Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Mr. Obama Attacks Unemployment

|

| Barack Obama |

Ever since two months after his inauguration, Barack Obama has been declaring that the central issue of the re-election campaign of November 2012 will be unemployment, now running at 9.2% of the workforce, and higher among members of his race. To hear it chanted, the issue is Jobs, Jobs, Jobs. His opponents, particularly the Tea Party element of the Republican Party, reply that he is going to remake the issue as Inflation, Inflation, Inflation. The present depression is remarkably similar to the one in the 1930s, except possibly for its unknowable outcome.

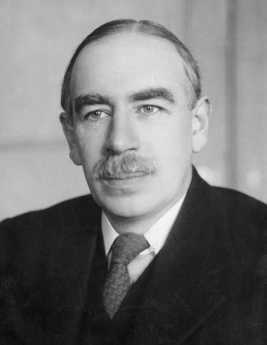

|

| Maynard Keynes |

Both Presidents Hoover and G.W. Bush were caught by surprise by a stock market crash, and both Franklin Roosevelt and Barach Obama were unprepared for it. It has been said that Roosevelt attempted the scheme of Maynard Keynes, while the Republicans in 1932 wanted to balance the budget. A little of that is still uncertain, but it's pretty clear that Obama is now attempting the Keynes remedy, while the Republicans seem to be saying we should balance the budget. But a more accurate description of what is privately promoted is that Obama wants to take money from the public sector and have the private sector pay it back after we recover from the depression. The Tea Party wants to take money from the public sector and pay it back after a private sector recovery. Same thing. Forget about token taxes on the "rich" and diversionary bluster about balancing the budget. They both want to shift money from the public sector to the private one, and they both plan to pay it back later when we can afford to. Or else never pay it back, letting one sector or the other dwindle. But the problem with this proposal from either party is that recovery is likely to take longer to arrive than the next election. Like Franklin Roosevelt, Obama will try to make it appear the recovery has arrived, first. That illusion worked well enough in 1936 for Roosevelt to be reelected in a landslide, but as soon as pump-priming relaxed, the double-dip of 1937 rebounded, adding to the political fury of the Supreme Court-packing issue. Five years of artificial stimulating wasn't long enough in 1937, and very likely won't be long enough in 2012. If Obama can't get past the five-year mark, the Democrats are probably done for, because the public won't stand for a five-year repeat of something that didn't work. The possibility of a third party, or a major two-party rearrangement, would be a real one.

What about balancing the budget -- will that work? No one knows, but it seems likely the public would be in a mood to try the one proposal that hasn't been attempted. It's not impossible that a deflation this severe will always take longer than five years to cleanse itself, so nothing at all will work until, in Andy Mellon's words, the evil has been wrung out of the system. At least we might then start telling ourselves that a catastrophe which ruins a whole generation is too hideous a price to pay for a housing spree. Ever again.

Originally published: Wednesday, September 07, 2011; most-recently modified: Friday, May 24, 2019