Related Topics

Academia in the Philadelphia Region

Higher education is a source of pride, progress, and aggravation.

Old Age

New topic 2019-04-09 16:04:33 description

New Jersey (State of)

The Garden State really has two different states of mind. The motto is Liberty and Prosperity.

The Garden State really has two different states of mind. The motto is Liberty and Prosperity.

Old Age, Re-designed

A grumpy analysis of future trends from a member of the Grumpy Generation.

Insurance-Like Financial Retirement

There are other ways to support retirement, but most retirement plans before the public are based on the insurance model.

Starving the Beast of Early Retirement

|

| Chairman, Ben Bernanke |

Inflation-targeting, unless someone is keeping a big secret from us, is the only arrow in the quiver of a nation's central bank, in our case the Federal Reserve. A strong case that the Federal Reserve should acquire no other duties, rests on the fear that any new duty might conflict with holding inflation on target (at present, 2% per year). The recent adventure of the present Chairman, Ben Bernanke, into "Quantitative Easing" illustrates that diluting and confusing the role of the Federal Reserve will tempt the Executive Branch to poach on its independence. In this particular case, the adventure was the purchase of vast amounts of bad loans in order to remove them from the economy, never mind the future problem it will create of re-selling those loans to someone. Mr. Bernanke is lending credibility to the outcry of Representative Ron Paul (R, Tx) that the Federal Reserve should be abolished entirely.

|

| Kenneth S. Rogoff |

Maintaining price stability (Inflation targeting) rests on Alan Greenspan's simplification of Milton Friedman's "monetary" theory that you can combat inflation or deflation by appropriate adjustments of interest rates and the money supply. Greenspan's further insight was that you needn't measure "monetary aggregates", you just have to measure inflation itself and react like a helmsman with a compass. Until 2008 it looked as though Greenspan had won the argument, by avoiding a deep recession for seventeen years, in the so-called "Great Quieting". Inherent in this helmsman theory is a deeper theory that all episodes of deflation (depression, recession, whatever) are merely over-reactions to inflation; avoid inflation and then forget about deflation. Still further behind this analysis is the observation that all governments at all times are pushing toward inflation, count that as an immutable law. The blunder of holding interest rates too low in 2001-3, for example, has been blamed as deliberately inflating in order to combat the Dot-Com crash of 2001 for political reasons; by this reasoning, the rescue of the DotCom dip led straight to the 2008 Subprime plunge. There is thus evidence that monetary effort by the Federal Reserve is powerful enough to control inflation, provided other branches of government abstain from political interference. In the long run, however, the Fed can only smooth out wobbles in the main trajectory. As Rogoff has shown, all crises whether of currency, banking, commodities or securities, are pretty much the same and caused by unwise borrowing. Avoiding inflation is enough to prevent a recession since government pressure to inflate can be counted on. Paul Volcker may have proved the issue in another way in 197_. During the Carter Administration, the country experienced "stagflation", we had inflation and unemployment at the same time. Improving one might seemingly make the other worse. But, dismissing the whole mess as inflation in disguise, Volcker promptly jacked up interest rates a great deal -- and both inflation and unemployment then went away. What seems proven is that stagflation is just a variant of inflation and should be treated by sharply raising interest rates.

If inflation targeting is as powerful as that and as simple as that, what could go wrong? One present worry is that so much American money has fallen into foreign hands that the Federal Reserve could lose control. There is a second source of danger. Broadly speaking, this concern is that public opinion might demand inflation -- or policies which would surely cause it -- and in a democracy, the time might come when the Federal Reserve would have to give people what they demand. James Madison warned us about that. In a democracy, it's their country to ruin if they please.

|

| Fringe Benefits |

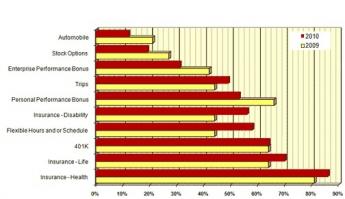

New Jersey increased the number of state employees and their fringe benefits. As is so often the case, these state employees and their union became the core voting bloc for the party in power, usually Democrats. Not only are there a remarkable number of employees in each of the local offices for the Bureau of Motor Vehicles for example, but New Jersey included the local municipal and school employees (mainly police and school teachers) in the state health and pension system, a decidedly unusual step. These were not trivial costs. Longer life expectancy makes pensions and health care more expensive. Just how a ten-mile ambulance ride gets to cost $1700 is a related story, passed over here. And then, a few years ago it seemed like clever bookkeeping to float a bond issue to bring the state pension system up to full funding. Long term full funding tends to mean a stock portfolio, buying stocks with a bond issue is like buying stock on margin. By a stroke of timing, the booming dot-com stock market promptly crashed, taking New Jersey's margined stocks down even faster. In a sense, not only has the state raised the reimbursement of its workers, it has guaranteed them for life.

New Jersey has always had high real estate taxes, now painfully high. But Jersey residents once could console themselves they had no sales tax and no income tax. Now, NJ sales and income taxes are nearly the highest in the country, and just about every other form of state taxation is at unsustainable levels. Doesn't matter, the state is running a $5 billion deficit and will run a greater deficit for as long as anyone can predict. Forbidden by the courts to borrow money, it's not easy to see what the Governor can do except raising taxes some more. Well, perhaps there is one thing if the unions will let him. He can extend the retirement age of state employees from the present age 55 to age 75. Having retired at age 81 I have little sympathy and have even written a long essay praising the joys of late retirement.

But let's see him try to do that without anyone noticing.

Originally published: Thursday, June 22, 2006; most-recently modified: Thursday, May 02, 2019