Related Topics

Philadelphia Economics

economics

Railroad Town

It's generally agreed, railroads failed to adjust their fixed capacity to changing demands. It's less certain Philadelphia was pulled down by that collapsing rail system.

It's generally agreed, railroads failed to adjust their fixed capacity to changing demands. It's less certain Philadelphia was pulled down by that collapsing rail system.

Drexel and Morgan, Investment Bankers

|

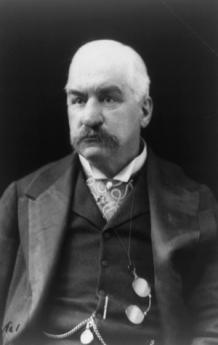

| J.P. Morgan |

In the 1840's it was America that was the developing nation, and Europe was the rich old developing country with risk capital looking for opportunities. The situation is reversed now, and we have developing country funds devised for the purpose of investing in risky foreign adventures without knowing much about them. Anthony Drexel, born in Austria but doing business at 3rd and Chestnut Streets, could see all the problems which now would face an American investor wishing to take a flier in, say, the African Central Republic. How are you supposed to tell a good one from a bad one; how do you keep from being fleeced? Today's investor in Private Equity becomes a limited partner of a general partner who may do his best but can look forward to your fees and commissions no matter what his performance turns out to be. If he sits in an office in America, he likely knows little of what is going on in Africa; if he works in Africa, he is beyond your reach in the event of shenanigans. Drexel's solution was to offer a job to young J.P. Morgan.

|

| Junius Morgan |

J.P. was to run the New York office of Drexel and Company. His father, Junius Morgan, was to work in London. Junius would gather up investment funds from Dukes, Earls and similar, and send them to America. Meanwhile, J.P. Morgan would have the job of discovering the best investments and overseeing the ventures, which at that time were mostly railroads. At this point, Drexel's approach began to differ from the current investment fund, which mainly tries to give good advice. J.P. was a leader in Wall Street and an informal enforcer of rectitude. As everyone sort of knows, Pierpont Morgan was one mean mama. He may seldom have actually done it, and he certainly never said it in so many words, but his manner radiated the news: if you mess around with one of my clients, I will promptly ruin you. That he was clearly able to do so was sufficient threat. The Wall Street air was filled with his maxims, such as "I shall never do business with a man I don't trust." and "Brains don't make you rich, a character does." He was a tough man, in a tough business. Underneath his pompous maxims, the threat they implied was real.

|

| George B. Roberts |

Morgan had a general approach to industries, developed well before the Sherman Antitrust Act of 1895, and best exemplified by his approach to transcontinental telephone systems. Instead of starting a telephone company on the East Coast and expanding it to the rest of the country, he took the approach of encouraging the creation of dozens of small local telephone companies. Watching their performance, he merged with the ones with the best track record and set about quashing those who refused to merge. From his point of view, it sorted out the good ones from the bad ones and created a nation-wide network in an undeveloped country much more rapidly than trying to establish a national champion by building it up. Variations of this simple approach were successful in the steel, coke, banking, and railroad industries. All of these were highly cyclic industries; when there was a general financial crash, it was time to buy up the survivors, and squeeze the hold-outs. Most people regarded a financial panic as something to be avoided at all costs. For the Morgan firm, they were buying opportunities which came along every few years if you saved your cash and waited for them. During the 1929 panic, another financier famously rubbed his hands and remarked that "It would squeeze all the rottenness out of the system."

|

| Corsair |

In the case of the railroad industry, J.P. Morgan set about consolidating small railroads into the New York Central about 1880. In 1885, he reached a famous accommodation with the Pennsylvania Railroad, called the "Corsair Accord" after his yacht on which it was signed. The two actual signatories were George B. Roberts, President of Pennsylvania RR, and Chauncey Depew, acting on behalf of William H. Vanderbilt, President of the New York Central RR, who was sick and eventually died in a few months. The agreement was relatively simple: the two railroad giants would stay out of each other's way. Ten years later, the Sherman Antitrust Act would be enacted, flying the flag of enshrined competition as the national goal in every industry. The Act was mainly directed against Morgan's ideas if not his person since Morgan would unashamedly point to duplication of rail systems as a perfect example of asinine behavior. Political correctness was not his style.

Originally published: Thursday, October 21, 2010; most-recently modified: Monday, May 20, 2019