Related Topics

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Making Money (4)

If lowering taxes is inflationary, how can it be that several financial columnists refer to buying low priced

|

| China Man |

Chinese imports as "importing deflation"? It would seem, in both cases, that consumers end up with more money in their pockets, so both cases must be inflationary. To answer that twister, you also need to consider where the inflationary new money comes from.

|

| chinese labor |

When the government lowers its revenue by lowering taxes, it creates a deficit which is paid for by issuing bonds. That's inflationary until the bonds are paid off. If the bonds are ever paid off, the amount of money in circulation then returns to its original level. The public has effectively given itself a loan by lowering taxes, so after a temporary spell of inflation, there is no permanent effect on circulating money at all. By contrast, when Chinese workers agree to work for lower wages than Americans, that causes inflation for the American economy because Americans have more spending power left over. How they spend it is their business; the bonanza may surface as a stock market bubble or a real estate bubble, a credit card bubble or a spectacular Christmas shopping season. But gradually the extra money seeps out into the economy as extra wealth of some sort. Whether you describe it as real added wealth or just inflation, maybe a quibble -- but it clearly is not deflation.

|

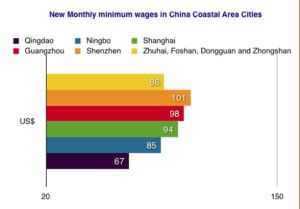

| Chinese wages |

But when a successful financier, betting his own money on his analysis, says that America is "importing Chinese deflation", it's likely he says something important, however imprecise technically. In this case, it would seem to be an observation that the globalization method of creating inflation minimizes some of the usual consequences of inflation. Since the low prices of Chinese products are mainly due to low Chinese wages, they discourage wage demands in this country, even in industries which do not compete against imports. That's politically important, even though there are many more consumers than manufacturing workers, and the nation as a whole is better off for the globalization. In short, inflation is not invariably a bad thing.

Now, just think of the problems that create for the Chairman of the Federal Reserve, who is charged with maintaining level prices, and defines our whole currency system on doing whatever it takes -- to avoid inflation.

Originally published: Thursday, June 22, 2006; most-recently modified: Thursday, May 23, 2019