Related Topics

Japan and Philadelphia

Philadelphia and Japan have had a special friendship for 150 years.

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Making Money (5)

|

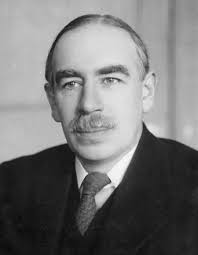

| Keynes |

Every newly-rich country seems to experience at least one episode of adolescent giddiness, thinking there is no stopping them, their trees will all grow to the sky. America's comeuppance took place in 1929, Japan's in 1990. Sooner or later the Chinese and the Indians will learn that it is unwise to grow faster than human systems can readjust, overcapacity is certain to appear at some point, and the new bumpkin will then appreciate what it means to have a business cycle. After a variable time, deflation reaches the bottom, and it is past time to inflate back to normal. Lord Keynes (pronounced "Caine's") advised Franklin Roosevelt to promote government spending, even useless spending, but it didn't help as much as they hoped. The Japanese built bridges and tunnels to nowhere, and that didn't help much either, although encouraging residential construction worked better than they expected. Wars are good for deflation, too, but only if you win them.

America has devised three methods for combating deflation: cutting taxes when other nations maintain fixed currencies, cutting consumer prices at the expense of developing countries, and cutting costs by improving productivity. You could combine these three methods into one principle: if you can't increase the amount of money, you must increase virtual spending power by cutting prices. In a deflation, consumer prices have fallen because of overcapacity, so you must cut consumer costs in those areas which will not respond to overcapacity. Same money, more buying power. Other countries are apt to resort to gold as a way of preserving their buying power; it will be an interesting struggle.

Nevertheless, it will be important for America to spend its affluence on increasing productivity rather than trinkets and junkets; we, too, have our share of adolescents. Computers have helped us reduce transactional costs everywhere; transportation is in fair shape. Education is an expensive mess, simply begging for improvement. Housing is still using 19th Century methods. Entertainment is expendable. We have a huge supply of underutilized labor in the black male community, in the early retirees, and in our comfortable work habits. Fighting wars is a pretty expensive hobby. How well we withstand the next world recession will depend to a major degree on how well we solve the problems that obviously need solving.

The business cycle will continue to cycle, but it is possible to feel pretty good about American ingenuity in relating, globalizing and enhancing productivity. There is even a wicked satisfaction in reminding our British cousins of their little witticism which made the rounds after World War II:

In Washington, Lord Halifax

Once whispered across to Lord Keynes:

"It's true that they have big moneybags,

But we have all of the brains."

Originally published: Thursday, June 22, 2006; most-recently modified: Thursday, May 23, 2019