Related Topics

The European Union

New topic 2013-11-19 21:20:53 description

Decline and Fall of Philadelphia

In 1900, Philadelphia was described as the largest commercial (ie non-capital) city in the world. By 1929 it was flat on its back, and never recovered its former position. Why did this happen?

Right Angle Club: 2015

The tenth year of this annal, the ninety-third for the club. Because its author spent much of the past year on health economics, a summary of this topic takes up a third of this volume. The 1980 book now sells on Amazon for three times its original price, so be warned.

Euro unification

New topic 2015-02-08 19:47:28 description

2015 As Predicted from Pittsburgh

|

| Stuart A. Hoffman |

For the past 14 years, LaSalle University has featured an economics meeting at the Union League in January, usually with an economist predicting the local outlook for the year. Increasingly, the luncheon in Lincoln Hall has been packed and sponsored by some local firm. This year, the speaker was Stuart A. Hoffman, the chief economist of PNC Bank, who turns out to be quite a witty fellow. The lunch itself was gourmet, although a little on the feminine side for a mostly male audience. And because the place was filled with an audience, the waitresses of the League were taking it away faster than the eaters could eat it. It's hard to say what the audience might have felt about that, because most of them could afford to lose a few pounds, just like the Chef himself.

Dr. Hoffman feels the big news this year is OIL. It sort of fell out of heaven at the right moment, but even the politicians who opposed it are forced to acknowledge it was a very good thing, indeed. Its international effect, in creating oil independence, was especially powerful and undeniable. However, there are winners and losers. Our North American neighbors in Canada and Mexico may feel some painful effects, for example. In any event, the discovery and exploitation of fracking seem very likely to bring the recession to an end, sooner than we deserve, at least.

So the prediction for the year is rather bright for wages, unemployment, and housing, perhaps even banking. The relevant parts of the stock and bond market will prosper -- undeservedly, as always. But at the end of the year, we are likely to see that recovery as historical only, as we begin to see the long term gloom inherent in health care and educational costs, and the rest of the world begins to affect us more than we affect them. How's that for a January prediction, largely revolving around unexpected events in OIL. We'll try to remember to compare this January prediction with the subsequent December retrospective realities, later in this volume. We'll even see if Dr. Hoffman has to eat his words since today he had very little time to eat his lunch.

|

| Mario Draghi Chairman of the European Bank |

In the Question period, it was particularly interesting to hear a short description of what recently happened to the Swiss franc. The Swiss never joined the monetary union, but they did peg their currency to the Euro. As time went on, it was increasingly painful for Swiss exporters to have the franc suppressed by the lagging Euro, and when the Chairman of the European Bank announced his intention to start buying bonds, the Swiss bank capitulated and cut the tie of the Swiss franc to the Euro. The franc promptly rose, and that's all there is to the matter. Except if it isn't. The Germans are in much the same position within the Eurozone, and the English are restless, outside of it. So, if the prosperous parts of Europe decide to follow the Swiss example, the whole European monetary scheme may be in trouble. And if Europe has a monetary convulsion, it is trading partners in Africa and South America may follow, dragging in China, and -- who would be so brave as to suggest the USA could remain unaffected? Especially if Putin and the Arabs misbehave, pulverizing Israel in the process. When all you have is a hammer, you treat everything as a nail. Central Asia used to have two things, oil, and ruffians. And now they have apparently lost their dominance in oil.

|

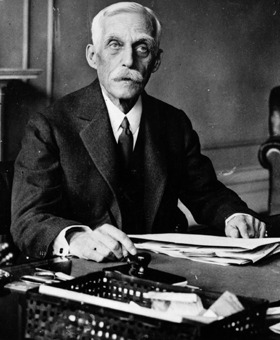

| Andy Mellon |

Well, that's about the size of it, from Pittsburgh. Pittsburgh was largely settled by going West on the Erie Canal, so they never liked being attached to the Quaker end of the state. Philadelphia dominated with its banks, to Andy Mellon's great distaste, and largely controlled the shift of steel production from Eastern anthracite to Western bituminous coal. So now, Philadelphia scarcely has a bank to its name and has to hear the News of the World in Review -- from the other end of the state.

Originally published: Thursday, January 22, 2015; most-recently modified: Thursday, May 09, 2019