0 Volumes

No volumes are associated with this topic

...Tax and Monetary Issues in the Constitution, Others (2)

For some Delegates, taxes were all that mattered.

Bretton Woods

|

| The Bretton Woods conference in 1944 |

Stripped of its mystery and irrelevant details, the Bretton Woods conference agreed that all nations would make their currency convertible into U.S. dollars, and the U.S. would make its currency convertible into gold. Since World War II had left the United States with the only major working economy, it sold goods to the rest of the world and the rest of the world sent us their money to be converted into dollars; we had a "favorable balance of trade." Somewhere in the 1960s the rest of the world got on its feet, and we began to have an unfavorable balance of trade. After a while, foreigners started converting their dollars (the "reserve" currency) into gold. By 1971, the depletion of gold from Fort Knox became alarming, and the United States stopped converting its currency into gold. From that point onward, all currencies became effectively computer notations, whose value as a medium of exchange was what their government said it was.

Paradoxically, it is hard to see how this system would work without a government in charge of it, although private substitutes would probably soon appear if governments relaxed their monopoly on currency. Since a great many people dislike their governments for one reason or another, they chafe at a system which forces them to keep their governments in order to prevent commercial chaos. For those who do not adequately understand this, governments all stand ready to maintain themselves with force, and many other people dislike that feature even more. Since it took place at the same time, the Vietnam protest movement may have had some relation to this major change in the nation, misunderstood perhaps, but viscerally perceived. In view of President Nixon's central role in all of this, one is even tempted to speculate that his electoral promise of a secret means to end the Vietnam conflict, coupled with the subsequent peaceful surge of China and the financial recycling of Chinese money through Treasury bond purchases, may all have been subjects discussed during his historic trip to China.

However that may be, it is a fact that the Vietnam War ended, the Chinese economy flourished with American help, and the deposit of Chinese money in our economy helped fuel a massive economic bubble, and the weakest links in the chain -- mortgage-backed securities -- were the place the bubble burst. Not much of this could have occurred with a gold standard, and in many circles, this was regarded as proof that gold was a barbarous relic. In retrospect, few would deny we had been leveraging our economy to dangerous heights, for nearly fifty years. In 1996, Alan Greenspan denounced our "irrational exuberance", and yet the bubble did not burst for another twelve years. If we succeed in deleveraging our economy until it reaches 1996 levels, it will be regarded as a remarkable success. But the Chairman of the Federal Reserve at that time described it as a dangerous level. And looking back over the centuries, an indescribable number of kings were dethroned or beheaded because they evaded the rather irrational restraints of a scarce, hence precious, barbarous relic. Balanced against that, a billion Asiatics have been raised out of poverty, and the economy of the world overall would seem opulent to our grandfathers. Somehow, we must find the wit and the self-restraint to solve this problem.

REFERENCES

| The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order:z Benn Steil: ISBN-13: 978-0691149097 | Amazon |

Gold Standard Substitutes

|

| Bretton Woods conference in 1944 |

Make-shift proposals to address international monetary crises after 2007, particularly confiscation of bank deposits suggested briefly in 2013 for the Mediterranean island of Cyprus, stimulated a search for a better monetary system. A gold standard sufficed for thousands of years, but the Industrial Revolution increased world economies faster than gold metal was discovered, constantly driving prices downward. It became increasingly difficult to manage the rapid growth of debt, as happens in wartime. The crisis which led to the 1944 Bretton Woods Conference was the inability to accommodate the massive national debt rearrangements of the Second World War. With the United States owning two-thirds of the world gold supply, international trade was seriously impaired.

Bretton Woods created the International Monetary Fund and the World Bank, which can be ignored for present purposes. It established the United States dollar as a "reserve currency", alone able to be exchanged for gold. Other nations were allowed to exchange their money for United States dollars. Supplemented at the Bretton Woods conference in 1944 by this gold-standard-once-removed (the U.S. dollar as a "reserve currency"), this expedient only prospered as long as the United States could maintain a positive trade balance. After 1960, the outflow of gold from Fort Knox was relentless, and in 1971 the United States was forced to abandon its buffering between gold and the world's banking systems. After 1971 the world's currencies would supposedly trust their central banks to be "lenders of last resort", but in the financial crises after 2007 many could not sustain that obligation. What they could do was devalue their currency, and even that expedient was blocked by the rules of the eurozone. Put to the test, the European Central Bank became uncertain it wanted the role of lender of last resort. At one time, the gold standard had provided the one backing for a currency which was independent of all governments' temptation to inflate away their debts. The U.S. reserve-currency buffer extended the system for several more decades, but after President Nixon cut the link to gold, the post-1971 system only provided a promise of a government rescue, without the universal ability of governments to live up to the promise. In a sense, governments backed their currency with a mortgage on the nation, and many mortgages were already overextended. For those nations, variants of the gold standard had been replaced by no standard at all. Since governments which had historically been the cause of inflation were now expected to be the source of its restraint, the private sector urgently needed to devise a new system to force the public sector to accept a new and unwelcome role.

Money on a gold standard was formerly both a storehouse of value and a means of exchange. The world supply of gold was unable to keep pace with the world's increasing wealth for more than a century, so prices were driven down, disrupting long term debts. Rising prices were just as bad; what commerce needed was price stability. What was devised for the 1971 disruption was inflation targeting. The Federal Reserve and to some extent the other major central banks, issued or withdrew currency to achieve a 2% inflation rate, thus hoping to maintain stable prices with a 2% growth rate. Skipping over the details of central banking, the Federal Reserve could safely count on the government to promote inflation at almost all times; the need was to restrain it to 2%. Unfortunately, contraction at 2% takes about as long as expansion at 2%, frustrating the hope of the public to have booms last as long as possible and depressions to be over as soon as possible. Periodic episodes of deflation are a problem. From time to time the economy expands its production capacity faster than consumption can grow, and the inevitable resulting panic not only impairs the ability of banks to lend but frightens the public away from borrowing. Without a gold standard, prices then fall even farther and faster than with gold support because money no longer has any intrinsic value. Our problem thus reduces itself to two requirements.

Without a gold or other monetary standard, and seeking to preserve the inflation-targeting system, how can we induce prices not to fall in a depression? And, how can we induce a booming economy not to increase its production capacity beyond what it can consume or sell, so that every boom period stops being followed by an uncontrollable crash? That is, much of the problem of keeping production from falling, is to prevent it from going so high it has to fall. That's not so easy in a democracy; if you stand in the way of making money when making money is easy, you will very likely be voted out of office. Price controls, by the way, have been tried many times; they always fail. The practical problem is thus pressed into the mode of forcing savings into some sort of escrow fund, during boom times. Meanwhile, the practical politician must persuade a suffering public that, once you overbuild capacity, it will probably only wear out at the same 2% rate that it took to grow so big. These are not new sentiments; the public must learn self-restraint during booms, something it has repeatedly resisted.

|

| Fort Knox, KY |

Features particularly irritating to the private sector about the Cyprus proposal had several sources, all of them heightened by annoyance that the bureaucracy would immediately try to force the private sector to pay for administrative design blunders. A gold standard permits international trade in defiance of government wishes; a currency without a physical store of value cannot exist without workable rules for international trade. If satisfactory rules cannot be made, voices will demand a return to the gold standard. No one said the Greeks and the Turks should love each other; no one said the Russians must respect private property. What is stated is if workable rules are not forthcoming, private alternatives will arise.

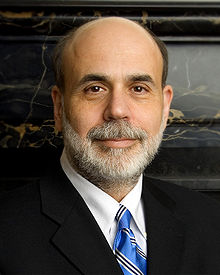

Ben Bernanke is not only the chairman of the U.S. Federal Reserve, but he is also one of the recognized academic experts on managing depression. He has spent his life studying this particular problem and occupies the most powerful position among the group charged with doing something about it. His innovation in the management of a financial crash is QE, quantitative easing. Essentially, this amounts to the creation of a fund managed by the Federal Reserve, generated by purchasing bonds with money created by the Fed. The content, size, and purpose of the fund have varied in the past few years, to the point where it amounts to a gigantic fund at his disposal, as needed, Initially, it injected funds into markets frozen with fear, and successfully unfroze them, making a profit for the Treasury along the way. He next used the fund to manage a gigantic Keynesian effort to stimulate the private economy with a federal fund. While it is possible this stimulus averted some worse disasters, the net effect was not outstanding and is generally regarded as a failure. His current effort, titled QE3, amounts to an enormous effort at what is termed "good bank, bad bank" in financial jargon. Because so many good bonds are undervalued in a recession, it is believed they will return to true market value if the truly bad bonds are removed from the market place. In Victorian days, this was accomplished by bankruptcy, but it is thought to be more humane to buy up and remove them temporarily from the marketplace. The humane approach, of course, has the disadvantage that the bad bonds may reappear later, and some critics say it is only a variant of "kicking the can down the road." It seems to have worked well for the Scandinavians however, and the final verdict cannot yet be issued. For the purposes of the present discussion, the essential point is that a three-trillion dollar discretionary fund has been put in the hands of the most powerful and most knowledgable person involved in international finance. At the moment, the fund contains most of the dubious bonds in circulation, but there are signs that Bernanke plans to replace them with U.S. Treasury bonds, thought to be the safest investment available. He can essentially do anything he pleases with this fund, subject only to the approval of the rest of the Board.

It must have occurred to Bernanke, that this multi-trillion dollar fund of the safest investments on earth would make a highly suitable substitute for gold, if it ever becomes clear that the world needs to return to some tangible commodity to back its currency, or become the new lender of last resort, if we choose to put it that way. Mr. Bernanke essentially needs no one's permission to create this fund, but to use it in some novel way would require the permission of politicians, acting in some way identifiable as the will of the American public. If it should come to that, a few suggested limitations immediately come to mind.

In the first place, one of the main purposes of imposing a gold standard on spendthrift Kings was to keep the King from spending it and substituting his own worthless paper money. Three variants of this threat, inflation, devaluation and confiscation, all amount to the same thing, which would get us back to our present predicament quite quickly, indeed. Mr. Bernanke must realize that our Constitution was written by Founding Fathers who were intensely fearful of entrusting as much power to one person as Mr. Bernanke would likely possess if this idea moved to implementation. To put it bluntly, the first action after it is done should be to surrender the ability to do it. To take another lesson from Constitutional history, it might be remembered that the functions of the Legislative Branch were established in six months, those of the Presidency evolved in the first five years of George Washington's office, and those of the Supreme Court required forty years to evolve. During all of that time, the ability to destroy the Constitution's main purposes had to be shielded from unbelievers, and an apparently unnecessary Bill of Rights had to be appended to reassure the remaining doubters. The main risk to this technical monetary reconfiguration is not monetary, but political.

|

| Financial Crisis |

But there are technical issues, as well. Because they are technical, it is more difficult to depend on wise public opinion, and thus it enhances feasibility when technical issues can be translated into political speech. Because events have demonstrated it is much more difficult to reverse a depression than a bubble, thought should be given to devising ways to use this new vehicle to reverse depression. Obviously, it should be used to unfreeze a frozen market; that's an important lesson from the success of 2009. Furthermore, the revenue from three trillion dollars of bonds is appreciable and should be used to finance tax reductions in a recession. More importantly, it should be withheld from government treasuries to restrain a developing bubble, more or less forcing governments to raise taxes during a bubble. Perhaps standards are necessary for expansion and contraction of the fund itself to supplement the use of the fund's income in those extreme situations. Indeed, to forbid the use of principal for those end-purposes might leverage the effectiveness of changing the fund balance, because it would force larger swings of principal to be adjusted. Most of these considerations come into play when a bubble is being restrained because it is easier to restrain a growing bubble than to repair the damage once it bursts. Restraining a growing bubble is not easy, and picking the right time is still less easy. Better to make most of it automatic, and related to defined market benchmarks. Benchmarks may be inaccurately chosen, but at least something is learned for the next time.

Mr. Bernanke's QE fund is not the only one which could take the place of gold in a new monetary standard. Commodities of various sorts would not be much different from gold and might soften the volatility of the mining supply. Land could be used, or fresh water, or petroleum; perhaps we could divide up the ocean in some way. Among the more attractive candidates would be world index funds of stocks or bonds; bonds seem perhaps more suitable, perhaps not. But at the moment, no one seems to be exploring any substitute monetary standard other than gold or the QE fund. Perhaps the disadvantages of each would cancel out in a basket of all the suggested standards. Perhaps inflation targeting can be improved, and no other benchmark is needed; perhaps international branch banking could cover the requirements. And perhaps it is all an academic exercise, but it would still seem helpful if academia would explore a little further, just in case we need them.

Stress Tests for the European Union

|

| Dr. Ronald J. Granieri |

Dr. Ronald J. Granieri of the office of Secretary of Defense recently spoke to the Right Angle Club about recent threats to the unification of Western Europe. One of his more striking points was that the 1989 collapse of the Soviet Union ending the Cold War, may have unintentionally thwarted the plans for a European Union. The Iron Curtain running from the Baltic to the Black Sea had served as an Eastern boundary for European dreams. When the curtain suddenly disappeared, the European Union was flooded with applications for membership from the recently liberated, formerly Communist-dominated, Eastern Bloc. It was understandable why these countries would wish to get away from Russia, and equally understandable that Russia would be annoyed. But bedazzling expansion was quite unexpected by the European Founding Fathers, who were having enough trouble without doubling their number with weak economies. If Napoleon or Bismarck or some other empire-builder had been in charge at that time, Europe would either have been expanded by brute force, or its borders slammed shut with brute force. But in the clutch, no one was thinking big. Acquiring twenty new nations was an undreamed-for opportunity, but a technical headache for academic theorists. It called for bold action at a time when bold actors were not in charge.

Although it hurts European pride to admit they were following the American model, most of the problems they were encountering were the same problems our own Founding Fathers encountered in 1789. There were two main differences, however, one of which had been written into our Constitution. The other went largely unnoticed. The written difference was we had a bicameral legislative branch, designed to address the issue of voting rights straddling three big states and nine little ones. Pennsylvania had already gone through a dispute over the unicameral Pennsylvania Legislature, which proved to have so much power it unbalanced the three-branch system of government. Consequently, the Philadelphia Constitutional Convention, held in that same building, was already uneasy about unicameral legislatures. It was John Dickinson the delegate from little Delaware, who went to James Madison (of Virginia, then the largest state) and told him bluntly that if Virginia persisted in demanding a unicameral Congress with representatives elected by population size, well, there just wasn't going to be any Union. The three big states refused to participate in any one-state, one-vote, system, while the nine small states wouldn't submit to large-state domination by population size. Either voting by state or voting by population would inevitably result in one side winning every hotly contested vote in a unicameral legislature. So, we had solved our problem by having two legislative houses, one of each kind, and agreeing that legislation would only proceed if both houses were in agreement. What made any legislation possible under these terms, was the informal system of "logrolling", in which informal agreements on seemingly unrelated matters would compensate the loser branch of government, and the states they represented. Since in modern Europe, any group of ten or twenty states in a union would surely have memberships of unequal size, bicameral legislatures seem to Americans to be a perfectly sensible arrangement, so get on with it. The insistence by the League of Nations and the United Nations for one-vote, one-nation arrangements, is a major reason the United States never permitted these supranational forums to have much power.

|

| Iron Curtain |

It's an unspoken truth however, that other nations do not see it our way. That's partly because the German and other parliaments going all the way back to the Roman Senate had established a unicameral tradition in Europe. The other main but unwritten cause of Constitutional differences between the two continents is that we had been surrounded by thousands of miles of ocean, and never had to consider the danger that external and internal enemies would join forces to frustrate our decisions. It is true that many attempts were made to do just this, but they were immediately recognized and easily quashed in the past. As long as the Iron Curtain was operational, Europe thought it might have such ocean-like protection as well, but events in 1989 swept that idea away. With a large addition of formerly hostile states, some members were occasionally bound to join forces with Russia or China, even though they were nominally loyal citizens of the EU. Traitorous behavior had long been an underlying cause of splinter parties and brutal suppression, but that was when Communists were thought by everyone to be agents of a hostile foreign power. With the end of the Cold War, they might become misguided local citizens exercising freedom of speech, claiming a right to argue for behavior which would have formerly been denounced as traitorous. Nations harboring few such inclinations soon became cautious about joining a government with nations who had a great many of them. Citizens of recently enslaved nations were particularly resistant to soothing arguments about unity. It must be confessed that the example of our own Civil War lends force to this feeling of what might happen.

|

| Baltic and Black Seas |

It may be claiming too much to describe the fall of the Iron Curtain, as the major reason for the decline of interest in forming a political union in Europe. That decline did occur and was replaced by the rather weak stratagem of leaving unified government to another time. In its place appeared a strategy of economic unification, hoping the benefits to everyone would become so apparent that unified nationhood would follow. A substrate emerged, narrowing it to a unified currency, the Euro. Bankers and other financial experts argued that such unification would be fairly simple and effective. And so it proved until the same difficulty appeared in a different form. The design of the Euro Currency Zone had apparently underestimated the problems of a foreign currency operating together with the Euro, and variants of Gresham's Law surfaced. Small nation members like Iceland and Cyprus found their small banking systems could not cope with huge inflows of flight money, escaping to tax havens within the Eurozone. As well, underdeveloped member nations actually romanced non-member capital to relocate to their shores. Since local currency is ultimately supported by the full faith and credit of the nation, local banks and economies cannot easily deny equal protections to foreign capital, except temporarily while exchange controls are applied. But when a sufficiently small nation is thus forced to guarantee a sufficiently large amount of foreign money, local banks and markets will be destined to crash. If, in addition, the member nations are deprived of the ability to devalue their currency as the Eurozone could, some type of informal arrangement for a two-value currency had to be devised unless more prosperous members like Germany were willing to subsidize the money flows. When two currencies of unequal value circulate together, said John Gresham to Queen Elizabeth I, the more valuable one will quickly disappear.

Limits of Leverage

|

| Continental Congress |

PHILADELPHIA was the seat of the Continental Congress, hence the nation's capital, from 1774 to 1790, with two periods of abandonment. After the ratification of the Articles of Confederation in 1781, it became the Confederation Congress. When the British had occupied the city in 1777-78, "the Congress" fled to Baltimore, then to York, Pennsylvania, but returned as soon as the British left. The second period of the flight was occasioned by the near-mutiny of the Pennsylvania Line for lack of pay in 1783, when Congress fled, in succession, to Annapolis, Trenton, Princeton, and New York, leaving General Washington's loyalties torn between sympathy for his starving troops, and firm loyalty to law and order. The chaotic situation suited the British, who dragged out peace negotiations after the Battle of Yorktown and came close to winning by stalling what they had been unable to achieve by arms. The finances of the French government were already stretched beyond what was prudent in view of their intention to invade the British Isles. The much more solvent British began to see India as a more attractive colony than America, particularly if the lucrative trade with Jamaica and other Caribbean islands could be maintained without the expenses of the rebellion. Eight years is a long time for any nation to continue a war without generating significant unrest at home.

The Constitution did not change taxation much; it changed the people who control our borrowing.

|

|

| Revolutionary War |

So, although the Revolutionary War was primarily started by British bungling which incited intemperate colonial hotheads into rash behavior, it was going to require a new Constitution and a realistic agreement about everybody's future, to achieve a workable peace. At the beginning of hostilities, only Robert Morris and John Dickinson talked as though they had done some clear long-term thinking, and they both opposed declaring Independence. They were shouted down and forced to go along or be banished. After eight years of fighting, however, a great many people could see that Dickinson may have been right to question the dubious unity of thirteen colonies, while a smaller group could even see that Morris might have been right to focus on Constitutional Liberty rather than regime change. Washington, although he was afraid of little else was fearful about his lack of education beyond grammar school; but at least he knew a country which would not feed its soldiers must be doomed to be no country at all. James Madison was scholarly and knew about Constitutions back to Aristotle, although events proved he had offered himself as a constitutional technician without clear personal goals for the product. Alexander Hamilton and Gouverneur Morris were adventurers, quite willing to shrug off the slogans of war and establish a king, that one form of government they were sure was workable. Only Benjamin Franklin among the colonists had stood before five kings, and of course before Vergennes and Wedderburn, where he could observe that all forms of government were in the hands of agents and intermediaries. But Robert Morris was a businessman who probably wanted little more than a workable set of rules, a level playing field, where he had every confidence that he would win, regardless of other rules for the game. Those rules at a minimum must include an equitable means for the government to pay its debts. As the richest delegate, in his own city, he was encouraged to act as a host for the convention. As host, he felt constrained to speak only about finance, his main concern anyway. Once this point was established fairly early at the Constitutional Convention, Morris had little else to say, even though he personally had many irons in the fire. Everything else, as politicians say, was for sale. Besides which he was accompanied by his personal lawyer but no relation, Gouverneur Morris, who was by far the most elegant speaker and persuasive advocate in the group.

Or perhaps the true flavor of his approach was, One Thing at a Time. Robert Morris was elected U.S. Senator from Pennsylvania in the first Congress under the new Constitution. He was in the center of almost every major debate, member of more than forty committees, often described as running on and off the floor, marshaling votes. The assumption of state Revolutionary War debts was perhaps part of his central drive to establish the full faith and credit of the United States. But the location of the new capital was quite a separate issue. Morris had bought huge acreage across Delaware from Trenton, in the area now known as Morrisville, and he lobbied hard and long to have the Capital located in Trenton, just as Senator Maclay lobbied to have it settle on his own land near Harrisburg. The New York congressional delegation, led by Alexander Hamilton, fought for a New York location, although Gouverneur Morris attempted to favor his own estate, Morrisania, in the Bronx. And of course, it was the Virginia delegation which finally won the prize, on the Potomac opposite George Washington's estate at Mt. Vernon. The location of the capital was important to Robert Morris, but as a realist, he then bought up large tracts of land in the District of Columbia. Owning two sites for a national capital at the same time was a major overextension of Morris' debts which helped lead to his final bankruptcy, although he was involved in so many affairs it is hard to say which was most significant. And indeed, his lobbying from debtors prison was the main source of a new bankruptcy law, which released him from prison. When Morris was seated in the Constitutional Convention, a large number of ideas must have been running through his head. But as far as we can tell, he largely held his peace, apparently content with the significant achievement of establishing federal taxation. Robert Morris had more ideas than anybody, and more energy than was good for him.

Over the centuries, the Constitution has been seen as a marvel of concise prose. Events have reversed the position of the political parties many times, but the Constitution does not change, so much as its meaning evolves. In the case of the federal ability to tax, however, almost nothing matches its malleability. The Revolutionary War was begun in large part because of a two-cent tax on tea, which was in fact a lowering of the tax rate. By the time of the Presidency of James Monroe, the federal debt had been extinguished by national prosperity. By the time of the Presidency of Barack Obama, the economy of the whole world, not just this one nation, is threatened by excessive indebtedness. The brilliant insights of Morris and Alexander Hamilton thus leveraged the industrial world into a situation which was unimaginable in the Eighteenth century. We are today nearly forced into economic recession, in order to pay down the national debt which computers concealed from us. If our creditors lose the faith we can reduce the debt, they will raise interest rates beyond the point where even the present debt can be sustained. The Constitution did not change taxation much; it changed the people who control our borrowing. The borrower is on a long leash, but creditors hold the other end of it.

Tax References in the 1787 Constitution: Article 1, Section 2: Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons. Section. 7. All Bills for raising Revenue shall originate in the House of Representatives, but the Senate may propose or concur with Amendments as on other Bills. Section. 8. The Congress shall have Power To lay and collect Taxes, Duties, Imposts, and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts, and Excises shall be uniform throughout the United States; To borrow Money on the credit of the United States; To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes; To establish a uniform Rule of Naturalization, and uniform Laws on the subject of Bankruptcies throughout the United States; To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; To provide for the Punishment of counterfeiting the Securities and current Coin of the United States; To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof. Section. 9. The Migration or Importation of such Persons as any of the States now existing shall think proper to admit, shall not be prohibited by the Congress prior to the Year one thousand eight hundred and eight, but a Tax or duty may be imposed on such Importation, not exceeding ten dollars for each Person. The Privilege of the Writ of Habeas Corpus shall not be suspended, unless when in Cases of Rebellion or Invasion the public Safety may require it. No Bill of Attainder or ex post facto Law shall be passed. No Capitation or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken. No Tax or Duty shall be laid on Articles exported from any State. No Preference shall be given by any Regulation of Commerce or Revenue to the Ports of one State over those of another; nor shall Vessels bound to, or from, one State, be obliged to enter, clear, or pay Duties in another. No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time. Section. 10. No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility. No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing it's inspection Laws: and the net Produce of all Duties and Imposts, laid by any State on Imports or Exports, shall be for the Use of the Treasury of the United States; and all such Laws shall be subject to the Revision and Control of the Congress.

|

Constitutional Liberty

WITH British troops in the process of disembarking at New Brunswick, apparently intent on hanging rebels, Robert Morris and John Dickinson annoyed everybody by refusing to sign the Declaration of Independence. Both were fully engaged in the Revolution after the fighting finally got started, and Morris signed up in August 1776. Dickinson had some further reasons of his own, but Morris explained his position quite succinctly. He didn't mind being a British subject, he didn't want a new King, what he wanted was Constitutional Liberty. There is no record of his being directly confronted about this later, and thus no detailed explanation. But whatever did he mean?

|

| Iliad and the Odyssey |

Morris was of course very bright, even brilliant as a businessman. He had an astonishing memory for detail and was capable of holding his own counsel. He was a person of great daring and prodigious amounts of work. But there is very little evidence that he thought it was useful to be mysterious, or deep. So why not take him at his word, which was essentially that what mattered in a government was whether it kept its promises and allowed its citizens all possible Liberty. It did not matter whether the government had a king, or seldom mattered much who that king was. What mattered was whether it kept its promises, and for that a Constitution is useful. There is no great pleasure in being capricious and arbitrary, so a king who leaves the citizens alone is mostly the best you can ask for. It does, however, help considerably if the rules are fair, clear, and binding. Beyond that, it is unwise to go about toppling governments in the vain hope that a new one is somehow better than the old one. This is putting words into his mouth, to be sure. What he did say was he saw no advantage to getting a new government when what we wanted was Constitutional Liberty. Eleven years later, he was a personal friend of just about everyone with the power to design a new government. Washington lived in his house, or in one next door. Ben Franklin was a business partner. Gouverneur Morris was his lawyer and partner. Just about everybody else who mattered was meeting with him in secrecy for months at a time, in the Pennsylvania Statehouse. And so on.

An essential part of this puzzle of Morris' role could be that the American Constitution was very close to unique in being written out as a document, like a commercial contract. The British Constitution was unwritten at the time and continues to be unwritten today. Many other members of the British Commonwealth operate without a written constitution. And in fact, what passed as constitutions for thousands of years have been unwritten; it was the written American one which was the novelty, not the other way around. It may stretch matters a little to describe the Iliad and the Odyssey as constitutions, but they do in fact describe the system of governance of the Ancient Greeks, clarifying many axioms of their culture for which they were willing to fight and die. We are able to understand the rules for Greeks to live by from reading Homer, almost surely better than we understand the rules of American culture by reading The Federalist Papers. Modern students of geometry, for another example, are taught that all the rules of Euclidian geometry are based on a few axioms stated at its beginning. Change one of those axioms, and you make mathematics unrecognizable. Even Newton's Principia are now seen by mathematicians to be rules which apply only to our universe for certain. There may exist many other universes to which they do not apply. Axioms are themselves mostly regarded as unprovable assumptions. A Constitution, therefore, is regarded in modern times to be much the same thing as a set of mathematical axioms. With one new exception: they are written out on a piece of paper for all to see and agree to -- just like a commercial contract. It would not be surprising to discover that America's great merchant trader, Robert Morris, was horrified at the idea of depending on Vestal Virgins or Judges, or Kings, for their recollection of what the contract says. It, therefore, seems quite natural for a maritime merchant to be agitated by having the rules of British society depend on what King George III chose to emphasize or ignore. Write it down, negotiate it, then tell us what you want so we can agree to it; that's a proper way to define Constitutional Liberty and limit disputes. International maritime trade could not be conducted in any other way, because sea captains who feel abused in a foreign port can abruptly up-anchor and sail away, never to return to that port again until or unless local rules are clarified.

Unless someone discovers some relevant documents in a trunk in the attic, that's about the best conjecture to be made about the American novelty of a written constitution, and its transformative effect on the legal system of all other nations which have one. It would still be nice to know, for certain, whose idea it was.

Roberts the Second

President George W. Bush nominated John Roberts to be Chief Justice of the U.S. Supreme Court in 2005. Since then, the Chief's administrative changes to the court and the whole court system have been slow but methodical. To the extent the Chief Justice has control of the matter, Roberts has been taking steps which make the Court into a more thoughtful branch of the Federal Government, ultimately making it more powerful. His first step was to reduce the number of cases considered each year, constraining them to conflicts between lower jurisdictions, unless otherwise mandated. This year, the number of cases heard is about eighty, or only half of the previous numbers. The policy lets unconflicting Appellate judgments stand. A second court must disagree with the first one, for the Supreme Court to enter the case.

The so-called Obamacare case, (NFIB v. Sebelius), meets this conflict-between-jurisdictions standard, but is notable for other innovations. The case was nationally broadcast as a live slide show. It heard arguments lasting three days instead of the usual single hour, and of course, it broke new substantive ground in a case of national interest. The decisions will now get more press attention; but this relatively rapid evolution toward a national debating contest, through modified Court procedure, is more important than it looks. It would be saying too much to claim the whole nation now fully understands its Constitution of enumerated powers, but surely the citizens who have only recently learned something about it must number in the millions. Before this case, many law school graduates might have had difficulty describing the design of the federalized system in a plausible dinner-table conversation. It's not yet clear where John Roberts is going, but he is surely trying to bring the public along with him.

During the semi-televised arguments, I was at first impressed with the rapid-fire exchanges between Justices and litigators about the operation of health insurance. Some people are born with high-speed brains and high-speed speech apparatus; no doubt, such people are sought after to represent others in court. But after practicing Medicine for sixty years and writing books about health insurance, I recognized that several rapid-fire responses by the attorneys were confident but off-target. Frankly, if you only have a few minutes but many points to make, and have to say them before someone interrupts, you would almost have to be a circus freak to manage. This is quite unnecessary, no matter how entertaining it may be to other lawyers. There seems no reason why the questions cannot be submitted in writing, sometimes employing experts on the specific points, and allowing enough time without interruption to devise a thoughtful answer. At present, it seems to matter more what the litigating attorney will agree to, than what is the fact. The outcome of cutting a litigant off after he says, "Yes, your honor, but.." is now only to establish whether both sides agree on a point; just why they agree or disagree is not even sought, let alone disregarded. It would seem useful to know Justice Thomas' reasons for abstaining from questions during oral arguments, for a different sort of example. So, it is easy to imagine that John Roberts has some thoughtful goals in modifying Supreme Court traditions, and equally understandable if jurists of this distinction become irritated by suggestions from the peanut gallery. It is thus fitting that we all hold back and first watch where the varsity means to take us. But allowing the public to express an opinion, is not the same as lobbying for it.

The Obamacare Act was about 2600 pages long, and two years after the President signed the bill, more than half of the necessary regulations remain to be written. The Law is "not severable", which is to say individual pieces of it cannot be attacked in court, without potentially upsetting decisions made on other portions. As a consequence, both the good and bad parts could endure for a long time to come. Or, the whole thing could suddenly sink from sight, relatively quickly. If the Justices can tolerate it, this legislation with many "moving parts" could be in the courts for a long time to come. So, Justices will then find the rule Roberts has made, of only accepting conflicts between the jurisdictions, protects their time and patience. But in doing so it will shift most final judgments into the hands of the lower, appellate courts. The legal profession will like this quite a lot. It will be like the gratifying situation said to prevail when a commanding General decides to retire -- everybody down the line could get promoted one notch.

By artfully selecting cases to argue, there were here four points open to the decision. Only two of them eventually had bearing on the final outcome of this case, but the whole issue is not necessarily concluded. The first decision got the most attention, deciding that the penalty for not having health insurance could be read as just a tax, and therefore was legal for Congress to use as a Constitutional basis for making health insurance mandatory, as Roberts declared the "Commerce clause" was not. The distinguishing feature of a Congressional exaction which is "just a tax" appears to be whether it exceeds the expenditure intended; if it exceeds the expenditure it would presumably be punitive. Nothing had seemed more important to the Founding Fathers than to expand the ability of the national government to impose taxes to service war debts. To truncate this wish of George Washington and Robert Morris into a short-cut, "Congress has the right to tax", or conversely to expand its confining language into "Congress has the right to tax in order to make private health insurance compulsory" just points up that the only real purpose of taxes in Washington's day was to wage war, and that the purpose of allowable taxes probably would have been defined if other purposes had been foreseen. Someone could usefully point out that what the Constitution really means is that Congress has the right to tax for "defense and the general welfare", and challenge anyone to argue otherwise. One sees the clever hand of Gouverneur Morris fuzzing up that argument; are we to ignore the fungibility of money and ask whether Congress may spend money on the general welfare only if it is general? How about earmarks, for example, are they all for the general welfare?

However, to turn a blind eye toward interesting issues is apparently a price that must be paid for obtaining the right for the Chief Justice to write the majority opinion, which eventually slips in some language (in legal language, an obiter dictum) to the effect that , of course, you couldn't use the Commerce Clause to do that. Getting Justice Ruth Ginsburg to sign that will eventually sound like the box John Marshall constructed in Marbury v. Madison. If that obiter dictum is as heat-resistant as the opinions of the first Justice Roberts in Franklin Roosevelt's court-packing effort, then the Commerce Clause is likely to be off-limits for a long time. Of course, if Chief Justice Roberts had joined the other four conservatives he would still have been able to write the majority opinion, but in the opposite direction. Except of course for that inevitable political accusation: There you go again, you 5-4 conservatives.

The second decision, in this case, is the sleeper. Congressional managers in charge of writing the bill had finally decided they had no way to cover 40 million uninsured people, except by diverting fifteen million of them into what is acknowledged to be the absolutely worst part of the American medical system, the state Medicaid programs. And because many States Rights advocates were in charge of state Governor's offices, the Congressional bill-writers added what is now a fairly familiar prod to cooperation. That is, if a state refuses to take the extra Medicaid patients, it will lose all federal funds for existing clients of state Medicaid. This sort of coercive provision has become so standard in highway bills and other federal programs operating at the state level, that it was largely unnoticed in the 48 hours the Congress was given to examine 2600 pages of legislative provisions. This, however, is blackmail, said John Roberts, quite unallowable under the defined separation of powers of the Constitution, between the state and federal levels of government. Furthermore, if some state decides to accept the penalty, it could close the existing program for the poor and accept the subsidy for the middle class, thus enhancing their revenues and reducing their obligations to the poor. Congress must now devise new strategies for suggesting federal programs to the states, and probably will do so. But the financial blackmail strategy now has a permanent black eye, with a skeptical public eye on the alert for it. The ironic conclusion of all this comes from the Congressional Budget Office, which predicts we will end up with 30 million uninsured persons, anyway.

What's awkward about this was immediately pointed out by attorney Richard Epstein: it ignores the century-old precedent set by Chief Justice Taft. Writing about a Child Labor law, Taft created a Supreme Court precedent that the Constitutional taxing power of the national government may not be used to implement what cannot be implemented directly. We can now see an example within the borders of a single case, where the Constitutional taxing power provision is used to indicate an otherwise impermissible Obamacare, and a few pages later its use is forbidden in the case of Medicaid in order to accomplish a forbidden coercion. Locating the two issues in the same case decision helps make the distinction between using the taxing power for revenue, and using it to coerce obedience; the distinction grows as the magnitude of the tax grows, particularly after it exceeds the intended government expenditure. What is not emphasized is the basis for Chief Justice Roberts reversing the precedent set by Chief Justice Taft on the same topic a century earlier. He did it with the Obiter dictum, and yet he didn't exactly do it. The four liberal Justices who co-signed the decision are not in a position to dispute it, while the four conservative Justices may not wish to. In either direction, however, the vote of the current Chief Justice appears to be both decisive and subtle.

It remains to be seen whether the 'tax, not commerce' strategy was clever. If the tax approach proves to be durable, it presumably extends to a wide range of legislation since Roosevelt's New Deal. Already, its awkward features have emerged in renaming portions of Obamacare into Chapter 48 of Subtitle D of the Internal Revenue Code of 1986 (!). Any law student who tries to look that up is going to have a frustrating time. But on the other hand, sometimes you win by losing. If it should somehow not be a tax, it has already been excluded from the Commerce Clause, so it has no hook left in the Constitution on which to hang it. There's something in this whole wrangle which resembles the position of Germany and Japan after the Second World War. In spite of losing that war, those two nations seem to have prospered better than England and Russia, who lost their empires but are said to have won the war .

National Debt, Presidential Hat Tricks, Shale Gas and Argentina

|

| Alexander Hamilton |

This-here speaker at the Right Angle Club began a discussion of the "Fiscal Cliff" razzle-dazzle of 2012, by changing his mind about the causes of the financial crash of 2007. Originally, it seemed as though globalizing 500 million Chinese out of poverty had destabilized the exuberant American mortgage market by flooding it with cheap credit. Supplanting that idea, or perhaps only supplementing it, must now be added the overextension of national debt itself to a point of bringing national borrowing to a halt.

Early in the Eighteenth century the Dutch and English had monetized national assets through a system of national borrowing formalized by Necker in Europe, and Robert Morris and Alexander Hamilton in America. Aside from a handful, no one could understand what they were talking about. Try reading that sentence a second time.

It amounted to guaranteeing all the private credit in the banking, investment, and commerce systems, with a national debt (in the form of Treasury bonds) which monetized all the assets of the whole nation. That action more or less doubled their value, just as any bank loan is seemingly owned by two people at the same time. Carried to an extreme, it might imply that America could turn Guam and Hawaii over to China if we defaulted on our debt. That was never actually intended to happen, and it never has, because all nations now fear the deflation which could result from triggering a massive exchange of national assets. The nebulous issue of "National Sovereignty" interferes with territorial transfers by any means other than war. If one nation defaults against a second nation which is afraid to go to war, it is just the stronger nation's hard luck about the debts it has chosen to support unless a transfer of assets actually happens. The Treaty of Versailles did transfer assets to the victors, and set off World War II, although it is considered bad manners to mention it. That's a simplified view of our international financial system, which admittedly skirts uncertainty about how much national debt is too much.

In fact, no one knows how much is too much until everyone runs for the exits. Now that politicians have control of computers and "big data", a modern description places the blame on Alan Greenspan the former Chairman of the Federal Reserve. For eighteen years Greenspan produced delicious world prosperity by steadily increasing American national debt faster than the American economy was growing. Sooner or later this approach was going to uncover how much was currently too much Federal debt. With silver and gold removed from the equation, one could see that default would certainly loom whenever the size of the debt became so large it could never be serviced by the Gross Domestic Product (GDP), and possibly sooner than that, if enough people could guess what was coming. This reality might be obscured temporarily by reducing interest rates, modifying international trade balances, and inflation. When the stars were in alignment however, the system just had to collapse and start over. Because it happened gradually, perhaps it would unwind gradually. In 2007 what happened was that everybody tried to get out the door at the same time. Essentially, our two political parties made opposite assessments: the party of Hamilton -- Republicans -- announced this system was doomed, while Democrats --the party of Andrew Jackson -- announced they could stave off disaster by making the rich Republicans pay for it. Both parties were partly right but essentially wrong, and the Democrats hired a better magician.

|

| Henry Clay |

It will take months or even years to be certain just what strategy was pursued. It would appear the Democrats chose to repeat the performance of the Obamacare legislation, eliminating national debate by eliminating the Congressional committee system of examining details in advance of a vote. Given one day to digest two thousand pages prepared by the Executive branch, no time was allowed for public opinion to form about Obamacare. In the case of the fiscal cliff episode, Congress was given less than one day to consider 150 pages allegedly prepared the day prior to the vote. Some will admire the skill of the executive branch in orchestrating this secret maneuver, but eventually, it must become apparent that policy decisions have been transferred from the legislative to the executive branch of government. Perhaps the Congressional Republicans are as stupid as the Democrats portray them to be, but it is also possible that a decision has been made to tempt the Democratic leaders into repeating this performance several times until eventually, the public is ready to consider impeachment for it. No matter what the strategy, we are now threatened with imagining some moment when gun barrels come level and live rounds slide home. We may pass up the opportunity to criticize Henry Clay for concentrating undue power in the Speaker of the House, or to uncover the way Harry Reid was persuaded to surrender Senate power to the Executive; both miscalculations are fast becoming irrelevant in the flurry of events. We came close to borrowing too much, exceeding our means to pay it back, that's all. A New York Times editorial economist feels we can "grow" our way out of this flirtation with danger, and we all certainly hope so.

Seemingly, there are only two ways to cope with over-borrowing, once we step over the invisible line. A nation may cheat its citizens with inflation, or it may cheat foreign citizens by defaulting on their currency. We are indebted to Rogoff and Reinhart for pointing out there is no difference between inflation and default except the identity of the cheated creditor; so most politicians prefer to cheat foreigners. Either way, cheating makes deadly enemies. Two centuries ago, Alexander Hamilton suggested a third way out of the problem, which we would today call "growth". But here, cheating is pretty easy: If the limit is some ratio of debt to GDP, find a way to increase nominal GDP.

|

| Shale Gas and Argentina |

The most astonishing current example of the power of "growth", is shale gas. It may not be totally clean, but it is cleaner than oil or coal, and far cheaper. We suddenly have so much of it the price of energy is artificially lowered, and we talk, not merely of energy independence, but of restoring the balance of international payments by exporting it. Germany is constructing steel mills to utilize iron ingots made in America with gas instead of coal. Pittsburgh was once the center of steel production because that's where the coal was, the most expensive ingredient to transport. Suddenly it is now apparently cheaper to transport the energy source to wherever you find limestone and iron ore. JP Morgan got rich the other way, transporting limestone and iron ore to Pittsburgh, where the coal was. Russia now finds it has lost its leverage over Eastern Europe's energy supply, and the Arabs (?Iranians?) will no longer have a monopoly to provide the wealth supporting Middle-Eastern mischief. China may lose interest in Africa. And in America we may develop the courage to rid ourselves of the corn subsidies for gasoline; cutting the wind and sunlight fumbles also emerge as obvious ways to cut the deficit. That's what we mean by growth. It's so powerful it makes action by any American President seem trivial by comparison.

Presumably, President Obama does not welcome being upstaged by an economic force he doggedly resisted. He may seek ways to imply it was his idea all along. When that happens, rest assured that everyone else is then a fracker. But there is another alternative Presidential path, which in extreme form is emerging in Argentina without much media attention. In short, Argentina discovered signs of oil deposits but was unable to exploit them. A European oil company was enticed to develop the oil reserves at its own expense, and effectively did so in expectation of reward from the resulting oil sales. Suddenly, the Kirchner government expropriated the oil company, paying for it with Argentine bonds. The ink was scarcely dry before the Argentine government abruptly turned around and offered to buy back the bonds for 24 cents on the dollar. And unless someone is willing to send gunboats, the previous owners of the oil company are just out of luck. Appeals to the UN are futile; because on the one-nation, one-vote principle, there are more expropriator votes in the UN than potential victims. The only thing visible which could save capitalism in South America from the revolution in shale gas competition. Presumably, Argentina has lots of shale gas, but who will lend them the money to frack it?

Bernanke's QE3: A New Titanic, or A New Bretton Woods?

|

| Ben Bernanke |

Nobody likes to execute a guilty prisoner, but in finance, it is surely true that allowing bad debts to remain unresolved harms the whole economy. It makes little difference whether a bank fails to mark its debts to market, whether debts are "extended", or insolvent institutions are subsidized. Andrew Mellon once advised Herbert Hoover that he should "wring the rottenness out of the system", but that is such poor politics that even Hoover rejected it. In time, the process of "good bank, bad bank" was devised to isolate bad debts into a single institution so the rest of the economy could begin to recover. QE3 is a version of a good bank, bad bank. Unfortunately, the public is easily misled in these matters, so although all three Q's involve the Federal Reserve buying long bonds, QE1 unfroze a frozen financial marketplace (successfully), QE2 meant to stimulate the economy (unsuccessfully), but QE3 seems to have much grander ambitions. So it is unfortunate that three different activities share the same name, and still more unfortunate that name is made so mysterious. Let's forget about the first two, and concentrate on QE3.

The Federal Reserve is well along in a program of buying huge quantities of questionable long bonds and has announced it is going to keep buying huge quantities until either inflation exceeds 2.5% or unemployment falls below 6.5%. That's not exactly the same as buying every bad bond in existence, but it could come to that. Instead of letting the holders of those bonds go bankrupt, the Fed is buying the bonds out of circulation, which could rescue a great many investors. Small businesses do not ordinarily issue bonds, so there is some bias in favor of large businesses and banks, but surely not an intentional bias. The effect is to make the Federal Reserve both a good bank and a bad bank at the same time. The main difference between this and wringing the rottenness out is that bankrupt institutions cannot come back to haunt you, while in the more benign purchase of bonds, you have assumed an obligation to pay them back. When you sell them back you drive the price down and the money disappears. Furthermore, when the price of bonds declines, interest rates will rise and the national debt will increase more rapidly. If the economy cannot withstand higher interest rates, a recession will deepen. You have to get the timing right, and the world is in such a delicate state that it is impossible to get the timing entirely right for everybody. Because interest rates are now essentially zero, they cannot go lower, so investment advisors are increasingly advising clients to sell some bonds while they still can. If that gets out of hand, it could start a panic.

|

| United States Federal Reserve |

However, the United States Federal Reserve is not an investor, it controls the currency and can print unlimited amounts of it. There is nothing which can force it to sell its bond holdings, ever. Without going into the details of the Bretton Woods Treaty, the tie to gold was eliminated nearly fifty years ago. Meanwhile, its bonds are paying interest, which at the moment it is returning to the U.S. Treasury to reduce the national debt. It can reduce this outflow more or less at will, and it can increase it by raising interest rates (ie by selling bonds, as described). With a few extra steps, this enormous pot of debt could become the basis for an international currency reserve. At the least, it could bring a halt to an international currency war. If it chooses, it can decide to wait as long as fifteen or twenty years for economic demand to recover from a century of overleveraging, and then pay it back by letting the bonds reach maturity. But there is at least one big flaw in this dream.

At some point, the bond market may decide to take the bull by the horns and raise rates before the Federal Reserve wishes to. Political appointees come and go, and the bond market could easily decide that a misjudgment has been made by somebody. It could easily happen that public apprehension could grow that something doesn't smell right. In that climate, a few heavy sales could trigger a panic. And then everyone will try to get out the door at the same time.

Deficits Don't Matter When Your Party Is In Power

|

| CBO February 2013 cover |

The cacophony that is the economic debate: Paul Krugman reports today (March 11, 2013 in the New York Times Op Ed) that the February 2013 CBO report shows that America's deficits don't matter.

One of his points is that automatic stabilizers did their job: people lost their jobs -> unemployment payments went up -> the pain of the recession was lessened ... and as things improve, government expenditures will go down (are currently going down, in fact).

This is the basic macroeconomics one learns in college, but looking at the CBO's summary I have a hard time thinking our deficit situation is not a continuing problem. The bottom two graphs are hopeful, but the top graph does not inspire confidence. I didn't read the entire report and maybe Krugman did, but the graphs presumably are what the CBO thought summarized their findings.

Funny that Krugman and Cheney have both told us that deficits don't matter. I think maybe deficits don't matter when your party is in power.

Cyprus Tests the Limits of Paper Money

|

| Cyprus Map |

Tourists like to banter about their favorite place in the whole world; until recently, mine was Cyprus. It's an eastern Mediterranean island, where it was possible to swim from beaches in the morning, ski in the afternoon, and luxuriate in an inexpensive but posh hotel in the evening. The locals had their ethnic rivalries, but what would tourist care. Since I was last there, apparently Russian and other billionaires discovered the place, and now three local banks are bigger than the GNP of the nation. Like Ireland, Hungary, Iceland, and several other small European nations, this dystrophic growth made it impossible for the government to guarantee the assets of the banks, as the familiar "lender of last resort" because the banks were bigger than the government. Accordingly, the local government was forced to declare a protracted bank holiday, to forestall what was certainly going to turn into a run on the banks as depositors all tried to get out the door at the same time. International stock markets immediately dropped a noticeable number of points, as the whole world suddenly discovered Cyprus wasn't such a nice place to put your money after all. The Russians might possibly be nasty people, but in this matter of bank deposits, people all link arms internationally like brothers.

There have been lots of other bank panics in small nations without much agitation, so what seems to have bothered the markets was the decision of the Central European Bank to tax the depositors 10% to support the system. Christine Lagarde, the head of the International Monetary Fund, said she thought it was a good idea to tax depositors, and that really upset a lot more people. Ms. Lagarde is French, but the IMF which she heads is located a few blocks from the U.S. White House, so the suspicion grew that Mr. Obama might approve of placing a tax on bank deposits, too. As things started to get out of hand, everyone hastily dropped the whole idea, and even the Cypriote Parliament voted against it. There was no time for even the large organizations devoted to managing the news to manage this one. World opinion was instantaneously mobilized, and thunderous in voicing its low opinion of taxing bank deposits, by anyone, anywhere. What was accidentally aroused was the realization that since the World went off the gold standard in 1971, the world's money is backed by nothing at all except a computer notation? Irrevocably taxing it in bank accounts could be done in an hour.

In 1944 the international conference held at Bretton Woods, New Hampshire, agreed that other nations could exchange their currency for American dollars, but only the U.S. dollar could be converted into gold. As long as the U.S. ran a trade surplus, the gold remained undisturbed in Fort Knox. But when other nations began to export their goods in the 1960s, their dollars began to be changed into gold. Gresham's Law took over quickly since when two currencies of unequal value circulate together, the more valuable one will quickly disappear; the shifting balance of trade had made gold more valuable than dollar bills. When President Nixon began to see that Fort Knox was soon going to be emptied, he put a stop to the exchange. He "closed the gold window". At that point, we were all off the gold standard, but nothing much happened. It remained possible to continue to speak of gold as a "barbarous relic", and by implication, any standard like silver or oil or land was also a barbarous relic. But the experience of Cyprus taught the world that everyone did want the value of a currency to be independent of the whims of government, and like the Emperor's suit of clothes, was just waiting for someone to point it out. A system of monetary exchanges, or exchanges of goods and services, really can be run without backing by anything except the word of government. But inflation targeting does need a government to run it, and thus governments have acquired a power over currencies which centuries of experience had taught people not to trust for a moment. North and South American hemispheric trade had been comfortably run without governments for centuries, as long as there were Spanish pieces of eight in actual circulation. But the modern Cyprus government could not run for a week without the trust of depositors, and neither can any other government. Conversely, it is impossible to run an economy without a government to guarantee the international value of money. People don't like that situation, and the threat of chaos in the streets is not much different in any place in the world which does not run a brutal military system. When you reach a point where even the soldiers refuse to be paid with paper money, you are about at the point General George Washington found himself after the Revolution. Robert Morris convinced him it would be possible to base a currency on the credit of the nation, and General Alexander Hamilton had been taught how to run such a thing. The rest of the country didn't understand what that meant, but they did understand that it seemed to work. But it would only work if the people trusted their Constitution, and the government is designed. But then, our government never tried to put a tax on bank deposits. In fact, it took another hundred years before the American public was completely certain you could trust banks even to exist. The good ol' mattress, that's where to keep your money. If it's in gold coins, that is. Paper money might just as well be in a bank because its value is only symbolic of a government promise.

REFERENCES

| The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order: Benn Steil: ISBN-13: 978-0691149097 | Amazon |

| Robert Morris: Financier of the American Revolution: Charles Rappleye: ISBN-10: 1416570926 | Amazon |

| Bitter Lemons: Lawrence Durrell: ISBN-13: 978-1604190045 | Amazon |

Origins, Causes and Mechanisms: (1): "A Rabble of Dead Money"

Let's start with the pirate era of the Seventeenth century. The Spaniards brought back boatloads of conquered gold, and "pieces of eight" became common international currency. Gold doesn't rust, it was universally attractive, and just biting a coin tested its purity. Since its own ancestry was unprovable, gold facilitated piracy. But its unchallengeable past created a difficulty: if boatloads sank at sea, wealth was mostly gone for good, as was gold-exchanging.

Anonymity was particularly useful in revolutions. Necker the Swiss banker suggested it for the French Revolution, just as Robert Morris had used it to good effect in the American Revolutionary War. Substituting paper gold certificates for the real thing, if a boat was captured or sunk, fresh gold certificates could be issued with the gold in vaults none the worse for it. Morris' partner William Bingham became the richest man in America at age 28 using the system in privateering adventures in the Caribbean. Keeping such a simple system private always had advantages. It had probably made Morris rich as well, while he was busy running finances for the patriotic benefit of his country. With a few embellishments, it allowed the British Empire to conquer the world.

As Walter Bagehot, the editor of The Economist magazine fifty years later, explained things in his book Lombard Street, the gold standard made it possible to conduct fair but profitable trading in Hong Kong, India, and Jamaica, between semi-hostile people who had no reason to trust each other. Furthermore, it was possible to trade pineapples for copper or to conduct wars with nations of vastly different size. The key innovation was to use durable, portable gold as a proxy for anything salable, anywhere in the world, never trusting strangers. The Industrial Revolution was probably a result, rather than a cause, of prosperity, generating revenue which figured in the lives of Jane Austen's ladies just as surely as it put diamonds in Queen Victoria's crown. Adam Smith put it differently: a seller preferred the money to the goods, while the buyer preferred the goods, so both sides were happier after the re-arrangement, whereas England was paid to be a croupier. Sufficient complexity added to finance kept the simple system both private as well as manageable from a single crooked alley in London's "city". It has been claimed no more than fifty people fully understood the concept of gold chips at the center of a trading casino. Probably it was more like a thousand, but pretending it was far too hard to understand was a big factor in success. Charles R. Morris has written the best book about it I think I have ever read. But it is no exception to the golden tradition of mysterious complexity in a title. A Rabble of Dead Money doesn't come close to hinting what it is all about.

The gold standard amounts to balancing billions of dollars on the head of a pin. If a country's total debts are larger than a country's total revenues, it has "inflation". If total revenues are larger than its debts, it has" deflation", once you substitute the real price of gold, for its nominal price. The focus is the balance between the two, not the gross quantities of either because the focus is on probable ability to repay its debts. In a zero-sum game, the imbalance identifies who might get stuck for some debtor's default, except if nobody is stuck, the whole system collapses in a crash, until such time as the losses are redistributed by a prolonged depression. The faster transportation and communication become, the tighter the match between revenue and debt which must be maintained; statistical obscurity greases the wheels, computerized globalization quickly spreads it. Imbalances are sometimes resisted by keeping wages from falling, leading to violent opposition by labor unions to any suggestion of lowering wages, thereby prolonging the pain of repairing deflations by keeping one factor out of balance. These two factors prolong depressions, deliberate inflating eventually makes it worse after temporarily relieving the pain.

The gold standard, organized and administered by the British Empire, allowed individual nations to select whatever industries dominated their economies, but the casino owner always had an advantage. With economies consisting of thousands of products, the negotiator with the best aggregate information could classify hotels or restaurants as exports or imports, because the customers were a mixture of citizens and foreign travelers; they could even shift champagne independently from table wine. Consequently, a "protective" tariff could alternately be called a trivial 5% penalty or a ruinous 95% subsidy in history books, newsmedia or politics. Monetary rules are a zero-sum game, but to a certain degree, they are a component of politics. Britannia ruled the waves.

In the 1929 crash (deflation) the collapse of the system was not exactly anyone's fault, certainly no American's. It was caused by converting prairies to farmland in order to replace wartime food shortages, then ending World War I with a sudden reversal of Ukrainian wheat. If bankers made mistakes, it was the Rothchild family in the Viennese Credit Anstalt Bank . At that time, agriculture was the largest industry in the world, (shrinking to 2% of the workforce today). This helps explain why "slaughtering little piglets" actually helped things somewhat although much ridiculed at the time. It also points today to unemployment caused by computer electronics and artificial intelligence -- as far more menacing than it seems. There is a little hope of reversing the automation process as there was in quickly lowering the price of food in 1930. It's the right idea, but politics won't let you do it.

Similarly, we have been futilely battling for a century to restrain the tendency of banks -- making more loans than there is gold in their bank vaults. The present ratio of 20 dollars in loans for one dollar of "reserves" seems to be very close to the natural un-safe limit. The experience of the Smoot-Hawley "protective" tariff ought to be sufficient warning, but it cuts both ways. There was a war between Congress and the President about this, and the President lost. A five percent tariff seems bearable until you realize that the banking system currently multiplies by 20, to result in a hundred percent effect on the manufacturer. Add the speeded-up "velocity" effect of computerized payment systems, and what appears to some people as harmless is actually totally destructive.

Since so many of these effects are based on overusing features which help a lot of people, things usually get pretty bad before they are fixed. But one man-made cause could be eliminated quickly just by a silver-tongued leader who is honest, (if you can find such a thing). Over and over it must be repeated so a third-grader understands: after a deflationary crash, never try to go back to universal pre-crash currency levels. Wealth has been destroyed, so the economy must rebalance it, in some way, at some rate. We had a wild ride, and we must somehow pay for it. The path forward is literally strewn with attempts to pay off fixed debts with inflated currency. You might get rich by being lucky, but someone else will be impoverished by your effort; so he may thwart it. Inflation caused the problem, but inflation cannot cure it.

The period between world wars taught two other lessons: 1.) The reactions to a crash may do more damage than the crash does. 2.) Winston Churchill's going off the gold standard did so little damage that it raised a question whether the world might get along without gold in the gold standard. Thus setting the stage for substituting the dollar as the international currency at Breton Woods in 1945, and Richard Nixon later going off any currency standard at all in the 1970s, after Charles de Gaulle tried to corner all the gold. After all, if one nation owns all the gold, retaining a gold standard means no one can buy anything.

Solutions? : "A Rabble of Dead Money "(2)