Related Topics

Investing, Philadelphia Style

Land ownership once was the only practical form of savings, until banking matured in the mid-19th century. Philadelphia took an early lead in what is now called investment and still defines a certain style of it.

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Academia in the Philadelphia Region

Higher education is a source of pride, progress, and aggravation.

Philadelphia Economics

economics

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

Nobel Prizes

Some Philadelphians won Nobel Prizes for work done here, or elsewhere. Some prize winners would deny they are Philadelphians, but their work was nevertheless done here.

Hayek Confronts Keynes

|

| The Four Horseman |

Catastrophes seem to have fashions. There was a time when the four horsemen of the apocholypse -- pestilence, war, famine, and death -- rounded up the main things to keep you awake with worry. Perhaps it is too soon to gloat, but pestilence and famine seem tamed, even ready to be "put down". War remains a serious cause for concern, but a case can be made that two economic disasters, inflation, and recession, have moved up to dominate our nightmares. Indeed, it is the Summer of Love in 1967 which seems to mark the watershed moment, when basic survival stopped being the main risk in life, supplanted by threats to existence that are largely self-inflicted. The first warning of this sea-change appeared in the fall of 1929 when it seemed to be deflation, unemployment and all the other havoc of economic recession that caused wars, famines, and pestilences. The 1929 crash did not send a fully readable message, however, because it was so one-sided. It took another 37 years for the world generally to appreciate there was an opposite side to it; inflation was just as bad as recession, and both problems were largely man-made. One person gets most of the blame for the distorted emphasis. John Maynard Keynes, later Lord Keynes, was the prophet who seemed to save the world with the doctrine that the deflation emergency was so dire that civilization could not afford to worry about the long-term drawbacks of deliberate inflation. He persuaded world leaders to inflate the currency before civilization disappeared. After all, in the long run, we are all dead.

|

| Roosevelt Stamps |

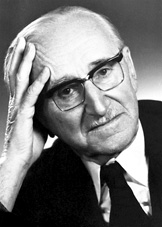

There's an irony that Franklin Roosevelt was a hobbyist who collected postage stamps because stamp collectors were about the only Americans who were dimly aware that Germany and Austria had hyper-inflation as the main curse. Austrian postage for billions of marks gradually filtered into our collections of odd foreign stamps, arousing mild international curiosity. But Friedrich August von Hayek was living in the midst of it, painfully aware of its pain and chaos. It became the central focus of the life of an aristocratic decorated war veteran who became a distinguished economist, eventually winning a Nobel Prize. What caused inflation? Why didn't it stop? Why was it so destructive? How can inflation be prevented? How could Maynard Keynes possibly urge the leaders of nations to inflate their currency deliberately?

As a scholar in the dismal days of world depression, Hayek had a hard time, living for long periods on the charity of a few philanthropists who recognized his talents. He is best known for his scorching analysis of collectivism, a craze which swept through academic and political leadership, particularly in Europe, and his persuasive views probably constitute the main intellectual force which ultimately ended the Cold War. It is seriously stated that personal animosity by Socialist-leaning academics materially injured his academic career, although it probably gave him more time, and motive, for serious writing. Inflation and political collectivism do not seem tightly connected, but it is easy to observe that command economies do inevitably clash with private property and market decisions. For the present, it seems useful to set aside Hayek's monumental political achievement of discrediting Communism and focus on his penetrating view of inflation.

|

| August von Hayek |

You can almost watch his mind at work. If you give long hard consideration to the topic of inflation, you have to conclude that there seems no reason for it to be a bad thing. It may take a little time, but the price of everything will eventually readjust to a new higher level, and relationships will go on undisturbed. At first glance,

You can almost watch his mind at work. If you give long hard consideration to the topic of inflation, you have to conclude that there seems no reason for it to be a bad thing. It may take a little time, but the price of everything will eventually readjust to a new higher level, and relationships will go on undisturbed. At first glance,

inflation is just a harmless numbers game. You can understand the power of inflation; everybody likes a little of it for his own personal benefit. If everybody enjoys a little of it in his own sphere, then the whole world is pushed to a higher numerical level.

After long consideration, Hayek came to see that the disruptions of inflation are caused by the uneven speed of penetration throughout an economy or nation. If the price of oil goes up, the price of transportation goes up, then the price of home heating. But those who take the train or who heat their homes with coal are not affected so soon. Mortgages carry a fixed interest rate for thirty years until the unwisdom of such agreements becomes clear, but it takes time. The process of inflation creates winners and losers, and disruption in the culture of payments. The speed of payment is itself a factor in the virtual size of the monetary pool. In the long run, we're all dead and it all settles out unless we set in motion a universal scramble to get out the door before others get there. Inflation is just as much evil as collectivism, and somehow the two are usually seen together. The Road to Serfdom sits on the shelf, right next to The Austrian Theory of the Trade Cycle, and Other Essays .

Originally published: Thursday, June 28, 2007; most-recently modified: Tuesday, May 21, 2019