2 Volumes

Four Constitutions

Multi-national unions of republics are uncommon, usually brief and seldom voluntary. America has had three of them, but we only got it right the second time. Uncertain why we succeeded when many others failed, we remain skeptical of changing the rules. The Europeans, on the other hand, are uncertain whether they want to follow the Confederate States of America toward extinction, or the United States of America toward world domination. When deeply considered, it is a hard choice.

Worldwide Common Currency and Corporate Headquarters

The Death of Money

The European Union

New topic 2013-11-19 21:20:53 description

Ruminations About the Cyprus Crash

|

| Map of Cyprus |

The Cyprus banking crisis of 2013 affected thousands of people, some of them very severely, and reached billions of dollars in consequences. But in the scheme of world banking, it was a pretty small event. Its truly serious consequences may lie in the precedents it sets, or the contagion it ignites. It is too soon to know what the full consequences may be, but some pretty serious possibilities are quite evident. The crash was partly the fault of Cypriotes themselves, and partly the result of Russian flight capital overturning a small banking system which could not handle it. The Cypriotes' fault? Sure, it must have been a temptation for a Paradise Island to imagine it could become another Luxembourg or Switzerland. Or Monaco or the State of Delaware for that matter, all seeking to profit from weak spots in the planning of larger neighbors. In any event, it was inevitable that Cyprus will blame the Russians, and the Russians will blame the Cypriotes; in the early reports, it was hard to tell which was the main villain. After that gets clarified, surely the real blame will be transferred to flaws in the design of the Eurozone. On every side, short-term expedients kicked the can down the road, sacrificing sound banking principles to politics. Perhaps it will turn out it had been a good thing to have the smallest participants in European union turn out to be its weakest link, breaking down while repair was still able to contain it.

The European central bank and the International Monetary Fund demanded certain conditions before lending their own money for a bailout. Without much doubt, they canvassed the views of the larger nations in the European Union before doing so. Since Russia is not a member of the EU, to some degree its point of view was probably "neglected". The bailout would not be forthcoming unless the stockholders were wiped out and the major depositors assessed. The stockholders were, in theory, able to elect directors, who were, in theory, able to appoint the bank managers, who were responsible for the banks' contribution to the mess. In addition, it was demanded that the depositors in the banks contribute to the losses. Without much doubt, the mindset of the bailout was that the rich (Russian) depositors were evading local laws by moving to foreign banks, which in this case were supported by the wealth of the whole common market, not just the nation of Cyprus. Therefore, punishing the depositors had the effect of discouraging any future money-laundering which might hope for the financial support of large EU economies, who at present tolerate loopholes created by small EU members. Only depositors of more than $100,000 would be taxed, which would mostly capture non-voting, non-Cypriote depositors, but a 40% assessment is closer to a confiscation than a tax. Since by eurozone rules depositors of less than $100,000 are fully insured, the threshold is completely meaningless, but among populists can be reassuringly termed a tax on depositors who are rich enough to be uninsured. Its confiscatory nature is acknowledged by exchanging the assessment for common stock in the bank since taxes do not normally receive considerations in return. Since the other stockholders were wiped out, the mostly Russian large depositors now appear to own the bank. That surely cannot be the intention, so further modification must be expected.

So there's the first problem to be adjusted: how can the European Union avoid turning the entire banking system of one of its members over to citizens of a non-member nation? Ignoring for the moment the fairly recent Russian disregard for private property, the problems of coordinating the rules of euro banking with the rules of a non-member owner of the whole banking system of a euro member, are fairly daunting. They probably rise to the level of coaxing Germany and Finland into swallowing their pride and bailing out Cyprus, after all. Or persuading France and other advocates of European Union to eject Cyprus from the arrangement, which accords with the opinion of a large number of Cypriotes as well. The problem seems to be this: either a full European bailout or a total ejection of Cyprus seems feasible, but any intermediate compromise triggers consequences which are impossible to assess.

Many other problems are imaginable, as well. For instance, how can a price be assigned to the stock of the banks? Set too high, the former owners will protest they have been fleeced by illegal application of bankruptcy powers. Set too low, the "compensation" would become a windfall for the Russian depositors it was intended to punish. Set too high, the drop in price at the time of future market sales would trigger endless lawsuits in the courts of several nations. This difficulty might be circumvented by making the stock non-transferrable, or salable only to the Cypriote government, both of which would be precedents quite difficult to integrate into a uniform euro zone set of policies, and present a permanent set of future headaches for the evolution of the system. Since the overall plan is to achieve eventual political union by first creating a financial brotherhood, little Cyprus would acquire a permanent voice to which it would not ordinarily be entitled.

REFERENCES

| Bitter Lemons: Lawrence Durrell: ISBN-13: 978-1604190045 | Amazon |

Minimum Wage Fangdoodle

|

| Governor Chris Christie |

The November 2013 elections have been widely accepted to be a spectacular win for New Jersey Governor Chris Christie, suddenly making him a presidential front-runner for 2016. The only other significant election was a close win in the Virginia gubernatorial race for a fund-raising crony of Bill Clinton over the Attorney General who started the Supreme Court Case over Obamacare. In the view of the news media, there were only two elections in this off-year -- a landslide in New Jersey, and a dead heat in Virginia, for Governor.

Well, as a matter of fact, there was also an election in New Jersey for all of the members of the legislature, which means that I was running against the Democratic majority leader in the 6th Legislative District. I got 19,000 votes, but I needed more to win. At least in my family, it was a big event, particularly since no one else in New Jersey contributed a dime to my campaign, and while Governor Christie may have whispered a few encouraging words to me, there was no evidence of his assistance. But you can forget about that, too, because this election was really about the minimum wage.

The first inkling I got that something was up was receiving a sample ballot, three days before the election, where there was a referendum question about the minimum wage that no one had told me about, although it could scarcely have been a secret to get it on the ballot. And secondly, on election day there was scarcely any evidence of campaigning for Democrat candidates except for a few yard signs, but literally, dozens of campaign workers poured into the subway stations, handing out great volumes of campaign literature about the minimum wage. Even that went past me unnoticed, because who in the world would vote for a proposal which would increase unemployment during a severe recession? When I expressed the same sentiment to my Democratic friends, I was surprised to discover they all knew about it in advance. In retrospect, that was a fairly good indication that the Internet had selectively urged support of this proposition to the party faithful, but had not said one word in campaigning for it. It won endorsement by a heavy margin, as things soon turned out. What's worse, what had been endorsed by referendum had been to amend the constitution to this effect, automatically indexing it to the cost of living. It's going to be pretty hard to reverse that since all constitutions have been written to make it very hard to amend them.

p> In the week after the election, I notice that several other states have been considering raising the minimum wage. An article appeared on the editorial page of the New York Times arguing that research showed there was no evidence that raising the minimum wage caused unemployment, and a few days later, Paul Krugman had a learned column on the Times editorial page to the effect that smart people all knew there was no reason to expect unemployment from raising the minimum wage, and only the hopelessly ignorant rubes would imagine there was reason to think so. Having spent some time with editorial writers, it seemed pretty evident to me that there was a nationally coordinated effort to convert this into a truism, accepted so widely it would be futile to argue against it. When it is also possible to see the existence of a campaign to impose a maximum wage (and not merely in Switzerland, where it was defeated on a ballot), the trajectory of a rising minimum wage meeting a falling maximum wage easily led to conjectures that what was really afoot was a campaign to take wages out of the marketplace. Or was that really the goal?

|

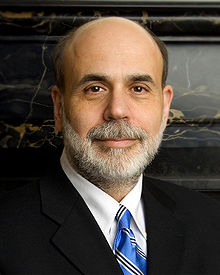

| Ben Bernanke |

For months, the Federal Reserve Chairman has been emphasizing that the Fed must obey two mandates: to maintain price stability and to minimize unemployment. Meanwhile, the dirty little secret among economists has been that unemployment is the main obstacle to inflation in the face of a massive enlargement of the money supply. Unemployment is currently at 7.1% and falling, while the Fed has lifted the veil of "transparency" to reveal it made a promise in double-speak to start selling some of the bonds it issued to combat the recession when unemployment reaches 6.5%. As time has gone on, Mr. Bernanke has seemed to back away from that promise. He is not so sure that unemployment is a good measure of unemployment, other measures may be a better measure of what we are driving at. He never meant to start selling bonds when unemployment reached 6.5%, he only meant that he might reduce the number he planned to buy. He never meant to make a promise, he only was being transparent about the current thinking of the Board. And anyway, Janet Yellen will take over his job in a month, so you can't very well bind your successor to do anything at all. What's this tap-dancing all about?

Well, it simply won't do, to suggest that the Federal Reserve isn't as independent of politics as it pretends to be. But everyone noticed that the stock market had a bad fainting spell when he suggested a few months ago that the Board had been discussing the matter; just imagine what it would do if he actually made a promise to act, let alone actually taking an action. By itself, such an announcement would probably send interest rates on a rise toward normal levels. The stock market mostly anticipates the future, so it would jump ahead of whatever action was taken. Since the United States is now the largest debtor on earth, a rise of interest rates would immediately add huge amounts to the current deficit and the projected national debt. The stock market would almost surely drop, possibly severely, in response to such commotion in the debt markets. And the national economy would certainly feel the deflationary effect of such activity in the financial markets, sending markets even lower. Fear of such a reaction would surely persist longer than the real need for monetary easing, making the resultant inflation even worse than it had to be.

Is it possible the Obama Administration prefers a little extra unemployment, to risking a stock market crash before a coming election?

|

| Minimum Wage Uproar |

In an era of desperate experimentation with the simultaneous solutions of several problems at once, perhaps the best conservative response to this paper is to seek ways to relax its inflexibility. The political process, particularly the amendment of state constitutions, is a lengthy and cumbersome impediment to agile management of the economy. It is fairly unlikely that a secret springing of a referendum trap can be repeated. The greater risk is that we will know what should be done, but become unable to do it quickly.

Meanwhile, the politicians are designing things and politicians like things simple. The Republican solution is to pass a minimum wage, but keep its benefit slightly below the entry-level wage; they get credit for passing it, but it has almost no applicability. The Democrat approach is to make a big noise about passing a meaningless bill, promising they will make it up with off the balance sheet entitlements, like health care and college tuition. Either way, usually nothing much happens after the election is over.

2015 As Predicted from Pittsburgh

|

| Stuart A. Hoffman |

For the past 14 years, LaSalle University has featured an economics meeting at the Union League in January, usually with an economist predicting the local outlook for the year. Increasingly, the luncheon in Lincoln Hall has been packed and sponsored by some local firm. This year, the speaker was Stuart A. Hoffman, the chief economist of PNC Bank, who turns out to be quite a witty fellow. The lunch itself was gourmet, although a little on the feminine side for a mostly male audience. And because the place was filled with an audience, the waitresses of the League were taking it away faster than the eaters could eat it. It's hard to say what the audience might have felt about that, because most of them could afford to lose a few pounds, just like the Chef himself.

Dr. Hoffman feels the big news this year is OIL. It sort of fell out of heaven at the right moment, but even the politicians who opposed it are forced to acknowledge it was a very good thing, indeed. Its international effect, in creating oil independence, was especially powerful and undeniable. However, there are winners and losers. Our North American neighbors in Canada and Mexico may feel some painful effects, for example. In any event, the discovery and exploitation of fracking seem very likely to bring the recession to an end, sooner than we deserve, at least.

So the prediction for the year is rather bright for wages, unemployment, and housing, perhaps even banking. The relevant parts of the stock and bond market will prosper -- undeservedly, as always. But at the end of the year, we are likely to see that recovery as historical only, as we begin to see the long term gloom inherent in health care and educational costs, and the rest of the world begins to affect us more than we affect them. How's that for a January prediction, largely revolving around unexpected events in OIL. We'll try to remember to compare this January prediction with the subsequent December retrospective realities, later in this volume. We'll even see if Dr. Hoffman has to eat his words since today he had very little time to eat his lunch.

|

| Mario Draghi Chairman of the European Bank |

In the Question period, it was particularly interesting to hear a short description of what recently happened to the Swiss franc. The Swiss never joined the monetary union, but they did peg their currency to the Euro. As time went on, it was increasingly painful for Swiss exporters to have the franc suppressed by the lagging Euro, and when the Chairman of the European Bank announced his intention to start buying bonds, the Swiss bank capitulated and cut the tie of the Swiss franc to the Euro. The franc promptly rose, and that's all there is to the matter. Except if it isn't. The Germans are in much the same position within the Eurozone, and the English are restless, outside of it. So, if the prosperous parts of Europe decide to follow the Swiss example, the whole European monetary scheme may be in trouble. And if Europe has a monetary convulsion, it is trading partners in Africa and South America may follow, dragging in China, and -- who would be so brave as to suggest the USA could remain unaffected? Especially if Putin and the Arabs misbehave, pulverizing Israel in the process. When all you have is a hammer, you treat everything as a nail. Central Asia used to have two things, oil, and ruffians. And now they have apparently lost their dominance in oil.

|

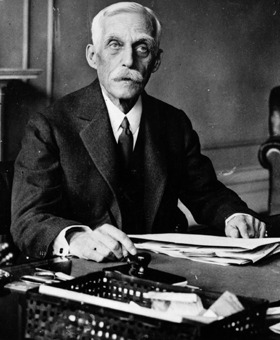

| Andy Mellon |

Well, that's about the size of it, from Pittsburgh. Pittsburgh was largely settled by going West on the Erie Canal, so they never liked being attached to the Quaker end of the state. Philadelphia dominated with its banks, to Andy Mellon's great distaste, and largely controlled the shift of steel production from Eastern anthracite to Western bituminous coal. So now, Philadelphia scarcely has a bank to its name and has to hear the News of the World in Review -- from the other end of the state.

3 Blogs

Ruminations About the Cyprus Crash

The importance of the Cyprus crash is not so much itself, as its potential consequences for others.

The importance of the Cyprus crash is not so much itself, as its potential consequences for others.

Minimum Wage Fangdoodle

While no one was looking, mandating a minimum wage turned into a contrivance to maintain low-interest rates.

While no one was looking, mandating a minimum wage turned into a contrivance to maintain low-interest rates.

2015 As Predicted from Pittsburgh

New blog 2015-01-22 22:42:48 description

New blog 2015-01-22 22:42:48 description