1 Volumes

What Made Philadelphia Decline?

In 1900, Philadelphia was said to be the richest city in the world. Then, what happened?

Decline and Fall of Philadelphia

In 1900, Philadelphia was described as the largest commercial (ie non-capital) city in the world. By 1929 it was flat on its back, and never recovered its former position. Why did this happen?

Decline and Fall of Philadelphia

|

| 1929 Crash |

We talk high finance here, so perhaps a simple story from Wall Street is needed to introduce the topic to a non-Wall Street audience. Following the 1929 crash, and consequent to the Glass Steagall Act, Morgan Stanley was the only American investment bank in existence. It was the first of a new kind, but barely in existence, doing something like $300,000 worth of business in 1933. As finance adjusted to the new ground rules, Morgan Stanley grew in size, commonly referred to as the "White Shoe" investment bank. That term was an allusion to the Ivy League background of its partners, who came from colleges which affected white buckskin shoes among their more elite students. It also referred to the fact that almost all Morgan Stanley partners were pretty rich and fairly young, entirely able to live by a code of behavior which might be summarized as, "We don't find it necessary to cheat."

Buried within that motto was the idea that Morgan Stanley was as good as its word, and tried very hard to avoid doing business with anybody who did cheat. In a business where a great deal of business was transacted too quickly for written contracts or vetting by law firms, that meant a lot.

<Morgan Stanley soon climbed to the top of a very tough heap and stayed there for fifty years. Many of its partners were millionaires in their twenties, but so what, they were mostly pretty rich before they joined the firm. The company ran as a partnership, with the capital they leveraged coming from the personal fortunes of the partners. Under these circumstances, it is not surprising many partners retired in their forties, taking their enhanced capital with them. The Glass-Steagall Act (now being imitated by the Volcker Rule within the Dodd-Frank Law) made it illegal for a depository bank to be under the same roof with an investment bank. Much of the capital in the pre-1929 days had been supplied by the deposits in the depository bank, but Glass Steagall cut that off when it created depository insurance, on the theory that deposit insurance was a Federal gift, and its "moral hazard" should not flow through to the speculation of investment banking.

That comment was tinged with populism, with the dubious implication that those who are two generations off the farm are less likely to cheat than those who are five generations off the farm. So the depository bank of Morgan Guaranty has split away from the investment bank of Morgan Stanley, which was the three-step process by which Morgan Stanley eventually grew so big it could no longer be sustained by leveraging the personal wealth of its partners.

|

| Buy And Sell |

Eventually, the pressure to raise money by selling stock to the public could no longer be resisted. The rich partners became even richer by selling their company's stock on the stock exchange, the company did grow enormously, and a lot of new stockholders got rich, too. Unfortunately, when you sell a stock you also sell voting rights, so the sale transferred voting control of the company to the new stock purchasers. It did not take many years before the white shoe atmosphere was a thing of the past, along with the discipline that the atmosphere imposed on the rest of corporate America. When the 2008 crash came along, there was enough questionable behavior on Wall Street to justify a populist President of the United States to tolerate, or even encourage, a witch hunt of Wall Street bankers for ruining the country.

Even so brilliant an economist as Paul Volcker has encouraged the idea that separating the two forms of banks was an unmitigated blessing which must be restored, while in fact it is only justified by the gift of Federal Deposit Insurance to the depository arm, not the Investment Banking Arm. It seems only a matter of time before there will be agitation to extend the insurance to the investment arm so we will be chasing our own tail, of extending insurance to encourage risk-taking, instead of using demand deposits to do so. And thus inviting another crash.

I'm sorry, Paul, but there is a reversed way to describe it. The small investors demanded the entitlement of risk-free investing, protected by deposit insurance. And they declared this insurance was a special entitlement to which wealthy players were ineligible. When small punters go broke, it is a tragedy. When big players go broke, it serves them right for being so greedy.

|

| Gasoline |

Converting partnership or family businesses into stockholder organizations was a universal outcome of both World Wars, all over the world. The phenomenon can be looked at as one way of extracting frozen wealth to pay war debts. It is accompanied by an increase in national indebtedness, so it makes civilizations less stable. Scraps of partnership control do continue to persist in remote developing countries, and in tiny principalities like Luxembourg, but it seems only a matter of time before the public buys them out. The only major developed country to retain family control of businesses in Germany. Apparently, it was intentional, based on the inheritance laws. Tightly held countries are more commonly tightly held together by force, as in Russia, Saudi Arabia, and Monaco, usually because of a monopoly grip on oil or other natural resources. But even those governments could probably be toppled, except for fear of ensuing chaos, just as did happen to many former dictatorships, and was a source of fear in Philadelphia. A case can be made for populism if it is kept small and under control. Hardly any case at all can be made for chaos.

|

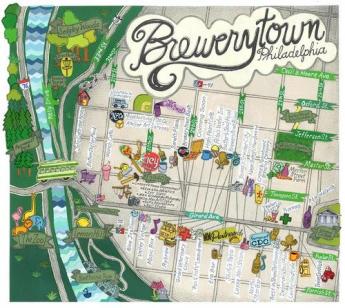

| Brewerytown Map |

For those of us who love Philadelphia and wonder what happened to it, let me point out three defining local peculiarities. Prohibition was more of a factor than we like to think because Philadelphia's Tenderloin was the former Brewerytown, filled with Beer Gardens, refrigeration plants (Lager beer is brewed in the cold) and beer distributors. The passage of the Volstead Act suddenly transformed the largest alcohol-production center in the country into the largest alcohol-consuming area, from River to River, from Franklin Square to the Schuylkill.

It was concentrated in the Brewerytown by being illegal, and somewhat secret. Brewerytown soon turned into the Tenderloin, and the Tenderloin into Skid Row, cutting off North Philadelphia from law and order, but in time it was alarming in a different way to see speakeasies spread into other sections of the city. Much as it tried, even the Mafia couldn't control the influx of amateur criminals, when the Tenderloin essentially cut the city in half.

When the great migration from the South occurred after WW II, the immigrants turned North Philadelphia into a slum. Cutting I76 along the same center-city lines helped shrivel North Philadelphia and hustle its flight to the suburbs. Some misadventures of Philco and Ford, Baldwin and Stetson hastened the process and may have caused some of it.

|

| Pennsylvania Railroad |

America grew into a mighty industrial nation as a result of becoming the Arsenal of Freedom in the Civil War and two World Wars. The nation needed to expand its industrial base from the essential monopoly corridor of the Pennsylvania Railroad, and it had the money to do so. The land was cheaper elsewhere, labor was nonunion elsewhere, and air conditioning made the South bearable. Wall Street saw an enormous opportunity to buy stock from the family partners of Philadelphia industries, and sell it again to the world. These new owners had no interest in preserving lovable Philadelphia; they wanted to reap the harvest of expanding what we had, to the rest of the country, maybe even the rest of the world.

Once a spiral like this gets started, it runs by itself. The owners of the mansions on the hills, proprietors of what were big businesses by Victorian standards, sold their partnerships, their children were converted into coupon clippers, and their grandchildren into trust-fund babies. If you really have nothing much to do, why not do it in California next to the beaches? Hollywood made trust fund babies seem glamorous on the Main Line, just as Madison Avenue had once made patriots on the left bank seem fatally attractive. Those movies and novels made somebody pretty rich, but whoever it was, doesn't live here, anymore.

The Streets of Philadelphia, on Ben Franklin's Birthday

|

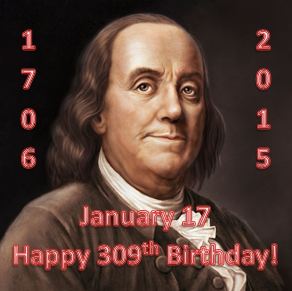

| Benjamin Franklin 309th Birthday |

They changed the calendar in the Eighteenth Century, so it's always confusing to talk about the birthdays of the Founding Fathers. Benjamin Franklin for example was born on January 6, 1705, but by the time he got around to being famous, he was born on January 17, 1706. Scholars handle this awkwardness by saying he was born on January 17, 1706 [OS, January 6, 1705]. That's not all the problem, however. This year on January 17 he had his 309th birthday, unless you wish to say he had his 310th birthday on January 6. The novelty has long since worn off, and nowadays most birthday celebrants prefer just not to mention the matter. You might think Don Smith would think this is of vital importance, but he cheerfully brushes it off with a chuckle.

|

| BenFranklin Celeabration |

Don Smith is the current leader of the Ben Franklin Birthday Celebration, which is held at 9 AM every year, on January 17th [NS], starting at the American Philosophical Society's Franklin Hall on Chestnut Street, once a very substantially-built bank building. The constituent members are affiliated with one of the thirty-odd organizations which Franklin founded, although anyone interested is welcomed. On what usually turns out to be the coldest day of the year, the birthday celebrants gather for hot drinks and cookies, followed by one or two really outstanding lectures about Franklin. Sometimes the lecture's connection to Franklin is a little stretched, but all of them are excellent. At 11 AM, the group marches together to Ben's grave at 5th and Arch for a short ceremony, led by Franklin re-enactors and honest-to-goodness members in the uniform of the National Guard, which Franklin founded. He did so when the Spanish and French ships were bombarding the coast, and as the editor of the town's newspaper, Franklin called for troops to defend us. The Quaker government declined to be violent, so Franklin published an invitation for volunteers to bring their guns and join him. Ten thousand showed up, and Franklin's career in public life was established. He was a hero to everyone -- except Thomas Penn, who saw him as a threat. Much subsequent Colonial history revolves around this episode and its consequences.

After the march, the group settles down for a good lunch, and hears yet another outstanding lecture. This year it was given by Paul R. Levy, the President of a planning organization called the Center City District. Steve's message this year was about how the streets of Center City Philadelphia were constructed for walking, or at most riding horseback. That is, they were narrow. They widened somewhat as they went West and had to accommodate a city of carriages. That was quite good enough through the Gilded Age, when Philadelphia could credibly claim to be the richest city in the world.

|

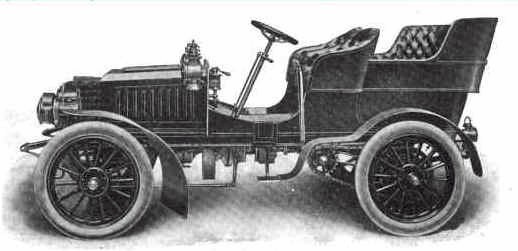

| Auotmoblie |

But then what happened was not the two World Wars, the stock market crash of 1929, or anything resembling that. What happened in Paul Levy's view, was the automobile. Hundreds, then thousands of autos filled the streets, scattering chickens and children, and eventually making the city impassible. Nothing would do but to move to the suburbs, which among other things provided the thrill of driving too fast and too carelessly, and reducing the pedestrians while increasing the business of accident rooms. There was certainly no room for bicycles, which were driven away without a tear being shed, and defying the efforts of city planners to find a safe place for them. Europe, good old Europe where we came from, was more successful in hounding the imposter autos off the bike paths of Amsterdam and Copenhaven. And preserving intercity high speed train service, at great taxpayer expense. Those Europeans really know how to live, in sidewalk cafes, unaffected by bicycles, preserving a much older collection of narrow city streets leading to empty cathedrals, in Germany, France, and Central Europe. That wasn't the American way, at all. We just pulled up sticks and moved to the suburbs, abandoning the dirty old defeated cities to their ethnic neighborhoods.

It's a novel theory, and maybe even a correct one. It could explain a lot, if Philadelphia is seen as a victim of Detroit, strangling on their mutual industrial excesses.

Suburb in the Big City

|

| Brown Brothers Harriman Co. |

In gathering views on what made Philadelphia deteriorate, a rather surprising response was given by Don Roberts, of Brown Brothers, Harriman. Don had obviously given this matter considerable thought, and without a moment's hesitation he answered, "The City-County Consolidation of 1858." For a few weeks, I puzzled over this answer, but my older daughter Miriam suddenly made it clear.

Miriam lives in Chestnut Hill, the suburb within the city. Her answer was made up of two anecdotes, relating personal experiences with city employees. The first had to do with the Water Department, which I had always heard was the crown jewel of the City bureaucracy. One day, she had no water in her house. Her first impulse, for whatever reason, was to call Roto Router. The nice man came and told her her pipes were fine, but the water had been turned off at the street, and he was forbidden to turn it back on. Happens all the time, he said, and he knew it was a waste of time to call anyone but the City. After several phone calls to the Water Department, the department sent out a man. At first, the Water Department denied they had turned it off. The next day a man came and, well, Yes, we did turn it off. Your next door neighbor hadn't paid her water bill, so we sent a man to turn off her water. He couldn't find her pipe, so he turned off the nearest thing he could find, which happened to be yours. After hearing my daughter screech in her best accent, they turned it back on. Sorry about that.

|

| Earth Day |

The second anti-city-consolidation episode was to discover a uniformed city employee rummaging in her garbage. Asked what he was doing, he announced he was fining her $85 for failing to separate garbage from the trash. After being told she was freakishly diligent in doing so and was in fact one of the founding members of Earth Day, he rummaged some more and found a cardboard box with some strawberry juice smeared on it. So, she took the next day off from work, went down to headquarters to spend the whole day, and had the satisfaction of having the fine removed. Her neighbors later told her, happens all the time. When it happens to them, they just pay the fine and shrug it off.

Those of us who live in the unconsolidated suburbs are universal of the opinion that neither of these episodes could possibly have ever happened in their suburb because suburban officials listen to the citizens. Come to think of it, I'll plan to ask Don Roberts where he lives, just to see if this was the point he was making.

Bullseye Sociology

Philadelphia is turning inside out. It used to be a commercial, financial and business center, surrounded by beautiful suburbs. It is now turning into a marvelous urban residential area, surrounded by a ring of commerce based on the ring of interstate highways. Commuters leaving the city in the morning outnumber the commuters coming in, and traffic jams are worse in the outer ring.

|

| Phila Skyline |

More precisely, the metropolitan area is a series of concentric rings. The bull's eye is Center City, with urban residences, culture, entertainment. Immediately surrounding the bullseye is a ring of decaying industrial slum. Surrounding that are the suburbs, and beyond them are the new malls and industrial parks. Further out is exurbia, where Philadelphia's "equestrian class" is mixed with what is left of the farmlands, rapidly being invaded by McMansions intended for employees of the commercial ring. Some people live their whole lives in just one ring.

Somewhere near Washington's old encampment at Valley Forge there is an invisible line. The people who live inside that line, live in Philadelphia. But just one house further out, on the other side of the invisible line, the orientation is toward central Pennsylvania. The people outside the ring mean "Pottstown" when they say they are going to town; if they say they are going to The City they mean "Reading". Going to Philadelphia is for them like going to Paris; they did it once.

There are other invisible lines. At the edge of the central city bullseye, there is gentrification; yuppie families are renovating the 19th Century mansions their grandparents abandoned for the suburbs, displacing working-class families who lived for a generation or two in decaying grandeur. The local bars are inhabited by one class, the neighboring restaurants are where the newcomers hang out. Beer in one, wine in the other, and sour looks when members of the wrong class blunder in. In London, you see the same thing, except it is usually a single building with two entrances.

There is another border region out further, where upwardly mobile minority groups are pushing out toward the suburbs. Curiously, working-class Philadelphia always tended to live in "neighborhoods", and their out-migration has more commonly leap-frogged to "Jersey", their places being increasingly taken by Asian immigrants.

Smothered to Death in Greenbacks

Here's my macroeconomic nightmare, brought on by thinking too much about paying for health care costs, and supposing, just supposing, we were successful in doing it. The equivalent nightmare would be to imagine that some multi-billionaire walked into the offices of Vanguard or Fidelity, and said he would like to speak to the manager. After he had a cup of coffee, he would explain that he wanted to make a deposit of $5 trillion dollars in a total-market index fund. After an initial reaction resembling a Grade B comedy movie, the manager would begin to see the idea was pretty disruptive.

In the first place, $5 trillion is more than twice the size of the largest index fund currently in existence. We're getting there, but at the moment no one can be entirely certain what it would do. It might take months or even years to feed that much money into the markets without creating violence. That one buyer alone would dominate the stock markets of the world, bankrupting some, enriching others. In the Grade B movie I envision, dozens of beautiful starlets would be sent around for the sole purpose of learning what our buyer was buying next week. And what would he care, he would tell them. If he decided to make a big sale, markets would tumble, maybe crash.

Now, assuming this money was honest and not "dirty" as they say, the consequence of steady buying in huge amounts would be to flood the markets with liquidity. There might well be spurts of both directions, but in general, the addition of this much money concentrated in the stock market would send the price of stocks up, in response to supply and demand. If the price of a stock is generally raised without underlying business transactions to justify it, earnings per share would go down. In the long run, that could send the value of stocks down, resulting in inflation, because it would be possible to sell more stock without raising prices. In any event, reducing the scarcity of stocks would lessen the value of capital, compared with the value of labor. Reducing the value of capital would itself cause disorders in the economy before the markets regained equilibrium. Prices of labor-intensive goods would rise, prices of things which could be automated by using capital would fall. It would create new winners and losers; new elites.

For these reasons, students of economics generally hate macroeconomics. It's important, but it's hard to make final conclusions. In our Grade B movie, the bald-headed little manager ends the scene by jumping out the window.

River to River, Pine to Vine

|

| R. Bradford Mills |

Brad Mills, a former Marine officer who now is a Commercial real estate advisor for Tactix Real Estate Advisors, was recently on the podium of the Right Angle Club. His theme was the Decline of the Suburbs, creating a return to Center City. Although some other cities have experienced an even greater change, his point generally corresponds to everyone's experience. If Stephen Levy is right that the automobile choked center city to death in the 1920s, this reversal of fortunes would seem to correct the migration of a century ago. The big question is whether it will continue, once an economic recovery, and cheap gasoline prices, make the auto popular again.

|

| Center City Scene |

The Center City scene at present is summarized by its rental prices: $100 per square foot for offices, $400 per square foot for top-level residential. So, naturally there are a number of office buildings being transformed into either residential or mixed-use. And about 20% of office space is unoccupied. The offices themselves are being transformed into a style which absolutely no one likes. Open space offices with insignificant partitions between them. Even the top officers are forced to abandon corner offices in order to show the rest of the employees they are participating in the new style, which as mentioned, everyone hates. Another statistic: the office space averages ten units per 1000 square feet, instead of the more luxurious 4 per thousand, and more often single offices. SEI carries matters to some sort of extreme: desks on wheels can be gathered together for conferences, pulled apart to talk on the phone. And to make things even worse, this seems to be following a European style. Ugh. For one thing, no American likes to appear European. No one likes it when office space is "hotelized", sharing a desk between someone in the office and someone else who is on the road, visiting the trade.

|

| Comcast Building |

There's a lot of talk of Drexel showing us the future, but that's probably in the far future, when Drexel has to consider building over the West Philadelphia train tracks along the river, for dormitories or whatever. In time that may happen, but what's immediately in prospect is the second building Comcast is building next to the existing one. To a degree, the people who will fill the new building are already here, scattered out in vacant spaces around City Hall. When the building is finished, those people will move into it, leaving their existing space -- either empty, if the recession continues, or occupied with "secondary" offices if we recover from the recession in time. It's a time of anxiety for architects.

And the people? Well, we have a doughnut hole model. The top executives want to be in town, close to work, where the action is. And young couples want to save on commuting expenses, living close to work, using public transport, living close to other people their own age. Out in the suburbs, things are emptying out, prices are down, and "crazy money" from New York is moving in for what they imagine are bargains. It promises to be an exciting scene, full of action. But what's missing? School-age children. It won't be much of a normal city without some kids, and to get them you need good schools, public safety, and a shift in taxes from that 19th Century wage tax, to the more modern real estate tax. Meanwhile, our speaker has his own individual office -- in Radnor.

2015 As Predicted from Pittsburgh

|

| Stuart A. Hoffman |

For the past 14 years, LaSalle University has featured an economics meeting at the Union League in January, usually with an economist predicting the local outlook for the year. Increasingly, the luncheon in Lincoln Hall has been packed and sponsored by some local firm. This year, the speaker was Stuart A. Hoffman, the chief economist of PNC Bank, who turns out to be quite a witty fellow. The lunch itself was gourmet, although a little on the feminine side for a mostly male audience. And because the place was filled with an audience, the waitresses of the League were taking it away faster than the eaters could eat it. It's hard to say what the audience might have felt about that, because most of them could afford to lose a few pounds, just like the Chef himself.

Dr. Hoffman feels the big news this year is OIL. It sort of fell out of heaven at the right moment, but even the politicians who opposed it are forced to acknowledge it was a very good thing, indeed. Its international effect, in creating oil independence, was especially powerful and undeniable. However, there are winners and losers. Our North American neighbors in Canada and Mexico may feel some painful effects, for example. In any event, the discovery and exploitation of fracking seem very likely to bring the recession to an end, sooner than we deserve, at least.

So the prediction for the year is rather bright for wages, unemployment, and housing, perhaps even banking. The relevant parts of the stock and bond market will prosper -- undeservedly, as always. But at the end of the year, we are likely to see that recovery as historical only, as we begin to see the long term gloom inherent in health care and educational costs, and the rest of the world begins to affect us more than we affect them. How's that for a January prediction, largely revolving around unexpected events in OIL. We'll try to remember to compare this January prediction with the subsequent December retrospective realities, later in this volume. We'll even see if Dr. Hoffman has to eat his words since today he had very little time to eat his lunch.

|

| Mario Draghi Chairman of the European Bank |

In the Question period, it was particularly interesting to hear a short description of what recently happened to the Swiss franc. The Swiss never joined the monetary union, but they did peg their currency to the Euro. As time went on, it was increasingly painful for Swiss exporters to have the franc suppressed by the lagging Euro, and when the Chairman of the European Bank announced his intention to start buying bonds, the Swiss bank capitulated and cut the tie of the Swiss franc to the Euro. The franc promptly rose, and that's all there is to the matter. Except if it isn't. The Germans are in much the same position within the Eurozone, and the English are restless, outside of it. So, if the prosperous parts of Europe decide to follow the Swiss example, the whole European monetary scheme may be in trouble. And if Europe has a monetary convulsion, it is trading partners in Africa and South America may follow, dragging in China, and -- who would be so brave as to suggest the USA could remain unaffected? Especially if Putin and the Arabs misbehave, pulverizing Israel in the process. When all you have is a hammer, you treat everything as a nail. Central Asia used to have two things, oil, and ruffians. And now they have apparently lost their dominance in oil.

|

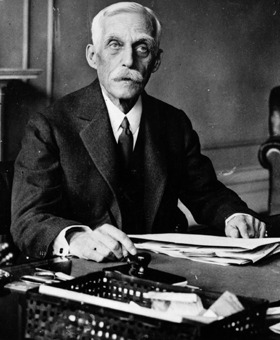

| Andy Mellon |

Well, that's about the size of it, from Pittsburgh. Pittsburgh was largely settled by going West on the Erie Canal, so they never liked being attached to the Quaker end of the state. Philadelphia dominated with its banks, to Andy Mellon's great distaste, and largely controlled the shift of steel production from Eastern anthracite to Western bituminous coal. So now, Philadelphia scarcely has a bank to its name and has to hear the News of the World in Review -- from the other end of the state.

How to Make a City Rich

It now may seem hard to believe, but in 1900 many people referred to Philadelphia as the richest city in the world. By 1948, when I first arrived there, it was dirty, defeated old wreck. The Gilded Age was pretty much forgotten. What makes a city first rich and then poor? How could that happen so quickly? I asked people who might likely know answers and got back an astonishingly wide variety of them. Some answers were pretty trivial, like the one which emerged from an old fellow who, in all seriousness, said he thought everyone at that time had two houses, and in 1929 most of them had to sell one house. So they sold the one in Philadelphia with the higher taxes, and the greater cost to heat. Others made more thoughtful answers, but probably wrong ones, like Digby Baltzell's book on Quaker Philadelphia and Puritan Boston, which essentially says Quaker diffidence discouraged people from getting rich. What he really seems to be saying is the Quaker trustees and officers at the University of Pennsylvania had kept it from becoming Harvard by not donating enough.

So let's temporarily skip to some answers which attract an influential following. At the moment, that group notably includes John Bogle, who founded Vanguard Group in 1974 and now has a customer base worth roughly three trillion dollars. Vanguard is now busy adding international offices in London and Melbourne, presumably to be able to provide 24-hour daily trading to a stock-trading world which is increasingly Vanguard's own little oyster. It's true their near competitor, Fidelity in Boston is largely owned by Ned Johnson and his family, whereas Vanguard is a mutual company owned by its customers. The consequence of that simple decision for the Johnson family emerged later: the Johnsons are immensely rich while the Bogles are merely prosperous. But mutualization of ownership does allow Vanguard to be slightly cheaper than Fidelity, which Fidelity makes up for, by providing better personal service. Perhaps we should wait until both companies have been through the inheritance tax meat-grinder, before judging who made the better choice of the corporate form. We may find Fidelity was somehow warped in its approaches by its need to escape inheritance taxes.

Essentially, the three-part Bogle message is: Random investment in the whole market through index funds, has a slight performance advantage over stock-picking and market-timing; taxes are reduced by a buy-and-hold philosophy, and eliminating stock-picking reduces overhead costs. The Bogle method is called "passive investing" whereas more conventional approaches are called "active investing". The differences are small but consistent, essentially providing an easy way path for converting 1% advantages into a comfortable retirement if you just start but forget about them, for fifty years. The system thus has appeal for the relatively small investor who does need a retirement income but has neither training nor interest to devote to his investment portfolio. Over a major portion of a lifetime, small differences can amount to a truly important set of advantages, particularly the ability to make a purchase, forget it, and remain reasonably confident he won't be cheated by his agents. One by one, kings and democracies cheat by inflating the currency, while hired money managers routinely cheat their employers. It doesn't seem to matter whether you are the slave or the master; the final outcome is rather similar. John Bogle offers the common man a method he can understand, trust-- and neglect.

The price the common man must pay is to surrender the hope of getting rich while young enough to enjoy life in youthful ways. He won't get rich unless he invests most or all of his savings, for major portions of his lifetime, employing a process known as "dollar-cost averaging". The pay-off comes later in the thirty extra years of unexpected longevity, which would otherwise be a bleak time for most of them. Even the long term Nirvana is clouded by occasional thirty or forty year cycles of "black swans", or market-wide swings in the value of the 1929 Crash variety. If a person's life happens to superimpose long-cycle crashes on top of life's major expenditures, as it would with a sudden major illness, or convulsions of some sort in his primary source of livelihood, he definitely won't get rich, ever. He can however still expect to perform better than he would with active investing. This style of passive investment is best suited for people who have some other source of income, who nevertheless save a small amount for a rainy day. It's also well suited for endowments and perpetual non-profits, who tend to get large lump-sum gifts at infrequent intervals, have relentless expenses from their charitable mission and are managed by experts in some special field, other than investing. The endowment situation can also be characterized as a rich person entrusting his funds to the management of non-rich employees whose financial competence is not entirely trusted by the donor. It's transparent, but it is both simple and safe.

Unfortunately, it's an approach unlikely to make anyone rich. The profits in the long run equal the profits of the entire stock market, or at most the profits of the whole nation's economy. Those profits have been remarkably consistent, and even with multiple wars and "black swans", have averaged 8%, plus or minus one standard deviation (i.e. seventy percent of the time), and requiring reserves to carry through 3 or 4 years of black swan dips, every 25 years or so. That's 8 percent, but inflation averages 3%, so real returns will average 5%. Since recent governments frown on perpetuities, most non-profits are required to disburse 5% a year. In theory, an endowment could last forever if the rules are precisely followed, but a single lifetime's retirement period is a more realistic goal than perpetuity within a culture which distrusts perpetuities. It will serve, as "active investing" will not serve, for the two main purposes of saving money, and can certainly justify accumulations in the trillions of dollars per nation. Three cheers for John Bogle.

But, it won't make us rich. Not if we expect to start poor, like Horatio Alger, and accumulate a fortune. A five percent disbursement, required by a Federal tax system which leaves little room for State taxation, will survive quite a while, but eventually will encounter unexpected difficulties, and start a downward spiral. A retirement system is similarly dependent on only working for forty years out of ninety-year longevity, and supporting the remaining fifty years on small incremental savings magnified by 5 percent. Although the long, long term picture is that of a cheap cure for cancer and Alzheimer's disease rescuing the retirement costs, no one now alive had the better count on such a rescue from very narrow calculations. Some people will borrow money at just the right time, and pay it back at just the right time, thus leveraging the savings or gaming the black swans. But many more people will go broke trying to get away with it. The Bogle system simply will not work for 350 million people, without a discouraging number of people falling off the wagon on the way. And all of this omits to mention thermonuclear adventures, collisions with asteroids, or global warming bringing the ocean beaches to Omaha. John Bogle can rightly be proud of devising a system which can make millions of people comfortable. But it isn't going to make very many people rich.

Who wants to be rich, when the alternative is to be comfortable? To get back to the plight of Philadelphia, the city simply must have more people get rich. To have a rich city, it needs to contain a lot of rich people. So the two problems are really only one problem: what sort of system will make a lot of people rich? Under the surface, that question amounts to asking what kind of people are we going to elevate? Are we talking about making poor people into rich ones, or are we talking about making a lot of borderline millionaires into billionaires? If you ask a large number of people how to get rich, most of them will answer, "Start a business". Some of them will say, "Rob a bank", and others will say, "Become an outstanding athlete." To be outstanding at anything has a scarcity limit, and robbing banks is what George Washington was thinking of when he repeatedly intoned, "Honesty is the best policy." That's been our message to immigrants, ever since, and it is discouraging to Americans to see that most of the other billions of people on earth, still need to be convinced of it.

Two-thirds of all new businesses go bankrupt in a year or two, and some of the survivors find the courage to start a second time. We can even give credit to another Philadelphian, Robert Morris, for the bankruptcy laws which make it possible to get on your feet and continue fighting. It's easy to see why so many people prefer to play it safe with a steady job or profession; it's even possible to see the attraction of working in the public sector. But I'm sorry, if you want to start a business, you have to be willing to take the risks of failure. You have to take the risk of becoming poor. And do you know, some people are risk-takers and some people aren't. The so-called head-hunters, who examine dozens of employment resume's every day, notice a curious thing. Those whose first job was in the public sector, tend to remain in the public sector all their lives, and those whose first job was in the private sector, tend to stay in that sector in subsequent jobs, similarly. You can interpret this finding in several different ways, of course. Some people are sheep, and other people are goats. The political lines recently are drawn in a way that a few employers really will not employ some kid who has been tainted by a brief tour of the wrong sector. But without getting into social philosophy, one point does emerge. Once a community tilts past the tipping point of risk versus security, a downward economic spiral has begun.

The Lawsuit That Ate Philadelphia

|

| F. Hastings Griffin |

Hastings Griffin ("Haste") died last week in his nineties. The Orpheus Club put on a concert at his memorial service, and probably the Squash world put on something because he was the reigning world champion for his age group. And his wife was there in all her glory, having married and outlived three men, all of whom were roommates at Princeton; among women, that's a champion on a different level. I knew Haste as a fellow member of the Shakspere Society, where his booming voice was an arresting feature, particularly when you knew his motorcycle was parked outside, ready for the 30-mile trip home at night to his home near Valley Forge. But I knew him to be most famous as the lawyer who was on the losing side of a lawsuit which cost Philadelphia the whole computer industry.

|

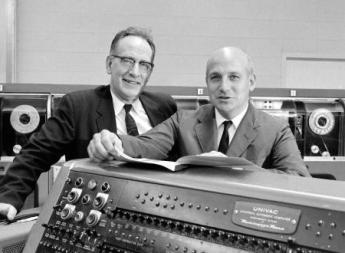

| John Mauchly (on Left) and J. Presper Eckert |

As a matter of fact, I am very friendly with Ben Heintzen, the lawyer on the winning side of the same case. So, over a period of years, I was able to piece together the main facts of the case, checking remarks from one side against the recollections of the other. First of all, the computer as we know it was assembled by Mauchly and Eckert, on the faculty of the University of Pennsylvania. Eckert had patented it, but the University had a rule that patents of the faculty belonged to the university. Unfortunately for that position, all of the money was government money. Right there, you have the makings of a big lawsuit, but there was much more. Ben Heitzen had discovered a paper by a Midwestern professor, Iowa I believe, who seems to have put the patent in the public domain by publishing the main substance of it, or what lawyers contended was the essence of the case. Furthermore, the case had many plaintiffs and defendants, working more or less together, but under the team leadership of Sperry Rand for the defendants, and Honeywell for the plaintiffs. The case dragged on for more than eight years, to the delight of the law firms and dismay of the Judge, who had been heard to growl that he didn't,t want to spend the rest of his life listening to this same case. All a losing lawyer had to do was wait for the verdict to tell you who won, and then file an appeal that the Judge had acted in prejudice. Furthermore, the Judge expressed the opinion that IBM wanted to mass produce computers, whereas Sperry was really only in the "patent infringement business." Somebody said that perhaps it was the Judge. Well, there's more.

|

| Sperry Rand Building |

It happens that Sperry Rand had round holes in their punch-cards, and IBM had square holes. The hanging chad issue became famous in the Gore-Bush presidential election, and you would suppose square holes would have more of a tendency to hang their chads than round ones, but it was actually the other way around. It seemed so to Sperry Rand, too, so they finally hired IBM engineers to tell them what the matter was, and those IBM engineers were hanging around while the trial was going on. They must have picked up the gossip in the lunch room, and reported back to Tom Watson at IBM something like, "Do you know what these people are doing with computers?" So they were given orders to stretch out the hanging chad matter and see what else they could learn. When Watson heard more, he told his lawyers to ask what Sperry wanted in return for letting IBM out of the lawsuit, and the answer came back, "Ten million dollars". To which Watson replied, "Pay them immediately because we are going to mass-produce those things." At that time, there were only a handful of computers, all doing such things as calculating field artillery aiming instructions. So Watson was essentially betting his whole company on success. At that time, General Electric, RCA, Sperry, Burroughs, Honeywell, and others were in Philadelphia, trying to imitate what they had heard the machines were capable of, so it was not a sure-fire gamble at all, but it was certainly successful in moving computers to upstate New York, and eventually to Silicon Valley.

|

| UNIVAC (Sperry Rand) Unimatic terminal |

Since half of this story comes from Griffin, let me reconcile a point that came up at his funeral. One of his partners heard him boast he had never lost a case, and when challenged on it, replied that it didn't matter what the jury decided, it was the judge who must approve the size of the settlement. His claim was based on getting settlements down to much less than the client was afraid it might be and was therefore persuaded he had been lucky. Well, in this case, it was a little different. The chief lawyer of the firm took the case away from Griffin and carried it himself. Shortly later, Griffin was heard to shout at the boss, "You are going to lose this case!". The next morning he was standing at the airport, next to the President of Sperry Rand. The President came close and asked him, "How do you think this case is going?"

To which Haste replied, "Well, sir, you'll have to ask my boss."

9 Blogs

Decline and Fall of Philadelphia

The Streets of Philadelphia, on Ben Franklin's Birthday

New blog 2015-01-22 23:44:26 description

New blog 2015-01-22 23:44:26 description

Bullseye Sociology

Philadelphia is stratifying into concentric rings, with prosperity alternating with decay. The challenge is to unify the rings of the bullseye.

Philadelphia is stratifying into concentric rings, with prosperity alternating with decay. The challenge is to unify the rings of the bullseye.

Smothered to Death in Greenbacks

New blog 2014-07-18 23:55:26 description

River to River, Pine to Vine

New blog 2015-01-24 23:37:34 description

New blog 2015-01-24 23:37:34 description

2015 As Predicted from Pittsburgh

New blog 2015-01-22 22:42:48 description

New blog 2015-01-22 22:42:48 description

How to Make a City Rich

Get more rich inhabitants.

The Lawsuit That Ate Philadelphia

Other cities want to attract Silicon Valley, Philadelphia drove it away.

Other cities want to attract Silicon Valley, Philadelphia drove it away.