Related Topics

Reflections on Impending Obamacare

Reform was surely needed to remove distortions imposed on medical care by its financing. The next big questions are what the Affordable Care Act really reforms; and, whether the result will be affordable for the whole nation. Here are some proposals, just in case.

Right Angle Club: 2015

The tenth year of this annal, the ninety-third for the club. Because its author spent much of the past year on health economics, a summary of this topic takes up a third of this volume. The 1980 book now sells on Amazon for three times its original price, so be warned.

What Obamacare Should Say But Doesn't

|

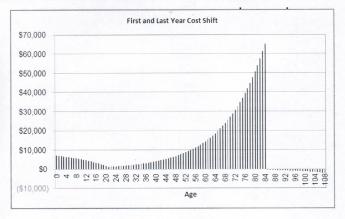

1a. TAX EQUITY. All tax exemptions stimulate overuse because they amount to a discount. For example, federal tax exemptions now mainly extend to two consumer purchases: health insurance and home mortgages. We currently have national crises in both at the same time. The tax-subsidized home-mortgage housing bubble played a major role in the 2007 financial panic, while tax-subsidized health care threatens to lead health costs into a second unsupportable bubble. Higher education seems to be going the same way, and it becomes difficult to imagine what would result if two or three of these bubbles merge. The expression "Children playing with matches" comes to mind. Giving a tax advantage to one group but not to its competitors is essentially just a variant, containing the paradoxical advantage that the competitors will object to it if they can't extend it to themselves.

Giving a tax subsidy to employees but not to self-employed or unemployed persons nevertheless created a uniquely American system of employer-based health insurance, and lobbying now perpetuates this rather odd system. Noting the allegedly temporary origins of this tax quirk (as a wartime expedient) merely dramatizes its lack of justification for seventy years afterward. It should not be necessary to describe collateral damage like job lock and internal hospital cost shifting. The issue of equal justice alone should be enough to justify the abolition of this unfairness. To mandate individual coverage but differentially exclude large subpopulations from tax exemption, is to invite a Supreme Court case. And since such a law has been passed, the sooner a damage case is granted certiorari , the better. To achieve equity, it does not matter whether tax exemption is given to everyone, denied to everyone, or limited to part of the cost (reducing the exemption for some, partly extending it to those who do not have it). Any choice between these three would make it equitable, although gradual elimination would be better, still.

If health insurance is mandated, its tax treatment must be uniform.

|

| Hidden Cost |

Once the tax is equalized, this proposal clears away the main obstacle to

1b. INDIVIDUAL OWNERSHIP OF HEALTH INSURANCE POLICIES, already proposed in Congress; but seemingly without hope of adoption. Determined opposition from the current owners of "self-insured" groups, the employers, or the unions who have acquired this function from employers. Since most such arrangements are de facto "administrative services only", insurer protests of higher administrative costs for individual ownership are often just relics of ancient combat between Blue Cross and commercial insurers.

Regardless of the internal structuring of incentives, healthcare reform cannot be permanently settled without individual ownership. It must be understood, however, that eliminating the tax preference could be resisted at first by patients who acquire it, because of fear the eliminated tax would in some way be shifted to them. That need not be true if consideration is given to the relative size of the losers and gainers. Since the membership of group policies greatly outnumber individual policyholders, the redistributed revenue cost of tax equity would be considerably smaller than 50/50. The CBO should provide a sliding scale estimate for negotiating purposes.

1c. ENCOURAGE WIDE-SPREAD DIRECT MARKETING OF HEALTH INSURANCE. Since Health Savings Accounts and Catastrophic High-Deductible Health Insurance are libertarian ideas without religious overtones, it is uncomfortable to advocate them as mandatory, even passing laws to that effect. However, the libertarian doctrine does not seem to preclude creating incentives for universal adoption. This doctrinal attitude imposes slower adoption than mandating them, although a better product result from more trial and error as the idea spreads. Therefore, readers may be surprised to see me advocate electronic insurance exchanges as a way to speed up trial and error spread of the idea's adoption. It is a way of preserving the flexibility of deductibles, benefits, alternative uses of surpluses, and vendor arrangements. It is also a way of narrowing the conflict with the Tenth Amendment, combining state regulation with inter-state marketing. If multiple alternative details prove necessary, direct computer marketing would be a quick way to discover what the permissible alternatives would be. Finally, the widespread examples of other interstate marketing can be employed to search out how to convert marketing from intra-state to interstate, rather than assume certain commerce is inherently (and permanently) interstate or inherently within-state.

An accidental feature of Health Savings Accounts is that the account can be growing for a number of years before the re-insurance feature is frequently needed. Indeed, young people may need a certain form of reinsurance protection and a different form as they grow older. The important feature is to have permanently stable savings vehicle in place while different forms of re-insurance are proving themselves. It seems heresy to say so, but we might even discover niches of the marketplace where first-dollar coverage or service benefits have some useful temporary role.

The States Are in the Road

|

1d. PRE-EMPT STATE LAWS WHICH INHIBIT CATASTROPHIC COVERAGE. State mandated benefits now severely limit high-deductible insurance in many states, and are the main reason Health Savings Accounts have been slow to spread. The provisions of ERISA shield employer-based health insurance from the unfortunate health coverage mandates in question. ERISA could not have been successful without this pre-emption, so unions and management unite in absolute concern to isolate ERISA from congressional meddling, although for different reasons.

1e. REVISIT McCarran FERGUSON ACT . This act effectively makes the "business" of insurance the only major industry restricted to the state rather than federal control. It should be amended to permit the sale and portability of health insurance policies across state borders and interchangeability of individual policies when people change state residence, thus greatly increasing competition and reducing prices. Once more, present law discriminates in favor of the employees of interstate corporations, who are also exempted by ERISA.

1f. MANDATE DISPLAY OF DIRECT COST MULTIPLES NEXT TO PRICES (FEDERAL PROGRAMS ONLY) (whenever prices are displayed, as in bills, price lists, etc.) FOR ITEMS COVERED BY HEALTH INSURANCE. Some high mark-ups are justified, but the public has a right to criticize them. This would not prohibit, but would considerably hamper, cost-shifting. It should be presented to provider groups as forestalling the prohibition of cost-shifting because of abuse. For this and other reasons, it would enhance provider competition.

1g. REIMBURSE HOSPITALS ONLY ON RECEIPT OF ASSURED POST-DISCHARGE HANDOVER OF MEDICAL RESPONSIBILITY (FEDERAL PROGRAMS ONLY). Unfortunately, hospitals do need increased incentive to improve post-discharge communication, which now increasingly occurs on a Saturday. Payment by diagnosis, otherwise a seemingly attractive idea, results mostly in sequestration of medical charts within the accounting department. That's undesirable at any time, but is most destructive at the vulnerable moment of hand-over.

1h. Similarly, REIMBURSE HOSPITALS FOR LAB WORK ON THE LAST DAY OF HOSPITALIZATION ONLY AFTER DEMONSTRATION IT HAS BEEN REPORTED TO A RESPONSIBLE PHYSICIAN. Such lab work, frequently obtained within hours of discharge, is sometimes overlooked and may even be unobtainable for the previously mentioned reasons, which in this case also apply to the hospital's own physicians.

1i. RESTORE ORIGINAL FORM OF PROFESSIONAL STANDARDS REVIEW ORGANIZATIONS (PSRO). These physician organizations effectively regulated many issues which are now the subject of the complaint. They were lobbied into ineffectiveness in 1980, and together with "Maricopa", essentially turned medical oversight over to insurance companies who thus receive no physician advice except from their own employees.

Treat liabilities like debts. And transfers from the general fund as liabilities.

|

| Accounting, for Congressmen |

1j. ENCOURAGE THE ESTABLISHMENT OF REGIONAL BACKUPS FOR AMBULANCES DRAWN OUT OF AREA. At present, ambulances are limited to going to the nearest hospital, rather than to the hospital of patient preference. The main justification for such behavior is the possibility that a second call might come while the ambulance was in a distant area. Fire departments have long solved this problem by shifting reserve vehicles into an overstrained area, to cover that area while the home vehicle is temporarily unavailable. In some areas, a reserve vehicle backup might require additional ambulances, but mostly it requires a mobile phone network. In areas of extreme distances between ambulances, the main need would be to relax regulations which exclude volunteer vehicles from serving that function. In densely settled urban areas, we now have the preposterous situation of mothers in active labor being stranded at the wrong hospital, only a few blocks away from the obstetrician who has their records. When such situations are repeatedly encountered, the current IRS exemption from financial reporting should be rescinded from the ambulance sponsor.

1k. As a general principle, when a service, device or drug is used in both the inpatient area and the outpatient one has its price exposed to regular market forces in the outpatient arena, the same price should be applied to it in the inpatient arena. It would be sensible to add a (separately negotiated) inpatient overhead adjuster reimbursement which generally applies to inpatients, and a second adjuster for the emergency room. There will be some services which are totally unique to inpatients or emergency rooms, which will have to be treated as outliers. In this way, a mutually reinforcing restraint is placed on such dual-use items -- with the market holding down outpatient costs, and the DRG ultimately holding down inpatient/emergency costs including outliers. As a general rule, the overhead cost-multiple established for dual-use should apply to the single-use items of either in-patient or out-patient. The key to all of these balancing limits is to permit open competition between hospital emergency services and private competitors, and an absolute prohibition of linkages between providers and emergency vehicle operators. After a brief trial, all such price constraints should be exposed to re-negotiation with an eye toward establishing transparent regional norms.

The Supreme Court Needs Help, Too

|

2. LEGISLATE OVER-RIDE OF 1982 MARICOPA CASE. This unfortunate U.S.Supreme Court 4-3 decision was never tried and upholds only a motion of summary judgment about a per se violation. It prohibits physician groups from agreeing on lower prices and has been taken to mean physicians are excluded from exercising control of HMOs and Managed Care. It also perpetuates the notion of individual competitors in a profession which is rapidly acquiring larger groupings as units of competition. By some quirk, the full tape recording of the 1982 U.S. Supreme Court arguments can be heard on the Internet. It is "above this author's pay grade" to know whether it would be better to ask the Supreme Court to review its earlier decision, or to make legislative changes in the antitrust law which would somehow result in a better outcome.

Originally published: Sunday, September 20, 2009; most-recently modified: Friday, June 07, 2019

| Posted by: Nona | Sep 7, 2011 1:12 PM |

| Posted by: Maggie | Sep 7, 2011 12:15 AM |