Related Topics

Japan and Philadelphia

Philadelphia and Japan have had a special friendship for 150 years.

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Paying Bills Electronically

|

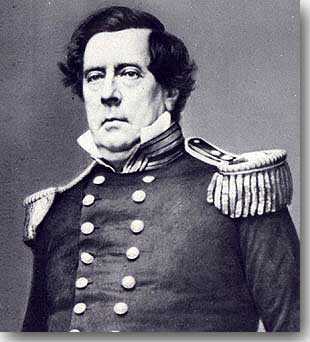

| Commodore Matthew Perry |

Commodore Perry "opened up" Japan in 1854, but Ronald Reagan opened up the banks and finances of that country more than a century later. Because his chief of staff Don Regan had been in charge of Merrill Lynch, the Japanese let that company in, and because of some favors by J. P. Morgan in the 19th Century, they also admitted Morgan Stanley. Although several Japanese banks had grown to be the largest in the world, the Japanese never adopted the popular American habit of personal checking accounts. One of the surprised observations of the new American pioneers was that a bank could be pretty successful, without all that expensive nuisance of processing checks. Twenty years later, American banks are starting the long and difficult job of weaning their customers away from paper checks.

There's even a personal story of an early American expatriate sent to work in Tokyo for Morgan Stanley, taking his shirts to be ironed by the local Japanese laundryman whose English was poor. Each time he collected his shirts, the American would pull out a blank check, signed with a flourish, accepted with much bowing and murmuring of delight. After several months, an English-speaking Japanese was summoned to one of these ceremonies, and the expiate was politely asked what he was planning to do about paying his bill. His highly venerated checks were all neatly stored in a lacquered box under the counter but had never been taken to the bank.

Americans are now engaged in a frenzy of using credit cards. Something has to change in that system, which is proving to be a very expensive substitute for checks since it amounts to giving short-term loans to and from a lot of people who don't need, and didn't ask for, a loan. Given an open choice of paying the invisible extra cost of using a plastic card, or just waiting until the end of the month to complete the transaction, most sensible people would prefer to wait. The plastic card system just can't continue in its present form, and one possible substitute is to use a personal computer to pay bills electronically. That's a step better than using plastic, but as we will describe, it needs to become two steps better before it is really satisfactory.

To do electronic bill-paying you, of course, need to have a computer, and you have to go through the laborious process of entering a lot of information about each person who is going to get paid. Once that is done, and security precautions established, paying bills is a much simpler task than it used to be. The helpless consumer even has the occasional experience of finding that some creditor billed him twice, or inaccurately; my computer caught your computer making a mistake. It now hard for me to imagine going back to paper checks and bank stubs.

However, I've become spoiled and demanding. There are four deficiencies in this system which irritate me enough to bring me to an open bidding process ill switch my accounts to any bank that fixes them.

1. Invoice memo entry. The entry screen you use when you prepare a check should contain a block to enter some kind of notation, such as the biller's invoice number. When that block is completed, the material should be printed on the check. The memo might say "Girl Scout Cookies", or "Hedge trimming", or "Invoice # 123456". Any programmer ought to be able to make that change in half an hour, and it could transform the average consumer's box of canceled checks into a meaningful set of accounts. More importantly, returning the invoice number to the biller would allow him to match the payment to the item, an important step in keeping your accounts straight with a regular counter-party. You are of course saving your creditor some trouble; but if he gets your accounts scrambled, it soon becomes your trouble, too. The inability of any bank I've asked, to make this simple change, is a clear sign that they are using a software vendor for this process, and everybody has stopped engineering the product once a sale has been made.

2. In Process, Processed, Paid. When you pay a bill, the item is noted to be "In Process". An impatient creditor can be told to be patient, it takes a day or so to get this work done. When the bank sends the check, the notation is changed to "Processed". But then, there is a limbo. The bank has sent the check, it washes its hands of it. Six months later, if the postman lost the check in the mail, it will still say "Processed", the creditor is dunning you, you tell him you paid it, he says he never got it, you call the branch bank to get an 800 number to stop payment. On the other hand, if the bank would change the word to "Paid" when the check clears, you would know that the problem is entirely different and act accordingly. If a check is still "In Process" after say two weeks, you stand alerted. Fixing this problem is somewhat more difficult, involving a matching process between the bill paying and the check clearing. The fact that this isn't already done is a strong indication that the bill paying is being done by an outside vendor, and two parties have to come to an agreement about how to match records. If, on the other hand, both steps are run by two departments in the same bank, then it may be time for management shuffling.

3. Your bank balance. Once you recognize that this internal reconciliation isn't being done, you see that your bank balance is inaccurate to some unknowable degree. If your bank balance is debited when the check is issued by you, you will have an uncertain balance to the degree that checks haven't been cashed, and you will be less likely to be alert to lost items. If the balance is only debited at the time the item is cashed by the recipient, you can easily be misled into thinking there is more money in your account than there really is. You will then be tempted to overdraw your account, thinking the stated balance is available to spend. If the third possibility is followed, the balance is debited when the bank puts the check in the mail, and you will never be sure just where you stand. So, although an argument can be made for each of the three methods, all three mislead the customer. There is no escaping it, the bank needs to post two different balances, or at least add a third notation for "items in process". A fourth item would be still better, "overdue items", for checks that have been sent but not cashed within a reasonable time. Lets even consider going big-time: put an asterisk beside items in the process, and two asterisks beside overdue items. And then total the asterisked items at the bottom of the page. Now, is that so hard?

4. Yearly Bank Statement. My present bank purges these records every three months, and even tell me of the big savings it makes by reducing dead storage space. That's a pain, because everybody pays income tax once a year, making it a big convenience to have all deposits, payments and pending items totaled for the year. For about a hundred dollars, I can buy enough disk space to hold about 10,000 yearly statements of average size, so yearly statements could be stored for a year at a cost of about a dime. It's pretty hard to believe there wouldn't be more savings than that, for the bank, in reduced telephone inquiries. If not, here's my dime.

And here's my checking account, with gratitude, for any bank that has the moxie to do these things for me. It would be well worth the nuisance of re-entering the account information to switch to a bank that seems to care what its customers would like. And if that new, imaginative bank gets as many customers as I think they would get, they will need an automated program to transfer all that account information.

Originally published: Thursday, June 22, 2006; most-recently modified: Friday, May 31, 2019