Related Topics

Reflections on Impending Obamacare

Reform was surely needed to remove distortions imposed on medical care by its financing. The next big questions are what the Affordable Care Act really reforms; and, whether the result will be affordable for the whole nation. Here are some proposals, just in case.

Concerns Provoked by "Whole life" Health Insurance

An entirely new concept like reconstructing health insurance on the "whole life" model can be expected to provoke concerns. Here are a few of what surely is not yet a complete list:

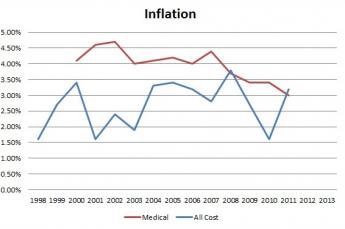

Inflation. It is true that rampant inflation would be injurious to the whole idea of permanent health insurance. However, it is the job of the Federal Reserve to maintain price stability, and many changes have taken place in the Federal Reserve's methods of operation since 1913. The most notable one was the abandonment of the gold standard by President Nixon in 1972 as a late consequence of flaws first introduced at the Breton Woods Conference in 1945. Observers may be of the opinion that the gold standard was stronger protection against inflation than the present inflation-targeting one, but the latter is nevertheless the system under which we operate. It should be recalled that in 1945, America had two-thirds of all the gold in the world, and international trade was being stifled by the unbalanced distribution of any common means of exchange. The correction of this gold maldistribution finally came to an end when a correction was no longer necessary, and indeed in 1972, it was possible to foresee an American gold shortage if trends continued. The American currency is no longer supported by a link to gold or any other commodity. In its place, the Federal Reserve issues or withdraws currency from circulation in response to inflation, attempting to maintain a steady inflation rate of 2% to match the growth of the economy. There are disputes about exactly which inflation rate would be ideal, but the ability of the Federal Reserve to maintain its stated targets has been reassuring. While there is room for argument among economists about the precisely optimum inflation target, the variation has been less than 1/2 %, even in times of economic disorder as severe at the present one. The projected finances of funded health insurance can safely sustain much greater miscalculation than this. If a threat is present, it comes from other directions.

|

| Inflation |

The suggested choice of an index fund composed of the entire list of domestic American common stocks was intentional and may be vital. The Affordable Care Act's provision for mandatory universal coverage makes it official that the full faith and credit of the American taxpayer stands behind the funding, so the American stock market is a close surrogate of that pledge. Anything which could destroy the stock market would constitute a threat to America much greater than a collapse of its health insurance, and enormous efforts would surely be invoked to prevent such a disaster. The wisdom of ransoming the whole economy to a comparatively small component of itself can be questioned, but it is nonetheless difficult to imagine a default when such heavier consequences would follow it. The same can be said of a permanent stock market decline, a devaluation of the currency, or a bond market default. These things can happen, but injuring health financing would scarcely enter the discussion.

The Changing Mix of Disease. Most of the rest of the world still concentrates its medical attention on the treatment of contagious diseases. In America, contagious disease scarcely makes the top ten concerns. No one would have predicted this a century ago, and no one can predict the mix of diseases, or their cost, a century from now. We do know that people will continue to be born and invariably to die, but we do not know what will kill them or what it will cost. It is even possible that an epidemic will unexpectedly sweep the globe, or an asteroid will hit the earth, but in general, big changes occur over more than a decade and give some time for readjustment. We tend to feel confident that our longevity will continue to lengthen, although in Russia it has lately shortened. Generally, new treatments have patent and development costs at first, and then become cheaper. But even healthcare workers enjoy raising their own salaries. It is difficult to predict population costs for healthcare eighty years from now, or whether they will be distributed evenly throughout the population. Unfortunately, this uncertainty will bedevil any system of financing that can likely be devised, but that does not mean reimbursement systems cannot be designed to cope with it.

Therefore, it is essential that any long-term plan, not just this one, build an accordion system into its initial design, and assign the task of watching over this problem to a permanent oversight body, particularly one which is able to resist the general economic pressures bearing down on the Federal Reserve. Inevitably, there will be times when the two bodies are adversaries. The easiest approach is, to begin with, the first and last years of life as anchors, and extend the reimbursement to intervening years as needs can be projected. This is one of several reasons why it is advisable to anticipate two parallel systems, one paying the bills as they appear and raising premiums if need be, while the other reimburses the first one as its fund permit. If a cure for cancer or Alzheimer's disease should appear, there might be funds to reimburse the other system for eight, ten or more years, readjusting premiums as it goes. If those miracle cures prove to be astonishingly expensive, the accordion would contract the other way, or its premiums would readjust in the other direction. Let us be clear what we are attempting: to reduce the annual premium of health insurance for the working years of life as much as we can. We must resign ourselves to remaining uncertain how much the premium can be reduced in the far future. No one spends public money as carefully as he spends his own. Complexity is therefore useful in areas where moral hazard is an important issue. Otherwise, grown-ups will behave like children at someone else's picnic.

Fluctuating Interest Rates.

At the time of this writing, the Federal Reserve has forced American short-term interest rates almost to zero, and held them there for three years. Japan did the same thing two decades ago, and they have had the unprecedented experience of remaining near zero for nearly twenty years, held there against the will of the Ministry of Finance by what is known as a "liquidity trap". Meanwhile, by the Fed buying long-term bonds in what it calls QE3, long-term interest rates have been forced in the opposite direction to a higher level than normal by the Federal Reserve. It is not necessary to explain here how this was accomplished, or why.What it is important to see is that the value of bonds, both short and long-term, can be manipulated by the Federal Reserve at the will of the Chairman or at most a handful of committee members. Therefore, predicting future prices or rates is nearly futile for everyone else, and investing in bonds is much riskier than it seems. However, there are economic consequences to interfering with markets, so over long periods of time, there are limits to what the Federal Reserve can do without destroying the economy. In a sense, this is one of the prices we pay for controlling inflation by inflation-targeting. There are boundaries within which the Federal Reserve can operate, and eventually, interest rates will revert to their long-term averages. In the very long run things will average out, and in the present context, we are imagining investment horizons of eighty or more years. This is why insurance companies can buy bonds with serenity, and just wait long enough for interest rates to normalize. But there must be an organization with some feature of immortality to intervene if the counterparty (The Federal Open Market Committee) is immortal and has unlimited funds at its disposal.

However, the Federal Reserve is not independent, no matter how hard we try to make it so. We are here discussing money which belongs to individuals who can vote, and who will surely be concerned about the investment policies of 17% of the Gross Domestic Product. The Federal Reserve can thus be easily imagined to develop an occasional severe conflict of interest between what is good for healthcare financing and what is good for the economy as a whole. The pressures which the public might decide to exert are not predictable, except that they would be hard to resist. The public has long proven itself to be a poor investor, buying high and selling low, even when it knows better. It almost seems better to avoid bonds in the portfolio of investments entirely rather than take the political risks, until it is recognized that this fund would soon develop the need to pay its claims every year, even if the stock market is at a low or stock dividends are zero. Therefore, it becomes clear enough that when bonds start paying 4% or more, the fund ought to buy some of them and hold them to maturity, just as life insurance companies do. Perhaps it becomes clearer why insurance companies hold a portfolio of 60% stocks and 40% bonds, but it is not exactly clear what to do when a fund of this size proposes to start when interest rates are at their present extreme. This sort of technical issue just has to be left to bond market professionals, since it involves short selling and other arcane issues that the public ought to know enough to stay away from.

The Investment Fund Becomes a Gorilla. Any insurance company must segregate a claims reserve fund, to assure it always has money available to pay its claims. In the system we envision here, the potential claims are too far in the future to be confident how much they will eventually become for a newborn baby, etc., but for the cohort just beginning that last year of life, the average cost of the previous year's Medicare claims will be abundantly clear in Baltimore, where they keep such records; it will probably be close to 20% of Medicare's budget. It certainly will be clear contributions to the pool of Health Savings Accounts cannot possibly match the claim cost of the first year in operation, and should try to do no more than reducing the initial end-of-life claims by whatever is available.

Adverse selection of beneficiary composition. Since the actual beneficiary would be the Medicare Trust Fund (and not the subscribers, who would then be dead) the impact of the news of this program would focus on the reduced Medicare premiums for younger subscribers. Medicare premiums would be reduced by no more than 20%, which would nevertheless probably be greeted as a windfall. The true beneficiaries would mainly be successor cohorts already in retirement, although paying off some of the Medicare debts dating back to 1965 would be a splendid idea. The fund will gradually level out, but it will likely take at least ten years to do so. Social Security and Medicare had the same problem at the time of their beginnings and elected merely to borrow the money, essentially never repaying it to the "pay as you go" system.

Eventually, Medicare will be put to the expense of developing premium billing systems of some complexity. At least, this new system has a source of revenue in the investment of its cash accumulations, with an estimated time of twenty years for it to catch up with itself. Much would depend on the medical costs of the twenty years prior to the individual last year of life; at the moment, they are might even be sufficiently lower to make this approach workable. But if some new treatments, for cancer let us say, are more expensive than the years they would add to longevity, this mixed blessing would have to be treated as an independent problem. Other solutions are available; the ability of the government to borrow at lower than prevailing rates are based on the assumption that it is a sovereign debtor. While this advantage is not guaranteed, it does exist and probably would be difficult to change. Furthermore, whether pre-funding would initially appeal more to younger or older people is hard to predict, calculating the potential source of revenue or losses from various mixtures would have to account for any difference in costs among various ages. Creating enrollment quotas for various ages in the early years of an accordion expansion might be workable.

And then, there are some macroeconomic perplexities. As mutual fund and index fund usage expand, fewer stockholders vote their proxies; the present proposal would make this problem worse so there would be even less resistance to lavish management salaries. The influence of family controlled stock within the portfolio, and of hedge-fund control would increase; possibly, foreign control would be easier. While true enough, these issues are not for this paper to deal with, only to mention.

The success of a pre-funded program would probably be judged by the extent of voluntary acceptance of it, and success would mean the endowment fund grows to be vast and well-distributed. Success would entail huge sums of money, potentially disruptive of the existing financial system. At peak capacity, the financial markets would have to absorb weekly inflows of about 1/4% of GNP, and eventually liquidations of double that size. Success might also entail a significant shrinkage of our oversized medical complex. Background churnings of that size would soon underlie every calculation in the markets, with uncertain consequences for what would probably be a steadily growing world financial marketplace, perhaps a disruptively international one. Not everything can be predicted so far in advance, but it is safe to say it would be tested for flaws until the markets conclude it is flawless, a very long time indeed. Such a Leviathan cannot be set on automatic pilot, but neither dare it relies on having the wisdom to make unblemished mid-course corrections. There are risks in attempting a middle approach, which must just be accepted as being less than the potential rewards of taking the risk.

Originally published: Friday, August 02, 2013; most-recently modified: Wednesday, May 15, 2019