4 Volumes

Constitutional Era

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

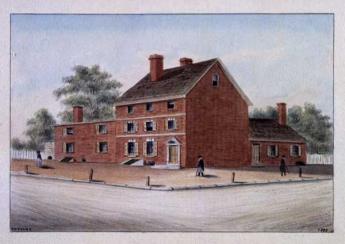

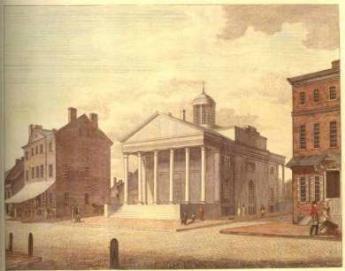

Philadephia: America's Capital, 1774-1800

The Continental Congress met in Philadelphia from 1774 to 1788. Next, the new republic had its capital here from 1790 to 1800. Thoroughly Quaker Philadelphia was in the center of the founding twenty-five years when, and where, the enduring political institutions of America emerged.

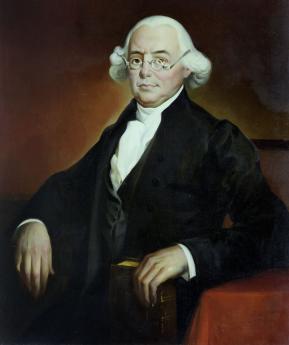

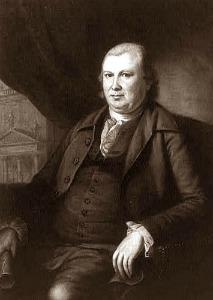

Robert Morris' United States

Robert Morris of Philadelphia created many of the best features of the United States. His face might be carved on Mount Rushmore if he hadn't created one really bad feature, as well.

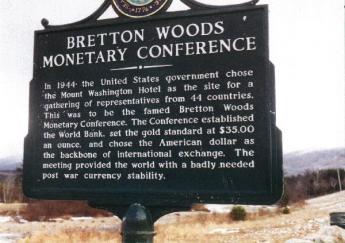

Worldwide Common Currency and Corporate Headquarters

The Death of Money

Robert Morris: Think Big

Robert Morris wasn't born rich, or especially poor, but he was probably illegitimate. He had no recollection of his mother; his father, a tobacco trader in England, emigrated to Maryland and died rather young. It didn't take long for young Robert to become one of the richest men in America.

Robert Morris was born in England, probably illegitimately, to a mother of whom he had no recollection, and a father engaged in tobacco trading. The father emigrated to the Eastern shore of Maryland, traded tobacco furiously, and soon sent for his 10-year old son to join him. Later dying at age 39 in a waterfront accident, the father left orphan Robert to be sent from Maryland to Philadelphia for apprenticeship and tutoring. Trading tobacco produces a particular personality in the trader, since a distinctive feature of tobacco is that it does not spoil if stored. This characteristic then allows it to be held off the market until prices improve, an extension of which is the ability to dump it on the market unexpectedly. This makes tobacco trading a contact sport, where winning regularly involves jostling your competitor friends by driving their prices down. Thus, tobacco traders are distinctive, neither complaining when they are hurt, nor tolerating competitors who complain when the game goes against them. The nature of things makes the personalities of tobacco traders different from traders of commodities which must be sold as soon as possible, regardless of price.

Judging from the concise prose of Robert Morris' later correspondence, and the complicated transactions of the large merchant firm he soon managed, his haphazard education must have been more effective than it sounds. An orphan on the waterfront might easily be expected to develop his sort of aggressive toughness. And his conviviality bordering on excess drinking behavior might be anticipated from his waterfront adolescence, or even the fact that he sired an illegitimate daughter.

On the other hand, this particular waterfront orphan quickly picked up the manners of gentility from employment by Josiah and his son Thomas Willing, the most prominent merchants of Philadelphia. After his own father died, Thomas Willing soon welcomed Robert Morris into partnership in the firm renamed Willing & Morris, boasting nine ships operating from its own wharf and counting house, and sharing ownership in a number of other ships. Morris then married Mary White, according him assured standing within the highest society of the largest city in America, renting his own family pew in Christ Church and all the rest. He was talented, a quick learner with prodigious energy. And one who was unashamedly on the make.

Background: Low-Hanging Fruit Starts Running Low

|

| Peaceable Kingdom |

The Royal Proclamation of 1763 terminated the French and Indian War with a clause prohibiting westward settlements past what is now the Appalachian trail. The resulting peacefulness with the Indians encouraged new waves of immigration, but to different degrees among the colonies. Pennsylvania had been settled rather late, so it still had ample room for expansion within its borders. The consequence was prosperity, followed only later by growing land shortage. Since the Proclamation declared that only the British Government might authorize land purchases from the Indians, a suspicious reaction among some speculative minded colonial settlers was that it was intended to create an unfair monopoly for the British Ministry to use as a patronage pool. While the colonials clearly had ulterior incentives, there is no doubting the sincerity of their uneasiness whenever King George appeared to be seeking to co-opt the Parliament, which they viewed as protecting the interest of the citizens against those of the Crown. Other signs of land hunger were beginning to surface as well. Virginia topsoil was wearing out from tobacco farming, while New England never did have more than a thin rocky soil. New England and Virginia were therefore particularly pinched by the Proclamation. Pennsylvania settled nearly a century later was less bothered. George Washington himself was a good example of Virginia Cavaliers turning uneasily toward the vast Ohio Territory for future expansion. Mt. Vernon was already costing him money instead of providing him income. While New Englanders had similar aspirations for the Western Reserve (of Ohio), they also had options of turning to manufacture and maritime trade for revenue.

Meanwhile, the parent nation of Great Britain was itself starting to look for new revenue sources to finance its growing overseas empire and European wars. With a change in the dynasty of Kings of England to the Germanic William and Mary, there appeared to be less sensitivity to the traditions of liberty among English settlers in North America, less awareness of the emotional depth of colonial insistence on individual rights and property. These were not recent 1763 issues; they were connected to English quarrels with King Charles I and other matters dating back to the Magna Carta. But after several decades of outright neglect of America, the British Ministry nevertheless turned to the North American colonies as a cash cow. And just like businesses treated as cash cows within a modern corporate conglomerate, the cows demanded more control over the milking.

To this, add the effect on Puritan minds of licentious behavior reported about the rulers of Restoration England, an impression constantly reinforced by flamboyant costumes and hair-do on display in aristocratic portraits. As viewed by earnest religious settlers in frontier America, this country might be getting to be an empire exploited by unfit rulers, quite unlike the austere religious utopia which had tempted them to settle here. Since the earlier English Civil War had taken the form of empowering members of Parliament to be citizen defenders, ultimately even leading to the execution of Charles I, it was troubling to imagine rentier aristocracy log-rolling with Parliament, even wearing the same sort of garments. These descendants of refugees could even imagine English aristocrats might be reaching across the ocean, and into their pockets.

Foreground: Parliament Irks the Colonial Merchants

|

| Charles Townshend |

Charles Townshend, Chancellor of the Exchequer under King George III in 1766-67, had a reputation for abrasively witty behavior, in addition to which he did carry a grudge against American colonial legislatures for circumventing his directives when earlier he had been in charge of Colonial Affairs. His most despised action against the Colonies, the Stamp Act, seems to have been only a small part of a political maneuver to frustrate an opposition vote of no confidence. The vote had taken the form of lowering the homeland land tax from four to three shillings (an action understood to be a vote of no confidence because it unbalanced the budget, which he then re-balanced by raising the money in the colonies.) The novelist Tobias Smollett subsequently produced a scathing depiction of Townshend's heedless arrogance in Humphry Clinker, but at least in the case of the Stamp Act, its sting was more in its heedlessness of the colonies than vengeance against them. One can easily imagine the loathing this rich dandy would inspire in sobersides like George Washington and John Adams. After Townshend was elevated in the British cabinet, almost anything became a possibility, but it was a fair guess he might continue to satisfy old scores with the colonies. When King George's mother began urging the young monarch to act like a real king, Townshend was available to help. On the other hand, the Whig party in Parliament had significant sympathy with the colonial position, as a spill-over from their main uproar about John Wilkes which need not concern us here. Vengefulness against the colonies was not widespread in the British government at the time, but colonists could easily believe any Ministry which appointed the likes of Townshend might well abuse power in other ways before such time as the King or a more civilized Ministry could arrive on the scene to set things right. It was vexing that a man so heedless as Townshend could also carry so many grudges. Things did ease when Townshend suddenly died of an "untended fever", in 1767.

Whatever the intent of those Townshend Acts, one clear message did stand out: paper money was forbidden in the colonies. Virginia Cavaliers might be more upset by the 1763 restraints on moving into the Ohio territories, and New England shippers might be most irritated by limits on manufactures in the colonies. But prohibiting paper money seriously damaged all colonial trade. Some merchants protested vigorously, some resorted to smuggling, and others, chiefly Robert Morris, devised clever workarounds for the problems which had been created. Paper currency might be vexingly easy to counterfeit, but it was safer to ship than gold coins. In dangerous ocean voyages, the underlying gold (which the paper money represents) remains in the vaults of the issuer even if the paper representing it is lost at sea. Theft becomes more complicated when money is transported by remittances or promissory notes, so a merchant like Morris would quickly recognize debt paper (essentially, remittance contracts acknowledging the existence of debt) as a way to circumvent such inconveniences. In a few months, we would be at war with England, where adversaries blocking each other's currency would be routine. By that time, Morris had perfected other systems of coping with the money problem. In simplified form, a shipload of flour would be sent abroad and sold, the proceeds of which were then used to buy gunpowder for a return voyage; as long as the two transactions were combined, actual paper money was not needed. Another feature is more sophisticated; by keeping this trade going, short-term loans for one leg of the trip could be transformed into long-term loans for many voyages. Long-term loans pay higher rates of interest than short-term loans; it would nowadays be referred to as "riding the yield curve." This system is currently in wide use for globalized trade, and Lehman Brothers were the main banker for it in 2008. And as a final strategy, having half the round-trip voyage transport innocent cargoes, the merchant could increase personal profits legitimately, while cloaking the existence of the underlying gun running on the opposite leg of the voyage. If the ship is sunk, it can then be difficult to say whether the loss of such a ship was military or commercial, insurable or uninsurable. In the case of a tobacco cargo, the value at the time of departure might well be different from the value later. Robert Morris became known as a genius in this sort of trade manipulation, and later his enemies were never able to prove it was illegal. Ultimately, a ship captain always has the option of moving his cargo to a different port.

Other colonists surely responded to a shortage of currency in similar resourceful ways, including barter and the Quaker system of maintaining individual account books on both sides of the transaction, and "squaring up" the balances later but eliminating many transaction steps. Wooden chairs were also a common substitute as a medium of exchange. But "Old Square-toes," Thomas Willing, experienced in currency difficulties, and his bold, reckless younger partner Morris displayed the greatest readiness to respond to opportunity. Credit and short-term paper were fundamental promises to repay at a certain time, commonly with a front-end discount taking the place of interest payment. The amount of discount varied with the risk, both of disruption by the authorities, and the risk of default by the debtor. This discount system was rough and approximate, but it served. Quite accustomed to borrowing through an intermediary, who would then be directed to repay some foreign creditor, Morris, and Willing added the innovation of issuing promissory notes and selling the contract itself to the public at a profit. Thus, written contracts would effectively serve as money. A cargo of flour or tobacco represented value, but that value need only be transformed into cash when it was safe and convenient to do so.

The Morris-Willing team had already displayed its inventiveness by starting a maritime insurance company, thereby adding to their reputation for meeting extensive obligations; they established an outstanding credit rating. Although primarily in the shipping trade, the firm was also involved in trade with the Indians. There, they invented the entirely novel idea of selling their notes to the public, essentially becoming underwriters for the risk of the notes, quite like the way insurance underwriters assumed the risk of a ship sinking. Their reputation for ingenuity in working around obstacles was growing, as well as their credibility for prompt and reliable repayment. In modern parlance, they established an enviable "track record." A creditor is only interested in whether he will be repaid; satisfied with that, he doesn't care how rich or how poor you are. The profits from complex trading were regularly plowed back into the business; one observer estimated Robert Morris's cash assets at the start of the Revolution were no greater than those of a prosperous blacksmith. It didn't matter; he had credit.

In the event, this prohibition of colonial paper money did not last very long, so profits from it were not immense. But ideas had been tested which seemed to work. Today, transactions devised at Willing and Morris are variously known as commercial credit, financial underwriting, and casualty insurance. In 1776, Robert Morris would be 42 years old.

Pennsylvania: Browbeaten Into Joining a War

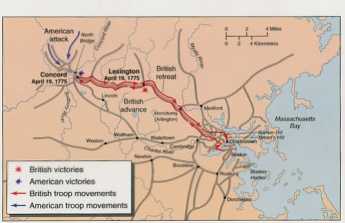

|

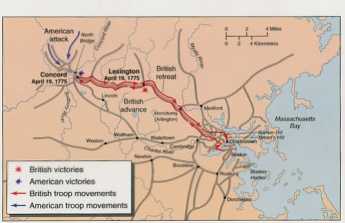

| Battle of Lexington |

In April 1775, the colonial militia were shooting it out with British soldiers at Bunker Hill and Lexington/Concord. If you include December 16, 1773, Boston Tea Party, Massachusetts had been fighting the British for almost three years before July 4, 1776. It had never been absolutely clear to Pennsylvanians just what they were fighting about in New England, beyond the fact that a considerable store of gunpowder was hidden in Lexington and Concord and British soldiers had been sent to confiscate it, along with those two trouble-makers, Samuel Adams and John Hancock. The militiamen behind the trees were just as British as the soldiers were, and their short slogan of fair treatment was to elect representatives to any Parliament which claimed a right to tax them. Snubbed by a high-handed King, they got his attention by shooting back when the King tried to enforce laws they had not had a chance to vote on. Seeing your neighbors shot soon clarifies your options. Other colonies, especially Pennsylvania, Delaware and South Carolina, were slower to anger about either taxation or representation, worrying more about the motives of unstable leaders in Massachusetts like Samuel Adams, and content to stall while British Whigs led by Edmund Burke and the Marquess of Rockingham tried to civilize the king's ministry. Besides, the British were not attacking Pennsylvania.

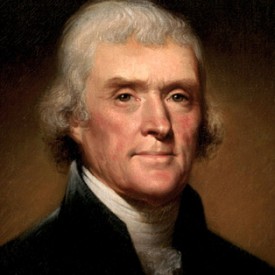

To be fair to the hot-headed New Englanders who were apparently stirring up so much unprovoked trouble, a better case could have been made against the heedless British ministry, and New England lawyers should have made it. Following the Boston Massacre, there was genuine alarm among lawyers like John Adams that King George was eroding historic legal rights achieved over several centuries, indeed, preferentially undermining them more for mere colonists than for U.K. citizens with a vote. The Navigation Acts of the British government, in particular, were offensive to American colonists; randomly chosen representatives on juries proceded to render them unenforceable with a wide-spread refusal to convict. They were employing William Penn's strategy of "Jury Nullification", and better acknowledgment of its legal history was sure to make a favorable impact on Philadelphia minds. Somehow, the Boston legal community felt this line of argument was too specialized to be effective, or else shared the alarm of their enemy the British Ministry that Jury Nullification in the hands of the public could be too hard to control. John Adams had made a particularly famous defense of John Hancock who was being punished with confiscation of his ship and a fine of triple the cargo's value. Adams was later singled out as the only named American rebel the British refused to exempt from hanging if they caught him. As everyone knows, Hancock was the first to step up and sign the Declaration of Independence, because by 1776 there was also widespread colonial outrage over the British strategy of transferring cases to the (non-jury) Admiralty Court. Many colonists who privately regarded Hancock as a smuggler were roused to rebellion by the British government thus denying a defendant his right to a jury trial, especially by a jury almost certain not to convict him. To taxation without representation was added the obscenity of enforcement without due process. John Jay, the first Chief Justice of the Supreme Court of the newly created United States, ruled in 1794 that "The Jury has the right to determine the law as well as the facts." And Thomas Jefferson built a whole political party on the right of common people to overturn their government, somewhat softening it is true when he saw where the French Revolution was going. Jury Nullification then lay fairly dormant for fifty years. But since the founding of the Republic and the reputation of many of the most prominent founders was based on it, there may have seemed little need for emphasis of an argument any modern politician would seize with glee.

|

| Bunker Hill |

At that time, only a third of colonists were in favor of fighting about it, and a third was entirely opposed. Samuel Adams himself had written his supporters that it would be best to hold back until greater revolutionary support could be gathered. Unfortunately, in the minds of the British ministry, hostility had already escalated irrevocably when the Continental Congress in June 1775 created the Continental Army and dispatched George Washington to Boston to join the fight. This was probably the moment when war became inevitable in the collective mind of the British Parliament; a full year had passed since then. Regardless of Bunker Hill, the British were incensed by the creation of the Continental Army, and passed the Prohibitory Act, which declared that all thirteen colonies (belonging to the Congress) were renegades, their decision to raise armies placing them "outside the protection of the king". All American shipping was now subject to seizure, not just that of Massachusetts, as were foreign vessels engaged in American trade. News of this Parliamentary thunderbolt first came to Robert Morris through one of his ships, accompanied by news that 26,000 troops had been raised for an invasion of American ports. The British position was that all thirteen colonies had gratuitously formed a government and an army, and needed to be punished for such treason. Pennsylvania was no exception; the offending Continental Congress had met there, and Benjamin Franklin had represented both Massachusetts and Pennsylvania before Parliament. Confirmation of that particular British attitude toward them greeted Pennsylvanians when British warships promptly appeared in May 1776, to patrol the mouth of Delaware. Three cruisers exploring up the river were attacked by American galleys. In response, the cruisers sailed directly at Philadelphia until they were finally beaten back by citizen flotillas, supervised by Robert Morris and the Committee on Safety. Morris wrote to Silas Deane in Paris that war was probably inevitable. Far less tentatively, the British felt it had already been in progress for a year.

The British Ministry had probably been unreasonably hostile, but they were not unanimous and they were not fools. In response to colonial unrest up until these almost irretrievable events, the British were concentrating on depriving the colonists of arms and gunpowder, mostly avoiding direct violence; it seemed an effective strategy. During the Boston Tea Party, for example, British warships in Boston harbor merely stood by and watched the fun. Although gunpowder was a simple chemical, comparatively easy to make, it was less likely to blow up in your face if finely ground and milled in a major factory; for a real Colonial war it had to be imported. The British strategy had been: Take away their weapons, and they will capitulate. Unfortunately, that was not the response at all, since even loyal colonists felt they needed good gunpowder for hunting and self-protection. Gunpowder blockades and confiscations were going to be bitterly resented. Nevertheless, British patience with the colonists was probably only irretrievably exhausted in June 1775, when the Continental Congress formed its own army and Washington marched them to Boston. If Pennsylvania became convinced of that inevitability, the war was certainly on. After the naval battles right here on Delaware, what really became hard to believe was that -- only a week earlier -- Pennsylvania's moderate voters had soundly defeated the revolutionary radicals in an Assembly election.

Pennsylvania had indeed been far less eager to fight than Massachusetts and Virginia, but the more belligerent colonies felt they needed allies in order to prevail. In the Continental Congress Pennsylvania and South Carolina voted against rebellion in the Spring of 1776; and in the May 1776 election where independence was the main issue, the Pennsylvania voters elected an Assembly 70% opposed to rebellion, including that eminent merchant Robert Morris. Some of the determined Massachusetts efforts to persuade the Mid-Atlantic colonies bordered on subversion, but Pennsylvania remained unmoved. Nevertheless, they could see a real danger of war and had approved Secret Committees to be prepared if it came. Robert Morris was ideal for covert activity and could be expected to keep the activity under control, along with Benjamin Franklin and several prominent merchants. Morris made no secret of his affection for England the country of his birth, or of his membership in the John Dickinson group which hoped economic pressures would suffice. When the Secret Committee chairman suddenly died of smallpox, Morris was then appointed a chairman. His personal integrity was widely respected; in several hotly contested elections, he was nominated by both the radicals and the conservatives.

It seems absolutely necessary to prepare a vigorous defense since every account we receive from England threatens nothing but destruction.

|

| Robert Morris: December 1775. |

The Secret Committee was charged with smuggling in some gunpowder, just in case. Several of the members agreed to ship arms and gunpowder in their own ships; there was no one else to do it. The decision to engage in treasonous gunrunning was greatly assisted by the unexpected appearance of two Frenchmen with aristocratic accents in a boat loaded with gunpowder, who proposed themselves as French counterparties in a major gunpowder and weapons smuggling network which did actually materialize. Just who sent them has never been made entirely clear, but later events make the playwright Beaumarchais a reasonable guess, acting as a secret agent of the French King. Beaumarchais the famous playwright had been caught in a police trap, and forced to act as a government spy; just whose agent he was is a little murky. The American merchants on the Secret Committee knew gun running was expensive for them; they all expected to be paid for dangerous work, so it was also profitable. And treasonous. If caught, there was every possibility of being hanged. Initially, the Americans all imagined the Frenchmen were simply in it for the money, and that is possible. Surprisingly, no one seems even to have speculated they were agents of the French government on a mission to stir up trouble against the English. Spies had surely informed the French King of approaching war, at least six months before the Americans knew of it. Since these two foreign shippers (giving their names as Pierre Penet and Emmanuel de Pliarne, and surely sent to spy) demanded to be paid in hard currency, Morris did send one ship with hard money to pay for munitions to be carried in its hold on the return voyage. But he soon devised safer payment approaches.

For my part I abhor the name & the idea of a rebel, I neither want or wish a change of King or Constitution & do not conceive myself to act against either when I join America in defense of Constitutional Liberty.

|

| Robert Morris: December 1775 |

Since he had agents and offices in most major foreign ports, Morris could arrange for the money to arrive independently of the cargo ships. Or better yet, send ordinary commodities on the outward journey and make a private profit on that, returning with munitions paid for by the "remittances" -- revenue from the other cargo. Money was also sent on other circuitous journeys and through other channels, particularly the discounted debt system he had earlier perfected when the paper currency had been prohibited. There was thus less incriminating evidence on the ship, and even if the ship burned or everyone got hanged, the money was at least out of the hands of the enemy. Secrecy was, of course, essential, this activity could be called treasonous, and it was most assuredly smuggling. When neutral countries were found supporting gunrunning, that assistance might well be called an act of war, so all nations prohibited it. In spite of his earlier reluctance about independence, Morris could easily see that gunrunning by the privateers of a recognized nation might be better protected by the conventions of war than exactly the same activity conducted by, say, brigands, profiteers or pirates.

Gunrunning was always seriously dangerous; Morris soon lost four ships, one by a mutiny of secretly loyalist sailors, and two were captured by unscrupulous American privateers. There would be some protection from hanging for gun runners as authorized combatants of a recognized nation. In retrospect, we can now surmise that Franklin was committed to independence, and was probably nudging his friend on the Secret Committee. John Adams could barely contain himself, openly and repeatedly. Washington was already outside Boston leading an army. The commitment had many levels.

In July 1776 Morris was called on to vote in Congress for the independence he always said he opposed. Caesar Rodney rode in from Delaware to deliver his state for Independence; now, Pennsylvania alone stood in the way. When the moment came, on the advice of Franklin, Robert Morris, and John Dickinson left the room to allow other Pennsylvania delegates to constitute a Pennsylvania majority, casting the state's vote for the war. Commitment to the war had many variants, even after the war began.

Constitutional Liberty

WITH British troops in the process of disembarking at New Brunswick, apparently intent on hanging rebels, Robert Morris and John Dickinson annoyed everybody by refusing to sign the Declaration of Independence. Both were fully engaged in the Revolution after the fighting finally got started, and Morris signed up in August 1776. Dickinson had some further reasons of his own, but Morris explained his position quite succinctly. He didn't mind being a British subject, he didn't want a new King, what he wanted was Constitutional Liberty. There is no record of his being directly confronted about this later, and thus no detailed explanation. But whatever did he mean?

|

| Iliad and the Odyssey |

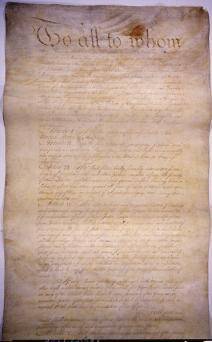

Morris was of course very bright, even brilliant as a businessman. He had an astonishing memory for detail and was capable of holding his own counsel. He was a person of great daring and prodigious amounts of work. But there is very little evidence that he thought it was useful to be mysterious, or deep. So why not take him at his word, which was essentially that what mattered in a government was whether it kept its promises and allowed its citizens all possible Liberty. It did not matter whether the government had a king, or seldom mattered much who that king was. What mattered was whether it kept its promises, and for that a Constitution is useful. There is no great pleasure in being capricious and arbitrary, so a king who leaves the citizens alone is mostly the best you can ask for. It does, however, help considerably if the rules are fair, clear, and binding. Beyond that, it is unwise to go about toppling governments in the vain hope that a new one is somehow better than the old one. This is putting words into his mouth, to be sure. What he did say was he saw no advantage to getting a new government when what we wanted was Constitutional Liberty. Eleven years later, he was a personal friend of just about everyone with the power to design a new government. Washington lived in his house, or in one next door. Ben Franklin was a business partner. Gouverneur Morris was his lawyer and partner. Just about everybody else who mattered was meeting with him in secrecy for months at a time, in the Pennsylvania Statehouse. And so on.

An essential part of this puzzle of Morris' role could be that the American Constitution was very close to unique in being written out as a document, like a commercial contract. The British Constitution was unwritten at the time and continues to be unwritten today. Many other members of the British Commonwealth operate without a written constitution. And in fact, what passed as constitutions for thousands of years have been unwritten; it was the written American one which was the novelty, not the other way around. It may stretch matters a little to describe the Iliad and the Odyssey as constitutions, but they do in fact describe the system of governance of the Ancient Greeks, clarifying many axioms of their culture for which they were willing to fight and die. We are able to understand the rules for Greeks to live by from reading Homer, almost surely better than we understand the rules of American culture by reading The Federalist Papers. Modern students of geometry, for another example, are taught that all the rules of Euclidian geometry are based on a few axioms stated at its beginning. Change one of those axioms, and you make mathematics unrecognizable. Even Newton's Principia are now seen by mathematicians to be rules which apply only to our universe for certain. There may exist many other universes to which they do not apply. Axioms are themselves mostly regarded as unprovable assumptions. A Constitution, therefore, is regarded in modern times to be much the same thing as a set of mathematical axioms. With one new exception: they are written out on a piece of paper for all to see and agree to -- just like a commercial contract. It would not be surprising to discover that America's great merchant trader, Robert Morris, was horrified at the idea of depending on Vestal Virgins or Judges, or Kings, for their recollection of what the contract says. It, therefore, seems quite natural for a maritime merchant to be agitated by having the rules of British society depend on what King George III chose to emphasize or ignore. Write it down, negotiate it, then tell us what you want so we can agree to it; that's a proper way to define Constitutional Liberty and limit disputes. International maritime trade could not be conducted in any other way, because sea captains who feel abused in a foreign port can abruptly up-anchor and sail away, never to return to that port again until or unless local rules are clarified.

Unless someone discovers some relevant documents in a trunk in the attic, that's about the best conjecture to be made about the American novelty of a written constitution, and its transformative effect on the legal system of all other nations which have one. It would still be nice to know, for certain, whose idea it was.

The Network

|

| Robert Morris |

It's true that Robert Morris had been engaged in smuggling gunpowder past the British blockade for more than six months before the 4th of July, 1776. It's also true he had found ways to make international payments in spite of a prohibition of paper money, which served well in a wartime freeze of money transfers. Still, his establishment of an effective way to wage maritime war in only two or three months is an achievement that is nearly miraculous.

Essentially, he shipped normal commercial cargo out, bought munitions with the revenue, and sailed the ship home loaded with gunpowder and guns; his firm made a profit on the outgoing shipment, and the government paid for the return trip with munitions. Because of the pre-war blockade, the commercial trade was badly needed, and extremely profitable. He wrote to one agent that one shipment which was successful would pay for 2,3, or 4 losses. That's a pretty cold-blooded way to describe 2,3 or 4 ships lost with all hands, but sometimes the sailors were only captured and imprisoned.

|

| William Bingham |

The system needed to find a way to make the exchange between guns and butter safer and more devious, so the ships leaving American ports would mainly sail to the Caribbean, to New Orleans, or to France. Sometimes transfers were made in North Carolina. At first, almost any cargo was highly profitable, but in time the main cargo was tobacco, highly desirable in Europe. New England had very little trade, so its ships were directed to Southern ports, and then took up the trade to some other transfer destination. New Orleans was in the hands of the Spanish, so negotiations were tricky. Caribbean areas had numerous ports, but plenty of pirates and/or privateers, as well. William Bingham was dispatched by Willing and Morris to Martinique and proved to be a master of the business. He added privateering to the list of his activities, paying to have ships built and then going shares with an enlisted crew. Their technique was to approach a British ship and take it as a prize. If on approaching the ship they could tell it was a British naval vessel, they ran up a French flag and headed for port. Bingham often was able to persuade the crew of a captured vessel to join him, and so the number of his ships and the number of British captures multiplied rapidly. By the end of the war, he was able to return to Philadelphia at the age of 28, temporarily the richest man in America.

Another source of privateers was the Pine Barrens of southern New Jersey, where the Willing and Morris firm itself was able to oversee the construction of vessels, the recruitment of crew, and the sharing of spoils on return to home port. The winding creeks behind Barnegat Bay were places the British soon learned to fear. One cannon on a river bend could suddenly stop any invaders. Enormous amounts of British shipping and British seamen were lost to American privateering, probably inflicting more British casualties than Washington's army.

|

| Silas Deane |

The ultimate main source of munitions was France. To the end, the French regarded the Revolutionary War as one fought between the French and the British, with Indian and colonial allies. Morris sent Silas Deane of Connecticut over to France to see if he could make connections, but he immediately found the French were ahead of him. The French King was immediately willing to advance 200,000 livres in loans, and Vergennes the foreign minister was prepared to clear up any difficulties that might arise with local police, customs and other French officials who were uninformed about the realities. And above all, Beaumarchais was in charge of local arrangements, to be sure gunpowder and guns were available in the right amount at the right places, and that local outlet was located to dispose of tobacco and other products coming in to pay for the munitions. Beaumarchais seemed to believe he had thought up this whole arrangement, and perhaps to some degree, he had. In any event, there was no problem persuading France to get involved. After a while, the enterprise was so successful the French began to fear it would bankrupt them, but that is another story. As is the notion that in 1783 the French were preparing to make a separate peace with the British, and thus to leave the colonists hanging. So to speak.

REFERENCES

| The Pine Barrens: John McPhee: ISBN-13: 978-0374514426 | Amazon |

Beaumarchais: A Playwright Brings France into the American Revolution

|

| Pierre Augustin Beaumarchais |

Pierre Augustin Beaumarchais, the son of an 18th Century French watchmaker, was born Protestant in a Catholic country. While possibly inclined by this circumstance to be a free thinker, his unusual artfulness was more likely inborn. After revolutionizing watchmaking before he reached the age of twenty, with an escapement mechanism for small portable watches, he rose to social attention when the Royal Watchmaker claimed the invention was his own, and Beaumarchais sued him. Thus gaining Louis XV's notice, Beaumarchais became Royal Watchmaker himself. He was soon giving harp lessons to the ladies of the court, writing plays like The Barber of Seville, and engaging in business schemes with wealthy investors. His career as a court favorite lasted sixteen years, first bringing him considerable wealth, but then sudden ruination by a lurid lawsuit which cost him his fortune. In brief, Beaumarchais had tried to bribe a French judge with less money than his opponent offered, and so spent a few months in prison. After concluding a long, public battle through the appeals courts, he sought a more political role with the new young King, Louis XVI. He was sent to London to pay off a former French Agent, Chevalier D'Eon, who was blackmailing the French government. D'Eon's social connection to John Wilkes, the outspoken critic of the British King, sparked Beaumarchais' initial interest in Whig politics and the American rebellion.

|

| John Wilkes |

When he arrived in England Beaumarchais found British politics in turmoil; John Wilkes headed a whiggish opposition movement denouncing Royal authority and hosting gatherings of the like-minded, some of which Beaumarchais attended. Fueling these domestic British flames of liberal reform was the recent and increasingly serious rebellion on the other side of the Atlantic. As Beaumarchais spent more time in England discussing the rebellion with Virginian Arthur Lee (who highly exaggerated its strength), he became increasingly convinced it would be a good strategy for France to help the colonists. For all the trouble Arthur Lee ended up causing, he can fairly claim credit for enlisting Beaumarchais to French support for the American cause.

|

| Charles Gravier, Comte de Vergennes |

Beaumarchais reported his findings to Charles Gravier, Comte de Vergennes, the foreign minister of France. He urged the French government to support the American rebellion, consistently taking the line of French self-interest; after suffering a humiliating defeat in the Seven Year War, France might now undermine England's growing regional power by helping the colonists loosen their affiliation to the rising island empire.

When the young and hesitant Louis XVI finally agreed to take Beaumarchais' advice, it was still unclear whether the American rebellion was a serious movement. The French monarchy was not ready to unsettle its already shaky relationship with England by coming out in public support of untested rebels. To preserve the appearance of neutrality, the French Government loaned Beaumarchais one million lives in June 1776 to start a private trading firm, the Rodriguez Portales Company. This new firm would buy old French military supplies from the French government, then re-sell those supplies to the Americans with return payment of American products, primarily tobacco. Beaumarchais was therefore expected to run a completely self-sustaining operation, free from association with the French government. Rogue and adventurer that he was, Beaumarchais took on this risky challenge with enthusiasm, working tirelessly in France and around Europe to provide the Americans with ammunition, military supplies, and food. His efforts did not go undetected, however. England's ambassador to France, Lord Stormont, grew suspicious of Beaumarchais' frequent trips across the channel and notified the French government of his displeasure. But Beaumarchais simply ignored these protestations.

Matching Beaumarchais' work in establishing Rodrigez and Hortalez, the American Congress sent a covert representative to nurture French support. Silas Deane, sent to France under the disguise of a colonial merchant in July 1776, learned of Beaumarchais' plan to support the American army and at first, the two became fast friends. Unfortunately, this friendship sparked the jealousies of Colonists and Frenchmen alike. Arthur Lee became a particularly vicious opponent of the Beaumarchais/Deane pair, resenting Silas Deane for having been chosen over him as a diplomat to the French, and suspecting Beaumarchais of money laundering. Even when he was later sent in company with Benjamin Franklin to continue negotiations with France, Lee remained suspicious of Deane and Beaumarchais' collaboration. The American mission to France during this period remains famous for strife and factionalism, which was as much a free for all as two-sided animosity. Personal ambition and cultural differences complicated these relationships; no one eventually suffered more because of it than Beaumarchais and Deane.

While Deane negotiated with Beaumarchais, Arthur Lee corresponded with Congress to undermine both Beaumarchais and Silas Deane. Lee was highly suspicious of both men, accusing them of using the privateering scheme for their own profit. The result was a split in Congress between those who supported Lee and those who supported Deane's work with Beaumarchais. The first congress was full of alliances, tempers and faulty information that led to frequent, if not constant, conflict. The Lee brothers were particularly vocal opponents of an alliance with France, and this opposition by a prominent family within the Continental Congress kept French and American relations strained and hesitant.

The first shipment to the colonies by the Rodrigez and Hortalez Company carrying nearly 25,000 pounds of ammunition, was a shaky and often blind operation. Continental Congress never received news of Deane's plans (and request for ships) and remained busy working away at a proposed Declaration of Independence, the publication of which would, with luck, ensure France's official cooperation. Deane was forced to make crucial shipment decisions without the support or approval of Congress. Adding to this instability, the ships were discovered by Lord Stormont right before the first shipment left for the colonies, and the English Ambassador to France quickly protested their sailing to the French government. Vergennes, eager to keep smooth relations with England, particularly in view of the seeming failure of the American cause at that time, officially banned their sailing off the French coast. Fortunately for the Americans, Beaumarchais sent the supplies anyway, which were greeted warmly by colonists in Portsmouth, New Hampshire in early 1777. These supplies helped the colonists win the Battle of Saratoga, the success of which finally convinced the French to emerge in full support of the American Revolution. Beaumarchais continued to supply the Colonists despite England's protests, but privateering increased the threat of war between England and France.

|

| Barber of Seville |

By September 1777, Beaumarchais had shipped 5 million lives worth of supplies to America without repayment. By 1778 his firm had accrued so much debt that by the end of the war it was in complete ruin. The French government was unwilling to acknowledge its support for Beaumarchais before or after the war, and Silas Deane's entreaties were, unfortunately, not enough to convince Congress that the American colonies owed Beaumarchais for his generous work. Beaumarchais continued his requests for compensation after the war, and Congress continually refused or ignored these requests. Thirty-six years after his death, his heirs were paid back a small fraction of the original debt. Forced to travel to Congress to fight their ancestor's case, his descendants were awarded 800,000 lives of the several million owed. In effect, Beaumarchais nearly single-handedly supplied the American Revolution with arms receiving very little in return except his financial ruin.

It is surprising that a man with so much talent and character should have died in near obscurity; yet Beaumarchais' plays, not his political maneuverings, are what have survived today as part of the standard repertory. When his wildly successful The Barber of Seville premiered in 1775, Beaumarchais was already a well-known playwright and champion of the down-trodden common man. Perhaps he was too great for his own time; The Barber proved more popular when adapted into a libretto by Lorenzo Da Ponte and then later into an opera by Gioachino Rossini in 1814. An independent mind and flamboyant character immortalized his art, but the same characteristics may have brought him, and France, to political and financial ruin.

Richard Henry Lee: A Pennsylvania Viewpoint

|

| Patrick Henry |

Although Colonial Massachusetts was combative and outspoken in its demands for liberty, somehow, pacifist Quaker Pennsylvania still got along with Bostonians reasonably well. It was Virginia that was always in Pennsylvania's face, proud, loud and defiant. Patrick Henry was certainly one of Virginia's leaders, but most of the time it was the residents of Westmoreland County VA who wrangled with Pennsylvania, people with names like Washington and Lee. Some of this animosity had to do with competition for access to the Ohio territory through Pittsburgh, some of it was a strong difference in attitude toward the Indians, whom the Quakers sought to treat as equals. Eventually, there was a division over slavery. Arthur Lee had attended Eton College no less and was often the agent who acted out the repeated efforts to stir Pennsylvania from its torpor about rebellion against England. But very likely it was his brother Richard Henry Lee who schemed the most.

|

| Richard Henry Lee |

Richard Henry Lee was the author of the Westmoreland County Resolution of 1765, which essentially proclaimed to the neighbors that anyone who cooperated with the Stamp Act was going to be sorry about it. It was the same Richard Henry Lee who introduced the Virginia Resolution of June 1776, declaring that:

Americans are and of right ought to be, free and independent States, that they are absolved from all allegiance to the British Crown, and that all political connection between them and the State of Great Britain is, and ought to be, totally dissolved.

Hotheads of Virginia and Massachusetts formed a political group at the Continental Congress, usually referred to as the Eastern Party. The leadership of a Moderate Party was less clearly defined, but Benjamin Franklin, John Dickinson, and Robert Morris probably qualified. It was almost pre-destined that Morris and Franklin would have trouble with the Lee brothers, especially when Arthur was the spokesman and Richard Henry the ringleader. Like cats and dogs, they seemed to have been some sort of genetic antagonism; topics under dispute tended to vary. No doubt, Robert Morris' enormous wealth and the ease with which he accumulated, even more, irritated the Virginia gentry whose tobacco farms were starting to exhaust their topsoil. For his part, Morris was not likely to be deferential, merely to their ancestry. Morris did sign the Declaration of Independence a month late, but under the circumstances, he could no longer vote for it; Richard Henry Lee had written the Virginia Resolution which glorified the very crux of it. A Secret Committee was soon formed to obtain arms and gunpowder, including Morris and Franklin; Richard Henry Lee saw to it that his brother Arthur was added. When Arthur was sent to watch out for Morris' agent Silas Deane in Paris, Arthur got sent along to stand guard, stirring up endless trouble with Foreign Minister Vergennes. When the Lees finally caught on to the system of sending American products to France on ships that would return with gunpowder, they wanted Franklin removed, Robert Morris' brother Thomas removed, and another Lee brother William added to the group in charge of exchanging goods with the Frenchman Beaumarchais, who was a particular Lee favorite. When Beaumarchais indicated a strong preference for tobacco as the product most in demand in France, it must have set off bells in Richard Henry Lee's head. The Lee home region of Westmoreland County in Virginia dominated the tobacco trade. But Robert Morris was himself a second generation tobacco trader; the Lees had little new to teach him about tobacco. Time and again, Morris defeated the Lee brothers in some such petty quarrels. Gradually, the Lees lost credibility, particularly after scholars began to discover evidence that when the Stamp Act was enacted, Richard Henry Lee had applied for the job of a local agent, and had been rejected.

The Lees were not always in the wrong. Thomas Morris was indeed a hopeless alcoholic and an extreme embarrassment to Robert. But a more fraternal relationship might have led to Lee helping Morris ease Thomas out while concealing his indiscretions; he could have made a friend of Robert Morris for life. Morris was certainly willing to play this game; he praised Arthur Lee in public for his assistance in monitoring the secret committee, a description which at this distance is simply hilarious. John Adams in Paris might be forgiven for taking Puritanical offense at Ben Franklin's exuberant Parisian high life. It is likely the Virginia Cavaliers looked at dalliance through the same lens as the Adams family, disliking Franklin and Morris for having a jolly time, and worse still being acclaimed for it.

Christmas, 1776, Behind the Scenes at Trenton

|

| Washington Crossing Delaware |

Cornwallis and the British regulars came thundering down the narrow waist of New Jersey from New Brunswick to Trenton, just before Christmas, 1776. Washington's troops retreated before them, fleeing to the Pennsylvania side of the Delaware River. The British then fortified the Hessians in Trenton and went back into their own winter quarters nearer New York. Plenty of time seemed available to finish off Washington in the Spring, and then leisurely conquer the enemy's capital in Philadelphia. The Continental Congress thought so, too, and moved its capital to Baltimore. Only three members of the Congress, Robert Morris, George Clymer, and George Walton (of Georgia), remained in Philadelphia to run the government; Morris was essentially in charge, in the role of financier whatever that meant. With Congress seeking refuge, Morris was for practical purposes, acting President of the United States. Washington swept up all of the boats on Delaware, set up camp on the Pennsylvania side, and begged Morris to get him some money to reward re-enlistments by January 1. Others saw the end of the year as Christmas time; Washington saw it as the end of the year when enlistments expired. He quite plainly stated that it was all over for the Continental Army unless he could get some hard currency, silver preferred, to show the troops that the rebellion could survive another year. About ten dollars per soldier would probably do it, but then there was also a need for hard money to buy food and supplies for the starving troops.

|

| General Charles Cornwallis |

Just how Morris managed to find the money is unclear, or how much of it was his own. But he did manage, with the lucky arrival of a gunpowder smuggling ship from France, and eighteen cannon somehow supplied by General Knox. The Colonials rallied to re-cross Delaware, surprise the Hessians, outmaneuver Cornwallis as he once more thundered back down the New Jersey waist, now intent to wreak vengeance. The military essence of it all reached a climactic moment when Washington used fake bonfires to trick the British while he sneaked around them. Captain Sam Morris and Philadelphia's First City Troop managed the bonfire deception. When cannon fire in Princeton announced the trick, the British raced back to their ships at Staten Island to protect their supplies before Washington who now had a head start, could get to the ships, leaving the British to starve in the woods. Both sides were exhausted by the chase, and although he had won this race, Washington had to retreat to winter quarters in Morristown, New Jersey (named after a former New Jersey Governor.) Meanwhile, with Congress taking refuge in Baltimore, Philadelphia was nearly deserted except for some Quakers who felt they had no quarrel with the British. And Robert Morris, who continued to run his smuggling operation with Beaumarchais the famous playwright on the French end of it. Tradition has it that some Quaker gardens were dug up to find enough silver to reward reenlistments, and if so it is unclear how much was freely contributed and how much was just plain stolen; indeed, how much of it might have been Morris' own money. By the next fall, Washington was able to fight the largest battle of the war at the Brandywine Creek, so Morris must have been very active smuggling guns and gunpowder to resupply the Colonials during that intervening winter and spring.

During periods of the lull in infantry warfare, other warfare including privateering at sea, blockades, and the diplomatic intrigue in Paris, were unmerciful. If Washington's army had been wiped out, the Revolution would have ended. But other misadventures might have ended it as well. The colonists were demoralized, and their dismay was summarized by a letter from Morris to Silas Deane, a line of which was the bitter observation that "Sorry I am to say it, many of those who were foremost in noise, shrink coward-like from the danger.".

A few days before that fateful Christmas, Ben Franklin had arrived in Paris to take over our diplomatic mission with the French. When the news of Washington's victory reached him, the new American arrival was being acclaimed as the world-famous scientist and witty author and was thus in a position to make the most of it with the French court. He may be forgiven for exaggerating Washington's exploits a little. The Trenton victory was rough and ragged, but it would serve. Washington, Franklin, and Morris. The three Americans who mainly won the Revolutionary War for us now took the stage, front and center.

Fort Wilson: Philadelphia 1779

|

| James Wilson |

OCTOBER 4, 1779. The British had conquered then abandoned Philadelphia; an order was still only partially restored. Joseph Reed was President of the Continental Congress, inflation ("Not worth a Continental") was rampant, and food shortages were at near-famine levels because of self-defeating price controls. In a world turned upside down, Charles Willson Peale the painter was a leader of a radical group of admirers of Rousseau the French anarchist, called the Constitutionalist Party, leaning in the bloody direction actually followed by the French Revolution in 1789. Peale was quick to admit he had no clue what to do with his leadership position and soon resigned it in favor of painting portraits of the wealthy. Others had deserted the occupied city, and many had not yet returned. The Quakers of the city hunkered down, more or less adhering to earlier instruction from the London Yearly Meeting to stay away from any politics involving war taxes. About two hundred militia roamed the city streets making trouble for anyone they could plausibly blame for the breakdown of civil order. Philadelphia was as close to anarchy as it would ever become; the focus of anger was against the pacifist Quakers, the rich merchants, and James Wilson the lawyer.

|

| Fort Wilson |

Wilson had enraged the radicals by defending Tories in court, much as John Adams got in trouble for defending British troops involved in the Boston Massacre; Ben Franklin advised Wilson to leave town. It is still possible to walk the full extent of the battle of Fort Wilson in a few minutes, and the tourist bureau has marked it out. Begin with the Quaker Meeting at Fourth and Arch. A few wandering militiamen caught Jonathan Drinker, Thomas Story, Buckridge Sims, and Matthew Johns emerging from the Quaker church, and rounded them up as prisoners. The Quakers were marched down the street for uncertain purposes when the militia encountered a group of prominent merchants emerging from the City Tavern. Unlike the meek Quakers, Robert Morris and John Cadwalader the leader of the City Troop ordered the militia to release the prisoners, behave themselves, and disperse; Timothy Matlack shouted orders. It was exactly the wrong stance to take, and about thirty prominent citizens were soon driven to retreat to the large brick house of James Wilson, at the corner of Third and Walnut, known forever afterward as Fort Wilson. Doors were barred, windows manned, and Fort Wilson was soon surrounded by an armed, shouting, mob. Lieutenant Robert Campbell leaned out a third story window and was soon dropped dead by a lucky bullet. It remains in dispute whether or not he fired first. Crowbars were sought, the back door forced open, but the angry attackers scattered after fusillades from inside.

|

| Joseph Reed |

Down the street came President Reed on horseback, ordering the militia to disperse, with Timothy Matlack at his side; both men were well-known radicals, here switching sides to maintain law and order. The City Troop arrived, an order was given the cavalry to Assault Every Armed Man. The radicals were finally dispersed by this makeshift cavalry charge, cutting and slashing its way through the dazed militia. When it was over, five defenders were dead and about twenty wounded. Among the militia, the casualties were heavier but inaccurately reported. Robert Morris took James Wilson in hand and retreated to his mansion at Lemon Hill; Wilson was the founder of America's first law school. Among other defenders huddled in Fort Wilson were some of the future framers of the Constitution from Pennsylvania: General Thomas Mifflin, Wilson, Morris, George Clymer. Equally important was the deep impression left on radical leaders like Reed and Matlack, and Henry Laurens, who could see how close the whole war effort was to dissolution, for lack of firm control. Inflation continued but the center-productive price control system was abandoned and never revived; the Patriots had a bad scare, and the heedless radicals forced to confront the potentially disastrous consequences of their own amateur performance when entrusted with the power and responsibility they had just been demanding. It was one of those rare moments in a nation's history when the way suddenly opens to previously unthinkable actions.

|

| Timothy Matlack |

The Battle of Fort Wilson was the only Revolutionary War battle fought within Philadelphia city limits; a revolution within a revolution, every participant was a Rebel patriot. Reed and Matlack were the two most visibly appalled by the whole uproar, forced by circumstances to attack the forces of their own political persuasion. But it seems very certain that Robert Morris and the other prosperous idealists were also left with an indelible conviction that even a confederation must maintain central command and discipline with an iron will, or all might be lost. A knowledgable French observer estimated that Robert Morris then owned assets worth eight million dollars, an almost unimaginable sum for the time. But he would lose every penny if effective political control could not be restored. A few days later in the October election, he and all the other Republican (conservative) officials lost their seats. It did not matter; Morris then knew what to do, and his opposition didn't.

Robert Morris, In Charge By Popular Demand

Robert Morris was in charge of the nation's finances (his title was Financier) for two intervals following two landmark emergencies: the Battle of Fort Wilson was one, and the threatened mutiny of the Pennsylvania Line of the Continental Army was the other. There was an interval without Morris in office in 1780. Both emergencies grew out of monetary panics, so a financial leader seemed a natural choice. Morris was in fact in charge of almost everything non-military, for the peculiar reason that we had no designated chief executive. The Continental Congress had a President, but the activities of the country were actually run by congressional committees. Morris wasted no time replacing this system with permanent departments under his supervision, so it is not too much to say his wartime role was acting chief executive. The improved efficiency of this approach was so evident the Constitutional Convention of 1787 seems to have spent little time arguing against continuing it, although lurking anti-Federalists never got over the idea that something had been put over on them. For reader convenience, we here take mild liberties with the chronology of individual initiatives, preferring instead to center around the two crises. The first of these, immediately following the Battle of Fort Wilson, was worthless paper money ("not worth a Continental") inflation, with soaring prices, futile price controls, and consequent false shortages of necessities. The second episode followed the later near-revolt of the Continental Army, and it was essentially a deflation provoked by the French running out of money to support us, and real shortages of necessities. Here, Morris had to cope with the end of the war in sight, but in fact not ending. Everyone was reluctant to fight battles without military purpose but unable to return to farming. Credit and hard currency reserves were exhausted. At the same time British, French and American politicians connived for advantage after a war each had failed to win militarily. By this route, having earlier described the creation of modern banking, we arrive at the cluster of clever expedients which Morris handled like a juggler as he raced from inflation to deflation, and back.

|

| Robert Morris, Financier |

The revolt of the Pennsylvania Line, along with Washington's clear sympathy for his soldiers, threw the Continental Congress into a panic. Their own responsibility for the crisis, as well as their lack of any clear idea about what to do about it, were as obvious to the public as to themselves. The approaching result went beyond a mere disgrace, and might even lead to a dictator, or God saves us, another king. A decade later, this crisis might have suggested to some that a guillotine should be set up behind the State House on Chestnut Street. Indeed, Thomas Jefferson made some remarks which might be taken in just that way. The soldiers themselves put an end to that sort of wild talk. British General Clinton sent some emissaries to the American Army, looking around for some deserters to turn Tory. The soldiers promptly executed the emissaries. George Washington, Morris' best friend, played his ambiguous position like a master. He was ultimately responsible for maintaining order, but his sympathies with the soldiers' complaint were obvious. Calling the officers together, he made the theatrical gesture of pulling off his glasses, intimating that he was going blind in his nation's service. Since his eyes served him very well for the next decade, that was unlikely. Although it is possible he believed what he was saying, most certainly the officers did.

What helped the perplexing monetary situation most was the ready availability of a financial genius to turn it around; there was no real need for others to understand it. Robert Morris had made his pile, probably the richest man on the continent, and he had the grievance of having been rejected from office after the Battle of Fort Wilson. He also had the perfectly normal motive of wishing to hold things together until the Paris peace negotiations could restore order. He had some novel plans which he wanted to try; it is not too much to surmise he wanted to show them off, particularly since their central feature would require his prodigious energy, applied to his seemingly unlimited succession of ingenious solutions. No one else even came close.

At this critical moment, Morris played coy. He was not so sure he would accept the office of Financier, a term newly invented for the occasion. Accepting Ben Franklin's cynical assessment of the future, he wanted everyone to be clear that he was going to retain his private partnerships. And he insisted on his right to hire and fire anyone he pleased within the government bureaucracy who was concerned with public money. He would accept responsibility for new debts of the government, but not for old debts which were incurred before he took office. He would delay taking the oath of office for a few months. These conditions generated a storm of opposition in Congress; Morris was serene about that, and Congress finally agreed to his terms. Most of these terms had an obvious purpose, making no secret of his distrust of Congressmen. However, the opposition might have hardened its position if the purpose of delaying the oath had been fully expressed. Morris wanted to delay becoming a federal officer in order to delay resigning from the Pennsylvania Assembly. During the interval, he applied the same power tactics to the Legislature, ending up in charge of administering state finances in parallel with his federal duties.

|

| Yorktown: Oct. 19, 1781 |

The purpose was soon to emerge, as just one instance of a general approach. As inflation tossed and turned the finances of just about everyone, Morris would buy with one currency and sell with the other, taking advantage of transient fluctuations in their respective values, then quickly reverse the currency transaction when the advantages shifted. He arranged with the French and Spanish ministers to keep their loans and foreign aid in separate accounts, doing the same thing with state accounts, and even near and distant counties within Pennsylvania. He thus had his choice of a number of currency values at any one moment. His far-flung commercial network supplied him with more precise information than his counterparties could get, and usually more quickly, so his trading activities were quite profitable. One rather extreme example was the arrangement with Benjamin Franklin in Paris; he would write checks to Franklin in one currency while Franklin would write identical deposits back to him on the same day but a different currency. He thus expanded ancient practice among international merchants. Carrying it over to government operations had the effect of creating a modern currency market. To outsiders, however, particularly his political enemies in Massachusetts and Virginia, it looked fishy. To modern observers, the astonishing thing was his ability to keep such complexity in his head. The political class which even today sees it as natural that governments might want to manipulate currency as they please would regard Morris strategies as reprehensible. Those who believe the market price is the true price however, must applaud this strategy for forcing manipulated prices back to market levels. Since here has rested a central dispute in American politics for two centuries, Morris must at least be credited with inventing the dispute. One would normally suppose that doubling the silver price of American currency in two months would vindicate this trading strategy; but it has not, suggesting the nature of the opposition has been more ideological than economic.

Within days of assuming office, the "legal tender" laws were repealed, stripping government of the ability to force its citizens to accept the worthless currency, impose rationing and price controls or otherwise assume the pose of "sovereignty". Like a miracle, food began to reappear in the Philadelphia marketplace at a lower price, and confidence in the competence of government began to return. To whatever degree the British ministry had been deliberately stalling the peace talks in the hope of American collapse, even that incentive abated.

The list of financial innovations which Morris produced in a remarkably short time, is seemingly endless. He was central in the creation of the first American bank of the modern sort, the Bank of North America. And somewhere in the welter of activity appears to be the recognition of the so-called yield curve. Loans for a few weeks or months command a much lower interest rate than long-term loans; in the colonial period, almost all loans were for six months or less. Morris seems to have realized early that great profitability could be achieved by stringing a series of short loans into one long one. He thus devised a number of strategies which had the general effect of linking short loans together. Using the remittance for a transatlantic cargo in one direction as payment for the return cargo on the same ship was an early example. Once you grasped the idea and did it deliberately, long sequences of linked loans began to appear. Just to complete the thought, it might be noticed that globalization reverses the process with shorter-term loans for components rather than longer-term loans for the entire assembled product. With lower interest rates, prices can be reduced, unless a choice is made to increase the profits.

There's one last issue in Robert Morris folklore: Did he finance the Revolution out of his own pocket? The answer is surely no because Beaumarchais ended up spending much more than any other individual, although involuntarily. The degree to which hard currency originated with the French, Spanish and American governments is a little unclear, and war damages are impossible to summarize. There were moments when Morris did personally finance major cash shortages, adding the considerable advantage of speeding up what could be a cumbersome process of budgeting, committee consideration, disputes, and hesitation. Where it was feasible, he sought restitution. Every bureaucrat has experienced delays and obstructions he wished he could eliminate by simply paying for it himself; Morris had the advantage that in an extremity, he could afford it.

The more important contribution was his pledge to make good. Creditors generally preferred his credit to that of the government; his pledge was to make good if the government defaulted. His position was that of reinsuring government debts, or in modern terms offering the equivalent of a Credit Default Swap. If we lost the war and our debts defaulted, Morris would have lost everything he had. But short of that, his pledge would result in much smaller losses. The public couldn't be expected to understand all that, so some simplified explanations were understandable. There were probably a number of similar examples, but near the end of the war, there was a particularly clear one. The Continental Army was very close to revolt when it looked as though Congress would disband the soldiers without paying them; there was no money to pay them but demobilization would likely send rioting soldiers through the countryside. Morris came forward with a million dollars of his own money and saved the day. Washington was forced to make emotional speeches appealing to the patriotism of the troops, but with most of the army barefoot, that was not likely to suffice. Under those circumstances, to come forward like Arthur Lee and remonstrate that Morris had once refused to sign the Declaration of Independence, was ingratitude of the meanest sort.

The accusation made after the war was that he profited from government losses, but there has never been any evidence of that. His position was that he came out about even. Unspoken in these quarrels was the plain fact that until he got involved in the real estate boom, he didn't need to cheat. Probably didn't have time for it.

The Revolutionary War continued for two years after Morris took office, so war losses continued in spite of improved financial management. Both the French Government and the American one were at the edge of bankruptcy. Britain was also in political chaos, but it was small consolation that Parliament had granted Independence to the Colonies when George III was adamant and intransigent in his opposition to any such idea. Strengthened by the British defeat of the French Caribbean fleet, the capitulation by the Spanish about Gibraltar, and great uncertainty about the Crimea and India -- almost anything was possible. Eventually, matters were deteriorating again. The British had the financial strength to hold out much longer, but the neglect of other opportunities eventually wore them down. Morris seemed to be winning, just by not losing.

In the midst of such anarchy, Morris had to admit his greatest failure as the Financier but was already formulating his plan for setting things on their feet. The Revolutionary War as seen by a financier had either been won by the British system of taxation or else lost by the American and French lack of such a system. It was irrelevant whether the War was described as a defeat for Britain or a victory; in Morris' view, the British had a good system and we had a poor one. No nation can finance a major war out of current receipts; you had to borrow. Your security for the loan was the economy of your nation. Even if your illiquid assets were adequate for the war, the banking markets regard your ability to pay cash for the interest on the loan as the only reliable test of your solvency. That is, a nation at war must have the ability to keep the bankers happy with regular interest payments. For that, a nation had to have a proven system of reliable taxation. Britain had it, and the American/French alliance didn't. Franklin's masterful diplomacy was just lucky enough to achieve permanent independence, but that wasn't good enough, we had to have a Federal tax system. And to achieve that, we had to have a new Constitution. Never mind that resentment about British taxes got us into this mess. Never mind the chaos of the Treaty of Paris. Never mind the war-weariness, bitterness, and destitution of the troops. Never mind that Morris was about to embark on one of the most mind-boggling real estate ventures in history, was going to go to debtor's prison, was going to engage in millions and millions of dollars of borrowing and restitution. Never mind. We needed a new Constitution, and we were going to get one. Think big.

Private Sector Disciplines Congress

|

| Adam Smith |

Two centuries after our present narrative, when President William Clinton once proposed a financial adventure, Robert Rubin replied, "The bond market won't let you do it." In this way, the former Wall Street investment banker educated his politician boss that the most powerful wealth of any nation is hidden, locked up in homes, businesses, infrastructure, population education, and other long-term assets. Such wealth normally transforms into cash only when the Treasury borrows it (usually by selling government bonds) because by Constitutional intention the alternative of raising taxes is essentially confiscatory. By contrast, the use of bonds requires only an agreement on price. Bond use is thereby related to supply and demand, with the government generally selling bonds and the public generally buying them. The government sells as many bonds as it pleases, but the price received will immediately sink if too many bonds are for sale. Viewed another way, bond prices announce the market's daily assessment of probable government solvency because the isolated bond market is solely interested in the probability of being repaid.

In modern wars, the longest purse must generally determine the event.

|

| George Washington, May, 1780 |

In 1779 there was no bond market, so Robert Morris set about creating one. Acting then as only a private citizen, but faced with his government being run into the ground, Robert Morris proposed the creation of a "bank", the Bank of Pennsylvania, created, owned and managed by private citizens. The first bank in the nation didn't take retail deposits and was unlike banks we have today in other ways. Modeled more like a bond fund of the Twenty-first century, the Bank of Pennsylvania got its funds through fairly large subscriptions from wealthy people. Robert Morris himself was probably the heaviest subscriber. A bond market was thus created, with subscriptions flooding in when the public was pleased with its government, and flooding out when the public didn't like the looks of things. Naturally, there was a profit: the bonds the bank sold to subscribers were priced higher than the bonds the bank bought from the government. In this way, the public was assured the process of setting prices remained in neutral hands. The government could print bonds freely, but the Bank of Pennsylvania couldn't buy them unless somebody gave it some money, and that wouldn't happen unless prices rose to the "market clearing level," of agreement between potential buyers and sellers. The nature of the deal didn't change much when later banks got their funds from deposits, and one later enduring feature also didn't change: Governments hate banks because banks are in a position to frustrate governments intent on spending what they please.

|

| Jacques Necker |