funds (as what insurance experts might call re-insurance) and isn't covered. Employers get around this difficulty for their employees by buying the insurance themselves and "giving" it to the employees. Without monkeying around with this rather dubious maneuver to maintain tight control, we propose the premiums for the Catastrophic health portion of the HRSA might instantly become tax-exempt if the Savings Account paid the premium. That would appear cheaper for the Treasury, than proposing to make the whole package deductible. Because the other parts are already tax-exempted.As an aside, it's true the subscriber to a Health Savings Account is not fully covered in his first few years, until the account builds up to the deductible. That makes a very good argument for starting the accounts while you are quite young. At first, that was a concern, but it has proved largely unnecessary to provide for it, among young healthy subscribers. Apparently, by the age hospital-level illness becomes common, the ability to meet the deductible has mostly been achieved. Nor has it proved necessary to resort to sliding-scale deductibles hidden in the slogan, "the higher the deductible, the lower the premium" -- probably because lower premiums immediately transform into more money for saving. These features might be reviewed when self-selected frugal applicants taper off since HSA enrollment has so far attracted younger enrollees. For the moment, sales incentives seem adequate; everything else may be indirectly changed by HSAs, but very little is changed directly.To permit something like that would require a one-line amendment to the HSA enabling act, but would restore fairness to the system, and bring out how much cheaper the Health Savings Account really is. Making it cheaper means more people could afford it, thus relieving the Treasury of the need to subsidize those people under the Affordable Care Act. That would compensate for some of the loss of revenue to the IRS for making the Catastrophic Health Insurance tax-exempt. Regardless of how the CBO scores this complexity, it should be remembered that poverty is not a lifelong condition for most poor people; after a temporary period of poverty, many if not most of them rise toward becoming tax-payers. Equal treatment under the law is itself a valuable asset; it could paradoxically be provided by lowering the corporate income tax since many corporations already eliminate the corporate tax with the healthcare deduction. But that's not so self-evident, and politically hard to explain. If the Congressional Budget Office would extend its dynamic scoring to include retirement taxation on the HSA's eventual compound interest (instead of limiting its horizon to ten years), it would visibly be better to choose the compromise of letting the Accounts by the reinsurance.

2. A better Cost of Living Adjustment for HSA deposit limits. There is presently an annual limit of $3400 for deposits into Health Savings Accounts, whose limits have seldom been raised very much. This new COLA should be formalized into a continuing cost-of-living adjustment which is somehow related to the current rate of inflation in the medical economy, and perhaps takes account of a potential transition to HRSA by people over age 60. These late arrivals simply do not have sufficient time to catch up within the present deposit limits, even should they possess the savings to do so.

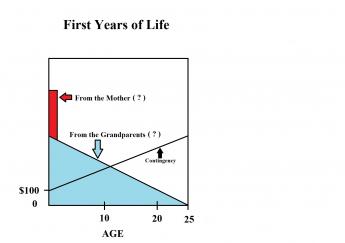

3. Age Limits for HSAs It is a quirk of compound interest (originally noticed by Aristotle) that interest rates rise with the duration of the investment. Consequently, much or most of the revenue appears after forty years, and consequently HSAs get more valuable with advancing age. To put it another way, young people contribute more time for interest to grow, old people must contribute more money to catch up. At present, HSA age limits are set to match employment, but the HSA will inevitably focus on funding retirement. Removing all age limits might go a little too far, but would substantially increase the amount of investment income generated, at almost no extra cost to the government. It might also supplement the platform for funding childhood health costs, a problem age group which stubbornly resists improvement. It might greatly enhance revenue for older subscribers as well (by reducing their health insurance cost), the surplus from which could be used at their death for the grandchildren generation.

Young people contribute more time for interest to grow, old people must contribute more money to catch up.

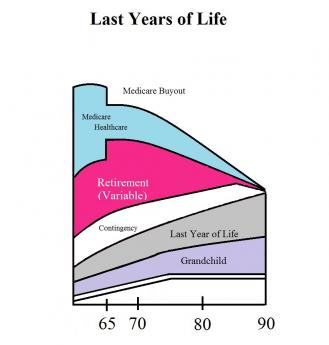

Extending the age limits would potentially also serve as a platform for re-adjusting dangerous imbalances in the healthcare financing system. We are fast approaching demography of thirty years of childhood and education, followed by thirty years of working life, followed by thirty years of retirement. Substantially all of the revenue comes from the middle third, while the remaining two-thirds of the population contains most of the health costs. To some extent this is unavoidable, but the whole health financing system becomes a dangerously unbalanced transfer system for well people to subsidize sick ones. It is possible to foresee the beginnings of class warfare, based on age alone. Consequently, society would be well served to create the more stable system of subsidy between yourself as the donor and yourself as the beneficiary. The alternative is to continue the process of having one demographic group collectively subsidize two other groups of strangers who generate most of the cost. Eventually, this could induce well people to dump the burdensome sick people. I hope I am unduly concerned, but to extend the age limits for individual self-financing seems a very cheap way to begin stepping out of that particular mud puddle.

Finally, there is a conflict with inheritance laws. By extending the age limits for the funds to the legal boundary of perpetuity (one lifetime, plus 21 years), the ability to transfer funds between generations is enhanced without the perplexities of inheritance. It would be particularly useful to permit the fund to remain active until a grandparent's death, or even extend to the birth of the designated grandchild's 25th birthday. Like a trust fund, it could gather interest after the death of the owner, leaving the selection of heir to the last possible moment.

To return to the subject narrowly at hand, it is easy to see so many projects are made possible, you end up with an aggregate of goodies which eventually sink the lifeboat. Something must be chosen, something must be deferred, and the choice should be a delayed one, left to individual choice as much as possible. It can be commented in advance that retirement costs potentially dwarf sickness costs, and small single payments held at interest for long stretches have the greatest efficiency. There seems little choice but to constrain retirements to what the individual can manage independently, rather than permit retirements to absorb all the benefit of a new windfall. The theme is and should be, one step at a time.

Future Expansions.

How far these three short amendments would extend retirement solvency, is hard to predict into the future, but it would be considerable. Aside from any improvement never seeming like enough, it is almost impossible to guess the future timing of health costs, even when you can see them coming. But while the amendments might assure a comfortable future for Health and Retirement Savings Accounts, they do seem unlikely to address the full over-expectations of retirement. So the problem for many, many afternoons' deliberations, would be to expand the potential of HSAs until they become objectionable to competitive concerns. For that, I have four additional proposals which might work but inevitably collide with professions who would be quick to suggest narrower limits. Let's describe them, meanwhile waiting to assess objections from those they would discomfit:

1. A re-insurance scheme (insurance company to insurance company), called First and Last Years-of-Life Re-Insurance.This has already been described.2. Medicare should be modularized but without other basic change, so recipients need only buy pieces they need, using the invested proceeds for retirement. Obstetrical coverage immediately comes to mind. Sometime during the next fifty years, it can be predicted at least one of the five most expensive diseases (Alzheimer's, diabetes, cancer, psychosis, and Parkinsonism) will be inexpensively cured, once the initial cost increase is absorbed. We need a way to fine-tune the transfer of such medical savings into retirement income, understanding many competitors will hope to divert a windfall to themselves. Redirecting the Medicare withholding tax makes an easy way to channel the funding, as would reductions of Medicare premiums. Scientifically, Medicare is eventually destined to shrink as we find cures, but funding the resulting longevity must be given the first call on the savings.

3. The investment component of Health Savings Accounts should be dis-intermediated, partially if not completely.Ibbotson reports the stock market has produced--for a century--10%-11% long-term returns on large-cap stocks and less steadily, 4-5% on bonds, minus 3% inflation. You might not expect that judging from the returns investors often receive; investors are definitely absorbing most of the risk. The volatility is much less than most people imagine, and there is every reason to suppose Index funds of these entities should perform better with less volatility at far less cost, perhaps 0.1-0.3%. The days fast fade, when the public will continue to surrender the present level of stockmarket transfer costs and fees, which now sometimes erode investor return to as low as 1%. The fast-growing and simpler system is "passive" investing with index funds, and its goal should be an average return to the retail customer of at least 6.5% after inflation and costs. The struggle will be a fierce one, but the retail finance industry must re-examine who is at risk, and who are rewarded for taking that risk.

4. The center of medical care should migrate from medical centers toward shopping centers attached to retirement villages. Architects report it will always be cheaper to build horizontally than vertically. Since we seem destined to spend thirty years in retirement, and the principal occupation of retired people is taking care of their own medical needs -- the wrong people are doing the medical commuting. Teaching hospitals were located close to the poor, in order to use them for teaching material. But now "meds and eds" are fast becoming the principal occupations of high-rise cities. If there is ever a good time to place medical care closer to the patients, this is it.

The wrong people are doing medical commuting.

And if ever there is a way to put the doctor back in charge of medical care, decentralization is the way to do it smoothly. We will always need tertiary care, but we don't need indirect overhead, skyscraper construction, or multiple layers of overcompensated administration. Even continuing-education is becoming a revenue center. No one can claim the present centralization made things cheaper, and the disadvantages of medical silos certainly call the quality issue into question. The Supreme Court failed us in the Maricopa Decision; so let's see what Congress can do with reconciling the Sherman Act with the Hippocratic Oath.

Originally published: Tuesday, December 29, 2015; most-recently modified: Sunday, July 21, 2019