Related Topics

Right Angle Club: 2015

The tenth year of this annal, the ninety-third for the club. Because its author spent much of the past year on health economics, a summary of this topic takes up a third of this volume. The 1980 book now sells on Amazon for three times its original price, so be warned.

FUTURE VERSIONS

Some ruminations about health financing, written while we wait for the Supreme Court to announce its decision on King v.Burwell.

Hospitals and their Future

New topic 2019-03-21 19:29:46 description

Paying for the Healthcare of Children

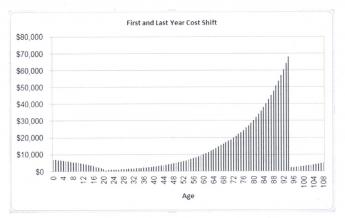

It has been said by others that eventually healthcare will shrink down to paying for the first year of life, and the last one. Right up to that final moment, medical payments must somehow evolve in two opposite directions. We might just as well imagine two complimentary payment systems immediately because the two persisting methodologies could eventually conflict unless planned for. Paying in advance is fundamentally cheaper than paying after the service is rendered because there is no potential for default in payment.

The two methods even result in different aggregate prices; in one case you pay to borrow, while in the other you get paid to loan the money. Dual systems are a fair amount of trouble; remember how long it took gasoline filling stations to adjust to credit cards versus cash. When gas prices eventually got high enough, they just charged everybody a single price, again. This isn't just lower middle-class stubbornness. Dual payment systems slow you down, and profit is generated from repeated rapid transactions. The buyer wants the goods and the seller wants the money. The profit comes from doing exchanges as fast and often as you can manage them.

In a well designed lifetime scheme, with balances successively transferred from one pidgeon-hole to another, it becomes possible to maintain a positive balance for years at a time (thereby reducing final prices, because the income from compound interest keeps rising toward its far end). That was a discovery of the ancient Greeks, but sometimes Benjamin Franklin seems like the only person to have noticed.

The last year of life is more expensive, But the first year of life may cause more financial pain.

|

However, In real-life health costs, there is one intractable exception. Because obstetrics can be costly, particularly the high costs of prematurity and congenital abnormalities, the first year of life averages $10,500, or 3% of present total health costs. It, therefore, results in pricing which many young parents cannot afford, in spite of insurance overcharges to catch up later. And thereby a multi-year stretch of interest income is jumbled up, often lost entirely. It gets worse: childhood costs from birth to age 21 average 8% of lifetime healthcare. Please notice: Single-year term insurance premiums always rise to a much higher level than a lifetime, or whole-life, premium costs, because of internal float compounds in whole-life. Modern medicine has also resulted in rising lifetime costs, with only this obstetrical exception. Someone surely would have figured this out, except excessive taxation of corporations created a motive not to notice the effect on tax exempted expenditures.

This problem obviously could be approached by borrowing or subsidizing. Someone might even envision a complicated process of transferring obstetrical costs to the grandparents for thirty-five years, then transferring the costs back to the parent generation. Since we are describing a cradle-to-grave scheme, it seems much better to imagine a single person's costs eventually becoming unified. Grandparents do in fact share continuous protoplasm with grandchildren, but before that was recognized, the courts had decided a new life begins when a baby's ears reach the sunlight. Stare decisis beats biology, almost every time. A society which already has a high divorce rate and plenty of other family upheavals probably feel better suited to the principle of "Every ship on its own bottom." -- except for this financing issue. For childless couples and parentless children, some kind of pooling is possibly more appealing, and the complexities of modern life may eventually lead that way.

|

In the meantime, lawyers, who see a great deal of human weakness, are probably better suited to suggest a methodology for transferring average birth costs between generations, and back, although a voluntary process seems more flexible. It would seem grandparents are often most likely to be in a position to leave a few thousand dollars to grandchildren in their wills, and age thirty-five to forty seems the time when competing costs are at a lifetime low, making that the best time to pay it back.

Some grandparents are destitute, however, and some parents are basketball stars. There are surely generalizations with many exceptions. The process is happily simplified by a birth rate of 2.1 children per couple, which is also 1:1 at the grandparent/grandchild level and our Society has an unspoken wish to increase the birth rate if it could afford it. For legal default purposes, matrilineal rather than patrilineal descent may be more workable. But -- if every grandparent willed an appropriate amount to some grandchild's account, it would work out (with a small balancing pool), creating a small incentive for the intermediate generation to have more children.

The answer to this dilemma probably lies in revising the estate-resolution process, making HSA-to-HSA transfers largely automatic within families, devising a common law of special exceptions and adjustments, and creating a pooling system for special cases which defy simple-minded equity. A large proportion of grandparents have an indisputable defined obligation, and a large proportion of grandchildren have an indisputable entitlement. The difficult problems reside in the exceptions and require a Court of Equity to decide them. We leave it to others to fill in the details because there could be many ways to accomplish this, and some people have strong preferences. The basics of this situation are the grandparents with surplus funds are likely to die later, but they are still likely to die, close to the age when newborns are appearing on the scene.

When you get down to it, the problem isn't hard if you want to solve it. By arranging lifetime deposits in advance, a large number of grandparents could die with an HSA surplus of appropriate size. A large number of children will be born without a standard-issue family and need the money. After the standard-issue cases have been automatically settled, these outliers can be referred to a Court of Equity charged with doing their best. After a few years of this, the results can be referred back to a Committee of Congress to revise the rules.

A basic fact stands out: most newborn children create a healthcare deficit averaging 8% of $350,000, or $29,000, by the time they reach age 21. Most young parents have difficulty funding so much, and so all lifetime schemes face failure unless something unconventional is done to help it. A dozen more or less legitimate objections can be imagined, but seem worth sacrificing to make lifetime healthcare supportable. The main alternative is to pour enormous sums into the government pool, and then redistribute them. I am uneasy about letting the government get deeply mixed into something so personal. So, speaking as a great-grandfather myself, about all that leaves as a potential source of funds, is grandpa, and even grandpas sometimes have an aversion to long hair and rock music.

Originally published: Wednesday, February 18, 2015; most-recently modified: Friday, May 31, 2019