Related Topics

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

Old Age, Re-designed

A grumpy analysis of future trends from a member of the Grumpy Generation.

Insurance-Like Financial Retirement

There are other ways to support retirement, but most retirement plans before the public are based on the insurance model.

Rentier Class

To hope to retire is to hope to be prosperous without working. Those who must work can grow sullen about it.

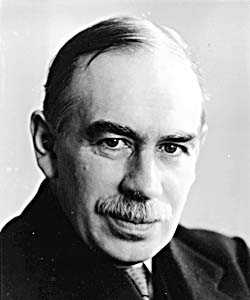

|

| Dr. Fisher |

Rentier income is passive income, such as interest on savings accounts. Lord Keynes gave the term a nasty rap by defining rentiers as "functionless investors". That suggested Keynes shared some sentiments about passive investing with Karl Marx, who seems to have invented the term; both authors apparently judged the rentier class by the standards of novels by Jane Austen and Edith Wharton, or perhaps movie stars depicted in the novels of F. Scott Fitzgerald. That is, not gainfully employed, mainly occupied with debaucheries and expensive luxuries. This envy-based image dies hard but may subside if rentier life becomes everyone's goal. Or it may turn vicious, if a majority of voters see themselves as Jacobins in the water with the sharks, looking hungrily at the lucky few in the lifeboat. Guillotine, anyone?

|

| Lord Keynes |

To a certain degree, these attitudes can be managed, as possibly illustrated by bankers. After all, bankers extend credit to financially secure borrowers at the lowest interest rates and refuse credit to the penniless clients who need it most. It is thus frustrating to discover that you can't have any borrowers unless you have some lenders, too. In the main therefore, the public remains tolerant of the differential cost of taking risks. However, the public is often intolerant of the true value of a banker's role: simultaneous exchanging of capital between those with a surplus, and those with a need. That's unforced barter; forced relief of need requires the use of political majorities, responding to political viewpoints. If votes were all that mattered, however, the growing proportion of the population in retiree status could afford to be more complacent than they are. So 30-35% of American GDP would now qualify as the spending of passive income, although the varying degrees of risk within such investment are hard to evaluate. The risk is sure to rise as more labor-intensive work gets globalized away. Observers notice a paradox: passive income seemingly increases as the labor to achieve it diminishes, quite the opposite of the 19th-century Communist idea of work as the source of all wealth. Rentiers are never far from the need to defend the value of non-work income, at the same time everyone seeks to avoid hard labor, except as recreation. Our inconsistency does need some fine-tuning.

|

| F Scott Fitzgerald |

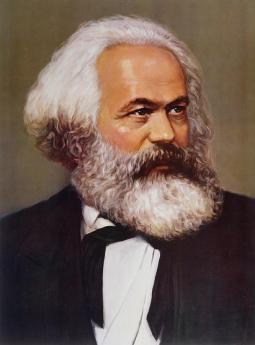

In the future, one thing seems certain: a greater proportion of our population will be retired persons, living on pensions, rentier income from savings, and government handouts. As it becomes the universal expectation of everyone that thirty years of rentier life awaits in the retirement stage of life, there will be less chance for Keynes, Marx, and Fitzgerald to seem so congenial to the voting class. But take care; young people, particularly unemployed young people, are never far from asking, "And what have you done for us, lately?", as if fairness were something to be measured with a spoon.

|

| Karl Marx |

Curiously, one implication about rentier income has almost disappeared. Interest is paid by a debtor to a creditor; as Marx would have it, the poor workingman is paying the rich rentier. Dividend income represents the profit from a business to its owner or a farm to its farmer. But emotionally, that is hardly so. We have so sterilized the investment process that we seldom think of debtors and creditors but speak of "fixed income" and "fixed income investors". The income from ownership, or "equity", is now thought by economists to bear a definable relation to the "prevailing return from fixed income". To them, it's all the same thing. Future attitudes can be hard to predict, but although everyone seems destined to be both a creditor and debtor at the same time, the two are surely not the same thing.

It's also hard to predict Americans attitudes if passive income becomes say eighty percent of GDP. Or fifty percent of the population become rentiers. Eighty percent rentiers, if you exclude children. Americans worship work; even labor leaders cry out, "Jobs, jobs, jobs." Western Europeans, however, seem willing to sacrifice luxury in order to live without work as threadbare rentiers. Is that the product of brain-washing, or have they discovered some evil in work that Americans are unable to see? The ancient Romans once aspired to more luxury, fewer soldiers. Unsympathetic barbarian neighbors then wiped them out. Better do some thinking about this because the Law of Gravity will not save the situation, any more than history lends much comfort to it.

Originally published: Thursday, June 22, 2006; most-recently modified: Tuesday, April 30, 2019

| Posted by: Sojourner | Jan 11, 2010 1:09 PM |