Related Topics

Old Age

New topic 2019-04-09 16:04:33 description

Health Savings Accounts, Regular, and Lifetime

We explain the distinction between Health Savings Accounts, Flexible Spending Accounts, and Lifetime Health Savings Accounts. Sometimes abbreviated as HSA, FSA, and L-HSA. Congress should make it easier to switch between them. All three are superior to "pay as you go", health insurance now in common use, only slightly modified by Obamacare. It's like term life insurance compared to whole-life. (www.philadelphia-reflections.com/topic/262.htm)

Amending HSAs To Include Tax Sheltering

|

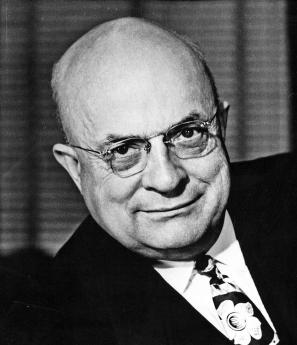

| Bill Archer |

There is nothing the matter with Bill Archer's law to enable Health Savings Accounts, except one thing: it forbids payment of health insurance premiums via the Accounts. Probably, that provision was a necessary compromise, to get the bill passed. But just imagine what would happen if it were amended to permit such payments: money legitimately passing through the accounts gets an income tax deduction.

|

| Henry J Kaiser |

Anybody can start an HSA, so with a small amendment, anyone could get an income tax deduction for health insurance, by writing a check from the Account to pay the premium on his present health insurance, or even just notifying his bank's Bill-Pay to do it automatically. By this simple maneuver, everyone would be eligible for the Henry Kaiser tax exemption now limited to employer-paid insurance. This simple change would eliminate a festering sore of unequal treatment under the law which has been allowed to persist for eighty years. Except possibly for those who don't want a tax exemption or don't want to take the trouble to use the HSA. It's hard to imagine anyone taking that attitude, so a powerful incentive to create HSAs would leap into place. As we have said in many places, if the tax cost of the universal exemption to the government is an objection, it could easily be paid for by lowering the exemption for employer-based insurance. The number with the exemption at present so greatly outnumbers the population excluded from it, that the reduction in tax exemption making it equal is surely less than 25%. It will nevertheless be resisted, not because of the small tax cost, but because the present inequality drives people toward employer basing. Even employers would not lose much because all the business competitors would be treated equally. The main resistance would come from insurance companies which specialize in the weird forms of health insurance specially designed to adjust to existing law. Perhaps they should be compensated for their loss, although that sort of thing is seldom done in our system of government. Rather, they would be expected to accommodate the new rules of business or go out of the business. That's traditional, and it is traditional for their stockholders to insist that they resist it, leading to the eternal struggles of "creative destruction," which is universally praised as an ornament of our culture, except when it applies to yourself.

Conversely, insurance companies which provide Health Savings Accounts will flourish with new customers, so existing health insurance companies are urged to add a new form of business and prosper. Any change of the rules requires time to re-adjust, so there will be room for both kinds of health insurance, for a long transition period, perhaps permanently. Let a hundred flowers bloom. In fact, all of the current plans being offered under Obamacare contain deductibles of at least $6000, so the designers of that Act have grasped the right idea, which includes tacit phasing out co-payments. A copayment of 20% is well demonstrated not to be enough to influence patient behavior, and a copayment of 50% is seen by the public as no insurance at all. Copayment has always been a way of making the premium cost appear smaller than it really is, and it's very simple to calculate in a bargaining negotiation. A twenty percent copayment reduces the premium by twenty percent, and that's about all there is to it. Total costs are largely unaffected, except they trigger the invention of another layer of insurance to cover them.

|

| Obamacare |

It presently is difficult to know how many people will have health insurance after Obamacare settles down, and how much it will cost. But the Wall Street Journal reports that all of the plans being offered by the Insurance Exchanges have at least $6000 deductibles, and the various approved insurance plans cost between $187 and $590 a month. The Obama administration seems to have grasped the idea that paying small claims with three layers of insurance is a pretty expensive way to pay your bills. Therefore, it is possible to imagine an agreement between the Democratic Senate and the Republican House of Representatives, for reasons of cost, alone. Later in this book, we propose that all small claims by everyone be paid out of Health Savings Accounts, and all hospital claims are paid by diagnosis since the bedfast patient has no opportunity to bargain in the marketplace. Getting the hospitals to charge everyone the same, is an entirely different issue. The concern about such a rule is that it may contain an incentive to perform elective surgery as an inpatient when a vast number of small surgeries are adequately managed as less expensive outpatient procedures. Special accommodating adjustments such as patient discounts will probably prove necessary to prevent such an unwise migration of the locus of care. Indeed, the small but irritating local monopolies of ambulances may need to be addressed, as well, since a patient may be well enough to recover at home, but not well enough to drive himself home.

For the moment, let's not get down into the weeds of this thing. Let's just pass it, and immediately.

Originally published: Saturday, February 15, 2014; most-recently modified: Thursday, May 09, 2019