Related Topics

Banking Panic 2007-2009 (1)

Mankind hasn't learned how to control sudden wealth, whether in families, third-world countries, or the richest nation in history. The world banking crisis of 2007 is the biggest example yet.

Brunnemeier's Explanations for the 2007 Crash

|

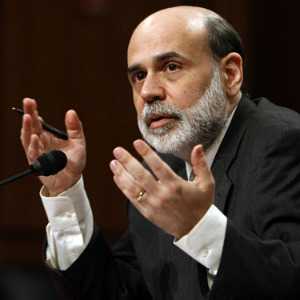

| Ben Bernanke |

The Chairman of the Federal Reserve from 2005-2014, Ben Bernanke, spent much of his time explaining current economic tangles to committees of Congress. At a hearing, his suffering audience asked for some homework. "Please suggest a few articles you think we should be reading." Two of his four resulting suggestions were written by Markus K. Brunnermeier, Professor of Economics at Princeton. Some of what Brunnermeier said was already known, some of it was novel. Of greater significance was that Bernanke, a scholar of economic collapses, and then vested with the power to investigate just about any lead, would make a public endorsement of Brunnermeier's analysis to Congressmen who actually held the power to implement laws. They weren't talking to an audience of helpless college students. Congressmen knew less about the minutia of the topic, but they had the power to act on their beliefs.

No doubt, further investigation will uncover more kinks in the hose, and subtleties will prove particularly arcane, or particularly blameworthy. Nevertheless, we seem to have probably reached the point to assume the main features of the catastrophe were on the table, articulated to people not easily deceived. Moreover, Congressmen had already adopted one 2000 page law that almost none of them had read; this must not be permitted to keep happening. So among other things, let's hope they have at least learned to be careful. If Brunnermeier and Bernanke have given us a list, let's expose it to public discussion. What's usually important is what they do, not what motives they claim.

|

| Markus K. Brunnermeiere |

1. Following the dot-com collapse in 2001, the Federal Reserve held interest rates abnormally low, claiming fear of even more severe deflation from the bubble bursting uncontrolled. By this description, the housing bubble was really the second dip of a double bubble. Within endless successions of bubbles, a futile issue is which tooth of the buzz saw cut off your finger. What determines your conclusion is the point where you chose to start. In this case, the preceding seventeen year period of "Great Calming" may perhaps make routine stress-test analysis possible. For contrary example, was a seventeen year quiet period without a major recession actually a coiled spring? If you can guard against such exceptions, perhaps correct conclusions may be reached.

2. The emergence of the developing world, especially China, from extreme poverty into relative affluence generated huge wealth surpluses which no economy was ready to absorb without danger of inflation. There is a feeling that China should have allowed its currency to rise. However, the same was said of Japan two decades earlier, and in any event, we may not have had the power to change it.

In summary, then, the emerging problem was one of too much cheap credit. Because of related uncertainties, this was a storm we probably could not prevent.

|

3. For decades, America has sought the goal of universal home ownership. Borrowing to buy a home has been encouraged by tax-favored mortgages, loosened credit, and bankruptcy standards, and weak borrowers have been supported by government guarantees in the form of FHA, Fannie Mae, Ginny Mae, and Freddie Mac. The Savings and Loan crisis can be viewed as another variation on the theme of wider home ownership. Meanwhile, renting has been discouraged by low returns for the landlord, with the additional hazard of reducing the mobility of the workforce, particularly in a recession.

4. Home mortgages have traditionally been issued by local lenders. However, cheap credit was primarily available from China, so new conduits needed to be constructed. The process of securitization of mortgages through aggregation and packaging as marketable bonds was a swift and effective way to put the cheap Chinese credit to work, serving the acknowledged national desire to promote home ownership.

In a second summary, cheap credit from the Orient pushed us toward some sort of bubble. Our own encouragement of home ownership assured the bubble would be a housing bubble. Perhaps some other form of a bubble would be preferable; if that is the case, our government is at fault.

|

The first four bullets in this analysis constitute conventional argument why we had the collapse of a housing bubble in August 2007, and this collapse in some way is supposed to have led to a recession. In his recent memoir, Tony Blair of England reduced the argument to a politician's catchy phrase. "We didn't have a market failure, we had a failure of one sub-segment of one portion of the market." But that is not exactly true. In August 2007 the markets experienced a sudden liquidity crisis, a lack of ready cash to pay immediate bills. A sudden worldwide shortage of cash caused a halt to the trading of just about everything. People could not collect their bills so they could not pay their bills. Survival in this environment depended less on how wealthy you were than on how much loose unemployed cash you happened to have when the music suddenly stopped. Possibly because of the real estate bubble, and possibly for other reasons, the whole world was in a trading frenzy, and cash was king. At this point, Brunnermeier is surely right that the comparatively small amount of real estate defaults was tiny in comparison with the trillions of dollars lost in the crash. He searches for "amplifiers". The possibility exists however that panic and hysteria resulted in bizarre losses, simply because everything uses money, so a shortage of money paralyzes everything. Consider the following issues:

5. It is said that 70% of stock market trades are now conducted between two unattended computers. The finest mathematicians in the world are probably programming those computers, but transaction speeds are now measured in nanoseconds. There is no time to evaluate events; it is inconceivable that every event has been anticipated. Imposing sudden pauses in trading, even for five or fifteen minutes, has proven to be remarkably effective in combating false rumors. However, the shift in trading from deposit banks to investment banks has created a whole host of unexpected advantages for the first trader who ducks out of the market. A traditional "run on the bank" is essentially based on first-mover advantage. But when short-term loans must be turned over in a day or two, simply pulling out for a day amounts to a run on the bank of a slightly different sort. It's the exploitation of the first-mover advantage in commercial credit, money market funds, repo's, daily auctions and many other nooks and crannies. A liquidity crunch makes many people into first-movers who didn't intend to be one.

6. Globalization has tended to externalize transactions within an international corporation into many sales steps between suppliers and assemblers all over the world. While this transformation has been accomplished with remarkable ease, it still vastly increases the volume of short-term loans, subject to the new form of a bank run, by hesitation whenever liquidity dries up.

Boom times and inexperience with new techniques created unsuspected instabilities. Major examples are found in computerization, globalization, derivatives, and -- curiously -- diversification.

|

7. For fifty years, diversification has been regarded as a safeguard, particularly when the various components are in independent environments. A liquidity crunch wipes out the advantages of diversification, however, because every sale involves money. Just as important is the hidden risk that failure in one area may drag down another. The most drastic example in the recent crisis was in the "Monoline" insurers, who insured only municipal bonds until recently when they diversified into insuring mortgage-backed securities. And of course, when subprime mortgages collapsed, they took down municipal bonds, with many more ripple effects after that. Diversification improves safety, but only if the entities which fail are inconsequential to the whole portfolio. Innovative bundling and tranching of securities can create hidden aggregates with the power to spread contagion if they injure the credit rating, or bond rating, or reputation rating of a company. Advanced mathematics could probably establish guidelines for the danger points, but then other advanced mathematics will find ways to evade the analysis.

8. Credit default swaps are merely short-term insurance policies against definable risks, and they have greatly increased the willingness of international commerce to take risks they would otherwise avoid. However, they are also hidden over-the-counter transactions; when they grew in a couple of years to be several times the size of the entire stock exchange, they frightened the regulators. When the crunch came, regulators were not reassured to be told that most of these swaps were in opposing directions, which would surely "net out" to a comfortable equilibrium. As matters turned out, credit default swaps did not apparently cause many financial failures. But when it was learned that it would take nearly three years to untangle all the paper at AIG, it was highly unsettling. Innovators and mathematical quantitative traders will always outwit regulators because they have a far greater incentive to get ahead of the curve. But more midnight accusation sessions at the time of a crash simply cannot be tolerated. If clearing credit default swaps through an exchange does not improve transparency, something else must be suggested and tried. The issue here is the huge volume of transactions. It should not be impossible to devise volume standards, above which all future innovations must develop transparency mechanisms.

In the fourth summary, the default of subprime mortgages was fairly serious, perhaps amounting to two or three hundred billion dollars. However, the liquidity crunch was much more serious, requiring $850 billion just to get the markets open, and leading to stock market losses in the trillions. More research is needed to decide how much of the difference is explainable by the existence of amplification mechanisms, as Brunnermeier believes, or whether a more substantial explanation for the recession lies in world-wide leveraging and deleveraging. The size of the mortgage defaults was clearly not large enough to explain the crash, but it may have been large enough to destabilize key elements of the system into a domino effect of some sort. The distinction is somewhat semantic, with its main value in moderating political opinion about the issue of "too big to fail". That is, the general public perception of the role of huge economic forces, as opposed to blunders by a few key firms.{ILQ-End}

|

9. The liquidity crisis of the summer of 2007 was a brief, almost total, lock-up. This is not to imply that worldwide cash shortages had necessarily been building up for months until the system crumpled; simple miscommunication could explain a brief lock-up just as well. But there can be little doubt that chaos convinced major decision-makers they would be wise to conserve their own cash more carefully. The instantaneous main conclusion was that certain interest rates had been too low, and would soon go up. A rise in interest rates forces a decline in the value of the loan, the bond, or the guarantee. If interest rates double, the principle will be worth only half as much for the duration of the loan; even refusing to sell the asset leads to an opportunity loss throughout the duration to maturity. For a while, there was uncertainty just how many roles the subprime mortgages were playing, but it scarcely mattered. Alan Greenspan had famously remarked that low long-term interest rates were a "conundrum". If they went back up to conventional levels, it would not so much matter that foreclosures would rise from 5% to 10% or even 20%. What would matter was that the 80-95% of un-foreclosed mortgages would become 5% bonds in a 10% bond environment, and hence destroy many times as much wealth. Since that cat was out of the bag, it might be a long time before it got stuffed back. Looking back for causes, it was suddenly clear that we had created a situation where everyone was terrified interest rates would become normal. If they became normal suddenly, bankruptcies would be wide-spread. If they went back slowly, fearful paralysis might last a long time. The Federal Reserve had already lowered short-term rates to nearly zero, so their efforts to ease the pressure on deposit institutions led to the purchase of long-term bonds. It was not reassuring to see that if long rates went up later, the lender of last resort would then likewise be in the position of losing money.

10. At a time when commercial liquidity was weak, the public started to draw down its cash reserves. The protracted experience of low short-term rates was particularly hard on unemployed people, especially retirees, who tend to live on the interest on money market funds and CDs because of a concern for the safety of principal. When ready cash is depleted, such people invade their long term securities; when times are precarious, even the affluent ones decline to invest and limit discretionary consumption. The nation thus begins to use up its cash reserves, and the consumer goods segment of the economy starts to weaken. In a primitive country, this sort of response soon leads to famine; in more affluent America, it is less obvious that cars are getting older, clothes are getting worn out. Meanwhile, businesses are declining to expand or to hire, and cash reserves are possibly even expanding, waiting for a more suitable time to invest. If the subprime mortgages and similar toxic debts can be cleaned up before the nation really exhausts its hidden cash reserves, the recession will pass. If cash reserves ever do get depleted beyond a tipping point, industrial growth will slow, and a twenty-year recession such as the Japanese are suffering, cannot be completely dismissed.

Originally published: Tuesday, September 07, 2010; most-recently modified: Wednesday, May 15, 2019