Related Topics

Improving Our Political System

Republics and their Flaws

Haddonfield (all 26)(1 of1)volume 38

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

Haddonfield is a bit of a secret. It's Philadelphia's "Main Line, East"

Reminiscences

"The past is never dead. It's not even past." -- William Faulkner, Requiem for a Nun

Whither, Federal Reserve? (2)After Our Crash

Whither, Federal Reserve? (2)

Personal Passions

My own personal short list; eight decades in retrospect.

...Pending and Later Amendments

New topic 2012-08-01 19:06:55 description

Great Depression (1929-1939)

New topic 2012-08-29 11:32:11 description

Right Angle Club: 2013

Reflections about the 91st year of the Club's existence. Delivered for the annual President's dinner at The Philadelphia Club, January 17, 2014.

George Ross Fisher, scribe.

Fisher on Running For Office

Last night, I was honored to receive the Republican nomination for a seat in the state Assembly, to represent the district where I have lived for over fifty years.

Last night, I was honored to receive the Republican nomination for a seat in the state Assembly, to represent the district where I have lived for over fifty years.

Creating the European Union: Forces and Factors

New topic 2013-11-19 20:53:10 description

The European Union

New topic 2013-11-19 21:20:53 description

Minimum Wage Fangdoodle

|

| Governor Chris Christie |

The November 2013 elections have been widely accepted to be a spectacular win for New Jersey Governor Chris Christie, suddenly making him a presidential front-runner for 2016. The only other significant election was a close win in the Virginia gubernatorial race for a fund-raising crony of Bill Clinton over the Attorney General who started the Supreme Court Case over Obamacare. In the view of the news media, there were only two elections in this off-year -- a landslide in New Jersey, and a dead heat in Virginia, for Governor.

Well, as a matter of fact, there was also an election in New Jersey for all of the members of the legislature, which means that I was running against the Democratic majority leader in the 6th Legislative District. I got 19,000 votes, but I needed more to win. At least in my family, it was a big event, particularly since no one else in New Jersey contributed a dime to my campaign, and while Governor Christie may have whispered a few encouraging words to me, there was no evidence of his assistance. But you can forget about that, too, because this election was really about the minimum wage.

The first inkling I got that something was up was receiving a sample ballot, three days before the election, where there was a referendum question about the minimum wage that no one had told me about, although it could scarcely have been a secret to get it on the ballot. And secondly, on election day there was scarcely any evidence of campaigning for Democrat candidates except for a few yard signs, but literally, dozens of campaign workers poured into the subway stations, handing out great volumes of campaign literature about the minimum wage. Even that went past me unnoticed, because who in the world would vote for a proposal which would increase unemployment during a severe recession? When I expressed the same sentiment to my Democratic friends, I was surprised to discover they all knew about it in advance. In retrospect, that was a fairly good indication that the Internet had selectively urged support of this proposition to the party faithful, but had not said one word in campaigning for it. It won endorsement by a heavy margin, as things soon turned out. What's worse, what had been endorsed by referendum had been to amend the constitution to this effect, automatically indexing it to the cost of living. It's going to be pretty hard to reverse that since all constitutions have been written to make it very hard to amend them.

p> In the week after the election, I notice that several other states have been considering raising the minimum wage. An article appeared on the editorial page of the New York Times arguing that research showed there was no evidence that raising the minimum wage caused unemployment, and a few days later, Paul Krugman had a learned column on the Times editorial page to the effect that smart people all knew there was no reason to expect unemployment from raising the minimum wage, and only the hopelessly ignorant rubes would imagine there was reason to think so. Having spent some time with editorial writers, it seemed pretty evident to me that there was a nationally coordinated effort to convert this into a truism, accepted so widely it would be futile to argue against it. When it is also possible to see the existence of a campaign to impose a maximum wage (and not merely in Switzerland, where it was defeated on a ballot), the trajectory of a rising minimum wage meeting a falling maximum wage easily led to conjectures that what was really afoot was a campaign to take wages out of the marketplace. Or was that really the goal?

|

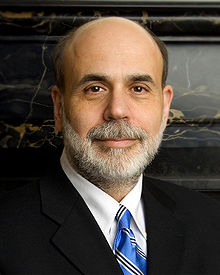

| Ben Bernanke |

For months, the Federal Reserve Chairman has been emphasizing that the Fed must obey two mandates: to maintain price stability and to minimize unemployment. Meanwhile, the dirty little secret among economists has been that unemployment is the main obstacle to inflation in the face of a massive enlargement of the money supply. Unemployment is currently at 7.1% and falling, while the Fed has lifted the veil of "transparency" to reveal it made a promise in double-speak to start selling some of the bonds it issued to combat the recession when unemployment reaches 6.5%. As time has gone on, Mr. Bernanke has seemed to back away from that promise. He is not so sure that unemployment is a good measure of unemployment, other measures may be a better measure of what we are driving at. He never meant to start selling bonds when unemployment reached 6.5%, he only meant that he might reduce the number he planned to buy. He never meant to make a promise, he only was being transparent about the current thinking of the Board. And anyway, Janet Yellen will take over his job in a month, so you can't very well bind your successor to do anything at all. What's this tap-dancing all about?

Well, it simply won't do, to suggest that the Federal Reserve isn't as independent of politics as it pretends to be. But everyone noticed that the stock market had a bad fainting spell when he suggested a few months ago that the Board had been discussing the matter; just imagine what it would do if he actually made a promise to act, let alone actually taking an action. By itself, such an announcement would probably send interest rates on a rise toward normal levels. The stock market mostly anticipates the future, so it would jump ahead of whatever action was taken. Since the United States is now the largest debtor on earth, a rise of interest rates would immediately add huge amounts to the current deficit and the projected national debt. The stock market would almost surely drop, possibly severely, in response to such commotion in the debt markets. And the national economy would certainly feel the deflationary effect of such activity in the financial markets, sending markets even lower. Fear of such a reaction would surely persist longer than the real need for monetary easing, making the resultant inflation even worse than it had to be.

Is it possible the Obama Administration prefers a little extra unemployment, to risking a stock market crash before a coming election?

|

| Minimum Wage Uproar |

In an era of desperate experimentation with the simultaneous solutions of several problems at once, perhaps the best conservative response to this paper is to seek ways to relax its inflexibility. The political process, particularly the amendment of state constitutions, is a lengthy and cumbersome impediment to agile management of the economy. It is fairly unlikely that a secret springing of a referendum trap can be repeated. The greater risk is that we will know what should be done, but become unable to do it quickly.

Meanwhile, the politicians are designing things and politicians like things simple. The Republican solution is to pass a minimum wage, but keep its benefit slightly below the entry-level wage; they get credit for passing it, but it has almost no applicability. The Democrat approach is to make a big noise about passing a meaningless bill, promising they will make it up with off the balance sheet entitlements, like health care and college tuition. Either way, usually nothing much happens after the election is over.

Originally published: Sunday, December 01, 2013; most-recently modified: Sunday, July 21, 2019