Related Topics

Healthcare Reform: Looking Ahead (2)

The way to make certain you have enough -- is to have too much.

Health Savings Account, Classical Version

Well, it's all called the Health Savings Account, Classical Version. John McClaughry and I invented it as the Medical Savings Account in 1981, and we both consider it to be on the short list of things we want to be remembered for. The central feature of these accounts is they pay your medical bills with a special debit card, and they get every tax deduction we could find, except one.

Proposal 79: The law says they must be linked to catastrophic health insurance but are forbidden to pay the premium. This omission should be repaired, by changing the law or regulation; with this change, they would become superior to the discriminatory employer-based tax abatement discussed below, because that could extend the income tax relief equally to everyone, regardless of employer.Since almost everyone would agree, why not adopt it and get on to other business? The essence of the whole remaining debate is how to pay for comparatively low-cost care, especially for people with low incomes, neither impoverished nor affluent. Some people will have to be subsidized, and the rest are mostly able to save enough to pay their medical bills. We can ease things for borderline cases with tax deductions, and the rest is mostly a routine drawing of lines. The concept is discussed in greater detail in later sections of this book. Right now, all it immediately needs is a revision of those two regulations of the Affordable Care Act.

An HSA should be overfunded. Any surplus can be used as a retirement fund.

|

Instead of confronting, let's out-bid them, with a Lifecycle Health Savings Account (L-HSA). The dreams of the future usually include legalizing a few radical advancements which become normal parts of the landscape in time. By adding passive investing and the power of compound interest, the HSA becomes a Lifecycle (multi-year) Health Savings Account, providing the balance can be legally carried forward for a lifetime or even longer. The out-bidding already takes the form of adding a new revenue source, not by reducing the benefits.

Proposal 80:At this point, it probably would be wise to add some legislation clarifying the ground rules since several professions would have to cooperate in allowing a new line of business for whole-life insurance.In effect, it could become a do-it-yourself whole-life insurance company, which pays for health insurance instead of funerals. I'd love to see the whole-life insurance companies adopt the idea, which comes close to imitating their business model. There's no reason why stockbrokers and/or investment managers couldn't do much the same thing in competition--it all depends on what the enabling statutes happen to enable. Whole-life insurers could manage the money professionally and would create much-needed competition for old-style health insurance companies, now operating on the "use it or lose it" principle. The large amounts of money the savings account approach would generate, seemingly almost discredit the idea as exaggerated; we'll, therefore, let the reader do some of the math. Perhaps you do need to dangle astonishing incentives to get people away from the something-for-nothing term-insurance approach which is now threatening to shoot itself in the foot. The full transition is a fifty-year project, but long-term progress usually doesn't seem so long looking back on it, and it gives everybody a chance to claim some credit. Remember, it's only long-term lack of progress you really need to fear.

Let's not quibble. It might even be legally or financially possible to adopt one approach, year by year, or the other, spread over a life cycle; and hurry it all up by making it into a mandatory monopoly. But it is inconceivable for half of a whole unwilling country to tolerate a mandatory health system they widely resent. However, it seems possible to implement parts of both approaches voluntarily right now, without major disadvantages except extra cost. You can do that, or you can read the Lifecycle-HSA as just an alternative proposal to consider. The main dream offered here prefers to cut average lifetime health costs in half ($175,000) but might be expanded to full lifetime coverage of $350,000. Or reduced by individual vendors to some more affordable fraction, such as by a reduction of average costs by only a quarter ($85,000) or a tenth ($35,000). To do this requires some legislation, but $35,000 times 300 million population is scarcely trivial. Even Bill Gates isn't worth half of that.

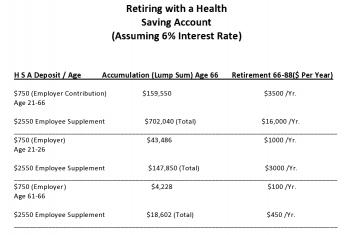

Over-investment in Health Savings Accounts -- The Retirement Alternative. Because it's a new program, with financing uncertainties, we advise everyone with an HSA to consider overfunding it as a precaution. If you could use resulting surpluses for something else, it should reduce the hesitation to overfund. One alternative is to use Medicare exclusively after age 66 and transfer the surplus to your IRA retirement fund. That's legal and essentially cost-free. Consider all the foregoing to be a short introductory look at the theory of Health Savings Accounts; we next display an actual example, using actual numbers which just came across our desk from a large and local insurer. To keep it simple, we assume the client had no serious illnesses at all and paid for minor illnesses out of pocket. That will rarely be the actual case, but its use here is to illustrate the safety of over-investing in the product in order to fund a healthy retirement with the overflow. Although it will provoke extensive discussion later, we assume the deposits into the HSA will earn 6% compound interest.Read on, to see how the passage of a few relatively harmless laws, might offer poor people a way to get a rich man's health care. Getting rich in this sense amounts to funding your medical bills in a radically new way, but it does not imply any change in the kind of care you receive. Otherwise, it certainly will cost somebody $350,000 per average lifetime, as calculated by Michigan Blue Cross, verified by Medicare.Example One. Assume an average employee aged 21 receives $750 yearly from the employer and deposits $3300 into the HSA account, adding the personal supplement permitted of $2600 extra, until age 66. Deposits earn 6% compounded. After age 66, income tax is paid and the remainder rolled over into an IRA. Subsequent to retirement, the minimum retirement is paid annually, while the balance continues to earn 6% after tax.

Example Two. Assume an average employee aged 21 receives $750 yearly from the employer and deposits $3300 into the HSA account, adding the full supplement permitted of $2600 extra, until age 26 when he/she retires to get married. Deposits earn 6% compounded. After age 66, income tax is paid and the remainder rolled over into an IRA. Subsequent to retirement, the minimum retirement is paid annually, while the balance continues to earn 6% after tax.

Example Three. Assume an average employee aged 61 receives $750 yearly from the employer and deposits $3300 in the HSA account, adding the full supplement permitted of $2600 extra, until age 66. Deposits earn 6% compounded. After age 66, income tax is paid and the remainder rolled over into an IRA. Subsequent to retirement, the minimum retirement is paid annually, while the balance continues to earn 6% after tax.

You pay income taxes when you make the transfer to the IRA and on IRA withdrawals. Most of the investment return is tax-sheltered, however. Assuming 6% tax-free earnings and a 15% blended income tax rate, your investment of $132,000 would be worth $698,000 pre-tax, and $482,000 after income tax, at age 66. At that point, suppose you pay your HSA tax and re-invest the proceeds in an IRA. Assuming a life expectancy of 88 years at that point, you would leave $1,638,000 when you die, or $1,493,300 after income tax. That's assuming you actually spend nothing out of the account, but since it's a surplus, it also represents how much you could have spent without affecting the retirement. Be careful of this point, however, because the age at which you spend it will markedly affect the outcome. That's unlikely to be sure, but if you consume it all you have paid for all your lifetime healthcare, as best we can estimate it. The point of this calculation is not to make everyone rich, but to demonstrate the financial power of the approach. With a little management, it easily covers the actuarily projected lifetime cost of health care of $350,000 per person and leaves enough slack to be comfortable about it. In case anyone questions the ability of a poor person to save $3300 per year, lifetime savings would amount to $440, per dollar invested at the beginning. That's too attractive to brush aside on the grounds you might never be able to do it, even for brief periods. It's quite honest and legal, starting today, but an additional reason to show it here is to demonstrate how little anyone has to lose by investigating it today. In fact, over 12 million people have already started such arrangements. If the rudiments of the plan are that attractive, just imagine what a few legal clarifications could accomplish.

What's the secret? Instead of paying 10-15% to service your bills, you earn 5-6% interest by pre-paying them. The swing between those two is the difference between comfort and worry. There are other swings, but that's the main one.

But it doesn't imply that no one will be worse off. There are 1,500,000 employees of health insurance companies, but there are only 800,000 licensed physicians. Doesn't it seem excessive that for every doctor you see, there are two insurance employees handling the bills? It's probably conservative to guess that every doctor hires another insurance employee, and every pharmacy hires several. Every hospital probably hires a hundred, and every laboratory or x-ray laboratory hires more; it just seems to go on, and on. Five or six clerical insurance employees per doctor don't seem like a wild guess since a lot of doctors aren't actually practicing. Those who want to continue with this sort of thing can pay for it. Surely, the rest of us deserve some other choice.

Because this book is written during a confusing period where both Health Savings Accounts and Obamacare have been enacted, but the position of the Supreme Court has not been clarified, nor the regulations coordinated, -- what an individual should do is highly specialized to his age and situation. We cannot predict what upsets the November 2016 elections will bring, or what the result of their reconciliation will be.

Essentially, this particular health plan offers its groups the choice between an Obamacare with, and Obamacare without, a Health Savings Account. Into the HSA version, the employer effectively contributes $750 but gets a lower premium from raising the deductible. Never mind the economic argument that the cost ultimately comes from the paycheck; most people will say it feels like a gift. The compound interest in the future dictates that every young person should enroll in an HSA at the earliest possible moment, and supplement the employer contribution to the limit of his ability. A young lady, for example, should go to work immediately after graduation from school, even though she plans to drop out of employment when she gets married. An older employee, on the other hand, is far less expensive to the employer than he appears to be if the retirement benefits are considered. If a person reaches age 61 without provision for retirement, there is little to be done about it.

Commentary. The high deductible portion of Obamacare serves as the catastrophic link required by the HSA enabling act. The employee is annually allowed to contribute up to $2600 to the savings account additionally. (There's a family plan, with different contribution rates.) There's no way to know how long an employee will remain with the same employer, or whether a new employer would continue the same coverage; but at least an individual's HSA has been established, provided you go ahead and do it. If an employee starts this plan at age 21 and continues it to age 66, the outside potential is to transfer $159,550 to a regular IRA at age 66, assuming 6% interest, but no personal supplement, and only out-of-pocket health withdrawals. Never mind theoretical economists; it's a very good deal, and it almost feels free.

But don't get carried away; you can't spend the money twice. The example shows the financial benefit of being lucky with your health; it could also be said to reflect the cost of being unlucky or careless if your health is bad. Its success depends on young healthy people saving their money and generating extra income before they become older people getting sick and having to spend their savings. Meanwhile, scientific progress will exaggerate both the savings and the attained age before the spending begins. In the past century, that added thirty years of longevity, and hence thirty years of compound interest. If some scientific miracle should add more cost than longevity, a mid-course correction might have to be applied. Some future generation might have to answer the question, "Didn't you want to live an extra ten or twenty years?" I would have to say the medical profession has been pretty good with this juggling act in the past when we were in control of it; one of the ponderable dangers of upsetting the system is the danger of upsetting this balance in the future if control of the payment system falls into other hands.

The foregoing should suffice as a summary of this book's proposal. The next section describes some of the other serious problems with healthcare and how they got that way in the past century. Sometimes more funding will help these problems, sometimes it won't. The section following that will describe some of the nuts and bolts of Health Savings Accounts, and sketch in some more elaborate variations which might be possible. By far the most important new concept to be thoroughly absorbed is the approaching wrestling match between the health industry and its finance partner. Recall that we have estimated the Health Savings Accounts would earn 6% compound interest income during the long lifecycle between healthy youth and sickly elderly. Actually, that is likely to be an under-estimate.

Stock Market Issues.For the past century, the foremost student of the matter, Roger Ibottson, has shown the equity stock market has averaged about an 11-12.7% total return. Investors in index funds of the same stock have received about 5%. Three percent of this attrition is ascribed to inflation, leaving another three percent unaccounted for. Money managers use the residual 3% for expenses and to buy bonds as a safety measure. While the law of large numbers will ordinarily account for the ordinary jiggles of the stock market, there is some other cycle at work causing a severe crash every 25-30 years. It is thought wise to set aside 25-40% of the portfolio in bonds to ride out such "black swan" storms. This, in essence, is the central issue of the third section. The final section describes other variations of the Health Savings Account concept, particularly as it involves transitions from other funding mechanisms.

Originally published: Friday, June 26, 2015; most-recently modified: Tuesday, May 21, 2019